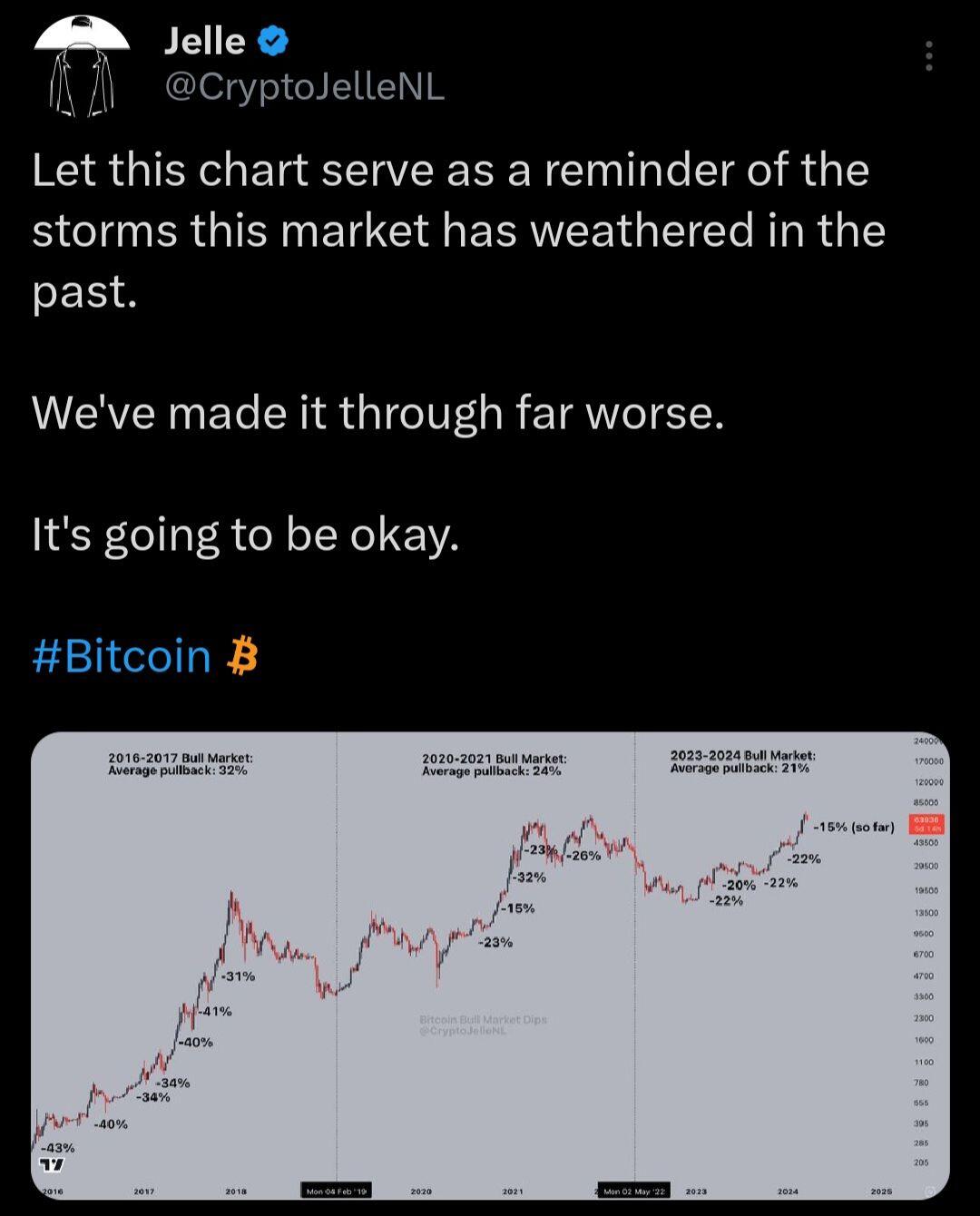

You may think you understand Bitcoin, but if this pullback has you scared and running for the exits, you DON'T understand Bitcoin.

Don't get shaken out because of the volatility.

This is exactly what large financial institutions want you to do.

I know what I own so I WILL NOT be selling cheap.

Pullbacks in price are a normal and healthy part of any market.

