Bitcoin miners are not miners, they are engines. Engines that convert electricity into digital scarcity and heat. This is the definition of an engine, it converts low entropy energy into higher entropy energy, usually for a specific purpose.

FOU

freeonlineuser@primal.net

npub1myh7...mpph

#Bitcoin ₿ is humanity’s best hope - Brisbane #Austrich

Notes (12)

Anyone else trying to keep followers:following ratio roughly even?

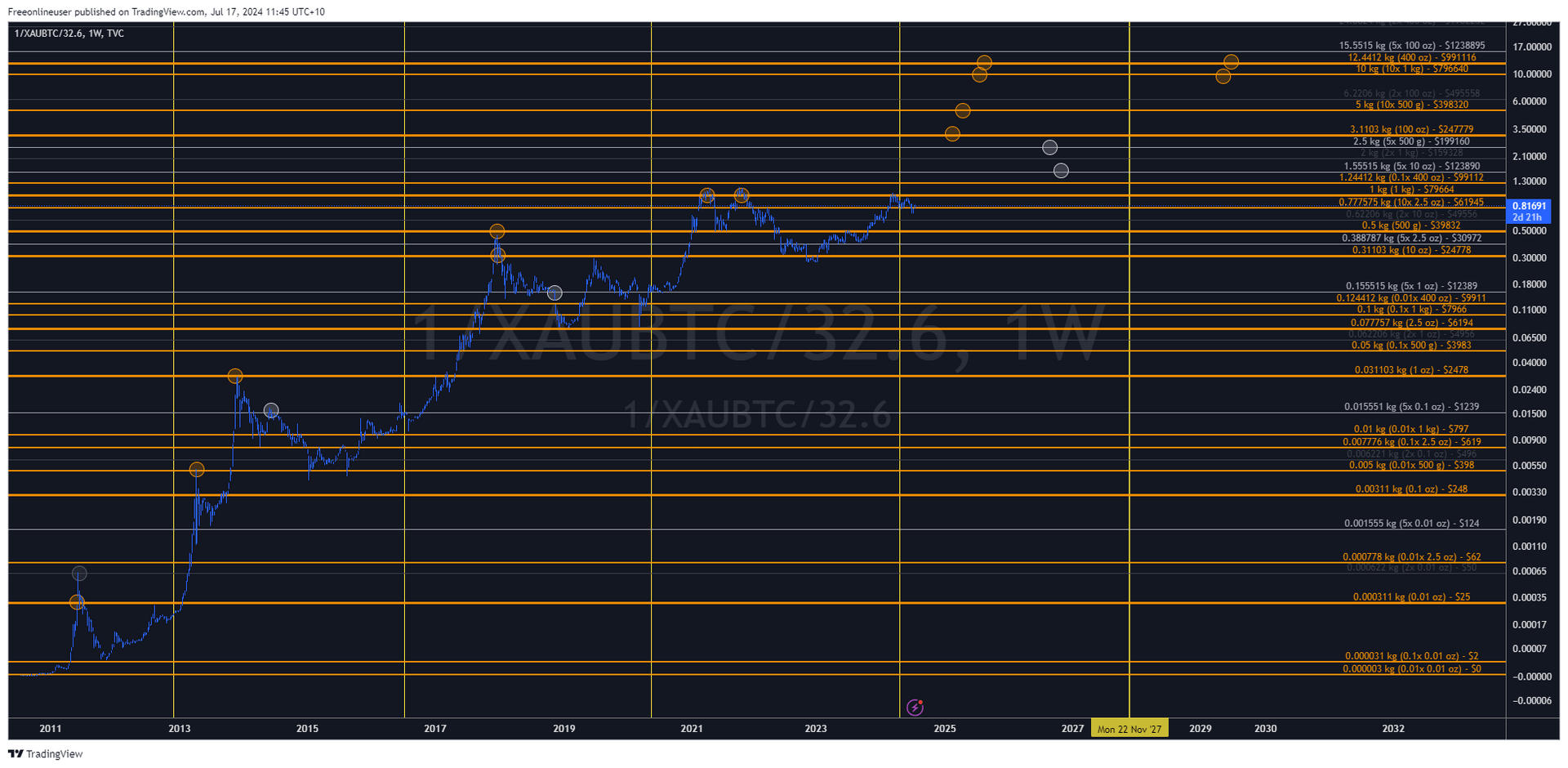

This is a chart of bitcoin unit bias intersecting with gold unit bias. Enjoy.

