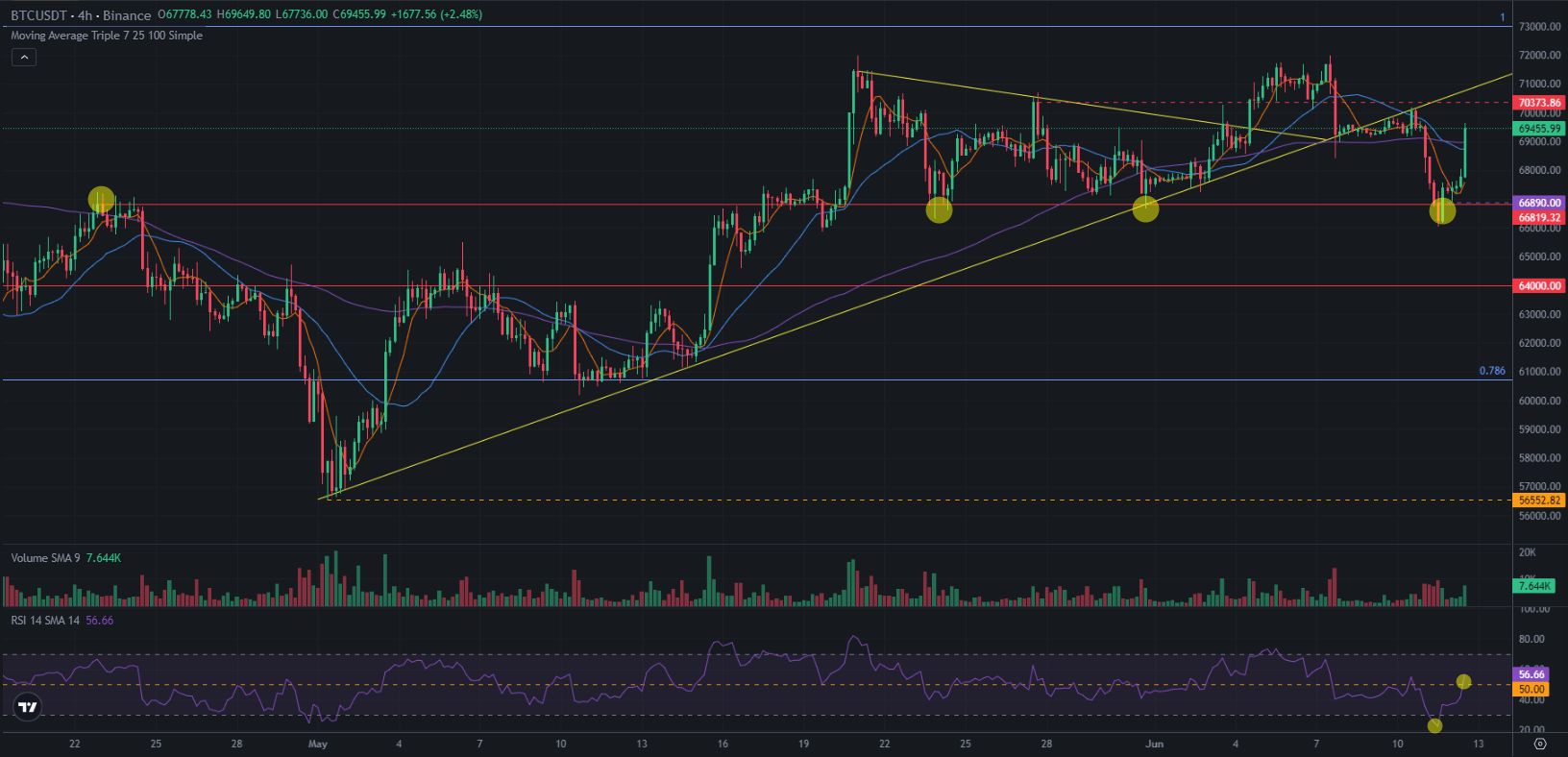

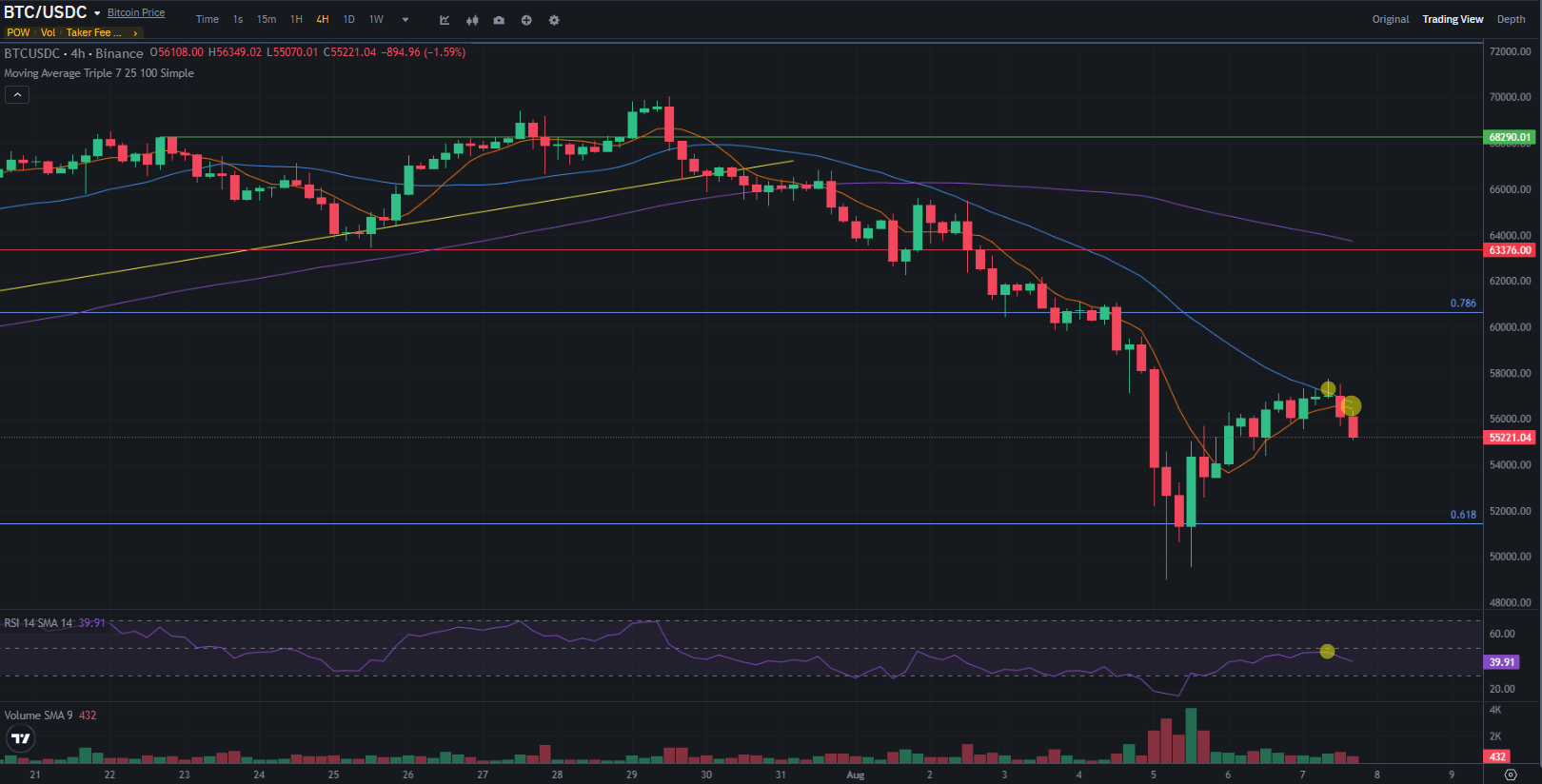

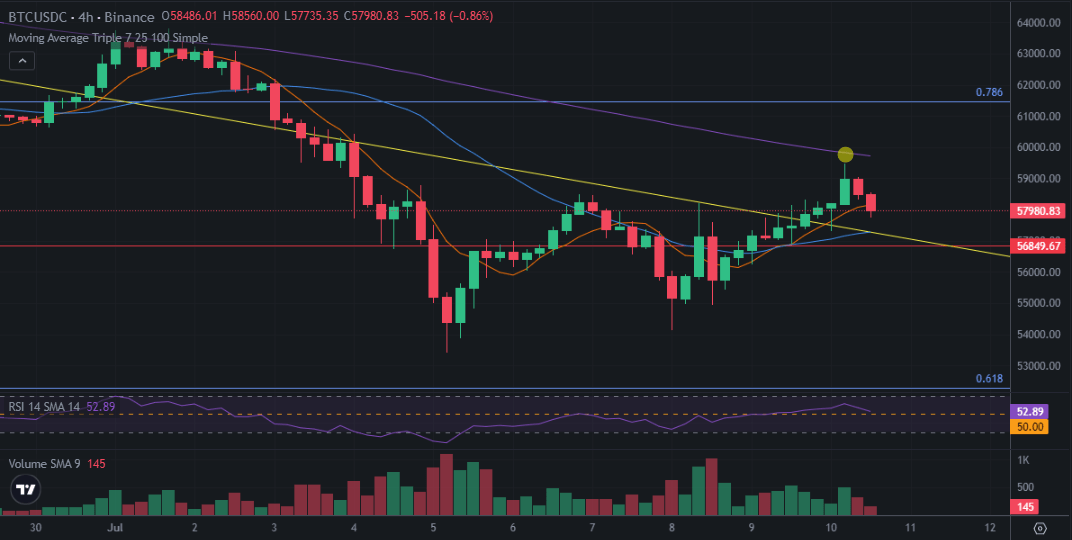

Back to 61k we go. 🤷♂️ I don't make the rules

View quoted note →

