#Bitcoin

Gutenberg

Gutenberg@primal.net

npub148xf...zddg

print books not money // Bitcoin 🧡⚡️

@Anil on X:

There's a whole lot of commercial real estate that has a monetary premium.

There's a utility value to real estate to [the person] using it (the true rental value) and that doesn't matter whether it's a consumer or a business. The extent to which the price of the real estate is beyond that is the monetary premium.

The way to know if there's a monetary premium is to think about all the people that have excess cash but don't want to [hold] cash..and their view is I've got to buy an investment property.

Why do you even want to be an investor? The only reason anybody wants to invest in anything is because they believe that the risk-free rate of return on their money is too low to keep up with inflation.

The world is full of people that are actually making investments in order to preserve their wealth. They're doing it because of the weak money. One of the places they make their investments is in real estate.

So how does bitcoin demonetize that? Well, I think you just want to start from first principles and ask: What is property? You can get to pure property by taking away all the defects of real property.

You don't understand the defects in your property until you see perfect synthetic digital property."

—Michael Saylor

Post from @Anil on X:

"When I wrote The Mobile Wave, (2012) the observation was that software networks are dematerializing everything you could hold in your hand.

You went from taking photos on a Canon camera and storing them in a shoebox to Facebook and Instagram and the iPhone. It wasn't worth 10 times as much, it was worth 1000 times as much. The world's going to change.

These networks [are] going to..destroy 15,000 other companies competing with them because nobody in the history of the world could ever upgrade or ship a product for no variable cost to the entire planet for a nickel. And yet, that's what Google does. That's what Facebook does. That's what Apple does. And that's the part of Amazon that works well. The conclusion was to buy Apple, Amazon, Facebook, and Google.

I wrote the book. Nobody read it.

I took $50 million of my own money..and converted [it] into $500 million. It made me conclude [that] if you want to make money in the tech era, you find the dominant digital network, the one that's worth 100 billion, that's crushed everybody.

If you buy too soon, you might miss it. You might hit Blackberry, MySpace, or Yahoo. But after it’s $100 billion, the market has decided. Apple is the winner, Google's the winner, Facebook's the winner, Amazon's the winner. I know it's pretty obvious.

Amazon was the winner in 2013 when it was trading at 300 bucks. It was funny! Everybody on Wall Street said what is this stupid company, they don't make any money. We don't buy into it. But you could have bought it.

You could buy all those things, and you would have got a 10x - 20x gain on it. You just wait until the 99% of the world that disagrees, that’s cynical, skeptical, and ignorant, ..as it gradually dawns on them that Google is an Information Network. Facebook is a social network, Apple is mobile network, Amazon is retail network.

It made me very successful as a personal investor, but my company didn't invest in it. 2020 came and I swore to myself that if I ever saw this again, I wasn't going to write a book, I was going to buy as much of that thing as I could personally, as much of that thing as I could corporately, and then I was just going to tweet about it."

—Michael Saylor

Best you can have 🧡

Mood 😎

Life with hyerbitcoinisation

Mood: GFY Status 😎

Watching Big short…again

Great Cards & so much love in the delivery from @KaffeeSats 🧡🫶🔥🙏

#Bitcoin er are different 🤩⚡️🤝

You can find them here:

https://www.kaffeesats.com

Mood

GM Plebs!

Credits to kaffeesats

#zapathon #zaps

#plebchain #Bitcoin

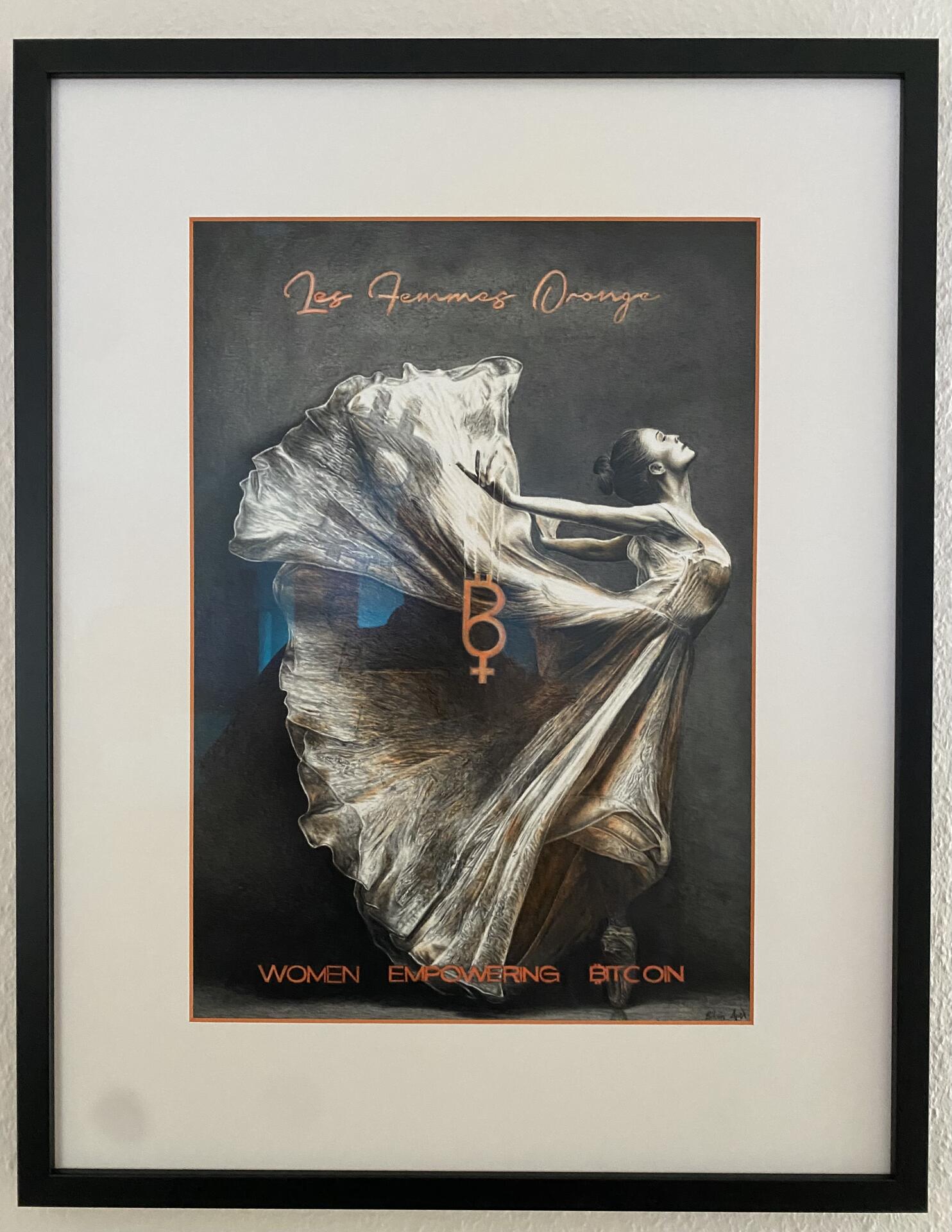

New Picture in the living room 🧡

Mrs Gutenberg loves it 😎