deeznuts

deeznuts@crypto.im

npub13tku...llwf

Enthusiasm enthusiast.

“No Amount Of Violence Will Solve A Math Problem”

Excel at research, analysis and meme-lording: https://memeticresearch.group/?page=contex.st

Is This MAGA? Trump Wants Lindsey Graham Donor To Challenge 'RINO' Massie | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Memetic Research Laboratories LLC

Memetic Research Laboratories LLC - Privacy-focused technology for digital content management and decentralized communication

GM!!

Long analysis / chat on Chinese gold hoard and US policy footguns:

# Insights: 12 Years Of Data Prove China's Belt & Road Initiative Is A Debt Trap | ZeroHedge

Generated on: Oct 19, 2025 at 11:34

Model: OpenRouter: openai/gpt-4o-mini

**AI Assistant** (11:34):

Context: Insights for 12 Years Of Data Prove China's Belt & Road Initiative Is A Debt Trap | ZeroHedge

URL:

Analyzed: 2025-10-19 15:34:53 +0000

Overall takeaway:

The Belt and Road Initiative has led to significant debt crises in developing nations, raising concerns about China's lending practices.

Short summary:

The Belt and Road Initiative (BRI) by China has been labeled a 'debt trap' for developing nations, with 75 countries facing significant debt crises linked to repayments. Critics argue that China's lending strategy often targets nations already in financial trouble, significantly impacting essential services.

Comprehensive summary:

- • The Belt and Road Initiative (BRI), launched by China in 2013, has been accused of creating a "debt trap" for developing nations, with 75 countries facing severe debt crises linked to repayments to China.

- • A record $35 billion is due from these nations this year, heavily impacting essential services like health and education.

- • Approximately 80% of Chinese lending went to countries already in or near default, reinforcing claims that China is intentionally creating a debt trap.

- • The Chinese Communist Party (CCP) counters the debt trap narrative with four flawed arguments, all of which fail under scrutiny.

- • The first defense, that many countries owe more to Western lenders, misrepresents the situation by ignoring that China often lends to nations that other lenders deem too risky.

- • The second argument, linking U.S. interest rate hikes to debt crises, overlooks that countries aware of their poor ratings should anticipate increased borrowing costs.

- • The third claim, attributing issues to currency depreciation and global economic slowdown, fails as many loans are denominated in dollars, making repayment more burdensome amidst a strong dollar.

- • The fourth argument, concerning asset seizure, is misleading; China's approach to "debt relief" typically prolongs dependency without reducing the financial burden on borrowers.

- • A significant shift in Chinese lending strategy has been observed, with $240 billion in bailouts provided to 22 countries by the end of 2021, indicating a move from infrastructure financing to emergency support.

- • Despite criticizing Western predatory lending, China's average rescue loan interest rate is over double that of the IMF's.

- • Hidden debts amounting to an estimated $385 billion complicate the true scale of B

Entities:

keyword: belt, debt, percent, lenders, china, road, nations, loans, countries, rates

location: Africa, West, Latin America, Road, U.S., China, Asia, Beijing

organization: Lowy Institute, Epoch Times, Years Of Data Prove China, People’s Bank of China, The Epoch Times, CCP, Kiel Institute, AidData, Chinese Communist Party, Harvard Kennedy School

person: Antonio Graceffo, Views

Conceptual model:

- BRI targets financially vulnerable nations.

- Debt crises impact essential services.

- China's lending often exceeds Western loans.

- Hidden debts complicate financial assessments.

- Shift from infrastructure to emergency support.

Suggested next steps:

- Investigate the long-term impacts of BRI on recipient countries.

- Explore alternative funding models for developing nations.

- Engage in discussions about global lending ethics.

Related content:

• Trump: Redrawing the Future of the World :: Gatestone Institute — similarity 0.91

• The Big Beautiful Downgrade - by Lau Vegys — similarity 0.90

• Doug Casey on the China Hysteria: Manufactured Threat or Inevitable Rival? — similarity 0.90

• Trump Concocted The 'Tariffs Hoax' To 'Decouple' With China, by Mike Whitney - The Unz Review — similarity 0.90

• June 2025 Newsletter: 3 Misconceptions About US Debt - Lyn Alden — similarity 0.90

• Michael Hudson: War on Iran is fight for US unipolar control of world - Geopolitical Economy Report — similarity 0.89

Use this context to answer follow-up questions. Ask for clarifications if needed.

**You** (11:36):

How does the Chinese efforts to lend compare and contrast to the US efforts to create 800 + military bases around the world? And also how does this compare contrast with the Federal Reserve notes lent into existence indenting the US citizenry and others?

**AI Assistant** (11:36):

The Chinese efforts to lend through the Belt and Road Initiative (BRI) and the U.S. establishment of military bases around the world represent two different approaches to influence and global engagement.

### Comparison of China's Lending and U.S. Military Bases:

1. **Objective**:

- **China**: The BRI aims to expand economic influence and increase trade connectivity. By lending to developing nations, China seeks to establish strategic partnerships, access resources, and enhance political leverage. Critics label this strategy as a "debt trap," suggesting an intention to create dependency.

- **U.S.**: The establishment of military bases serves as a means of projecting military power, promoting security commitments to allies, and ensuring geopolitical stability. These bases often serve to deter potential threats and maintain U.S. influence internationally.

2. **Mechanism of Influence**:

- **China**: Engages primarily through economic tools such as infrastructure development and lending. The strategy often targets nations that are financially vulnerable, with claims that this practice increases economic dependency and complicates fiscal sovereignty.

