# Comprehensive Analysis

Title: Powell Just Signaled the End of Quantitative Tightening

URL:  Collected: 2025-10-18 23:14:58 +0000

Analyzed: 2025-10-19 02:08:58 +0000

## Overall takeaway

The Fed is shifting towards a more accommodative monetary policy, signaling the end of QT and a potential return to QE by 2026 amid rising job cuts and inflation.

## Conceptual model

- QT is ending, leading to potential QE by 2026.

- Job market deterioration influences Fed's policy decisions.

- A larger balance sheet is the new normal for the Fed.

- Restarting QE may trigger inflation and asset bubbles.

- Investment strategies may shift towards commodities and mining.

## Next steps (optional)

- Monitor Fed announcements for updates on monetary policy.

- Evaluate investment portfolios for exposure to commodities.

- Research historical impacts of QE on inflation and markets.

## Short summary

Jerome Powell has indicated that the Federal Reserve is nearing the end of quantitative tightening (QT) and is likely to resume quantitative easing (QE) by early 2026. This shift comes amid rising job cuts and inflation concerns, suggesting a more accommodating monetary policy is on the horizon.

## Comprehensive summary

- • Jerome Powell, the Fed chairman, has indicated that quantitative tightening (QT) is nearing an end, signaling a shift towards monetary easing.

- • At a recent conference, Powell stated that the Fed plans to stop balance sheet runoff when reserves reach a certain level, suggesting the money printer will soon be activated again.

- • The sequence of monetary policy appears clear: interest rate cuts are happening now, followed by an end to QT, and then a return to quantitative easing (QE) likely in early 2026.

- • The Fed's decision is influenced by a deteriorating job market, with over 946,000 job cuts announced this year, and rising mortgage concerns among Americans due to high interest rates and inflation.

- • Despite a reported $2.2 trillion reduction in the Fed's balance sheet since June 2022, the current balance of $6.6 trillion remains significantly above pre-pandemic levels, indicating limited progress in QT.

- • The Fed’s approach has favored a slow reduction of its balance sheet by allowing bonds to mature rather than directly selling them, avoiding potential market crashes.

- • Powell clarified that the goal of normalizing the balance sheet does not mean returning to pre-pandemic levels, effectively accepting a new “normal” of a larger balance sheet.

- • Restarting QE from a bloated balance sheet will likely lead to double-digit inflation and potential currency devaluation.

- • The anticipated shift back to easy monetary policy could trigger a commodities bubble, particularly in precious metals, prompting investment in mining stocks.

## Entities

- keyword: inflation, highs, bonds, cuts, rates, sheet, powell, balance, money, quantitative

- location: America, Lau, Philadelphia

- organization: Fed, National Association for Business Economics, Federal Reserve, Google

- person: Doug Casey, Powell, QT, Trump, Jerome Powell

## Related content

1. June 2025 Newsletter: 3 Misconceptions About US Debt - Lyn Alden

Why: similarity 0.91

Summary: • **US fiscal deficits will remain large for the foreseeable future**, with the federal government consistently spending more than it receives in tax revenue, creating annual deficits that accumulate into total outstanding debt

• **"We owe it to ourselves" is misleading** - while some debt is held domestically, the $36 trillion federal debt translates to $277,000 per household, and holdings are unequally distributed between institutions, individuals, and foreign entities

• **Selective default has serious consequences** - defaulting on retirees, insurance companies, or banks would cause existential crises and protests, while defaulting on foreign entities ($9 trillion held) would damage US credibility and ability to attract future foreign investment

• **Foreign central banks are buying gold** in response to the US freezing $300 billion in Russian reserves in 2022, seeking assets protected from default and confiscation

• **China holds less than $800 billion in treasuries** (about 5 months of US deficit spending) and represents the highest selective default risk among foreign holders

• **Defaulting on the Fed's $4 trillion in treasuries would be problematic** as the Fed has assets and liabilities, pays interest on bank reserves, and is currently operating at a loss with hundreds of billions in unrealized losses

• **Currency devaluation is the more likely path** than outright default, as seen in the 1930s gold devaluation, 1970s decoupling from gold, and the 40% money supply increase in 2020-2021

URL:

Collected: 2025-10-18 23:14:58 +0000

Analyzed: 2025-10-19 02:08:58 +0000

## Overall takeaway

The Fed is shifting towards a more accommodative monetary policy, signaling the end of QT and a potential return to QE by 2026 amid rising job cuts and inflation.

