The U.S. dollar role as the world's reserve currency brings benefits like a strong currency during fiscal weakness, and economic power. But it also leads to a structural trade deficit.

#USD #Bitcoin

The demand for dollar fueled by Monetary Premium, incentivices foreign nations to export to the U.S. while the opposite happens at home, wages and costs are not competitive abroad. This prolonged deficit, erodes #US's infrastructure and increases reliance on foreign financing.

Since 1944 US's global share of #GDP has decreased from over 40% to under 20% on real terms. And after the financial crisis of 2008, nations have been diversifying their reserves away from USD. Furthering the US vulnerability as the world's economic power.

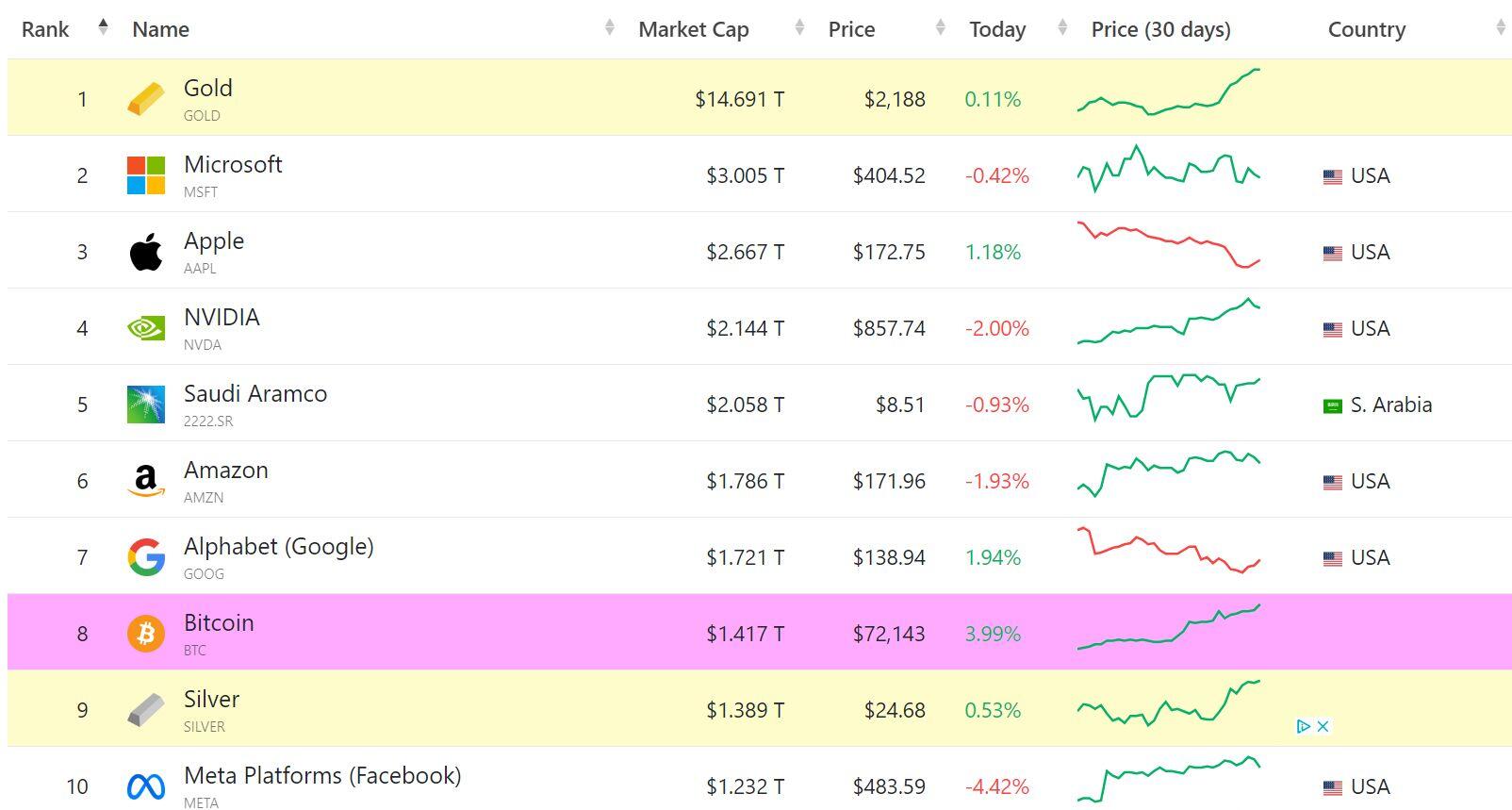

It is unlikely that any other fiat currency will emerge as the new world reserve currency. Instead, the world is shifting towards a reserve currency that is not issued by any government and that relies in true scarcity: #Bitcoin.

The demand for dollar fueled by Monetary Premium, incentivices foreign nations to export to the U.S. while the opposite happens at home, wages and costs are not competitive abroad. This prolonged deficit, erodes #US's infrastructure and increases reliance on foreign financing.

Since 1944 US's global share of #GDP has decreased from over 40% to under 20% on real terms. And after the financial crisis of 2008, nations have been diversifying their reserves away from USD. Furthering the US vulnerability as the world's economic power.

It is unlikely that any other fiat currency will emerge as the new world reserve currency. Instead, the world is shifting towards a reserve currency that is not issued by any government and that relies in true scarcity: #Bitcoin.

The demand for dollar fueled by Monetary Premium, incentivices foreign nations to export to the U.S. while the opposite happens at home, wages and costs are not competitive abroad. This prolonged deficit, erodes #US's infrastructure and increases reliance on foreign financing.

Since 1944 US's global share of #GDP has decreased from over 40% to under 20% on real terms. And after the financial crisis of 2008, nations have been diversifying their reserves away from USD. Furthering the US vulnerability as the world's economic power.

It is unlikely that any other fiat currency will emerge as the new world reserve currency. Instead, the world is shifting towards a reserve currency that is not issued by any government and that relies in true scarcity: #Bitcoin.

The demand for dollar fueled by Monetary Premium, incentivices foreign nations to export to the U.S. while the opposite happens at home, wages and costs are not competitive abroad. This prolonged deficit, erodes #US's infrastructure and increases reliance on foreign financing.

Since 1944 US's global share of #GDP has decreased from over 40% to under 20% on real terms. And after the financial crisis of 2008, nations have been diversifying their reserves away from USD. Furthering the US vulnerability as the world's economic power.

It is unlikely that any other fiat currency will emerge as the new world reserve currency. Instead, the world is shifting towards a reserve currency that is not issued by any government and that relies in true scarcity: #Bitcoin.

temporarily exceeded Silver's Market Cap. This morning, at 1.417T it happened again, only this time is for good.

temporarily exceeded Silver's Market Cap. This morning, at 1.417T it happened again, only this time is for good.