In a game like trading — where losses are inevitable — you don’t start by assuming you’re right.

You start by assuming you’re wrong, and let the market prove you correct.

Positions should be earned, not assumed.

You build into them only after confirmation, not before.

📉 If the market doesn't validate your trade, you reduce risk — or remove the position entirely.

📈 Only when the market confirms your thesis, do you let it grow.

Let the market speak.

Your job is not to be right — it’s to respond when you are.

Henrik Ekenberg

hekenberg@iris.to

npub1uh0f...ehtg

Trader // Small cap investor Sweden

Trading is a lonely journey — until the day your experience becomes someone else’s guide.

Your goal is simple: compound capital.

It doesn’t need to be fast —

Even slow, steady compounding creates real wealth over time.

But there’s one rule you can’t ignore:

❌ Eliminate big losses.

They destroy momentum and confidence.

You can’t afford to take one step forward and two steps back.

Protect your base. Grow with intention.

Many traders say, “I’m following the rules, but I’m not getting results.”

But what they’re often missing is this:

👉 Their sample size is too small.

They test on too little data.

They trade consistently for only a few setups.

Then they assign too much meaning to a few losses or a short losing streak.

But here’s the truth:

📊 Your sample size reflects your trading maturity.

It’s your ability to zoom out, stay consistent, and let the law of large numbers do the work.

Short-term results don’t validate a system — time and volume do.

I see people losing money in the markets every day because they think they "know enough" — and skip expert advice.

Look, I "know enough" about plumbing too…

Enough to flood my kitchen. Doesn’t mean I should touch the pipes.

If your trading strategy involves confidently handing over cash to strangers, congrats — maybe that’s the new definition of “knowing.”

But hey, who am I to judge?

🗣️ There’s a lot of talk about how the market will bounce after Trump’s comments…

But let’s be real — the market still looks weak.

Price action speaks louder than headlines.

Wait for strength to show up on the chart, not in the news.

Doing nothing isn’t laziness — it’s discipline.

📉 Patience shows you understand the game.

You can't just increase the number of trades at will — quality beats quantity in trading.

Never take trades that fall outside your system.

Every rushed entry damages the integrity of your trading data.

And if your data’s bad, probability can’t protect you.

🎯 Your goal?

Wait calmly. Execute only on high-quality setups that follow your rules.

Missed a trade? Let it go.

Chasing it only clouds your judgment.

One missed trade won’t ruin you — but one emotional trade might.

🧠 And remember:

High-quality doesn’t mean a winner.

It means a trade that aligns with your edge and your rules.

Stick to that, and time becomes your ally.

Trading while fearing losses is like trying to swim without getting wet — impossible.

Losses aren’t a flaw in the system — they’re part of it.

Stop chasing a 100% win rate. Instead, build a plan that embraces small, managed losses as part of the process.

💡 Profit isn’t the result of avoiding loss — it’s the reward for managing it well over time.

Follow-through day explained Apr 2025

#FTD

Smart traders don’t guess bottoms — they wait for the market to invite them back in

History doesn’t repeat itself—but it often rhymes. Is NVDA echoing Cisco, or ready to write its own path? #CSCO #NVDA

You won’t become the best trader by being right on small moves…

You’ll get there by learning to be wrong small.

✅ Small losses protect your capital.

✅ Big wins move your equity curve.

The real edge? Cutting losers fast, not chasing perfection.

"Buy the dip" börjar kosta mer och mer...

Varje nytt försök utan stöd från marknaden gräver djupare hål i portföljen.

Det handlar inte om att köpa billigt – det handlar om att köpa rätt.

