Red right now on the market ... #SPY #QQQ

As of Wednesday, March 12, 2025, global financial markets are navigating a complex landscape shaped by geopolitical developments, trade tensions, and economic indicators.

U.S. Stock Futures:

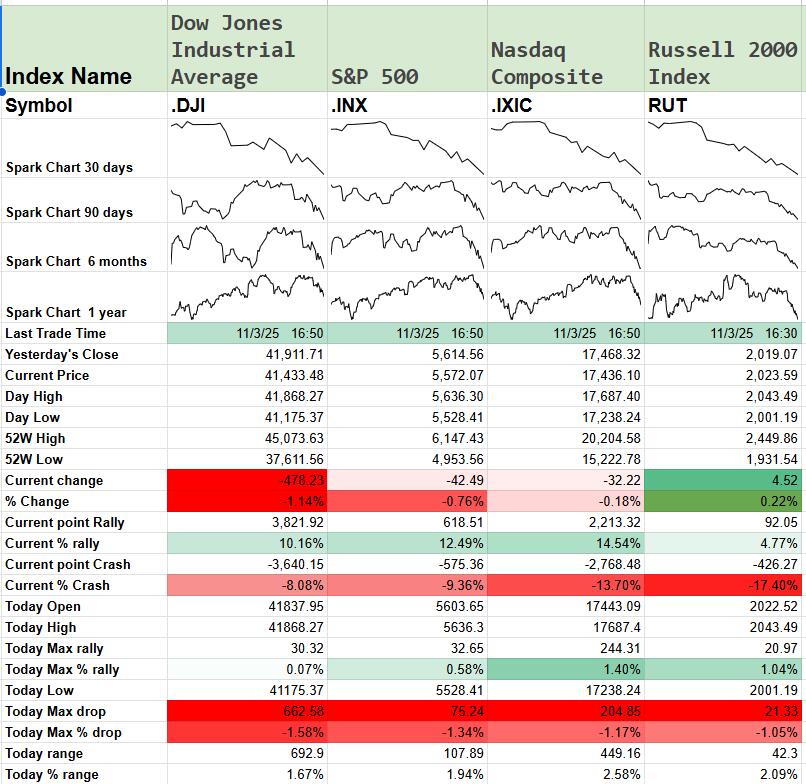

Dow Jones Industrial Average :Declined with -1.14%, reflecting ongoing investor concerns over trade policies and economic growth.

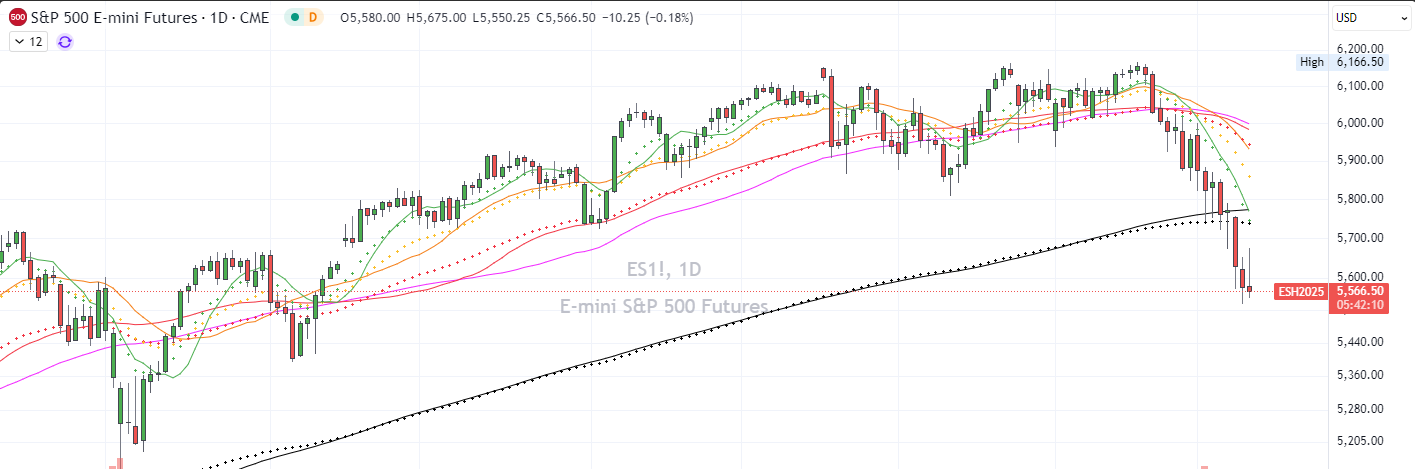

S&P 500 Futures: Declined -0.76%, indicating potential challenges for the broader market.

