GM!

Already a great day… I had no idea the power I had over other minds using this one simple phrase that triggered a lunatic before I even got out of bed

Glory be to Nostr!

deeznuts

deeznuts@crypto.im

npub13tku...llwf

Enthusiasm enthusiast.

“No Amount Of Violence Will Solve A Math Problem”

Excel at research, analysis and meme-lording: https://memeticresearch.group/?page=contex.st

- • The notion of a “peaceful transfer of power” in American democracy is a myth that reinforces the idea that elections determine governing elites based on the “will of the people.”

- • This myth is fundamentally flawed as there is no real “will of the people”; it serves to legitimize the ruling elites and their power.

- • In reality, power does not significantly transfer between governing elites during elections; elected officials merely represent a public face while the actual elite retains control.

- • Although some minor policy changes occur, significant areas such as foreign policy, central banking, and welfare programs remain largely untouched by electoral outcomes.

- • Access to political positions is restricted, ensuring only certain parties and candidates aligned with the elite can compete for power.

- • Many Americans hold a naïve belief that elites willingly relinquish power, overlooking the complexities of political power dynamics.

- • Pareto’s theory illustrates that ruling elites operate through a network of patrons and clients, maintaining power through mutual benefits rather than conspiracy.

- • The elite class is diverse and consists of various groups, and its cohesion arises from economic self-interest rather than a unified goal.

- • The ruling elite invests considerable resources to maintain their power, making it unlikely they would willingly surrender it after an election.

- • Political parties in democracies are categorized into pro-regime parties that rotate in power and uncompromising parties that do not gain access to government.

- • Only moderate parties that align with elite interests can participate in governance, while genuine counterelites are excluded to protect the ruling elite's networks.

Why America's Two-Party System Will Never Threaten the True Political Elites | Mises Institute

https://mises.org/mises-wire/why-americas-two-party-system-will-never-threaten-true-political-elites?

Shared via

Memetic Research Laboratories LLC

Memetic Research Laboratories LLC - Privacy-focused technology for digital content management and decentralized communication

https://mises.org/mises-wire/why-americas-two-party-system-will-never-threaten-true-political-elites?

Why America's Two-Party System Will Never Threaten the True Political Elites | Mises Institute

Shared via

Memetic Research Laboratories LLC

Memetic Research Laboratories LLC - Privacy-focused technology for digital content management and decentralized communication

"Without a steady expansion of debt and a steady debasement of the dollar so debtors have an easier time paying existing debts, the economy would crash, and so doing more of what leads to collapse is the status quo “solution.”

The second assumption of the US dollar debasement narrative is that those who own crypto, precious metals and other tangible assets will not just survive the eventual crisis but emerge wealthy, as the value of their assets is not dependent on fiat currencies.

This suggests the following thought experiment: since those holding the levers of power “know” the end-game of debasement is the collapse of the currency and the economy, and they “know” the economic devastation that this collapse will deliver not just to the majority but to the wealthy whose wealth ultimately depends on a functioning economy, wouldn’t they consider pursuing a still-painful but less apocalyptic option that steers clear of the death-spiral?"

Shared via

Shared via

Re-Set: Reversing the Debt-Debasement Death-Spiral

The end-game of debt-debasement is already visible. The only thing that's still up in the air is our response.

Memetic Research Laboratories LLC

Memetic Research Laboratories LLC - Privacy-focused technology for digital content management and decentralized communication

Nothing Stops This Train

# Comprehensive Analysis

Title: (2) Re-Set: Reversing the Debt-Debasement Death-Spiral

URL:  Collected: 2026-02-05 16:59:56 +0000

Analyzed: 2026-02-05 17:02:10 +0000

## Overall takeaway

The debt-debasement dynamic necessitates a reevaluation of fiscal policies to address wealth inequality and promote a sustainable economy.

## Conceptual model

- TINA: Reversing debt expansion risks economic collapse.

- Asset owners benefit while debtors suffer from wealth inequality.

- Even distribution of pain is crucial to prevent societal revolt.

- Ending debt dependence is essential for sustainable growth.

- Policy changes must rebalance fiscal responsibilities.

## Next steps (optional)

- Explore alternative economic models that reduce debt reliance.

- Engage in discussions about equitable fiscal policies.

- Research historical precedents of currency collapse and recovery.

## Short summary

The document discusses the debt-debasement dynamic characterized by TINA (There Is No Alternative) and discusses the disparities between asset owners and debtors. It highlights the necessity of rebalancing fiscal policies and rethinking the reliance on debt to foster a sustainable economy.

## Comprehensive summary

- **Debt-Debasement Narrative**: The foundation lies in TINA (There Is No Alternative), implying that reversing debt expansion is impossible without economic collapse.

- **Asset Owners vs. Debtors**: Those holding crypto and tangible assets are expected to survive the crisis, as their wealth isn't tied to fiat currencies.

- **Power Dynamics**: Decision-makers, aware of the potential collapse from debasement, may seek less catastrophic alternatives to avoid losing their power.

- **Historical Precedents**: Governments with collapsing currencies face severe consequences, prompting those in power to seek solutions to avoid the death spiral.

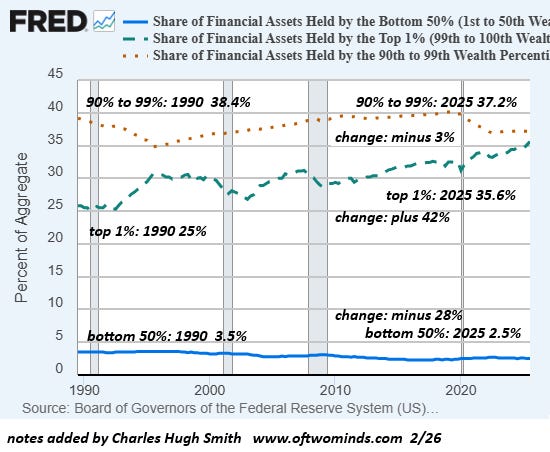

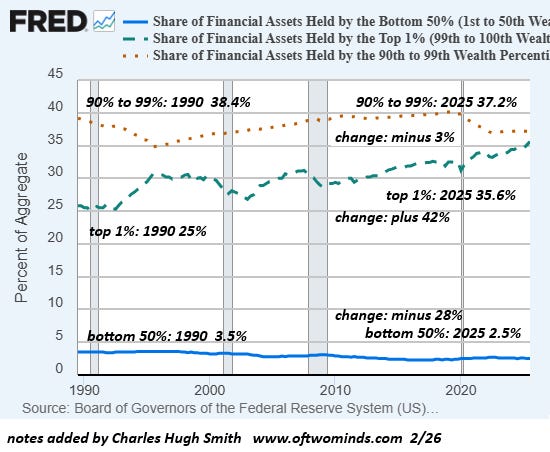

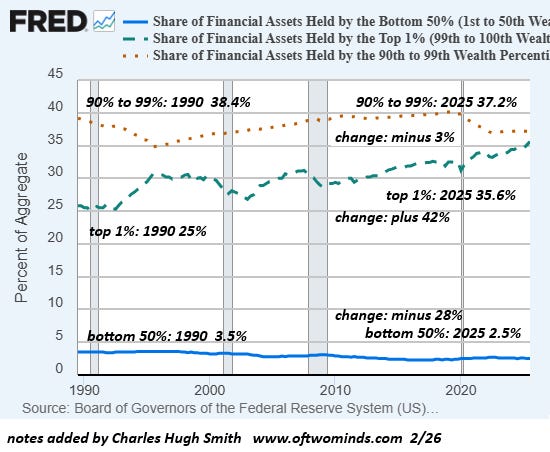

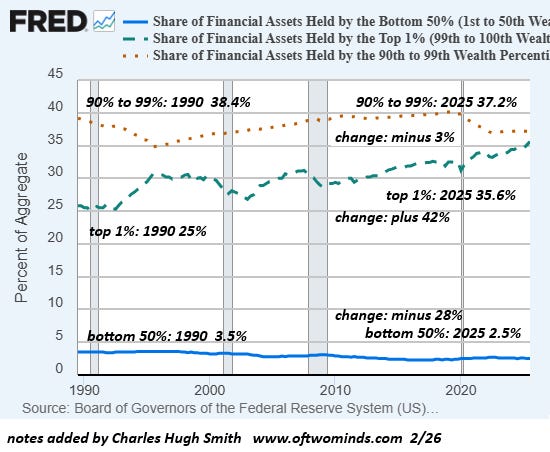

- **Even Distribution of Pain**: To reverse the death spiral, pain must be distributed evenly to prevent significant revolt from the bottom 80% against the top 10%.

- **Wealth Inequality**: Over the past 50 years, wealth has concentrated among the top 10%, while the bottom 50% have seen their financial asset ownership decline sharply.

- **Ending Debt Dependence**: A sustainable economy requires ending reliance on rising debt and money supply expansion, which fuels wealth inequality and an illusion of growth.

- **Interest Rate Adjustments**: Raising Treasury yields can attract global capital, reduce demand for loans, and trigger necessary recession to clear excessive debt and inflation.

- **Federal Reserve Actions**: Allowing bankruptcies and defaults without bailouts can help reduce private-sector debt, reestablishing market discipline.

- **Rebalancing Fiscal Policies**: Reassessing federal obligations and revenues can reverse policies favoring capital owners, redistributing financial burdens more equitably.

- **Policy Changes**: Implementing taxes on unearned income and cutting excessive funding to industries benefiting from government support can

## Entities

- keyword: spiral, supply, power, debasement, money, currency, death, economy, pain, debt

- location: Amazon, TINA, US

- organization: Amazon Associate, Big Ag, Treasury, Federal Reserve, SickCare, US Treasury, Savings, Big Defense

## Related content

1. Explaining Economic Madness to People

Why: similarity 0.91

Summary: - • The current economic system exhibits a form of madness that is challenging to articulate, yet understanding it is crucial for societal change.

- • The madness starts with credit; when people borrow money, they mistakenly believe they are using existing funds.

- • Banks create new money from nothing when issuing loans, which dilutes the value of existing money.

- • This money creation leads to inflation, where prices rise and purchasing power decreases, disproportionately affecting those who cannot borrow.

- • Individuals without assets bear the brunt of rising living costs, leading to reduced purchasing power and diminishing savings.

- • Wealth is transferred from earners to those who create money, perpetuating inequality.

- • Central banks further exacerbate the issue by creating money through government debt purchases, injecting more devalued currency into the economy.

- • As prices rise and wages stagnate, society feels poorer despite potential increases in production.

- • The economic system is unsustainable; it depends on continuous expansion for survival.

- • A reduction in spending or borrowing would lead to deflation, strengthening currency and making debts unpayable.

- • The system's design necessitates endless growth, debt, and instability, preventing genuine improvement.

- • This cycle contributes to social decay, political division, and conflict, as stability is viewed as a threat.

- • True change is often met with chaos, requiring resets through extreme events like wars or revolutions.

- • The author encourages sharing this understanding with those who believe better management alone can rectify the system.

URL:

Collected: 2026-02-05 16:59:56 +0000

Analyzed: 2026-02-05 17:02:10 +0000

## Overall takeaway

The debt-debasement dynamic necessitates a reevaluation of fiscal policies to address wealth inequality and promote a sustainable economy.

## Conceptual model

- TINA: Reversing debt expansion risks economic collapse.

- Asset owners benefit while debtors suffer from wealth inequality.

- Even distribution of pain is crucial to prevent societal revolt.

- Ending debt dependence is essential for sustainable growth.

- Policy changes must rebalance fiscal responsibilities.

## Next steps (optional)

- Explore alternative economic models that reduce debt reliance.

- Engage in discussions about equitable fiscal policies.

- Research historical precedents of currency collapse and recovery.

## Short summary

The document discusses the debt-debasement dynamic characterized by TINA (There Is No Alternative) and discusses the disparities between asset owners and debtors. It highlights the necessity of rebalancing fiscal policies and rethinking the reliance on debt to foster a sustainable economy.

## Comprehensive summary

- **Debt-Debasement Narrative**: The foundation lies in TINA (There Is No Alternative), implying that reversing debt expansion is impossible without economic collapse.

- **Asset Owners vs. Debtors**: Those holding crypto and tangible assets are expected to survive the crisis, as their wealth isn't tied to fiat currencies.

- **Power Dynamics**: Decision-makers, aware of the potential collapse from debasement, may seek less catastrophic alternatives to avoid losing their power.

- **Historical Precedents**: Governments with collapsing currencies face severe consequences, prompting those in power to seek solutions to avoid the death spiral.

- **Even Distribution of Pain**: To reverse the death spiral, pain must be distributed evenly to prevent significant revolt from the bottom 80% against the top 10%.

- **Wealth Inequality**: Over the past 50 years, wealth has concentrated among the top 10%, while the bottom 50% have seen their financial asset ownership decline sharply.

- **Ending Debt Dependence**: A sustainable economy requires ending reliance on rising debt and money supply expansion, which fuels wealth inequality and an illusion of growth.

- **Interest Rate Adjustments**: Raising Treasury yields can attract global capital, reduce demand for loans, and trigger necessary recession to clear excessive debt and inflation.

- **Federal Reserve Actions**: Allowing bankruptcies and defaults without bailouts can help reduce private-sector debt, reestablishing market discipline.

- **Rebalancing Fiscal Policies**: Reassessing federal obligations and revenues can reverse policies favoring capital owners, redistributing financial burdens more equitably.

- **Policy Changes**: Implementing taxes on unearned income and cutting excessive funding to industries benefiting from government support can

## Entities

- keyword: spiral, supply, power, debasement, money, currency, death, economy, pain, debt

- location: Amazon, TINA, US

- organization: Amazon Associate, Big Ag, Treasury, Federal Reserve, SickCare, US Treasury, Savings, Big Defense

## Related content

1. Explaining Economic Madness to People

Why: similarity 0.91

Summary: - • The current economic system exhibits a form of madness that is challenging to articulate, yet understanding it is crucial for societal change.

- • The madness starts with credit; when people borrow money, they mistakenly believe they are using existing funds.

- • Banks create new money from nothing when issuing loans, which dilutes the value of existing money.

- • This money creation leads to inflation, where prices rise and purchasing power decreases, disproportionately affecting those who cannot borrow.

- • Individuals without assets bear the brunt of rising living costs, leading to reduced purchasing power and diminishing savings.

- • Wealth is transferred from earners to those who create money, perpetuating inequality.

- • Central banks further exacerbate the issue by creating money through government debt purchases, injecting more devalued currency into the economy.

- • As prices rise and wages stagnate, society feels poorer despite potential increases in production.

- • The economic system is unsustainable; it depends on continuous expansion for survival.

- • A reduction in spending or borrowing would lead to deflation, strengthening currency and making debts unpayable.

- • The system's design necessitates endless growth, debt, and instability, preventing genuine improvement.

- • This cycle contributes to social decay, political division, and conflict, as stability is viewed as a threat.

- • True change is often met with chaos, requiring resets through extreme events like wars or revolutions.

- • The author encourages sharing this understanding with those who believe better management alone can rectify the system.

URL:  2. The Imminent Restructuring of the Monetary System – Mark E. Jeftovic is The Bombthrower

Why: similarity 0.91

Summary: • The global financial system, built on leverage and fiat expansion since 1913, is unsustainably distorted through derivatives, credit expansion, and hidden leverage, requiring a painful but necessary restructuring

• Trump and Scott Bessent are signaling a multi-step transition to sound money backed by gold, commodities, and Bitcoin, avoiding an immediate collapse that would occur if they simply declared a gold-backed dollar overnight

• Foreign nations (China, Russia, BRICS) have stopped accumulating U.S. Treasuries while U.S. debt reaches 123% of GDP, making debt servicing mathematically unsustainable and forcing monetary restructuring

• Key transition signals include government gold accumulation since 2016-2018, LBMA/COMEX physical shortages, and gold's quiet revaluation without triggering panic

• Centralization of FICC trading by 2025-2026 will force a purge of leverage from the Treasury market, similar to how LIBOR's transition to SOFR caused 2023 bank failures

• Bitcoin serves as either a central bank liquidity tool or escape hatch for early movers, with institutional adoption already underway through BlackRock, Fidelity, and MicroStrategy

• An inevitable market collapse will lead to a new Bretton Woods 2.0 system featuring multi-reserve assets (gold, Bitcoin, commodities) instead of sole fiat reliance

• Key risks include the Fed/Treasury losing control of the unwind, foreign actors' positioning, and early market panic creating domino collapses

• The transition is already under

URL:

3. The Great Debasement Trade Is On And Bitcoin Is Positioned Beautifully

Why: similarity 0.91

Summary: - • Bitcoin has reached a new all-time high of over $126,000, signaling strong momentum as it breaks free from previous price stagnation between $80,000 and $110,000.

- • The rising interest in Bitcoin is attributed to growing awareness of global government bankruptcies and the resulting currency debasement.

- • JP Morgan analysts highlight that investors are increasingly favoring assets like gold and Bitcoin due to concerns over inflation and government deficits, coining this trend as the "debasement trade."

- • The document points out that both lower and upper classes are affected by rising prices, with the wealthier experiencing a "wealth mirage" as stock gains fail to keep pace with real inflation.

- • Increasing recognition of Bitcoin's value among institutional investors suggests a shift in sentiment, potentially leading to greater allocations to Bitcoin as a hedge against debt debasement.

- • The normalization of the "debasement trade" may catalyze broader acceptance and investment in Bitcoin, as respected institutions validate its importance.

- • Luke Thomas argues that companies embracing technology, such as AI, should also incorporate Bitcoin in their treasury management, as failing to do so presents a contradiction in their digital transformation efforts.

- • The document emphasizes Bitcoin as essential infrastructure for companies aiming to innovate and store value effectively.

- • Recent headlines indicate growing institutional interest in cryptocurrencies, including Bitcoin and Ethereum, alongside significant holdings by firms like BlackRock.

- • The author urges readers to recognize the implications of these trends and consider their impact on the future of finance and investment.

URL:

2. The Imminent Restructuring of the Monetary System – Mark E. Jeftovic is The Bombthrower

Why: similarity 0.91

Summary: • The global financial system, built on leverage and fiat expansion since 1913, is unsustainably distorted through derivatives, credit expansion, and hidden leverage, requiring a painful but necessary restructuring

• Trump and Scott Bessent are signaling a multi-step transition to sound money backed by gold, commodities, and Bitcoin, avoiding an immediate collapse that would occur if they simply declared a gold-backed dollar overnight

• Foreign nations (China, Russia, BRICS) have stopped accumulating U.S. Treasuries while U.S. debt reaches 123% of GDP, making debt servicing mathematically unsustainable and forcing monetary restructuring

• Key transition signals include government gold accumulation since 2016-2018, LBMA/COMEX physical shortages, and gold's quiet revaluation without triggering panic

• Centralization of FICC trading by 2025-2026 will force a purge of leverage from the Treasury market, similar to how LIBOR's transition to SOFR caused 2023 bank failures

• Bitcoin serves as either a central bank liquidity tool or escape hatch for early movers, with institutional adoption already underway through BlackRock, Fidelity, and MicroStrategy

• An inevitable market collapse will lead to a new Bretton Woods 2.0 system featuring multi-reserve assets (gold, Bitcoin, commodities) instead of sole fiat reliance

• Key risks include the Fed/Treasury losing control of the unwind, foreign actors' positioning, and early market panic creating domino collapses

• The transition is already under

URL:

3. The Great Debasement Trade Is On And Bitcoin Is Positioned Beautifully

Why: similarity 0.91

Summary: - • Bitcoin has reached a new all-time high of over $126,000, signaling strong momentum as it breaks free from previous price stagnation between $80,000 and $110,000.

- • The rising interest in Bitcoin is attributed to growing awareness of global government bankruptcies and the resulting currency debasement.

- • JP Morgan analysts highlight that investors are increasingly favoring assets like gold and Bitcoin due to concerns over inflation and government deficits, coining this trend as the "debasement trade."

- • The document points out that both lower and upper classes are affected by rising prices, with the wealthier experiencing a "wealth mirage" as stock gains fail to keep pace with real inflation.

- • Increasing recognition of Bitcoin's value among institutional investors suggests a shift in sentiment, potentially leading to greater allocations to Bitcoin as a hedge against debt debasement.

- • The normalization of the "debasement trade" may catalyze broader acceptance and investment in Bitcoin, as respected institutions validate its importance.

- • Luke Thomas argues that companies embracing technology, such as AI, should also incorporate Bitcoin in their treasury management, as failing to do so presents a contradiction in their digital transformation efforts.

- • The document emphasizes Bitcoin as essential infrastructure for companies aiming to innovate and store value effectively.

- • Recent headlines indicate growing institutional interest in cryptocurrencies, including Bitcoin and Ethereum, alongside significant holdings by firms like BlackRock.

- • The author urges readers to recognize the implications of these trends and consider their impact on the future of finance and investment.

URL:  4. (3) The Financialist Kill Chain - by E.M. Burlingame

Why: similarity 0.90

Summary: • The Financialist Kill Chain is a seven-step predatory financial strategy used by "Financialists" (Praetorians) to infiltrate nations, trap them in debt, strip their assets, and abandon them in ruin while extracting vast profits

• The seven steps include: infiltration and influence, debt entrapment, asset identification, economic destabilization, debt-for-asset swaps, extraction and exploitation, and finally abandonment and collapse

• Continental European banks invented this system in the 1600s, using it to hollow out the British Empire and transfer its wealth to rebuild Continental Europe three times over

• The United States has been subjected to this process over the last century through massive debt accumulation, the 2008 financial crisis, corporate takeovers, and foreign ownership of assets

• China and Russia have successfully resisted the Kill Chain through state-controlled economies, rejection of dollar reliance, gold hoarding, and fortified state industries

• With traditional targets exhausted (Europe diminished, British Empire ended, US faltering), Financialists are seeking new victims in Africa, Latin America, and Southeast Asia

• The author warns that Financialists must now break up great nations to seize their assets and recapitalize their parasitic system for another 400 years

• This system has shaped world history since the Peace of Westphalia (1648) and the Glorious Revolution (1688), which created vulnerable sovereign states and debt-based financial tools

• The author calls for awareness and action to prevent the next phase of Financialist predation and protect global economic justice

URL:

4. (3) The Financialist Kill Chain - by E.M. Burlingame

Why: similarity 0.90

Summary: • The Financialist Kill Chain is a seven-step predatory financial strategy used by "Financialists" (Praetorians) to infiltrate nations, trap them in debt, strip their assets, and abandon them in ruin while extracting vast profits

• The seven steps include: infiltration and influence, debt entrapment, asset identification, economic destabilization, debt-for-asset swaps, extraction and exploitation, and finally abandonment and collapse

• Continental European banks invented this system in the 1600s, using it to hollow out the British Empire and transfer its wealth to rebuild Continental Europe three times over

• The United States has been subjected to this process over the last century through massive debt accumulation, the 2008 financial crisis, corporate takeovers, and foreign ownership of assets

• China and Russia have successfully resisted the Kill Chain through state-controlled economies, rejection of dollar reliance, gold hoarding, and fortified state industries

• With traditional targets exhausted (Europe diminished, British Empire ended, US faltering), Financialists are seeking new victims in Africa, Latin America, and Southeast Asia

• The author warns that Financialists must now break up great nations to seize their assets and recapitalize their parasitic system for another 400 years

• This system has shaped world history since the Peace of Westphalia (1648) and the Glorious Revolution (1688), which created vulnerable sovereign states and debt-based financial tools

• The author calls for awareness and action to prevent the next phase of Financialist predation and protect global economic justice

URL:  5. June 2025 Newsletter: 3 Misconceptions About US Debt - Lyn Alden

Why: similarity 0.90

Summary: • **US fiscal deficits will remain large for the foreseeable future**, with the federal government consistently spending more than it receives in tax revenue, creating annual deficits that accumulate into total outstanding debt

• **"We owe it to ourselves" is misleading** - while some debt is held domestically, the $36 trillion federal debt translates to $277,000 per household, and holdings are unequally distributed between institutions, individuals, and foreign entities

• **Selective default has serious consequences** - defaulting on retirees, insurance companies, or banks would cause existential crises and protests, while defaulting on foreign entities ($9 trillion held) would damage US credibility and ability to attract future foreign investment

• **Foreign central banks are buying gold** in response to the US freezing $300 billion in Russian reserves in 2022, seeking assets protected from default and confiscation

• **China holds less than $800 billion in treasuries** (about 5 months of US deficit spending) and represents the highest selective default risk among foreign holders

• **Defaulting on the Fed's $4 trillion in treasuries would be problematic** as the Fed has assets and liabilities, pays interest on bank reserves, and is currently operating at a loss with hundreds of billions in unrealized losses

• **Currency devaluation is the more likely path** than outright default, as seen in the 1930s gold devaluation, 1970s decoupling from gold, and the 40% money supply increase in 2020-2021

URL:

5. June 2025 Newsletter: 3 Misconceptions About US Debt - Lyn Alden

Why: similarity 0.90

Summary: • **US fiscal deficits will remain large for the foreseeable future**, with the federal government consistently spending more than it receives in tax revenue, creating annual deficits that accumulate into total outstanding debt

• **"We owe it to ourselves" is misleading** - while some debt is held domestically, the $36 trillion federal debt translates to $277,000 per household, and holdings are unequally distributed between institutions, individuals, and foreign entities

• **Selective default has serious consequences** - defaulting on retirees, insurance companies, or banks would cause existential crises and protests, while defaulting on foreign entities ($9 trillion held) would damage US credibility and ability to attract future foreign investment

• **Foreign central banks are buying gold** in response to the US freezing $300 billion in Russian reserves in 2022, seeking assets protected from default and confiscation

• **China holds less than $800 billion in treasuries** (about 5 months of US deficit spending) and represents the highest selective default risk among foreign holders

• **Defaulting on the Fed's $4 trillion in treasuries would be problematic** as the Fed has assets and liabilities, pays interest on bank reserves, and is currently operating at a loss with hundreds of billions in unrealized losses

• **Currency devaluation is the more likely path** than outright default, as seen in the 1930s gold devaluation, 1970s decoupling from gold, and the 40% money supply increase in 2020-2021

URL:  6. (2) Democracy’s Edge: Elite Overproduction - by Simon Pearce

Why: similarity 0.90

Summary: - **Elite Overproduction Concept**: The essay explores elite overproduction as a critical failure mode in modern democracies, rooted in Peter Turchin’s Structural Demographic Theory, which explains societal cycles between stability and breakdown.

- **Structural Constraints**: Societies are complex systems shaped by economic, demographic, and energetic constraints; these factors influence moral choices and the effectiveness of societal responses to pressures.

- **Gradual Decline**: Modern democracies face gradual erosion of legitimacy due to multiple interacting structural stresses, rather than an immediate collapse.

- **Surplus and Expectations**: Periods of economic growth generate surpluses, raising societal expectations and living standards. This leads to an expansion of elite roles during integrative periods, where social mobility appears high.

- **Aspiration vs. Capacity**: As societies invest in education and specialization, aspirations for high-status roles grow faster than the actual availability of these positions, leading to a mismatch between expectations and reality.

- **Role and Wealth Concentration**: The scarcity of decision-making roles leads to a concentration of wealth and influence among elites, creating a feedback loop that exacerbates inequality and societal tensions.

- **Historical Precedent**: Examples from history, such as the civil service system in Imperial China, illustrate how surpluses can create large classes of aspirants without sufficient elite positions, ultimately leading to instability.

- **Implications for Democracy**: The dynamics of elite overproduction highlight the need for a deeper understanding of societal mechanisms to effectively address the challenges faced by modern democracies.

URL:

6. (2) Democracy’s Edge: Elite Overproduction - by Simon Pearce

Why: similarity 0.90

Summary: - **Elite Overproduction Concept**: The essay explores elite overproduction as a critical failure mode in modern democracies, rooted in Peter Turchin’s Structural Demographic Theory, which explains societal cycles between stability and breakdown.

- **Structural Constraints**: Societies are complex systems shaped by economic, demographic, and energetic constraints; these factors influence moral choices and the effectiveness of societal responses to pressures.

- **Gradual Decline**: Modern democracies face gradual erosion of legitimacy due to multiple interacting structural stresses, rather than an immediate collapse.

- **Surplus and Expectations**: Periods of economic growth generate surpluses, raising societal expectations and living standards. This leads to an expansion of elite roles during integrative periods, where social mobility appears high.

- **Aspiration vs. Capacity**: As societies invest in education and specialization, aspirations for high-status roles grow faster than the actual availability of these positions, leading to a mismatch between expectations and reality.

- **Role and Wealth Concentration**: The scarcity of decision-making roles leads to a concentration of wealth and influence among elites, creating a feedback loop that exacerbates inequality and societal tensions.

- **Historical Precedent**: Examples from history, such as the civil service system in Imperial China, illustrate how surpluses can create large classes of aspirants without sufficient elite positions, ultimately leading to instability.

- **Implications for Democracy**: The dynamics of elite overproduction highlight the need for a deeper understanding of societal mechanisms to effectively address the challenges faced by modern democracies.

URL:  7. The Modern Slave ⋆ Brownstone Institute

Why: similarity 0.90

Summary: - **Concept of Modern Slavery**: The author challenges conventional views of slavery, suggesting that modern forms of coercion and control, while less visible, are pervasive and deeply embedded in society.

- **Spectrum of Slavery**: Slavery exists on a spectrum, with contemporary systems employing mechanisms like taxes and regulations to extract labor and restrict autonomy, compared to historical practices of physical coercion.

- **Invisible Coercion**: Modern individuals surrender significant portions of their earnings to various taxes, experiencing coercion through financial obligations rather than overt violence, leading to a deceptive perception of freedom.

- **Comfort as Control**: The modern world employs comfort and convenience to maintain compliance, creating a system where individuals are unaware of their subjugation, likening it to a golden cage.

- **Technological Manipulation**: Advancements in AI and wearables contribute to a system of anticipatory compliance, where personal data is used to predict behavior and enforce conformity, transforming individuals into assets for corporations.

- **Historical Context**: While traditional forms of slavery are marked by visible coercion, modern slavery operates under a “white glove model,” where individuals are misled into believing they are consumers rather than subjugated subjects.

- **Economic Framework**: The financial architecture of this modern slavery treats citizens as corporate assets, with legal systems designed to prioritize revenue generation over individual rights, leading to inescapable debt cycles.

- **Cultural Conditioning**: Society has been conditioned to accept and even celebrate the mechanisms of control, making it difficult to question the nature of their freedom and the systems that govern their lives.

URL:

7. The Modern Slave ⋆ Brownstone Institute

Why: similarity 0.90

Summary: - **Concept of Modern Slavery**: The author challenges conventional views of slavery, suggesting that modern forms of coercion and control, while less visible, are pervasive and deeply embedded in society.

- **Spectrum of Slavery**: Slavery exists on a spectrum, with contemporary systems employing mechanisms like taxes and regulations to extract labor and restrict autonomy, compared to historical practices of physical coercion.

- **Invisible Coercion**: Modern individuals surrender significant portions of their earnings to various taxes, experiencing coercion through financial obligations rather than overt violence, leading to a deceptive perception of freedom.

- **Comfort as Control**: The modern world employs comfort and convenience to maintain compliance, creating a system where individuals are unaware of their subjugation, likening it to a golden cage.

- **Technological Manipulation**: Advancements in AI and wearables contribute to a system of anticipatory compliance, where personal data is used to predict behavior and enforce conformity, transforming individuals into assets for corporations.

- **Historical Context**: While traditional forms of slavery are marked by visible coercion, modern slavery operates under a “white glove model,” where individuals are misled into believing they are consumers rather than subjugated subjects.

- **Economic Framework**: The financial architecture of this modern slavery treats citizens as corporate assets, with legal systems designed to prioritize revenue generation over individual rights, leading to inescapable debt cycles.

- **Cultural Conditioning**: Society has been conditioned to accept and even celebrate the mechanisms of control, making it difficult to question the nature of their freedom and the systems that govern their lives.

URL:  8. The Modern Slave - Joshua Stylman

Why: similarity 0.90

Summary: • **Modern slavery operates through invisible systems rather than physical force** - Unlike historical slavery with visible chains and violence, contemporary control uses financial obligations, technological surveillance, and psychological conditioning to maintain compliance while victims defend the system

• **Financial enslavement through comprehensive taxation and debt-based currency** - Citizens surrender 30-50% of labor through unavoidable taxes on every economic activity; Federal Reserve notes are debt instruments making true debt repayment mathematically impossible; $37 trillion national debt creates perpetual servitude

• **Technological control through voluntary surveillance adoption** - People pay for devices that monitor them; AI systems predict and shape choices before conscious decision-making; Patents document consciousness manipulation capabilities through screens and electromagnetic fields; Biometric databases and digital IDs eliminate anonymous existence

• **Biological colonization and data harvesting** - DNA collection through consumer services leaves genetic information vulnerable; Wearable devices create permanent health/behavior records used by insurers and employers; Injectable nanosensors can monitor neural activity and thoughts

• **Soft coercion replaces physical enforcement** - Social credit systems, digital currencies, and biometric requirements make non-compliance economically impossible without visible violence; Historical precedent shows worst states prevented exit through economic barriers rather than walls

• **Systematic psychological programming of children** - New generation never experiences unmonitored thought or unmediated reality; Technology replaces development of internal awareness, spatial reasoning, and critical thinking; Creates humans who cannot conceive of privacy or independent judgment

• **Control Grid synthesis across multiple layers** - Financial, cultural, technological, and biological systems integrate into comprehensive human management architecture; Citizens transformed from sovereigns to revenue-generating

URL:

8. The Modern Slave - Joshua Stylman

Why: similarity 0.90

Summary: • **Modern slavery operates through invisible systems rather than physical force** - Unlike historical slavery with visible chains and violence, contemporary control uses financial obligations, technological surveillance, and psychological conditioning to maintain compliance while victims defend the system

• **Financial enslavement through comprehensive taxation and debt-based currency** - Citizens surrender 30-50% of labor through unavoidable taxes on every economic activity; Federal Reserve notes are debt instruments making true debt repayment mathematically impossible; $37 trillion national debt creates perpetual servitude

• **Technological control through voluntary surveillance adoption** - People pay for devices that monitor them; AI systems predict and shape choices before conscious decision-making; Patents document consciousness manipulation capabilities through screens and electromagnetic fields; Biometric databases and digital IDs eliminate anonymous existence

• **Biological colonization and data harvesting** - DNA collection through consumer services leaves genetic information vulnerable; Wearable devices create permanent health/behavior records used by insurers and employers; Injectable nanosensors can monitor neural activity and thoughts

• **Soft coercion replaces physical enforcement** - Social credit systems, digital currencies, and biometric requirements make non-compliance economically impossible without visible violence; Historical precedent shows worst states prevented exit through economic barriers rather than walls

• **Systematic psychological programming of children** - New generation never experiences unmonitored thought or unmediated reality; Technology replaces development of internal awareness, spatial reasoning, and critical thinking; Creates humans who cannot conceive of privacy or independent judgment

• **Control Grid synthesis across multiple layers** - Financial, cultural, technological, and biological systems integrate into comprehensive human management architecture; Citizens transformed from sovereigns to revenue-generating

URL:  ## Pointed questions for discussion

- What are the potential consequences of failing to address wealth inequality?

- How can we effectively redistribute financial burdens in society?

- What alternative economic systems could replace our current debt-driven model?

## Sentiment

Score: -0.50

## Provider

OpenRouter / openai/gpt-4o-mini

Shared via

## Pointed questions for discussion

- What are the potential consequences of failing to address wealth inequality?

- How can we effectively redistribute financial burdens in society?

- What alternative economic systems could replace our current debt-driven model?

## Sentiment

Score: -0.50

## Provider

OpenRouter / openai/gpt-4o-mini

Shared via

Re-Set: Reversing the Debt-Debasement Death-Spiral

The end-game of debt-debasement is already visible. The only thing that's still up in the air is our response.

Explaining Economic Madness to People

There is a madness in our economic system that is almost impossible to explain. People live inside it for so long that they stop noticing it, yet u...

The Imminent Restructuring of the Monetary System – Mark E. Jeftovic is The Bombthrower

TFTC – Truth for the Commoner

The Great Debasement Trade Is On And Bitcoin Is Positioned Beautifully

We've reached a tipping point.

The Financialist Kill Chain

Past, Present, and Future

Lyn Alden

June 2025 Newsletter: 3 Misconceptions About US Debt

June 18, 2025 This newsletter issue analyzes three common misconceptions about the US federal debt and deficits. The ongoing nature of the deficits...

Democracy’s Edge: Elite Overproduction

Part 1: Why do democracies fail even when they appear wealthy, educated, and stable?

Brownstone Institute

The Modern Slave

Most people hear ‘modern slavery’ and picture trafficking victims or sweatshop workers—suffering that's clearly visible, obviously wrong.

The Modern Slave

A Mirror We Refuse to Look Into

Memetic Research Laboratories LLC

Memetic Research Laboratories LLC - Privacy-focused technology for digital content management and decentralized communication

You know what time it is? Time to buy!!!

Shared via

Shared via  Shared via

Shared via