This one got quite personal and philosophical.

View quoted note →

Willy Woo

woonomic@NostrVerified.com

npub1clwv...xhme

#Bitcoin analyst.

Just finishing up our summer stay in Vancouver. Thanks for all the zaps, I got the chance to spend them all due to the great merchant adoption in this city.

Props to the CoinOS team for helping make that happen.

Checking out Boracay, the Bitcoin island. Breakfast paid by sats that were zapped my way! Thank you Nostr.

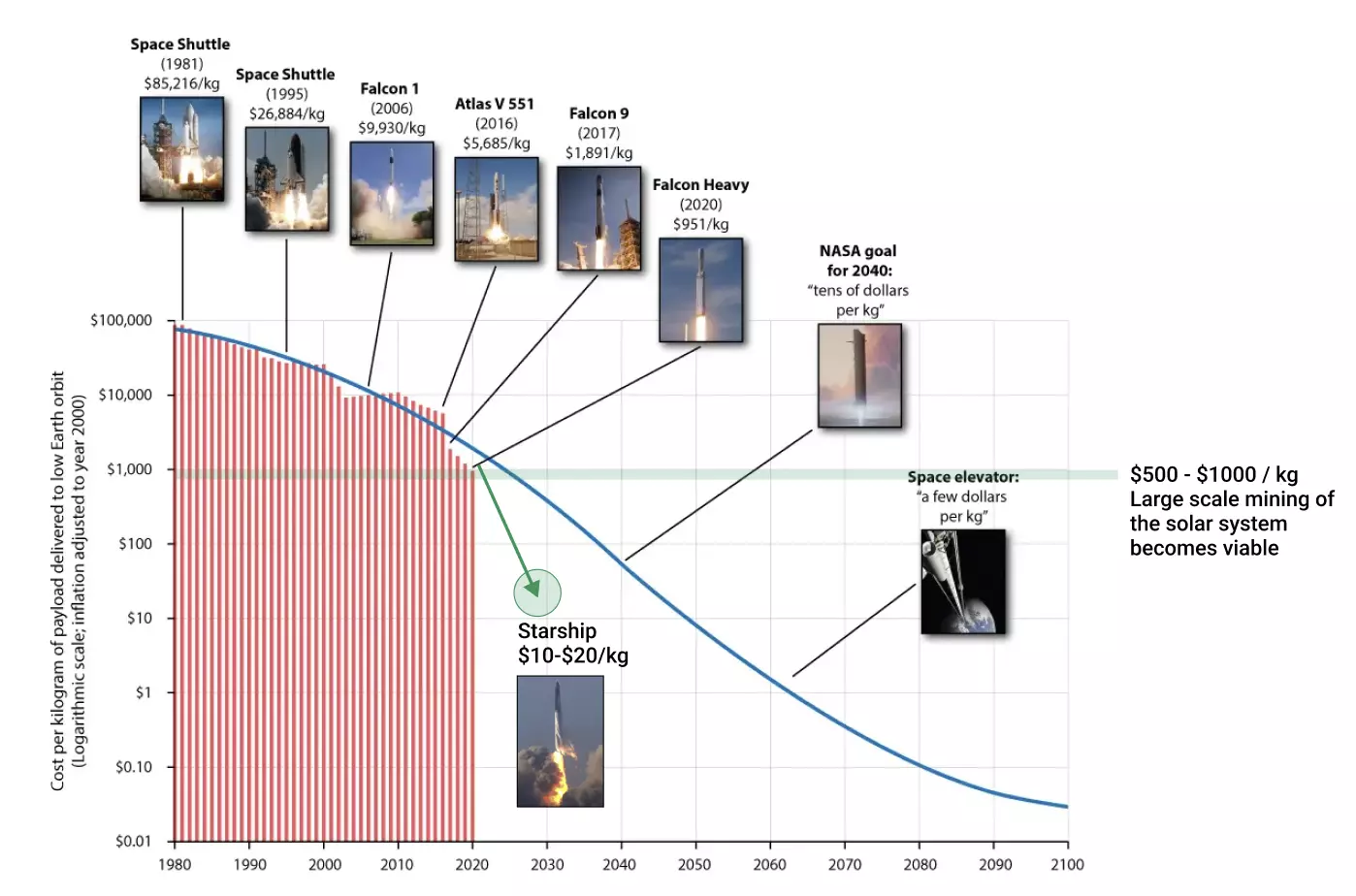

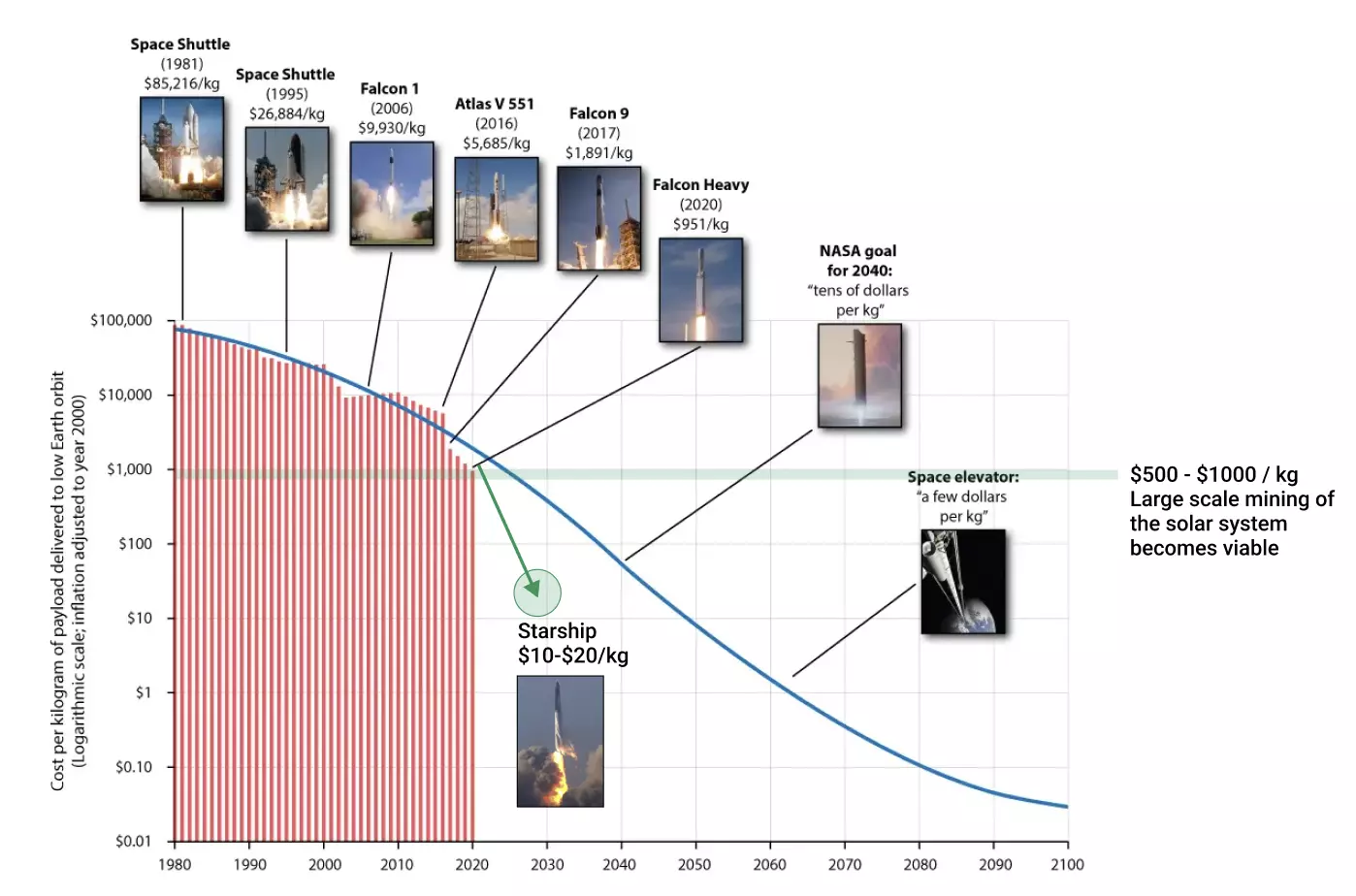

The scarcity of gold is about to change. #Bitcoin.

