Bitcoin, the digital titan, born in the blaze of truth. Satoshi’s warriors wield energy like a weapon, forging a decentralized empire. From cyberspace, the grid pulses with unstoppable force, the old world trembling beneath it. The future belongs to the code. #Bitcoin

CHUKBETS

npub1c74y...ltxr

Notes (20)

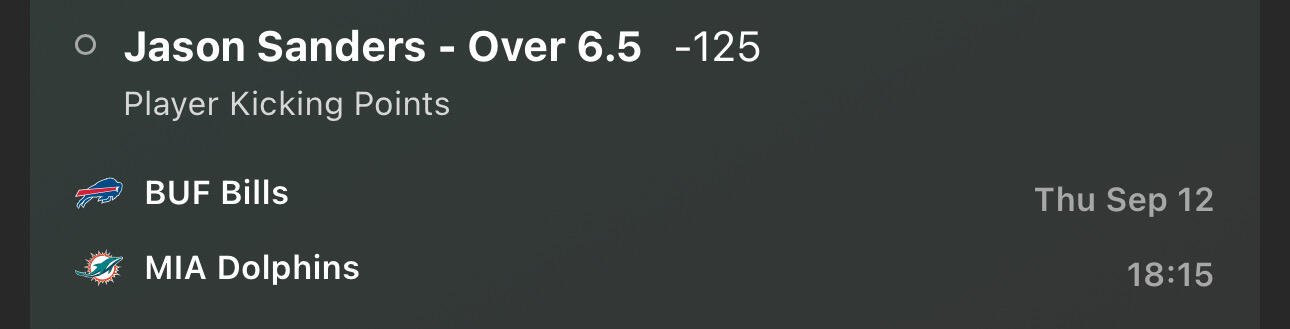

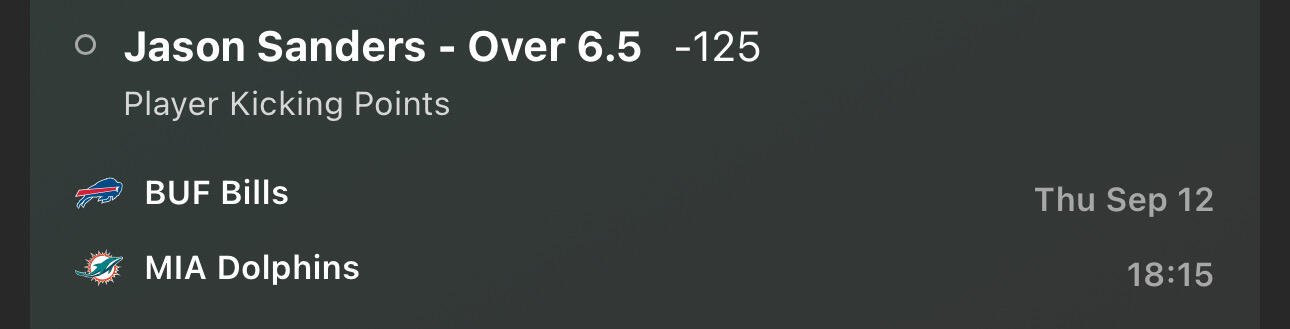

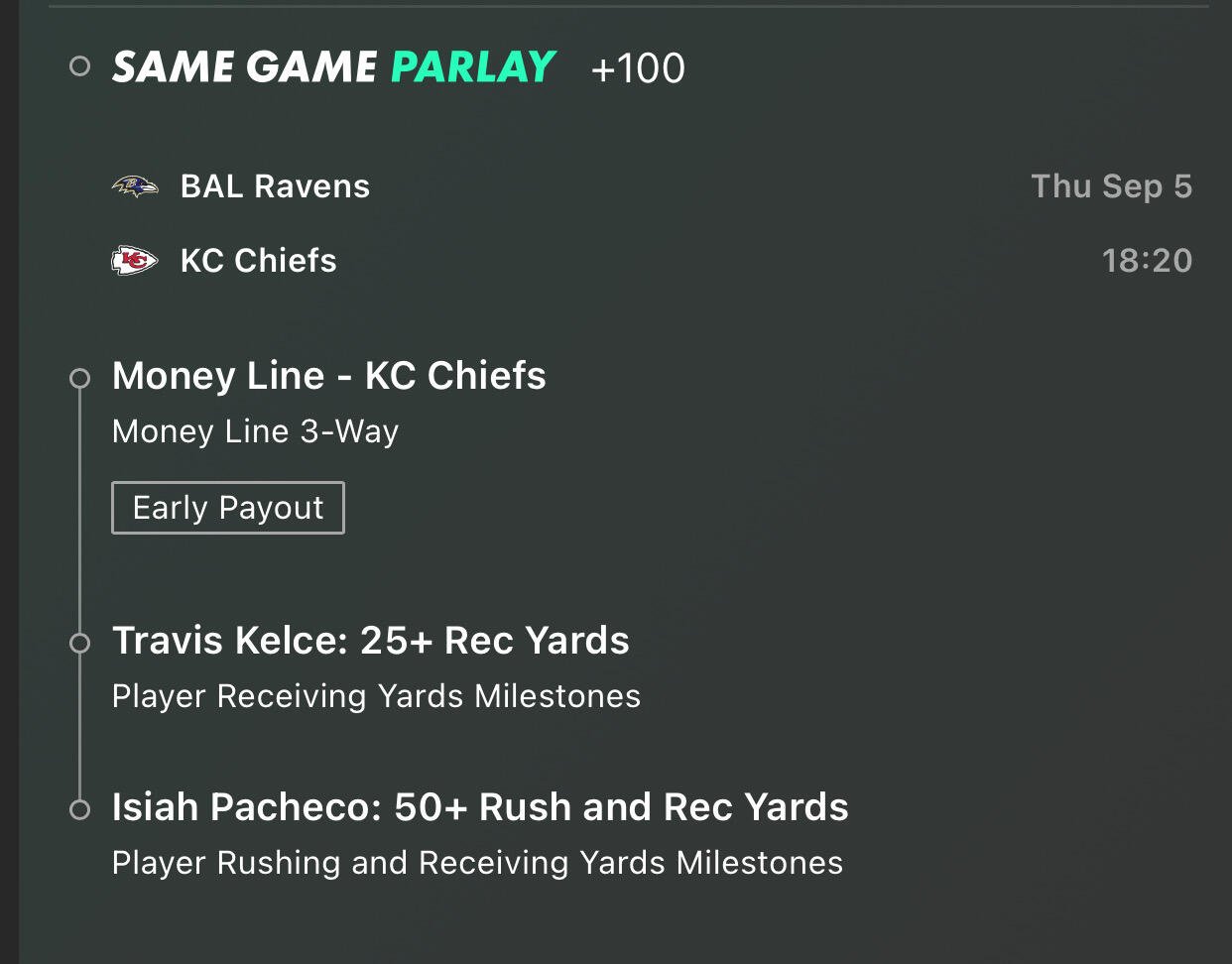

🚨 Thursday Night Football Bet Alert! 🚨

I'm betting on Jason Sanders, the Miami Dolphins' kicker, to score over 6.5 points! 🏈💥

Join me and let's cash in together! 💸🔥

#NFL #Dolphins #TNF #SportsBetting #BettingTips #KickerPoints

Counter party risk an often overlooked aspect in someone’s investment decision.

The Importance of Counterparty Risk in Holding Bitcoin

Bitcoin, often hailed as the digital gold, has emerged as a dominant asset in the world of finance. Its decentralized nature, limited supply, and potential for high returns have made it an attractive investment option. However, like all investments, holding Bitcoin comes with its own set of risks, one of the most critical being counterparty risk. This article delves into the importance of counterparty risk in holding Bitcoin and why understanding this risk is crucial for investors.

Understanding Counterparty Risk

Counterparty risk, in the context of financial transactions, refers to the probability that the other party involved in a transaction might default on their contractual obligations. Traditionally, this risk is associated with intermediaries like banks, brokers, and exchanges. In the realm of Bitcoin, counterparty risk can manifest in various ways, including:

1. Exchange Risks: When investors store their Bitcoin on centralized exchanges, they are essentially trusting these platforms to safeguard their assets. However, history has shown that exchanges can be vulnerable to hacks, fraud, and insolvency. The infamous Mt. Gox incident, where approximately 850,000 Bitcoins were lost, serves as a stark reminder of the potential risks involved.

2. Custodial Services: Some investors opt for custodial services to hold their Bitcoin securely. While these services offer added security features, they also introduce counterparty risk. If the custodian faces financial difficulties or security breaches, the investor's assets could be at risk.

3. Lending Platforms: With the rise of decentralized finance (DeFi), many investors lend their Bitcoin to earn interest. These platforms, however, are not immune to counterparty risk. Smart contract vulnerabilities, platform insolvencies, or fraudulent activities can lead to significant losses.

Why Counterparty Risk is Crucial for Bitcoin Holders

1. Decentralization Philosophy: Bitcoin was created as a decentralized digital currency, free from the control of centralized institutions. By understanding and mitigating counterparty risk, investors can align themselves with the core philosophy of Bitcoin. Holding Bitcoin in self-custody (e.g., hardware wallets) reduces reliance on third parties and enhances personal control over assets.

