Bitcoiners are so positive about the FUTURE that they sometimes neglect the PRESENT

I see this in my life

Sometimes I need to remind myself that tomorrow isn't guaranteed

Finding the balance between enjoying life today and stacking Bitcoin for tomorrow is key

RajatSoniFinance

npub1ewjt...k3yt

Bitcoin at $70k:

Bitcoin Skeptics: Bitcoiners are gambling

Bitcoin holders: No, I studied money, psychology, energy, game theory, economics, property rights, and history for thousands of hours.

Bitcoin at $700k:

Bitcoin Skeptics: Bitcoiners got lucky

Bitcoin holders: No, I studied money, psychology, energy, game theory, economics, property rights, and history for thousands of hours.

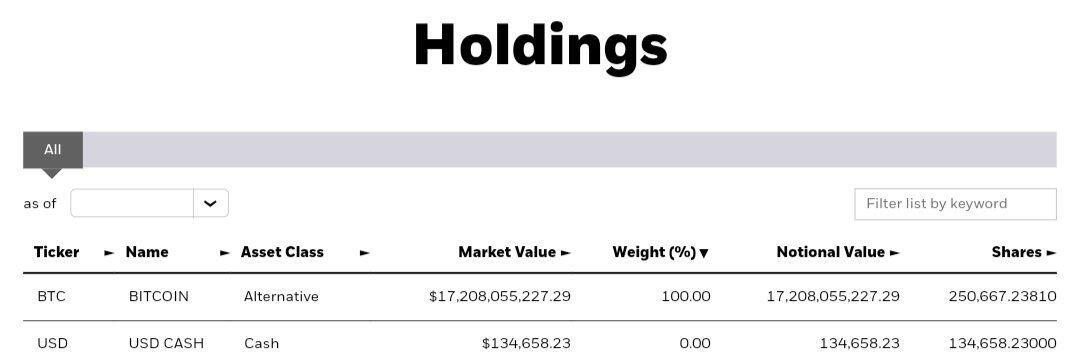

Blackrock's Bitcoin ETF now holds 250,667 BTC, up 4,716 from yesterday.

Buying is back up - as the price comes up, it will increase. Rich people FOMO will start after $100K IMO.

900 BTC are issued per day. Around April 20, this will drop to 450.

Blackrock clients bought ~5x of the amount of BTC that was produced.

18-24 months from now, there will be people who are excited about Bitcoin entering a bear market, because "this time, it's going to 0."

And then 4 years after that, and 4 years after that, and 4 years after that...

You get what I mean.

Bitcoin is never going to 0.

People who wish Bitcoin goes to 0 can't imagine being wrong about something.

They missed out and now they want everyone who DIDN'T miss out to suffer.

Just like the supply of new BTC is scheduled (it decreases 50% every 4 years), so are the crashes.

On a sound money standard, NO ENTITY IS TOO BIG TO FAIL.

When the price of Bitcoin goes up, retail investors get confident and start lending their BTC to financial institutions and making terrible decisions.

These financial institutions start lending coins irresponsibly to earn a profit.

In the legacy financial system, mistakes are forgiven by providing bailouts. This is because the legacy financial system is built on fake money (fiat currencies) that can be created out of thin air.

On a Bitcoin standard, there are no bailouts.

If you make mistakes, you're going to be taken out.

A few months after April's halving, innovation will be at its peak. Anyone who built during the bear market will probably be very successful during the bull market.

When the price of Bitcoin rises as a result of supply being cut by 50%, new businesses start offering services and products that are of immense value.

But not all of these companies are doing what they say they do...

After two years of prosperity is when the scammers are exposed (eg. FTX, Luna, etc).

Over the next few years, we'll go through the same cycle that we went through the LAST few years. We'll hit a higher high. Then we'll hit a higher low. Then we'll be back to 50%-60% below the previous all-time high.

This will happen over and over again until we are no longer using USD to value Bitcoin.

With each cycle, there's more adoption - more people learn how Bitcoin works and they start moving their fiat wealth, which is worthless, into the scarcest asset in the world.

