Some folks love to point and laugh when Bitcoin drops, like they’re suddenly the smartest person in the room.

But here’s a reality check: charging a premium to basically hug the index isn’t exactly a lofty pulpit to preach from.

And the irony?

Most of those “active managers” end up crying harder than anyone else when they fail to beat the benchmark they’re pretending to stray from.

All assets fluctuate—some more violently than others. That’s just how markets work.

Zoom out on equities, property, gold, or even Bitcoin, and you’ll often see an upward trend over the long haul. Mocking someone who’s invested in something that’s temporarily down doesn’t make you brilliant; it just shows you might be missing the bigger picture (or the fact that you probably wish you’d bought Bitcoin at $5 or loaded up on Sydney property a decade ago).

So if you’re going to charge top dollar and still play it safe by hovering near the index, maybe don’t get too smug about someone else’s short-term losses. Respect the volatility—or embrace it.

Either way, quit acting like a dip is proof of your superiority.

Leigh

npub1ardh...wt67

I invest, I write, I own a biz

Notes (16)

Good evening frenz

Where we at #nostr ?

The Pacific Peso.

Goin’ good 😅

What does a million-dollar banana have to do with your next investment?

In my latest article I explore how narratives drive markets just as much as numbers.

Think unprofitable tech stocks.

Think Sydney real estate.

Think Fartcoin.

The intangible story can magnify value beyond the balance sheet.

I’ve spent months behind the scenes, building businesses and shaping communications for other investors and it’s great to finally write in my own words again.

Check it out:

https://www.firstlinks.com.au/the-million-dollar-banana-and-the-power-of-story

Every time.

Heyyy gUyZzz, lemme give you my lunch only if you promise to sell it back to me.

RETARDS.

Can we make bullying ok again?

Some of the absolute dross on Nostr….

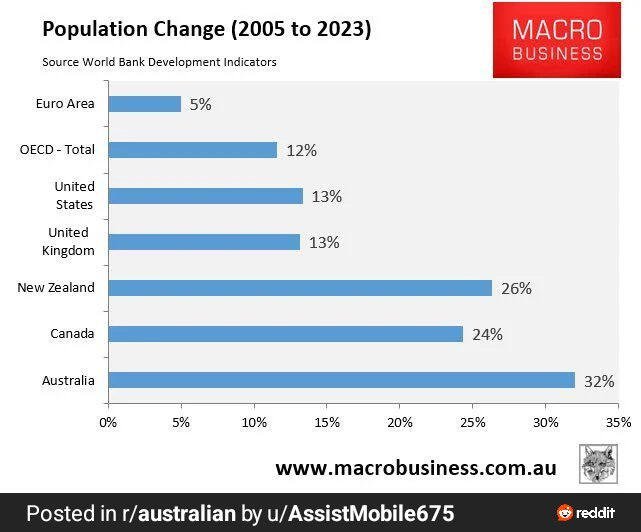

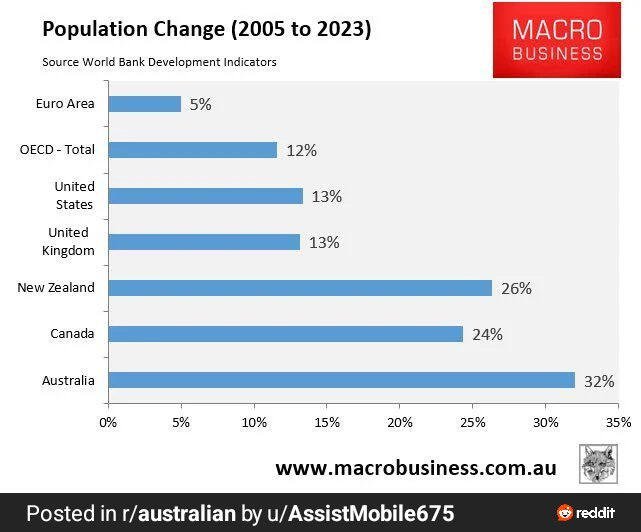

Highest population growth and yet Australia has a “skills shortage” and a housing “supply problem”

Does anyone have a friend who identifies as a cat or something?

#happynewyear

Australia is “a lucky country run mainly by second-rate people who share its luck”

“We’ve become very complacent, with little appetite for real reform, I worry we will need a very bad period to shock us into getting our act together.”

https://www.afr.com/policy/economy/the-lucky-country-has-blown-the-20-year-boom-20241217-p5kywb

They call #bitcoin a ponzi.