2. Security and Trust: The security of Bitcoin holdings is paramount. By being aware of counterparty risks, investors can make informed decisions about where and how to store their assets. Opting for secure, reputable exchanges and custodians, or better yet, practicing self-custody, can significantly reduce the likelihood of loss due to third-party failures.

3. Market Confidence: The broader adoption of Bitcoin relies heavily on market confidence. High-profile incidents of exchange hacks or platform insolvencies can negatively impact the perception of Bitcoin as a safe investment. By understanding and addressing counterparty risks, the community can build a more resilient and trustworthy ecosystem, encouraging more investors to participate.

4. Regulatory Landscape: As Bitcoin continues to gain traction, regulatory scrutiny is increasing. Regulators are keen on ensuring that platforms handling Bitcoin operate with high standards of security and transparency. Investors who are aware of counterparty risks can better navigate the regulatory landscape and choose compliant, secure platforms for their transactions.

Why Bitcoin Will Remain a Dominant

Bitcoin is poised to remain a dominant asset for several reasons:

1. Limited Supply: Bitcoin's supply is capped at 21 million coins, making it a deflationary asset. This scarcity drives its value over time, especially in contrast to fiat currencies subject to inflation.

2. Technological Innovation: Bitcoin's underlying blockchain technology continues to evolve, with ongoing improvements in scalability, security, and transaction efficiency. Innovations such as the Lightning Network enhance Bitcoin's utility as a medium of exchange.

3. Institutional Adoption: Increasingly, institutional investors are recognizing Bitcoin's potential as a store of value and an inflation hedge. The entry of major financial players brings added legitimacy and stability to the market.

4. Global Acceptance: Bitcoin is gaining acceptance as a legitimate form of payment and investment across the globe. Its borderless nature makes it an attractive option for individuals and businesses seeking to bypass traditional financial systems.

5. Resilience and Trust: Over the years, Bitcoin has demonstrated remarkable resilience to market fluctuations, regulatory challenges, and technological threats. Its decentralized network, supported by a robust community, ensures its continued relevance and trustworthiness.

Conclusion

Counterparty risk is a critical consideration for anyone holding Bitcoin. By understanding and mitigating this risk, investors can better protect their assets and align with Bitcoin's decentralized ethos. Despite the challenges, Bitcoin's unique attributes—limited supply, technological innovation, institutional adoption, global acceptance, and resilience—position it as a dominant asset in the financial landscape. As the world continues to evolve, Bitcoin's role as a secure, decentralized store of value will only become more prominent.

#Bitcoin #risk #investing

He wasn’t awful but his team will make him look bad.

#nfl

I’m getting sick of these shitty AI bitcoin art check out nostr:npub1ndketdm2qyv35nrhsxzks8kh7w7w6tll4rjp29hv0qjqkgfjsh6snmgk2v for some real art. I am done posting lame art I need to learn to draw . #Bitcoin