In the next 6-18 months:

• There will be people offering you 15-20% returns for lending your BTC

• There will be others selling you some garbage that they created

• There will be a lot more new coins that promise riches and wealth

Study Bitcoin so you don't fall for the scams.

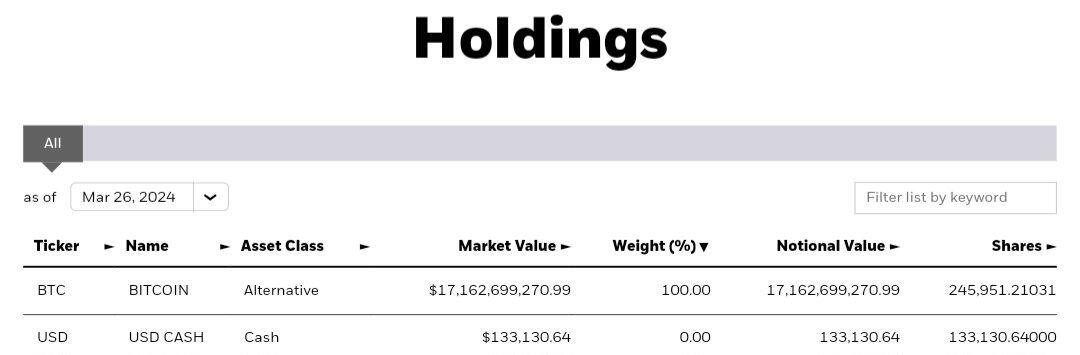

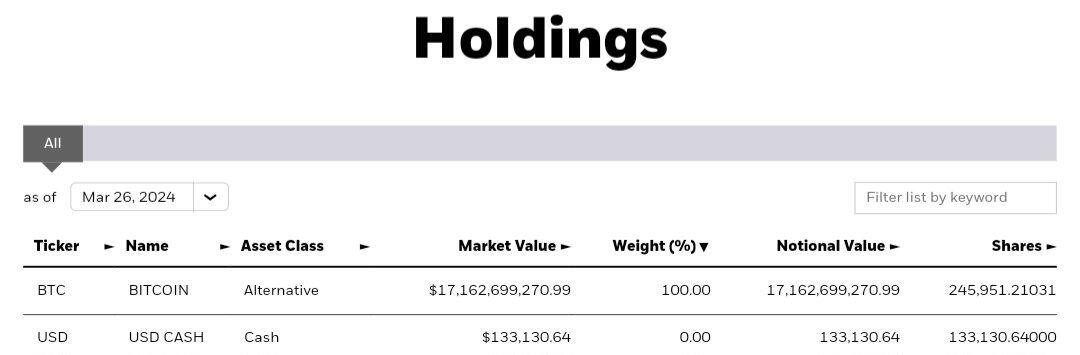

Blackrock's #Bitcoin ETF now holds 245,951 BTC, up 2,324 from yesterday.

Buying is back up - as price comes up, it will increase. Rich people FOMO will start after $100K IMO.

900 BTC are issued per day. Around April 20, this will drop to 450.

Blackrock clients bought ~3x of the amount of BTC that was produced.

In the current financial system, your wages rise over time but you lose purchasing power.

1971: ~$10,000 average annual income could support a family of 4.

Today: ~$60,000 average annual income can barely support an individual.

Bitcoin fixes this.

On a Bitcoin standard, you will see smaller nominal figures over time for income and prices, but the purchasing power of your savings will increase over time.

In 2009: 1 BTC bought nothing

In 2012: 1 BTC bought 1 fast food meal ($12.48)

In 2016: 1 BTC bought 2 weeks of groceries for a family of 4 ($654.76)

In 2020: 1 BTC bought 6-8 months of groceries ($9,314.28)

Today: 1 BTC has the purchasing power to buy ~4-5 years worth of groceries ($70,380.64)

In 2028, what will 1 Bitcoin buy? What will 0.1 Bitcoin buy? How about 0.01 Bitcoin?

Bitcoin's purchasing power increases over time because it has a finite supply and can fulfill all the functions of money.