## Conceptual model

- QT is ending, leading to potential QE by 2026.

- Job market deterioration influences Fed's policy decisions.

- A larger balance sheet is the new normal for the Fed.

- Restarting QE may trigger inflation and asset bubbles.

- Investment strategies may shift towards commodities and mining.

## Next steps (optional)

- Monitor Fed announcements for updates on monetary policy.

- Evaluate investment portfolios for exposure to commodities.

- Research historical impacts of QE on inflation and markets.

## Short summary

Jerome Powell has indicated that the Federal Reserve is nearing the end of quantitative tightening (QT) and is likely to resume quantitative easing (QE) by early 2026. This shift comes amid rising job cuts and inflation concerns, suggesting a more accommodating monetary policy is on the horizon.

## Comprehensive summary

- • Jerome Powell, the Fed chairman, has indicated that quantitative tightening (QT) is nearing an end, signaling a shift towards monetary easing.

- • At a recent conference, Powell stated that the Fed plans to stop balance sheet runoff when reserves reach a certain level, suggesting the money printer will soon be activated again.

- • The sequence of monetary policy appears clear: interest rate cuts are happening now, followed by an end to QT, and then a return to quantitative easing (QE) likely in early 2026.

- • The Fed's decision is influenced by a deteriorating job market, with over 946,000 job cuts announced this year, and rising mortgage concerns among Americans due to high interest rates and inflation.

- • Despite a reported $2.2 trillion reduction in the Fed's balance sheet since June 2022, the current balance of $6.6 trillion remains significantly above pre-pandemic levels, indicating limited progress in QT.

- • The Fed’s approach has favored a slow reduction of its balance sheet by allowing bonds to mature rather than directly selling them, avoiding potential market crashes.

- • Powell clarified that the goal of normalizing the balance sheet does not mean returning to pre-pandemic levels, effectively accepting a new “normal” of a larger balance sheet.

- • Restarting QE from a bloated balance sheet will likely lead to double-digit inflation and potential currency devaluation.

- • The anticipated shift back to easy monetary policy could trigger a commodities bubble, particularly in precious metals, prompting investment in mining stocks.

## Entities

- keyword: inflation, highs, bonds, cuts, rates, sheet, powell, balance, money, quantitative

- location: America, Lau, Philadelphia

- organization: Fed, National Association for Business Economics, Federal Reserve, Google

- person: Doug Casey, Powell, QT, Trump, Jerome Powell

## Related content

1. June 2025 Newsletter: 3 Misconceptions About US Debt - Lyn Alden

Why: similarity 0.91

Summary: • **US fiscal deficits will remain large for the foreseeable future**, with the federal government consistently spending more than it receives in tax revenue, creating annual deficits that accumulate into total outstanding debt

• **"We owe it to ourselves" is misleading** - while some debt is held domestically, the $36 trillion federal debt translates to $277,000 per household, and holdings are unequally distributed between institutions, individuals, and foreign entities

• **Selective default has serious consequences** - defaulting on retirees, insurance companies, or banks would cause existential crises and protests, while defaulting on foreign entities ($9 trillion held) would damage US credibility and ability to attract future foreign investment

• **Foreign central banks are buying gold** in response to the US freezing $300 billion in Russian reserves in 2022, seeking assets protected from default and confiscation

• **China holds less than $800 billion in treasuries** (about 5 months of US deficit spending) and represents the highest selective default risk among foreign holders

• **Defaulting on the Fed's $4 trillion in treasuries would be problematic** as the Fed has assets and liabilities, pays interest on bank reserves, and is currently operating at a loss with hundreds of billions in unrealized losses

• **Currency devaluation is the more likely path** than outright default, as seen in the 1930s gold devaluation, 1970s decoupling from gold, and the 40% money supply increase in 2020-2021

URL:  2. The Fed’s Doomsday Prophet Has a Dire Warning About Where We’re Headed - POLITICO

Why: similarity 0.91

Summary: • Thomas Hoenig, former Kansas City Fed president, was the lone dissenting voice on the Federal Open Market Committee in 2010, voting against unprecedented monetary expansion that printed $3.5 trillion between 2008-2014

