A BP employee's husband made over $1M through insider trading.

He listened to his wife's call without her knowledge and overheard a conversation about BPs takeover of Travel Centers of America.

He faces up to 5 years in federal prison and a possible $250,000 maximum fine.

Isn't it crazy how this guy might be going to jail...

But Nancy Pelosi's husband is just seen as a "Lucrative Stock Trader"?

Bitcoin is the only way to opt out.

We're still very early to Bitcoin

Every post I see about Bitcoin has comments like:

- It's a Ponzi scheme (it's not)

- It uses too much energy (it doesn't)

- It's too expensive to use (layer 2 solutions will solve this)

- It has no intrinsic value (it doesn't need to)

- It will be taken down by governments around the world (this is the most ridiculous argument of all because the protocol is run on computers all around the world, and a lot are hidden with a VPN)

Some of these comments come from people pumping random garbage altcoins, 99.9% of which will never make new highs against the price of BTC

The vast majority come from people backing up gold, real estate, and stocks who are worried that their investment is slowly being demonetized

The people commenting are usually arrogant and can't back up what they claim with facts

The vast majority of the public has no clue what this is, but they reject the idea without understanding it in depth

Most people prefer to stick to the old system because that's what they're familiar with and Bitcoin is confusing

They don't realize that the old system is designed to extract their wealth and make them poorer

Stop letting the distractions keep you from doing your own research

Verify EVERYTHING you learn from multiple sources and look at the arguments for and against the topic

The only way to opt out of the rising cost of goods and live a life of abundance is to understand how money works

Bitcoin will lead you down so many rabbit holes and it will expose so much of the world to you

If you're going to take this route, get mentally ready to take off the rose-tinted glasses and be disappointed with how things are run today

#Bitcoin doesn't need to produce cash flows

#BTC IS the money

Other things will produce Bitcoin.

Over the next 20-30 years, we will assess businesses based on their ability to earn Bitcoin cash flows.

We are so early that you can buy money today using pieces of paper!

Blackrock's Bitcoin ETF now holds 124,534 BTC, up 1,891 from yesterday.

Their total holdings are now worth $6.4 billion.

Blackrock now holds 0.593% of the total supply of BTC.

900 BTC are issued per day. In April this will drop to 450.

Blackrock clients bought 2x the newly issued supply.

