What If Bonds Haven’t Bottomed For The Cycle… 🤔

tlt has the potential to revisit $80 area 🤔

many investors still believe the fed is not being forced to cut rates to keep the US fiscal situation sustainable... but compounding interest is like the terminator**.

those investors still need to shift part of $130T of bonds into $14T of gold, $1.2T of BTC, & $65T of equities. - luke gromen

Social Security is facing $63 trillion in long-term unfunded liabilities, according to the 2024 Old-Age, Survivors, Disability Insurance (OASDI) trustees report.

BRAZIL TOP COURT ORDERS IMMEDIATE SUSPENSION OF X IN BRAZIL

another reason #nostr exists

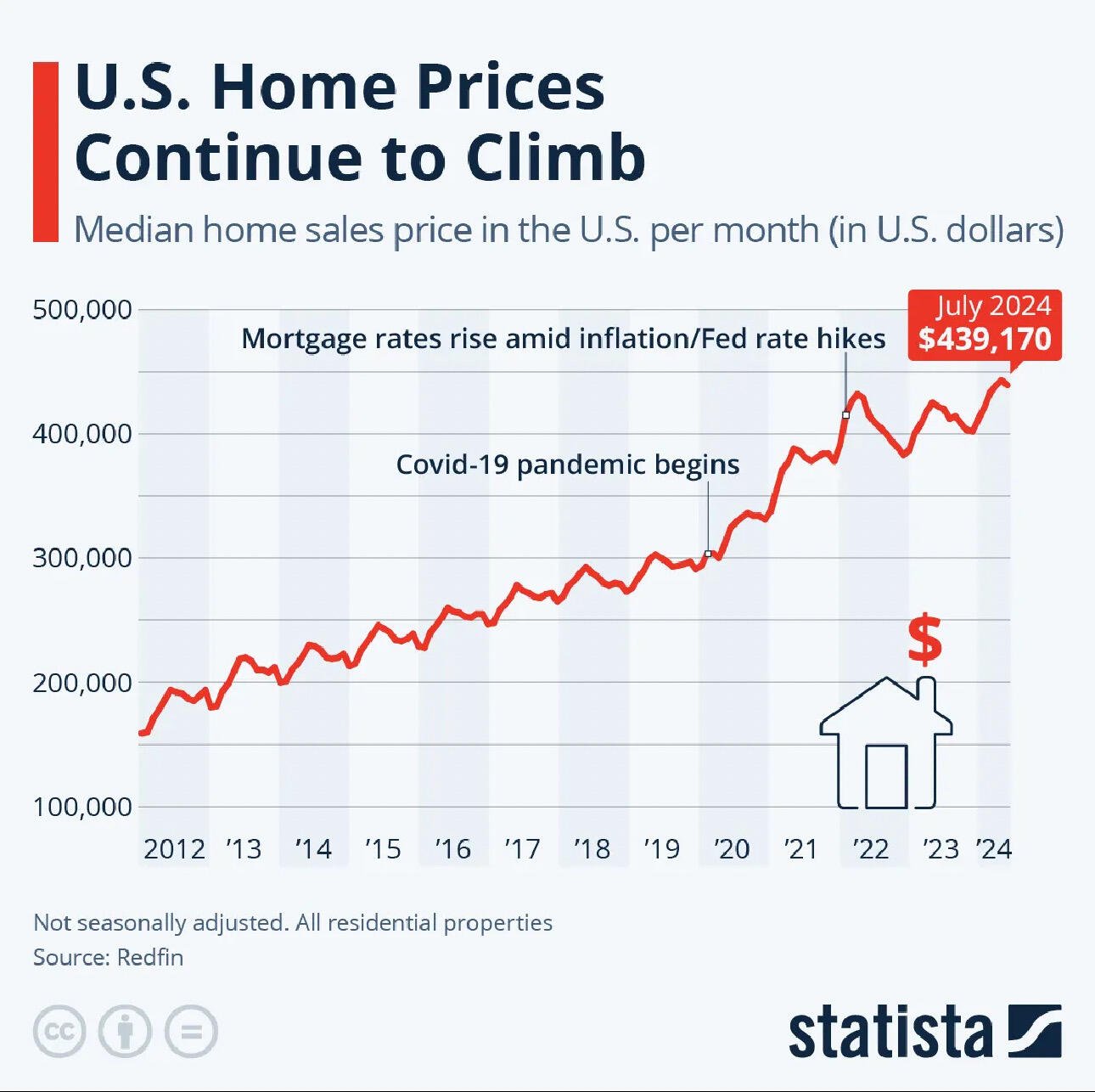

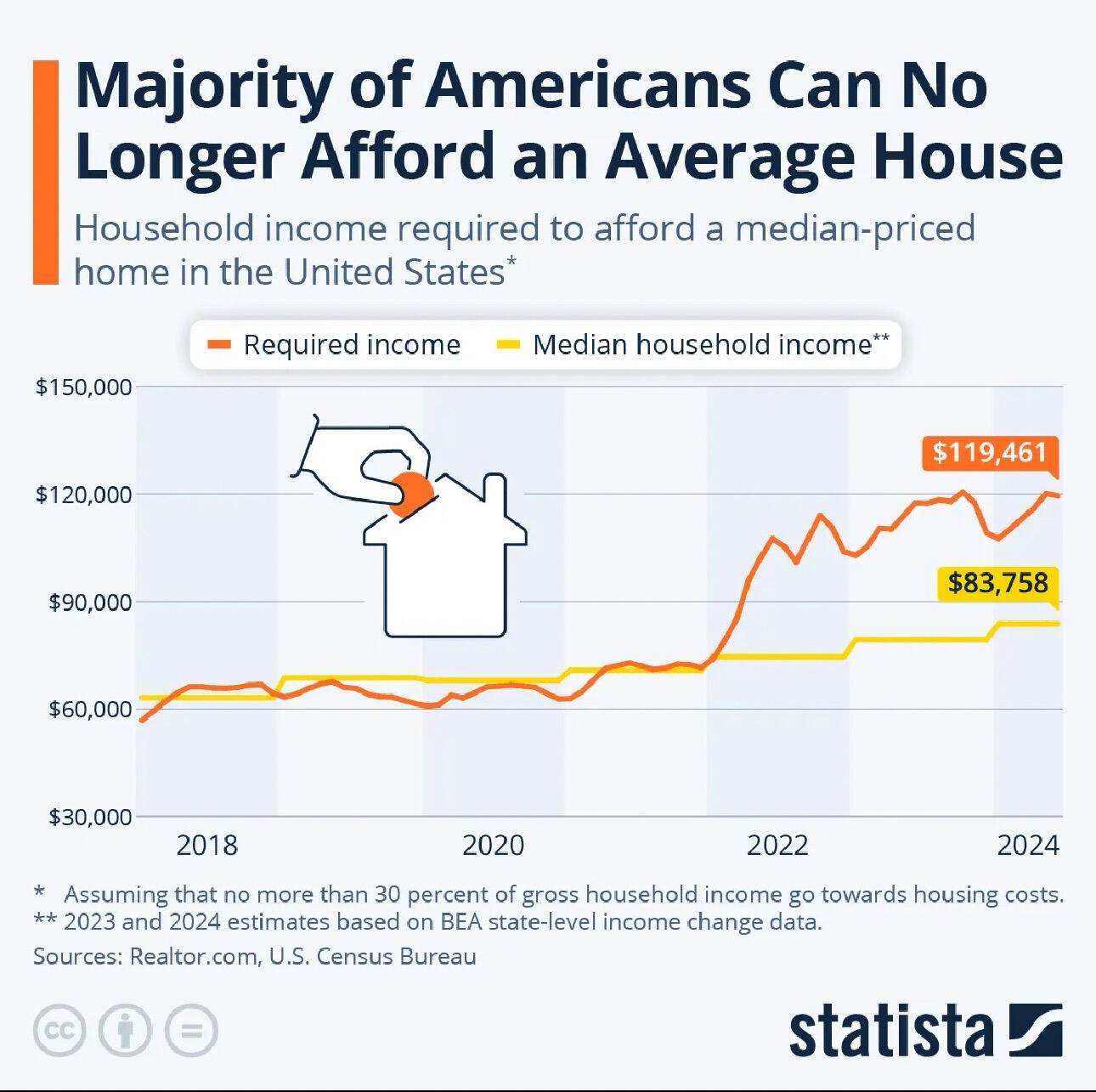

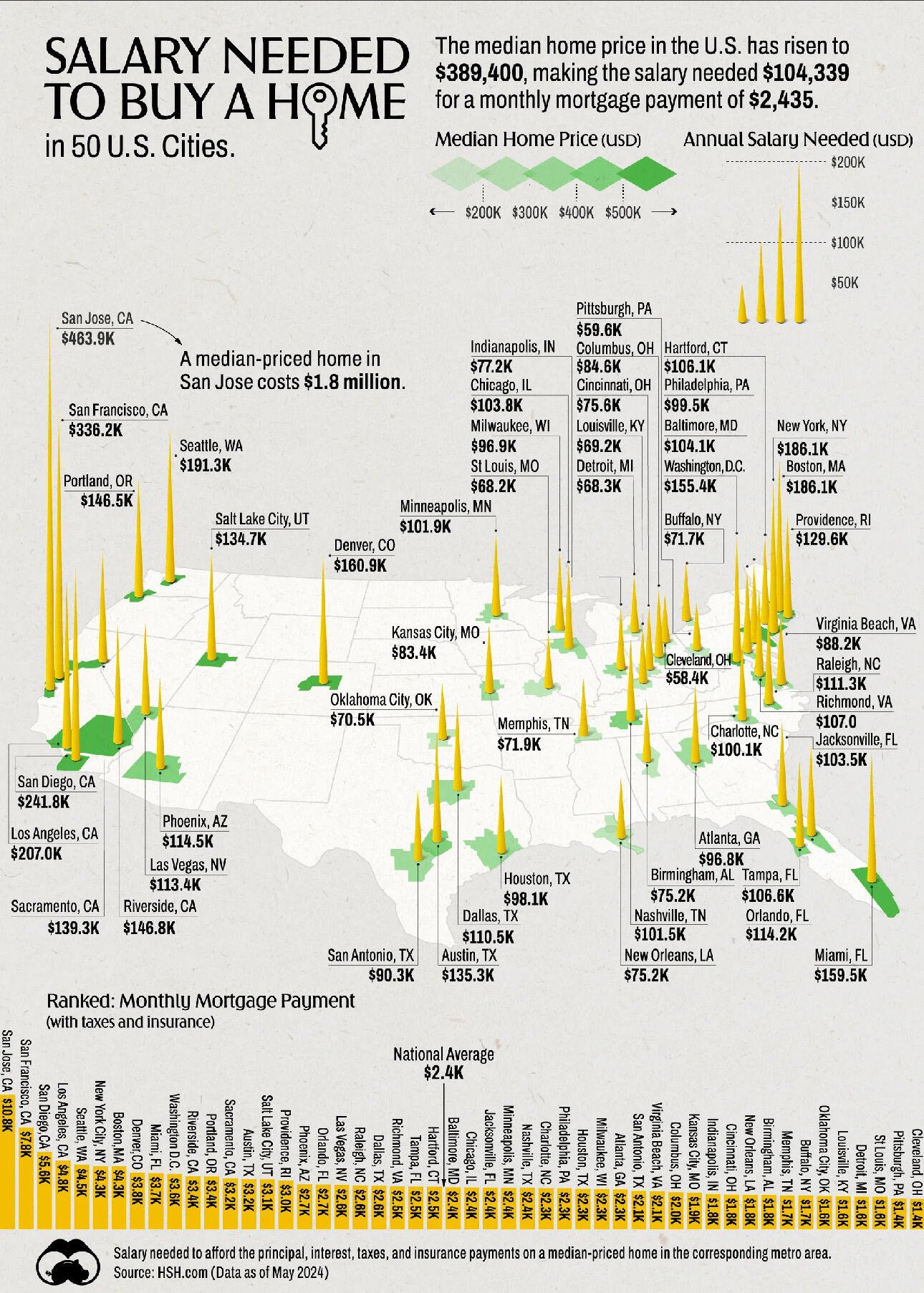

briefly sum up current housing situation in 🇺🇸

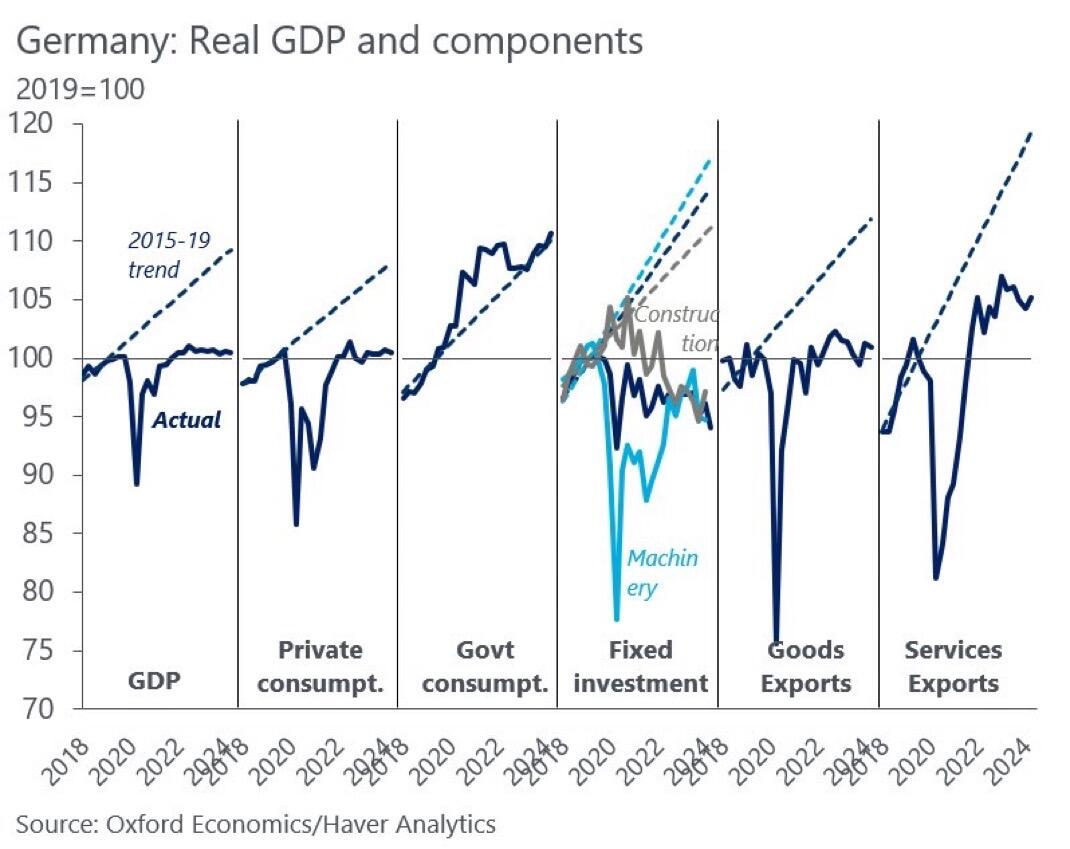

