The Jews need Trump to Build the 3rd Temple buy October 2027

This Holy Temple in Jerusalem, was originally destroyed by the Romans in 70 CE

AK

npub14h0l...qlua

Moving over from X

The spraying that goes on is criminal

Moon Energy

The Korean alphabet does not have the letter ‘R’

Literally.

So stop making fun of them when you hear them say things like “Fwied wice” or “bwo stop being a wee-tawd”

The more you know 😉

If you know, you know 🇺🇸

$BTC to $79,000 👀

🪐Those who know what the worship of Saturn is, and its connection to history will understand the significance of

AK

X.com/@Krypt707

Feb 4

Empowering Taxpayers: A Direct Allocation System for Tax Dollars 💰🇺🇸

Objective: To ensure that taxpayer money is spent in alignment with the ideological, principled, and desired outcomes of American citizens. 🗳️✨

Proposal:

1. Annual Tax Allocation Form:

📄Structure: Each taxpayer would receive an annual digital form during tax season with a series of checkboxes corresponding to various spending categories with detailed subcategories (e.g., Education 📚, Healthcare 🏥, Defense 🛡️, Environmental Protection 🌍, Social Services 🤝, Infrastructure 🏗️).

Selection Process: Taxpayers can allocate their tax contributions across these categories according to their preferences. The percentage of taxes allocated to each category would be determined by the taxpayer.

2. Minimum Tax Burden

Baseline: The minimum tax burden would be calculated based on a similar design to the current average tax rates relative to income, ensuring that everyone contributes a foundational amount.

Category Determination: Public Vote: During election season citizens would vote 🗳️ on which categories should be available for tax allocation. Only those categories receiving a majority vote would appear on the next year's tax form. This process ensures that the categories reflect current national priorities and values. A select highly crucially funded categories, which are transparent, and also voted on would be required from each taxpayer.

https://www.marketplace.org/2024/01/19/what-would-happen-if-we-could-choose-where-our-taxes-go/

3. Advantages

Transparency and Control: This system gives taxpayers direct control over how their tax dollars are spent, enhancing transparency and accountability in government spending 🔍💡.

Engagement: Making tax time an active choice rather than a passive obligation could transform the experience into an engaging civic activity, potentially increasing public participation in fiscal policy 📊🤩.

Efficiency and Effectiveness: By aligning government spending with public priorities, this system could lead to more effective and desired outcomes in policy implementation ✅🔧.

https://taxfoundation.org/blog/how-many-words-are-tax-code/

Empowerment: Empowering citizens with decision-making power could strengthen democracy 💪🗽, giving individuals a tangible sense of influence over national policy and spending.

Political Discussions: there would be less emotional and psychological burden among citizens when discussing politics, as they would feel less responsible for the opinion of others in situations of stark contrast.

https://taxfoundation.org/blog/how-many-words-are-tax-code/

Empowerment: Empowering citizens with decision-making power could strengthen democracy 💪🗽, giving individuals a tangible sense of influence over national policy and spending.

Political Discussions: there would be less emotional and psychological burden among citizens when discussing politics, as they would feel less responsible for the opinion of others in situations of stark contrast.

4. Implementation

Government Role: The government would be responsible for presenting the categories for public vote, managing the voting process 🗳️, and then implementing the tax allocation system based on the results.

Education and Outreach: Public education campaigns would be necessary to inform citizens about the implications of their choices, ensuring informed decision-making 📚👨🏫.

Live Accountability

Similar to the US Debt Clock, a live clock that reflects additions to selected tax categories could provide reassurance of designation of funds when selected.

5. Expected Outcomes

Increased Satisfaction: Taxpayers might feel more satisfied knowing their money supports causes they believe in 😊💸.

Policy Innovation: With public input, new areas of focus could emerge, leading to innovative policy solutions 💡🌟.

National Cohesion: This could foster a sense of unity 🤝 as citizens see

National Bureau of Economic Research (NBER) This article discovered that higher tax revenue is realized from citizens that feel more empowered by their choices regarding allocation of tax dollars:

"Our evidence contributes to understanding why some individuals are more willing to pay taxes than others and why tax compliance varies across countries. It has been documented that nations with the most effective government services, such as the Scandinavian countries, also exhibit the highest levels of tax morale (Kleven, 2014). The concept of reciprocal motivation offers a natural explanation for this correlation: better government services cause taxpayers to be more willing to pay their taxes. Moreover, this reciprocal mechanism can lead 64 For more details, see Appendix A.8. 30 to self-reinforcing cycles. For example, if taxpayers develop a negative bias about how much they benefit from their tax dollars, they may become less inclined to comply with their tax obligations. This reduced compliance can lead to lower government revenue and diminished services, turning the initial bias into a self-fulfilling prophecy."

https://www.nber.org/system/files/working_papers/w29789/w29789.pdf [page 30].

Conclusion: By implementing this system, we can make taxes not only a civic responsibility but also an exciting and impactful part of American democracy, delivered in a way that provides live accountability, 🗽🎉, handing back the power of wealth and influence to the people, who can decide how best to benefit the country, its citizens, and the world 🌎🌟

https://x.com/KalonKoritz/status/1832927785305698675

4. Implementation

Government Role: The government would be responsible for presenting the categories for public vote, managing the voting process 🗳️, and then implementing the tax allocation system based on the results.

Education and Outreach: Public education campaigns would be necessary to inform citizens about the implications of their choices, ensuring informed decision-making 📚👨🏫.