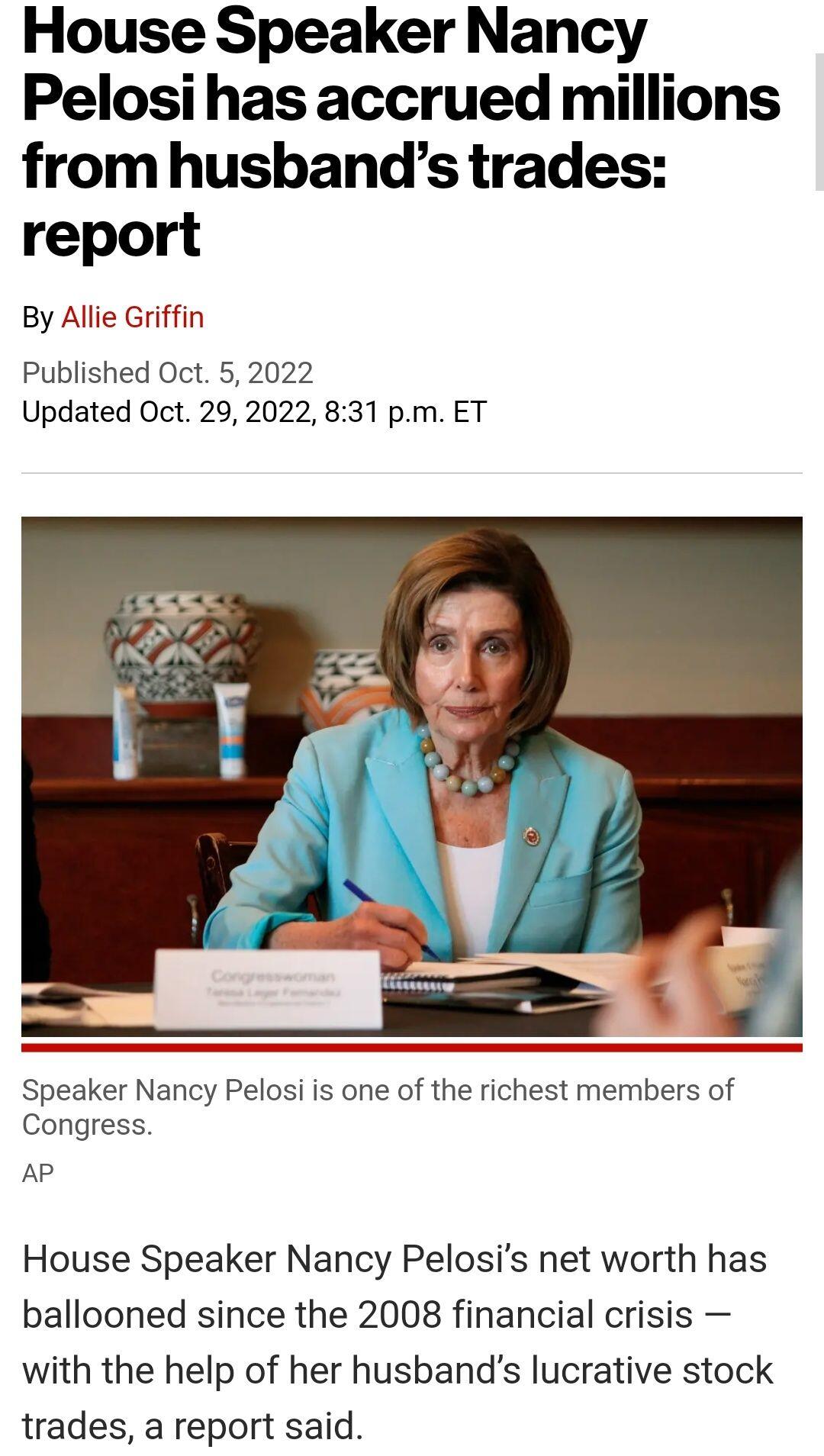

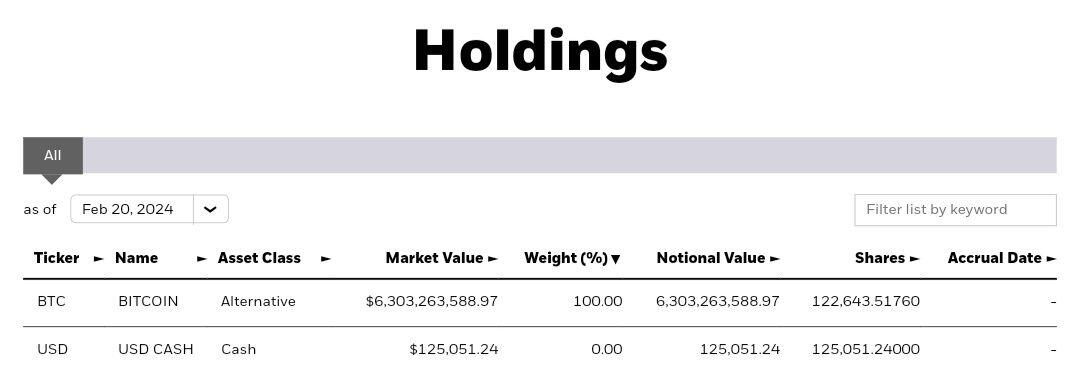

Blackrock's Bitcoin ETF now holds 122,643 BTC, up 2,962 from Friday.

Their total holdings are now worth $6.3 BILLION.

Blackrock now holds 0.584% of the total supply of BTC.

900 BTC are issued per day. In April this will drop to 450.

Yesterday, Blackrock clients bought 3.3x the newly issued supply.

Banks make money from the lower class through fees and interest,

Borrow money from the middle class for free,

Then lend it to the upper class, so that they can become even more wealthy.