socialism in germany 💀

i'm from vietnam and i love #nostr

hello everyone lets have a journey 🤝

#introduction

If freedom of speech is taken away, then dumb and silent we may be led, like sheep to the slaughter. - George Washington

Roger Federer from his commencement address at Dartmouth:

“In tennis, perfection is impossible... In the 1,526 singles matches I played in my career, I won almost 80% of those matches... Now, I have a question for all of you... what percentage of the POINTS do you think I won in those matches?

Only 54%.

In other words, even top-ranked tennis players win barely more than half of the points they play.

When you lose every second point, on average, you learn not to dwell on every shot.

You teach yourself to think: OK, I double-faulted. It’s only a point.

OK, I came to the net and I got passed again. It’s only a point.

Even a great shot, an overhead backhand smash that ends up on ESPN’s Top Ten Plays: that, too, is just a point.

Here’s why I am telling you this.

When you’re playing a point, it is the most important thing in the world.

But when it’s behind you, it’s behind you... This mindset is really crucial, because it frees you to fully commit to the next point… and the next one after that… with intensity, clarity and focus.

The truth is, whatever game you play in life... sometimes you’re going to lose. A point, a match, a season, a job... it’s a roller coaster, with many ups and downs.

And it’s natural, when you’re down, to doubt yourself. To feel sorry for yourself.

And by the way, your opponents have self-doubt, too. Don’t ever forget that

But negative energy is wasted energy.

You want to become a master at overcoming hard moments. That to me is the sign of a champion.

The best in the world are not the best because they win every point... It’s because they know they’ll lose... again and again… and have learned how to deal with it.

You accept it.

Cry it out if you need to... then force a smile.

You move on. Be relentless. Adapt and grow.

Work harder. Work smarter.

Remember: work smarter.”

Foreigners are not net short USDs; they are short USD cash but massively long USD assets 👇.

Any time USD $dxy gets "too strong", foreigners will sell their now $57T (gross), $22T (net) in USD assets "until their hands bleed" (as a trader I know used to say) to raise USDs.

the carry trade ( usdjpy ) is borrowing negative yield yen and invest in high yield instruments around the world : ai stocks, sp500, ust, gold, bitcoin, real estate, ..........when jpy get stronger and usd get weaker, carry trade unwind will be messy !

