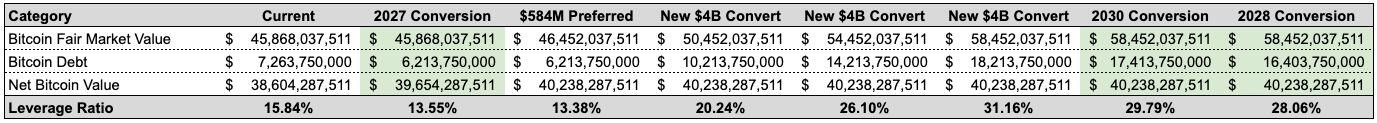

#Strategy #MSTR Leverage Ratios & Q1 2025 Potential

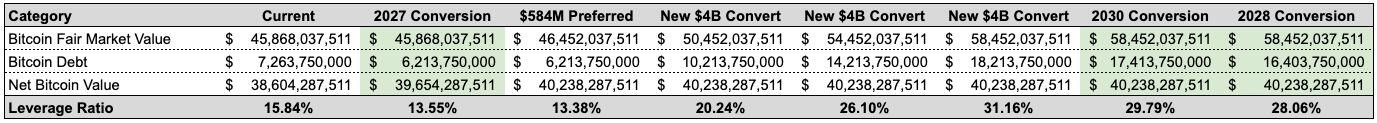

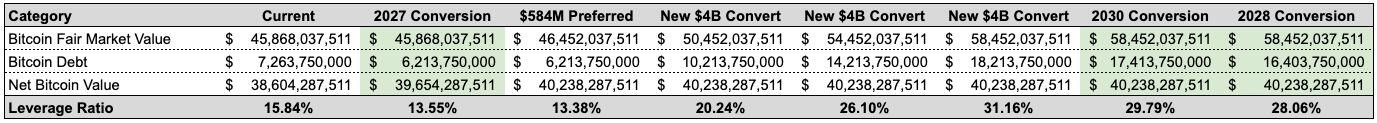

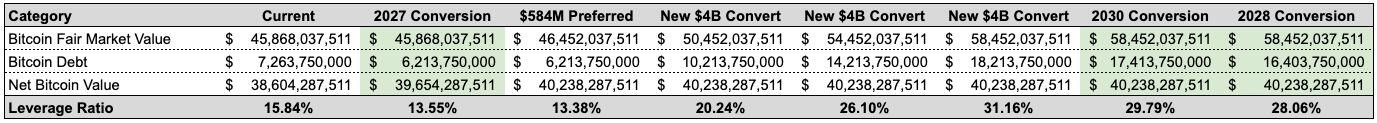

Now that MSTR has officially confirmed a target leverage range of 20-30% (which I interpret as the range they will actively leverage the balance sheets to), let's take a look at what might be in store for this quarter.

First the knowns.

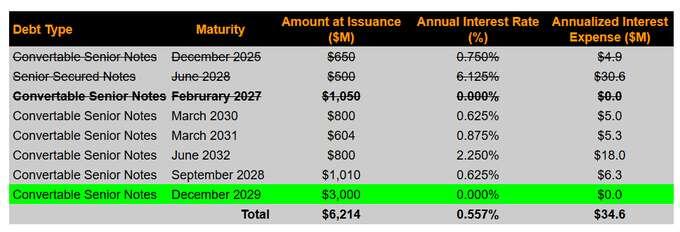

MSTR confirmed in their presentation that they view their leverage ratio as Bitcoin related Debt divided by Bitcoin Fair Market Value, simple. Now keep in mind that debt is not equal to fixed income. The reason this distinction is important is that while Preferred Stock may be classified as a fixed income offering in their 21/21 plan, it does not actually add a liability to their balance sheet as it is structure as equity.

So what do we know. We know that the 2027 Convertible Bonds will be fully converted in February. This removes $1.05B from the Bitcoin related liabilities.

We also know that they have closed the Preferred Stock offering for $584M which they will be using to buy more Bitcoin soon, if not already.

As things currently stand with Bitcoin's price, this would mean that their leverage ratio is effectively 13.38%. This is far below the target, and they will work to correct this quickly (likely starting as soon as next week).

The question on everyone's mind is how much can they lever up through fixed income instruments in the near term.

Based on what I see, it looks like they could potentially go up to $12B in new convertible offerings as things stand today.

