How it started, how it's going YTD.

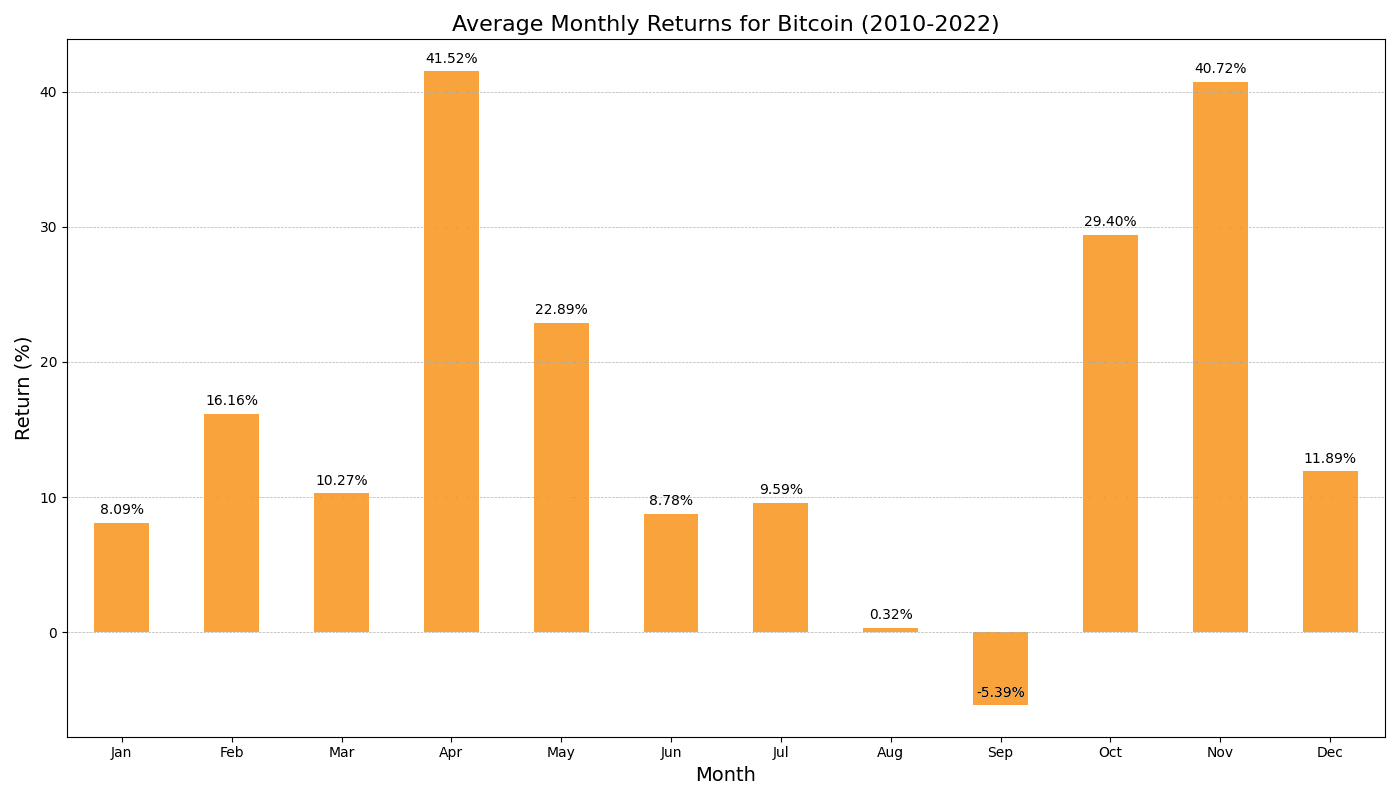

The $BTC data is about one day delayed but the seasonality appears to be playing out.