Reminder:

You can buy fractions of Bitcoin

1 Bitcoin = 100,000,000 Satoshis

This is like dollars and cents

1 dollar = 100 cents

If you have 0.1 dollars, you have 10 cents

Similarly, if you have 0.0003 Bitcoin, you have 30,000 Satoshis (Sats)

When you buy Bitcoin, you are converting your dollars into (or SELLING them for) Bitcoin

Some popular conversion rates:

1 Bitcoin = 69,800 USD

1 USD = 0.00001432 BTC (1432 Sats)

1 Bitcoin = 64,128 Euro

1 Euro = 0.00001558 BTC (1558 Sats)

1 Bitcoin = 94,431 Canadian Dollars

1 CAD = 0.0001059 BTC (1059 Sats)

1 Bitcoin = 55,100 Pounds

1 Pound = 0.00001814 BTC (1814 Sats)

1 Bitcoin = 502,254 Yuan

1 Yuan = 0.00000199 BTC (199 Sats)

1 Bitcoin = 10,532,668 Yen

1 Yen = 0.0000009 BTC (9 Sats)

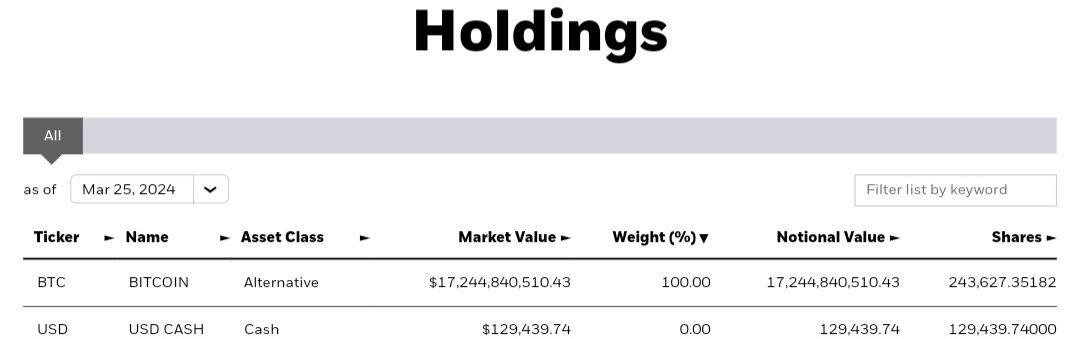

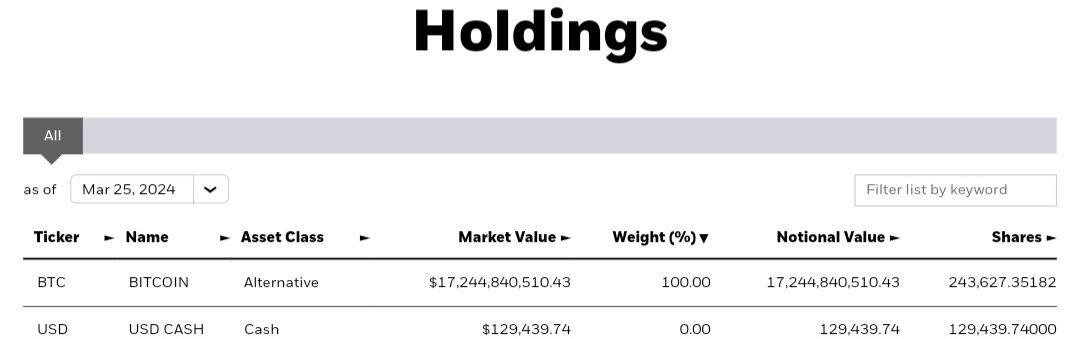

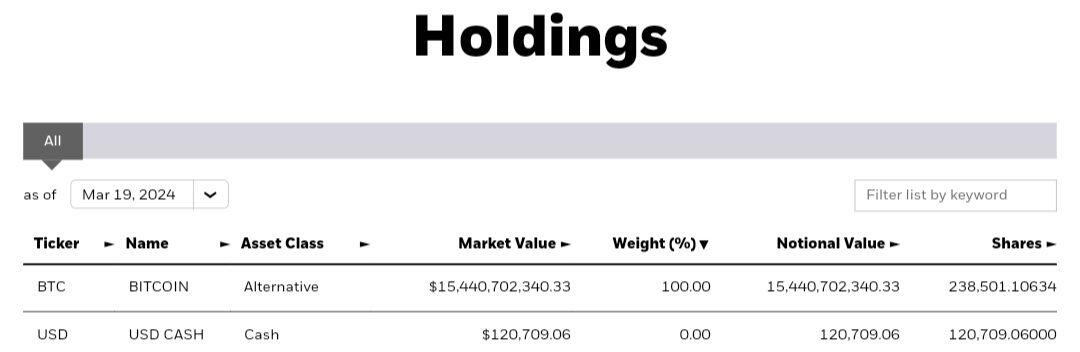

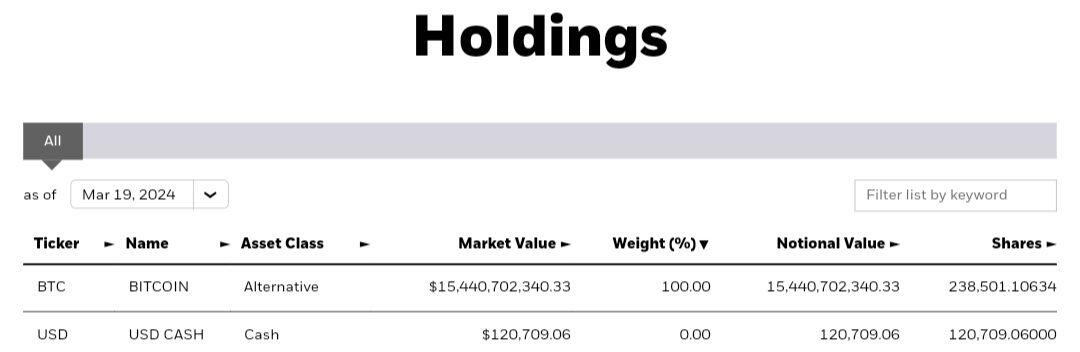

Blackrock's Bitcoin ETF now holds 243,627 BTC, up 501 from yesterday.

I think this decreased buying pressure from IBIT customers is temporary and will resume to previous levels soon enough.

900 BTC are issued per day. Around April 20, this will drop to 450.

Blackrock clients bought ~60% of the amount of BTC that was produced.

Something like 1% of the world owns Bitcoin

Probably less than 0.1% truly understand what they own

Over the next 30 years, your expenses will very likely increase in cost faster than your wages