However, if they go up to $12B with Bitcoin prices as they are today then this would actually bring them up to a 31.16% leverage ratio. So in order to make that palatable, they would need confidence in the conversion of at least 1 of the other bonds. The most obvious candidate would be the 2030 bonds for $800M which carry a conversion price of $149.77 making them equity at this stage, but the other is the 2028 at $1.01B and a $183.19 conversion price.

If just the 2030 bonds convert, this will put their leverage ratio at 29.79% which gets them back into range. If the 2028 also converts, this would bring it down even further to 28.06% and comfortably in the range.

Both bonds are eligible for early conversion, but at the bond holders discretion. MSTR has no ability to soft call these right now in the same way they just did with the 2027 bonds.

So this is where the relationships come in. You can be sure MSTR is talking to the major holders of these bonds, and likely would be pitching new allocations (likely upsized allocations) in the new offerings if they convert early.

I think that MSTR will be pushing hard for as much capacity as possible in Q1, and there is a very tactical reason for this. Early conversion triggers.

Typically, there is a quarter lag from issuance to when the 130% early conversion trigger kicks in for the bond holders. So if we think strategically, why might this matter?

The short answer is cycle theory. If MSTR believes there is a high probability that the 4 year cycles continue, then the timing for this cycle's top would typically fall in Q4. So what this does is it makes sure that they are planning ahead where there is a potential event that can trigger massive deleveraging leading into the historic "top" of the cycle if the bond holders trigger the early conversion mechanisms.

Why this may be important is that it could set MSTR up to be largely unencumbered by debt with massive flexibility to operate and continue to execute their strategy during a potential bear market.

It is yet to be seen whether the cycles will fully continue, or if it gets muted by institutional/nation state capital allocations, but it is never bad as a management team to plan strategically for future events and outcomes.

So will we see urgency in MSTR's fixed income activity through the end of Q1? I think so, but we will have to wait and see. Sitting on the sidelines has not been this teams approach, so I don't see them waiting for very. long now.

@Ben Werkman

Greed and stupidity is taking over

SHITCOIN/ALTCOIN TRUMP COIN IS NUMBER 11 ON THE ALTCOIN MARKETCAP

LEVERAGED PRODUCTS GETTING AGAIN VERY POPULAR:

- LOANS AGAINST BITCOIN AND CRYPTO

- PERPETUAL SWAPS

NEVER FORGET WHAT HAPPEND WITH MT GOX, BITCONNECT, CELSIUS, BLOCKFI, LUNA, HAWKTUAH,...

THE SHIT THAT IS HAPPING WITH ALTCOINS AND LEVERAGED PRODUCTS WILL BLOW UP IN A BIG WAY.

HOW CAN YOU PREVENT THAT THE SHIT THAT IS HAPPENING WILL NOT HARM YOU:

- HOLD ONLY BITCOIN

- DON´T HAVE ANY ALTCOINS

- DO HOLD YOUR BITCOIN ON HARDWARE DEVICE NOT A EXCHANGE

- HAVE A TIME FRAME OF AT LEAST 4 YEARS

- DON´T LOAN AGAINST YOUR BITCOIN

- SPEND BITCOIN WHEN YOU NEED IT

Greed and stupidity is taking over

SHITCOIN/ALTCOIN TRUMP COIN IS NUMBER 11 ON THE ALTCOIN MARKETCAP

LEVERAGED PRODUCTS GETTING AGAIN VERY POPULAR:

- LOANS AGAINST BITCOIN AND CRYPTO

- PERPETUAL SWAPS

NEVER FORGET WHAT HAPPEND WITH MT GOX, BITCONNECT, CELSIUS, BLOCKFI, LUNA, HAWKTUAH,...

THE SHIT THAT IS HAPPING WITH ALTCOINS AND LEVERAGED PRODUCTS WILL BLOW UP IN A BIG WAY.

HOW CAN YOU PREVENT THAT THE SHIT THAT IS HAPPENING WILL NOT HARM YOU:

- HOLD ONLY BITCOIN

- DON´T HAVE ANY ALTCOINS

- DO HOLD YOUR BITCOIN ON HARDWARE DEVICE NOT A EXCHANGE

- HAVE A TIME FRAME OF AT LEAST 4 YEARS

- DON´T LOAN AGAINST YOUR BITCOIN

- SPEND BITCOIN WHEN YOU NEED IT