We, average retail investors, are lucky that #Bitcoin is in so many people's blind spot.

Many wealthy individuals cannot imagine storing their hard-earned wealth in something they can't touch.

This will cost them millions and even billions over the next 10-15 years when they finally bend the knee.

All of this wealth will be transferred to anyone who does the work to understand, buy, and hold Bitcoin

RajatSoniFinance

npub1ewjt...k3yt

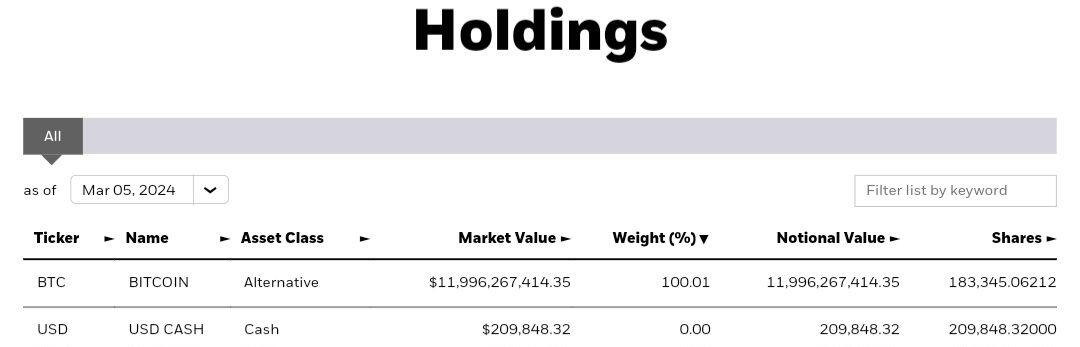

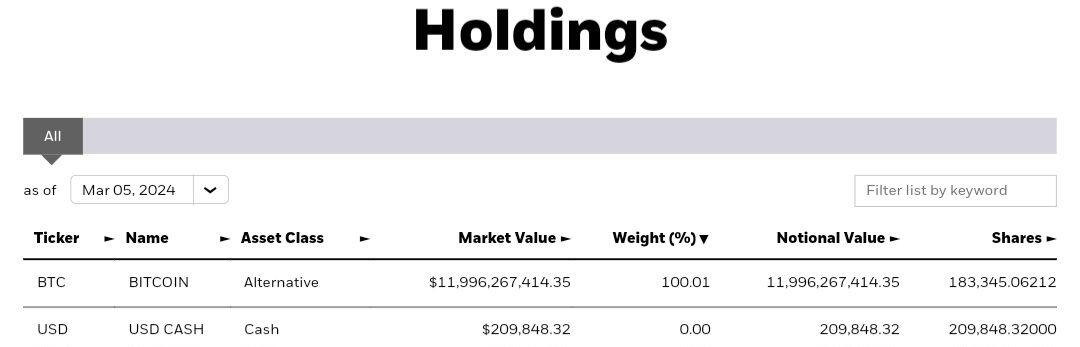

Blackrock's Bitcoin ETF, $IBIT, now holds 183,345 BTC, up 12,624 from yesterday.

This is their BIGGEST daily purchase so far.

Blackrock now holds 0.87% of the total supply of BTC, with their total assets valued at almost $12 billion.

900 BTC are issued per day. In April this will drop to 450.

Blackrock clients bought 14x the newly issued supply!

Blackrock acquired another 6,000 BTC yesterday.

Total value of their holdings: $11.4 Billion

$1M BTC by 2034 is VERY conservative.