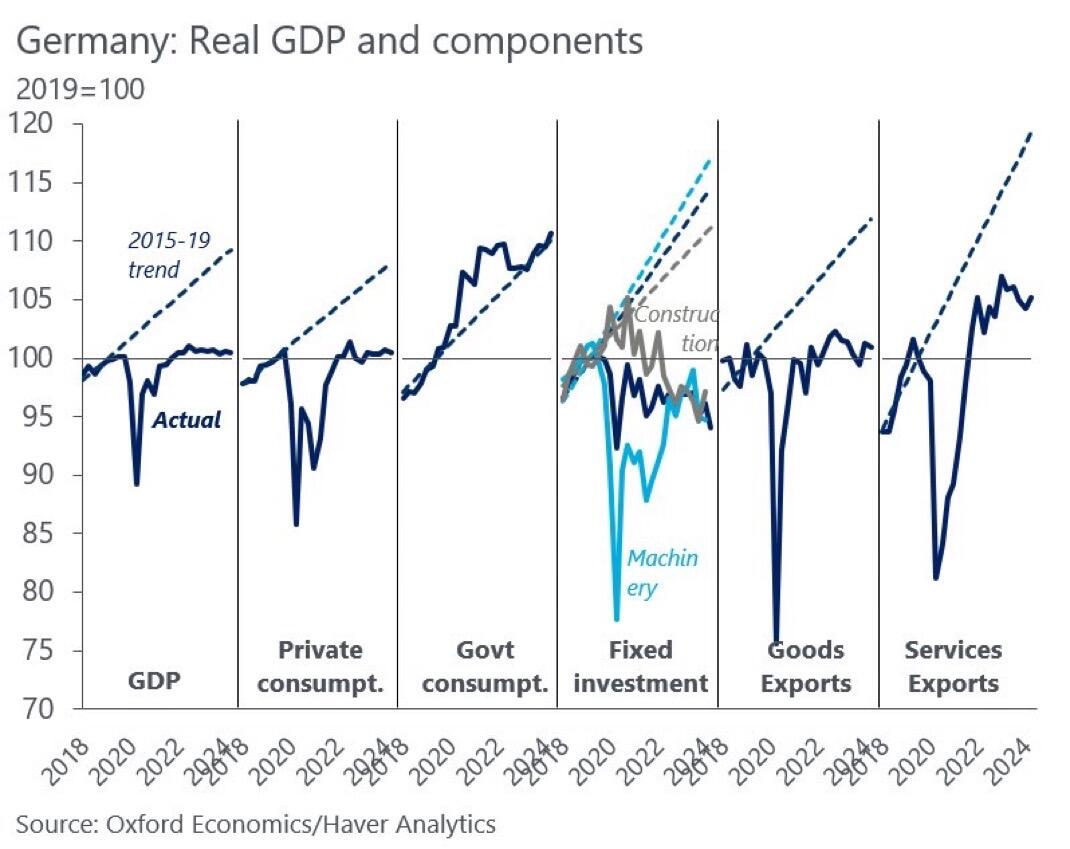

subsidized economic growth 😂

7% full employment deficit, we are in an era where fiscal deficits are structurally larger than the rate of bank lending and are set to grow in perpetuity, and so fiscal details tend to matter more than monetary ones.

Since the GFC, the US has substantially had Federal government-driven credit growth, yet many investors still operate from a first-principles basis of “the US is fundamentally capitalist.”

Wisdom is seeing things for what they are, not for what they are called.

The higher cost of owning an electric versus a gas-powered vehicle is a sticking point for many would-be buyers of EVs. Now, the price of a key EV component is falling, raising hopes that automakers could close the gap as they grapple with waning demand.

ford lose $40000 on every ev truck they sold = terrible business

vinfast delay usa factory

exploding ev battery

=> overall ev is a scam ???

renting is better than owning a home:

1. lower insurance or none

2. lower utility cost

3. no liabilities on damage, no maintenance / repair

4. freedom to move

5. no downpayment

6. no property tax

7. depreciating home price ?

leading causes of cancer:

1. tobacco use

2. obesity

3. genetic factors

4. environmental exposures

5. lifestyle factors

6. infectious agents

The two biggest source of broad money creation are 1) bank lending and 2) fiscal deficits, both of which cause inflation !

the arrest of Telegram founder Pavel Durov by france is why we need decentralized free speech platform !

-If Fed cuts aggressively here, JPY goes to 120 and every CUSIP has a flash crash, as the carry trade blows up.

-If Fed cuts slowly, then it may just blow everything up anyway, cause the economy is rolling over and the ‘wealth effect’ was the only thing holding it up.

-Meanwhile, we just had a 10-yr auction that effectively failed. So if the Fed cuts at all, they blow up the bond market and the banking sector. They realistically need to raise rates aggressively here to save things (imagine that!!). That’s the EM Dilemma. Which is why DMs do not want to become EMs. Or in other words, ‘they’re fuct!!’