- **U.S.**: Uses military presence to exert influence, often where strategic interests are threatened or where allies require defense support. This is more about military security than economic lending.

3. **Outcome for Host Nations**:

- **China**: Many countries experience significant debt burdens and may face crises due to unmanageable repayment obligations. Critics argue that this undermines essential services and puts them in precarious financial situations.

- **U.S.**: Host nations may benefit from military aid and security, but they can also become entangled in U.S. foreign policy and military strategies, which can lead to a lack of autonomy in their own defense and international affairs.

### Comparison of Lending Practices (Federal Reserve) and Chinese Lending:

1. **Nature of Lending**:

- **Federal Reserve**: Through monetary policy and the creation of Federal Reserve notes, the U.S. government circulates currency in the economy. This process can lead to national debt, as these notes often represent debt that needs to be repaid through taxation or government revenue.

- **China**: Sells loans directly to foreign governments. The loans are often tied to projects that can enhance China’s strategic influence and involve countries that are already financially vulnerable.

2. **Indebtedness**:

- **Federal Reserve**: The debt incurred by the U.S. citizenry relates to the overall national debt and impacts citizens through taxation, inflation, and the devaluation of currency. It creates a domestic financial obligation to repay government debt.

- **China**: Indebtedness via BRI loans affects the borrowing countries directly, as they face immediate financial obligations that can lead to austerity measures and impacts on essential services like healthcare and education.

3. **Impact on Sovereignty**:

- **Federal Reserve**: Indirectly affects U.S. citizens and state autonomy through economic policy decisions, inflation rates, and the overall financial health of the country.

- **China**: Directly affects the sovereignty of the nations involved by potentially undermining their financial independence and increasing dependency on China through debt.

### Summary:

In summary, China's lending practices and the U.S. military presence represent contrasting methods of global engagement. China primarily leverages economic tools that have led to increased debt in developing countries. In contrast, the U.S. maintains military bases to secure geopolitical interests. Both can lead to forms of dependency—financial for China and security-focused for the U.S. Meanwhile, the creation of Federal Reserve notes represents a domestic monetary policy that influences U.S. citizens and their economic obligations, often leading to an indirect form of indebtedness.

**You** (11:39):

How does the Chinese central bank’s acquisition of massive gold stocks compare and contrast to the US efforts to maintain its economic and military empire through dollar diplomacy ? What are likely outcomes as we head towards economic chaos?

**AI Assistant** (11:39):

The Chinese central bank's acquisition of massive gold stocks and the U.S. efforts to maintain its economic and military empire through dollar diplomacy represent fundamentally different approaches to managing national wealth, power, and global influence. Here’s a comparative analysis and exploration of likely outcomes as economic instability looms.

### Comparison of Chinese Gold Accumulation and U.S. Dollar Diplomacy:

1. **Strategic Purpose**:

- **China's Gold Acquisition**: China's accumulation of gold serves multiple purposes: it reduces dependence on the U.S. dollar, stabilizes its economy amidst global market fluctuations, and enhances its financial sovereignty. By diversifying its reserves, China aims to strengthen its position in global trade and as a potential alternative to the dollar.

- **U.S. Dollar Diplomacy**: The U.S. maintains its global dominance primarily through the dollar, which functions as the world's reserve currency. This dominance allows the U.S. to engage in dollar diplomacy, where it uses economic leverage (e.g., sanctions, trade agreements) to influence other nations and secure its interests. The U.S. benefits from "exorbitant privilege" by borrowing at lower costs and controlling access to global financial systems.

2. **Economic Implications**:

- **China**: By increasing gold reserves, China aims to mitigate risks associated with currency fluctuations and potential economic sanctions. Gold is viewed as a safe haven asset during periods of uncertainty, which could bolster confidence in China's economy and the yuan.

- **U.S.**: The reliance on the dollar allows the U.S. to exert significant influence on global finance. However, overreliance could also lead to vulnerabilities—such as exposure to foreign debt and potential shifts in global sentiment against the dollar, particularly as other countries diversify their reserves, including increased gold holdings.

3. **Influence on Global Financial Stability**:

- **China**: By accumulating gold, China aims to position itself as a more stable and trustworthy player in global finance. If successful, it could lead to a gradual shift away from U.S. dollar dominance and a more multipolar financial system, potentially causing volatility if investors lose faith in the dollar.

- **U.S.**: As the U.S. continues to leverage its dollar for global influence, persistent economic challenges (e.g., high debt levels, inflation) might erode trust in the dollar. Economic chaos could force U.S. allies to reconsider their reliance on the dollar, diminishing its central role in global trade.

### Likely Outcomes in the Context of Economic Chaos:

1. **Increased Demand for Alternatives**:

- As economic chaos unfolds, nations may seek alternatives to the dollar. China's gold acquisition could serve as a signal to other countries about the need for diversification, leading to increased demand for gold and other currencies or commodities.

2. **Potential Shift to a Multipolar Currency System**:

- If more countries follow China's lead and begin accumulating gold, or seek to transact in currencies other than the dollar, we could see a more multipolar monetary system. This would diminish the U.S.'s economic hegemony and change the global financial landscape.

3. **Inflation and Currency Devaluation**:

- The U.S. could face prospects of inflation and currency devaluation if confidence in the dollar diminishes, especially amid rising national debt and deficit issues. This could lead to economic instability domestically and abroad, as countries adjust to the new financial environment.