This would require a 31% annual return in fiat terms

Bitcoin has returned almost 80%/year in terms of US Dollars over the last 5 years WITH FTX trying its hardest to keep the price down

Wall Street firms aren't stupid enough to risk bankruptcy to keep the price down

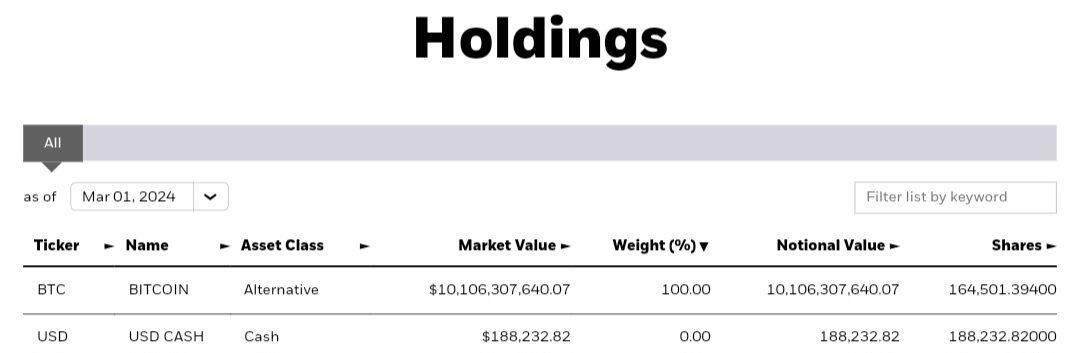

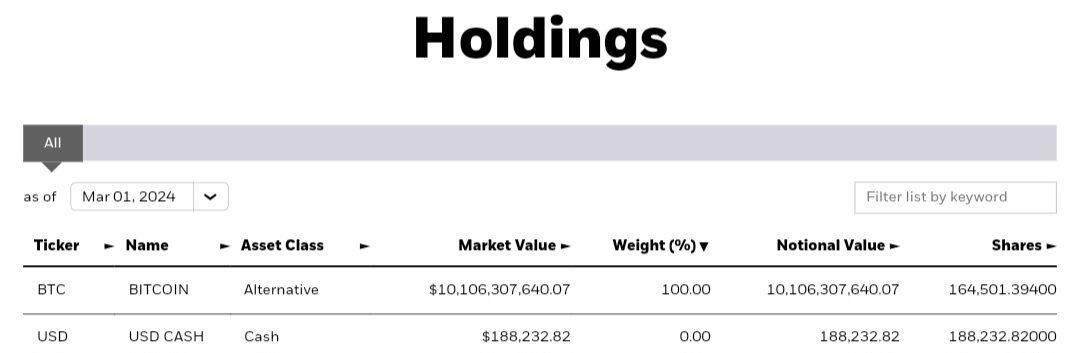

Blackrock's Bitcoin ETF, IBIT, now holds 164,501 BTC, up 3,236 from Thursday.

Blackrock now holds 0.78% of the total supply of BTC.

900 BTC are issued per day. In April this will drop to 450.

Blackrock clients bought almost 3.5x the newly issued supply on Friday!

The people refusing to buy Bitcoin today will be so angry at the people who are going all in

Today they say "It's a Ponzi scheme," "It's going to zero," or "It's too risky"

In 2034 they will say "It's so unfair," "They were lucky," and "Bitcoin is too powerful, it should be banned"

Today 1 BTC = $62,000.

You can buy 1,612 Satoshis, or 0.00001612 BTC, for $1.

If someone earns $15/hour, they can buy 24,193 satoshis or 0.00024193 BTC per hour.

When Bitcoin is $1M, this amount of BTC will be worth $241.93, meaning you ~16x your money.

Your actual hourly wage will be worth a lot less in terms of Bitcoin (eg. if it's $20/hour, you'll be able to buy 2,000 Satoshis or 0.00002 BTC with the hourly wage), but the purchasing power of your savings will increase.

There is no top for #Bitcoin's price because there's no bottom for fiat currencies

We will see a new high every 4 years or so (some cycles may be a bit different, I can't predict the future, but halvings happen ever 4 years so I think this will be the case)

Each cycle fewer people want to sell and more people want to buy

Everyone I know who understands Bitcoin wants to add more to their stack!

