Trying something new in an attempt to be more production on Nostr

Peter Alexander

npub1yy3u...kawc

China 30 year veteran

Joined Nostr at block 777177

TikTok is the canary in the China trade war coal mine.

If the Trump team is unable to secure a deal on the social media platform then the two parties remain at a stalemate.

The Chinese know how central TikTok is to a wide swath of Americans. If no deal is to be secured, as part of a much larger trade deal, then the Chinese will just burn it to the ground. Once that path is taken, the Chinese will blame the outcome on Trump.

I will also repeat that the Chinese side hasn’t even begun to play hardball with Trump. Once you see headlines about “export controls” on items beyond rare earths then you will know the game has been taken to the next level.

https://www.reuters.com/technology/trump-says-china-has-reached-out-tariffs-tiktok-deal-may-wait-2025-04-17/

Not that this #China strategy should come as a surprise. It’s the fact that Bessent and the entire Trump team actually view the strategy as being “doable”.

When reviewing which country represents the largest trading partner of other countries China has surpassed the US years ago.

The only solution is for the US and China to recognize the world as it is rather than the world they wish it to be. The solution will demand collaboration. That, however, isn’t the American position …… at least not at the moment.

https://www.wsj.com/politics/policy/u-s-plans-to-use-tariff-negotiations-to-isolate-china-177d1528?st=ynEXsW&reflink=article_copyURL_share

Been keeping busy but I so need to get back here with Notes. So much to share on the #China front. For now though there is this 7pm Tuesday night (today)

@preston @James Lavish themes - and more - which you both addressed last week on your podcast.

China has zero American fucks to give.

Think the Trump team will be waiting a bit longer for that inevitable “call from Beijing”.

https://www.reuters.com/world/asia-pacific/chinas-xi-visit-vietnam-malaysia-cambodia-april-14-18-xinhua-reports-2025-04-11/

What it’s means when you use the phrase “The Definition of Insanity”.

And pardon my vulgarity, but it has really devolved into a dick measuring contest at this stage.

https://www.wsj.com/world/china/china-trump-trade-tariff-war-98676e74?st=pACsqa&reflink=article_copyURL_share

So it appears that I’m waking up to the “Trump blinked”.

Between the erratic bond market and #China turning the screws, we now know where the line in the sand is.

No going back from here.

I cannot stress enough. No one, average folks, here in #China is talking about tariffs or even stressing.

Everyone is just going about their daily routine. It’s just another day.

The US cannot win the trade war with #China.

Walmart pulling forward guidance tells you everything you need to know. Price hikes on all things out of China are being passed on to either the American buyer (Walmart) or the American consumer.

And I’ll also repeat again. China hasn’t even begun playing hardball. Export controls will be the point when that changes.

Nonstop action. Seems like I haven’t been off a video call with people in the States since “Liberation Day”.

China. China. China. Essentially 90% of the hot takes across social media are completely off base.

The power players in Beijing won’t flinch and Chinese producers/manufactures are passing the entirety of the tariffs directly onto their American buyers.

As expected. TikTok gets another 75 day extension.

You tell me who has the leverage? If you can’t even bring #China to the table over TikTok what do you honestly think you see as possible in the bigger picture.

https://www.reuters.com/markets/deals/trump-tiktok-sale-deadline-looms-us-looks-deal-2025-04-04/