View quoted note →

View quoted note →

View quoted note →

View quoted note →

View quoted note →

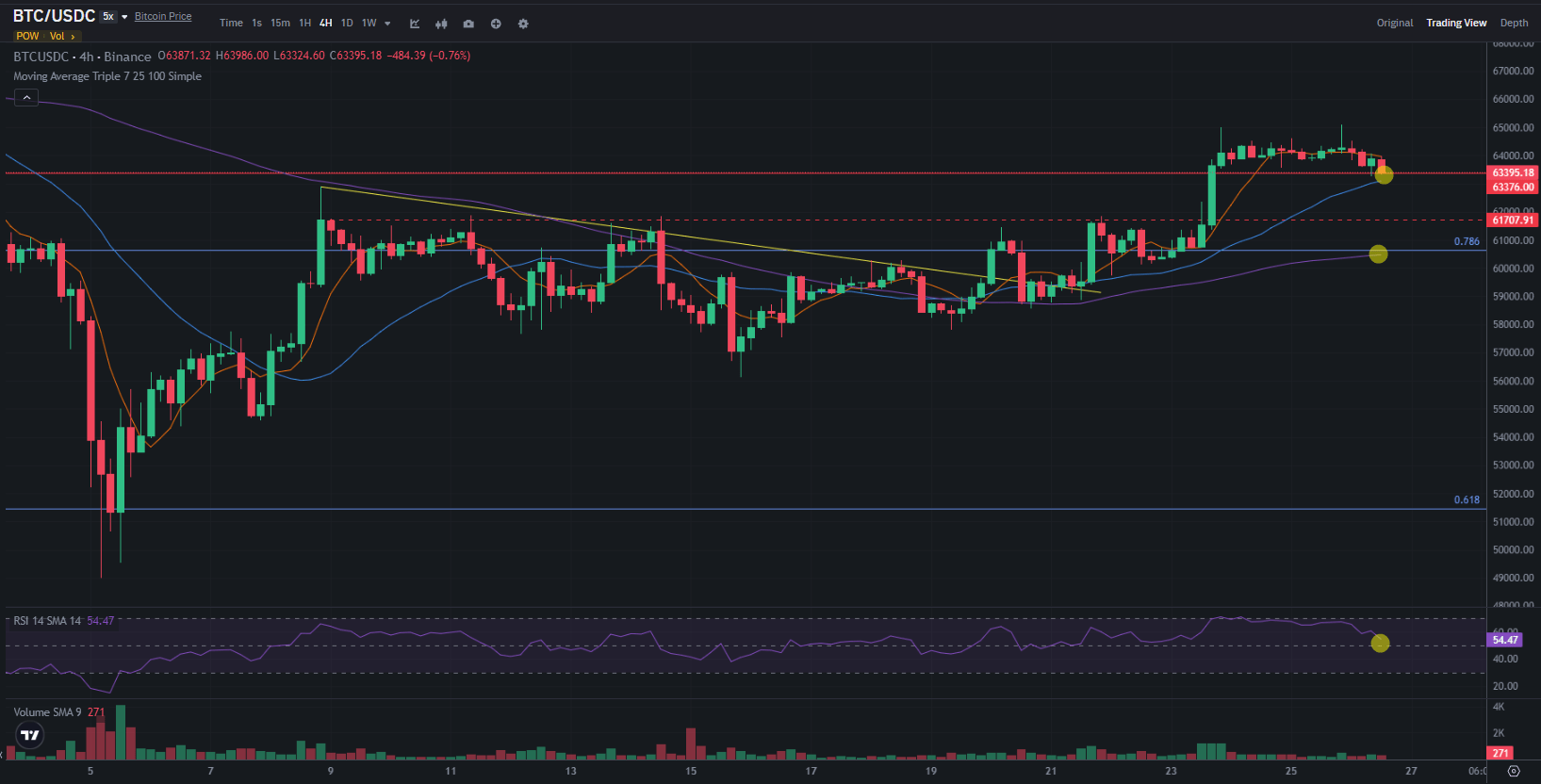

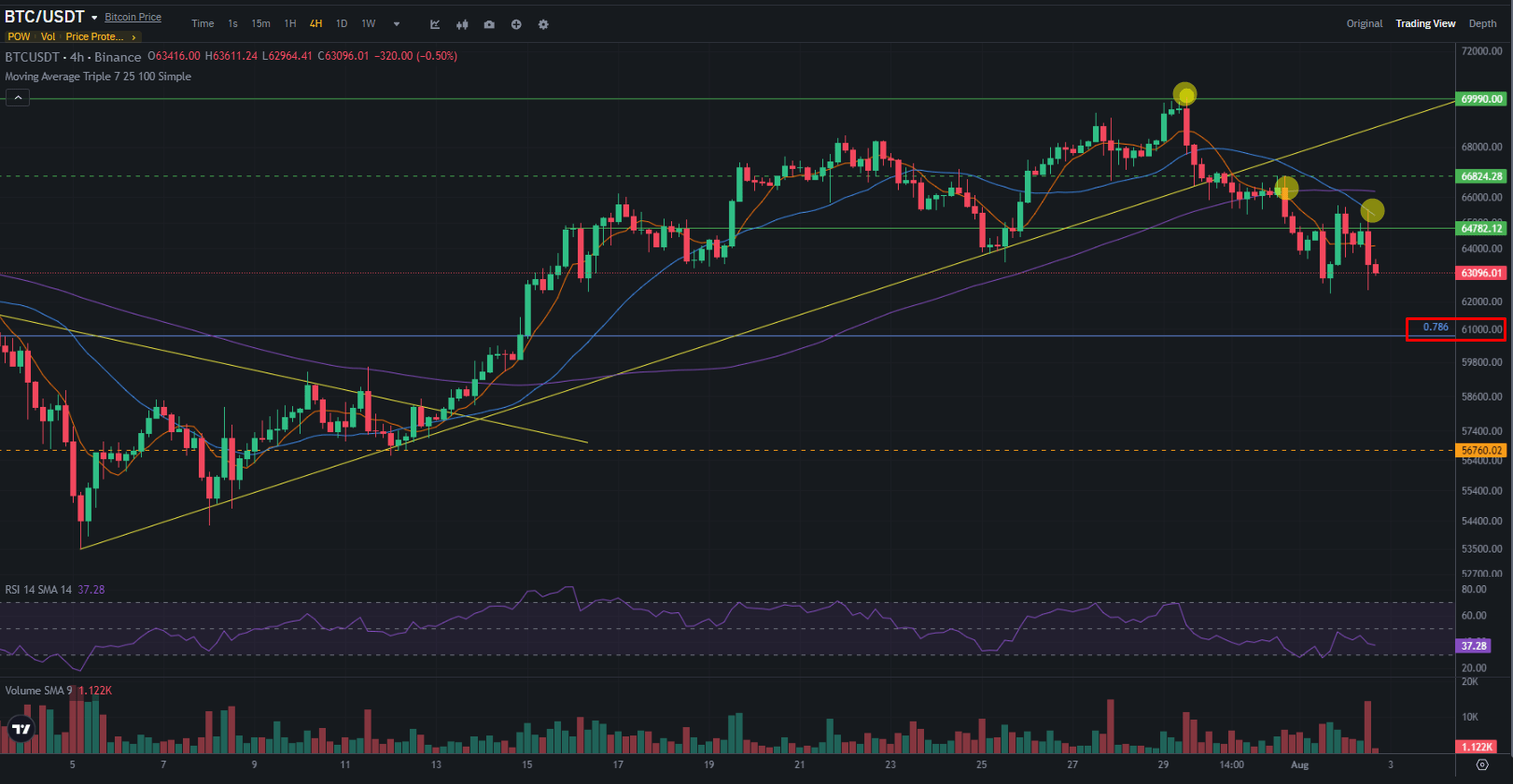

