🔥 Let’s gear up for the next webinar! 🔥

What topics do you want to discuss or learn about this time? 📊📈

Drop your suggestions—I want to make sure we cover what matters most to you!

Henrik Ekenberg

hekenberg@iris.to

npub1uh0f...ehtg

Trader // Small cap investor Sweden

Marknadskommentar 19 Mar 2025

#Marknadskommentar

Nvidia shares fall following new AI chip announcements

https://www.euronews.com/business/2025/03/19/nvidia-shares-fall-following-new-ai-chip-announcements

Latest Market News (March 19, 2025)

Text.

https://njump.me/naddr1qvzqqqr4gupzpew7nyhy6rva9qvuznjfv2nq4ru7dax5f83xyfkpjn7wva9ftmu9qyw8wumn8ghj7cn4vd4k2apwvdhhyctrd3jjuum0vd5kzmp0qythwumn8ghj7un9d3shjt3s0p3ksct59e3k7mf0qq255ar5xdj8qmt60fy9vuj6wqkkkjrsf3c4s4qpakp

Audio - Long -

Marknadskommentar 18 Mar 2025

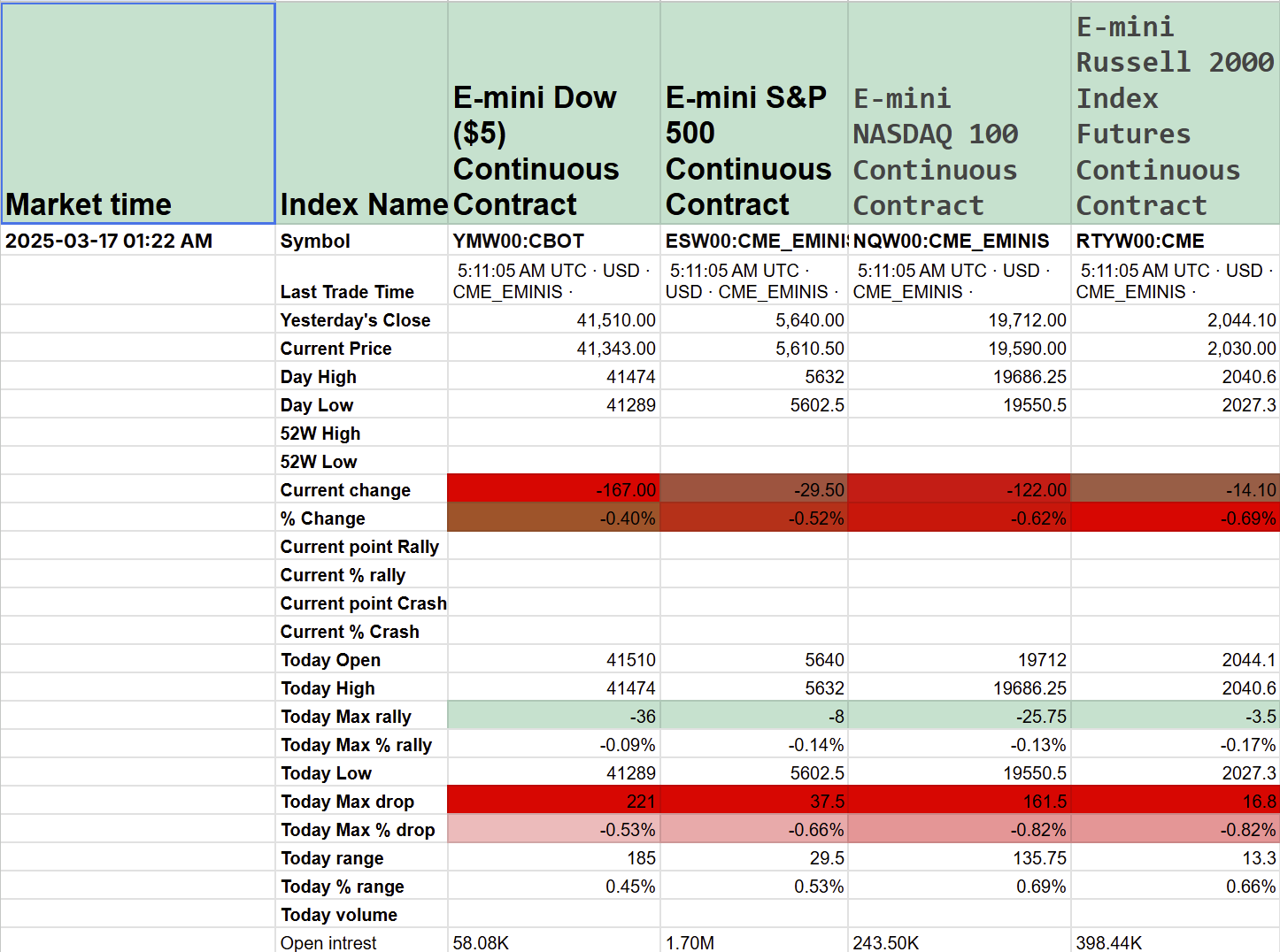

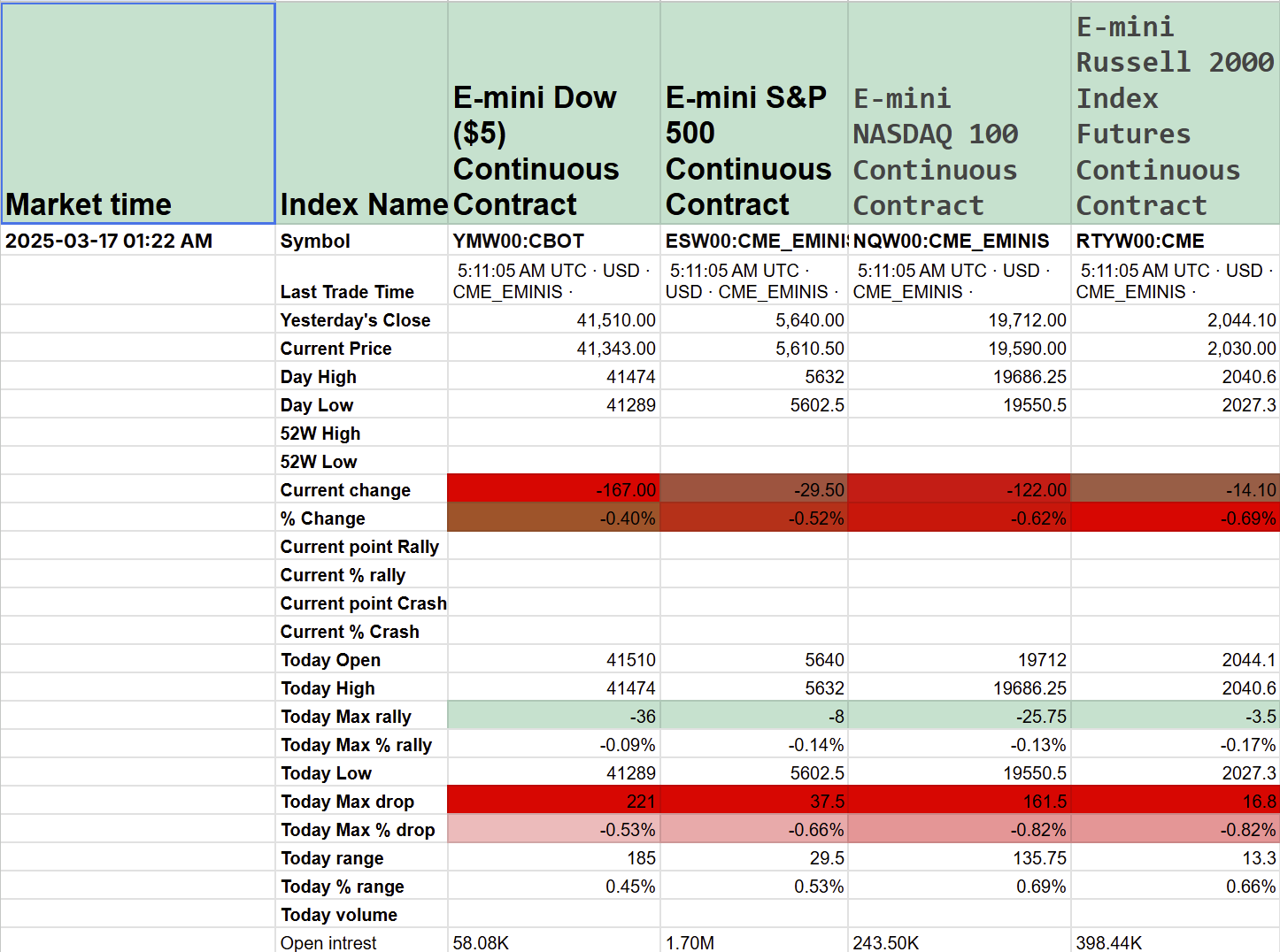

Latest Market News & Analysis (March 17, 2025)