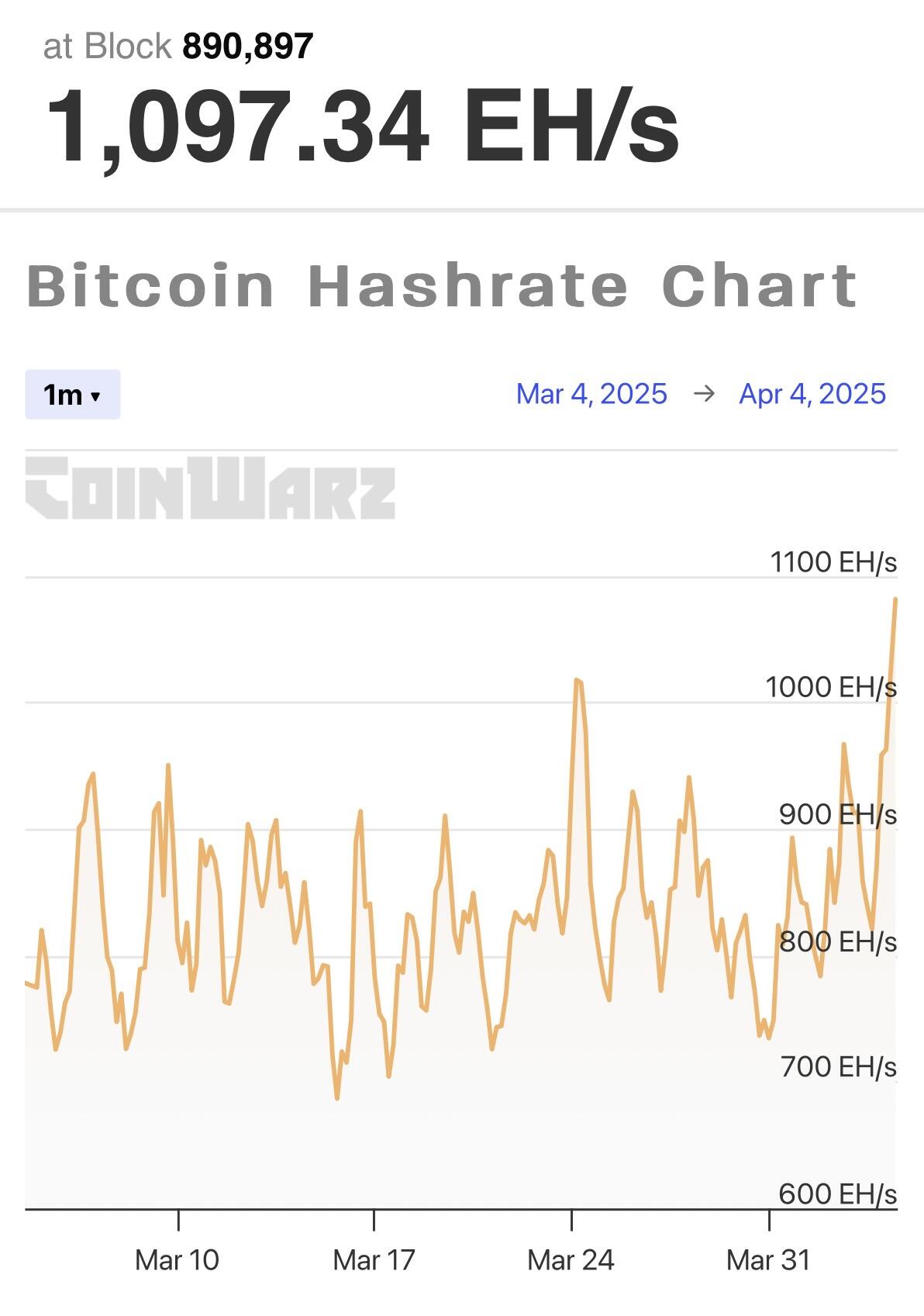

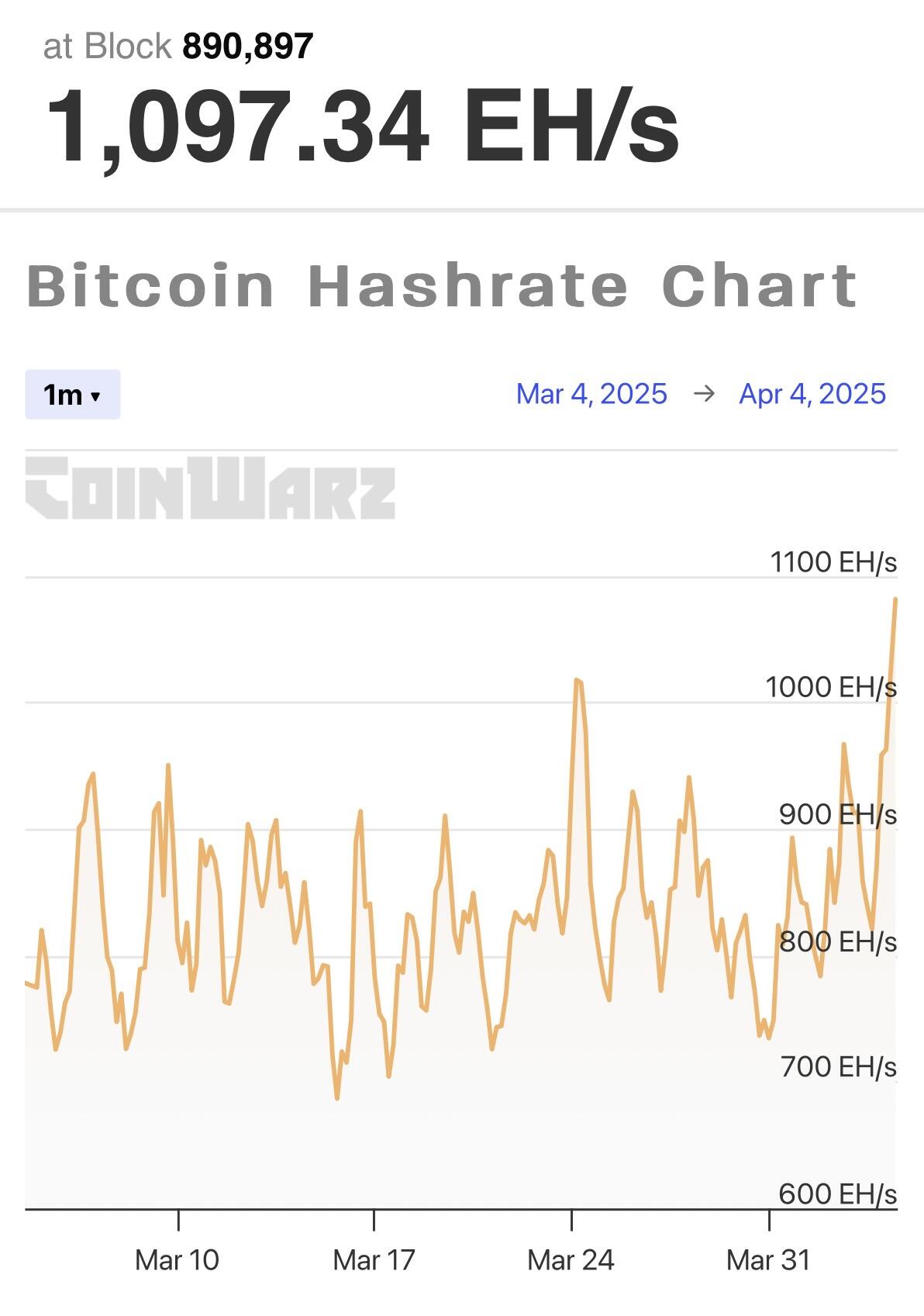

Meanwhile ……

Tick Tock, next block.

Important to keep in mind that China hasn’t even started playing hardball.

This is just the obvious response to “Liberation Day” activities.

This goal for now in Beijing is to find out what cards Trump is playing with. How far does he intend to go. When that road ends, then China drops the hammer.

CNBC

Trump tariffs fallout: China retaliates, Vietnam talks, U.S. markets melt down

China retaliated against Trump's tariffs with its own 34% levy. U.S. markets dropped on the news.

Back with a China Morning Missive

This one is simple. There will be no TikTok deal if Trump makes it a quid pro quo.

The Chinese know he could just as easily reverse any agreement made. I’m expecting the Chinese to refuse to play ball and the best case scenario is for the can to be kicked down the road.