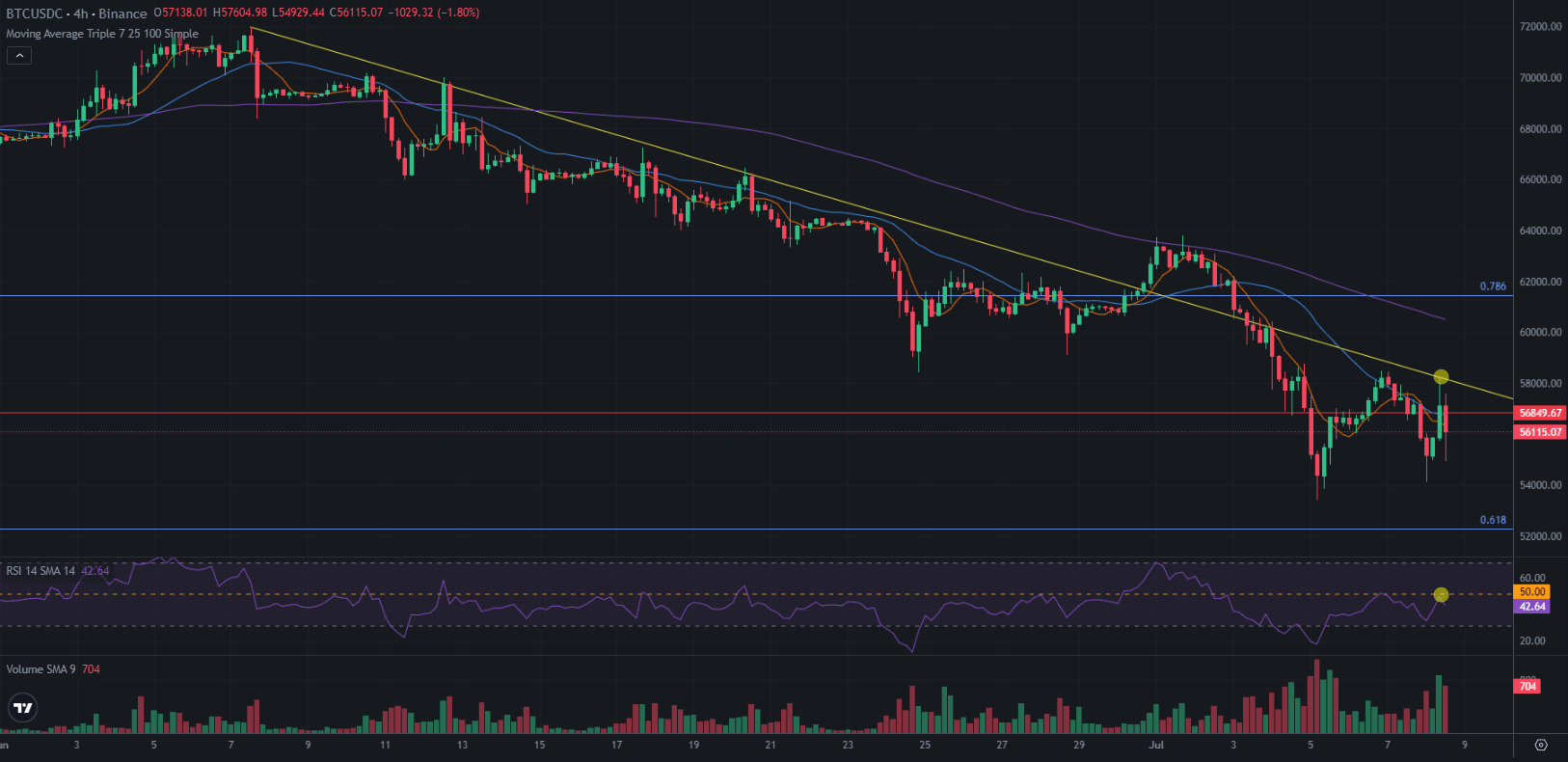

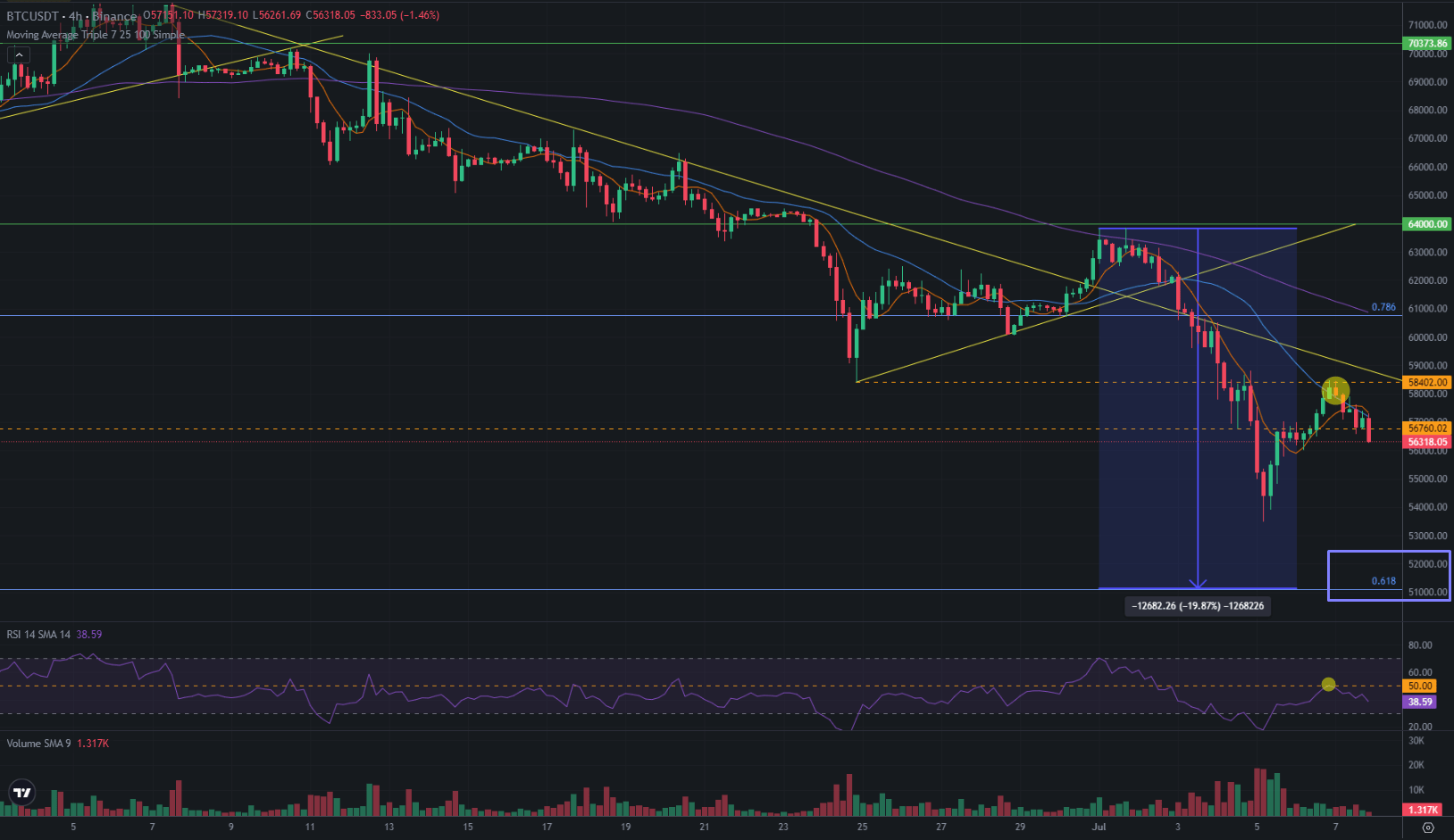

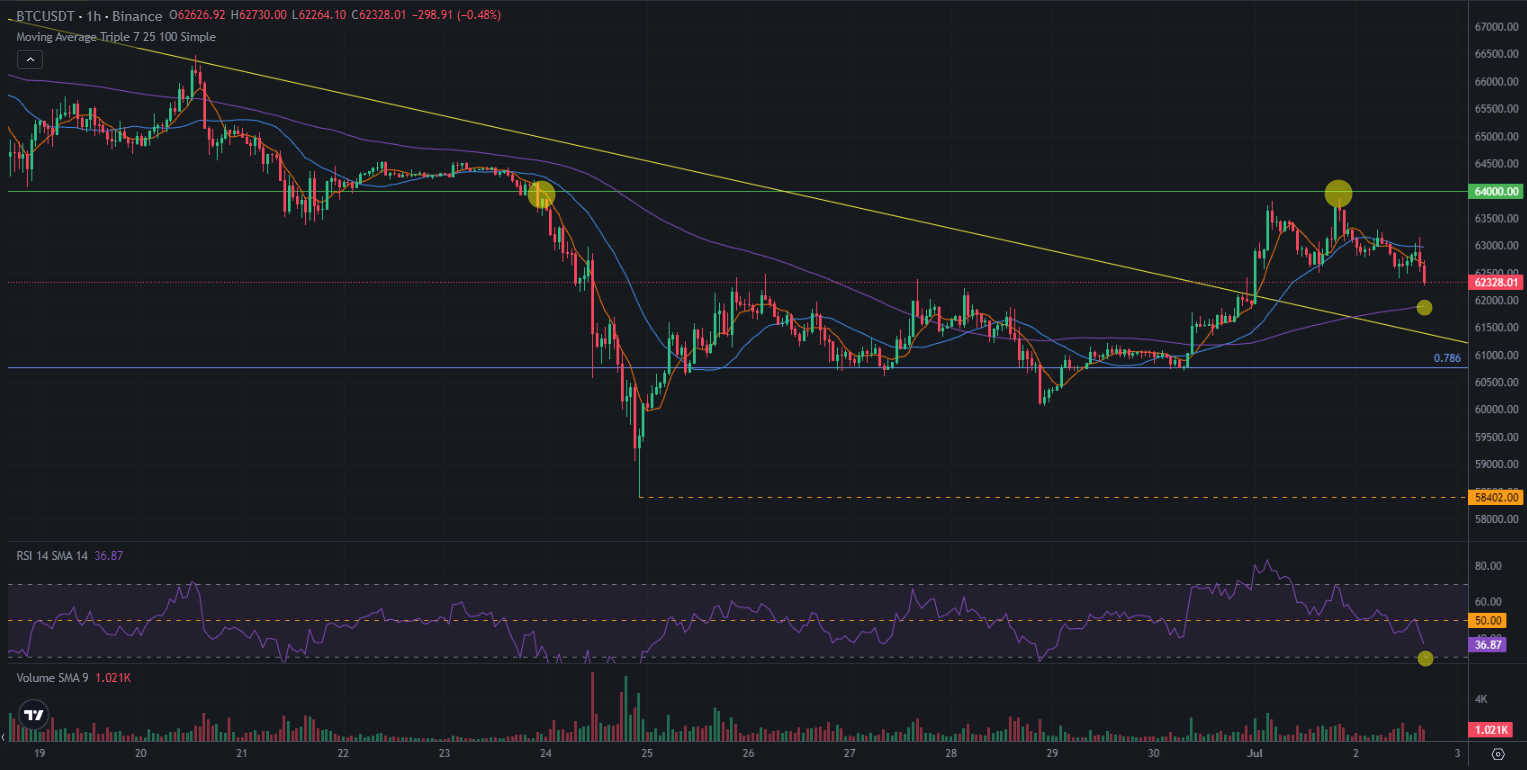

Generally, I don't stack sats unless we're in a clear upwards trend or I see a confirmed bounce which, at this moment of time, is still outstanding. We'll know if $64k will hold up in the next 8-16h but with miners transferring coins to the exchanges (adding to the sell pressure) and with shorts stacking the order books I doubt that $64k will hold and expect more of a tiny bounce when automated trading triggers at that level before it breaks downwards.