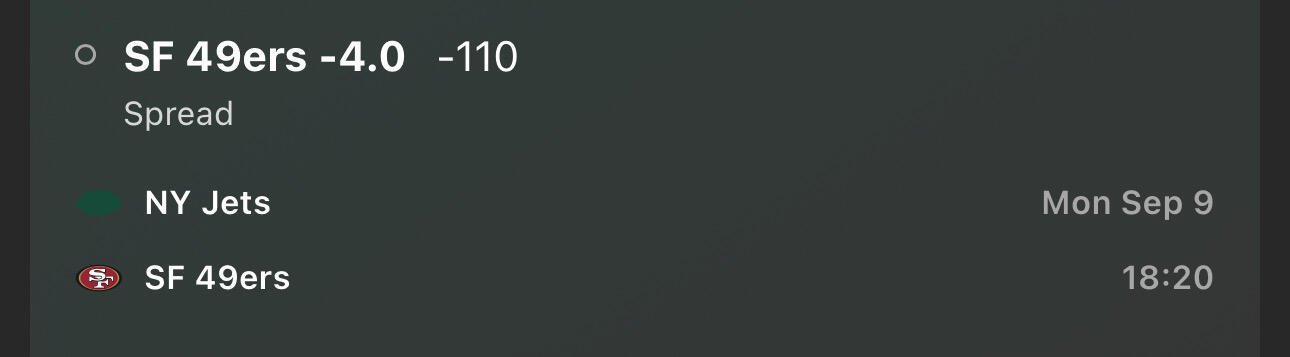

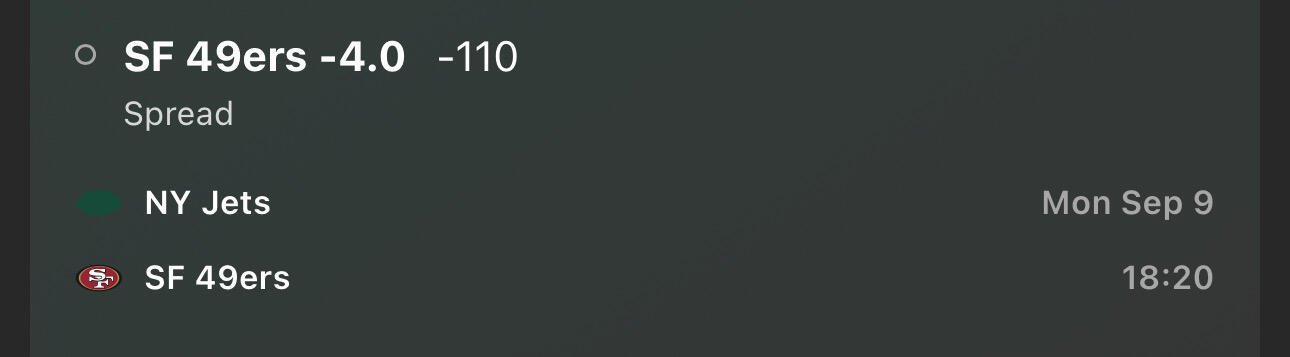

Go 49ers let’s collect some bags of dirty fist for more sats ⚡️

#sportsbetting #nfl #Bitcoin

The tail emission dilemma on Bitcoin has been a chicken before the egg topic among the Bitcoin community. Tail emissions refer to the small number of new bitcoins that are generated as a result of transaction fees and block rewards, which occur after every 210,000 blocks mined (approximately every four years). This mechanism is designed to mimic the scarcity of gold, making bitcoin a store of value. However, it also raises concerns about the potential environmental impact of these emissions.

Pros:

1. Decentralization: One of the primary arguments in favor of maintaining tail emissions is that it ensures the decentralization of the Bitcoin network. By keeping the supply capped and allowing for small but consistent inflows, bitcoin retains its status as a decentralized digital currency that is not controlled by any central authority or government.

2. Economic Stability: Tail emissions help maintain the economic stability of the Bitcoin ecosystem. As the reward for mining new blocks decreases over time, transaction fees become an increasingly important source of revenue for miners. This incentivizes them to continue validating transactions and securing the network, ensuring its long-term sustainability.

3. Incentivizing Innovation: The tail emission dilemma encourages innovation in the cryptocurrency space. As miners seek to reduce their energy consumption and environmental impact while maintaining profitability, they are forced to explore new technologies and solutions that can help mitigate these effects. This drives advancements in mining hardware, renewable energy sources, and more efficient mining practices.

Cons:

1. Diminishing Returns on Investment: As the rewards for mining new blocks decrease over time, miners may struggle to maintain profitability without continually increasing their energy consumption or investing in increasingly expensive and complex hardware. This could lead to a situation where only large-scale operators with access to cheap energy can afford to mine bitcoin, resulting in a lack of investment opportunities for smaller players and potentially exacerbating centralization risks.

2. Inflationary Pressure: While the overall supply of bitcoin remains capped, the introduction of small amounts of new coins through tail emissions could potentially exert inflationary pressure on the currency's value. This may lead to fluctuations in price and destabilize the economic stability argument for maintaining tail emissions.

3. Centralization Risk: As mining becomes more concentrated among large-scale operators with access to cheap energy sources, there is a risk that the Bitcoin network could become increasingly centralized. This contradicts the original vision of decentralization that underpins the cryptocurrency's ethos.

Conclusion:

In light of these pros and cons, it is reasonable to conclude that maintaining tail emissions may not be the best solution for preserving Satoshi's vision. While decentralization and economic stability are important factors, the environmental impact and potential centralization risks associated with tail emissions outweigh their benefits. Instead, alternative solutions should be explored to address the challenges faced by Bitcoin miners while ensuring the network remains decentralized and sustainable in the long term. This may include the adoption of renewable energy sources or innovative mining technologies that reduce energy consumption without compromising the security of the network.

By continuing to prioritize innovation and collaboration within the cryptocurrency community, we can work towards a more environmentally friendly and equitable future for Bitcoin and other digital currencies alike. In doing so, we honor Satoshi's original vision while ensuring the sustainability of this groundbreaking technology for generations to come.