The transition from gold to the worlds hardest money will happen at a speed determined by the issuance rate set by Satoshi in the bitcoin code. It's clear to me from this chart that during this transition humans will continue to use phycological biases to decide how to enter this new asset class. A trader sees they can buy a 1oz gold bar for 1btc and takes the trade.

The future circles are not a prediction, just an example of how these levels may come into play in the future bull runs. $1M btc could occur in the next cycle or two. Gold is represented in kg on the y axis, and the prices on each line are based on current gold price.

This is a pine script indicator I built for myself in tradingview. It shows commonly traded gold units, and the major multiples and division of these units. I made a similar indicator that I enjoy, that represents the same lines as they move dynamically with gold price on the standard btcusd chart.

This is a chart of bitcoin unit bias intersecting with gold unit bias. Enjoy.

The transition from gold to the worlds hardest money will happen at a speed determined by the issuance rate set by Satoshi in the bitcoin code. It's clear to me from this chart that during this transition humans will continue to use phycological biases to decide how to enter this new asset class. A trader sees they can buy a 1oz gold bar for 1btc and takes the trade.

The future circles are not a prediction, just an example of how these levels may come into play in the future bull runs. $1M btc could occur in the next cycle or two. Gold is represented in kg on the y axis, and the prices on each line are based on current gold price.

This is a pine script indicator I built for myself in tradingview. It shows commonly traded gold units, and the major multiples and division of these units. I made a similar indicator that I enjoy, that represents the same lines as they move dynamically with gold price on the standard btcusd chart.

When nationstates adopt bitcoin they won’t need to charge taxes.

Just a thought - If you find yourself relating to a tv character, it might be because a tv writer fully understands and can describe a simple psychological delusion, and you are currently stuck in this particular delusion. To some you might come across as an NPC. This idea attracts me to eccentric people, and to behaving with more eccentricity.

Digitally Tangible

Power law concept has been gaining traction for #bitcoin. This is why I think the concept is overly simplistic, and it breaks to the upside. https://open.substack.com/pub/freeonlineuser/p/navigating-tipping-points-from-diminishing

