Violent move in rates—why hasn't more broken?🤔

Luke Gromen makes a key point in update below: Intervention HAS thwarted deflation—trapeze artists can't get hurt when the net is always there.

BUT...what are long-term risks of the perpetual Fed Put???

Blue Collar Bitcoin

bluecollarbitcoin@NostrVerified.com

npub1a3hr...fg37

Firefighters explore economics, finance & #Bitcoin (Josh & Dan shared profile)

The Happiness of YOUR life depends on the quality of YOUR Thoughts

- Marcus Aurelious

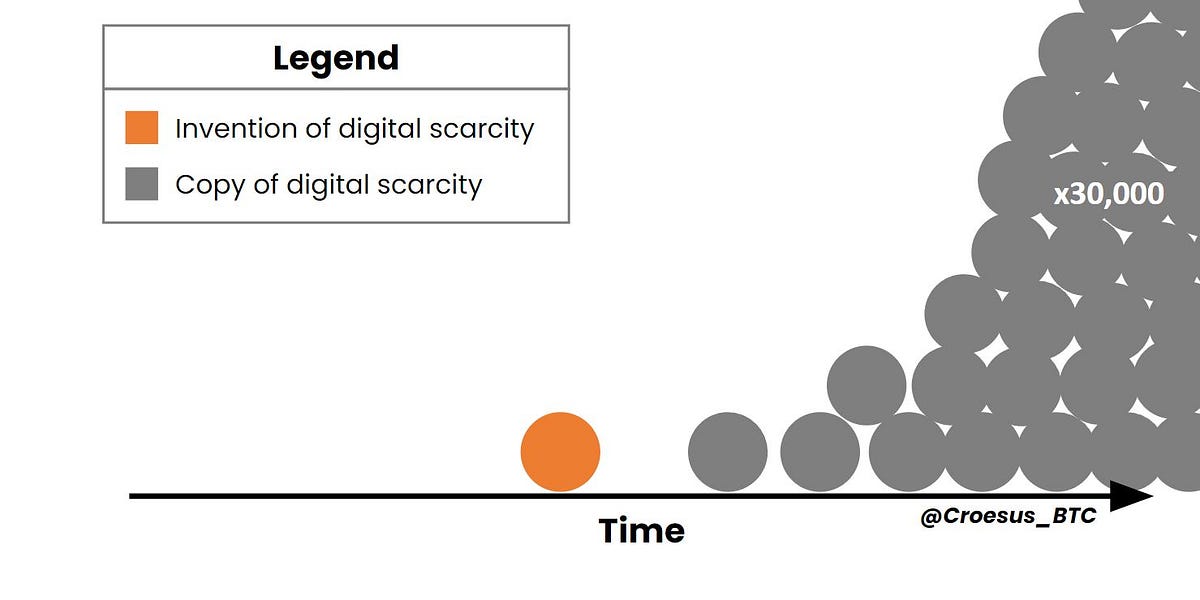

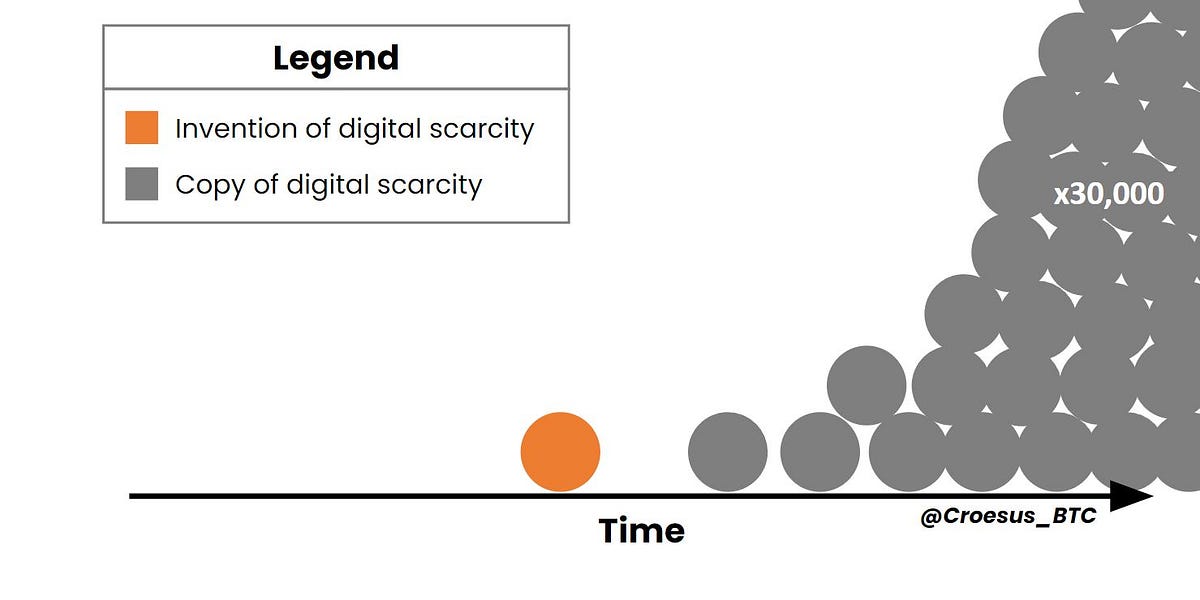

“Every upstart project in crypto faces their own impossible paradox as they attempt to catch up to #Bitcoin – the Crypto Catch-22:

1️⃣U can’t catch #BTC w/o a leadership team & a marketing budget.

2️⃣W/ a leadership team & marketing budget, ur a company masquerading as a decentralized protocol.”

—Jesse Myers

The Crypto Catch-22: Why Bitcoin Only

Three key reasons why Bitcoin is the only cryptoasset worth holding

In our view, what @Lyn Alden summarizes in this segment below is one of the most important concepts to grasp when assessing the fiscal (& broader macro) environment of the 2020s.

And trust us, water doesn't work well on grease fires.😉

👇👇👇

"During the 1940s, interest rates were not used as a policy tool to fight inflation, because it was fiscal-driven inflation rather than lending-driven inflation. Instead, the primary policy tools focused on ending the war, ceasing the fiscal deficits, and pivoting back towards a period of financial austerity.

During the 1970s, raising interest rates and performing other actions to reduce the high rate of bank lending was a successful inflation-fighting strategy, because it tackled the problem head on. Other non-monetary policies included improving the supply-side, such as resolving or getting around geopolitical oil embargoes. Federal debt as a percentage of GDP was only 30%, so higher rates on the public debt were manageable compared to the reduced rate of loan creation in the private sector that higher rates led to.

During the 2020s, we have a different problem. Most of the inflation was caused by large 1940s-style fiscal deficits, and yet the Federal Reserve has primarily used a 1970s-style playbook of raising interest rates to deal with it, even though that’s primarily a tool to constrain lending. However, raising interest rates when federal debt is over 100% of GDP substantially increases those deficits at an equal or larger pace than it reduces loan creation in the private sector.

An issue here is that the Federal Reserve doesn’t really know what else to do, because their tools don’t really address deficit-driven inflation; their tools are meant to deal with lending-driven inflation. It’s a fiscal matter, and so the best the Federal Reserve can do is try to suppress the private sector to offset some of what’s happening in the public sector, even though that’s not addressing the core problem.

So as the Federal Reserve raises rates, federal interest expense increases, and the federal deficit widens ironically at a time when deficits were the primary cause of inflation in the first place. It risks being akin to trying to put out a kitchen grease fire with water, which makes intuitive sense but doesn’t work as expected.

[....]

As we look years into the future via the following chart from the Congressional Budget Office, the rising federal debts and deficits will cause the fiscal dominance to continue into increase, which means interest rates become a less and less useful inflation-fighting tool over time."

Full newsletter here:

Lyn Alden

July 2023 Newsletter: Fiscal Dominance

July 2, 2023 Latest Article: Do High Interest Rates Fix High Inflation? This newsletter issue elaborates on my recent article about the relationshi...

In our view, what nostr:npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83asummarizes in this segment below is one of the most important concepts to grasp when assessing the fiscal (& broader macro) environment of the 2020s.

And trust us, water doesn't work well on grease fires.😉

👇👇👇

"During the 1940s, interest rates were not used as a policy tool to fight inflation, because it was fiscal-driven inflation rather than lending-driven inflation. Instead, the primary policy tools focused on ending the war, ceasing the fiscal deficits, and pivoting back towards a period of financial austerity.

During the 1970s, raising interest rates and performing other actions to reduce the high rate of bank lending was a successful inflation-fighting strategy, because it tackled the problem head on. Other non-monetary policies included improving the supply-side, such as resolving or getting around geopolitical oil embargoes. Federal debt as a percentage of GDP was only 30%, so higher rates on the public debt were manageable compared to the reduced rate of loan creation in the private sector that higher rates led to.

During the 2020s, we have a different problem. Most of the inflation was caused by large 1940s-style fiscal deficits, and yet the Federal Reserve has primarily used a 1970s-style playbook of raising interest rates to deal with it, even though that’s primarily a tool to constrain lending. However, raising interest rates when federal debt is over 100% of GDP substantially increases those deficits at an equal or larger pace than it reduces loan creation in the private sector.

An issue here is that the Federal Reserve doesn’t really know what else to do, because their tools don’t really address deficit-driven inflation; their tools are meant to deal with lending-driven inflation. It’s a fiscal matter, and so the best the Federal Reserve can do is try to suppress the private sector to offset some of what’s happening in the public sector, even though that’s not addressing the core problem.