60% of ByteDance is foreign owned. The Chinese would rather let it all burn to the ground than submit to demands by Trump.

https://www.reuters.com/technology/trump-says-china-could-get-tariff-relief-if-it-approves-tiktok-deal-2025-04-03/

Fuck me. I’m exhausted.

Three weeks of pure running and gunning.

Love Nostr. Love the Nostr fam.

Was back on CNBC last week and I remain gobsmacked at the 180-degree turn in sentiment towards China. Honestly, it wasn’t even a year ago and a clip of mine like this would have a comment section filled with nothing but “how much does the Party pay you?”

I’m beginning to think that years upon years of trotting out the same cast of characters, all of whom promised that China was on the precipice of collapse, no longer carries any credibility.

I mean, there does need to come a time when accountability finally takes hold, yes?

China Morning Missive

I’m taking the under on this bet. What does make me laugh though is that it was just last week that the media was saying, first, that Trump and Xi would meet in Beijing in June. Then reports surfaced that Trump might be headed to China “as early as next month”. Now we have this.

Here’s what I’m confident is actually going on.

First, it is more than reasonable to expect that there’s been a degree of backchanneling between the two countries in an attempt to secure something tangible so that the two leaders can meet. The difference, however, is that Beijing isn’t playing the same games as Canada, the EU or the other Trump targets.

Beijing is all but certainly slow rolling any sort of commitment to Trump. The longer China can drag out these backchanneling efforts, the higher the odds rise that a time will come where Beijing is in a genuine position to bargain.

More to the point, time is on Beijing’s side and is not on the side of Washington.

Newsweek

Trump says China's Xi coming to US amid tense trade war

President Donald Trump told reporters on Monday that Chinese leader Xi Jinping would visit Washington, D.C. soon.

China Morning Missive

Looks as though Beijing is trying to bring out the big guns. Late last night came a detailed directive specifically targeting increasing household consumption.

Truth be told, this is really nothing more than policy makers attempting to jawbone the Chinese citizenry. That said, what does look to be the primary focus is a revving up of the “wealth effect”.

What I mean by this is specific wording in the directive that both property and stocks are to be supported by central government policy. Explains why the Chinese stock market decently jumped on Friday. Expecting more once markets open here in less than an hour.

Again, not the biggest fan of the SCMP, but this article does do a decent job of laying out the plans announced.

South China Morning Post

China unveils 30-point toolbox to boost consumption

Support for household wealth, stock and property markets, AI funding and childcare in the works as China chases 5 per cent growth in 2025.

So it would appear as though American “industrial policy” is really nothing more than regulatory capture. I mean, how else is Sam Altman supposed to justify his BILLIONS of what may just be a complete waste of money.

The fact that OpenAI of all groups is pushing against the open source DeepSeek model shows, at least to me, that even after two months there is no competitive response.

Dammed no matter what option he takes, so Altman resorts to wrapping himself in the Red, White and Blue.

TechCrunch

OpenAI calls DeepSeek 'state-controlled,' calls for bans on 'PRC-produced' models | TechCrunch

In a proposal, OpenAI describes DeepSeek as 'state-controlled,' and recommends banning models from it and other PRC-affiliated operations.

China Morning Missive

Not exactly sure that Trump has played all that much of a role in the recent China equities rally. The more I think on this thesis the more I see it as pretty nonsensical.

There’s no question that the Hong Kong market has returned to life after multiple years of underperformance. The driver, however, has been a return of retail Chinese investors allocating to risk.

The catalyst for this return is the “DeepSeek” trade. Ever since that AI model ravaged its way into the global zeitgeist, Chinese investors decided to plow head on into all tech related equities. Perhaps no better example of this than Alibaba.

There’s also the fact that Chinese stocks have been trading at insanely cheap valuations, especially as compared to their peers in the United States. The only question which remains is whether, this time, the return of Chinese retail investors to the stock market will remain. Multiple times over the past five years these investors have waded into the markets to try their luck at knife catching. Each time, thus far, those investors have walked away slashed and cut.

Analysis-Donald Trump makes Chinese stocks (somewhat) great again