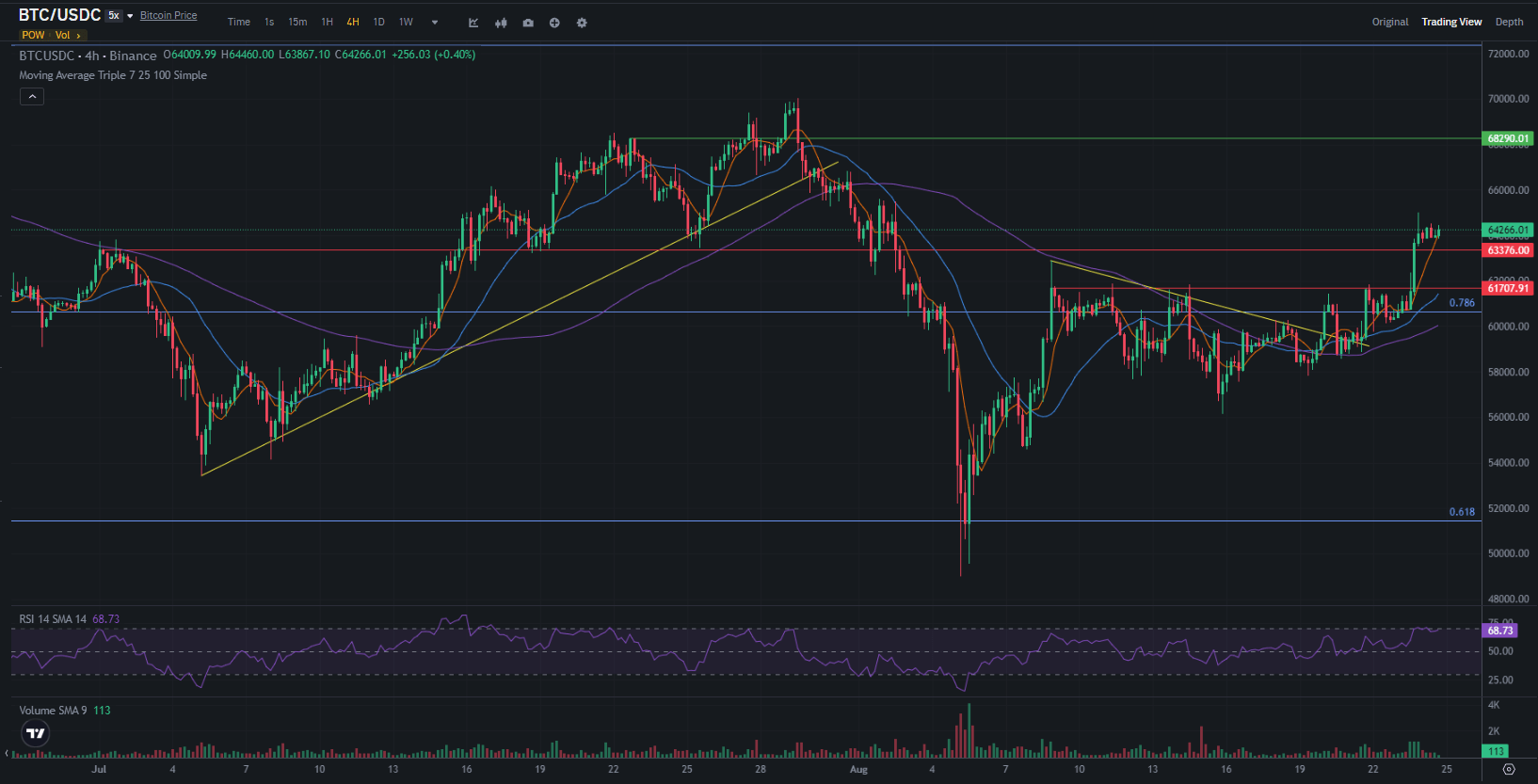

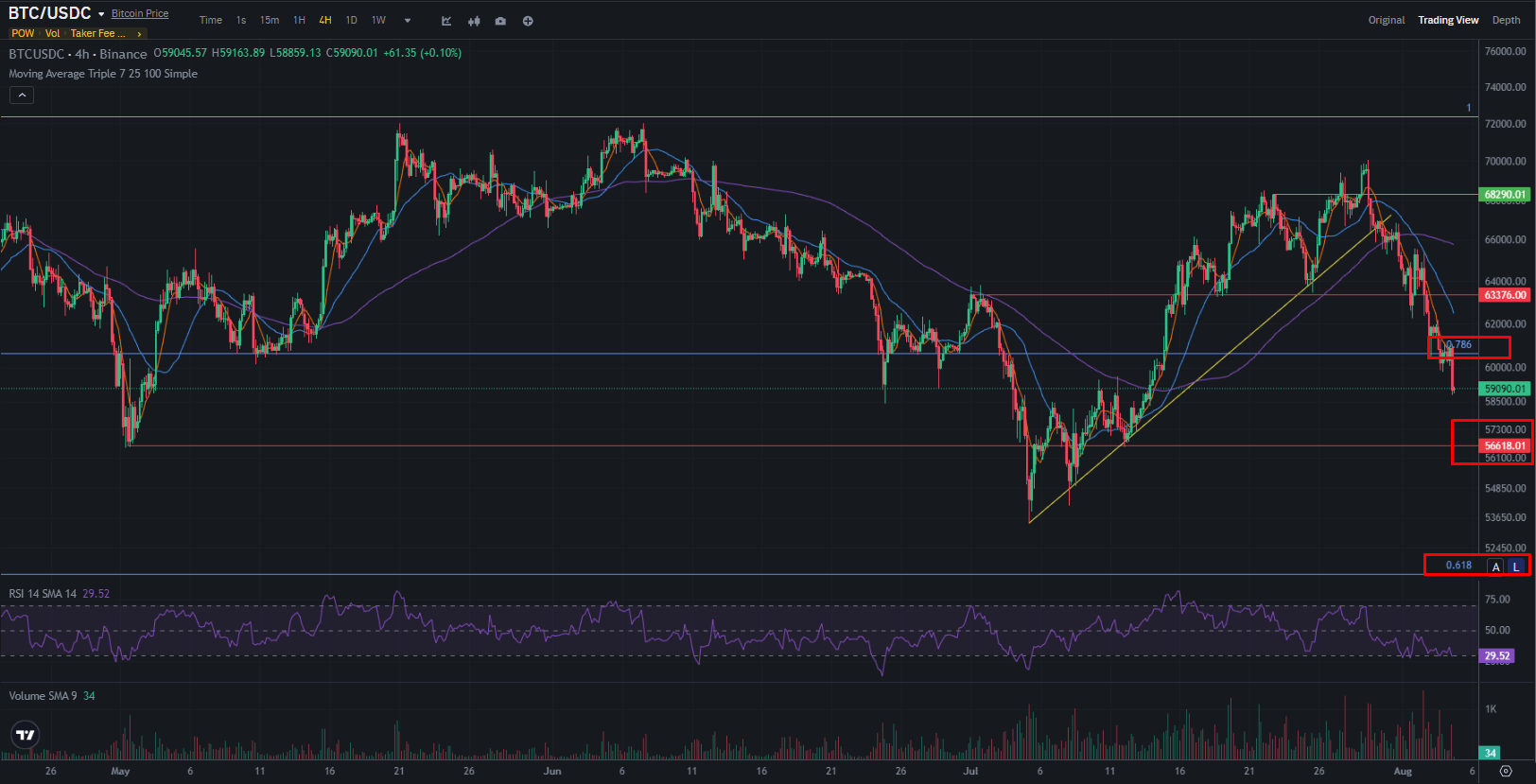

This could be very well the pre-summer vacation time retracement you're familiar with from previous cycles. As institutions, OTC and leveraged traders don't tend to leave their positions on the markets before the vacation time. They MUST zero-out their positions. Meaning they're neither long nor short. In addition institutional has to take gains on their long positions from last year. You know, when everyone was talking about a bear market while Bitcoin casually went up over 350%.