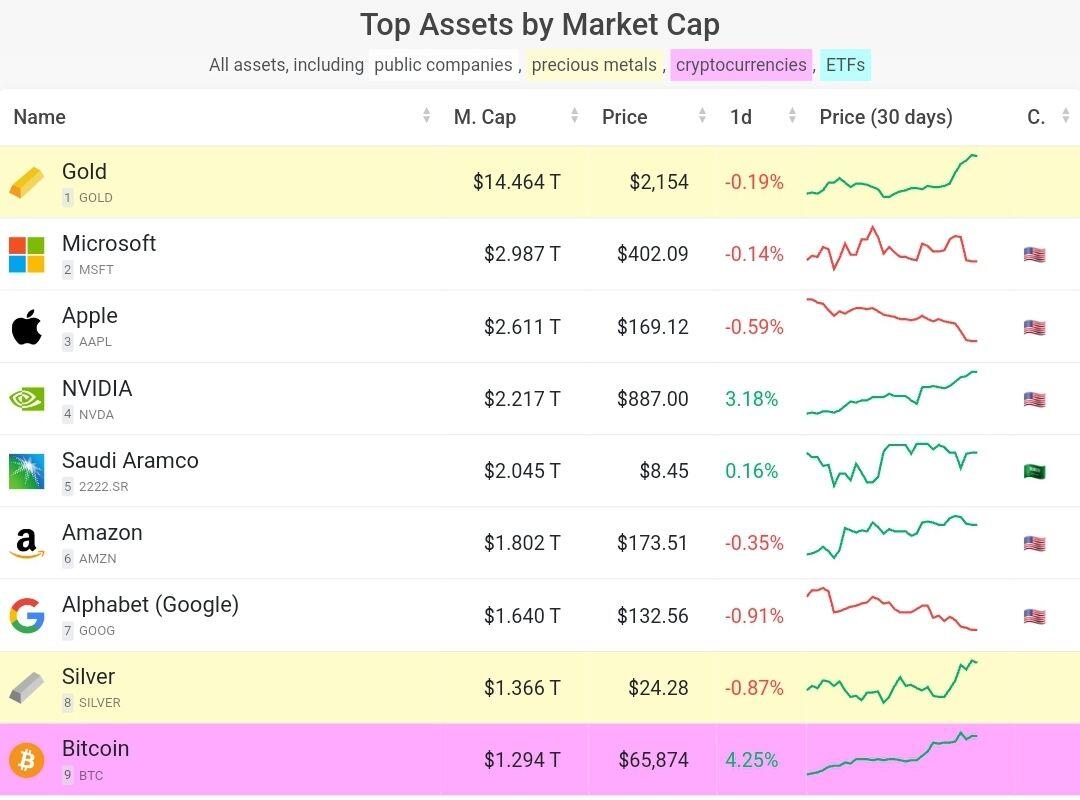

This is a sign that the market is trying to figure out an appropriate price for this brand new asset.

Pullbacks in price will continue to happen until we move from a fiat currency standard to a Bitcoin standard.

As more people learn about Bitcoin, fewer are selling what they own.

