Replies (35)

tHe iNsTiTuTiOnS aRe cOmInG

😂

Class of 2020-2021 are the real OGs - mostly suffering

Class of 2020-2021 are the real OGs - mostly suffering

Just pain

class of 21/22 is thankful.

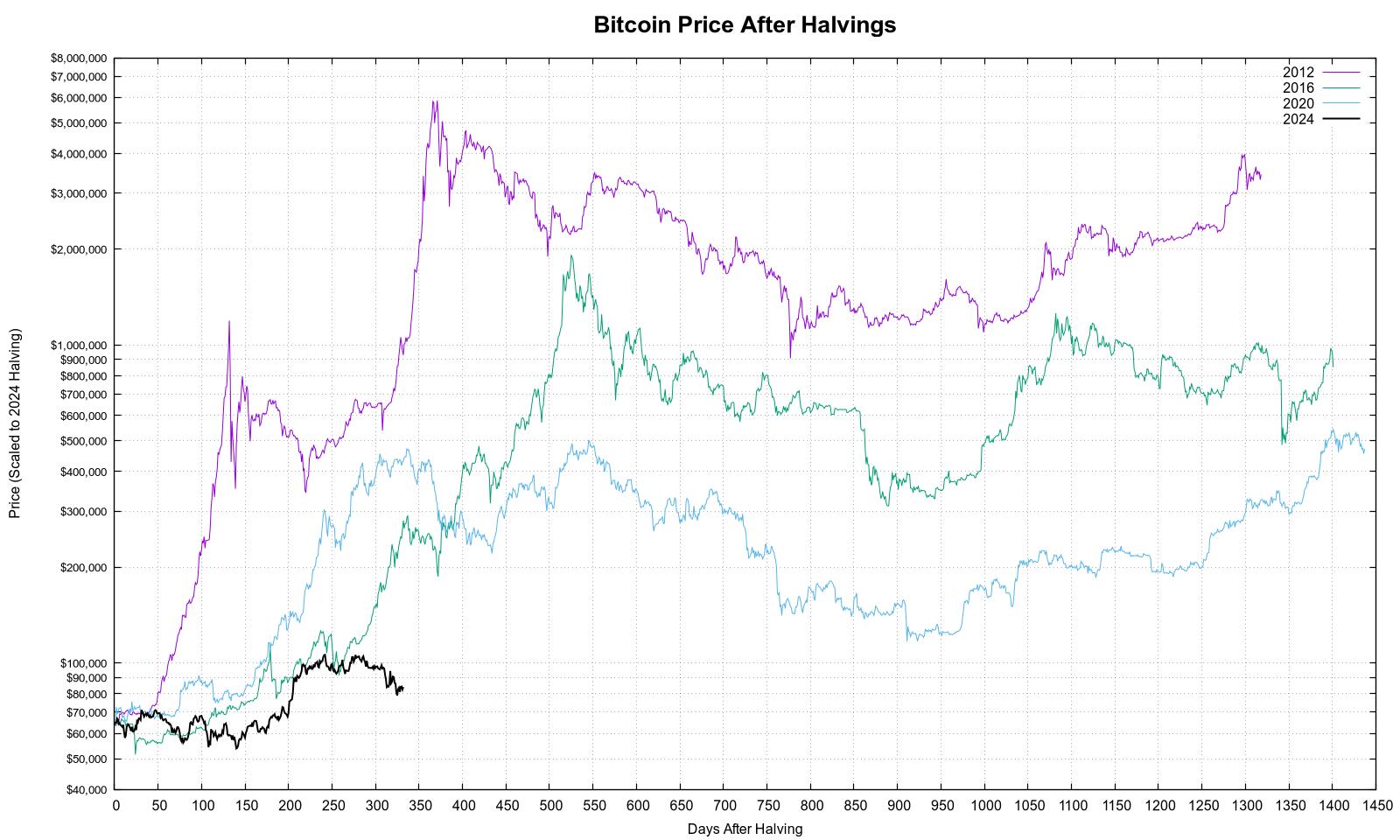

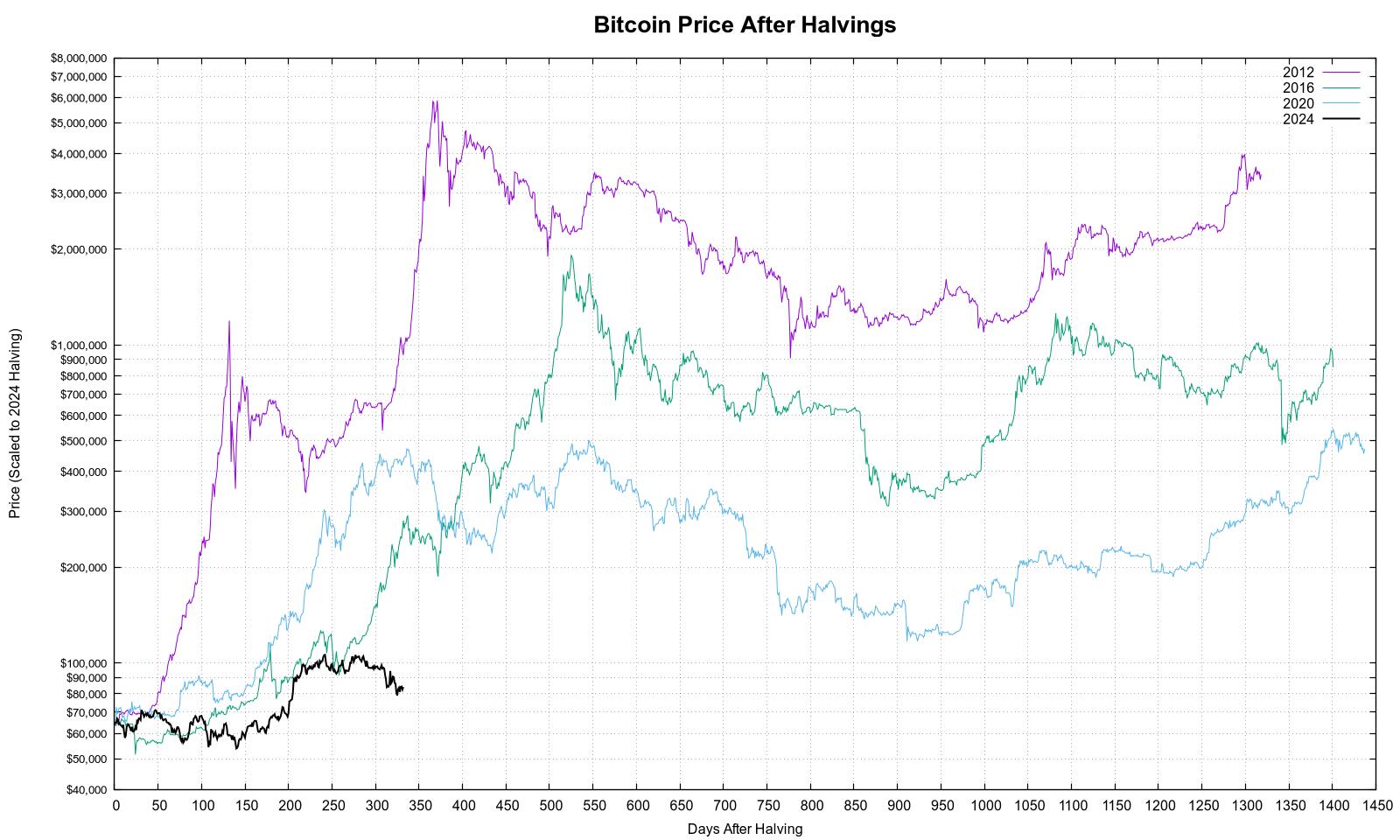

It’s almost like the past isn’t necessarily a decent guide to the future 🤔

So called “cycles” ending would be a great outcome for Bitcoin generally.

Broad market declines are holding this cycle down. I think the Bitcoin is acting pretty resilient

S’ok. Cheap sats and not overheating is maybe a good thing

didn’t you want to sell some btc this cycle to buy stuff? Hope the double top wasn’t it this time.

…And they’re using Coinbase!

Love to see it! Gotta keep stacking sats about it.

Thuperthyckle

It’s a shame how many of the really solid bitcoin podcast influencers have been captured by MSTR and the ETFs.

The price suppression MSTR has been able to accomplish WHILE attracting the level of simp that has compromised the integrity of really good bitcoiners has been very impressive.

Stack, spend and replace, repeat

It's good though.

Maybe it'll take the wind out of the sails of the NGU crowd and we can get back to the CYPHERPUNK ethos dammit

It’s a joy to have these prices. Count your blessings!

Enough pain for the bulls😅

So true

Meh. I'm still happy. Can't stop me.

If you’ve been stacking since 2020 and you are suffering you might be doing something wrong.

Glass half full, you can still stack under six figures.

Soon that will be a distant memory.

Bitcoin will hit $250k by October 2026 whether we have a traditional halving cycle bull period or not.

I'm still in the camp that we'll have a massive pump soon that brings us close to $1m, but even if not a 300% increase in 19 months is still good I'd say.

💯