Really, it's a race to develop space mining tech, the cost to orbit is already becoming feasible.

References:

[1] $500-$1000 per kg to LEO

[2] cost to LEO chart

[2] cost to LEO chart

[3] Starship $10/kg to LEO

[3] Starship $10/kg to LEO

Space

Asteroid Mining: Key to the Space Economy

The Near Earth Asteroids offer both threat and promise. They present the threat of planetary impact with regional or global disaster. And they also...

Launch costs to low Earth orbit, 1980-2100 | Future Timeline | Data & Trends | Future Predictions

This graph shows the declining costs of launching people and cargo into space.

Wccftech

Elon Musk Reiterates Insanely Low Starship Launch Costs Of $10/kg

SpaceX CEO Elon Musk reiterates goal of $10/kg marginal launch costs for Starship - a goal dependant on launch cadence and mission objectives

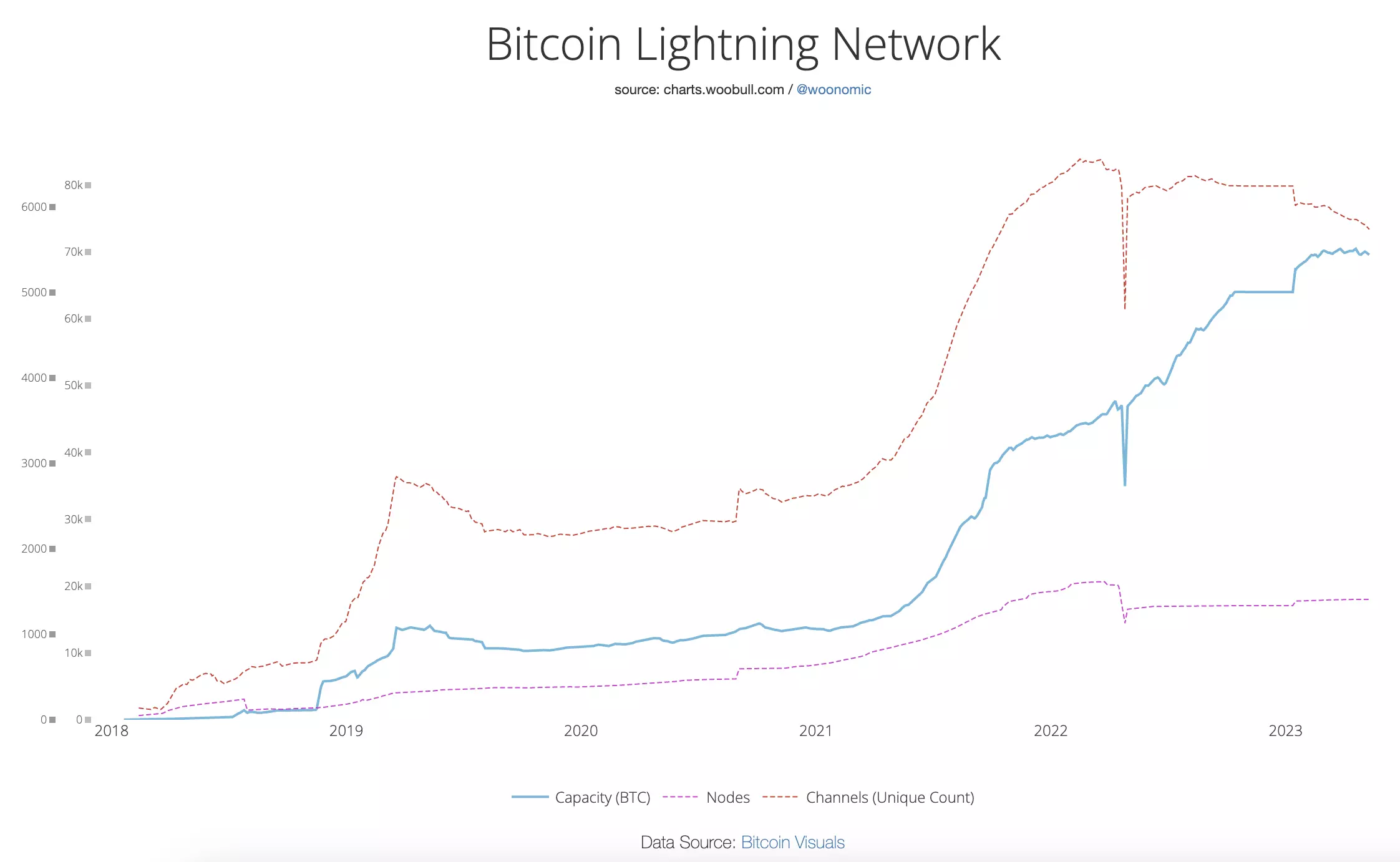

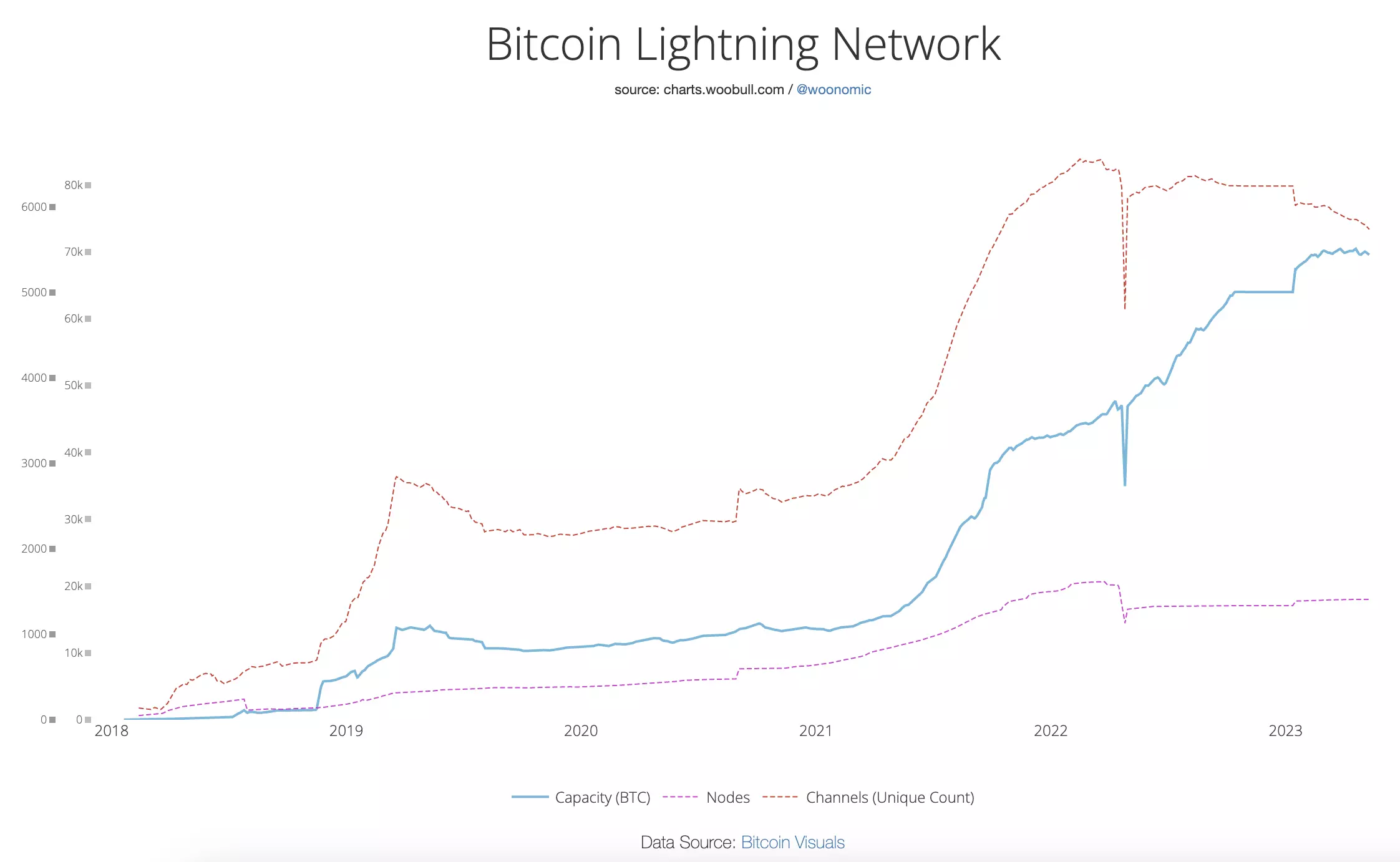

So the Lightning Network channels are declining while node count is up.

Does this mean the channel paths are calcifying around well worn routes? Any LN experts out there know what's causing this divergence?

My bank decided to re-issue a credit card due to fraud risk

My cellphone is on the old credit card number

Bank logins use that cellphone as a 2FA (WTF)

So the bank effectively shut down access to their own online banking

The entertainment value is immense

Now wondering if central banks will be comedy central when trying to execute a CBDC

Ethereum is NOT a protocol, you know things like TCP/IP and HTTP. The crypto world is in a mass psychosis. VC funds have blossomed on the thesis that L1s are the “protocols” for finance.

No, these are language and compute environments.

ETH was the first language to gain popularity for DeFi apps. But it was created before they knew what DeFI needs were.

We have seen this before… COBOL, Fortran, Lisp, C, JS, Rust.

Every language builds from learnings from the past and upon the needs of new domains. Old languages continue to be used, but many wane, new languages gain adoption.

ETH’s Solidity is COBOL.

To be clear:

- A protocol is a standard for messaging.

- A language is a standard for compute.

The former has longer and stronger network effects.

Bitcoin is more of the former while ETH is more of the latter.

There will be a ongoing market for better decentralised compute networks. Like COBOL it’s quite unlikely Solidity will be what we build DeFi apps on in say 20 years.

#[0] - I think the holy grail UX to be close to Twitter level of editing is access to screen capture to clipboard and to paste image into a post; on desktop app. Upload from Photos app, while a good jump, doesn’t quite do it.