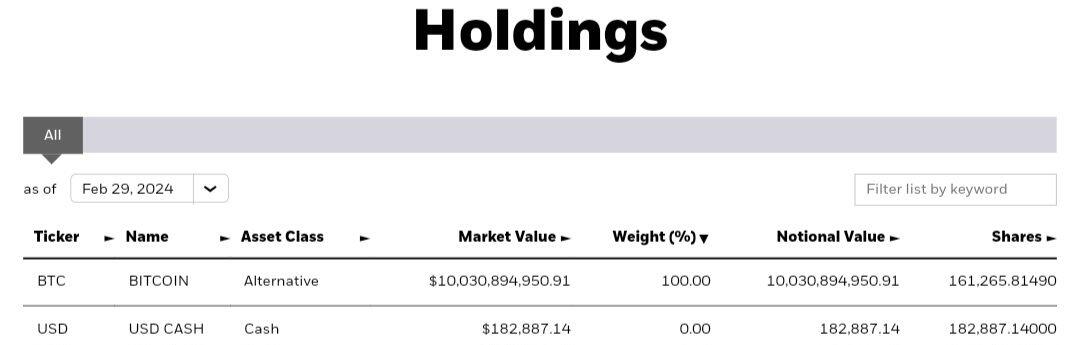

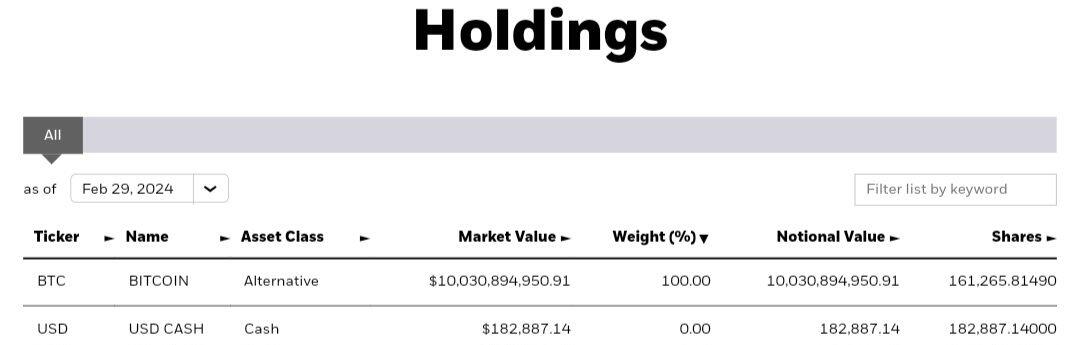

Blackrock's Bitcoin ETF SURPASSED $10 BILLION of assets under management!

$IBIT now holds 161,265 BTC, up 9630 from yesterday.

Blackrock now holds 0.77% of the total supply of BTC.

900 BTC are issued per day. In April this will drop to 450.

Blackrock clients bought almost 11x the newly issued supply!