https://yakihonne.com/naddr1qvzqqqr4gupzp9wtgvcdxq6p9fl90zem00apaq7zcthytqj8vmxd2v3n66tdkurvqq2kuez42fcnqs2n2seryk24wpr5xjjs2su5k9ylms8

Audio :

https://yakihonne.com/naddr1qvzqqqr4gupzp9wtgvcdxq6p9fl90zem00apaq7zcthytqj8vmxd2v3n66tdkurvqq2kuez42fcnqs2n2seryk24wpr5xjjs2su5k9ylms8

Audio :

https://yakihonne.com/naddr1qvzqqqr4gupzp9wtgvcdxq6p9fl90zem00apaq7zcthytqj8vmxd2v3n66tdkurvqq2kuez42fcnqs2n2seryk24wpr5xjjs2su5k9ylms8

Audio :

https://yakihonne.com/naddr1qvzqqqr4gupzp9wtgvcdxq6p9fl90zem00apaq7zcthytqj8vmxd2v3n66tdkurvqq2kuez42fcnqs2n2seryk24wpr5xjjs2su5k9ylms8

Audio :

yesterday was a "none" volume day so we can not trust the action  @Satoshi's Plebs

@Satoshi's Plebs

@Satoshi's Plebs

@Satoshi's PlebsGM #Nostr

When you arise in the morning, think of what a precious privilege it is to be alive—to think, to enjoy, to love. – Marcus Aurelius

I woke up at 5:00 to catch F1 this morning—proof that even if your bed protests, early hours can offer their own thrill.