• Hoenig warned that the Fed's quantitative easing and zero-percent interest rates would deepen income inequality, create dangerous asset bubbles, enrich big banks, and trap the Fed in a money-printing cycle it couldn't escape without destabilizing the financial system

• His concerns were rooted in his experience during the 1970s Great Inflation, where he witnessed firsthand how the Fed's "easy money" policies created asset bubbles in farmland, energy, and real estate through self-reinforcing cycles of cheap debt and rising prices

• The Fed's policies drove up not just consumer goods prices but also asset prices like stocks, bonds, and real estate, creating bubbles where rising prices encouraged more borrowing, which further inflated prices

• Hoenig's warnings proved correct - the Fed is now trapped between rising inflation (fueled by money printing) and the risk of crashing markets or causing recession if it raises interest rates

• Despite being dismissed as an inflation hawk and losing every vote 11-1, Hoenig was primarily concerned about systemic risks and inequality, not just inflation

• He believes there is now "no painless solution" and delays will only make the eventual economic correction more severe, potentially involving high unemployment and years of economic malaise

URL: https://www.politico.com/news/magazine/2021/12/28/inflation-interest-rates-thomas-hoenig-federal-reserve-526177?utm_source=substack&utm_medium=email

3. Fed Holds Rates, Signals QT Taper; Blames Trump 'Uncertainty' For Stagflationary Outlook | ZeroHedge

Why: similarity 0.91

Summary: • **Fed holds rates at 4.25%-4.50% target range** as expected, adopting a wait-and-see approach amid increased economic uncertainty

• **Economic projections turn stagflationary**: Fed slashes 2025 GDP growth forecast from 2.1% to 1.7%, raises core PCE inflation forecast from 2.5% to 2.8%, and increases unemployment forecast from 4.3% to 4.4%

• **Dot plot shifts hawkishly**: More FOMC members now see fewer rate cuts in 2025, with four members expecting zero cuts (up from one in December) and no members seeing four cuts (down from one)

• **QT taper announced**: Fed will slow balance sheet runoff starting April 1, reducing Treasury holdings decline from $25 billion to just $5 billion monthly - a sharp dovish signal

• **Fed blames Trump-related "uncertainty"** for deteriorating economic outlook, removing previous language about balanced risks between inflation and employment

• **Market positioning**: Markets remain more dovish than Fed for 2025 (expecting more cuts) but more hawkish for 2027; rate cut expectations have fallen to just 56bps from nearly 100bps two weeks ago

• **Waller dissents**: Fed Governor Waller supported holding rates but opposed slowing the balance sheet runoff, preferring to maintain current pace of securities reduction

URL:

4. The Money Supply Keeps Growing as the Fed Backs Off Monetary "Tightening" | Mises Institute

Why: similarity 0.91

Summary: • Money supply growth rose year-over-year in February 2025 for the seventh consecutive month (2.75%), marking the first such streak since mid-2022 and reversing the historic contractions seen throughout 2023-2024

• The US experienced the largest money supply drop since the Great Depression during 2023-2024, with no comparable decline in at least sixty years prior

• Current money supply totals remain dramatically elevated above pre-2020 levels, with $6.4 trillion added from 2020-2022 to finance federal covid stimulus programs

• Nearly 26% of the current $19.4 trillion money supply was created since January 2020, and two-thirds has been created in just the past thirteen years

• The Fed has abandoned its monetary tightening stance, cutting interest rates by 100 basis points over three months despite inflation remaining above the 2% target

• In March, the Fed drastically reduced its balance sheet reduction goals from $25 billion to only $5 billion per month for treasury holdings

• To return to pre-2020 money creation trends, the money supply would need to fall by at least $3 trillion, but the Fed shows no appetite for unwinding pandemic-era monetary expansion

• The Fed's massive asset portfolio created during crisis periods serves as an inflationary subsidy for the federal government and mortgage industry, yet aggressive reduction efforts have been abandoned

URL: https://mises.org/mises-wire/money-supply-keeps-growing-fed-backs-monetary-tightening?utm_source=MI+Subscriptions&utm_campaign=c6331c59b9-EMAIL_CAMPAIGN_2024_03_01_07_02_COPY_01&utm_medium=email&utm_term=0_-fb69bb184c-230131240