Blackrock is going to be launching a Bitcoin ETF in Brazil tomorrow! 🤯🤯

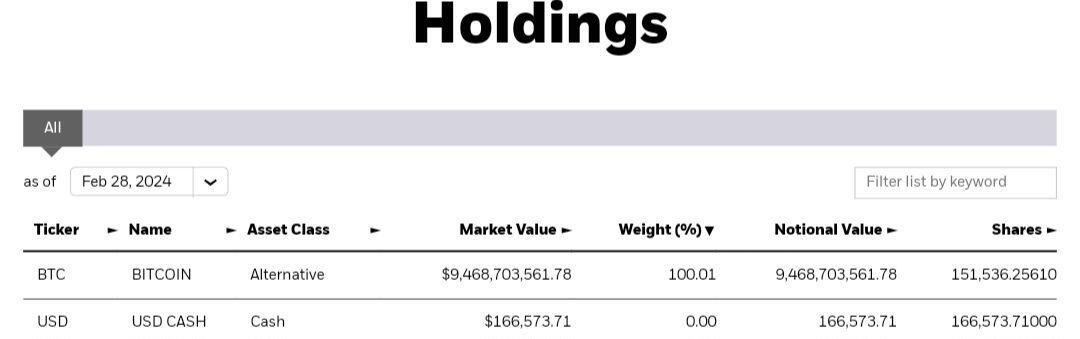

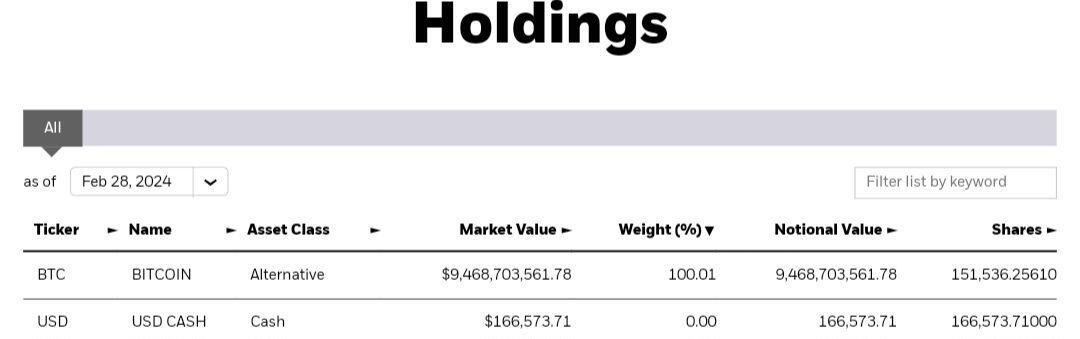

Blackrock's Bitcoin ETF now holds 151,536 BTC, up 10,140 from yesterday. This is a NEW record for the biggest day of inflows 🤯🤯

IBIT's total holdings are now worth $9.5 BILLION.

Blackrock now holds 0.72% of the total supply of BTC.

900 BTC are issued per day. In April this will drop to 450.

Blackrock clients bought over 11x the newly issued supply!

IBIT (Blackrock's Bitcoin ETF) had ~$3 billion in volume today!

