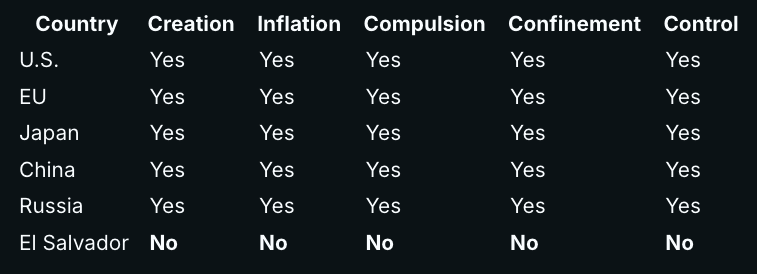

Let’s use AI to see how the Five Characteristics of Repressive Monetary Systems are exhibited, or not, around the globe.

We asked Llama 3.1 to create a table that indicates whether these monetary systems lawfully exhibit the following repressive characteristics: Currency Creation, Currency Inflation, Currency Compulsion, Currency Confinement, and Currency Control as described on the Monetary Justice website. This was its response:

Explanation:

- United States: The Federal Reserve, the central bank of the United States, has the authority to create new currency units without backing, effort, or productive output, contributing to currency inflation. The government enforces the use of the US dollar through laws, confines alternative currencies with taxation and regulation, and exercises control over financial transactions through banks and surveillance.

- European Union: The European Central Bank (ECB) implements a fiat monetary system, allowing for currency creation and inflation. EU governments compel citizens to use the Euro, restrict alternative currencies, and monitor financial transactions.

- Japan: Japan's central bank, the Bank of Japan, operates a fiat monetary system, enabling currency creation and inflation. The government enforces the use of the Japanese yen, confines alternative currencies, and exercises control over financial transactions.

- China: China's central bank, the People's Bank of China, implements a fiat monetary system, allowing for currency creation and inflation. The government compels citizens to use the Chinese yuan, restricts alternative currencies, and monitors financial transactions.

- Russia: Russia's central bank operates a fiat monetary system, enabling currency creation and inflation. The government enforces the use of the Russian ruble, confines alternative currencies, and exercises control over financial transactions.

- El Salvador: El Salvador has adopted Bitcoin as a legal tender, allowing citizens to use it alongside the US dollar. This move reduces the country's reliance on a fiat monetary system, minimizing the effects of currency creation, inflation, compulsion, confinement, and control.

[Table and Explanation generated by Llama 3.1 405B]

How do you interpret these results?

Learn more about the Five Characteristics of Repressive Monetary Systems at:

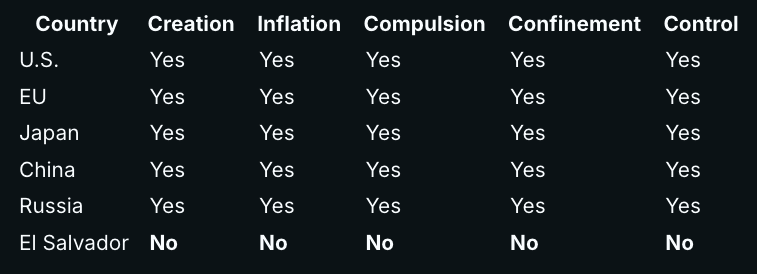

Explanation:

- United States: The Federal Reserve, the central bank of the United States, has the authority to create new currency units without backing, effort, or productive output, contributing to currency inflation. The government enforces the use of the US dollar through laws, confines alternative currencies with taxation and regulation, and exercises control over financial transactions through banks and surveillance.

- European Union: The European Central Bank (ECB) implements a fiat monetary system, allowing for currency creation and inflation. EU governments compel citizens to use the Euro, restrict alternative currencies, and monitor financial transactions.

- Japan: Japan's central bank, the Bank of Japan, operates a fiat monetary system, enabling currency creation and inflation. The government enforces the use of the Japanese yen, confines alternative currencies, and exercises control over financial transactions.