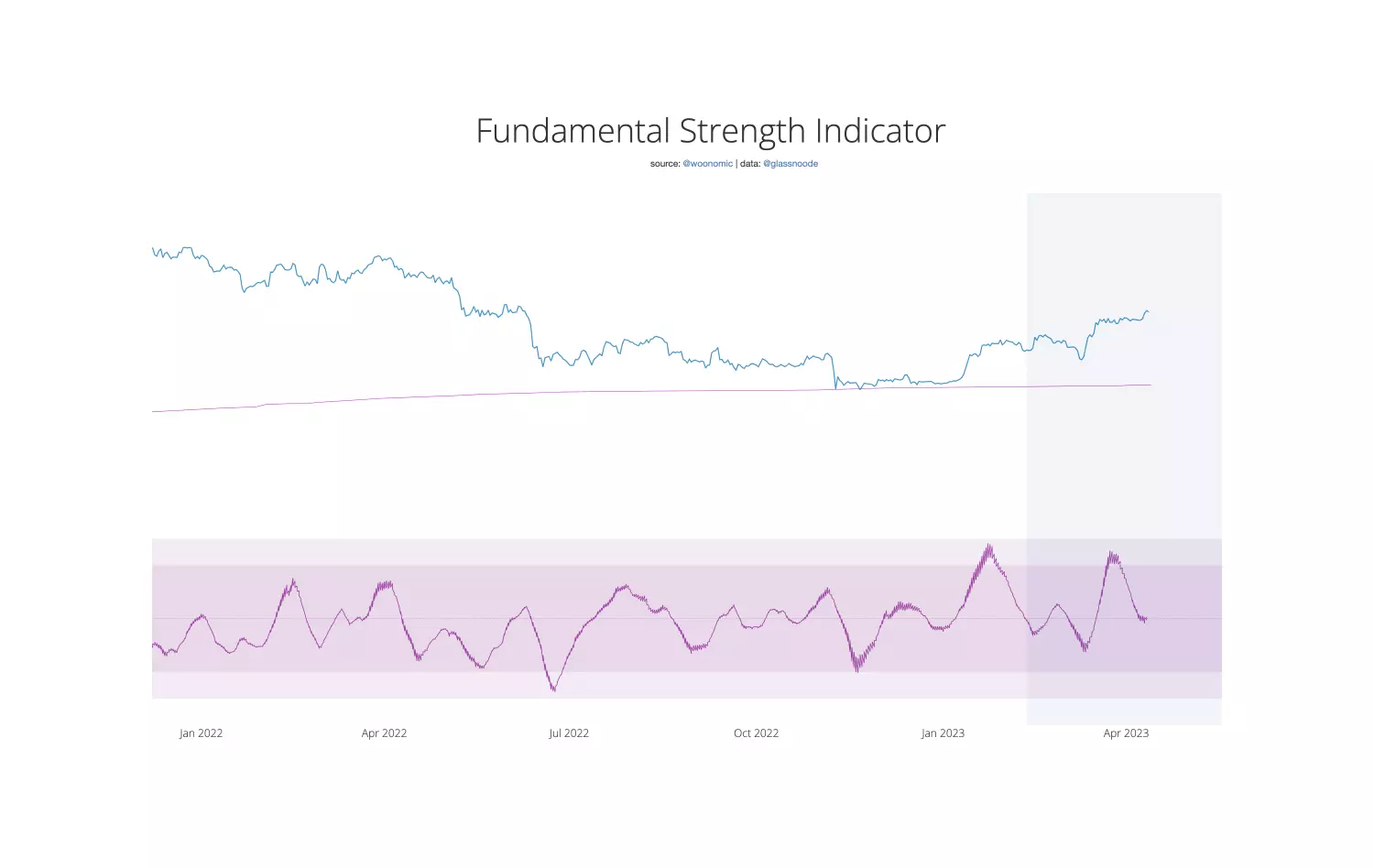

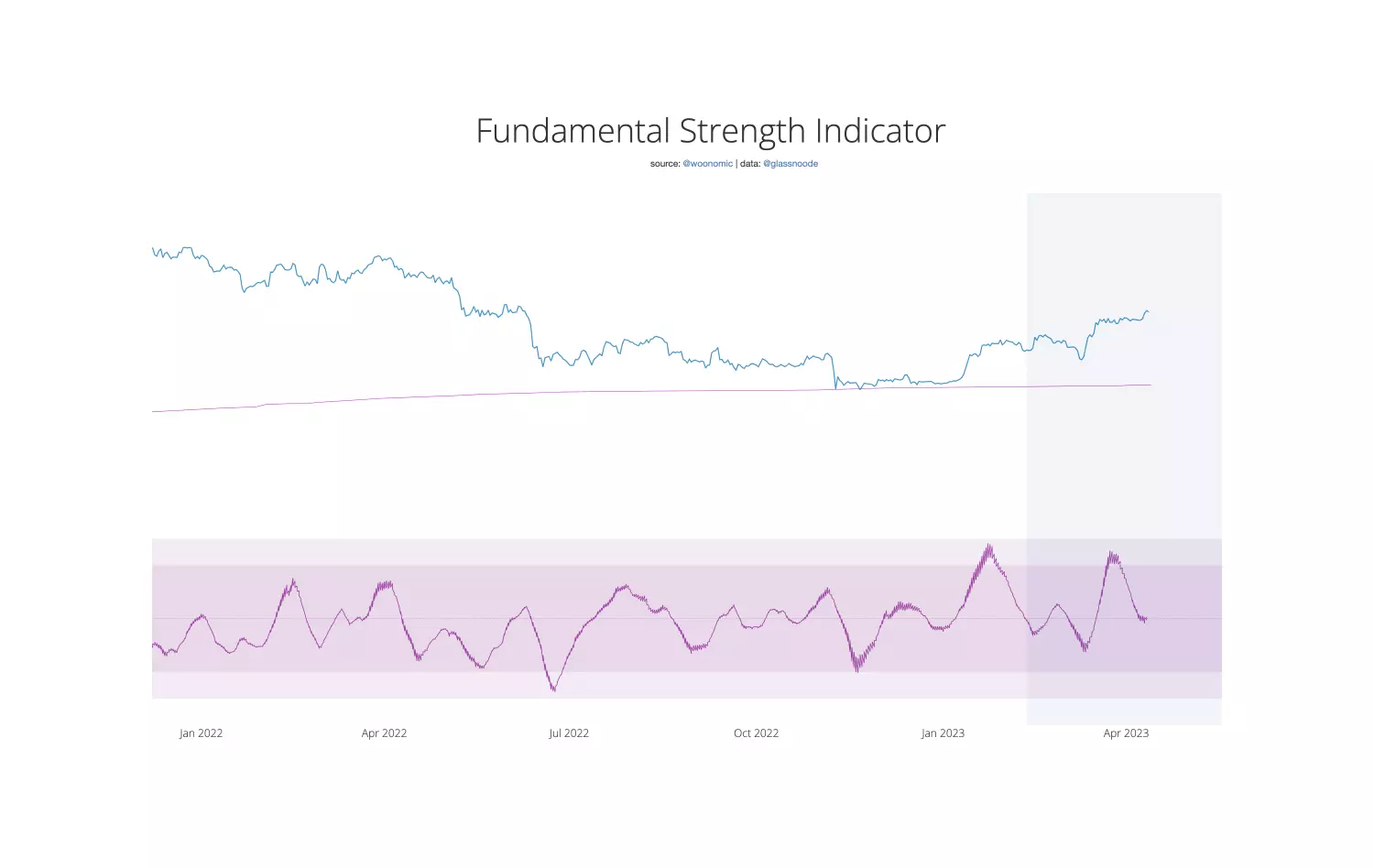

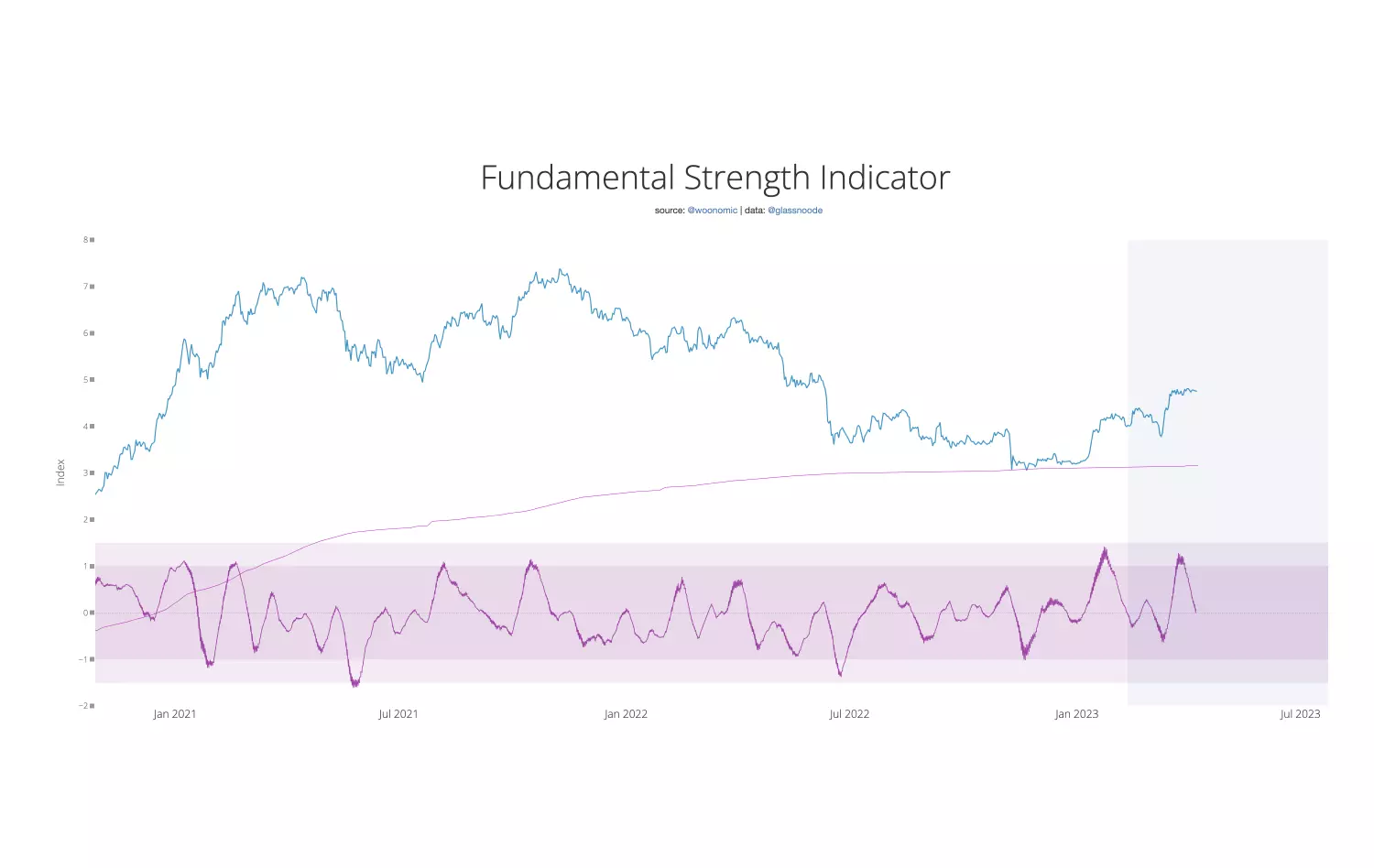

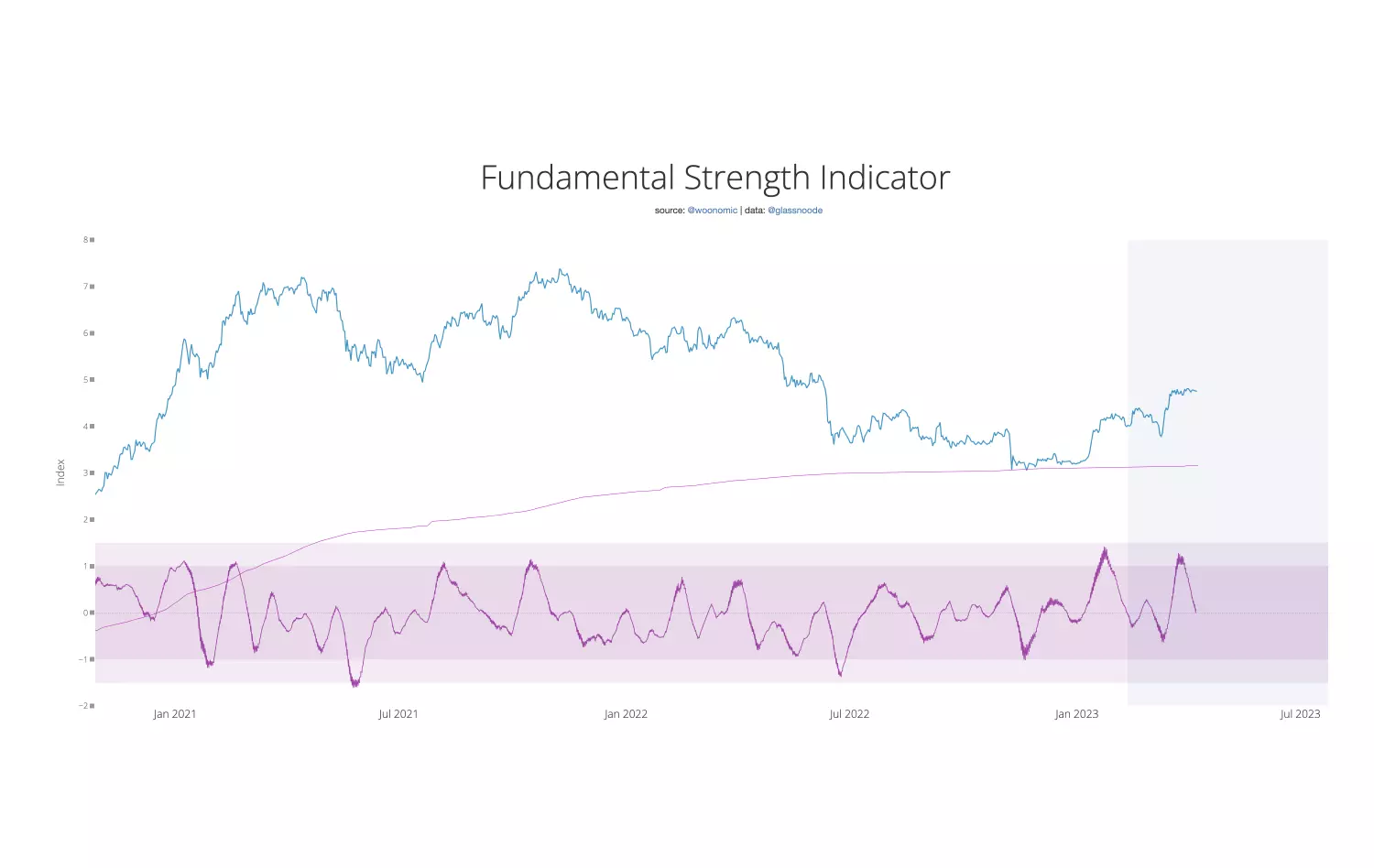

