Re: home mining, has anyone come across a good solution for 1-3 KW of mining/heating?

Setup is an oversized solar array, producing excess electricity (about $800 stored up)

The local grid pays 0.18c per KWh and charges 0.24c).

Daniel Batten

Dsbatten@nostrich.love

npub13lky...lpsy

Focusing 2026 on coaching Bitcoin builders and leaders

newsletter: danielbatten.substack.com

New study tells us what you probably already knew: medication helps a whole bunch of things including both memory and emotional regulation (more happiness and calm, less anger)

Yep. That’s why I was able to fight the most insane and inane bitcoin FUD for two years and still stay calm.

https://medicalxpress.com/news/2025-02-meditation-deep-brain-areas-memory.html

It’s interesting to me that while over 1M people have bought The Bitcoin standard, it’s the minority of Bitcoiners who seem to believe this is possible.

I get many comments like “Hopium” and “too much volatility” when I talk about how Suriname stands a chance of actually adopting a bitcoin standard.

Imagine not just watching the first country on a Bitcoin standard emerge, but being able to say years later "I was there, I was part of the team that did it."

Over the years, a lot of plebs have reached out and offer to volunteer some incredible services to me. I wasn't always able to utilize them. But Maya can

Why this matters: We have a once in a generation shot of creating a country that runs on a Bitcoin standard. If we miss the Suriname opportunity, another one that fits the profile (small, developing world, Central Bank is just a fiat wallet with no monetary policy function) may not come along for another 10 years.

Why that matters: Without a working example of a small country which has moved to a Bitcoin standard, larger nations will be too scared to follow.

Why I know I'm right about this: I grew up in NZ (another small country) in the 1980s when was first in the world to deregulate energy, telco and financial markets, fully float the dollar and lower the inflation target to 2%. The rest of the world quickly followed. Sadly, NZ no longer has the same bold political leadership, that epicenter has moved to a small handful of nations in Africa and Latin America, such as El Salvador, and Suriname.

But El Salvador has not and is not in a position to progress their Bitcoin revolution to a full Bitcoin standard. They are not in a position to remove their central bank, or replace their dollarized currency with Bitcoin. Suriname is.

I regard the work Maya is doing in Suriname right now as one of the most important projects we can dedicate our time and energy to. If you have a skill in organising, campaigning or just are really good at execution, reach out to her.

It won't be easy. That which is worthwhile seldom is. And I can't promise that your efforts will bear fruit, but if a shot at tangibly changing the course of not just Bitcoin history, but history, appeals you won't think twice about it.

From my newsletter of 1 Jan this year.

Hmm. That played out faster than I expected.

The Bitcoin Adoption Forecast is out. Check your email and spam filters

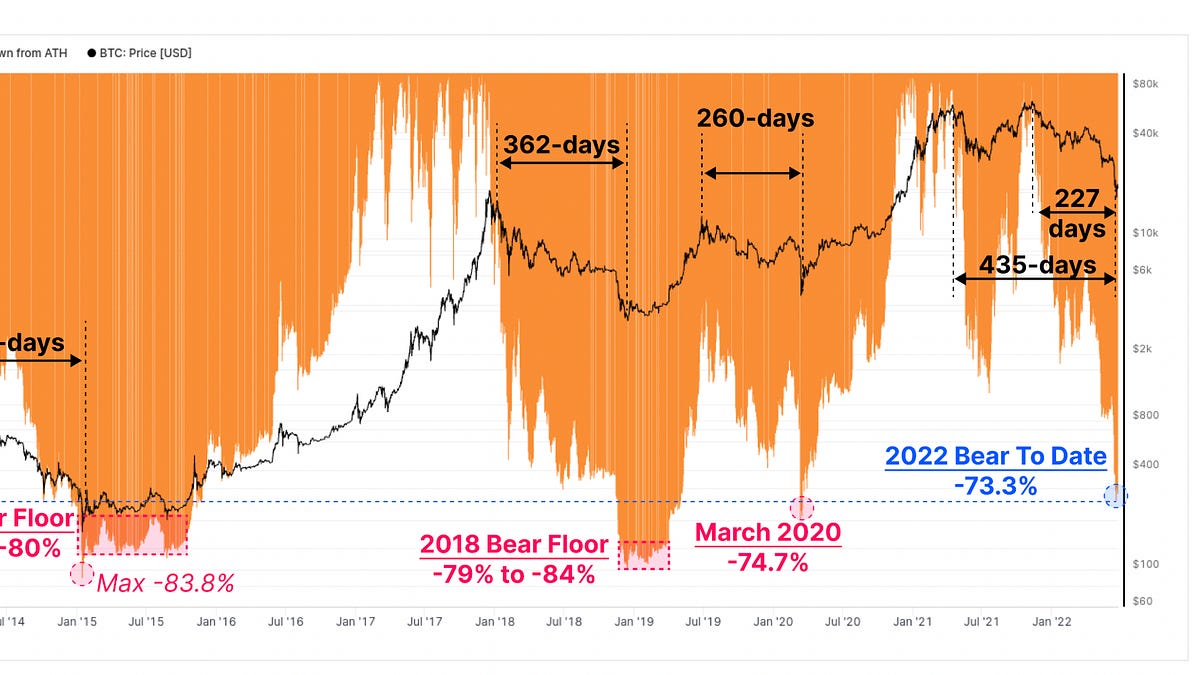

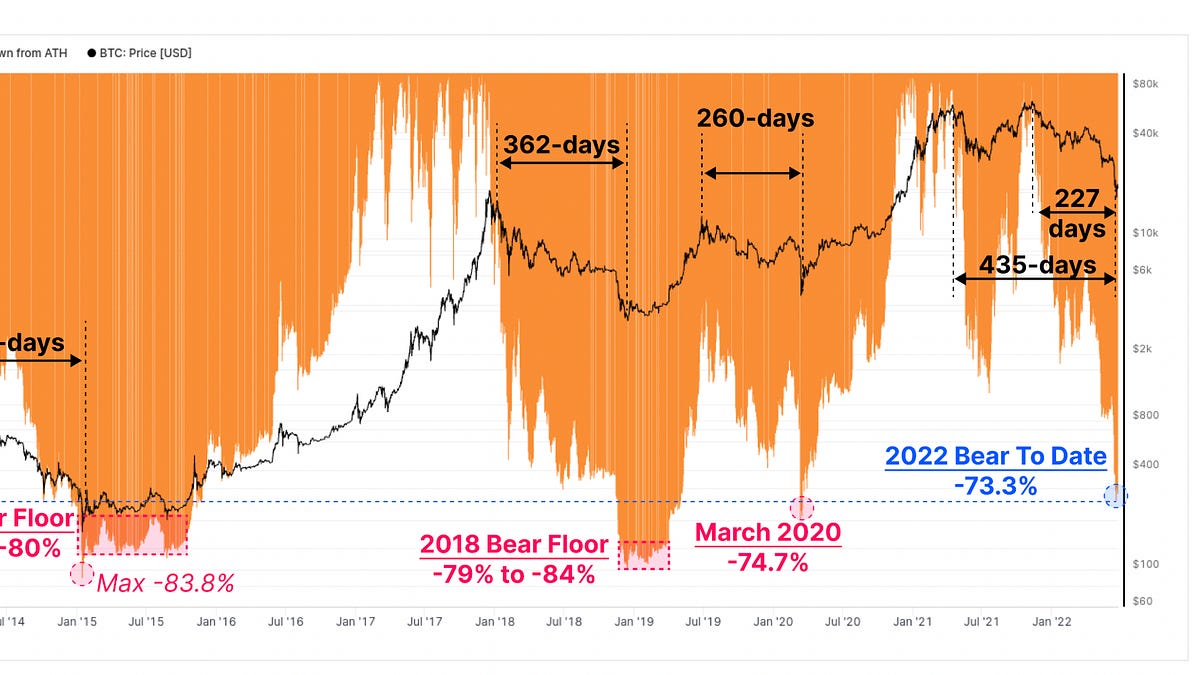

#027 The big volatility dip

Bitcoin bear markets are forecast to be a lot smaller. I explain why in my latest newsletter

Bitcoin headlines like this are becoming the new norm in mainstream media now

UK wastes 1 billion pounds each year in curtailed wind energy by not mining bitcoin.

The Guardian, who has been one of the world’s biggest Bitcoin gaslighters over the years, just ran this headline.

Can’t make this stuff up.

When you have to double-check you are not reading satire.

Welcome to Finca Koki Costa Rica. (Nostr first story)

You’re looking at 60 Ha of bush clad land on the side of of the Poás volcano, a 1.1MW hydro facility and a bunch of sheds mining bitcoin. It’s about an hour up the road from where I live on a good traffic day.

It belongs to Eduardo Kopper and the land has been in the family for 5 generations, who I met last year.

Here’s the thing: Eduardo was about to lose this land because during covid in 2020 the State Owned Utility said “demand for electricity is down. We aren’t going to buy your power any more”

With a large mortgage debt on the hydro plant, a cash cow became a white elephant overnight.

He went to the bank to say “here are the keys to the property. I cannot finance the loan any more”

But at the same time his son-in-law asked if he’d considered bitcoin mining.

He was highly skeptical but tried it on a single miner. It worked (of course) so he scaled up. The bank loaned him the money to get the first 700 kW of bitcoin mining (provided he called it a “datacenter”) and now he earns more than enough to pay off the loan interest.

He’s made Finca Koki into an eco retreat. Parties of school kids come through. Executives do team building on the adventure and recreation facilities he’s built which include canoeing and zip lines.

He sponsors poor local kids to do camping and life skills building, which his teenage son facilitates.

All made possible because of bitcoin mining.

As we say in Costa Rica

“Bitcoin: El futuro del dinero!”

(Bitcoin: the future of money)

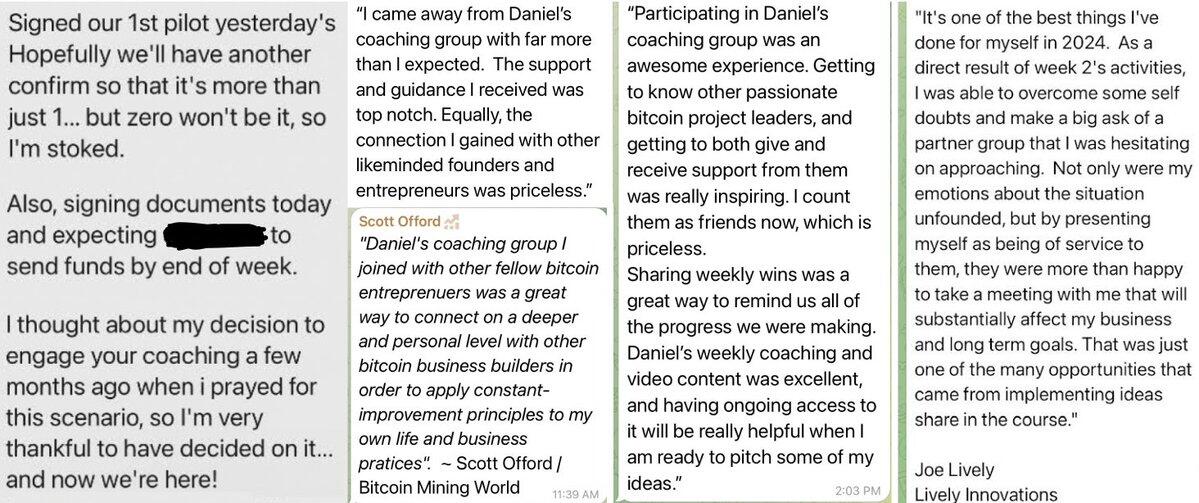

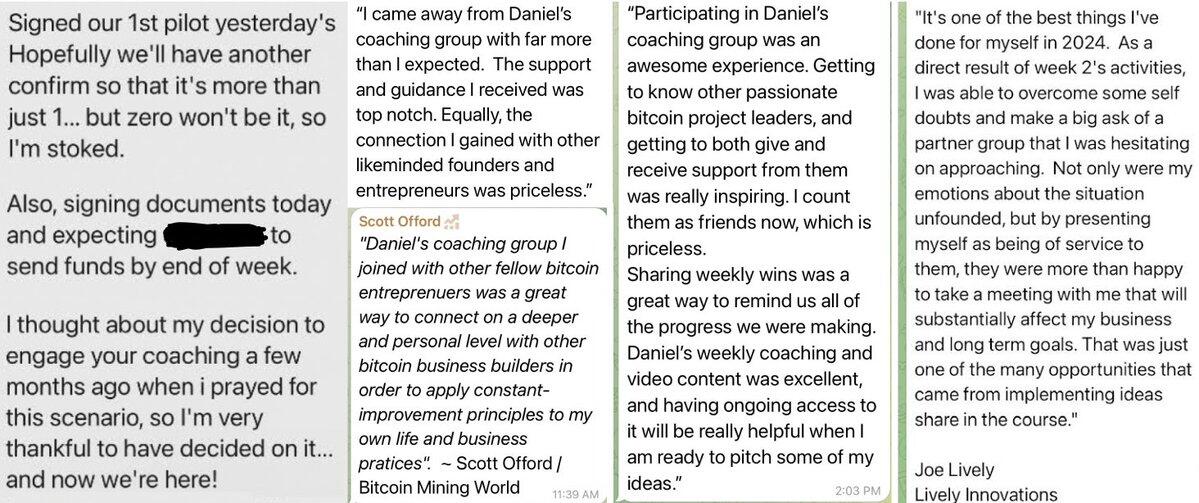

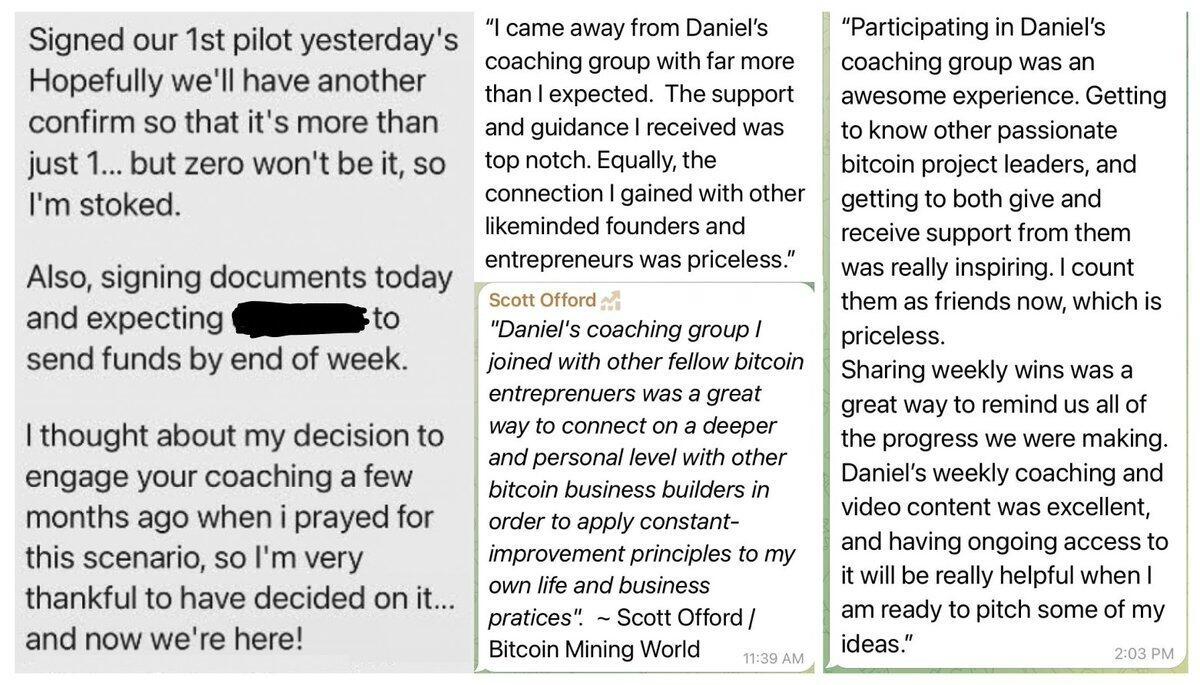

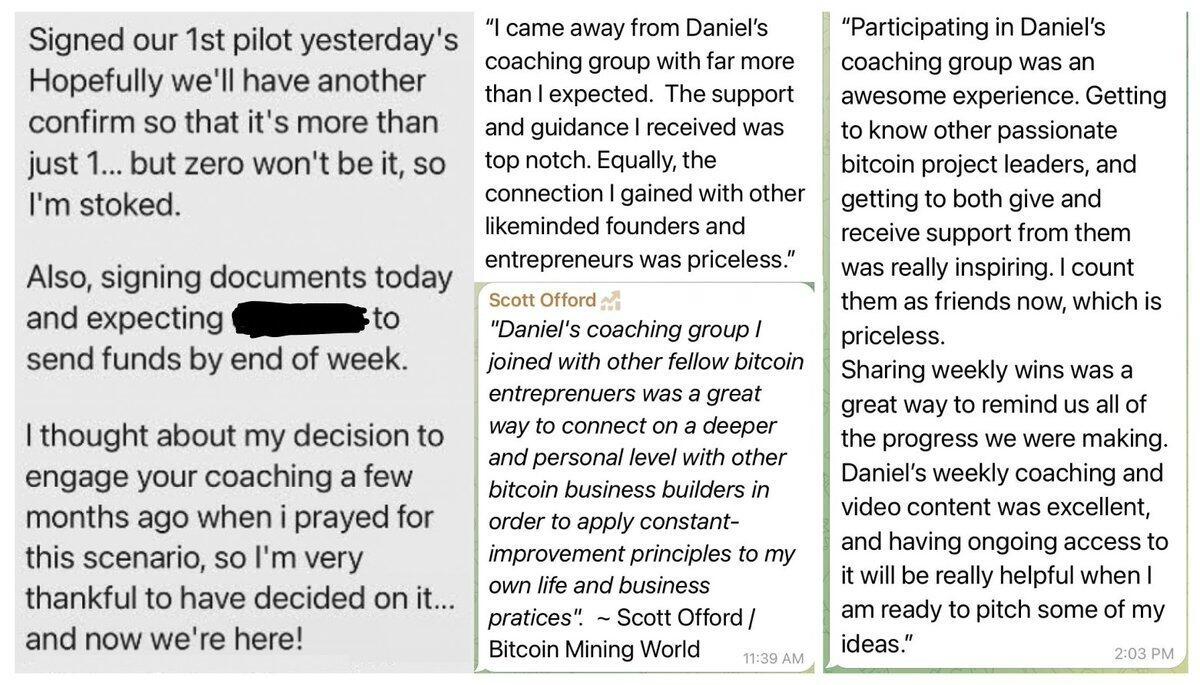

I've been doing group coaching with tech entrepreneurs for 10 years, and the pilot I ran for Bitcoin entrepreneurs and influencers last year went really well (see feedback). So delighted to offer this again

One place left on our next cohort, starting 24 Jan. Message if keen!

Good morning

We have a nice cohort forming of Bitcoin entrepreneurs and thoughtleaders for the next 10 week coaching group. (See feedback below from the last one)

2 places left

The combination of great coaching + peer group that inspires you skews the odds in your favor. Comment below or message to inquire

Hey I'd love your help with something.

A few people have asked "how do you find the time to debunk so much FUD?" It's my newsletter that increasingly is giving me the ability to allocate a lot of time to fighting FUD (which increases during bullruns).

And yet ... most people have no idea that I even run a newsletter!

The money from the newsletter (and my coaching) means I don't have to do a FIAT job, which frees up my time. And I re-invest that time straight back into defending Bitcoin mining and doing my freely available Bitcoin research. True circular economy. Apart from that, I'm told by others that the newsletter is pretty good !

I write research that is driven by data but accessible to people not from the world of finance about stuff like why this cycle there won't be a significant altseason or big drawdowns, what pension fund adoption will do for bitcoin, plus how the changing ESG narrative is helping Bitcoin adoption.

So if you're interested in institution-grade Bitcoin research without the institution-grade terminology once a month, please sign up for my newsletter and direct others there too. It's only $8/month, and if you don't like it, you have the freedom to drop away after the first month - so max risk of $8 (though I must warn you, very few do).

My newsletter signup is at www.batcoinz.com

It's a true win-win

Thank you 🙏

Daniel

PS: I'm not an important or big enough author yet for substack to offer me a Bitcoin payment option, but there is a workaround available, so msg me on Nostr if you want to take that option

Issue #26 of the Bitcoin Adoption Forecast is out

Check your email and spam filters

#26 Goodbye Altseason?

Dear subscriber

“For one who wears shoes, the whole world is paved with leather”

~ Yoga Vasistha

Success Nerds has just done a good independent appraisal of Bitcoin mining in a nuanced, well researched piece.

Recommended

18% of Ethiopian Electric Power’s revenue now comes from (previously wasted hydro-powered) Bitcoin mining

Probably nothing

Issue #25 of the Bitcoin Adoption Forecast is out now, featuring a story from Kenya.

Check your email and spam filters

#25 How Bitcoin protects against scams

Our newsletter on the suspension of the Greenpeace USA ‘Change the Code’ campaign was our most read newsletter ever.

Issue 24 of the Bitcoin Adoption Forecast is out:

How the "Pension Fund Blueprint" could change the next cycle of Bitcoin adoption

Check your email and spam filters

How the "Pension Fund Blueprint" could change the next cycle of Bitcoin adoption

Welcome to my first video newsletter.