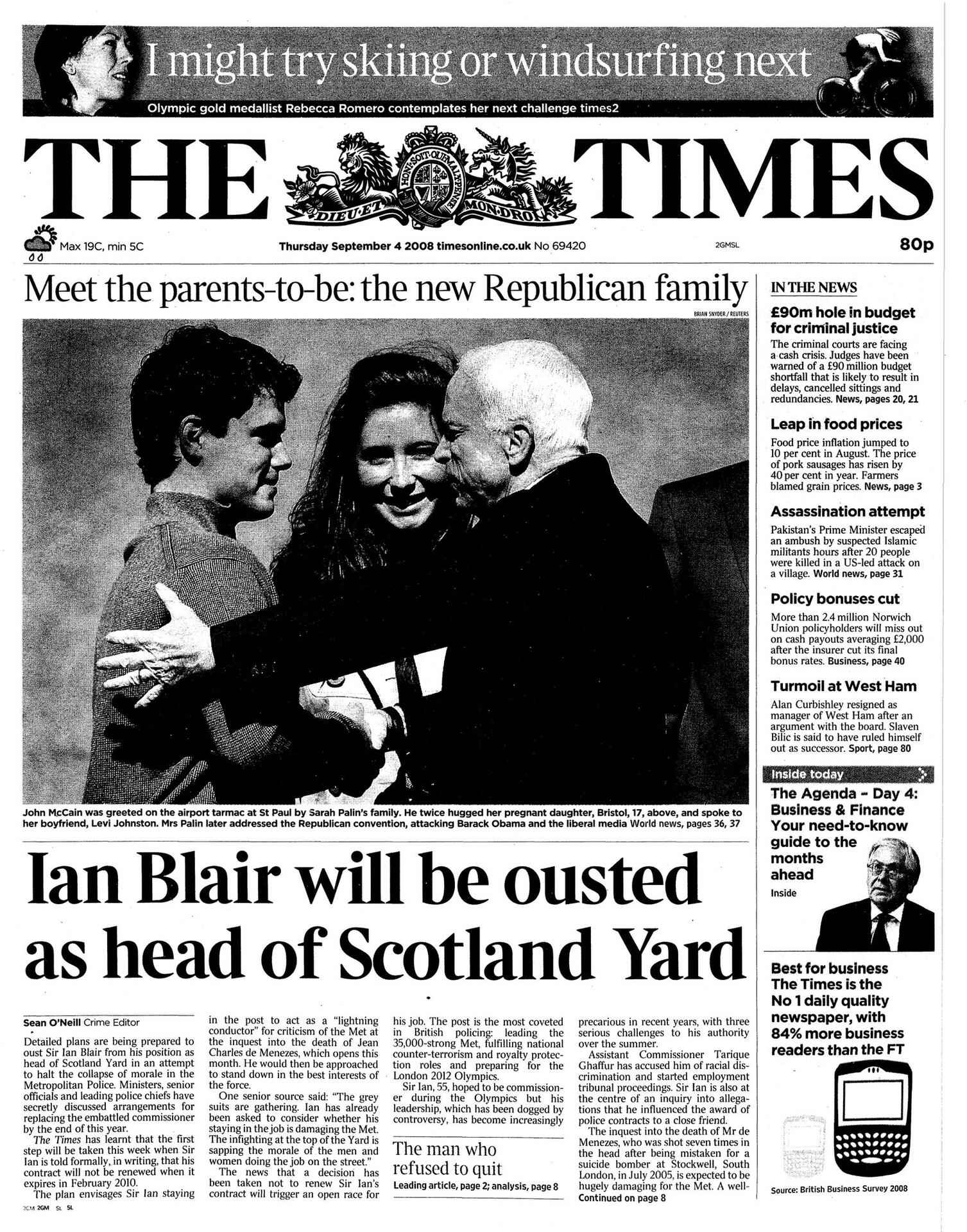

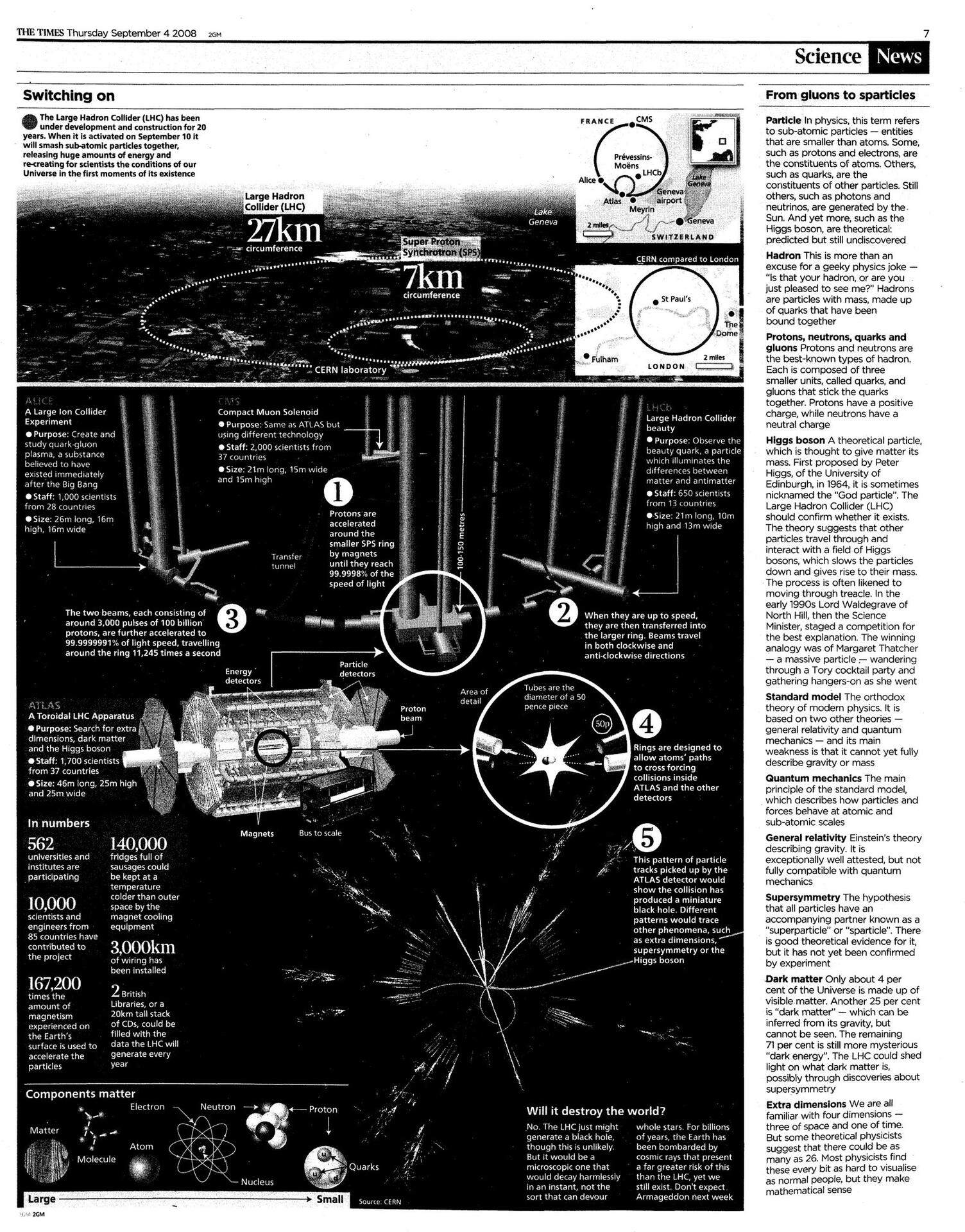

Jan 3rd 2009 The Times newspaper print 69523 was referenced in #Bitcoin genesis block

