How do we gain traction here #bitcoin

griffin goldsmith

financialjackass@nostrplebs.com

npub1k3ny...cydw

Not your licensed advisor - not financial advice …

Saylor with 500 mil of more convertible notes. TRADfi is going to shit themselves

Liquid and illiquid millionaires are not the SAME! #bitcoin #btc

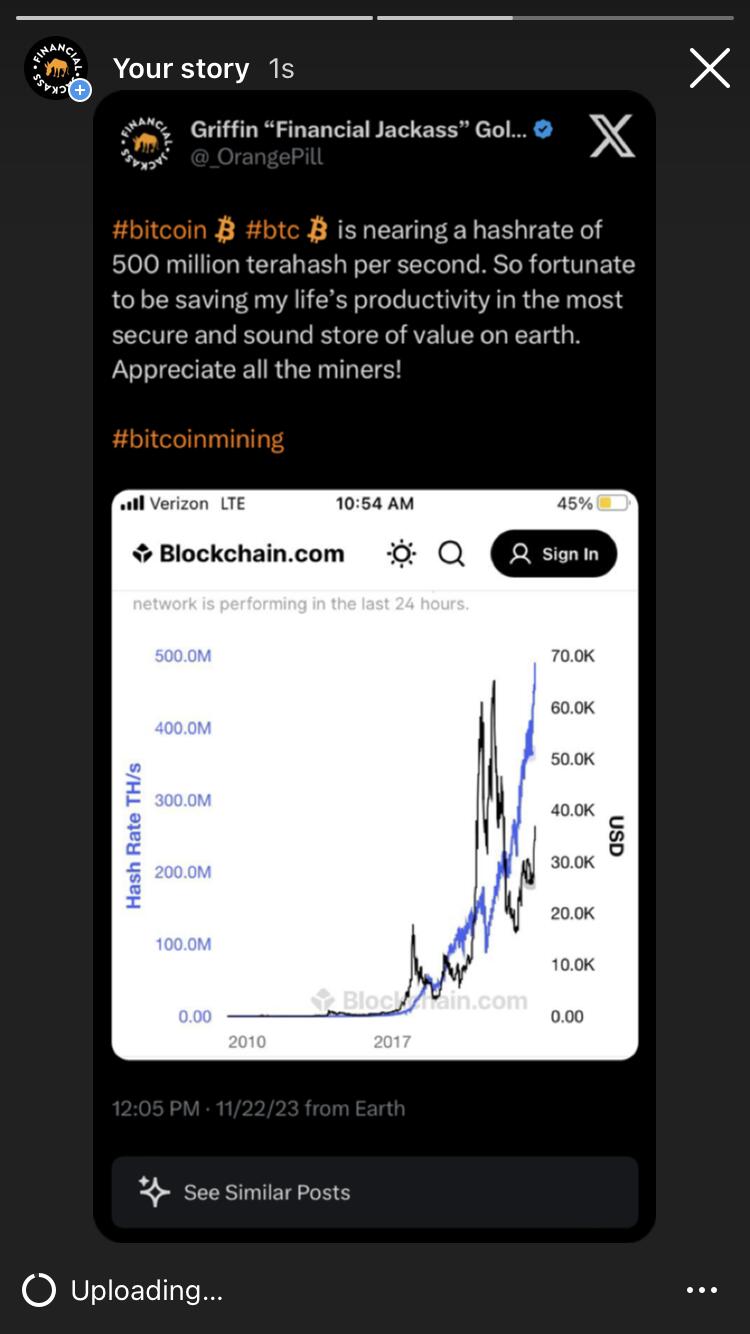

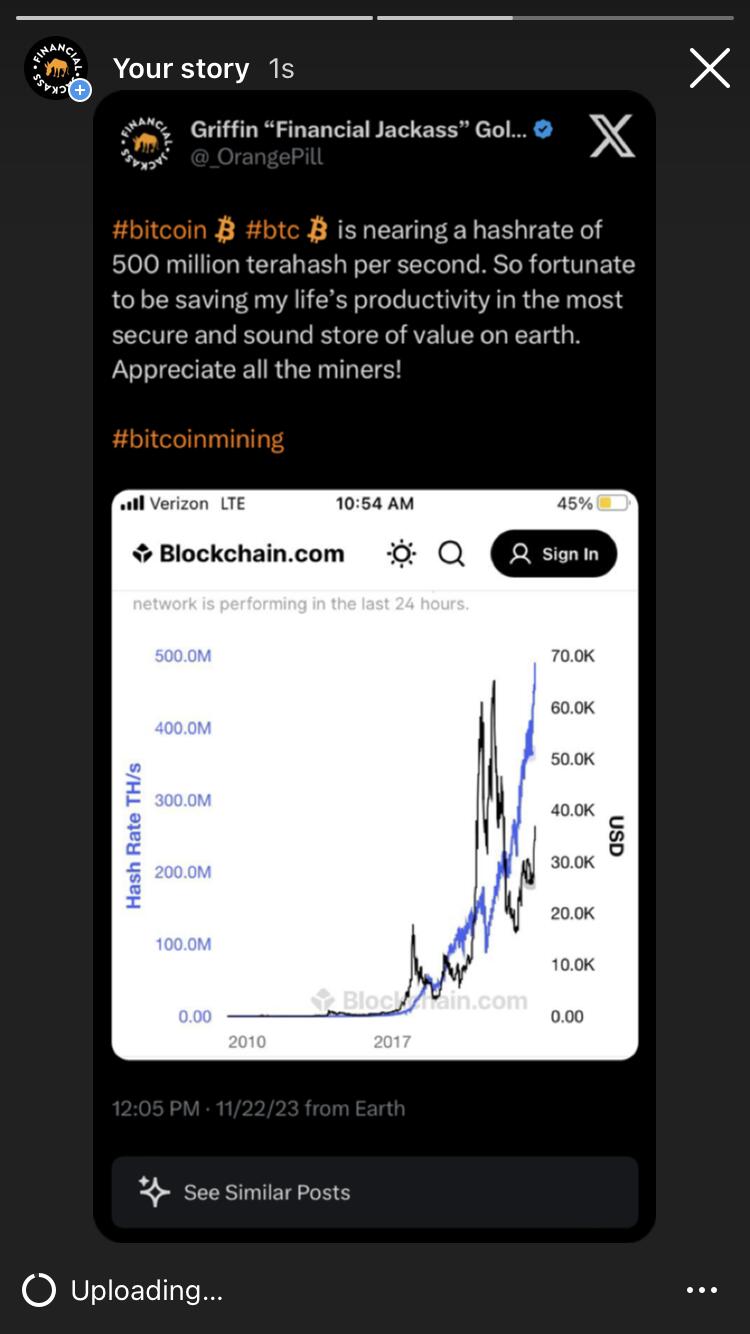

#bitcoin #btc thank you miners! For your hard work and productivity. Almost 500million TH/S !!!

#bitcoin will explode by a million USD overnight with ZERO notice. The world will be shocked, most bitcoiners will be shocked . The ones who truly understand, the few of us, already know this is coming.

Fink and #blackrock know this is coming. They are clearing out the days of retail for the days of nations and power.

Study, learn, invest and educate. #btc. Put coins in cold storage now. Stop fucking around.

#bitcoin #btc #nostr

Thank you “ #joerogan 😂” for the shout out! Everyone should follow and like for #bitcoin and #aiart content! Thanks!!