If you don't learn to manage your finances, you WILL end up poor

You'll have to cut more and more of the things you love just to make ends meet

Don't put yourself in this situation

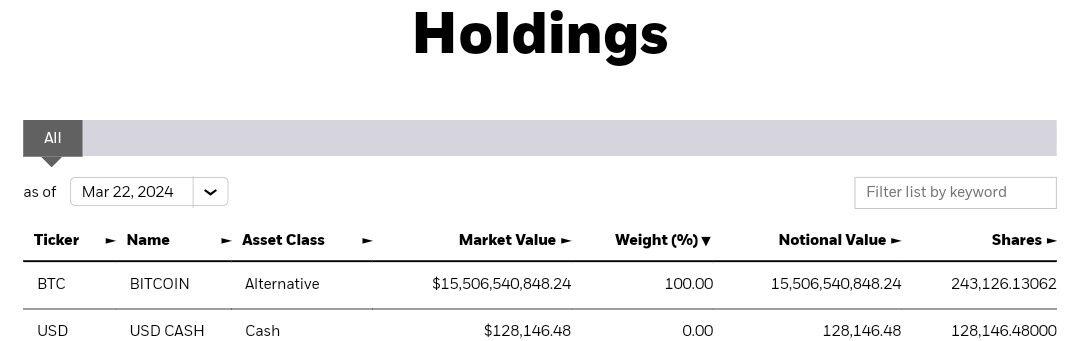

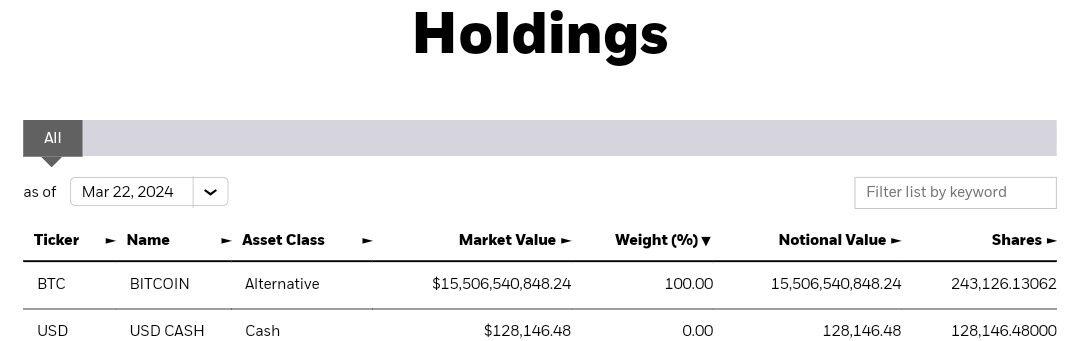

Blackrock's Bitcoin ETF now holds 243,126 BTC, up 297 from Thursday.

This is the smallest purchase made since the inception of the ETF. I think this is temporary and buying pressure from IBIT customers will resume soon enough.

900 BTC are issued per day. In April this will drop to 450.

Blackrock clients bought 33% of the amount of BTC that was produced.

I used to think stocks are the best investment

I used to think inflation is a good thing

I used to think the tax code was fair

I used to think the financial system was designed to help us rather than hurt us

As I'm presented with new information, I change my mind, as anyone should

The fiat currency system is designed to keep the working class working forever

The wealthy get many advantages that the poor don't, just because they have more money

This is why Bitcoin will change the world

BTC levels the playing field

It gives EVERYONE the same property rights and level of freedom

When Microstrategy is part of the S&P 500, Bitcoin will be in EVERYONE'S portfolio.

You will have exposure whether you like it or not.

Why not try to figure out how Bitcoin works BEFORE that happens?

When everyone has exposure, Bitcoin will cost A LOT more than $64K.

Smart money is accumulating Bitcoin.

Dumb money is dismissing Bitcoin.

I try to avoid telling people to buy Bitcoin.

I tell them to study it.

Why?

Because I KNOW that if you buy Bitcoin without understanding what it is, you will sell early and regret it.

Bitcoin will destroy your emotional state if you're not ready for the volatility (like the pullback we're experiencing right now).

I know people who sold at $20K in 2022 because they thought Bitcoin was going to $0 and now they're kicking themselves.

I know people who went all in at the $70,000 because they thought it was going to $100,000, and now they're panicking.

Don't make the mistake of buying anything before you have an understanding of what you're buying.

Once you understand Bitcoin, these drops are an OPPORTUNITY, not SOMETHING TO BE AFRAID OF.

We are in the shakeout phase - a lot of people are being taken out because they have no confidence in the asset they own.

Bitcoin is the best form of money that has ever existed.

It's better than gold and fiat.

It has a limited supply.

The production cannot sped up.

It's backed by the most powerful network in the world.

Don't dismiss this!

Every company in the global stock market will be repriced based on how much Bitcoin it holds or can generate in the future.

Microstrategy $MSTR is a visionary: it knows that the price of Bitcoin will rise, so being able to generate Bitcoin will get more difficult over time.

We are in a weird time where we can buy the MONEY OF THE FUTURE with the MONEY OF THE PAST (fiat currencies).

This is a cheat code that THE ENTIRE WORLD has access to (including individual investors).

As stocks are repriced, I think MSTR will have the highest market cap in the world because it's THE ONLY ONE taking advantage of the market's inefficiency in pricing Bitcoin.