- China: China's central bank, the People's Bank of China, implements a fiat monetary system, allowing for currency creation and inflation. The government compels citizens to use the Chinese yuan, restricts alternative currencies, and monitors financial transactions.

- Russia: Russia's central bank operates a fiat monetary system, enabling currency creation and inflation. The government enforces the use of the Russian ruble, confines alternative currencies, and exercises control over financial transactions.

- El Salvador: El Salvador has adopted Bitcoin as a legal tender, allowing citizens to use it alongside the US dollar. This move reduces the country's reliance on a fiat monetary system, minimizing the effects of currency creation, inflation, compulsion, confinement, and control.

[Table and Explanation generated by Llama 3.1 405B]

How do you interpret these results?

Learn more about the Five Characteristics of Repressive Monetary Systems at:

Explanation:

- United States: The Federal Reserve, the central bank of the United States, has the authority to create new currency units without backing, effort, or productive output, contributing to currency inflation. The government enforces the use of the US dollar through laws, confines alternative currencies with taxation and regulation, and exercises control over financial transactions through banks and surveillance.

- European Union: The European Central Bank (ECB) implements a fiat monetary system, allowing for currency creation and inflation. EU governments compel citizens to use the Euro, restrict alternative currencies, and monitor financial transactions.

- Japan: Japan's central bank, the Bank of Japan, operates a fiat monetary system, enabling currency creation and inflation. The government enforces the use of the Japanese yen, confines alternative currencies, and exercises control over financial transactions.

- China: China's central bank, the People's Bank of China, implements a fiat monetary system, allowing for currency creation and inflation. The government compels citizens to use the Chinese yuan, restricts alternative currencies, and monitors financial transactions.

- Russia: Russia's central bank operates a fiat monetary system, enabling currency creation and inflation. The government enforces the use of the Russian ruble, confines alternative currencies, and exercises control over financial transactions.

- El Salvador: El Salvador has adopted Bitcoin as a legal tender, allowing citizens to use it alongside the US dollar. This move reduces the country's reliance on a fiat monetary system, minimizing the effects of currency creation, inflation, compulsion, confinement, and control.

[Table and Explanation generated by Llama 3.1 405B]

How do you interpret these results?

Learn more about the Five Characteristics of Repressive Monetary Systems at:

Explanation:

- United States: The Federal Reserve, the central bank of the United States, has the authority to create new currency units without backing, effort, or productive output, contributing to currency inflation. The government enforces the use of the US dollar through laws, confines alternative currencies with taxation and regulation, and exercises control over financial transactions through banks and surveillance.

- European Union: The European Central Bank (ECB) implements a fiat monetary system, allowing for currency creation and inflation. EU governments compel citizens to use the Euro, restrict alternative currencies, and monitor financial transactions.

- Japan: Japan's central bank, the Bank of Japan, operates a fiat monetary system, enabling currency creation and inflation. The government enforces the use of the Japanese yen, confines alternative currencies, and exercises control over financial transactions.

- China: China's central bank, the People's Bank of China, implements a fiat monetary system, allowing for currency creation and inflation. The government compels citizens to use the Chinese yuan, restricts alternative currencies, and monitors financial transactions.

- Russia: Russia's central bank operates a fiat monetary system, enabling currency creation and inflation. The government enforces the use of the Russian ruble, confines alternative currencies, and exercises control over financial transactions.

- El Salvador: El Salvador has adopted Bitcoin as a legal tender, allowing citizens to use it alongside the US dollar. This move reduces the country's reliance on a fiat monetary system, minimizing the effects of currency creation, inflation, compulsion, confinement, and control.

[Table and Explanation generated by Llama 3.1 405B]

How do you interpret these results?

Learn more about the Five Characteristics of Repressive Monetary Systems at:

Americans for Monetary Justice

We