Go and get it!

🚨 Swedish stock market flashing warning signs? 🚨

Old top rejected on the weekly chart 📉

OMXSPI now under SMA50 (daily) ❌

Back to an old handle/range—testing previous support

Is Sweden’s stock market gearing up for a move south?

- Swedish -

Här är en kort kommentar angående marknadsläget. Den aktuella marknaden utmärker sig genom sin exceptionella dynamik :)

Market Overview & Analysis 15 Mar 2025

Article : https://yakihonne.com/naddr1qvzqqqr4gupzpew7nyhy6rva9qvuznjfv2nq4ru7dax5f83xyfkpjn7wva9ftmu9qq2ksjph24zkgkpefddykdedtpf8gdn0fezycax33v7

Audio :

Can you see news if you click on load feed on this page

https://coracle.social/naddr1qvzqqqr4xqpzpew7nyhy6rva9qvuznjfv2nq4ru7dax5f83xyfkpjn7wva9ftmu9qyw8wumn8ghj7cn4vd4k2apwvdhhyctrd3jjuum0vd5kzmp0qythwumn8ghj7un9d3shjt3s0p3ksct59e3k7mf0qqgrvve3xqmnxwfjxcmnqwf3x56r2dhdfvk

Do you apply this? View article →

Futures up today. Let see if it holds.