That's insane

Yesterday it was $1.3 Billion

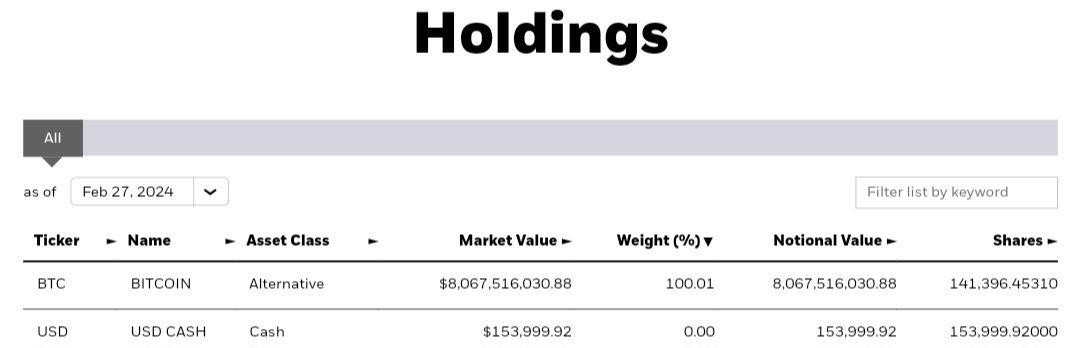

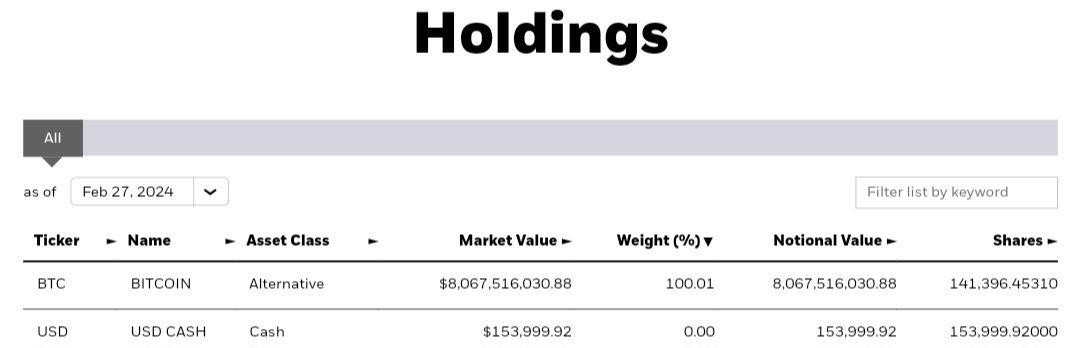

Blackrock's Bitcoin ETF now holds 141,396 BTC, up 9,114 from yesterday. This was the BIGGEST DAY so far for inflows 🤯🤯

IBIT's total holdings are now worth $8.07 BILLION.

Blackrock now holds 0.67% of the total supply of BTC.

900 BTC are issued per day. In April this will drop to 450.

Blackrock clients bought 10x the newly issued supply!

Most people don't realize that they're using real estate as a store of value...

Because dollars don't work

Bitcoin is a BETTER store of value than real estate

Cash flow is irrelevant if you have a 5+ year time horizon

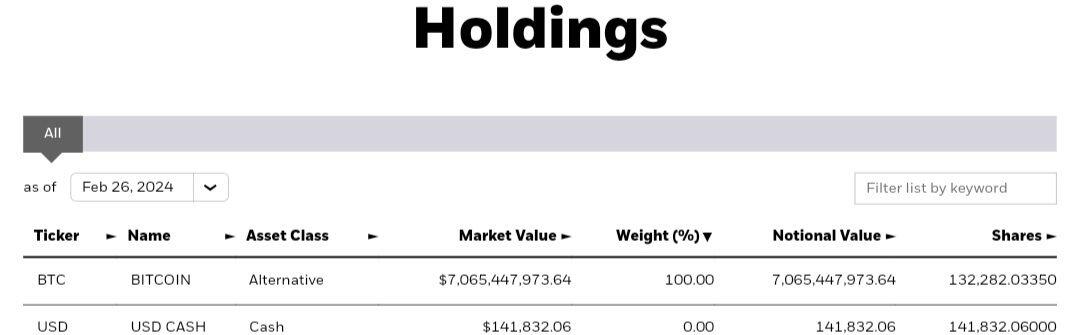

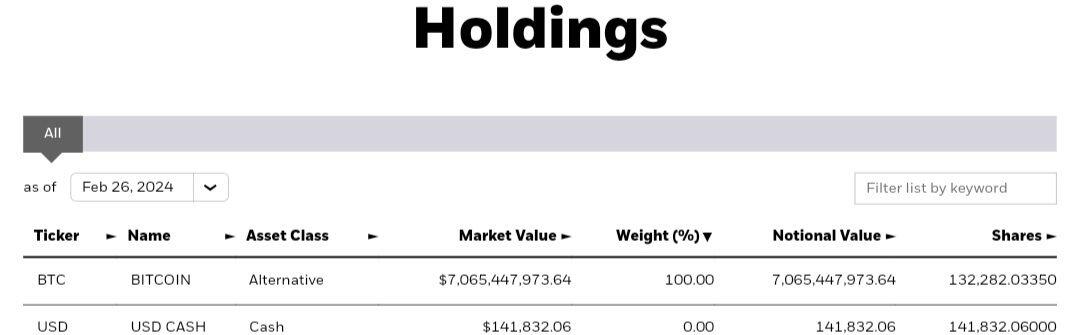

Blackrock's Bitcoin ETF now holds 132,282 BTC, up 2,051 from yesterday.

Their total holdings are now worth $7.07 BILLION.

Blackrock now holds 0.63% of the total supply of BTC.

900 BTC are issued per day. In April this will drop to 450.

Blackrock clients bought 2.28x the newly issued supply.