4. **Geopolitical Tensions**:

- Competition for economic influence may lead to increased geopolitical tensions. As countries like China accumulate gold and strengthen regional alliances, the U.S. might respond with military or economic measures to maintain its dominance, potentially escalating conflicts.

5. **Increased Financial Isolation**:

- If the U.S. continues its current approach without adapting to the changing dynamics, it may risk greater financial isolation, where countries form blocs to circumvent U.S. sanctions and establish alternative trading and financial systems.

### Conclusion:

In summary, while China’s acquisition of gold signifies a strategic shift towards securing economic stability and reducing reliance on the dollar, the U.S. continues to leverage its currency for global influence. As we approach potential economic chaos, the interplay between these approaches could reshape financial systems, lead to greater instability, and alter the power dynamics in international relations. Nations might reassess their financial strategies, potentially favoring commodities like gold and diversified reserves, which could significantly alter the established financial order.

**You** (11:41):

Did the sanctions on Russia and the freezing of western held Russian assets influence the Chinese moves?

**AI Assistant** (11:41):

Yes, the sanctions imposed on Russia and the freezing of Western-held Russian assets have likely influenced China's recent economic strategies, including its significant acquisition of gold reserves. Here’s how these events have affected Chinese moves:

### Influence of Sanctions on China’s Economic Strategy:

1. **Highlighting Vulnerabilities**:

- The sanctions on Russia following its invasion of Ukraine demonstrated how rapidly economic and financial stability can be undermined through international actions. This scenario showcased the risks of heavy reliance on Western financial systems and currencies, prompting China to reassess its own economic dependencies.

2. **Acceleration of Diversification Strategies**:

- In light of these sanctions, China has likely accelerated its strategies for diversifying its foreign reserves. The acquisition of gold can be seen as part of a broader effort to build a more resilient economic base that is less vulnerable to sanctions or aggressive financial tactics from Western nations.

3. **Desire for Financial Sovereignty**:

- Observing Russia's experience has likely reinforced China's desire for enhanced financial sovereignty. By increasing its gold reserves and potentially promoting the use of its currency (the yuan) in international trade, China aims to decrease its vulnerability to external pressures and sanctions that can arise from geopolitical conflicts.

4. **Strengthening Bilateral Relations**:

- The geopolitical landscape has shifted, creating opportunities for stronger ties between China and Russia. China’s support for Russia amid sanctions could also signify a strategic partnership, where both countries seek to establish alternative financial systems and reduce their reliance on the dollar-dominated global financial architecture.

5. **Potential Shift in Global Trade Alliances**:

- The sanctions against Russia may encourage China and other nations that feel threatened by Western hegemony to strengthen economic ties. China's moves may thus be a response to increasing collaboration with nations that share similar strategic interests in resisting Western influence.

6. **Market Dynamics and Global Currency Alternatives**:

- The freezing of Russian assets has prompted discussions about the reliability of holding assets in the U.S. dollar or in Western financial institutions. This could encourage China to promote the yuan as a viable alternative for trade, coupled with resource-backed arrangements that may include gold.

### Conclusion:

Overall, the sanctions on Russia and the subsequent freezing of assets have likely acted as a catalyst for China's economic maneuvers, emphasizing the need to mitigate vulnerabilities associated with Western financial systems. By accumulating gold and promoting economic independence, China is positioning itself not only to safeguard against potential future sanctions but also to enhance its role in establishing alternative frameworks for international trade and finance. This strategic pivot could have broader implications for global economic dynamics, particularly in light of increasing multipolarity and shifting alliances.

**You** (11:42):

Sounds like the Biden administration has shot the US in the foot over these sanctions? What do you think?

**AI Assistant** (11:42):

The effectiveness and unintended consequences of the Biden administration's sanctions on Russia are subjects of significant debate among analysts, policymakers, and economists. Here are some points to consider regarding whether these sanctions have negatively impacted U.S. interests:

### Potential Negatives of the Sanctions:

1. **Strengthened Russian-Chinese Ties**:

- The sanctions have pushed Russia closer to China, potentially fostering a stronger economic and military partnership between the two countries. This can enhance China's global influence and dilute U.S. power, countering American interests.

2. **Risk of a Multipolar Currency System**:

- Sanctions against Russia may motivate countries to seek alternatives to the U.S. dollar, challenging its status as the world’s reserve currency. This could reduce the "exorbitant privilege" the U.S. holds in international finance, potentially leading to higher borrowing costs and diminished economic influence.

3. **Increased Geopolitical Tensions**:

- The sanctions may escalate geopolitical tensions, pushing adversarial nations like Russia and China to create deeper alliances. This could lead to a more hostile international environment and increased military posturing against the U.S. and its allies.

4. **Economic Consequences for Allies**:

- U.S. allies in Europe and elsewhere that implement the sanctions may also face economic repercussions, such as rising energy costs and disruptions in trade, which can strain transatlantic relations and weaken collective responses to global challenges.

5. **Long-Term Strategic Fallout**:

- The focus on sanctions as a primary tool of foreign policy could lead to a reliance on economic measures rather than diplomatic solutions. This might limit the ability to negotiate or mediate conflicts if adversaries perceive the U.S. as unwilling to engage in dialogue.

### Counterpoints to Consider:

1. **Deterrent Effect**:

- Supporters of the sanctions argue that they serve as a deterrent against aggressive actions by states like Russia. By demonstrating a unified response, the U.S. and its allies aim to uphold international norms against aggression.

2. **Temporary Economic Pain**:

- While there may be short-term economic consequences, proponents believe that sanctions can have long-term efficacy in curtailing adversarial behaviors and forcing reconsiderations of aggressive policies.