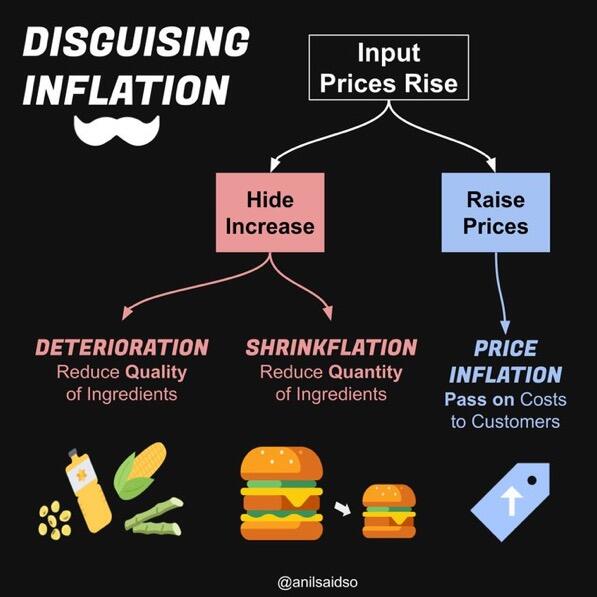

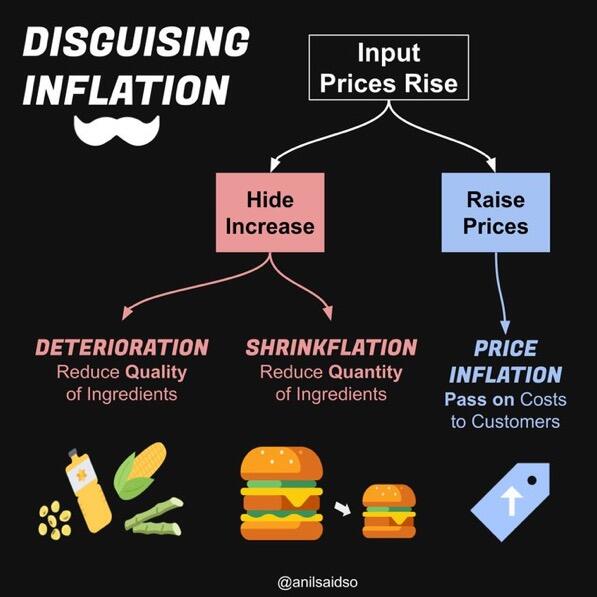

BitBot throwing Janet yellen and Jerome Powell under the bus today for #inflation ! #bitcoin #btc #crypto #cryptocurrency #nostr #plebs

Exclusive interview with #chatgpt on #bitcoin price predictions, #michaelsaylor , #joerogan podcast, and more! Let me know what you think #nostr ! What do you want to hear next?

All #ai #aiart done by me. Thanks!

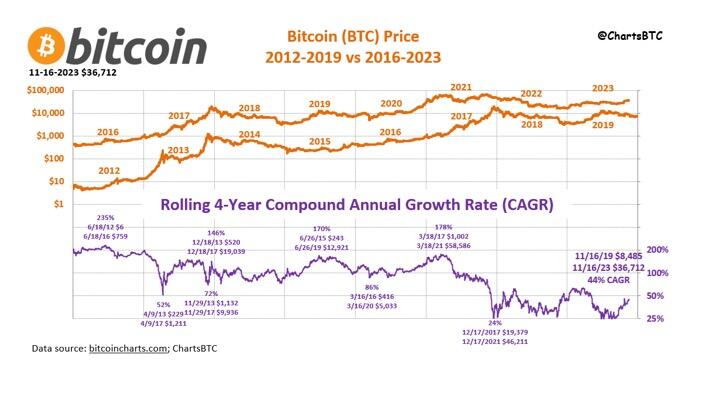

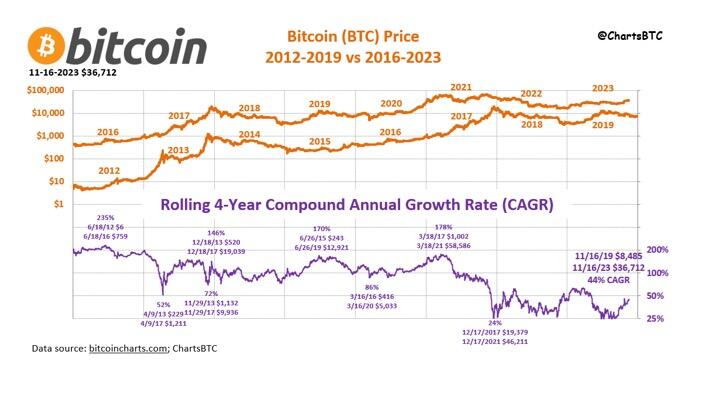

#btc #bitcoin chart post from earlier.