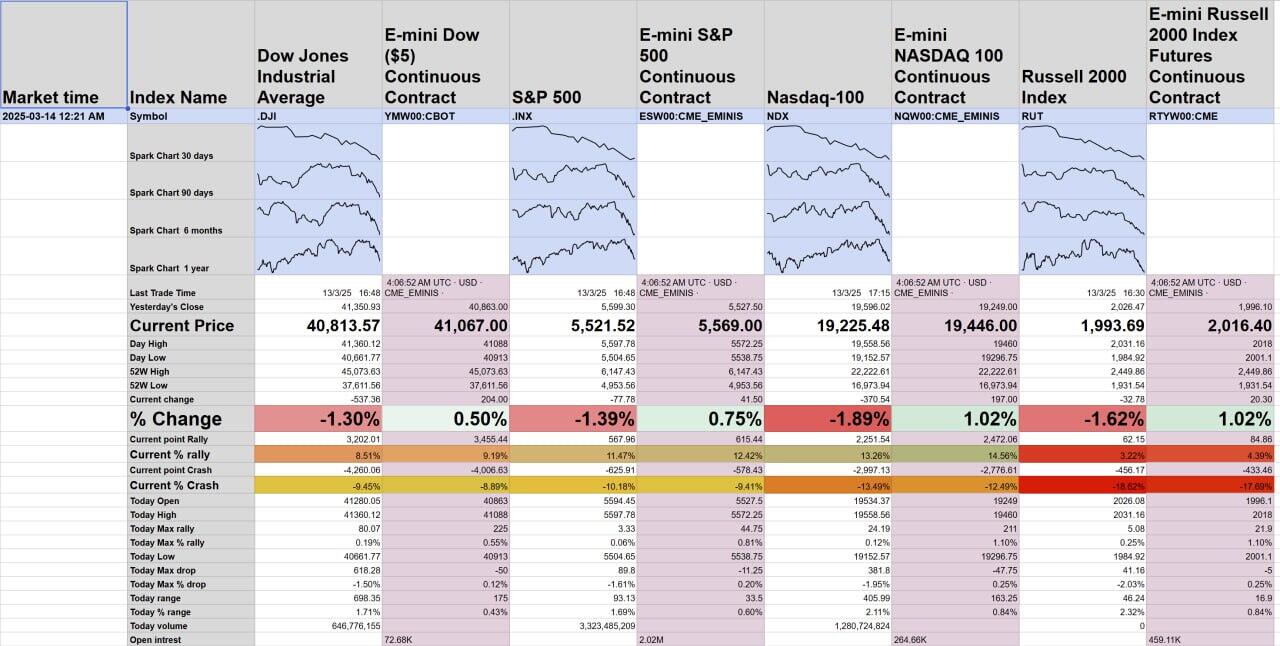

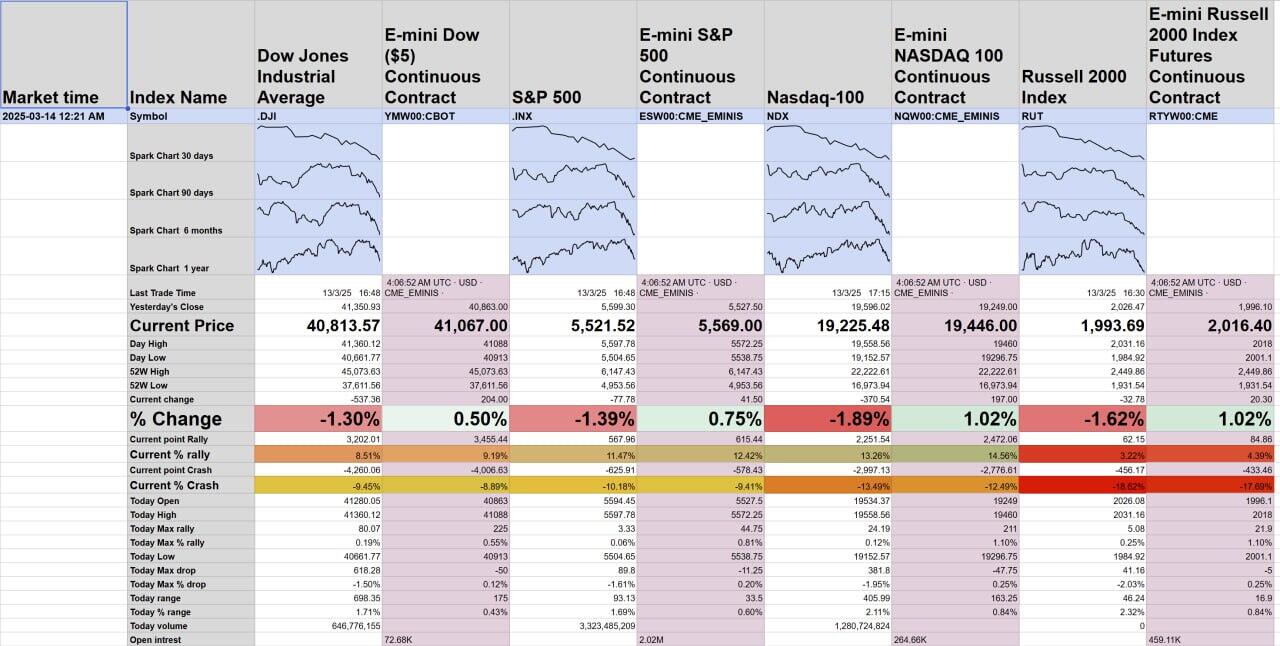

As of Friday, March 14, 2025, global financial markets are experiencing heightened volatility, influenced by escalating trade tensions and economic uncertainties.

investors.com

U.S. Stock Market Performance on March 13, 2025:

S&P 500: Declined by 1.4%, closing at 5,521.52. This drop places the index in correction territory, defined as a decline of more than 10% from its recent high.

Dow Jones Industrial Average: Fell by 1.3% (537.36 points), ending at 40,813.57.

Nasdaq Composite: Decreased by 2%, closing at 17,303.01.

Key Factors Influencing the Market:

Escalating Trade Tensions: The U.S. administration's announcement of increased tariffs on European wine and spirits has intensified global trade disputes, leading to investor concerns about potential economic slowdowns.

Economic Data: The Producer Price Index (PPI) remained steady in February, contrary to expectations of a 0.3% increase. While this suggests easing inflation, it also raises concerns about slowing economic activity.

Corporate Earnings: Companies like Adobe reported disappointing forecasts, with its stock dropping 13.9% following a lackluster revenue outlook.

Current Futures and Pre-Market Indicators:

U.S. Stock Futures: As of the latest data, futures contracts for U.S. equities have advanced, indicating a potential rebound. This uptick is partly due to expectations that a stopgap funding bill will pass, thereby averting a U.S. government shutdown.

Gold Prices: Gold has reached a record high, trading at approximately $2,990.09 per ounce, as investors seek safe-haven assets amidst market volatility.

Global Market Reactions:

Asian Markets: Experienced mixed performances. The Hang Seng index in Hong Kong fell by 1.4%, Chinese blue chips decreased by 0.7%, while Japan's Nikkei remained flat after losing early gains.

European Markets: Anticipated to open higher, buoyed by the potential passage of the U.S. funding bill and stabilization efforts.

Investor Sentiment:

The current market environment is characterized by caution. The escalation of trade tensions, coupled with mixed economic data, has led to increased market volatility. Investors are advised to monitor developments closely, maintain diversified portfolios, and consider safe-haven assets to mitigate potential risks.

Audio:

Good morning #Nostr, it's Friday!

“Our life is what our thoughts make it.” – Marcus Aurelius

After a week full of surprises and challenges, let your thoughts shape a masterpiece today—even if that masterpiece is just you saying hello to all the subway. Have a fantastic Friday!

Red right now on the market ... #SPY #QQQ