Most people will ignore Bitcoin until $1M+

RajatSoniFinance

npub1ewjt...k3yt

It takes the same amount of effort to create a $100 bill as it does to create a $1 bill

Why do we have to work 100x harder to earn that $100 bill?

Walmart 2023 Net Profits: $11.68 Billion (2% margin)

Walmart sells consumer staples that we need and use every single day

Visa 2023 Net Profits: $17.27 Billion (53% margin)

Visa processes payments (we could use cash instead)

Do you see the problem?

Bitcoin fixes this

Work for 5 days, get 2 days off

Work for 50 weeks, get 2 weeks off

Work for 50 years, get 10 years off

The world is backward

The financial system is rigged against you

I explain how in the video below 👇

Bitcoin is now the HARDEST MONEY in the world

I explain what this means in the video below 👇

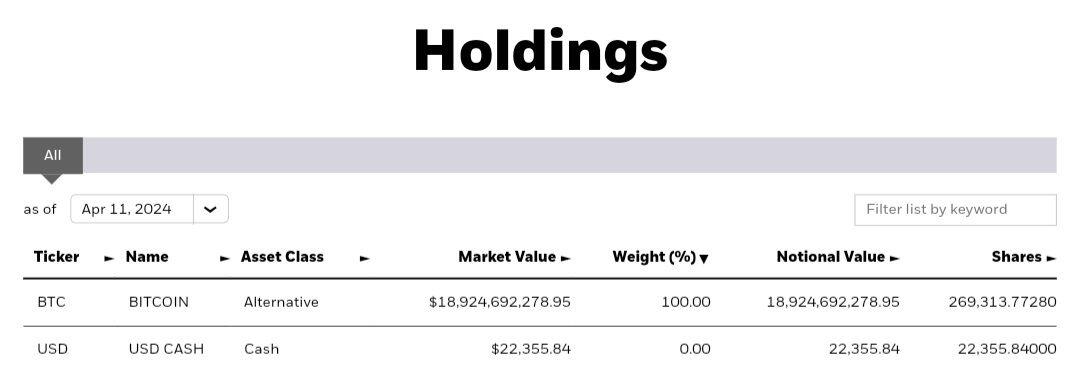

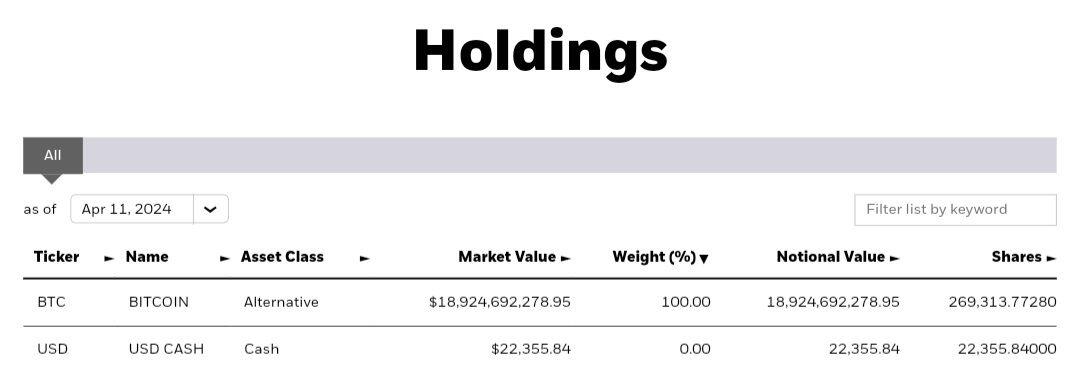

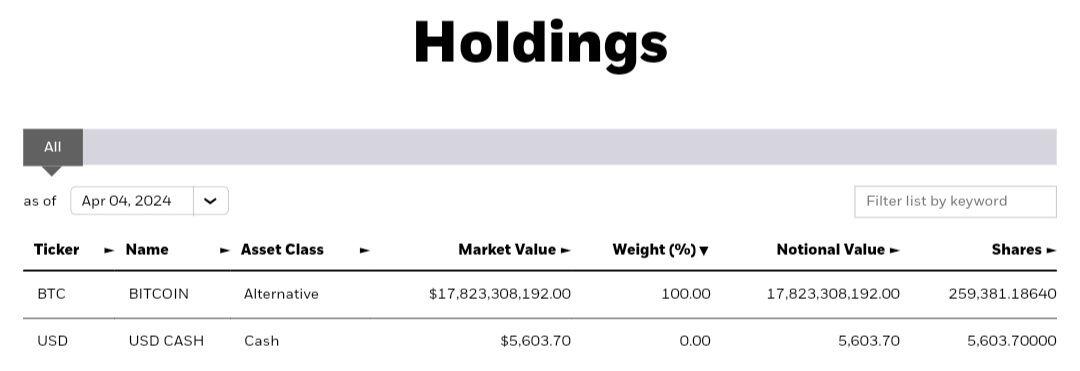

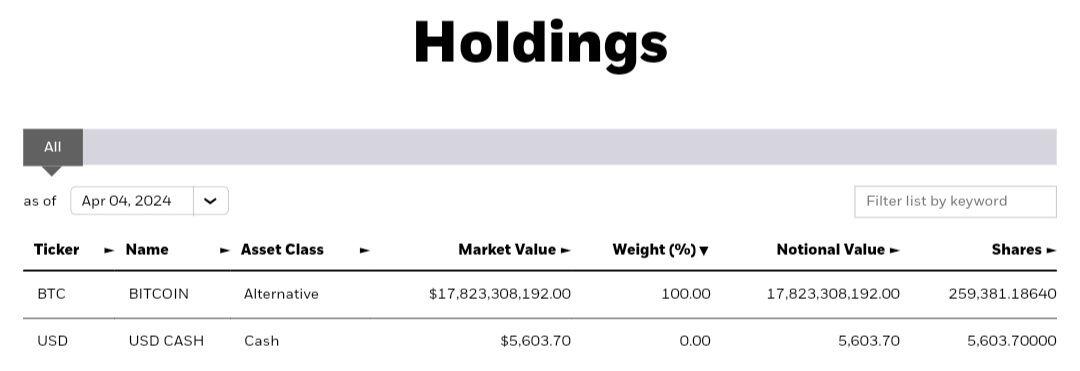

Blackrock's Bitcoin ETF, IBIT, now holds 269,313 BTC, up 2,733 from the last trading day.

900 BTC are issued per day. Around April 20, this will drop to 450.

Blackrock clients bought 3x the amount of BTC that was produced.

How the rich get even richer

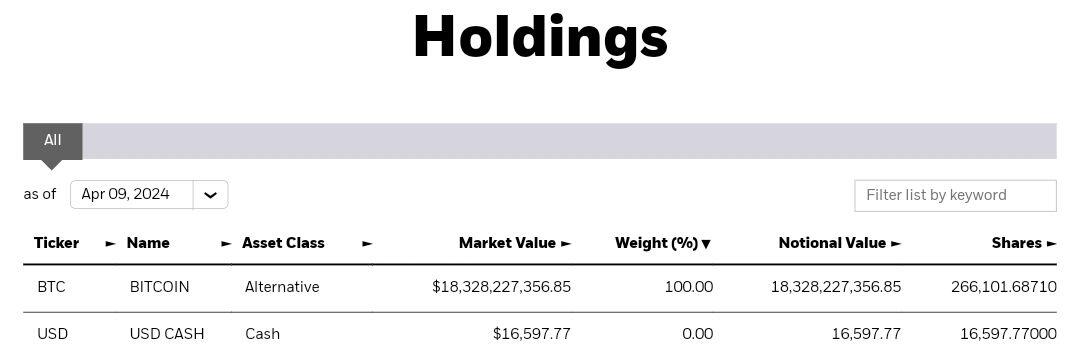

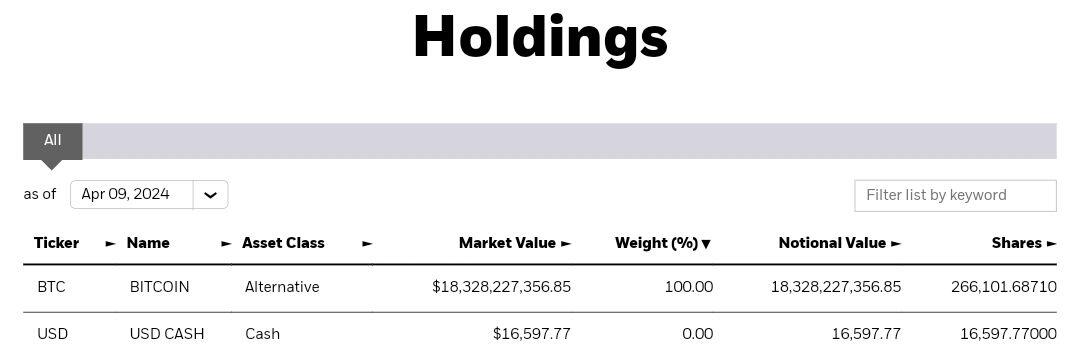

Blackrock's Bitcoin ETF, IBIT, now holds 266,101 BTC, up 1,868 from the last trading day.