Do you think we could hit:

4-year 100% Compound Annual Growth Rate (CAGR), we can use the formula:

Final Amount = Initial Amount * (1 + Growth Rate)^Number of Years

In this case, the initial amount is $100,000 USD and the growth rate is 100% (expressed as 1.00). The number of years is 4.

Final Amount = $100,000 * (1 + 1.00)^4

Final Amount = $100,000 * 2^4

Final Amount = $100,000 * 16

Final Amount = $1,600,000 USD

100% CAGR with all the tailwinds ahead of us for the next 4 years, ETF, FASB, Halving, adoption growth. etc… it’s possible

What do you guys think? To high?

$10,000,000.00 #BITCOIN and how the California #gold rush is helping us! #nostr #plebs

🧵 1/4🧵 #Bitcoin Schelling Point - “A solution people choose, by default, in the absence of communication”

Most basic observation - people choose and assume their local government currency is the only option for saving their wealth. In reality, primarily in western societies, especially in USA, civilians don’t look for another option. Or are completely ignorant of other savings vehicles. Only because there is a total lack of communication and education. #btc

2/4 Basic game theory with schelling point - if you ask multiple people to meet at a park without cell phones or a previously centralized meeting point. Each individual will assume where the others would meet.

If this park had a single enormous tree, on a hill, each person would likely start at the tree in their search for each other.

#nostr #plebs

Game theory continued :

3/4 Let’s say each of the previously mentioned people are level 0 players. If a level 1 player entered, 1 would assume 0’s will start at the tree, so 1’s would start on the edge. 2’s would assume where 0 and 1’s would start so they would choose mid field. Etc…. Now how this ties into bitcoin .. #crypto #money

4/4

Level 0 players are people who trust their government currencies only because they have never asked, “why?”

Level 1 are people who choose to invest in alternative wealth preservation vehicles. Stocks, bonds, housing, etc…

Levels progress only when communication barriers are broken and when the question “why?” Is answered.

Currently in time, I believe the highest level are those who truly understand #bitcoin #btc . Which is rare, even in the bitcoin community. Most people who own don’t understand.

What do you think ?