3. **Promotion of Allied Cohesion**:

- Sanctions can strengthen alliances among cooperative nations as they unite against a common adversary. This can enhance solidarity and might lead to more coordinated security efforts.

4. **Global Advocacy for Democracy**:

- The U.S. positions itself as a defender of democratic values, and sanctions can be a means to signal condemnation of actions perceived as violations of international law, such as Russia's invasion of Ukraine.

### Conclusion:

While there are valid arguments suggesting that the Biden administration's sanctions on Russia may have unintentionally created challenges for U.S. interests, the broader context of geopolitical dynamics, deterrence, and alliance-building offer a more nuanced view. The ultimate impact of these sanctions will depend on various factors, including the adaptability of U.S. foreign policy, the responses of other global players, and the resolution of ongoing conflicts. As global alliances and economic systems evolve, the consequences of sanctions will continue to play a significant role in shaping international relations and U.S. influence.

Shared via

12 Years Of Data Prove China's Belt & Road Initiative Is A Debt Trap | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Memetic Research Laboratories LLC

Memetic Research Laboratories LLC - Privacy-focused technology for digital content management and decentralized communication

# Comprehensive Analysis

Title: Powell Just Signaled the End of Quantitative Tightening

URL:  Collected: 2025-10-18 23:14:58 +0000

Analyzed: 2025-10-19 02:08:58 +0000

## Overall takeaway

The Fed is shifting towards a more accommodative monetary policy, signaling the end of QT and a potential return to QE by 2026 amid rising job cuts and inflation.

## Conceptual model

- QT is ending, leading to potential QE by 2026.

- Job market deterioration influences Fed's policy decisions.

- A larger balance sheet is the new normal for the Fed.

- Restarting QE may trigger inflation and asset bubbles.

- Investment strategies may shift towards commodities and mining.

## Next steps (optional)

- Monitor Fed announcements for updates on monetary policy.

- Evaluate investment portfolios for exposure to commodities.

- Research historical impacts of QE on inflation and markets.

## Short summary

Jerome Powell has indicated that the Federal Reserve is nearing the end of quantitative tightening (QT) and is likely to resume quantitative easing (QE) by early 2026. This shift comes amid rising job cuts and inflation concerns, suggesting a more accommodating monetary policy is on the horizon.

## Comprehensive summary

- • Jerome Powell, the Fed chairman, has indicated that quantitative tightening (QT) is nearing an end, signaling a shift towards monetary easing.

- • At a recent conference, Powell stated that the Fed plans to stop balance sheet runoff when reserves reach a certain level, suggesting the money printer will soon be activated again.

- • The sequence of monetary policy appears clear: interest rate cuts are happening now, followed by an end to QT, and then a return to quantitative easing (QE) likely in early 2026.

- • The Fed's decision is influenced by a deteriorating job market, with over 946,000 job cuts announced this year, and rising mortgage concerns among Americans due to high interest rates and inflation.

- • Despite a reported $2.2 trillion reduction in the Fed's balance sheet since June 2022, the current balance of $6.6 trillion remains significantly above pre-pandemic levels, indicating limited progress in QT.

- • The Fed’s approach has favored a slow reduction of its balance sheet by allowing bonds to mature rather than directly selling them, avoiding potential market crashes.

- • Powell clarified that the goal of normalizing the balance sheet does not mean returning to pre-pandemic levels, effectively accepting a new “normal” of a larger balance sheet.

- • Restarting QE from a bloated balance sheet will likely lead to double-digit inflation and potential currency devaluation.

- • The anticipated shift back to easy monetary policy could trigger a commodities bubble, particularly in precious metals, prompting investment in mining stocks.

## Entities

- keyword: inflation, highs, bonds, cuts, rates, sheet, powell, balance, money, quantitative

- location: America, Lau, Philadelphia

- organization: Fed, National Association for Business Economics, Federal Reserve, Google

- person: Doug Casey, Powell, QT, Trump, Jerome Powell

## Related content

1. June 2025 Newsletter: 3 Misconceptions About US Debt - Lyn Alden

Why: similarity 0.91

Summary: • **US fiscal deficits will remain large for the foreseeable future**, with the federal government consistently spending more than it receives in tax revenue, creating annual deficits that accumulate into total outstanding debt

• **"We owe it to ourselves" is misleading** - while some debt is held domestically, the $36 trillion federal debt translates to $277,000 per household, and holdings are unequally distributed between institutions, individuals, and foreign entities

• **Selective default has serious consequences** - defaulting on retirees, insurance companies, or banks would cause existential crises and protests, while defaulting on foreign entities ($9 trillion held) would damage US credibility and ability to attract future foreign investment

• **Foreign central banks are buying gold** in response to the US freezing $300 billion in Russian reserves in 2022, seeking assets protected from default and confiscation

• **China holds less than $800 billion in treasuries** (about 5 months of US deficit spending) and represents the highest selective default risk among foreign holders

• **Defaulting on the Fed's $4 trillion in treasuries would be problematic** as the Fed has assets and liabilities, pays interest on bank reserves, and is currently operating at a loss with hundreds of billions in unrealized losses

• **Currency devaluation is the more likely path** than outright default, as seen in the 1930s gold devaluation, 1970s decoupling from gold, and the 40% money supply increase in 2020-2021

URL:

Collected: 2025-10-18 23:14:58 +0000

Analyzed: 2025-10-19 02:08:58 +0000

## Overall takeaway

The Fed is shifting towards a more accommodative monetary policy, signaling the end of QT and a potential return to QE by 2026 amid rising job cuts and inflation.