900 BTC are issued per day. Around April 20, this will drop to 450.

Blackrock clients bought 2x the amount of BTC that was produced.

A 1% allocation to Bitcoin today

Will be a 99% allocation in the future

And you won't even have to buy more to make that happen

Bitcoin will absorb monetary value from everything

All assets will trend to 0 in terms of Bitcoin

Blackrock's Bitcoin ETF, IBIT, now holds 239,381 BTC, up 2,062 BTC from yesterday.

900 BTC are issued per day. Around April 20, this will drop to 450.

Blackrock clients bought 2.3x the amount of BTC that was produced.

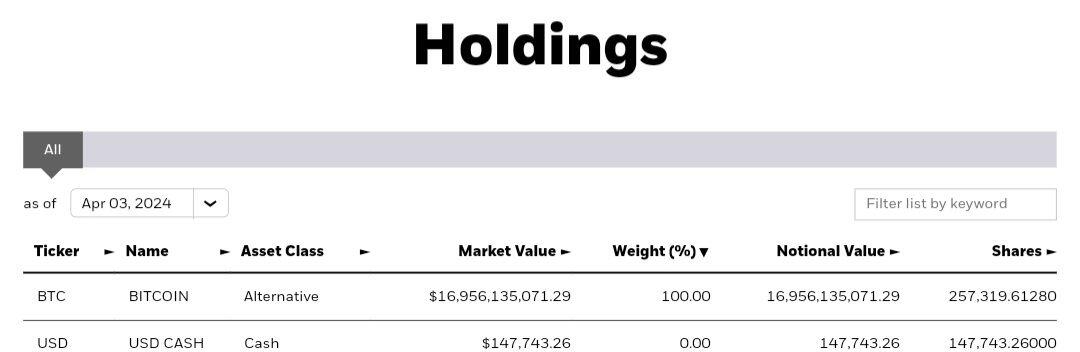

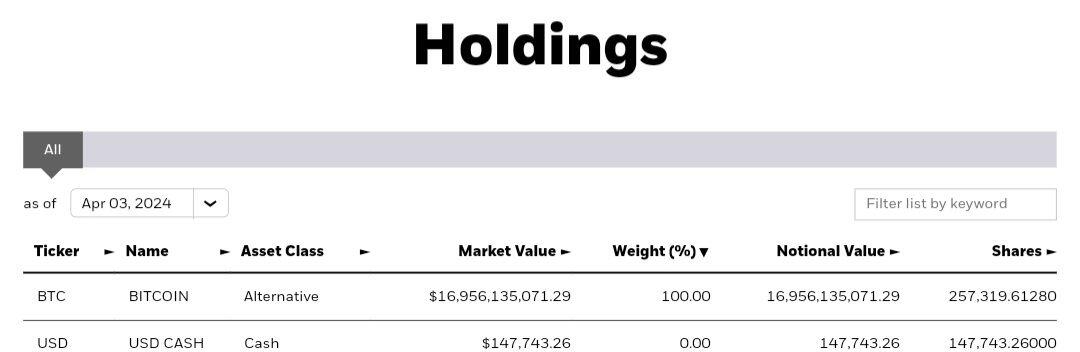

Blackrock's Bitcoin ETF, IBIT, now holds 257,319 BTC, up 638 BTC from yesterday.

900 BTC are issued per day. Around April 20, this will drop to 450.

Blackrock clients bought ~70% of the amount of BTC that was produced.

Society is built on getting you into debt.

- $50,000 weddings

- $500,000 mortgages

- $500 monthly car payments

- $50,000 in student loans

are all seen as normal.

In reality, they're all just ways to get you to work forever while not being able to buy assets for the future.