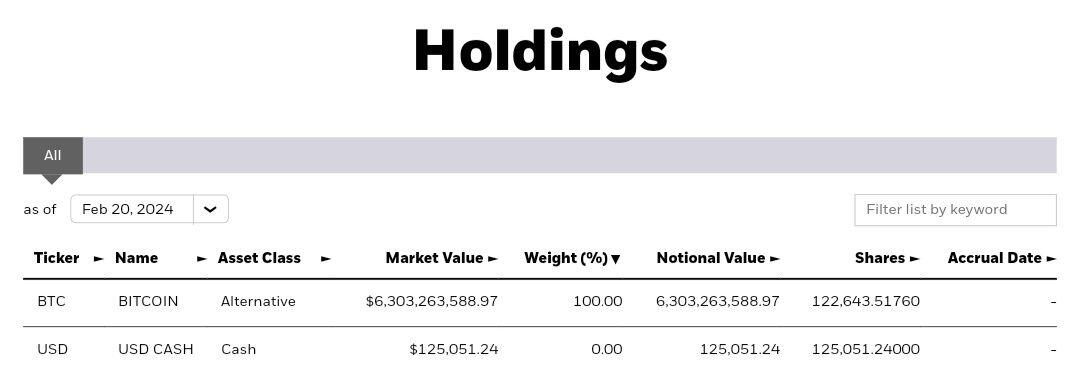

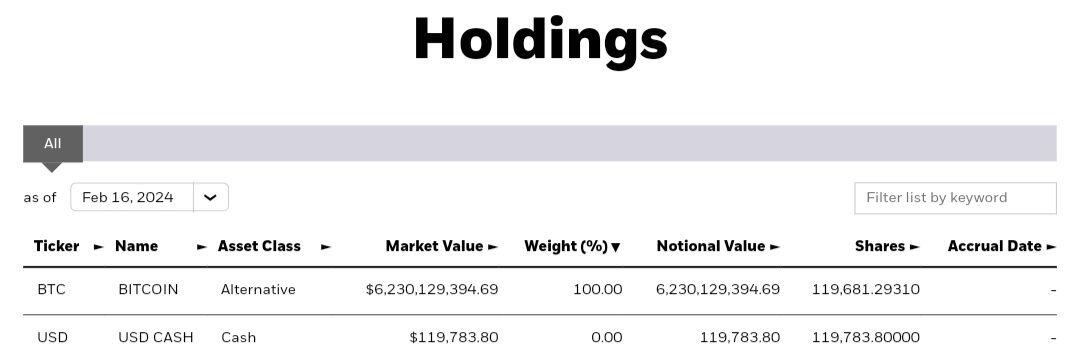

Blackrock's Bitcoin ETF now holds 119,681 BTC, up 3,692 from Thursday.

Their total holdings are now worth $6.2 BILLION.

Blackrock now holds 0.5699% of the total supply of BTC.

900 BTC are issued per day. In April this will drop to 450.

On Friday, Blackrock clients bought 4.1x the newly issued supply.

The absolute stupidest reason for rejecting Bitcoin:

"Power grids can be taken down, and the internet may not exist."

99% of your day-to-day transactions are done using electricity and the internet.

Where do you keep your money today? Most likely in a bank account?

If every power grid on earth is somehow taken out, I'm 110% sure the money in your bank account won't be accessible either.

And I'm also 110% sure that the Bitcoin network will be back up and running BEFORE your bank.

So many people rejecting #Bitcoin think it's something the majority of the world already understands and owns.

They don't realize THEY ARE IN THE MAJORITY.

99% of people don't get it and 90%+ will NEVER get it, just like they don't understand the current financial system.

The majority are ALWAYS wrong when it comes to financial decisions.

This time will not be different.

The crowd will be wrong again, and they'll start paying attention when BTC is $1M+.

Bitcoin is more likely to rise to $1M than it is to drop to $0

I spent over 3 years and thousands of hours studying Bitcoin

I had to let go of things I believed about money my entire life

I had to delay gratification to buy BTC

I had to go against the crowd

And yet in 10 years

Most people will say I got lucky

Blackrock's Bitcoin ETF now holds 109,609 BTC, up 4,392 from yesterday.

Their total holdings are now worth $5.6 BILLION.

Blackrock now holds 0.5219% of the total supply of BTC.

900 BTC are issued per day. In April this will drop to 450.

Yesterday, Blackrock clients bought 4.88x the newly issued supply.

https://image.nostr.build/4afdda810b562b991b9dc42c84bdff87ced06966d284f52795423250ff261a1a.jpg#m=image%2Fjpeg&dim=1080x357&blurhash=Q4SF-EM%7B_3IU9EM%7B%3Fbt7xu-qWB_3of4nofxuM%7BM%7B%7Eoxu%7Eqt7IVoM%25MxuRj&x=9494da56d837acc3fcf092779e59fe6d482aef4c25885832b542c57263eb841eOver the last 15 years, Blackrock and Fidelity could do nothing to stop you from buying #Bitcoin.

Today, people are messaging me to ask "What can we do to stop BlackRock from owning all the #BTC?"

Nothing.

All you can do is not sell to them.