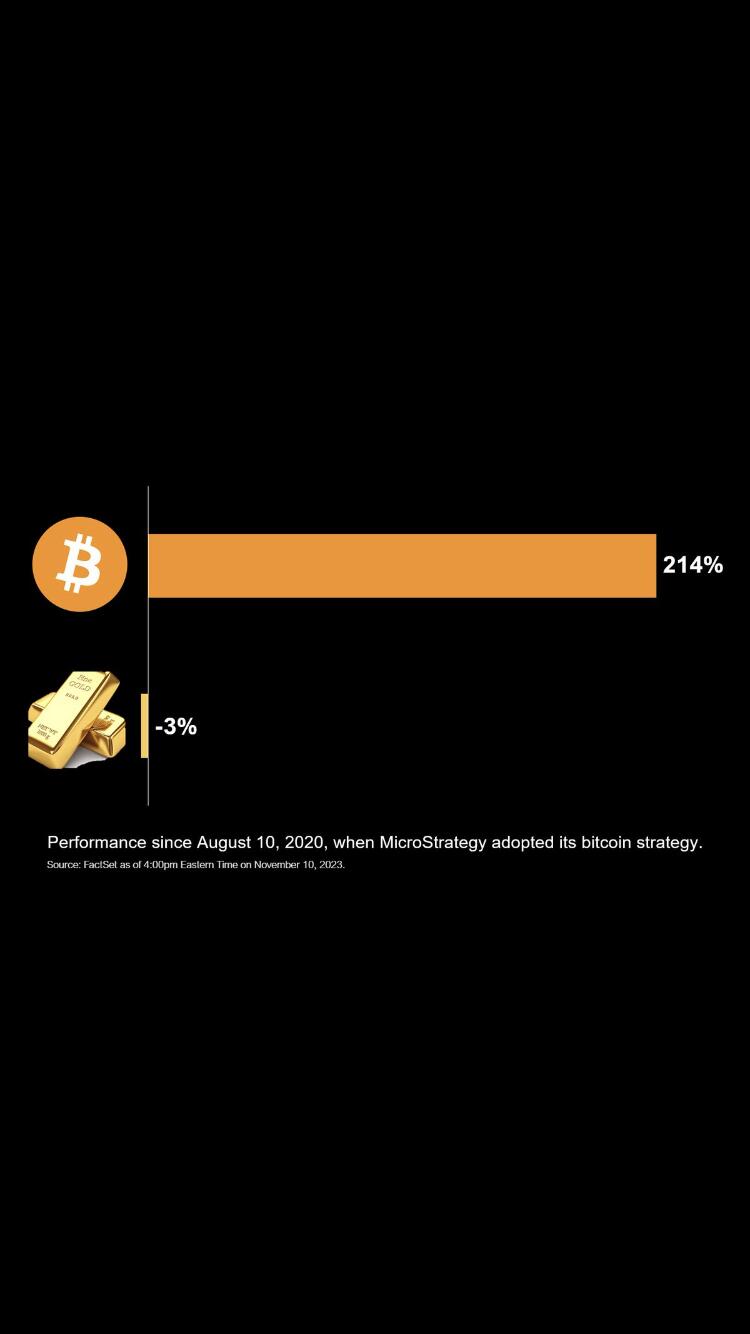

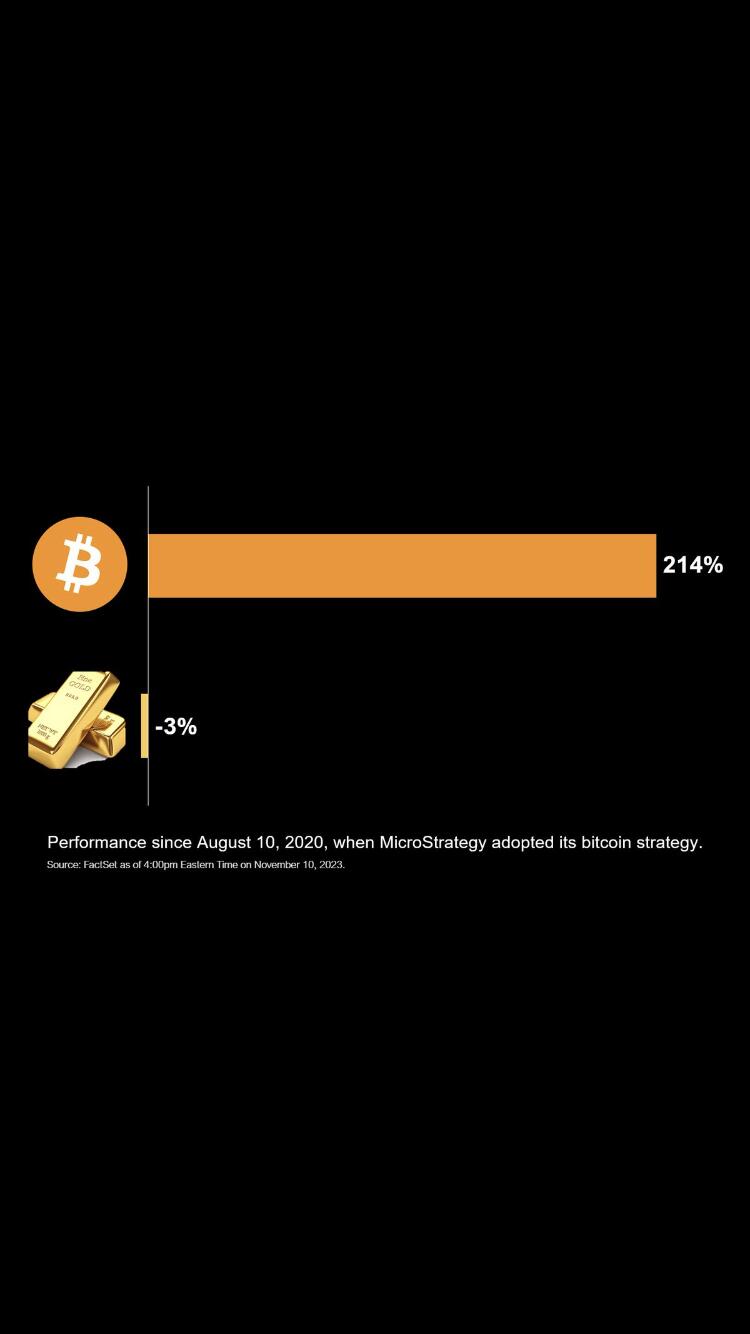

Anil is the man #bitcoin #btc #plebs #nostr

#bitcoin is the truth. #gold is manipulated.

Mainstream is here for #bitcoin #btc #freedom #nostr #plebs

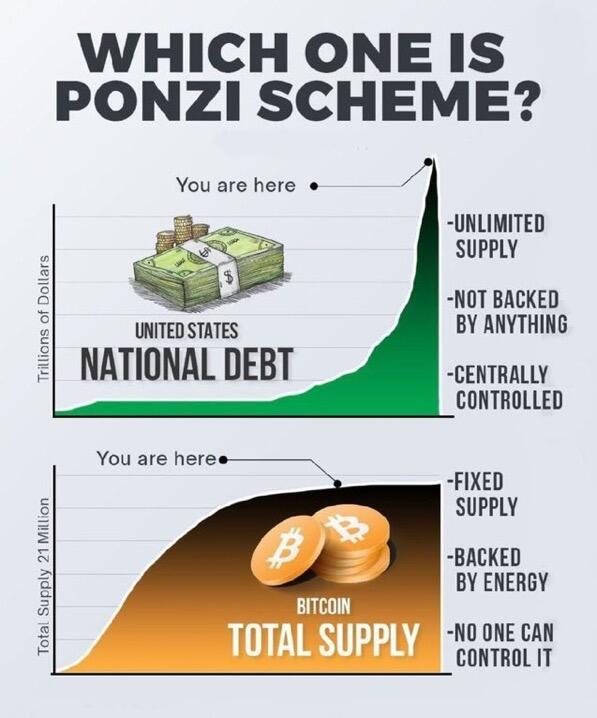

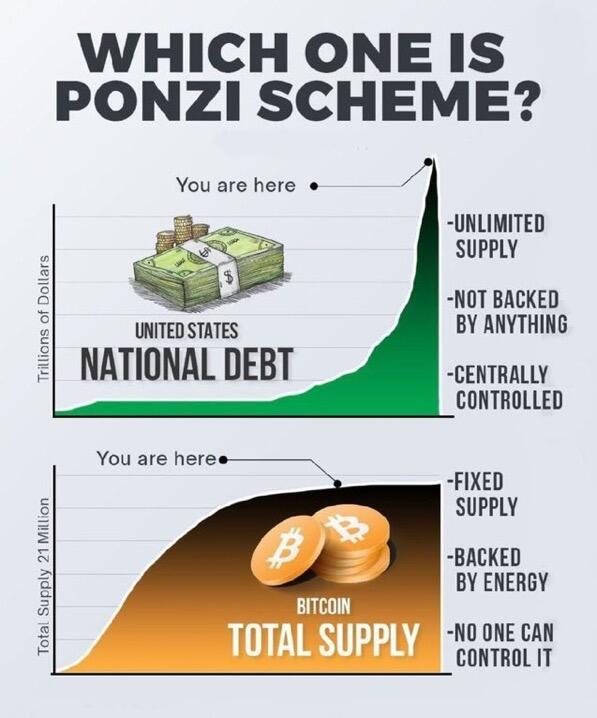

Ponzi doing Ponzi things #btc #bitcoin #crypto #nostr #plebs

#bitcoin #btc

“EARNING” aka “SAVING” ON Debasement with #bitcoin #btc

Will make this a video later today -

On September 18th, 2023, when the US debt hit 33 trillion and Bitcoin was priced at 26,700 USD, the value of Bitcoin could be seen as a potential hedge against government debt. If you had invested in Bitcoin instead of holding onto the US dollar, the increase in Bitcoin's value could have helped offset the debasement caused by the growing debt.