#Bitcoin

#trading

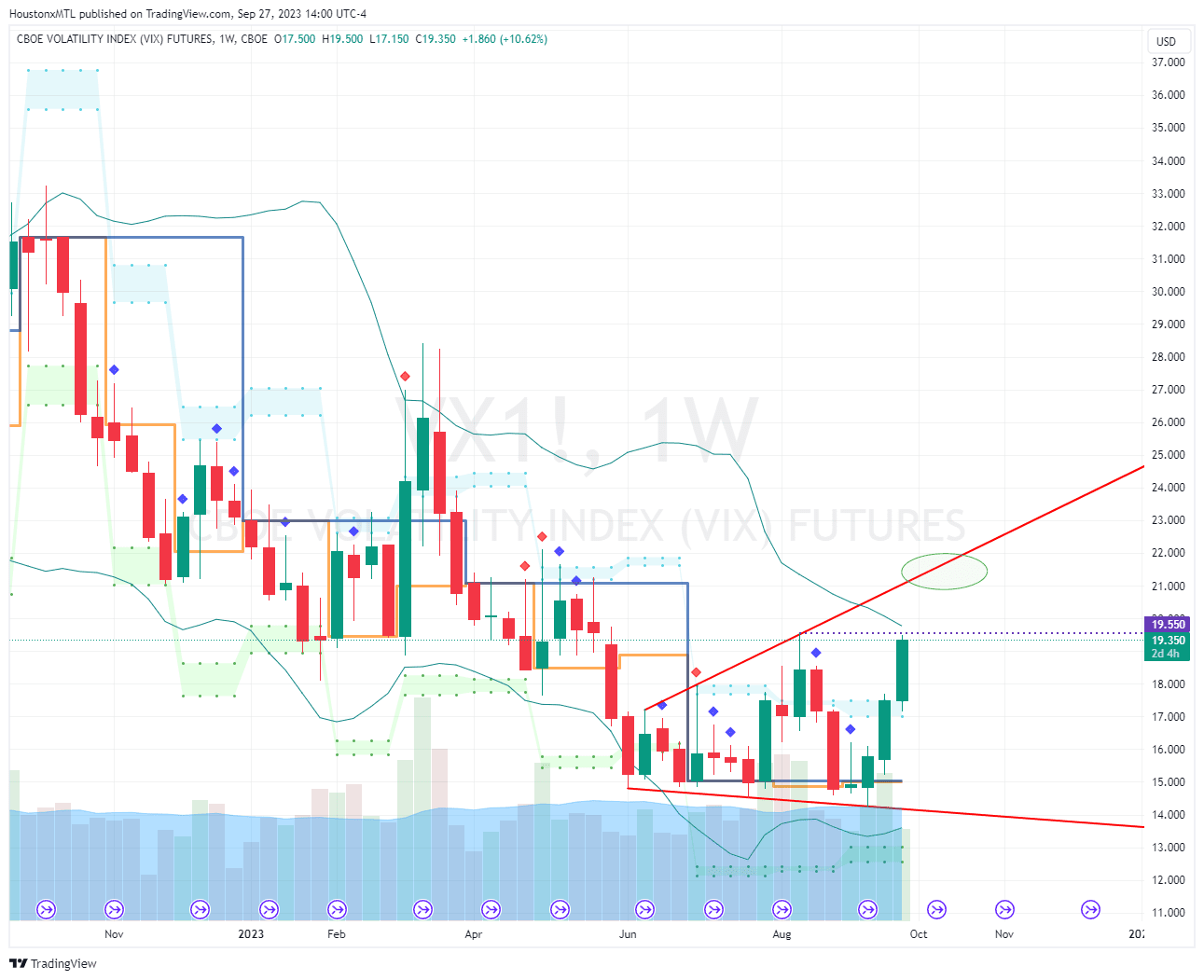

#trading Times like this are notable.

The bears got everything they could ask for but couldn't hold on to the gains.

Now the US 10-year yields are pulling back and $EURUSD is firming up.

Times like this are notable.

The bears got everything they could ask for but couldn't hold on to the gains.

Now the US 10-year yields are pulling back and $EURUSD is firming up.

It looks likely that we will get a bounce in equities.

So with the risk-on back in equities, will flows continue to pile into crypto as it has been negatively correlated with the SPY/QQQ lately?

It looks likely that we will get a bounce in equities.

So with the risk-on back in equities, will flows continue to pile into crypto as it has been negatively correlated with the SPY/QQQ lately?

Or do we get the coveted rally in both equities and crypto to close out Uptober?

Or do we get the coveted rally in both equities and crypto to close out Uptober? What will be the macro catalyst to ignite the move?🔥

https://iris.to/note1wytf8fe9uqvw0v6lqt8pxd0qas754rpeg40zmdsquaxswxw0hrcqaqkw7m

What will be the macro catalyst to ignite the move?🔥

https://iris.to/note1wytf8fe9uqvw0v6lqt8pxd0qas754rpeg40zmdsquaxswxw0hrcqaqkw7m

#trading #bitcoin

#trading #bitcoin #Bitcoin #trading

#Bitcoin #trading

#trading #Bitcoin

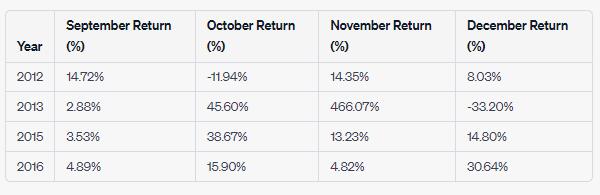

#trading #Bitcoin An interesting follow-up question is what does history have to say about months where September was actually positive?

Was the following month and the rest of the year positive?

Interestingly, since 2010, there have been 4 occasions where Sept. had positive returns.

After that, 3/4 had positive returns in October.

All 4/4 had positive returns in November and 3/4 had positive returns in December.

So on net, seasonally, it hasn't paid to be short #Bitcoin in Q4.

An interesting follow-up question is what does history have to say about months where September was actually positive?

Was the following month and the rest of the year positive?

Interestingly, since 2010, there have been 4 occasions where Sept. had positive returns.

After that, 3/4 had positive returns in October.

All 4/4 had positive returns in November and 3/4 had positive returns in December.

So on net, seasonally, it hasn't paid to be short #Bitcoin in Q4.

#BTC #trading

#BTC #trading