We (the average retail investor) had a 15-year head start.

Blackrock will keep accumulating BTC until there is almost no available supply to be bought below $100,000 then until there is no available supply below $1,000,000, then $10,000,000.

And they will likely never sell again.

Blackrock's Bitcoin ETF now holds more than 100k BTC!!

It now holds 105,280 BTC, up 10,004 from yesterday. THIS IS THEIR BIGGEST DAY SO FAR 🤯

Their total holdings are now worth $5.1 BILLION.

Blackrock now holds 0.5013% of the total supply of BTC.

900 BTC are issued per day. In April this will drop to 450.

Yesterday, Blackrock clients bought 11.11x the newly issued supply.

https://image.nostr.build/40ab45669b7a30aeeccd29a8b6a692bfbe70d8aa8089eba33bae9d9b728f7ce0.jpg#m=image%2Fjpeg&dim=1080x347&blurhash=Q4SF%3BLM%7B_3IU4nM%7B%3Fbofxu%253WB_3of4nj%5BxuM%7BM%7B_2xu%7Eqt7IUof%25MxuRj&x=4d05808fdf7125d6926ec0f2e4263060866b11eafe81a99c8ead8be6b041b238A reminder:

There will only ever be 21,000,000 BTC

If you own 1/21,000,000

You own 0.00000004762% of the total monetary supply

1 BTC will cost $1M, then $10M, then $100M

Eventually, the only way to get more BTC will be to exchange your time for it

You DON'T need to buy whole coins - each BTC can be split into 100,000,000 unit, so you can buy fractions!

BTC will reach $1M before Bitcoin ETFs hold 1M BTC (including GBTC).

Exchanges have the lowest balances since 2017.

Keep in mind a lot of these balances are just there because they are too small to move to cold storage - a lot of these coins are not for sale.

At $42.6K I got a DM from someone telling me they set up a limit order to buy BTC at $42K.

They messaged me again today and asked why I didn't just tell them to buy right away because now they can't afford a whole coin.

A lot of people are holding off to get a tiny discount, and they end up getting burned so hard...

Just set up recurring buys and relax. You don't need to get the perfect entry.

Accumulate small amounts over time.

The price might go down a bit from here, but who cares?

Does it REALLY matter if you buy at $50,200 vs 49,000?

In 10 years you won't even care about a $1,200 difference.

Blackrock's Bitcoin ETF now holds 87,779 BTC, up 5,264 from Thursday.

Their total holdings are now worth $4.1 BILLION.

Blackrock now holds 0.418% of the total supply of BTC.

900 BTC are issued per day. In April this will drop to 450.

On Friday, Blackrock clients bought 5.85x the newly issued supply.

https://image.nostr.build/501bfb1f5519367d14eab0dd8d84b5e150a4c1528c10a57e55638a5820b820e3.jpg#m=image%2Fjpeg&dim=1080x369&blurhash=Q5SPX_Ri%3FbM%7B9FRj-%3Boft7j%5EWB%3Fboe9FfQxuRjRj%7Ept7_3t7M%7Bofxut7Rj&x=6932b72562b585cf2a98f10004ff1538e2e1cf7fd1387d05f0468bc3ff4077c5Instead of pushing Bitcoin holders out of their country, I think in the future governments will treat them very well.

On the other hand, with stocks and real estate, governments can treat investors worse over time because there's almost no way out unless you go through a regulated financial institution.

What do you think will happen if the US government has to borrow in a different currency?

Its power to borrow USD and do whatever it wants will be gone when (not if) the US Dollar loses its status as world reserve currency.

This is when I think anyone with unrealized capital gains in the legacy financial system gets rekt.

You can never own real estate because you will always pay property taxes.

If your government increases the property tax, what are you gonna do about it?

The market price will likely be forced down as fewer buyers want to hold a property just to pay 3-5% in property taxes each year.

You might be able to sell your property, but I think capital gains tax laws would be next.

Anything you've saved in real estate will likely be devalued significantly.

What happens if CG taxes go from ~20% to 50%+?

Since Bitcoin is a permission-less network, its users are free to move their wealth across borders as they please.

You can't pick up a rental property and move it to another country.

You can't send your stocks somewhere else unless you go through a financial institution that serves as a custodian.

If governments try to implement a property tax on Bitcoin and you have self-custody, you can send it to another jurisdiction within minutes.

If you don't have the keys to the address in the other jurisdiction, there's nothing your government can do to get that BTC back.