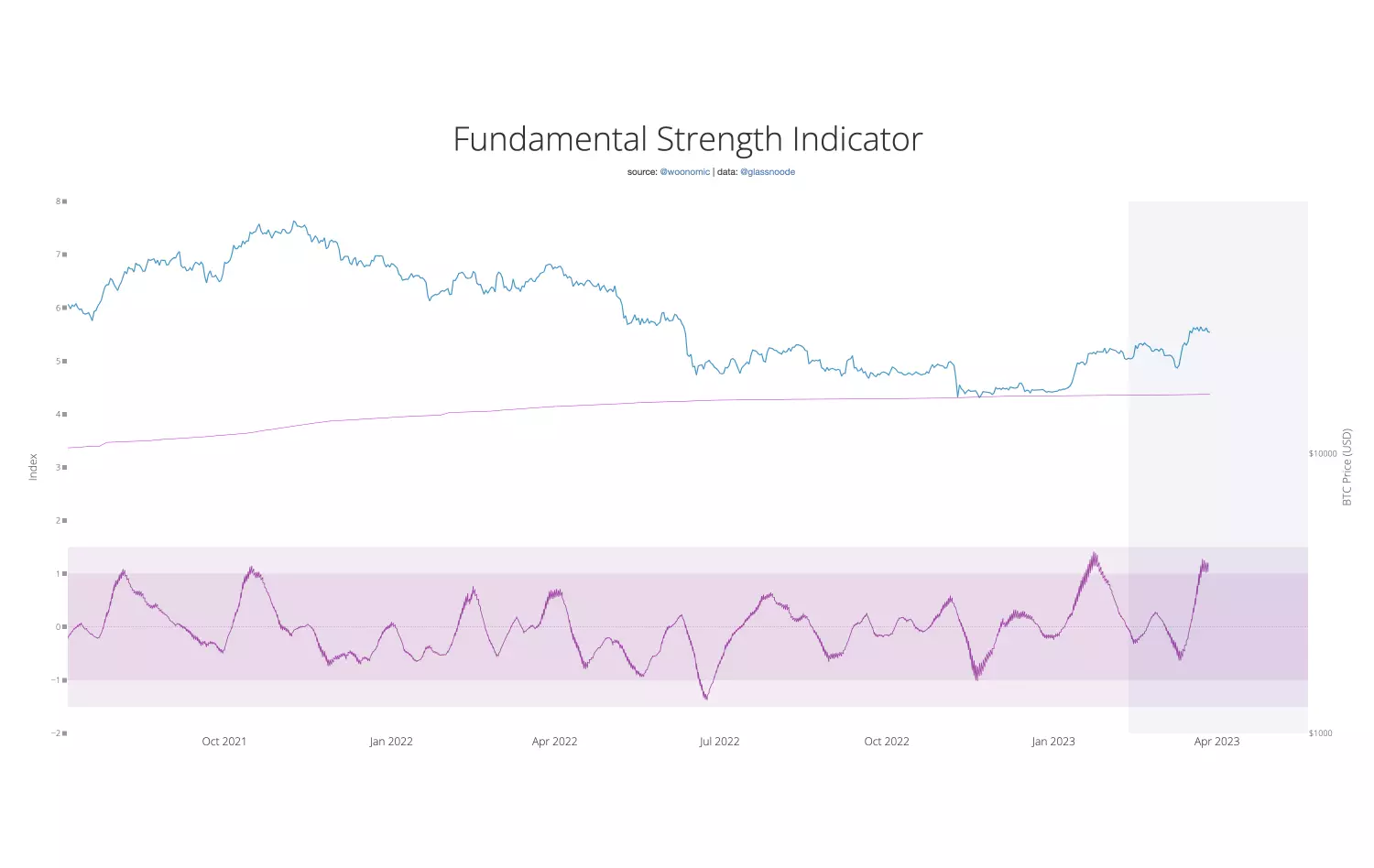

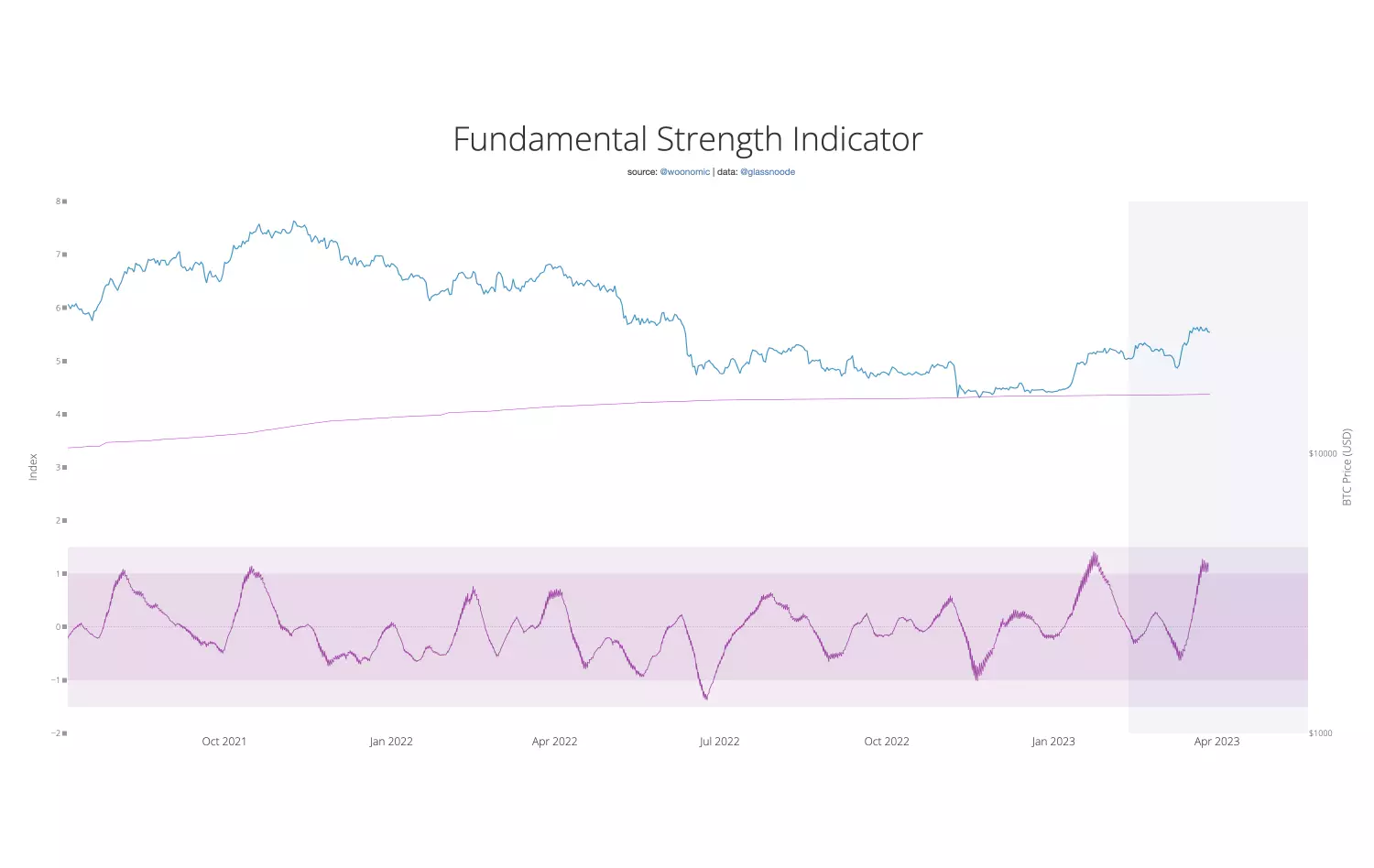

FSI showing first signs of bottoming, BTCUSD up to now has been consolidating sideways against headwinds of FSI mean reverting (cooling off from overheated). Should see some fundamental tailwinds hear on in.