## Conceptual model

- QT is ending, leading to potential QE by 2026.

- Job market deterioration influences Fed's policy decisions.

- A larger balance sheet is the new normal for the Fed.

- Restarting QE may trigger inflation and asset bubbles.

- Investment strategies may shift towards commodities and mining.

## Next steps (optional)

- Monitor Fed announcements for updates on monetary policy.

- Evaluate investment portfolios for exposure to commodities.

- Research historical impacts of QE on inflation and markets.

## Short summary

Jerome Powell has indicated that the Federal Reserve is nearing the end of quantitative tightening (QT) and is likely to resume quantitative easing (QE) by early 2026. This shift comes amid rising job cuts and inflation concerns, suggesting a more accommodating monetary policy is on the horizon.

## Comprehensive summary

- • Jerome Powell, the Fed chairman, has indicated that quantitative tightening (QT) is nearing an end, signaling a shift towards monetary easing.

- • At a recent conference, Powell stated that the Fed plans to stop balance sheet runoff when reserves reach a certain level, suggesting the money printer will soon be activated again.

- • The sequence of monetary policy appears clear: interest rate cuts are happening now, followed by an end to QT, and then a return to quantitative easing (QE) likely in early 2026.

- • The Fed's decision is influenced by a deteriorating job market, with over 946,000 job cuts announced this year, and rising mortgage concerns among Americans due to high interest rates and inflation.

- • Despite a reported $2.2 trillion reduction in the Fed's balance sheet since June 2022, the current balance of $6.6 trillion remains significantly above pre-pandemic levels, indicating limited progress in QT.

- • The Fed’s approach has favored a slow reduction of its balance sheet by allowing bonds to mature rather than directly selling them, avoiding potential market crashes.

- • Powell clarified that the goal of normalizing the balance sheet does not mean returning to pre-pandemic levels, effectively accepting a new “normal” of a larger balance sheet.

- • Restarting QE from a bloated balance sheet will likely lead to double-digit inflation and potential currency devaluation.

- • The anticipated shift back to easy monetary policy could trigger a commodities bubble, particularly in precious metals, prompting investment in mining stocks.

## Entities

- keyword: inflation, highs, bonds, cuts, rates, sheet, powell, balance, money, quantitative

- location: America, Lau, Philadelphia

- organization: Fed, National Association for Business Economics, Federal Reserve, Google

- person: Doug Casey, Powell, QT, Trump, Jerome Powell

## Related content

1. June 2025 Newsletter: 3 Misconceptions About US Debt - Lyn Alden

Why: similarity 0.91

Summary: • **US fiscal deficits will remain large for the foreseeable future**, with the federal government consistently spending more than it receives in tax revenue, creating annual deficits that accumulate into total outstanding debt

• **"We owe it to ourselves" is misleading** - while some debt is held domestically, the $36 trillion federal debt translates to $277,000 per household, and holdings are unequally distributed between institutions, individuals, and foreign entities

• **Selective default has serious consequences** - defaulting on retirees, insurance companies, or banks would cause existential crises and protests, while defaulting on foreign entities ($9 trillion held) would damage US credibility and ability to attract future foreign investment

• **Foreign central banks are buying gold** in response to the US freezing $300 billion in Russian reserves in 2022, seeking assets protected from default and confiscation

• **China holds less than $800 billion in treasuries** (about 5 months of US deficit spending) and represents the highest selective default risk among foreign holders

• **Defaulting on the Fed's $4 trillion in treasuries would be problematic** as the Fed has assets and liabilities, pays interest on bank reserves, and is currently operating at a loss with hundreds of billions in unrealized losses

• **Currency devaluation is the more likely path** than outright default, as seen in the 1930s gold devaluation, 1970s decoupling from gold, and the 40% money supply increase in 2020-2021

URL:  2. The Fed’s Doomsday Prophet Has a Dire Warning About Where We’re Headed - POLITICO

Why: similarity 0.91

Summary: • Thomas Hoenig, former Kansas City Fed president, was the lone dissenting voice on the Federal Open Market Committee in 2010, voting against unprecedented monetary expansion that printed $3.5 trillion between 2008-2014

• Hoenig warned that the Fed's quantitative easing and zero-percent interest rates would deepen income inequality, create dangerous asset bubbles, enrich big banks, and trap the Fed in a money-printing cycle it couldn't escape without destabilizing the financial system

• His concerns were rooted in his experience during the 1970s Great Inflation, where he witnessed firsthand how the Fed's "easy money" policies created asset bubbles in farmland, energy, and real estate through self-reinforcing cycles of cheap debt and rising prices

• The Fed's policies drove up not just consumer goods prices but also asset prices like stocks, bonds, and real estate, creating bubbles where rising prices encouraged more borrowing, which further inflated prices

• Hoenig's warnings proved correct - the Fed is now trapped between rising inflation (fueled by money printing) and the risk of crashing markets or causing recession if it raises interest rates

• Despite being dismissed as an inflation hawk and losing every vote 11-1, Hoenig was primarily concerned about systemic risks and inequality, not just inflation

• He believes there is now "no painless solution" and delays will only make the eventual economic correction more severe, potentially involving high unemployment and years of economic malaise

URL: https://www.politico.com/news/magazine/2021/12/28/inflation-interest-rates-thomas-hoenig-federal-reserve-526177?utm_source=substack&utm_medium=email