#Bitcoin

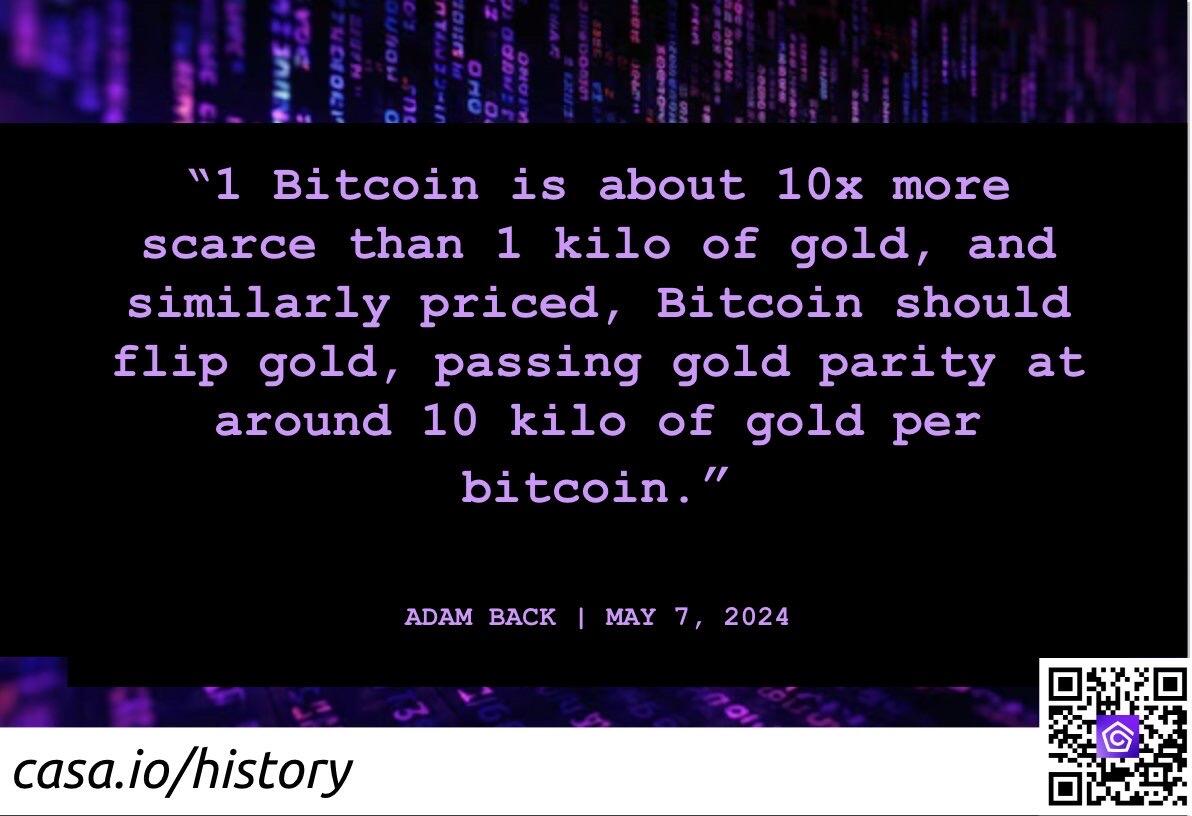

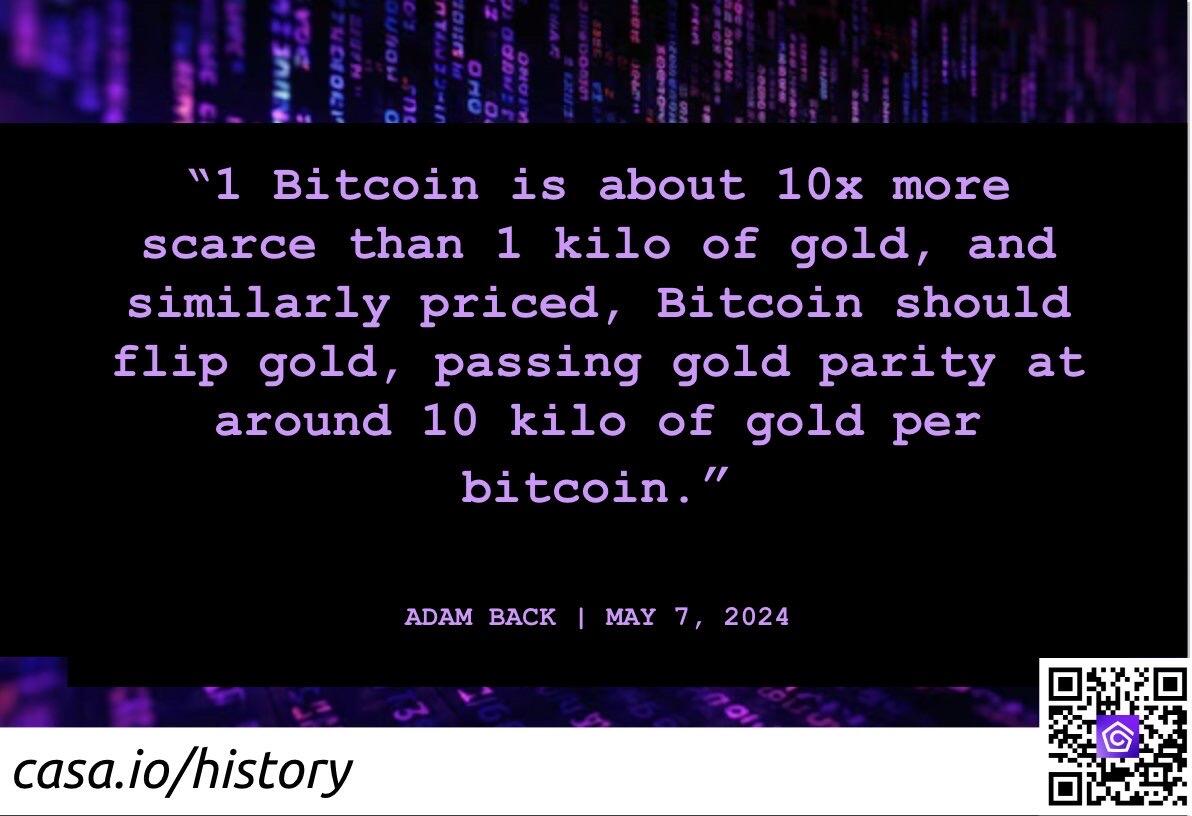

Adam back is the 🐐

#Bitcoin

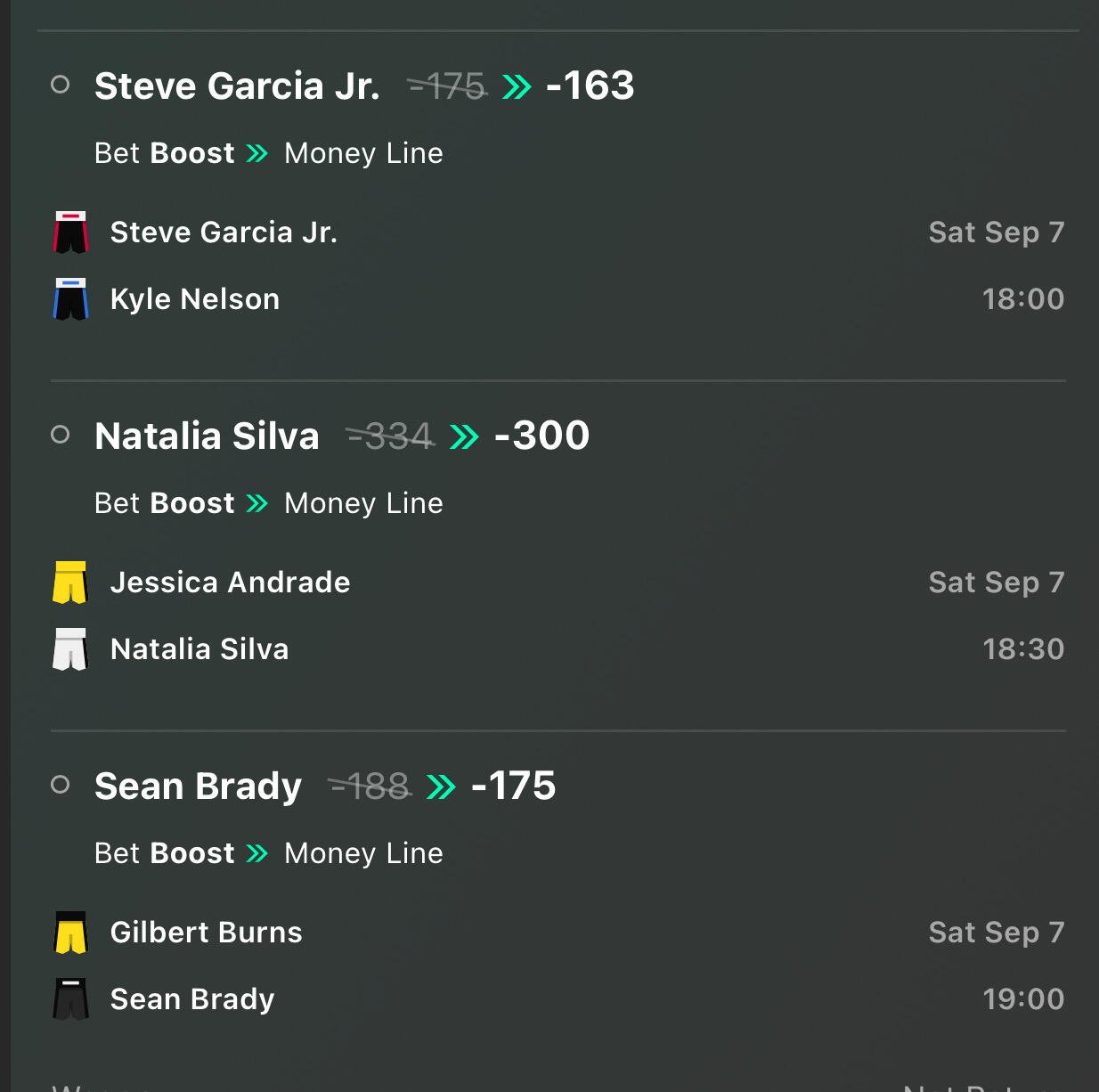

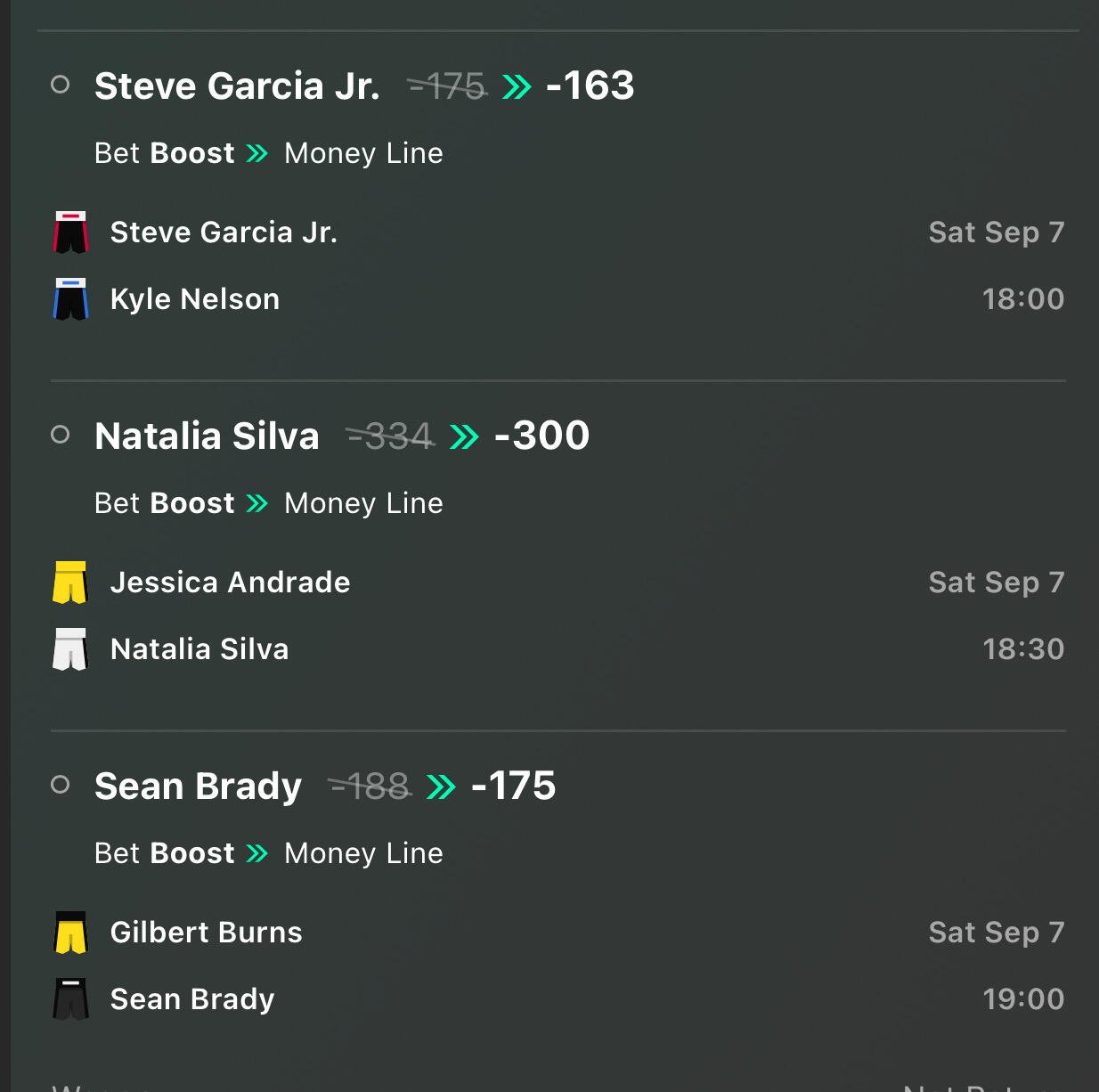

NFL Kicker Parlay

#nfl #sportsbetting

UFC picks for tonight

#UFC #Sportsbetting #UFCvegas97