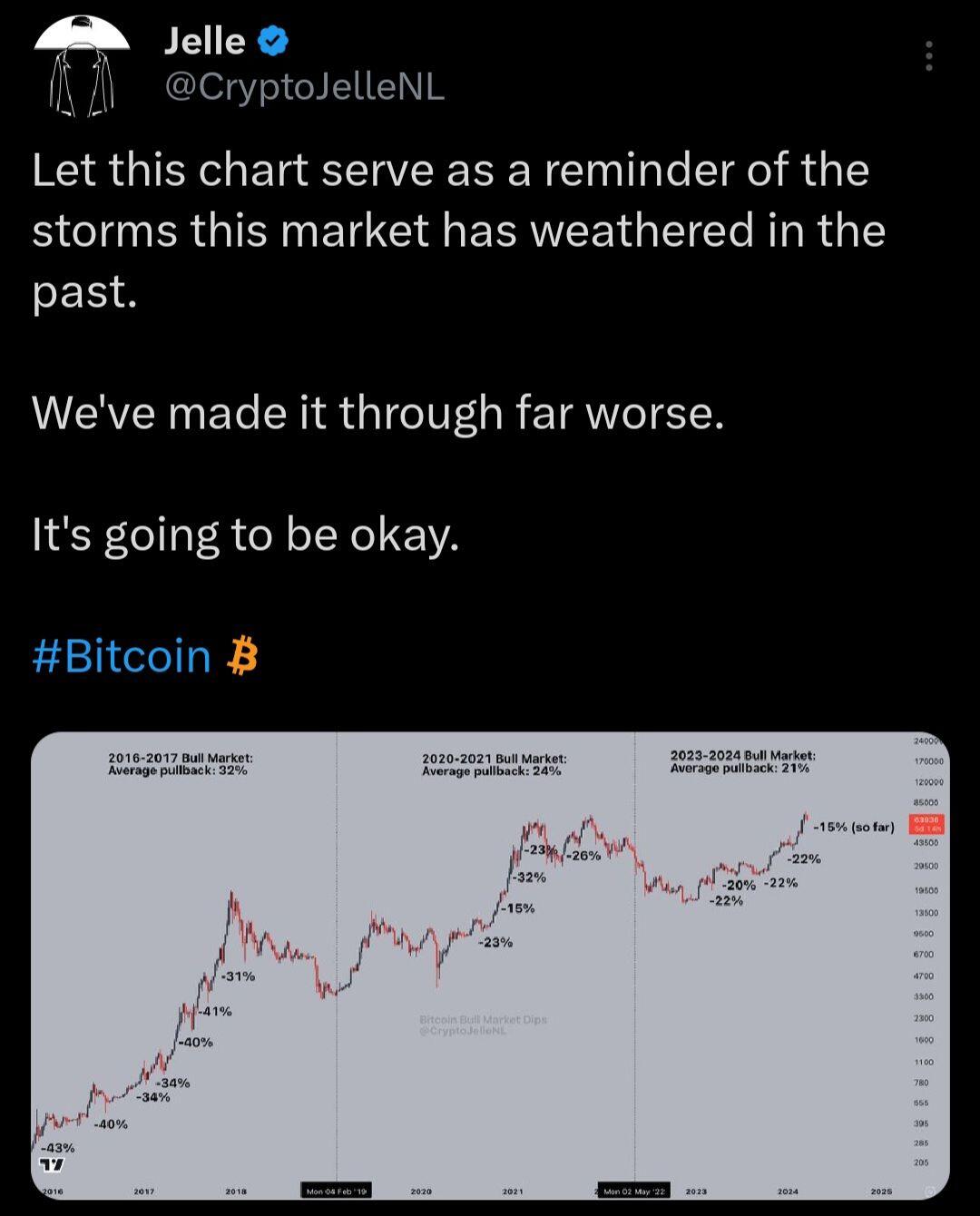

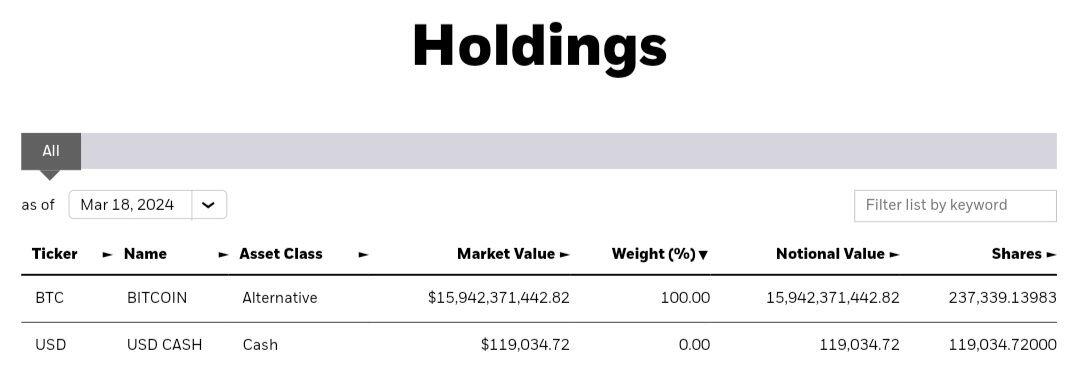

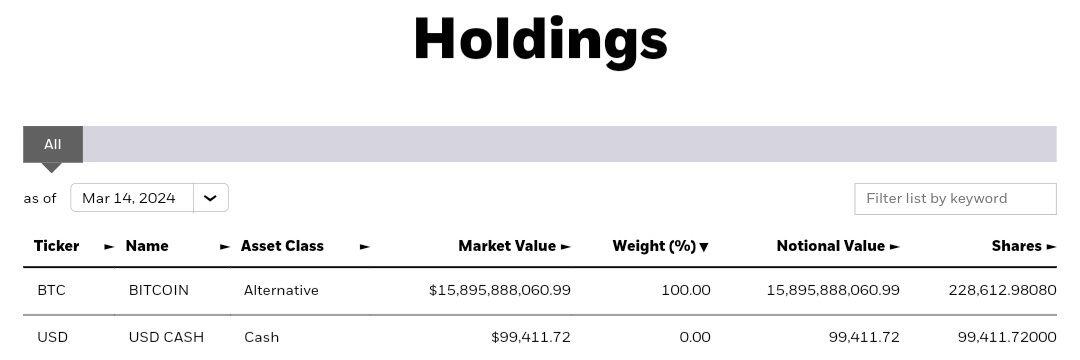

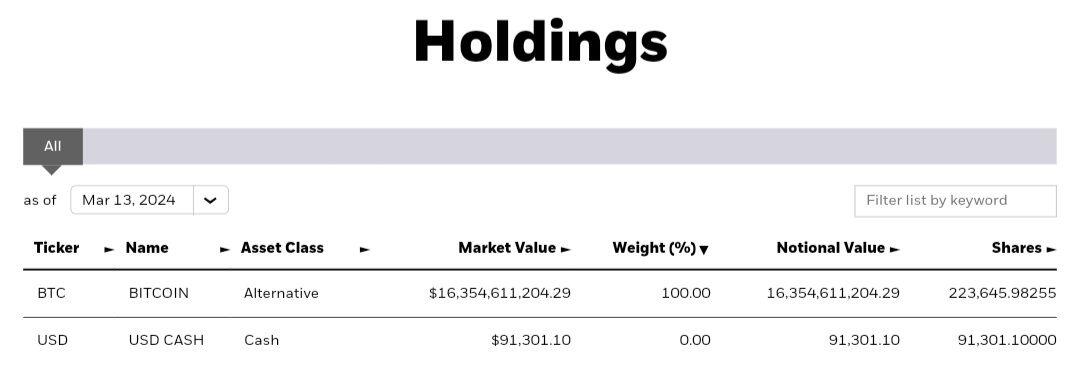

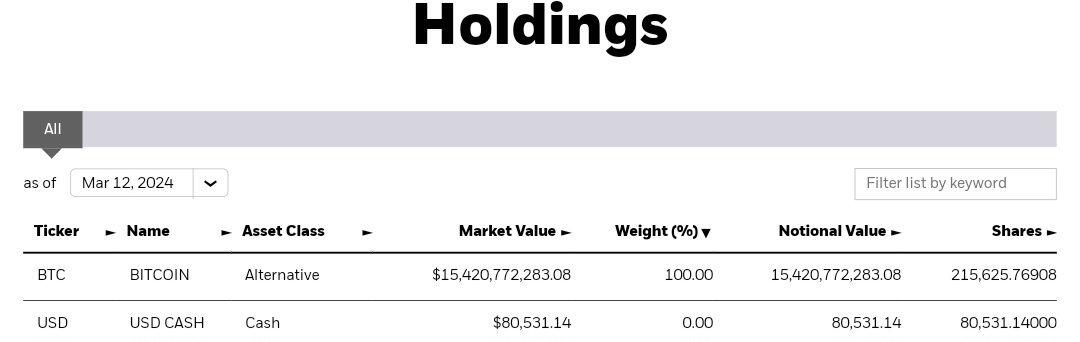

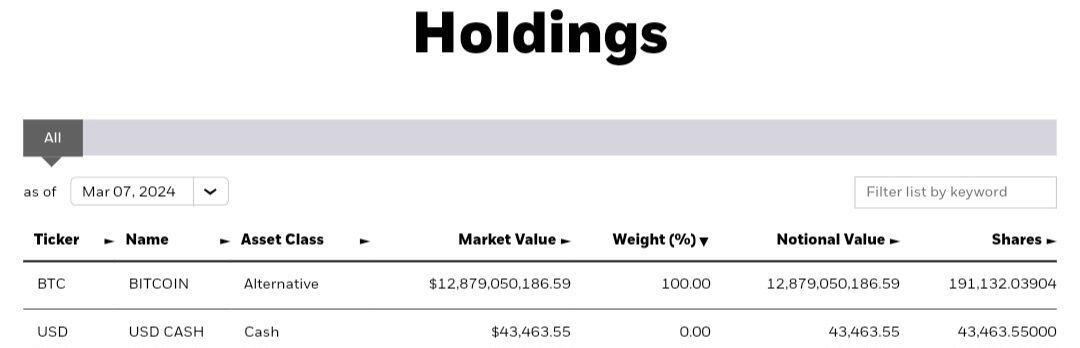

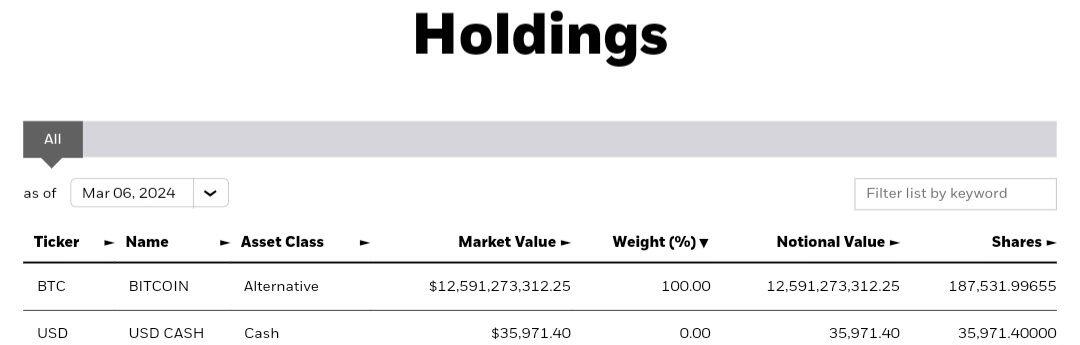

This bull run could be completely different from anything we experienced in the past because of Bitcoin exchange-traded funds buying thousands of BTC every single day.

I plan to hold my coins for at least 5 years so I don't care about the volatility along the way.

I'm using the volatility to my advantage by purchasing more at a lower price.