Can stablecoin issuers save the US dollar?

Andrew Tate claims that pushing Bitcoin to $1M could “save the dollar” by forcing stablecoin issuers to buy U.S. government debt. Let’s break down whether that idea holds up.

🟢 What are stablecoins?

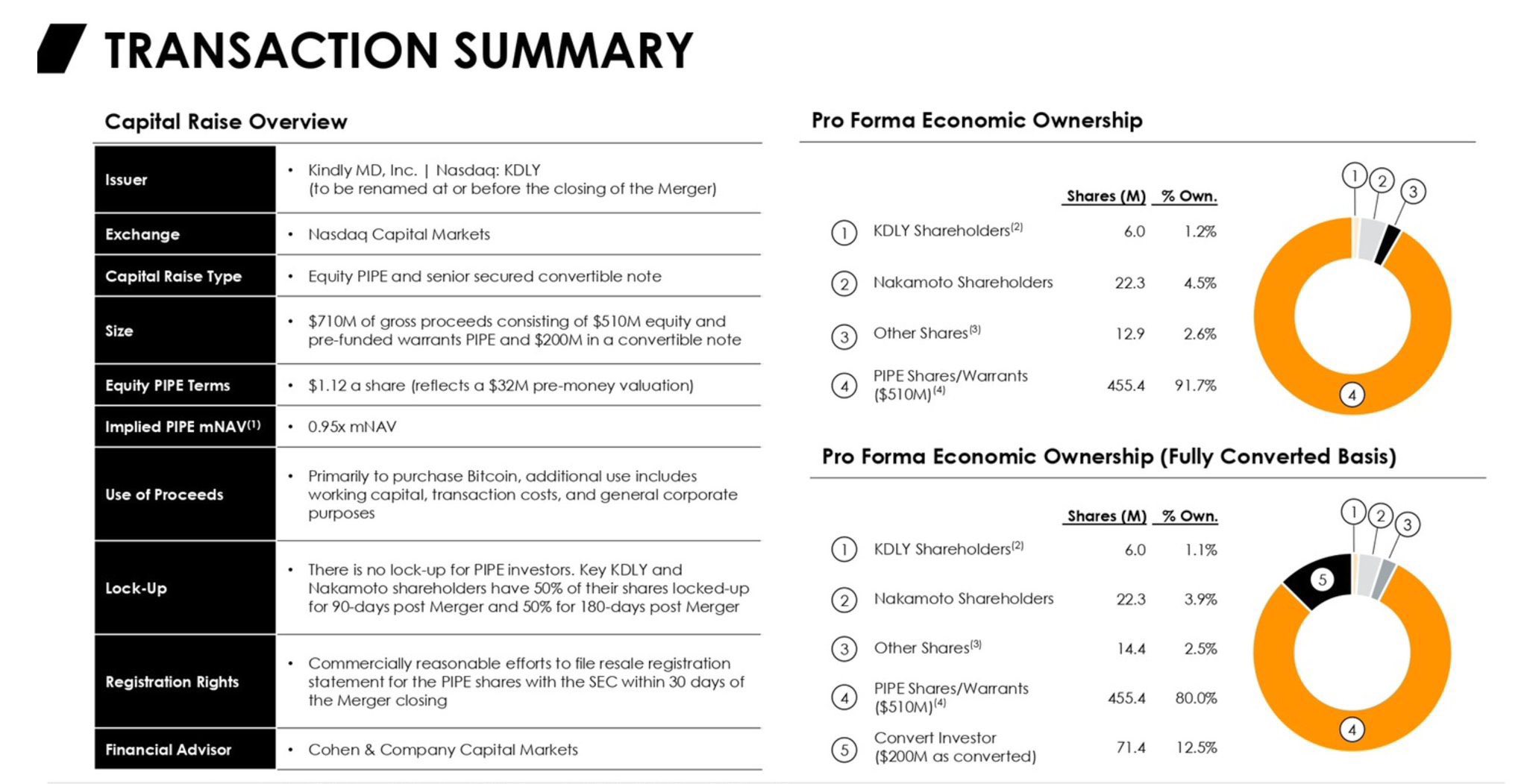

Stablecoins are digital dollars on blockchain rails, backed by real U.S. dollars or government debt. Two issuers dominate: Tether (USDT) and Circle (USDC). Together they’ve issued nearly $250B, with around $200B parked in U.S. Treasuries. Tether alone is now among the top 20 holders of U.S. government debt.

🟢 Does the dollar even need saving?

The dollar is still the world’s reserve currency, but the balance sheet is ugly.

U.S. debt is 120%+ of GDP. Historically, crossing 130% often precedes default within a decade (Reinhart, Rogoff).

In 2024, for the first time ever, the U.S. government spent more on interest than on the military. That’s a classic red flag for declining empires.

So yes, the dollar is strong globally, but structurally fragile.

🟢 Bitcoin and stablecoins move together

When Bitcoin rallies, stablecoin issuance explodes. Bigger BTC market cap → bigger positions, more collateral, more reserves. Today, Bitcoin’s market cap is about $2.2T, almost 10x the stablecoin market. If Bitcoin hit $1M, stablecoins could plausibly grow 10x too — to around $2.5T. That means perhaps $2T flowing into U.S. Treasuries. Massive.

But here’s where Tate’s theory breaks down 👇

🟢 Three problems

🔶 Structural deficits 💸

In 2024 alone, the U.S. issued $2T of new debt. Even if stablecoins pumped overnight, that covers just one year of overspending. The last budget surplus was in 2001. The U.S. isn’t fixing its deficits — it’s doubling down.

🔶 Better yields elsewhere 💰

Stablecoins can earn 2–3x Treasury yields just by being lent out in Bitcoin markets — without taking price risk on Bitcoin itself. In bull runs, these rates have spiked to 25–50%. Faced with that, why would investors settle for 4% from Treasuries?

🔶 Bitcoin escape velocity 🚀

Pushing BTC to $1M risks unleashing it beyond anyone’s control. Suddenly, everyday people would find their net worth multiplied. Merchants would be incentivized to accept Bitcoin directly, kickstarting circular economies. At that point, Bitcoin stops “saving” the dollar and starts replacing it.

🟢 The takeaway

Stablecoins delay the dollar’s reckoning by buying Treasuries in the short term. But they can’t save it. America’s problem isn’t a lack of buyers — it’s a lack of fiscal discipline. And the more Bitcoin grows, the more obvious that problem becomes.

Sources:

Sources: