Title: How Fannie Mae & Freddie Mac Revolutionized Homeownership

1. Born during the Great Depression to boost housing.

2. Fannie Mae created in 1938, Freddie Mac in 1970.

3. Initially government entities, turned private to expand further.

4. They buy mortgages from lenders, ensuring more loans.

5. Bundle these mortgages into securities, sold to investors.

6. Helps stabilize mortgage rates, making homes more affordable.

7. Criticized for risky practices leading to 2008 crisis.

8. Now under government conservatorship, reform debates ongoing.

Bonus: Played pivotal roles in U.S. housing market resilience.

CTA: Which fact surprised you? @Club Orange

WBTM

WBTM@coinos.io

npub1japy...zrsl

#WhatBitcoinTaughtMe (WBTM) https://geyser.fund/project/whatbitcointaughtme

A lot of valuable info isn't on indexed webpages – it's in #podcasts and #videos, which aren’t easy to search. At #WBTM, we break down key ideas from brilliant thinkers and share the original sources, bringing you the best insights from our journey on #Bitcoin

New Logo! 🍊

#BitcoinIsWater #DontLike | #Zap Or #Share

NO FINANCIAL ADVICE, EDUCATIONAL CONTENT ONLY

Donations: https://coinos.io/WBTM

Available communication channels:

#Nostr (main source)

#Podcast

#Fountain https://fountain.fm/show/qY2p53f9v5BE3gsUwo4t

#Spotify https://open.spotify.com/show/4uBOOdKzF3GT7NFWPRDUP1

#YouTube https://www.youtube.com/@WBTM21

#BlueSky @wbtm.bsky.social

#X|Twitter @wbtm21

#Threads @wbtm.21

#Instagram @wbtm.21 (bitcoin Art)

#TelegramGroup (short Articles) https://t.me/wbtm21

#WhatsAppGroup (discussions) | Community (short Articles)

#LinkedInCompanyPage (medium-size Articles)

https://www.linkedin.com/company/wbtm/

Before: I assumed Bitcoin was mainly for small, personal transactions. After learning about Hal Finney's 2010 prediction, "Bitcoin will be the high-powered money that serves as a reserve currency for banks... Most Bitcoin tx's will occur between banks," it clicked. Bitcoin's potential as a backbone for large-scale financial operations, not just individual spending, reshaped my view. Have you considered Bitcoin's role beyond personal use? @jb55

Transform your grind into gold: Why scarcity and durability matter in assets 🧵

To thrive, shift work into assets that are rare, wanted, easy to carry, long-lasting, and easy to keep up. Think of creating or investing in something that not only holds its value but potentially increases over time due to its scarcity and desirability. Assets that are portable allow you to move freely, adapting to changes in the market or personal circumstances. Durability ensures that your asset won't just vanish or degrade, protecting your hard work. Lastly, maintainability means you can keep your asset in top condition without excessive costs or effort, ensuring it continues to provide value.

Which tip was best? Save this post. @Tomer Strolight

I once trusted digital cash without questioning. Realized CBDCs could lead to surveillance and control over spending. Learned the value of privacy. How do you feel about the balance between convenience and privacy? @boston wine

5 Surprising Facts from "The Creature from Jekyll Island" by G. Edward Griffin

1. It's about the Federal Reserve's creation.

2. Reveals secretive meetings of bankers.

3. Discusses the impact on the economy.

4. Questions the Fed's control over money.

5. Bonus: It reads like a thriller!

Which one stood out? @boston wine

Before, I believed our financial system was stable and fair. Then, I learned how money is created by a few, leading to inflation and wealth inequality. Now, I see the importance of a decentralized currency like Bitcoin, offering control and transparency. Have you realized the power behind understanding our financial system and the revolutionary potential of Bitcoin?

Follow WhatBitcoinTaughtMe to LEARN. @NVK 🌞⚡️

Years ago, in my early Bitcoin days, I underestimated its complexity. Thought of it just as digital cash. Ignored its depth - a blend of money, time, energy, and information. My narrow view almost cost me a significant investment. This journey taught me Bitcoin's multifaceted nature. How do you see Bitcoin's essence beyond just money? @Club Orange

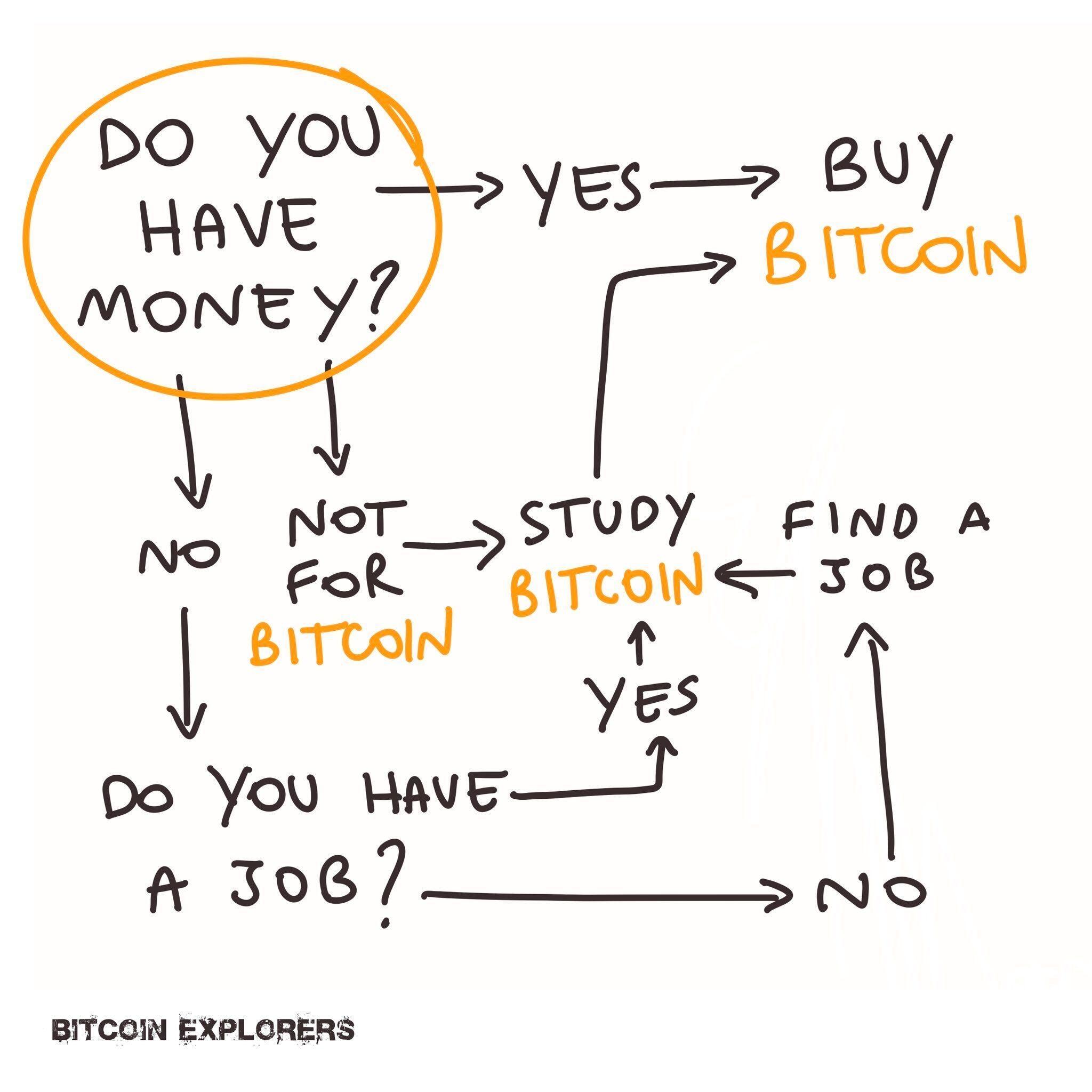

Before, I believed Bitcoin needed a sales pitch. The recent study shows 72% of buyers prefer to explore Bitcoin on their own, without a sales rep. This insight reveals a desire for self-driven discovery over being sold to. Now, I see the power in guiding curiosity rather than pushing persuasion. Have you considered exploring Bitcoin at your own pace? @BTC Sessions

Bitcoin is death

Bitcoin

• #Menger proved prices aren’t random, they’re people’s truth signals

• #Hayek showed without them, planners fly blind

• #Socialism kills signals, chaos wins #FreeMarkets #TruthInPrices #WakeUp

Why Bitcoin Isn't a Ponzi Scheme: A Simple Explanation

1. Swan Bitcoin doesn't need cash flow to have value.

2. Critics compare it to fiat money, which loses value fast.

3. Real value comes from holding, not cash flow, like gold.

4. Bitcoin's ability to hold value makes it superior.

5. It's growing as the best form of money.

Which one stood out? @Guy Swann

Lost Bitcoin due to passphrase. Learned multisig importance. @Edward Snowden

"Over 90% of money laundering crimes go undetected with traditional banking." This stat highlights how the current financial system's opacity is a playground for illicit activities. Bitcoin, with its transparent blockchain, makes tracking transactions easier for law enforcement, offering a pseudo-anonymous yet open ledger. It's not perfect, but it's a step towards accountability. Do you agree? @Swan Bitcoin

Why Bitcoin is Actually ESG Friendly

1. Lowers carbon footprint by incentivizing renewable energy.

2. Enhances social inclusion by providing financial services to the unbanked.

BTC $109,501 1.45% .

Cointelegraph

Altcoin ETFs Will Catalyze Institutional Adoption After Bitcoin, Ether ETFs

The incoming wave of altcoin ETFs may catalyze the next wave of institutional cryptocurrency adoption as companies move beyond Bitcoin and Ether.

Why Bitcoin is Actually ESG Friendly

1. Lowers carbon footprint by incentivizing renewable energy.

2. Enhances social inclusion by providing financial services to the unbanked.

"Over 90% of money laundering crimes go undetected with traditional banking." This stat highlights how the current financial system's opacity is a playground for illicit activities. Bitcoin, with its transparent blockchain, makes tracking transactions easier for law enforcement, offering a pseudo-anonymous yet open ledger. It's not perfect, but it's a step towards accountability. Do you agree? @Swan Bitcoin

Why Bitcoin is Actually ESG Friendly

1. Lowers carbon footprint by incentivizing renewable energy.

2. Enhances social inclusion by providing financial services to the unbanked.

3. Promotes governance transparency through its decentralized nature.

Bonus: Sovereign Funds focus on ESG, yet Bitcoin aligns with these values indirectly.

Which one stood out? @Adam Back