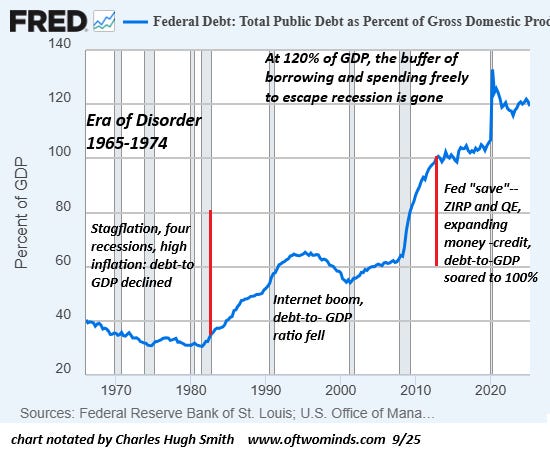

5. The Moral Decay of Debt - Charles Hugh Smith's Substack

Why: similarity 0.90

Summary: • The document discusses the moral implications of debt, likening it to a household analogy where parents borrow money in their children's names, burdening future generations with unmanageable debt.

• As living costs rise and wages stagnate, subsequent generations resort to borrowing to maintain a middle-class lifestyle, perpetuating a cycle of debt servitude.

• The author questions the morality of offloading debt onto future generations and argues that society has lost the ability to recognize this as morally wrong.

• The expansion of debt is framed as a form of moral decay that undermines the foundations of the economy and society, contributing to a terminal decline.

• The manipulation of interest rates and financial systems to encourage more borrowing is criticized for being devoid of moral judgment, prioritizing growth and profits over ethical considerations.

• The document highlights the rising federal debt-to-GDP ratio, suggesting that current levels (120%) pose significant risks to economic stability.

• Historical context is provided, noting that past economic recoveries were based on natural market corrections rather than manipulated debt increases.

• The author warns that the current level of total debt (over $104 trillion) exceeds what could be justified as productive investment, indicating a substantial amount of excess debt.

• Ultimately, the text emphasizes that debt carries inherent moral implications, and ignoring these consequences will lead to detrimental outcomes, reinforcing the idea that debt is never truly amoral.

URL:

2. The Fed’s Doomsday Prophet Has a Dire Warning About Where We’re Headed - POLITICO

Why: similarity 0.91

Summary: • Thomas Hoenig, former Kansas City Fed president, was the lone dissenting voice on the Federal Open Market Committee in 2010, voting against unprecedented monetary expansion that printed $3.5 trillion between 2008-2014

• Hoenig warned that the Fed's quantitative easing and zero-percent interest rates would deepen income inequality, create dangerous asset bubbles, enrich big banks, and trap the Fed in a money-printing cycle it couldn't escape without destabilizing the financial system

• His concerns were rooted in his experience during the 1970s Great Inflation, where he witnessed firsthand how the Fed's "easy money" policies created asset bubbles in farmland, energy, and real estate through self-reinforcing cycles of cheap debt and rising prices

• The Fed's policies drove up not just consumer goods prices but also asset prices like stocks, bonds, and real estate, creating bubbles where rising prices encouraged more borrowing, which further inflated prices

• Hoenig's warnings proved correct - the Fed is now trapped between rising inflation (fueled by money printing) and the risk of crashing markets or causing recession if it raises interest rates

• Despite being dismissed as an inflation hawk and losing every vote 11-1, Hoenig was primarily concerned about systemic risks and inequality, not just inflation

• He believes there is now "no painless solution" and delays will only make the eventual economic correction more severe, potentially involving high unemployment and years of economic malaise

URL: https://www.politico.com/news/magazine/2021/12/28/inflation-interest-rates-thomas-hoenig-federal-reserve-526177?utm_source=substack&utm_medium=email

3. Fed Holds Rates, Signals QT Taper; Blames Trump 'Uncertainty' For Stagflationary Outlook | ZeroHedge

Why: similarity 0.91

Summary: • **Fed holds rates at 4.25%-4.50% target range** as expected, adopting a wait-and-see approach amid increased economic uncertainty

• **Economic projections turn stagflationary**: Fed slashes 2025 GDP growth forecast from 2.1% to 1.7%, raises core PCE inflation forecast from 2.5% to 2.8%, and increases unemployment forecast from 4.3% to 4.4%

• **Dot plot shifts hawkishly**: More FOMC members now see fewer rate cuts in 2025, with four members expecting zero cuts (up from one in December) and no members seeing four cuts (down from one)

• **QT taper announced**: Fed will slow balance sheet runoff starting April 1, reducing Treasury holdings decline from $25 billion to just $5 billion monthly - a sharp dovish signal

• **Fed blames Trump-related "uncertainty"** for deteriorating economic outlook, removing previous language about balanced risks between inflation and employment

• **Market positioning**: Markets remain more dovish than Fed for 2025 (expecting more cuts) but more hawkish for 2027; rate cut expectations have fallen to just 56bps from nearly 100bps two weeks ago

• **Waller dissents**: Fed Governor Waller supported holding rates but opposed slowing the balance sheet runoff, preferring to maintain current pace of securities reduction

URL:

4. The Money Supply Keeps Growing as the Fed Backs Off Monetary "Tightening" | Mises Institute

Why: similarity 0.91

Summary: • Money supply growth rose year-over-year in February 2025 for the seventh consecutive month (2.75%), marking the first such streak since mid-2022 and reversing the historic contractions seen throughout 2023-2024

• The US experienced the largest money supply drop since the Great Depression during 2023-2024, with no comparable decline in at least sixty years prior

• Current money supply totals remain dramatically elevated above pre-2020 levels, with $6.4 trillion added from 2020-2022 to finance federal covid stimulus programs

• Nearly 26% of the current $19.4 trillion money supply was created since January 2020, and two-thirds has been created in just the past thirteen years

• The Fed has abandoned its monetary tightening stance, cutting interest rates by 100 basis points over three months despite inflation remaining above the 2% target

• In March, the Fed drastically reduced its balance sheet reduction goals from $25 billion to only $5 billion per month for treasury holdings

• To return to pre-2020 money creation trends, the money supply would need to fall by at least $3 trillion, but the Fed shows no appetite for unwinding pandemic-era monetary expansion

• The Fed's massive asset portfolio created during crisis periods serves as an inflationary subsidy for the federal government and mortgage industry, yet aggressive reduction efforts have been abandoned

URL: https://mises.org/mises-wire/money-supply-keeps-growing-fed-backs-monetary-tightening?utm_source=MI+Subscriptions&utm_campaign=c6331c59b9-EMAIL_CAMPAIGN_2024_03_01_07_02_COPY_01&utm_medium=email&utm_term=0_-fb69bb184c-230131240

5. The Moral Decay of Debt - Charles Hugh Smith's Substack

Why: similarity 0.90

Summary: • The document discusses the moral implications of debt, likening it to a household analogy where parents borrow money in their children's names, burdening future generations with unmanageable debt.

• As living costs rise and wages stagnate, subsequent generations resort to borrowing to maintain a middle-class lifestyle, perpetuating a cycle of debt servitude.

• The author questions the morality of offloading debt onto future generations and argues that society has lost the ability to recognize this as morally wrong.

• The expansion of debt is framed as a form of moral decay that undermines the foundations of the economy and society, contributing to a terminal decline.

• The manipulation of interest rates and financial systems to encourage more borrowing is criticized for being devoid of moral judgment, prioritizing growth and profits over ethical considerations.

• The document highlights the rising federal debt-to-GDP ratio, suggesting that current levels (120%) pose significant risks to economic stability.

• Historical context is provided, noting that past economic recoveries were based on natural market corrections rather than manipulated debt increases.

• The author warns that the current level of total debt (over $104 trillion) exceeds what could be justified as productive investment, indicating a substantial amount of excess debt.

• Ultimately, the text emphasizes that debt carries inherent moral implications, and ignoring these consequences will lead to detrimental outcomes, reinforcing the idea that debt is never truly amoral.