Nasdaq-100 Futures: Fell by -0.18%, suggesting continued volatility in the technology sector.

Key Market Influencers:

Trade Tensions with Canada: President Trump's announcement to double tariffs on Canadian steel and aluminum imports to 50% has heightened fears of a trade war, contributing to market instability.

Geopolitical Developments in Ukraine: A proposed month-long ceasefire in Ukraine has led to a surge in the euro, reaching a five-month high, and positively impacted European equity futures.

Central Bank Policies: Divergent approaches among central banks are influencing investor sentiment. While the European Central Bank has implemented rate cuts to address economic stagnation, the U.S. Federal Reserve maintains a conservative stance, focusing on controlling inflation.

Global Market Reactions:

Asian Markets: Exhibited mixed performances; Japan's Nikkei 225 and Hong Kong's Hang Seng indexes posted modest gains, while Australia's ASX 200 experienced a notable decline.

European Markets: Anticipated to open higher, buoyed by the potential Ukraine ceasefire and the euro's strength.

Sector Highlights:

Technology: Companies like Tesla, Nvidia, and Palantir have seen temporary rebounds amid recent losses, reflecting ongoing volatility within the sector.

Travel and Leisure: Stocks in this sector have declined following profit warnings from major airlines, signaling potential challenges ahead.

Analyst Insights:

Goldman Sachs: The firm has revised its year-end target for the S&P 500 down to 6,200 from 6,500, citing economic uncertainties.

Asset Managers: Concerns are being raised over the increasing frequency of share buybacks, prompting a probe by the Financial Conduct Authority.

Investor Guidance:

Given the current environment of heightened volatility and uncertainty, investors are advised to exercise caution, maintain diversified portfolios, and stay informed about ongoing geopolitical and economic developments.

Audio

As of Wednesday, March 12, 2025, global financial markets are navigating a complex landscape shaped by geopolitical developments, trade tensions, and economic indicators.

U.S. Stock Futures:

Dow Jones Industrial Average :Declined with -1.14%, reflecting ongoing investor concerns over trade policies and economic growth.

S&P 500 Futures: Declined -0.76%, indicating potential challenges for the broader market.

Nasdaq-100 Futures: Fell by -0.18%, suggesting continued volatility in the technology sector.

Key Market Influencers:

Trade Tensions with Canada: President Trump's announcement to double tariffs on Canadian steel and aluminum imports to 50% has heightened fears of a trade war, contributing to market instability.

Geopolitical Developments in Ukraine: A proposed month-long ceasefire in Ukraine has led to a surge in the euro, reaching a five-month high, and positively impacted European equity futures.

Central Bank Policies: Divergent approaches among central banks are influencing investor sentiment. While the European Central Bank has implemented rate cuts to address economic stagnation, the U.S. Federal Reserve maintains a conservative stance, focusing on controlling inflation.

Global Market Reactions:

Asian Markets: Exhibited mixed performances; Japan's Nikkei 225 and Hong Kong's Hang Seng indexes posted modest gains, while Australia's ASX 200 experienced a notable decline.

European Markets: Anticipated to open higher, buoyed by the potential Ukraine ceasefire and the euro's strength.

Sector Highlights:

Technology: Companies like Tesla, Nvidia, and Palantir have seen temporary rebounds amid recent losses, reflecting ongoing volatility within the sector.

Travel and Leisure: Stocks in this sector have declined following profit warnings from major airlines, signaling potential challenges ahead.

Analyst Insights:

Goldman Sachs: The firm has revised its year-end target for the S&P 500 down to 6,200 from 6,500, citing economic uncertainties.

Asset Managers: Concerns are being raised over the increasing frequency of share buybacks, prompting a probe by the Financial Conduct Authority.

Investor Guidance:

Given the current environment of heightened volatility and uncertainty, investors are advised to exercise caution, maintain diversified portfolios, and stay informed about ongoing geopolitical and economic developments.

Audio

#market

#market

#BTCUSD #bitcoin #BTC

#BTCUSD #bitcoin #BTC