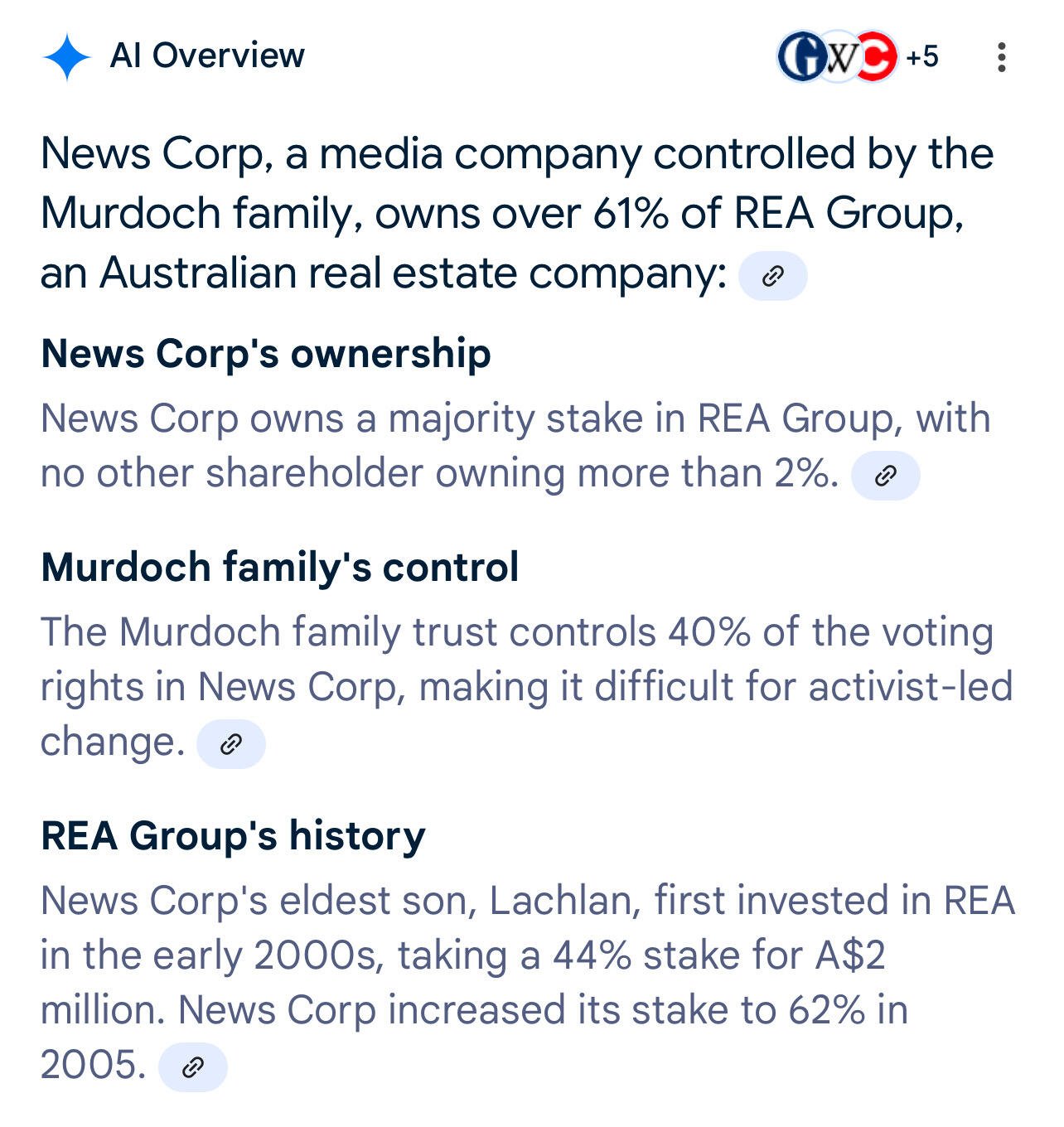

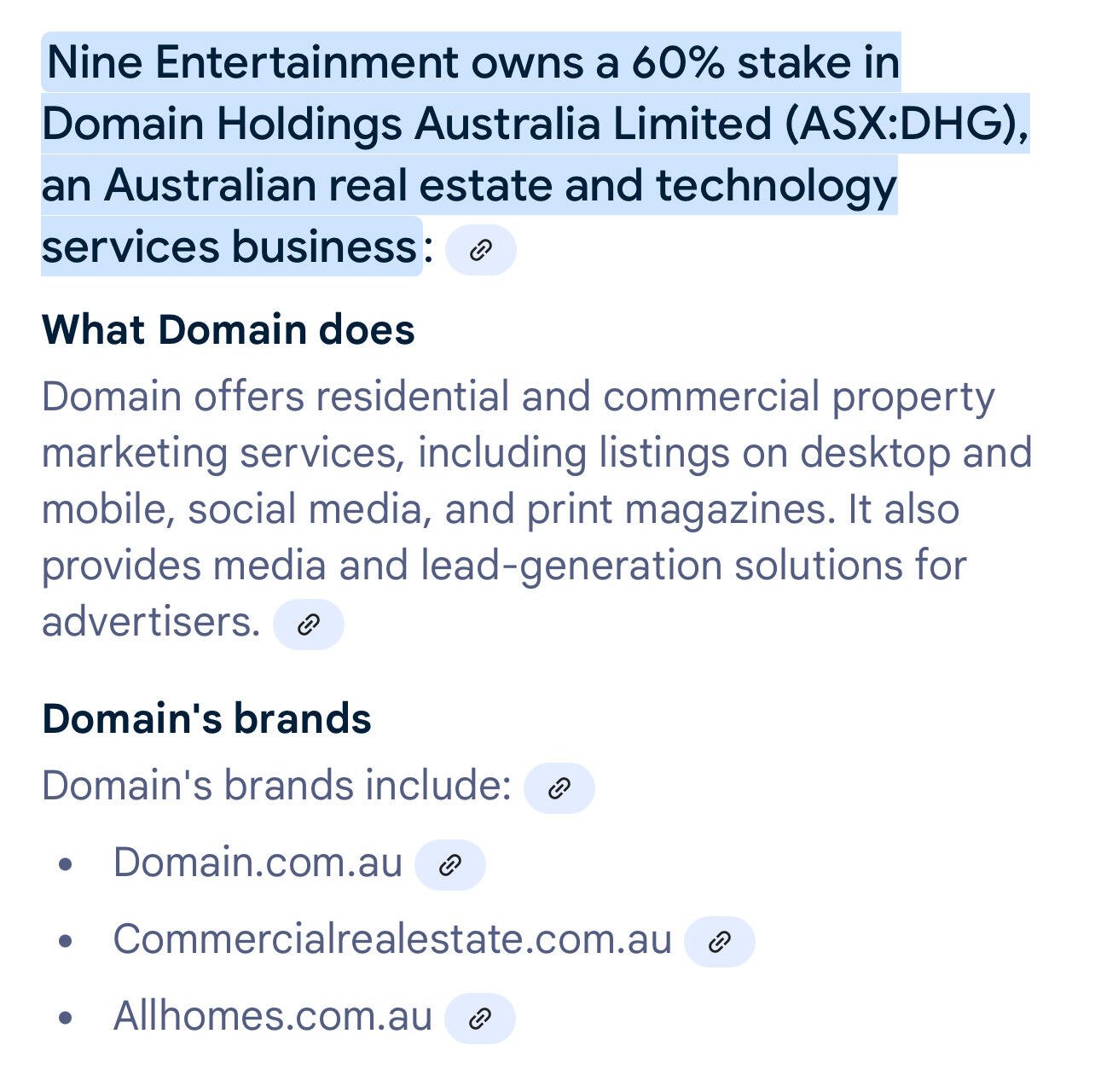

The two largest property platforms in Australia are owned by the two largest media groups.

We are constantly blasted with headlines like:

“What does [trivial matter] mean for Australian property?”

“How this influencer [i.e. OF slurry] bought 10 properties before her 30th birthday”

Every. F**king. Day.

Remind me, what’s a ponzi?

Just remember why mainstream media produces daily click bait and puff pieces about Australian property.

Tooooootally not a ponzi

‘some 42% of the near 60,000 people surveyed in August struggled to pay their home loan.’

https://michaelwest.com.au/mortgage-mountain-our-2-3-trillion-debt-and-the-big-4-oligopoly/

LOOK AT THIS.

87k at the MCG on Boxing Day, young debutant opener pulling off ramp shots like it’s a t20 scrubber, and the crowd basking in the Aussie heat.

Glorious cricket.

Sometimes, Australia is just bloody great.

Great, now Australia’s energy fumble ruined Christmas

#austriches look, it’s a pretty merry Christmas if you saved in bitcoin instead of the pacific peso