On Friday, November 10th, 2023, the US debt stood at 33.7 trillion, and Bitcoin was priced at 37,000 USD.

The difference in value between the US dollar and Bitcoin can be viewed as a measure of how much you could have saved.

To calculate the savings, we can compare the percentage increase in Bitcoin's value relative to the percentage increase in the US debt.

Using the given data, the percentage increase in Bitcoin's value from 26,700 to 37,000 is approximately 38.6%. Meanwhile, the percentage increase in the US debt from 33 trillion to 33.7 trillion is approximately 2.1%.

Therefore, in this particular example, by holding Bitcoin instead of US dollars, you would have potentially saved approximately 36.5% (38.6% - 2.1%) of the debasement caused by the growing government debt.

You can call this earning or saving, but it doesn’t matter because it is all in fiat. 1 bitcoin is 1 bitcoin. Live on bitcoin and beat debasement.

“EARNING” aka “SAVING” ON Debasement with #bitcoin #btc

Will make this a video later today -

On September 18th, 2023, when the US debt hit 33 trillion and Bitcoin was priced at 26,700 USD, the value of Bitcoin could be seen as a potential hedge against government debt. If you had invested in Bitcoin instead of holding onto the US dollar, the increase in Bitcoin's value could have helped offset the debasement caused by the growing debt.

On Friday, November 10th, 2023, the US debt stood at 33.7 trillion, and Bitcoin was priced at 37,000 USD.

The difference in value between the US dollar and Bitcoin can be viewed as a measure of how much you could have saved.

To calculate the savings, we can compare the percentage increase in Bitcoin's value relative to the percentage increase in the US debt.

Using the given data, the percentage increase in Bitcoin's value from 26,700 to 37,000 is approximately 38.6%. Meanwhile, the percentage increase in the US debt from 33 trillion to 33.7 trillion is approximately 2.1%.

Therefore, in this particular example, by holding Bitcoin instead of US dollars, you would have potentially saved approximately 36.5% (38.6% - 2.1%) of the debasement caused by the growing government debt.

You can call this earning or saving, but it doesn’t matter because it is all in fiat. 1 bitcoin is 1 bitcoin. Live on bitcoin and beat debasement.

“EARNING” aka “SAVING” ON Debasement with #bitcoin #btc

Will make this a video later today -

On September 18th, 2023, when the US debt hit 33 trillion and Bitcoin was priced at 26,700 USD, the value of Bitcoin could be seen as a potential hedge against government debt. If you had invested in Bitcoin instead of holding onto the US dollar, the increase in Bitcoin's value could have helped offset the debasement caused by the growing debt.

On Friday, November 10th, 2023, the US debt stood at 33.7 trillion, and Bitcoin was priced at 37,000 USD.

The difference in value between the US dollar and Bitcoin can be viewed as a measure of how much you could have saved.

To calculate the savings, we can compare the percentage increase in Bitcoin's value relative to the percentage increase in the US debt.

Using the given data, the percentage increase in Bitcoin's value from 26,700 to 37,000 is approximately 38.6%. Meanwhile, the percentage increase in the US debt from 33 trillion to 33.7 trillion is approximately 2.1%.

Therefore, in this particular example, by holding Bitcoin instead of US dollars, you would have potentially saved approximately 36.5% (38.6% - 2.1%) of the debasement caused by the growing government debt.

You can call this earning or saving, but it doesn’t matter because it is all in fiat. 1 bitcoin is 1 bitcoin. Live on bitcoin and beat debasement.