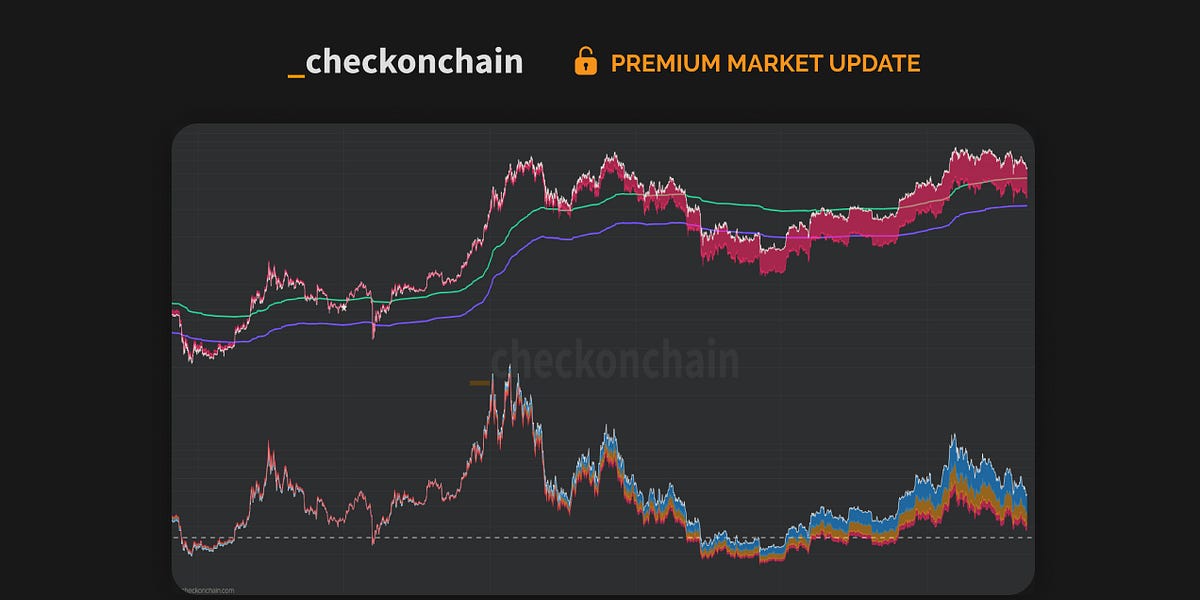

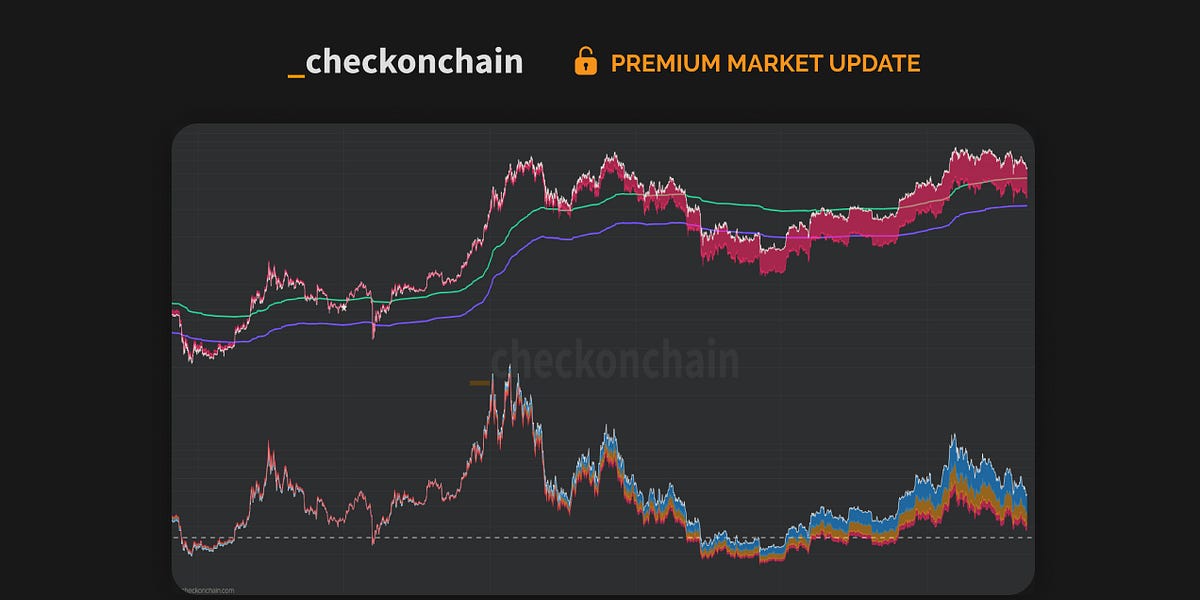

Inflationary Illusions.

My latest #Bitcoin research piece is out for _checkonchain subscribers, examining why this cycle, ATH, and market feels different to prior ones.

What if we never made a real ATH at all?

Inflationary Illusions

What is the price of Bitcoin when the ruler we measure it in continues to shrink in size? Did we really hit an ATH? Is there a reason this cycle fe...