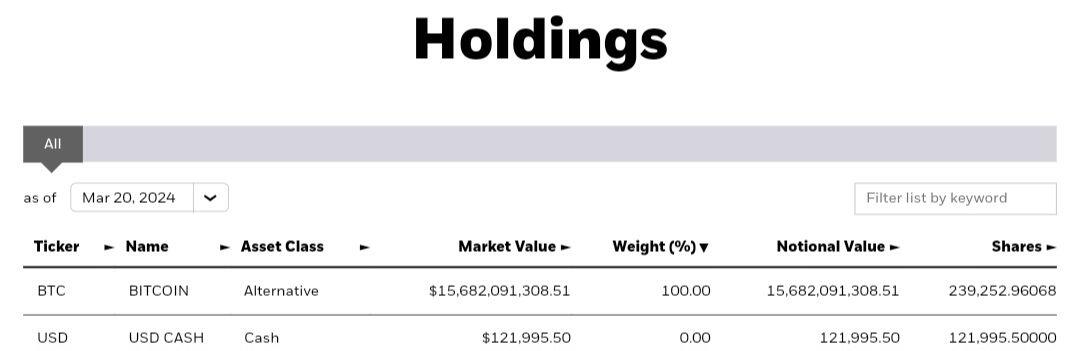

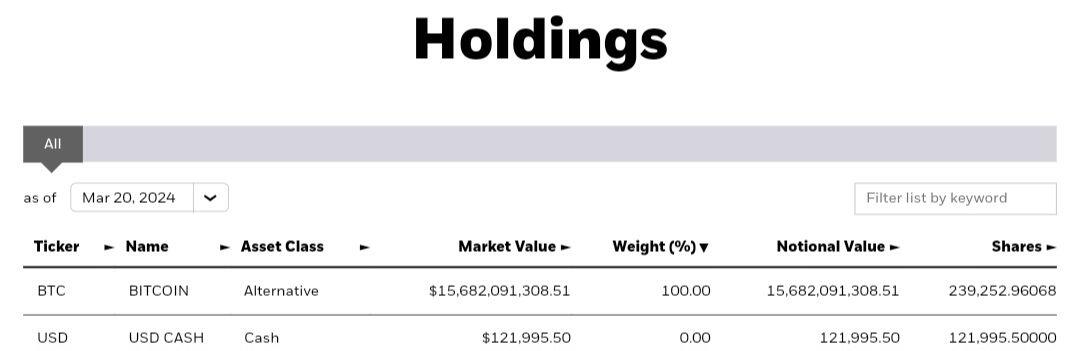

Blackrock's Bitcoin ETF now holds 239,252 BTC up 751 from yesterday.

Blackrock holds 1.14% of the total supply of BTC.

900 BTC are issued per day. In April this will drop to 450.

Blackrock clients bought 80% of the amount of BTC that was produced.

Blackrock's Bitcoin ETF now holds 238,501 BTC up 1,102 from yesterday.

Blackrock holds 1.14% of the total supply of BTC.

900 BTC are issued per day. In April this will drop to 450.

Blackrock clients bought 1.2x the amount of BTC that was produced.

Japan's state pension fund wants to diversify with Bitcoin.

What happens when EVERY pension fund in the world wants Bitcoin?

Every government?

Every central bank?

Keep in mind Bitcoin is hovering around 2021's all-time high...

Even adjusted for inflation we should be around $80,000.

If you haven't bought yet and you're waiting for a dip, you're gambling.

I hope it happens because I'll buy more.

But if it doesn't?

You'll lose 50-75% of your purchasing power.