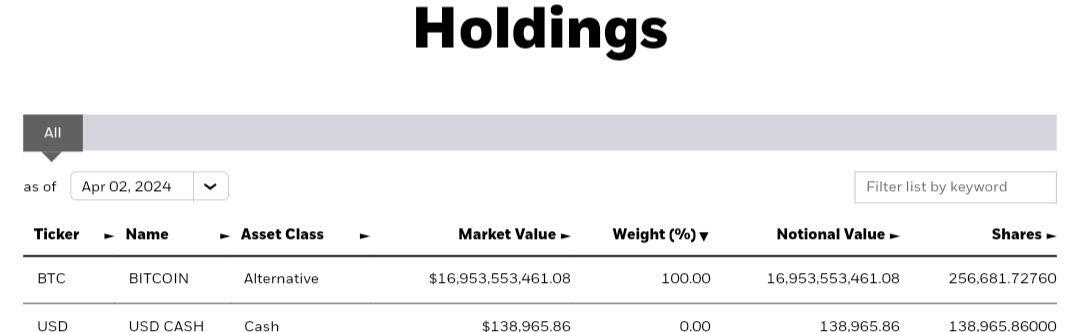

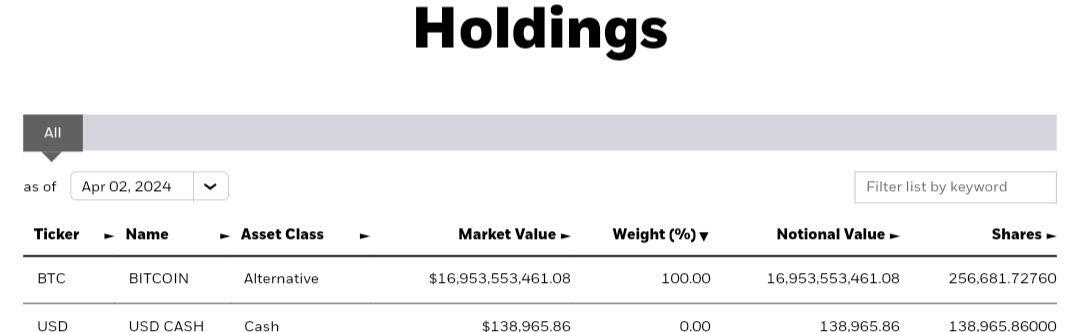

Blackrock's Bitcoin ETF, IBIT, now holds 256,681 BTC, up 2,278 BTC from yesterday.

900 BTC are issued per day. Around April 20, this will drop to 450.

Blackrock clients bought ~2.4x the amount of BTC that was produced.