3. Fed Holds Rates, Signals QT Taper; Blames Trump 'Uncertainty' For Stagflationary Outlook | ZeroHedge

Why: similarity 0.91

Summary: • **Fed holds rates at 4.25%-4.50% target range** as expected, adopting a wait-and-see approach amid increased economic uncertainty

• **Economic projections turn stagflationary**: Fed slashes 2025 GDP growth forecast from 2.1% to 1.7%, raises core PCE inflation forecast from 2.5% to 2.8%, and increases unemployment forecast from 4.3% to 4.4%

• **Dot plot shifts hawkishly**: More FOMC members now see fewer rate cuts in 2025, with four members expecting zero cuts (up from one in December) and no members seeing four cuts (down from one)

• **QT taper announced**: Fed will slow balance sheet runoff starting April 1, reducing Treasury holdings decline from $25 billion to just $5 billion monthly - a sharp dovish signal

• **Fed blames Trump-related "uncertainty"** for deteriorating economic outlook, removing previous language about balanced risks between inflation and employment

• **Market positioning**: Markets remain more dovish than Fed for 2025 (expecting more cuts) but more hawkish for 2027; rate cut expectations have fallen to just 56bps from nearly 100bps two weeks ago

• **Waller dissents**: Fed Governor Waller supported holding rates but opposed slowing the balance sheet runoff, preferring to maintain current pace of securities reduction

URL:

4. The Money Supply Keeps Growing as the Fed Backs Off Monetary "Tightening" | Mises Institute

Why: similarity 0.91

Summary: • Money supply growth rose year-over-year in February 2025 for the seventh consecutive month (2.75%), marking the first such streak since mid-2022 and reversing the historic contractions seen throughout 2023-2024

• The US experienced the largest money supply drop since the Great Depression during 2023-2024, with no comparable decline in at least sixty years prior

• Current money supply totals remain dramatically elevated above pre-2020 levels, with $6.4 trillion added from 2020-2022 to finance federal covid stimulus programs

• Nearly 26% of the current $19.4 trillion money supply was created since January 2020, and two-thirds has been created in just the past thirteen years

• The Fed has abandoned its monetary tightening stance, cutting interest rates by 100 basis points over three months despite inflation remaining above the 2% target

• In March, the Fed drastically reduced its balance sheet reduction goals from $25 billion to only $5 billion per month for treasury holdings

• To return to pre-2020 money creation trends, the money supply would need to fall by at least $3 trillion, but the Fed shows no appetite for unwinding pandemic-era monetary expansion

• The Fed's massive asset portfolio created during crisis periods serves as an inflationary subsidy for the federal government and mortgage industry, yet aggressive reduction efforts have been abandoned

URL: https://mises.org/mises-wire/money-supply-keeps-growing-fed-backs-monetary-tightening?utm_source=MI+Subscriptions&utm_campaign=c6331c59b9-EMAIL_CAMPAIGN_2024_03_01_07_02_COPY_01&utm_medium=email&utm_term=0_-fb69bb184c-230131240

5. The Moral Decay of Debt - Charles Hugh Smith's Substack

Why: similarity 0.90

Summary: • The document discusses the moral implications of debt, likening it to a household analogy where parents borrow money in their children's names, burdening future generations with unmanageable debt.

• As living costs rise and wages stagnate, subsequent generations resort to borrowing to maintain a middle-class lifestyle, perpetuating a cycle of debt servitude.

• The author questions the morality of offloading debt onto future generations and argues that society has lost the ability to recognize this as morally wrong.

• The expansion of debt is framed as a form of moral decay that undermines the foundations of the economy and society, contributing to a terminal decline.

• The manipulation of interest rates and financial systems to encourage more borrowing is criticized for being devoid of moral judgment, prioritizing growth and profits over ethical considerations.

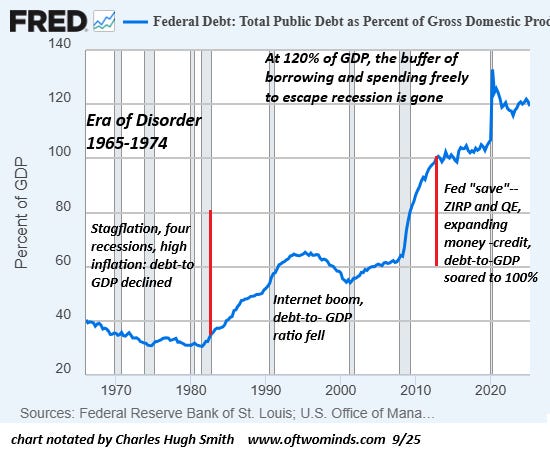

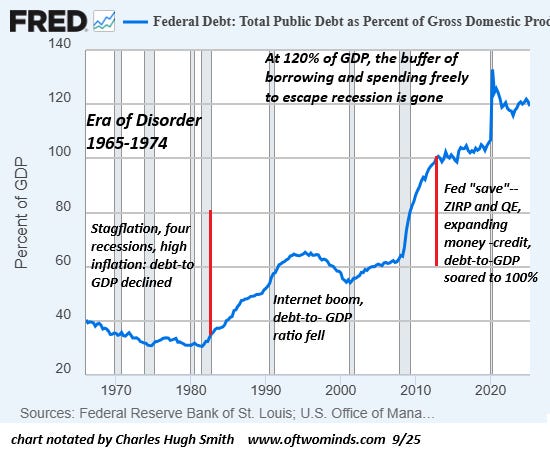

• The document highlights the rising federal debt-to-GDP ratio, suggesting that current levels (120%) pose significant risks to economic stability.