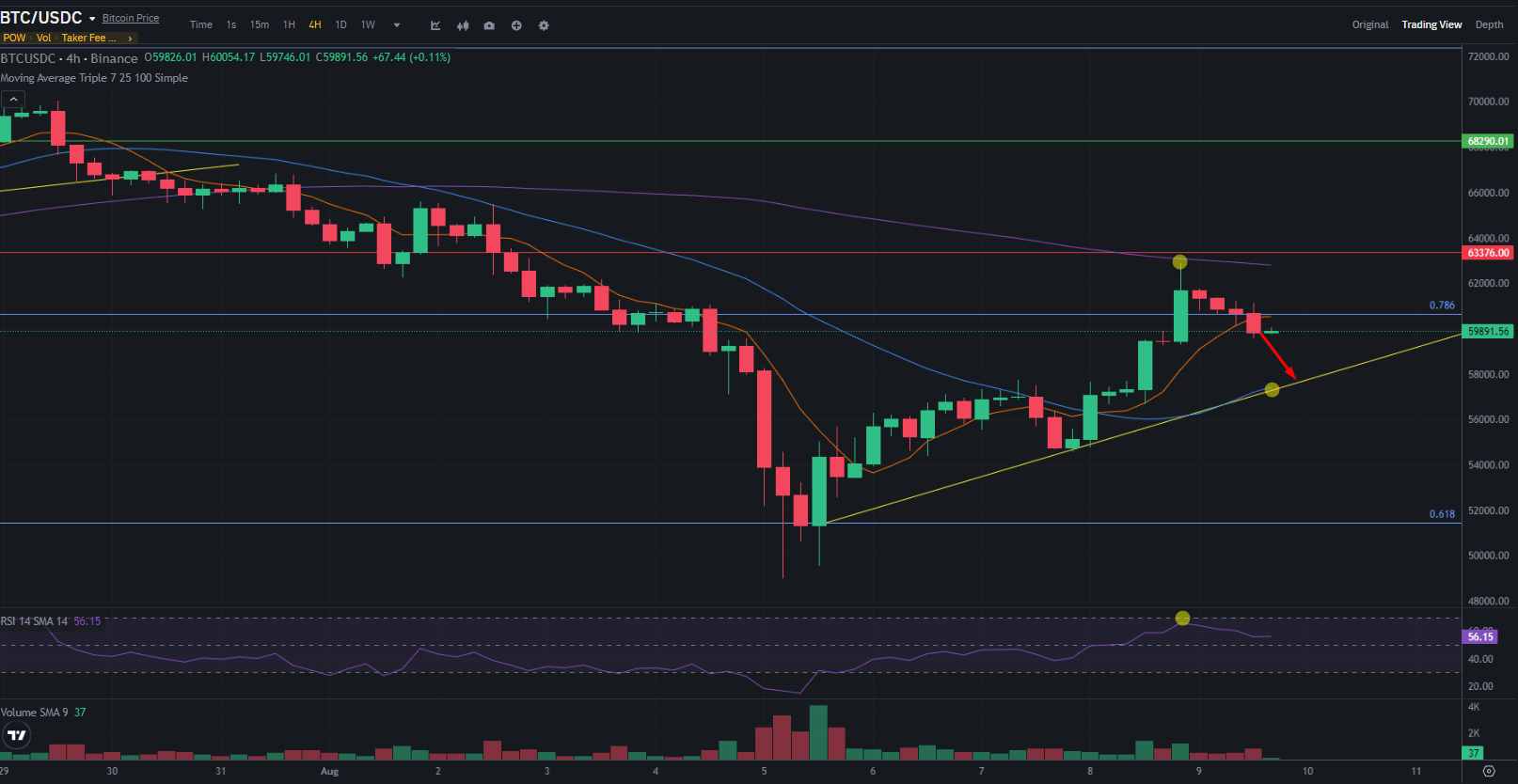

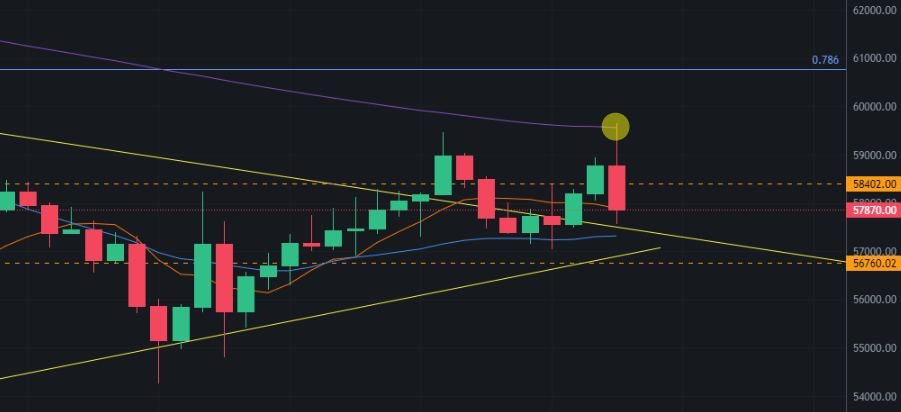

It's a good time to stack sats on upwards trends rather than on the way down or during tiny recoveries.

Generally, I don't stack sats unless we're in a clear upwards trend or I see a confirmed bounce which, at this moment of time, is still outstanding. We'll know if $64k will hold up in the next 8-16h but with miners transferring coins to the exchanges (adding to the sell pressure) and with shorts stacking the order books I doubt that $64k will hold and expect more of a tiny bounce when automated trading triggers at that level before it breaks downwards.

This could be very well the pre-summer vacation time retracement you're familiar with from previous cycles. As institutions, OTC and leveraged traders don't tend to leave their positions on the markets before the vacation time. They MUST zero-out their positions. Meaning they're neither long nor short. In addition institutional has to take gains on their long positions from last year. You know, when everyone was talking about a bear market while Bitcoin casually went up over 350%.

It's a good time to stack sats on upwards trends rather than on the way down or during tiny recoveries.