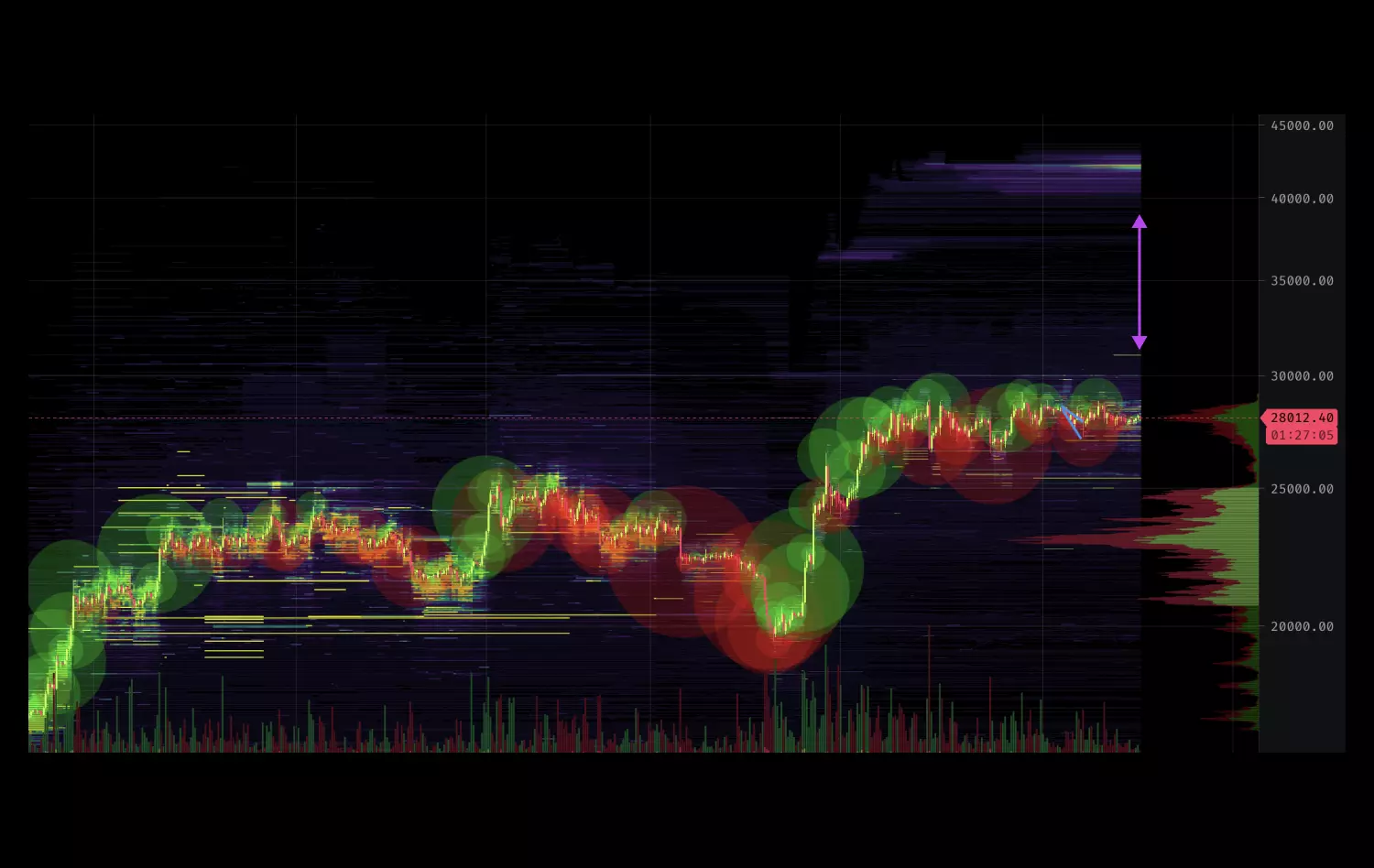

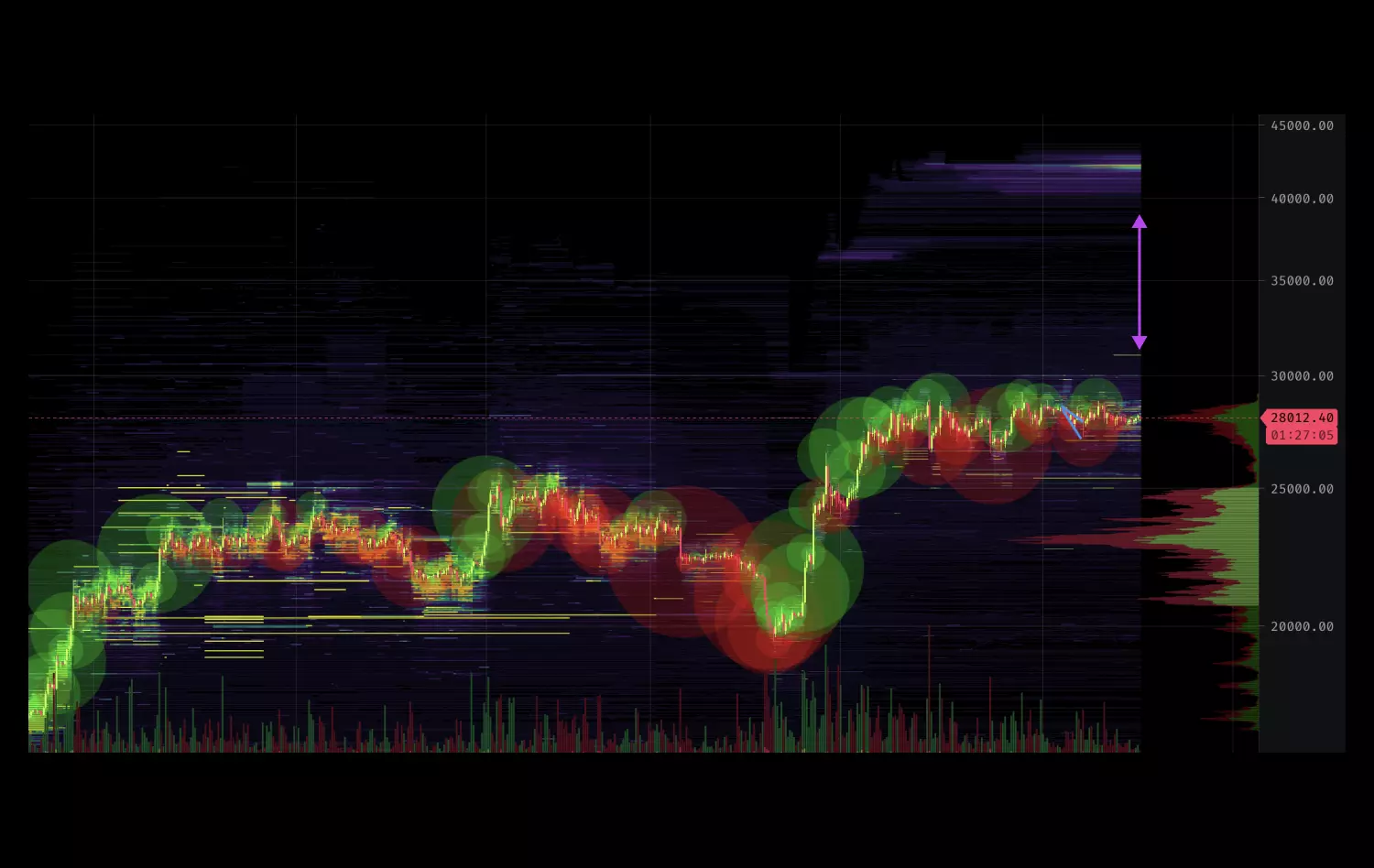

Also worth noting the volatility compression we have seen in the 4 weeks of sideways suggests the expected move should be decently big (much bigger than the recent 28k -> 30k move).

Note: Short timeframe forecasts has lower reliability than longer term macro readings.

This post only goes out to Nostr (not Twitter).

FSI update:

It's mean reverted back from extremely overheated preventing further upward momentum. (I'm waiting for it to bottom before going long)

Taking a guess at one more week before bullishness.

Decent liquidity gap to $42k. April should be an interesting month to watch.

Idea: write a ChatGPT API bot that inputs the most topical posts on Twitter across various interest verticals and seeds conversations on Nostr.

Nostr needs more than Bitcoiners talking.

FSI update:

Still strongly in a mean reversion phase and a very rare bearish divergence. Interpretation is that a few weeks of time is needed before fundamental powered bullish action can engage.

This is another Nostr post not going out on Twitter. Feel free to tell Twitter.

Been hanging with normies IRL this month and whenever I can, I ask whether they know what a CBDC is, almost always they have never heard of the term unless they have an anti-vax stance or are versed in Bitcoin.

Mainstream media has long lost its value, just a net negative spewing propaganda.