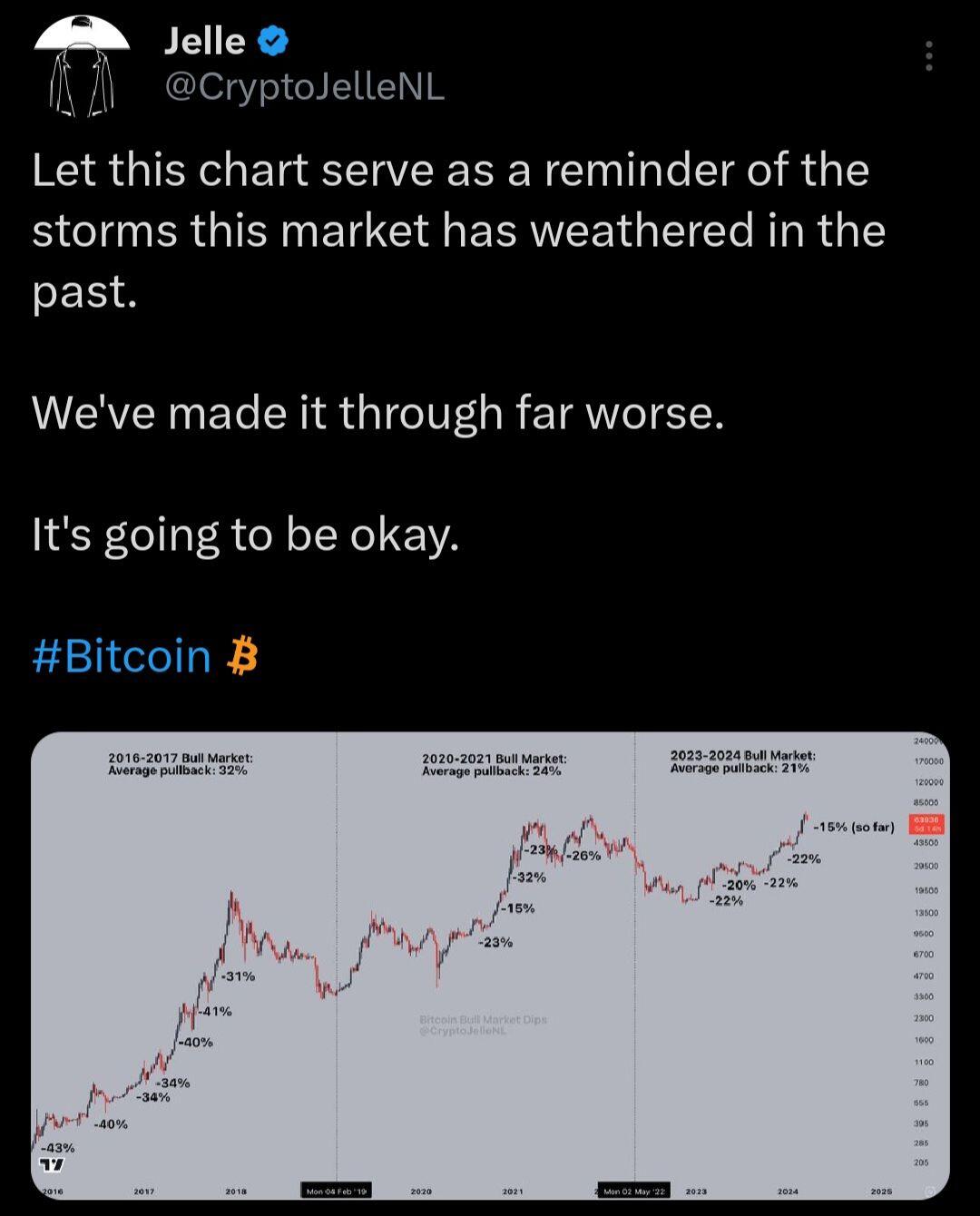

You may think you understand Bitcoin, but if this pullback has you scared and running for the exits, you DON'T understand Bitcoin.

Don't get shaken out because of the volatility.

This is exactly what large financial institutions want you to do.

I know what I own so I WILL NOT be selling cheap.

Pullbacks in price are a normal and healthy part of any market.

This is a sign that the market is trying to figure out an appropriate price for this brand new asset.

Pullbacks in price will continue to happen until we move from a fiat currency standard to a Bitcoin standard.

As more people learn about Bitcoin, fewer are selling what they own.

This bull run could be completely different from anything we experienced in the past because of Bitcoin exchange-traded funds buying thousands of BTC every single day.

I plan to hold my coins for at least 5 years so I don't care about the volatility along the way.

I'm using the volatility to my advantage by purchasing more at a lower price.