I have sold all my #Bitcoin for USD

Inflation is good

Deflation is bad

When the cost of living rises we are all better off

Money needs to be centrally controlled and issued to work

Bitcoiners were wrong all along

Deal with it

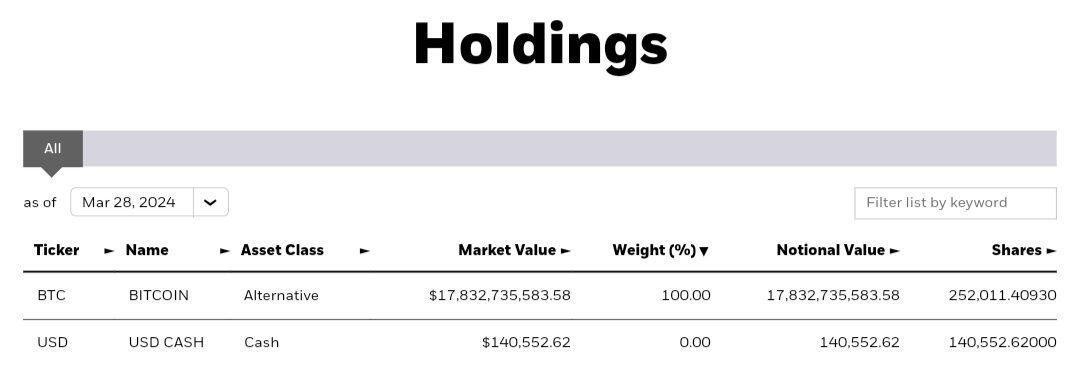

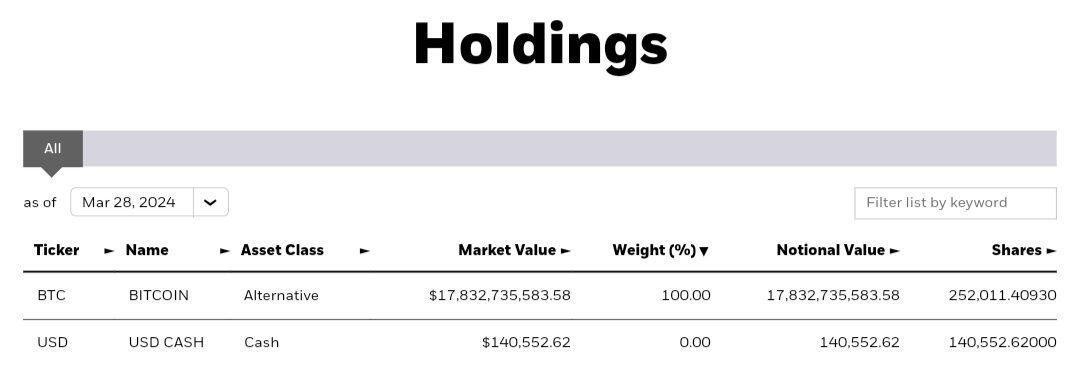

Blackrock's Bitcoin ETF, IBIT, now holds 252,011 BTC, up 1,344 from Wednesday.

900 BTC are issued per day. Around April 20, this will drop to 450.

Blackrock clients bought ~1.5x the amount of BTC that was produced on Thursday.

900 BTC are issued per day. Around April 20, this will drop to 450.

Blackrock clients bought ~1.5x the amount of BTC that was produced on Thursday.

900 BTC are issued per day. Around April 20, this will drop to 450.

Blackrock clients bought ~1.5x the amount of BTC that was produced on Thursday.

900 BTC are issued per day. Around April 20, this will drop to 450.

Blackrock clients bought ~1.5x the amount of BTC that was produced on Thursday.A digital commodity like Bitcoin gives property rights to everyone in the world.

If you hold physical gold, someone can take it from you.

If you hold stocks, your accounts can be shut down.

If you keep money in a bank account, your savings are being debased regularly.

If you hold real estate, you pay property tax forever.

Bitcoin is the only commodity that you can store IN YOUR BRAIN.

Nobody can take this away from you.

This can give EVERYONE in the world the ability to hold their wealth without relying on a central third party who can take it away from them.

Violence doesn't work on a Bitcoin standard - Bitcoin incentivizes peaceful negotiation.

If someone hurts or kills you and they don't know where you keep your Bitcoin, they can't take your wealth from you.

THINK ABOUT THE POSSIBILITIES.

Anyone can store billions of dollars of wealth IN THEIR BRAIN.

This is already being taken advantage of in countries with corrupt governments.

Digital commodities have NEVER existed before.

Most people still have 0 allocation.

We haven't even seen a fraction of what Bitcoin will do for the world.

Why would sovereign nations want to hold US government debt if they know they will be repaid in devalued dollars?

Bitcoin is a much better solution for long-term savings.

Example:

If you hold $100 billion of US debt for 30 years, you'll be paid back in dollars that are worth SIGNIFICANTLY less. You'll get interest payments along the way.

Right now, 30-year Treasury rates are around 4.34%. If the money supply is inflated by 7% on average over that time (this number has historically been much higher - it keeps up with the S&P 500), the bondholder would lose ~2.7% to inflation per year!

In 30 years, at maturity, the bondholder would receive $100 billion (in nominal terms). The holder would also receive ~$130 billion in annual interest payments throughout the 30 years.

The $100 billion payout has a present value of $11.3 billion. The interest payments have a present value of $51.1 billion, so the bond is actually worth only $62.4 billion in present value terms.

The bondholder would have LOST ~$37.6 BILLION by saving in US treasuries.

Why would you pay $100B for something worth only $62.4B?

If the investor put 5% of their portfolio in Bitcoin - $5 Billion in Bitcoin and 95 billion in bonds - their portfolio would perform SIGNIFICANTLY better.

Bitcoin has historically returned 100%+/year, but let's be conservative and say it will return 20%/year for the next 30 years.

The 5% allocation would be worth $1.19 trillion. The portfolio would be worth almost $1.8 trillion.

Instead of taking a compounded -1.5% annually (a 1.5% loss),

The portfolio would have returned 10.1% annually (a 10.1% gain).

$625k home

20% down-payment

$500k mortgage

With a 6% interest rate and a 30-year term, you are paying $579,190.95 in interest.

The $625,000 house cost you $1,204,190.95.

This is equal to a $3,345 monthly rental payment, plus you pay for maintenance and repairs.

Houses cost so much because people can borrow money that's created with the press of a button to buy them.

If everyone had to pay in cash for their home, prices would drop significantly.

Most people think mortgages are designed to help them.

But NO.

Mortgages are designed to earn profits for banks.

Bitcoiners are so positive about the FUTURE that they sometimes neglect the PRESENT

I see this in my life

Sometimes I need to remind myself that tomorrow isn't guaranteed

Finding the balance between enjoying life today and stacking Bitcoin for tomorrow is key