Live Accountability

Similar to the US Debt Clock, a live clock that reflects additions to selected tax categories could provide reassurance of designation of funds when selected.

5. Expected Outcomes

Increased Satisfaction: Taxpayers might feel more satisfied knowing their money supports causes they believe in 😊💸.

Policy Innovation: With public input, new areas of focus could emerge, leading to innovative policy solutions 💡🌟.

National Cohesion: This could foster a sense of unity 🤝 as citizens see

National Bureau of Economic Research (NBER) This article discovered that higher tax revenue is realized from citizens that feel more empowered by their choices regarding allocation of tax dollars:

"Our evidence contributes to understanding why some individuals are more willing to pay taxes than others and why tax compliance varies across countries. It has been documented that nations with the most effective government services, such as the Scandinavian countries, also exhibit the highest levels of tax morale (Kleven, 2014). The concept of reciprocal motivation offers a natural explanation for this correlation: better government services cause taxpayers to be more willing to pay their taxes. Moreover, this reciprocal mechanism can lead 64 For more details, see Appendix A.8. 30 to self-reinforcing cycles. For example, if taxpayers develop a negative bias about how much they benefit from their tax dollars, they may become less inclined to comply with their tax obligations. This reduced compliance can lead to lower government revenue and diminished services, turning the initial bias into a self-fulfilling prophecy."

https://www.nber.org/system/files/working_papers/w29789/w29789.pdf [page 30].

Conclusion: By implementing this system, we can make taxes not only a civic responsibility but also an exciting and impactful part of American democracy, delivered in a way that provides live accountability, 🗽🎉, handing back the power of wealth and influence to the people, who can decide how best to benefit the country, its citizens, and the world 🌎🌟

https://x.com/KalonKoritz/status/1832927785305698675

X (formerly Twitter)

The Rabbit Hole (@TheRabbitHole) on X

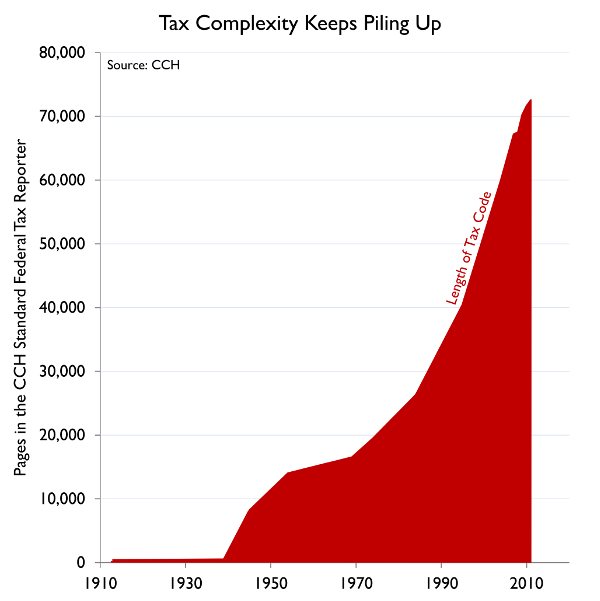

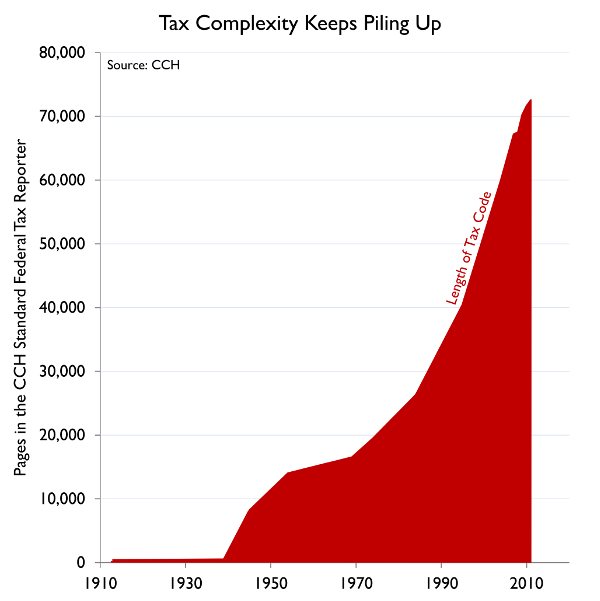

As of 2010, there are over 70,000 pages of tax regulations.

Democracy Journal

Your Money, Your Choice

Rethinking Taxes: Proud to Pay

U.S. National Debt Clock : Real Time

US National Debt Clock : Real Time U.S. National Debt Clock : DOGE Clock

🇺🇸 Donald Trump will bring peace to 🇺🇦 Ukraine and 🇷🇺 Russia

The corruption leading to Covid Research, black market weapons, wnd child sex trafficking will be exposed

People will criticize @realDonaldTrump for this, exposing their true nature and desire

Money is the root of all evil

So Taylor Swift might get deposed?

She was born 12/13/1989

She is a 🐍 snake

2025 is the year of the snake

Something tells me she will beat this

🇺🇸 When US government officials serve the interest of a foreign government over, and to the detriment of their own country

⚔️They will be punished for treason

Senator Randy Fine

x.com/VoteRandyFine will be exposed as a paid operative of the enemy

You will face consequences Randy

Americans see you now

Expresso Colored Art

Plans in plain sight

Prepare for what is coming 👀📉

I’d prefer to keep my first amendment right X.com/realDonaldTrump

🇺🇸 > 🇮🇱