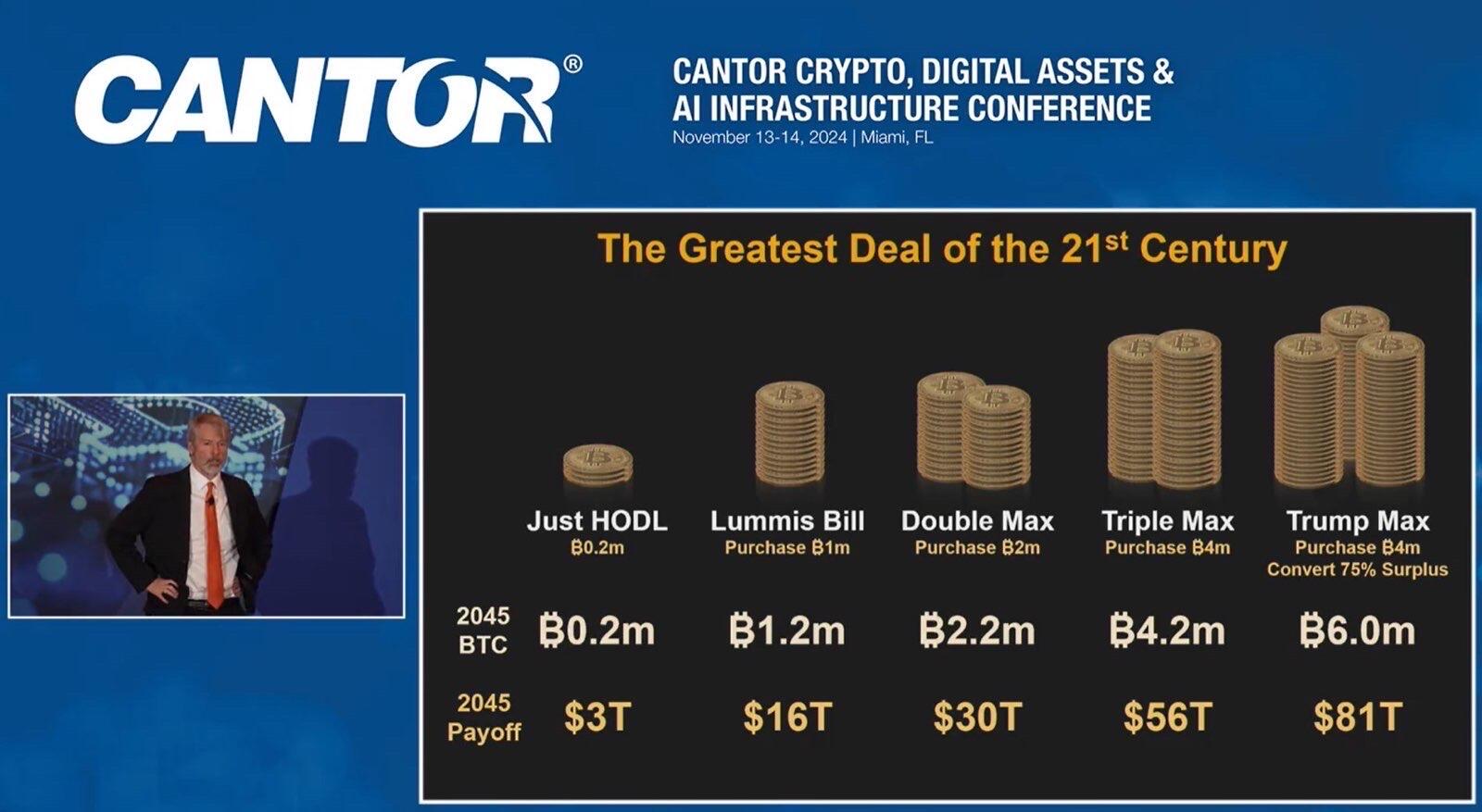

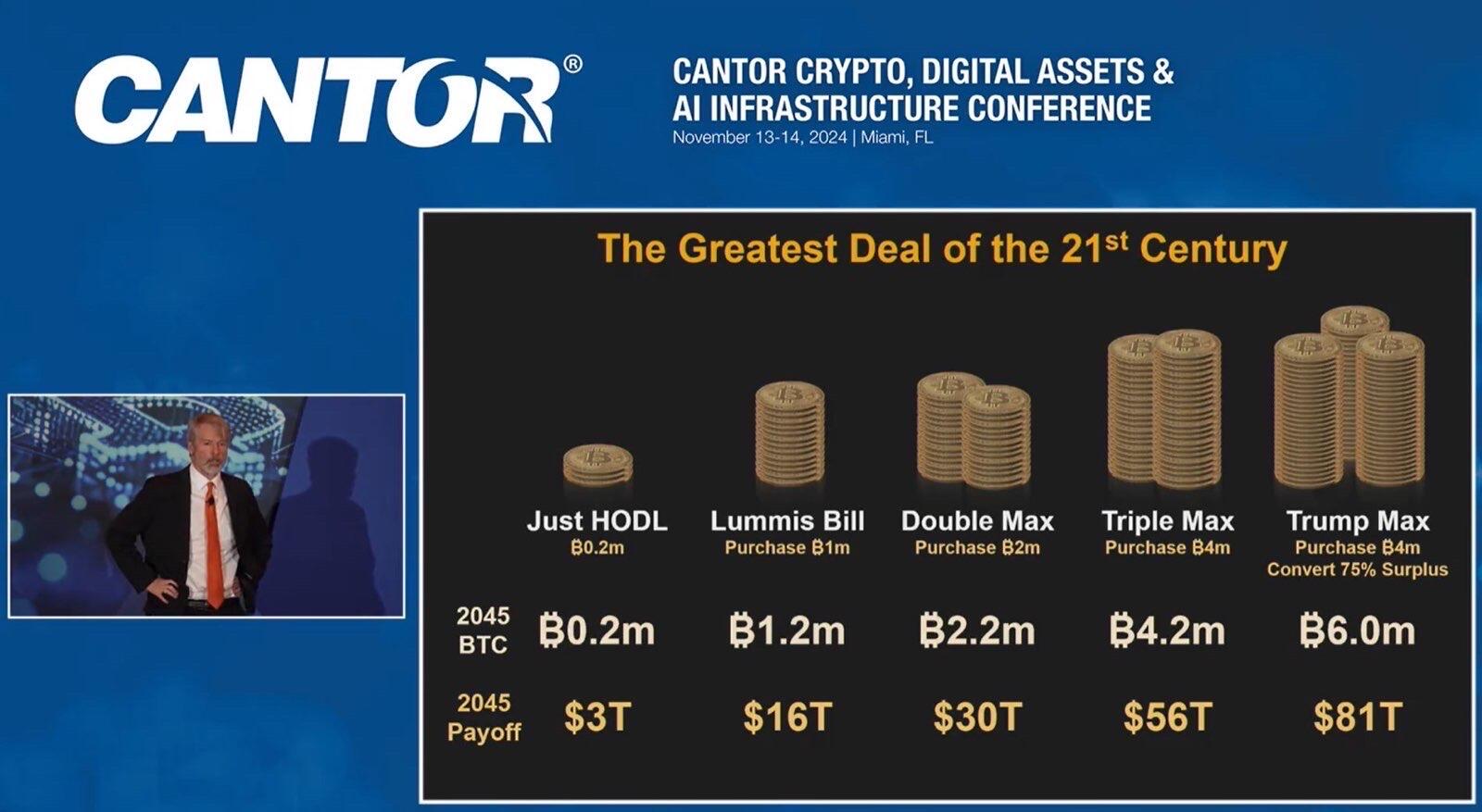

From the Cantor conference (the CEO is Trump’s transition manager). Saylor saying the Lummis bill will generate $16T in value ($16M per BTC)

$16T is half the 🇺🇸 debt. It’s a wild figure but entirely plausible. BTC and gold are the only two assets could be revalued in this way to back the debt.

If the USA revalued gold, that would disproportionately benefit Russia and China who have massive reserves. The USA has disproportionately large holdings of BTC in MSTR, ETFs, etc. Makes BTC the better choice.