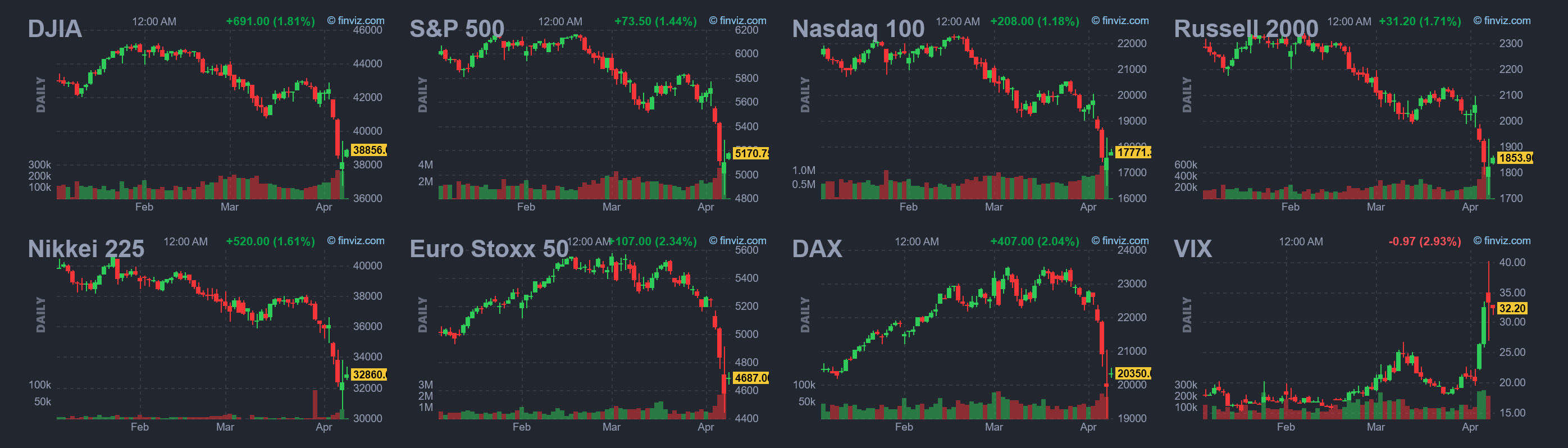

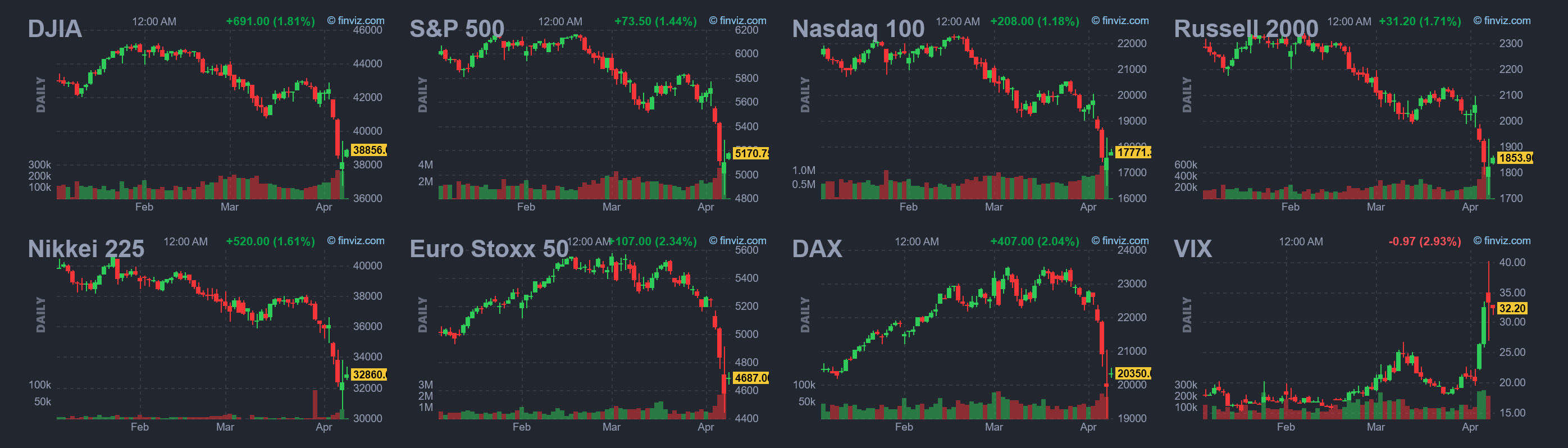

📊 We're about 1 hour from the European market open, and futures just turned green after being in the red just 1–2 hours ago.