• Historical context is provided, noting that past economic recoveries were based on natural market corrections rather than manipulated debt increases.

• The author warns that the current level of total debt (over $104 trillion) exceeds what could be justified as productive investment, indicating a substantial amount of excess debt.

• Ultimately, the text emphasizes that debt carries inherent moral implications, and ignoring these consequences will lead to detrimental outcomes, reinforcing the idea that debt is never truly amoral.

URL:

2. The Fed’s Doomsday Prophet Has a Dire Warning About Where We’re Headed - POLITICO

Why: similarity 0.91

Summary: • Thomas Hoenig, former Kansas City Fed president, was the lone dissenting voice on the Federal Open Market Committee in 2010, voting against unprecedented monetary expansion that printed $3.5 trillion between 2008-2014

• Hoenig warned that the Fed's quantitative easing and zero-percent interest rates would deepen income inequality, create dangerous asset bubbles, enrich big banks, and trap the Fed in a money-printing cycle it couldn't escape without destabilizing the financial system

• His concerns were rooted in his experience during the 1970s Great Inflation, where he witnessed firsthand how the Fed's "easy money" policies created asset bubbles in farmland, energy, and real estate through self-reinforcing cycles of cheap debt and rising prices

• The Fed's policies drove up not just consumer goods prices but also asset prices like stocks, bonds, and real estate, creating bubbles where rising prices encouraged more borrowing, which further inflated prices

• Hoenig's warnings proved correct - the Fed is now trapped between rising inflation (fueled by money printing) and the risk of crashing markets or causing recession if it raises interest rates

• Despite being dismissed as an inflation hawk and losing every vote 11-1, Hoenig was primarily concerned about systemic risks and inequality, not just inflation

• He believes there is now "no painless solution" and delays will only make the eventual economic correction more severe, potentially involving high unemployment and years of economic malaise

URL: https://www.politico.com/news/magazine/2021/12/28/inflation-interest-rates-thomas-hoenig-federal-reserve-526177?utm_source=substack&utm_medium=email

3. Fed Holds Rates, Signals QT Taper; Blames Trump 'Uncertainty' For Stagflationary Outlook | ZeroHedge

Why: similarity 0.91

Summary: • **Fed holds rates at 4.25%-4.50% target range** as expected, adopting a wait-and-see approach amid increased economic uncertainty

• **Economic projections turn stagflationary**: Fed slashes 2025 GDP growth forecast from 2.1% to 1.7%, raises core PCE inflation forecast from 2.5% to 2.8%, and increases unemployment forecast from 4.3% to 4.4%

• **Dot plot shifts hawkishly**: More FOMC members now see fewer rate cuts in 2025, with four members expecting zero cuts (up from one in December) and no members seeing four cuts (down from one)

• **QT taper announced**: Fed will slow balance sheet runoff starting April 1, reducing Treasury holdings decline from $25 billion to just $5 billion monthly - a sharp dovish signal

• **Fed blames Trump-related "uncertainty"** for deteriorating economic outlook, removing previous language about balanced risks between inflation and employment

• **Market positioning**: Markets remain more dovish than Fed for 2025 (expecting more cuts) but more hawkish for 2027; rate cut expectations have fallen to just 56bps from nearly 100bps two weeks ago

• **Waller dissents**: Fed Governor Waller supported holding rates but opposed slowing the balance sheet runoff, preferring to maintain current pace of securities reduction

URL:

4. The Money Supply Keeps Growing as the Fed Backs Off Monetary "Tightening" | Mises Institute

Why: similarity 0.91

Summary: • Money supply growth rose year-over-year in February 2025 for the seventh consecutive month (2.75%), marking the first such streak since mid-2022 and reversing the historic contractions seen throughout 2023-2024

• The US experienced the largest money supply drop since the Great Depression during 2023-2024, with no comparable decline in at least sixty years prior

• Current money supply totals remain dramatically elevated above pre-2020 levels, with $6.4 trillion added from 2020-2022 to finance federal covid stimulus programs

• Nearly 26% of the current $19.4 trillion money supply was created since January 2020, and two-thirds has been created in just the past thirteen years

• The Fed has abandoned its monetary tightening stance, cutting interest rates by 100 basis points over three months despite inflation remaining above the 2% target

• In March, the Fed drastically reduced its balance sheet reduction goals from $25 billion to only $5 billion per month for treasury holdings

• To return to pre-2020 money creation trends, the money supply would need to fall by at least $3 trillion, but the Fed shows no appetite for unwinding pandemic-era monetary expansion

• The Fed's massive asset portfolio created during crisis periods serves as an inflationary subsidy for the federal government and mortgage industry, yet aggressive reduction efforts have been abandoned

URL: https://mises.org/mises-wire/money-supply-keeps-growing-fed-backs-monetary-tightening?utm_source=MI+Subscriptions&utm_campaign=c6331c59b9-EMAIL_CAMPAIGN_2024_03_01_07_02_COPY_01&utm_medium=email&utm_term=0_-fb69bb184c-230131240

5. The Moral Decay of Debt - Charles Hugh Smith's Substack

Why: similarity 0.90

Summary: • The document discusses the moral implications of debt, likening it to a household analogy where parents borrow money in their children's names, burdening future generations with unmanageable debt.

• As living costs rise and wages stagnate, subsequent generations resort to borrowing to maintain a middle-class lifestyle, perpetuating a cycle of debt servitude.

• The author questions the morality of offloading debt onto future generations and argues that society has lost the ability to recognize this as morally wrong.