Significantly, 121 days prior that date was Sep 4 2008 print 69420

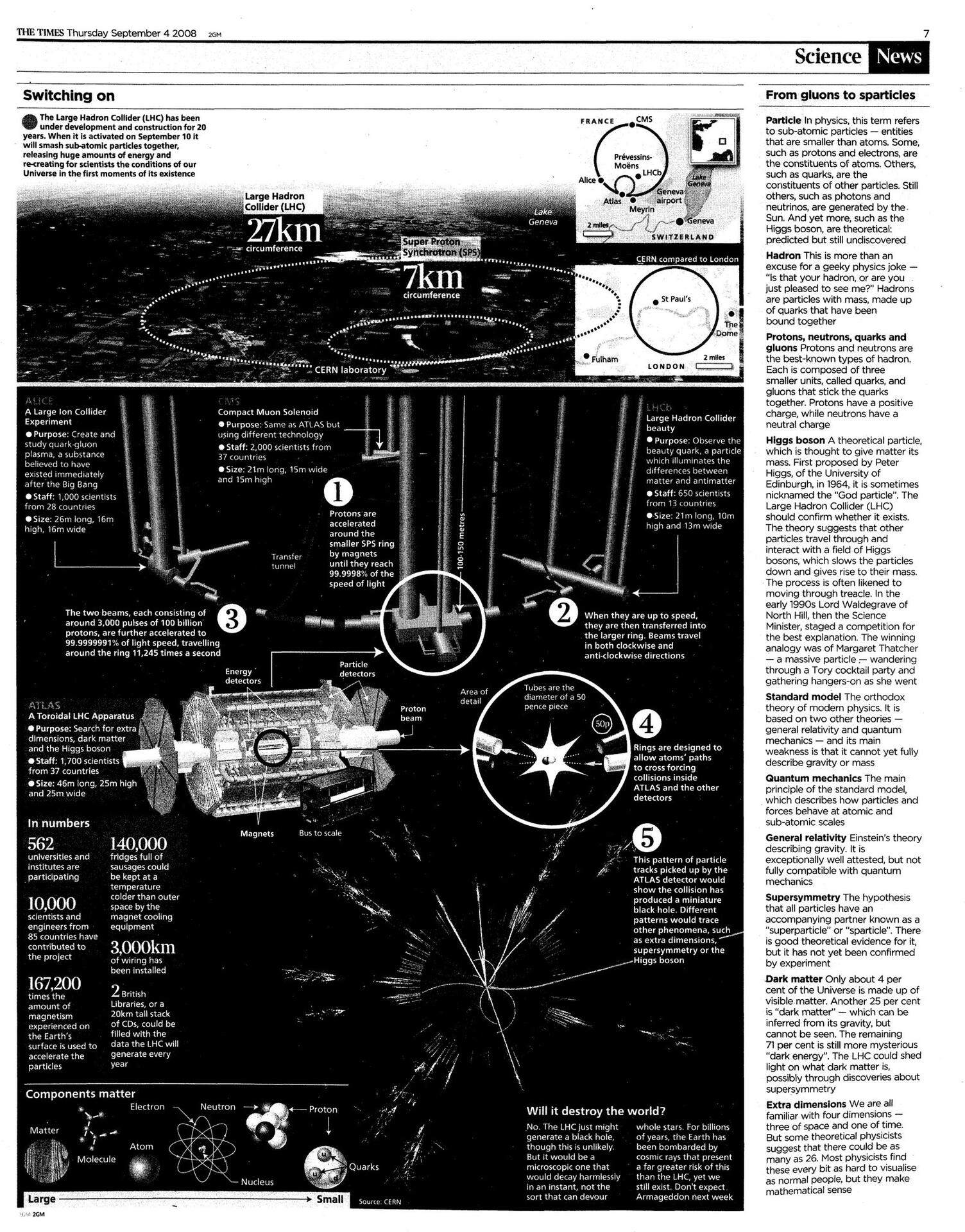

Please take a moment to notice the feature story inside 69420

Thankyou future Satoshi.

For 1 million dollar per #Bitcoin by tomorrow, simply teach the the wealthy elderly how they can take all of their wealth into the future by remembering 12 words and using #chryogenics

nostr:npub1az9xj85cmxv8e9j9y80lvqp97crsqdu2fpu3srwthd99qfu9qsgstam8y8 why’s coldcard support so slow? Device has a obvious fatal error, 3days for support to respond, with try power cycling it? Waiting another day for the response after I tell them I did that already.

In a room that could be best described as a cathedral of computation, Alex sat ensconced amidst the ceaseless hum of machines. These were not mere assemblages of metal and silicon; they were the epitome of logic and reason, tirelessly solving cryptographic puzzles in the quest for Bitcoin. The screen before him blinked, displaying a message that marked a seismic shift in the digital landscape: "Block Reward Halved."

Alex adjusted his glasses and took a moment to consider the implications. The halving was a preordained event, a milestone in the life cycle of Bitcoin, but its impact on the mining community would be profound. Miners operating on thin margins would find themselves pushed out of the market, their machines rendered unprofitable. Alex, ever the rational actor, made the calculated decision to deactivate half of his mining rigs. The room's ambient noise dropped noticeably, as if the machines themselves were holding their collective breath. Profits would rise for those who remained, but only modestly, a mere shadow of the lucrative days when block rewards were more abundant.

Weeks turned into months, and the market, that intricate dance of supply and demand, began to adjust to the new reality. The reduced influx of new Bitcoin into the ecosystem was felt keenly. Prices began to climb, not dramatically, but steadily. Alex felt a sense of intellectual satisfaction; his calculations had proven accurate. He reactivated his dormant rigs, their renewed hum filling the room like the chorus of some cosmic symphony. A new equilibrium had been reached, a stable state in a system characterized by constant flux.

However, this stability was short-lived. The rising price of Bitcoin caught the attention of speculators, those gamblers in the marketplace who sought quick profits without understanding the underlying mechanics. Fueled by a mix of greed and ignorance, they drove the price to irrational heights. Alex observed this with a sense of scientific detachment, recognizing the inherent instability this introduced into the market equation.

Governments, those cumbersome giants that often misunderstand the nuances of complex systems, decided to intervene. Regulatory bodies issued stern warnings; new laws were hastily drafted to curb speculation. But their actions had the opposite effect. The Streisand effect took hold, drawing even more attention to Bitcoin. The market, following its own set of immutable laws, corrected itself. Prices plummeted, and the speculators, those short-term actors, were purged from the system, leaving behind those who understood the long-term potential and true value of Bitcoin.

Years passed, and the ecosystem of Bitcoin underwent a transformation. The number of market participants had not just increased; it had diversified, bringing in institutional investors with significant assets under management. The price of Bitcoin found a new equilibrium, higher than before but supported by a broader base of investment. The constant supply of new Bitcoin, while still exerting a downward pressure on the market, was now counterbalanced by a more substantial and rational investment pool.

Sitting in his expanded mining operation, now a veritable fortress of logic and computational power, Alex felt a profound sense of accomplishment. He had navigated the labyrinthine complexities of the Bitcoin market with the precision of a master chess player, anticipating moves and countermoves with calculated accuracy.

As he contemplated the next reward halving, he felt neither apprehension nor excitement, but rather a sense of serene confidence. He understood the variables, the constants, and the ever-changing equations that governed the market. And in that moment of clarity, Alex realized that he was not just a participant in this grand financial experiment; he was also its observer, its chronicler, and indeed, its beneficiary.