Is this a real shift in sentiment—or just positioning ahead of the bell?

What does the market know that we don’t?

Stay alert. The first hour will tell us a lot.

📊 Historically, no bull market begins without a Follow-Through Day (FTD).

But here’s the catch: not all FTDs lead to a sustainable rally.

Just look at 2022—six FTDs failed before the market finally found a bottom.

FTDs are signals, not guarantees.

What matters is confirmation, strength, and leadership that follows.

Futures are green today....

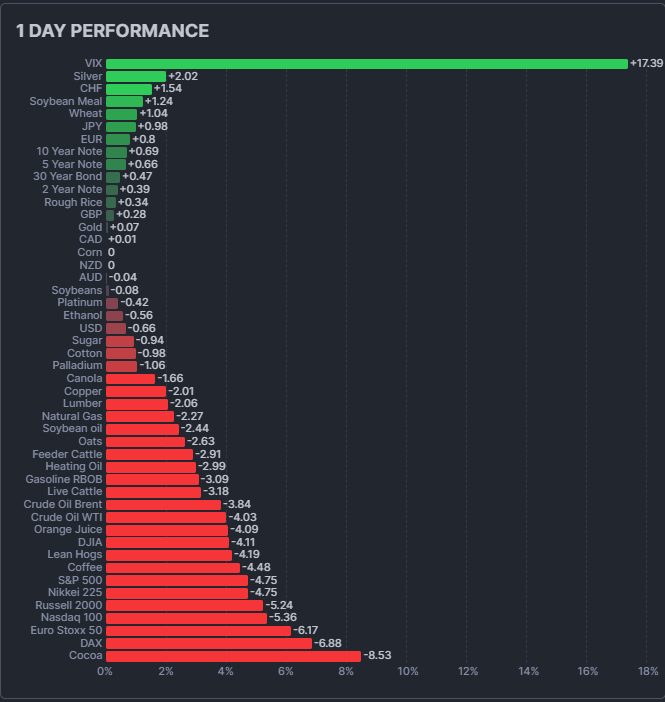

📉 The S&P 500 just posted its worst 3-day performance since October 1987.

Yes—since Black Monday.

This isn’t just volatility—it’s historic selling pressure.

In times like these, defense matters more than predictions.

#Finanstwitter

The recent significant declines in global stock markets and commodities like gold have indeed led to substantial margin calls among major investors. Hedge funds are experiencing their most significant margin calls since the onset of the COVID-19 crisis in 2020, as global markets reeled from the financial shockwaves caused by President Donald Trump's renewed tariff measures.

Gold prices have also been affected, dropping to a more-than-three-week low. This decline is attributed to investors liquidating bullion positions to cover losses in other assets.

Given the current market volatility and the potential for further declines, it's plausible that additional margin calls could occur if asset prices continue to fall. Investors should monitor market developments closely and consider risk management strategies to navigate this period of heightened uncertainty.

Why Most Investors Should Be Patient: The Impact of Tariffs, FOMO, and Rational Investing https://njump.me/naddr1qvzqqqr4gupzpew7nyhy6rva9qvuznjfv2nq4ru7dax5f83xyfkpjn7wva9ftmu9qyw8wumn8ghj7cn4vd4k2apwvdhhyctrd3jjuum0vd5kzmp0qythwumn8ghj7un9d3shjt3s0p3ksct59e3k7mf0qq2k6aehd4dyc3rjdpvrzve3g92hquzxdeh5v6sf6hw

#Market