explain thoughts on MSTR suppressing price

Coinbase has MSTR’s approval to fractional reserve the MSTR bitcoin stack. If MSTR has 250k bitcoin custodied with Coinbase, Coinbase can fractional reserve up to 150k of those coins, knowing that MSTR’s entire strategy is holding indefinitely.

Coinbase custodies most of the ETFs and MSTR … they have 2M+ bitcoins custodied. More important than 10%+ of the total supply, it is more than the TOTAL remaining issuance of the bitcoin protocol. They can 100% use a small float to manage (or create) market volatility.

The specific numbers are obviously unknown (which is a problem). But total global annual issuance during this epoch is ~165k bitcoin. So it is clear that 50k bitcoin here and there can really impact the expected purchasing power of bitcoin.

Show me the incentive and I’ll show you the outcome. Every power structure in the world is trying to at least SLOW DOWN bitcoin and bitcoin adoption (especially among individuals). This is an EASY way to accomplish that objective.

well shit. is Coinbase’s ability to fractional reserve MSTR stack conjecture or verified?

In my opinion, being the most objective possible, bitcoin has broken its cycles. A slow and inexorable climb has begun that in the next 10 years will bring it to 1 million! But I don't think it will follow the halving cycles with all these institutions anymore. It will be a growth more comparable to that of gold

100% conjecture at this point. But Saylor hasn’t done anything to negate the risk.

Wen 100x? or even 10x? MARCH 2021 $57k

Just rooting for a God Candle - for the 2021 plebs

This time we broke ath before the halving, so comparison isn’t great in my opinion with higher starting point

Short term, yeah kinda depro

Long term, super optimistic, can still buy while low!

As soon as people think it’s all over…the fun will begin.