URL:  6. (3) The Fed’s FAFO Moment Is Here - by Quoth the Raven

Why: similarity 0.90

Summary: • The Federal Reserve has lost its mystique and credibility as monetary policy has become mainstream knowledge through memes, Bitcoin education, and inflation's real-world impact on everyday Americans

• Bitcoin forced people to understand fiat money and central banking, exposing the Fed's circular logic, "2% inflation target" as slow robbery, and the manipulation of economic metrics

• The public now understands Fed tools like balance sheets, QE, and interest rate manipulation after watching "transitory" inflation ravage savings while the Fed accumulated $9 trillion on its balance sheet

• Past Fed confusion tactics no longer work - everyone knows the pattern: tightening cycles end in bailouts, bailouts bring money printing, and the system is addicted to low rates (evidenced by gold's rise despite high rates)

• The next round of QE will be the Fed's "FAFO moment" - the first massive money print facing a well-informed public that understands the tricks, marking a historic credibility crisis

• The credibility collapse comes from Reddit, Twitter, Coinbase ads, and TikTok explainers, not economists or foreign creditors - the masses are choosing sound money alternatives

• When the inevitable next print comes, people won't just mock the Fed with memes - they'll abandon the dollar for Bitcoin, gold, land, or any asset holding value

• The monetary regime ruling since the 1970s is dying as the public finally understands and rejects the fiat fantasy, moving toward sound money alternatives

URL:

6. (3) The Fed’s FAFO Moment Is Here - by Quoth the Raven

Why: similarity 0.90

Summary: • The Federal Reserve has lost its mystique and credibility as monetary policy has become mainstream knowledge through memes, Bitcoin education, and inflation's real-world impact on everyday Americans

• Bitcoin forced people to understand fiat money and central banking, exposing the Fed's circular logic, "2% inflation target" as slow robbery, and the manipulation of economic metrics

• The public now understands Fed tools like balance sheets, QE, and interest rate manipulation after watching "transitory" inflation ravage savings while the Fed accumulated $9 trillion on its balance sheet

• Past Fed confusion tactics no longer work - everyone knows the pattern: tightening cycles end in bailouts, bailouts bring money printing, and the system is addicted to low rates (evidenced by gold's rise despite high rates)

• The next round of QE will be the Fed's "FAFO moment" - the first massive money print facing a well-informed public that understands the tricks, marking a historic credibility crisis

• The credibility collapse comes from Reddit, Twitter, Coinbase ads, and TikTok explainers, not economists or foreign creditors - the masses are choosing sound money alternatives

• When the inevitable next print comes, people won't just mock the Fed with memes - they'll abandon the dollar for Bitcoin, gold, land, or any asset holding value

• The monetary regime ruling since the 1970s is dying as the public finally understands and rejects the fiat fantasy, moving toward sound money alternatives

URL:  ## Pointed questions for discussion

- How might the anticipated return to QE affect consumer behavior?

- What are the potential long-term consequences of a larger Fed balance sheet?

- In what ways can investors prepare for potential inflationary pressures?

## Sentiment

Score: -0.40

## Provider

OpenRouter / openai/gpt-4o-mini

Shared via

## Pointed questions for discussion

- How might the anticipated return to QE affect consumer behavior?

- What are the potential long-term consequences of a larger Fed balance sheet?

- In what ways can investors prepare for potential inflationary pressures?

## Sentiment

Score: -0.40

## Provider

OpenRouter / openai/gpt-4o-mini

Shared via

Powell Just Signaled the End of Quantitative Tightening

America’s Next Inflation Wave Starts Here

Lyn Alden

June 2025 Newsletter: 3 Misconceptions About US Debt

June 18, 2025 This newsletter issue analyzes three common misconceptions about the US federal debt and deficits. The ongoing nature of the deficits...

Fed Holds Rates, Signals QT Taper; Blames Trump 'Uncertainty' For Stagflationary Outlook | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

The Moral Decay of Debt

Debt has moral implications, and in denying this, we're choosing a rendezvous with Nemesis

The Fed’s FAFO Moment Is Here

How Memes, Bitcoin, and Internet Degenerates Are Tearing Down 50 Years of Fiat Fantasy

Memetic Research Laboratories LLC

Memetic Research Laboratories LLC - Privacy-focused technology for digital content management and decentralized communication

I’m negotiating

Shared via

I’m negotiating

Shared via  Talk about a shitcoin! This listing is on eBay right now and is an obviously fake coin. WTF eBay?!

Shared via

Talk about a shitcoin! This listing is on eBay right now and is an obviously fake coin. WTF eBay?!

Shared via  IS THIS 7D CHESS???

Shared via

IS THIS 7D CHESS???

Shared via  Shared via

Shared via