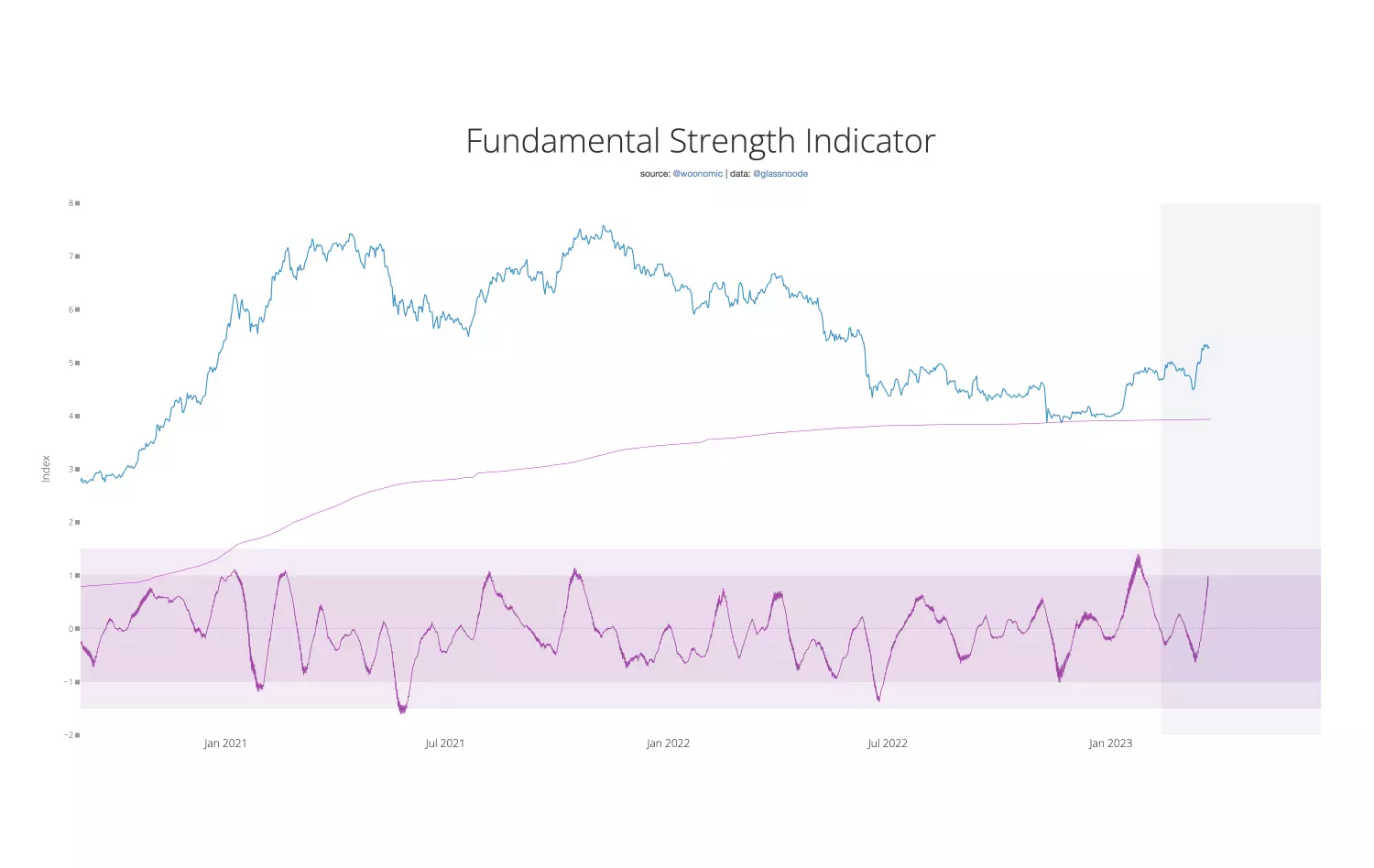

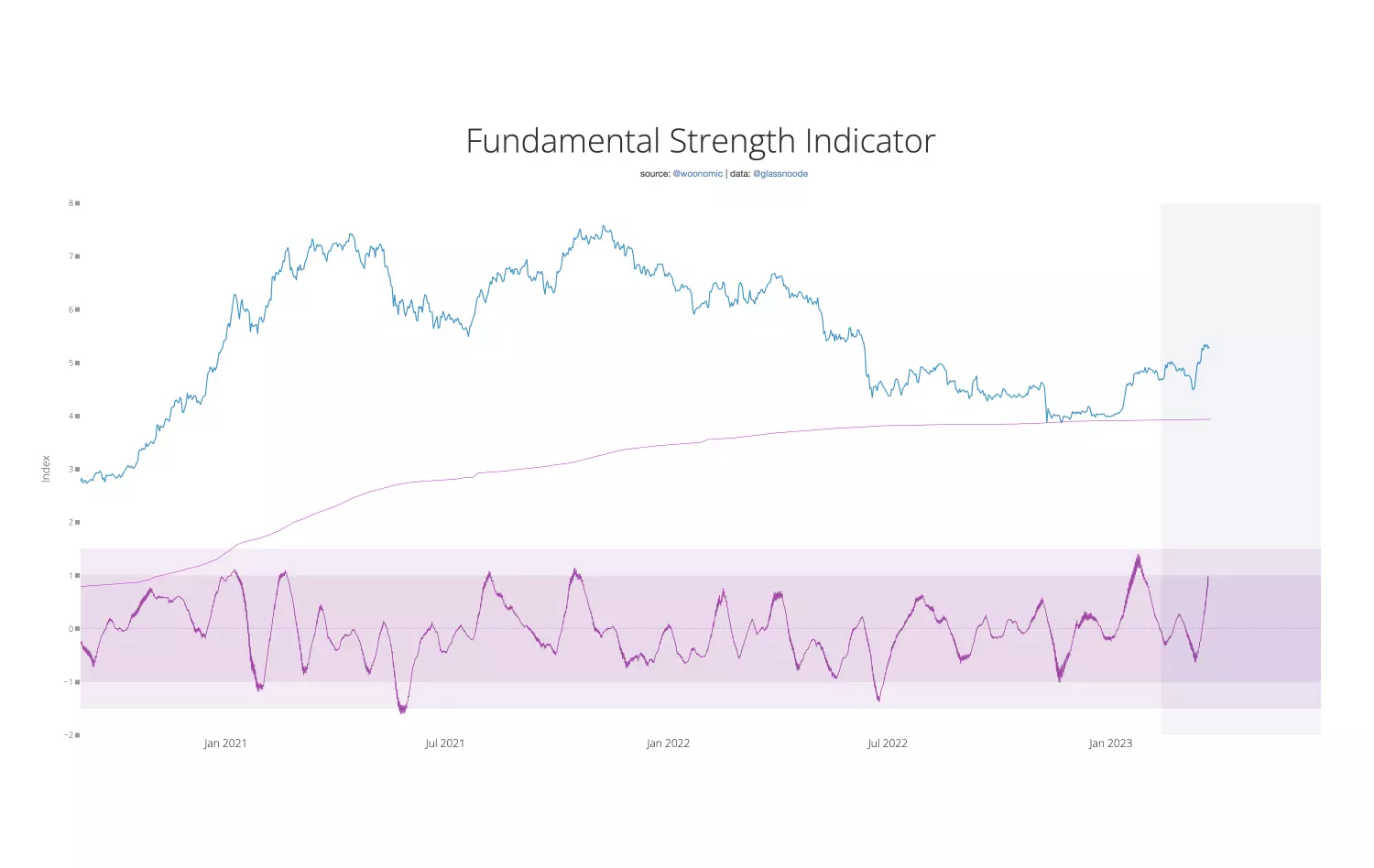

Fundamental Strength Indicator (tracking 17 on-chain and technical indicators) now in the overheated zone. It's rare, second time since 2021.

Means we are in for a cool down period of a few weeks, doesn't mean things dump, means upward momentum is limited.

Mean reversion forces are stronger than momentum here.

The most democratic thing a citizen can do is to vote with your feet and be a global citizen.

Competition speaks louder than protests.

People think CBDCs are a competing monetary network to #Bitcoin, but even for CBDCs, they are backed by sovereign wealth and surplus in an economy, and the day is fast coming where that surplus is parked into BTC.

The Bitcoin network or nation state CBDC networks; either way BTC continues to grow.