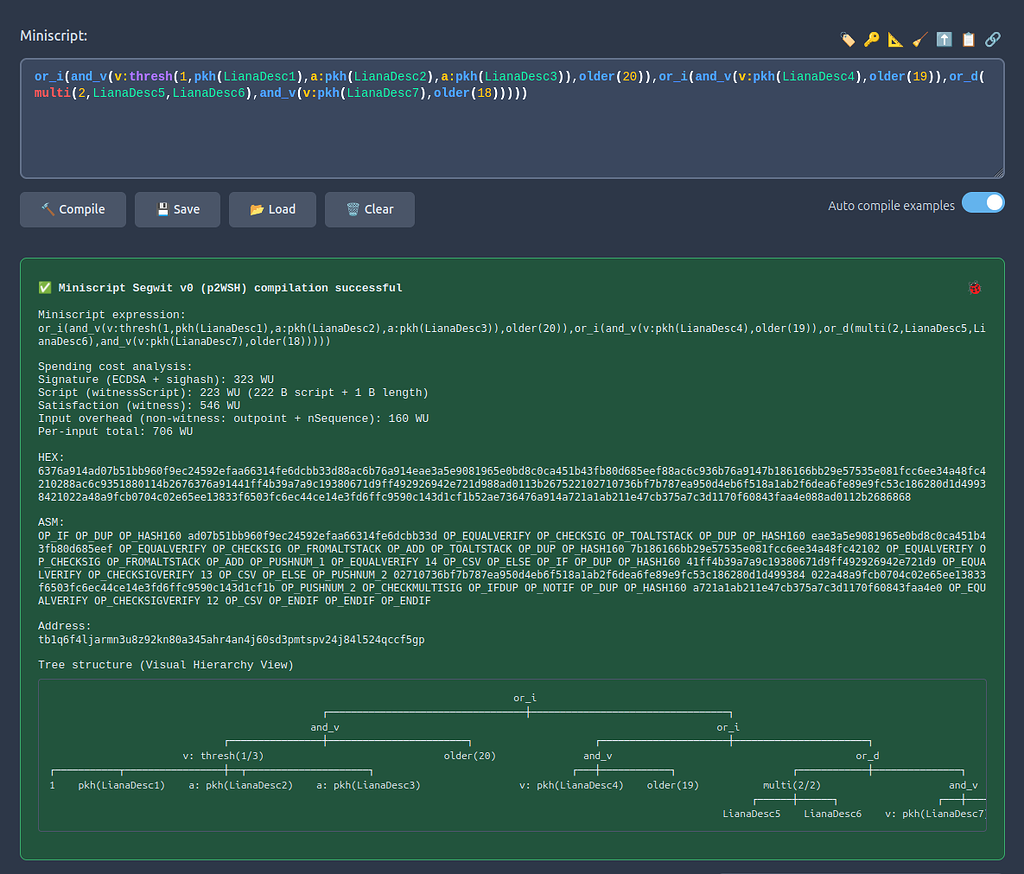

Miniscript Studio - a fulll IDE based on Rust Miniscript

Delving Bitcoin

Miniscript Studio - a fulll IDE based on Rust Miniscript

I built an online Miniscript Studio, a full IDE powered by the Rust Miniscript crate, with a strong emphasis on learning. https://adys.dev/miniscr...