So as the Federal Reserve raises rates, federal interest expense increases, and the federal deficit widens ironically at a time when deficits were the primary cause of inflation in the first place. It risks being akin to trying to put out a kitchen grease fire with water, which makes intuitive sense but doesn’t work as expected.

[....]

As we look years into the future via the following chart from the Congressional Budget Office, the rising federal debts and deficits will cause the fiscal dominance to continue into increase, which means interest rates become a less and less useful inflation-fighting tool over time."

Full newsletter here:

Lyn Alden

July 2023 Newsletter: Fiscal Dominance

July 2, 2023 Latest Article: Do High Interest Rates Fix High Inflation? This newsletter issue elaborates on my recent article about the relationshi...

Orange Pilling can be INCREDIBLY challenging & frustrating. We explore why w/ Austin Herbert in BCB120.

→#Bitcoin inception.

→Why fitness doesn’t have to be difficult.

→Boat Day Drinking.

→Camel Toe Ego.

🎧

Blue Collar Bitcoin • BCB120_AUSTIN HERBERT: Orange Pilling Is Hard, Fitness Doesn’t Need To Be • Listen on Fountain

Austin Herbert (Open Source Fitness) joins Dan and Josh for a discussion about orange pilling and fitness. Austin previously worked for Bitcoin M...

Was at the neighbors' house last night. They asked about #Bitcoin. I tried to keep it brief but talked for 1.5 hours.

It's almost impossible to explain this thing succinctly. One aspect cascades into the next, and the next, and the next....🤷

No bank holidays on #bitcoin

One day you might be so right about #Bitcoin that it’ll scare the shit out of you.

THE PROBLEM WITH KEYNESIAN ECONOMICS FOR DUMMIES:👇

1️⃣It requires an enormous amount of centralized control over money.

2️⃣When there is an enormous amount of centralized control over money…um, well…people create more money.

“Value is nothing inherent in goods, no property of them, nor an independent thing existing by itself. It is a judgment economizing men make about the importance of goods at their disposal for the maintenance of their lives and well-being. Hence value does not exist outside the consciousness of men.”

-Carl Menger

#Bitcoin is ACM Technology.

(Anti-Cuck Money Technology)

#Bitcoin Basics the OCHO

—Lightning Network

—Layered Money

—Scaling technologies

—Why scale in layers?

—Flicking beads

Thanks @Seb Bunney & @Daz B 🙏

👉

Blue Collar Bitcoin • Basics_08: Lightning Network, Layered Money & Bitcoin Scaling • Listen on Fountain

Bitcoin Basics Series Episode 8. Daz Bea, Seb Bunney, Dan & Josh cover the Bitcoin Lightning Network and the importance of a layered approach to Bi...

Most people in public discourse still think #bitcoin is a joke, when in fact it’s as serious as a heart attack.

Stack sats.

Most people in public discourse still think #bitcoin is a joke, when in fact it’s as serious as a heart attack.

Stack says.

Hal Finney in 2009.👇🤯

"I think it's likely that we'll see a layered approach to #Bitcoin services, w/ different layers specialized for different tasks. The base layer will be a relatively simple payment network, but there will be layers built on top of that for things like micropayments, anonymous transactions, and smart contracts."

In #Bitcoin, the message is the settlement. There's no debt layer above the settlement layer like the legacy system.

And w/ 2nd layers like #LightningNetwork settlement happens instantaneously—an HUGE upgrade in 21st c. payments!!

THE @Tuur Demeestr stops by for BCB118🔥

—Early days in #Bitcoin

—#BTC allocation strategies

—Bitcoin as an early retirement bet

—The Blocksize Wars & hurdles to come

—Avoiding pimps w/ guns

Blue Collar Bitcoin • BCB118_TUUR DEMEESTER: Bitcoin as an Early Retirement Bet • Listen on Fountain

Tuur Demeester (Founder of Adamant Research) joins Dan and Josh for an enlightening discussion about Bitcoin’s past and potential future. Tuur ha...

“[#Bitcoin] is the ONLY truly at scale censorship resistant technology that I’m aware of.”

— @jack

The conflation of #crypto & #Bitcoin is what we've been referring to as "Bitcoin Camouflage" for years. In our view, the connection btw these 2 in broader discourse presents an opportunity for those who recognize their foundational differences.

The former is primarily an innovation in VCs scamming retail with limited to zero use case, and the vast majority of tokens are deeply disempowering for most of society (especially the MiddleClass & below).

The latter is a truly decentralized, radically inclusive, barrier-breaking, accountability-inducing, equitable, & sound crack in the friction-filled walled garden that is the 21st century global financial system.