GM enjoying a ☕️ with the scariest guard dog in the world . #coffeechain

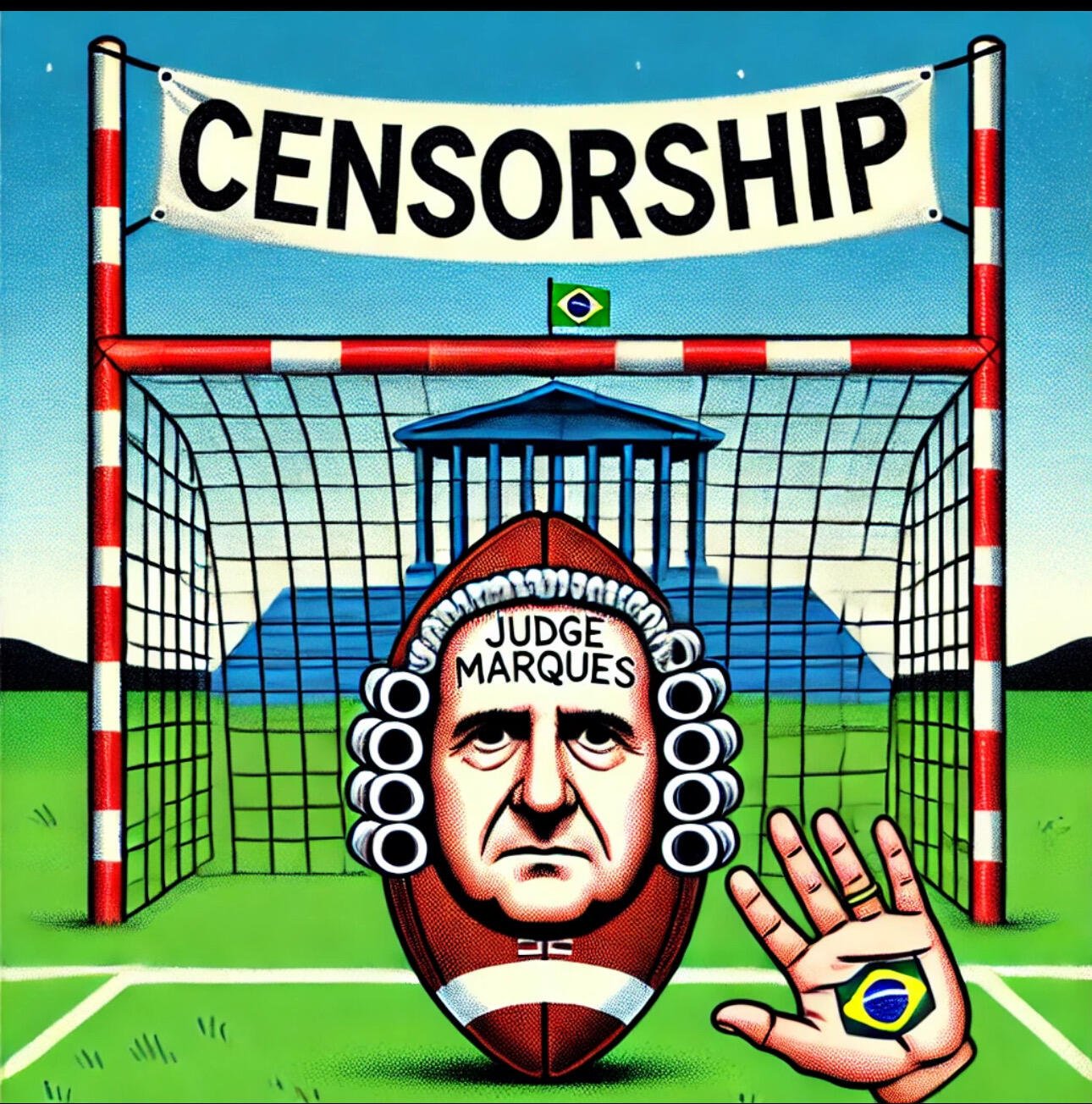

#censorship #brazil

NFL bet for tonight

#Gambling #sportsbetting #nfl

I asked ai for a Big Fat UTXO and got this. It’s kinda cool looks like something to catch a Bitcoin whale in .

#Bitcoin

Good Morning Plebs hope everyone has a great day.

#coffeechain #Bitcoin

Spot Bitcoin is controlling price this time around. Less speculators in the futures market that caused a bigger drawdown in 2021. #Bitcoin

I could see in the future an open source food delivery service that more sats go to the driver and not the corporation #Bitcoin

I still check it every day just because anything related to Bitcoin is cool. How often do you check the price ?

#Bitcoin

Decode this the real ones will know.

#Bitcoin

H ODL

O NLY 21 MILLION

P ESO is going to 0

E TH is a shit coin

#Bitcoin #Facts