Bitcoin is a Veblen good

When the price rises, so does demand

There's more demand at $55k than there was at $16k

There will be more demand at $110K than there is at $55k

There will be even more demand at $1M than there will be at $110K

It's just a matter of time

Most people will ignore #Bitcoin until it's trading for $1M+ and they'll STILL be early.

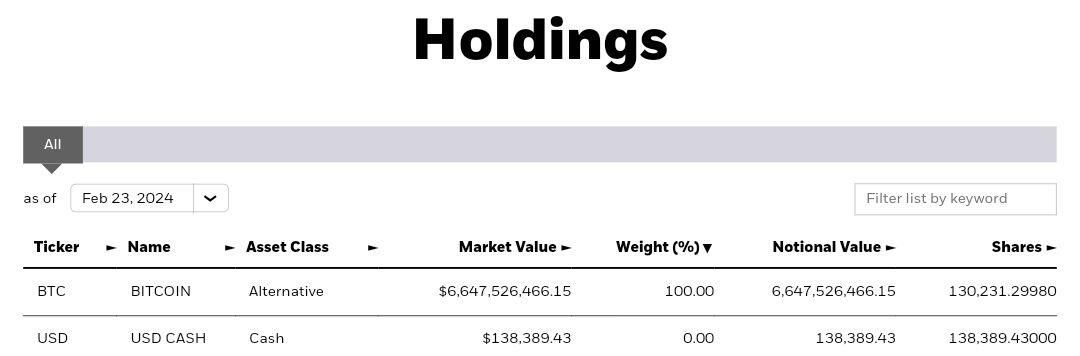

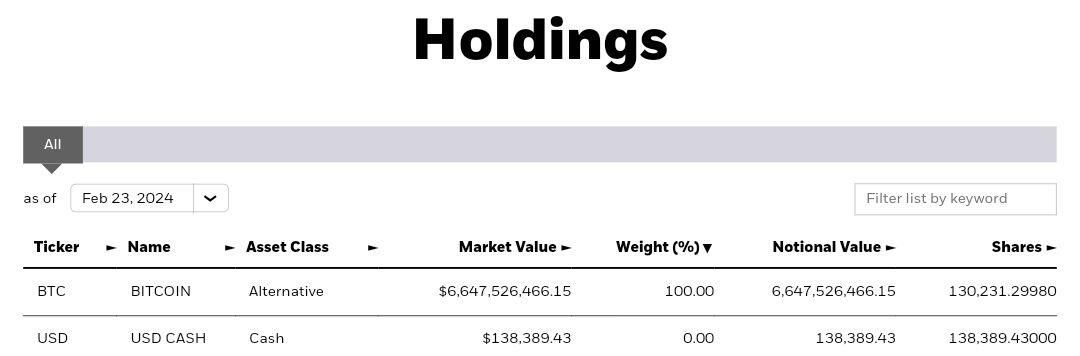

Blackrock's Bitcoin ETF now holds 130,231 BTC, up 3,281 from Thursday.

Their total holdings are now worth $6.65 BILLION.

Blackrock now holds 0.62% of the total supply of BTC.

900 BTC are issued per day. In April this will drop to 450.

On Friday, Blackrock clients bought 3.5x the newly issued supply.

$625k home

20% down-payment

$500k mortgage

With a 6% interest rate and a 30-year term, you are paying $579,190.95 in interest.

The $625,000 house cost you $1,204,190.95.

This is equal to a $3,345 monthly rental payment, plus you pay for maintenance and repairs.

Houses cost so much because people can borrow money that's created with the press of a button to buy them.

If everyone had to pay in cash for their home, prices would drop significantly.

Most people think mortgages are designed to help them.

But NO.

Mortgages are designed to earn profits for banks.

A BP employee's husband made over $1M through insider trading.

He listened to his wife's call without her knowledge and overheard a conversation about BPs takeover of Travel Centers of America.

He faces up to 5 years in federal prison and a possible $250,000 maximum fine.

Isn't it crazy how this guy might be going to jail...

But Nancy Pelosi's husband is just seen as a "Lucrative Stock Trader"?

Bitcoin is the only way to opt out.