• The expansion of debt is framed as a form of moral decay that undermines the foundations of the economy and society, contributing to a terminal decline.

• The manipulation of interest rates and financial systems to encourage more borrowing is criticized for being devoid of moral judgment, prioritizing growth and profits over ethical considerations.

• The document highlights the rising federal debt-to-GDP ratio, suggesting that current levels (120%) pose significant risks to economic stability.

• Historical context is provided, noting that past economic recoveries were based on natural market corrections rather than manipulated debt increases.

• The author warns that the current level of total debt (over $104 trillion) exceeds what could be justified as productive investment, indicating a substantial amount of excess debt.

• Ultimately, the text emphasizes that debt carries inherent moral implications, and ignoring these consequences will lead to detrimental outcomes, reinforcing the idea that debt is never truly amoral.

URL:  6. (3) The Fed’s FAFO Moment Is Here - by Quoth the Raven

Why: similarity 0.90

Summary: • The Federal Reserve has lost its mystique and credibility as monetary policy has become mainstream knowledge through memes, Bitcoin education, and inflation's real-world impact on everyday Americans

• Bitcoin forced people to understand fiat money and central banking, exposing the Fed's circular logic, "2% inflation target" as slow robbery, and the manipulation of economic metrics

• The public now understands Fed tools like balance sheets, QE, and interest rate manipulation after watching "transitory" inflation ravage savings while the Fed accumulated $9 trillion on its balance sheet

• Past Fed confusion tactics no longer work - everyone knows the pattern: tightening cycles end in bailouts, bailouts bring money printing, and the system is addicted to low rates (evidenced by gold's rise despite high rates)

• The next round of QE will be the Fed's "FAFO moment" - the first massive money print facing a well-informed public that understands the tricks, marking a historic credibility crisis

• The credibility collapse comes from Reddit, Twitter, Coinbase ads, and TikTok explainers, not economists or foreign creditors - the masses are choosing sound money alternatives

• When the inevitable next print comes, people won't just mock the Fed with memes - they'll abandon the dollar for Bitcoin, gold, land, or any asset holding value

• The monetary regime ruling since the 1970s is dying as the public finally understands and rejects the fiat fantasy, moving toward sound money alternatives

URL:

6. (3) The Fed’s FAFO Moment Is Here - by Quoth the Raven

Why: similarity 0.90

Summary: • The Federal Reserve has lost its mystique and credibility as monetary policy has become mainstream knowledge through memes, Bitcoin education, and inflation's real-world impact on everyday Americans

• Bitcoin forced people to understand fiat money and central banking, exposing the Fed's circular logic, "2% inflation target" as slow robbery, and the manipulation of economic metrics

• The public now understands Fed tools like balance sheets, QE, and interest rate manipulation after watching "transitory" inflation ravage savings while the Fed accumulated $9 trillion on its balance sheet

• Past Fed confusion tactics no longer work - everyone knows the pattern: tightening cycles end in bailouts, bailouts bring money printing, and the system is addicted to low rates (evidenced by gold's rise despite high rates)

• The next round of QE will be the Fed's "FAFO moment" - the first massive money print facing a well-informed public that understands the tricks, marking a historic credibility crisis

• The credibility collapse comes from Reddit, Twitter, Coinbase ads, and TikTok explainers, not economists or foreign creditors - the masses are choosing sound money alternatives

• When the inevitable next print comes, people won't just mock the Fed with memes - they'll abandon the dollar for Bitcoin, gold, land, or any asset holding value

• The monetary regime ruling since the 1970s is dying as the public finally understands and rejects the fiat fantasy, moving toward sound money alternatives

URL:  ## Pointed questions for discussion

- How might the anticipated return to QE affect consumer behavior?

- What are the potential long-term consequences of a larger Fed balance sheet?

- In what ways can investors prepare for potential inflationary pressures?

## Sentiment

Score: -0.40

## Provider

OpenRouter / openai/gpt-4o-mini

Shared via

## Pointed questions for discussion

- How might the anticipated return to QE affect consumer behavior?

- What are the potential long-term consequences of a larger Fed balance sheet?

- In what ways can investors prepare for potential inflationary pressures?

## Sentiment

Score: -0.40

## Provider

OpenRouter / openai/gpt-4o-mini

Shared via

Powell Just Signaled the End of Quantitative Tightening

America’s Next Inflation Wave Starts Here

Lyn Alden

June 2025 Newsletter: 3 Misconceptions About US Debt

June 18, 2025 This newsletter issue analyzes three common misconceptions about the US federal debt and deficits. The ongoing nature of the deficits...

Fed Holds Rates, Signals QT Taper; Blames Trump 'Uncertainty' For Stagflationary Outlook | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

The Moral Decay of Debt

Debt has moral implications, and in denying this, we're choosing a rendezvous with Nemesis

The Fed’s FAFO Moment Is Here

How Memes, Bitcoin, and Internet Degenerates Are Tearing Down 50 Years of Fiat Fantasy

Memetic Research Laboratories LLC

Memetic Research Laboratories LLC - Privacy-focused technology for digital content management and decentralized communication

Sputnik International

Trump is Done With Zelensky, Tomahawk Snub Clinches It - Ex-Pentagon Analyst

Ukraine isn

Memetic Research Laboratories LLC

Memetic Research Laboratories LLC - Privacy-focused technology for digital content management and decentralized communication

Shared via

Shared via  Shared via

Shared via  I’m negotiating

Shared via

I’m negotiating

Shared via