EU pushes ahead with joint debt project

The debate about so-called Eurobonds is now picking up speed again. Ursula von der Leyen is already talking about a volume of up to 800 billion euros, and the euro members have already granted 150 billion euros more or less. The Russian panic that has now broken out will build the bridge to the remaining maastricht rules and debt principles being thrown overboard. The European Union is thus taking a titanic step towards becoming a global state. Bad news for all those who rely on regional competencies and sovereignty.

https://www.reuters.com/world/europe/eu-defence-plans-could-mobilise-800-billion-euros-von-der-leyen-says-2025-03-04/

#eu #russia #ukraine #nostr #news #plebchain #grownostr #geopolitics

Ghost of Truth

npub1sclj...zprv

Seek wisdom, embrace freedom, secure Your future with #Bitcoin - be #ungovernable.

#History #Philosophy #Economy

New Fiscal Fiasco In Germany: Could Political Incompetence Finally Force Peace?

It didn't take long for the ripples caused by Vladimir Selenski's bizarre appearance in the White House to reach the old continent again. In a hectic emergency meeting in London, the leaders of European politics tried to demonstrate their unity and their will to continue the Ukraine project, whatever the cost. At times, it was like watching half-strength men playing with their muscles - somewhat bizarre and ridiculous, but not unfunny if it weren't a matter of life and death.

It was just over a week ago that the Germans re-elected the Bundestag after the collapse of the government a few months ago, and it quickly became clear that a coalition of familiar forces would be needed to keep the German globalists' mortal enemy, the AFD, out of business. And so the new Chancellor of the CDU, Friedrich Merz, will forge a coalition with the Social Democrats, as quickly as possible, and continue what they had started: the joint action against Putin's Russia.

It only took a few hours for Merz to announce immense new borrowing to expand the country's defense budget to possibly up to 600 billion euros in the coming years. Money that the eurozone's largest economy does not have, after having shot itself in the head several times economically. Just think of the war against the automotive industry and the phase-out of nuclear power, as well as the sanctions packages against Russia, which have left the German economy lagging behind.

Germany’s prospective black-red coalition is staring down this self-inflicted financial abyss. Sources close to the negotiations between the Union (CDU/CSU) and SPD reveal a staggering budget shortfall—between €130 billion and €150 billion—projected through 2028. Federal Finance Minister Jörg Kukies (SPD) dropped this bombshell during Friday’s exploratory talks, according to insider accounts confirmed by multiple outlets. The figure paints a grim picture of a nation teetering on the edge of economic ruin. Friedrich Merz, who campaigned on a promise to audit the federal books, must now wish he’d never peeked under the hood. What he found was worse than anyone dared predict: a fiscal mess so severe it’s rattling the foundations of Germany’s economic reputation. The numbers don’t lie, and they’re screaming a warning—Berlin’s balance sheet is bleeding red, and the coalition’s ambitions may drown in it. This isn’t just a hiccup; it’s a structural collapse years in the making. Analysts point to unchecked spending and systemic strains, though the talks remain tight-lipped on specifics. For now, the coalition hopefuls are scrambling to plug a gap that threatens to swallow their agenda whole.

This brings us to the Punch and Judy show and the team photo of the mimetically embarrassing group meeting in London. There, the two new strong men of Europe, Emmanuel Macron and host Keir Starmer, unceremoniously relegated the German Chancellor Olaf Scholz to last place, just to say: if you can't pay for anything, then you won't take part in the future big-man games!

Everyone knows that, with the possible exception of Poland, no other European state has any military power worth mentioning. They are all small shadows of their former selves, rotten economies with weak fiscal chests that have saved their shadow armies from the Cold War under the protective umbrella of the Americans, who are now withdrawing. But obviously no one in Europe has read this memo properly, otherwise how could this meaningless talk of boots on the ground in Ukraine and massive support for the country be understood? The Europeans will soon have to deal with completely different problems, migration policy, economic and security problems, and the Ukraine project will very quickly fade into the background. But to this day, no effort at diplomacy with Russia can be seen. It is a complete denial of reality among the so-called political elite of the old continent.

Let’s call it what it is: Germany’s fiscal implosion is a twisted stroke of good fortune for a continent on edge. For years, Berlin’s shot itself in the foot—wild spending sprees, an open-door rush into social welfare, and an economic self-sabotage that historians will marvel at in disbelief. This €150 billion chasm isn’t a glitch; it’s the bill coming due for a nation that’s been running on fumes. This economic seppuku might just douse the war drums thumping across Europe. With Germany’s credit rating poised to tank—hello, France’s shaky tier—the markets won’t stomach funding big kinetic wars or military gambits via the money printer. Hyperinflation would shred the euro before the first tank rolls. So, while Germany’s elites scramble to salvage their coalition, the rest of us might dodge a bullet. Economic chaos? Sure. But a quieter continent...

On a meta-level, a kind of war-weariness is taking place, which has demographic reasons and is based on the general decomposition of every form of patriotism. For decades, the radical left has successfully rooted out any form of traditional patriotic thinking from the minds and souls of the people and it will not be possible to activate them once again for a proxy war of the globalists from London and Brussels. No one in their right mind will fight for 15 minute cities, cbdc control money or forced vaccinations and total media control. The game is over!

#economy #eu #germany #debtcrisis #ecb #bitcoin #nostr #grownostr #plebchain

It was just over a week ago that the Germans re-elected the Bundestag after the collapse of the government a few months ago, and it quickly became clear that a coalition of familiar forces would be needed to keep the German globalists' mortal enemy, the AFD, out of business. And so the new Chancellor of the CDU, Friedrich Merz, will forge a coalition with the Social Democrats, as quickly as possible, and continue what they had started: the joint action against Putin's Russia.

It only took a few hours for Merz to announce immense new borrowing to expand the country's defense budget to possibly up to 600 billion euros in the coming years. Money that the eurozone's largest economy does not have, after having shot itself in the head several times economically. Just think of the war against the automotive industry and the phase-out of nuclear power, as well as the sanctions packages against Russia, which have left the German economy lagging behind.

Germany’s prospective black-red coalition is staring down this self-inflicted financial abyss. Sources close to the negotiations between the Union (CDU/CSU) and SPD reveal a staggering budget shortfall—between €130 billion and €150 billion—projected through 2028. Federal Finance Minister Jörg Kukies (SPD) dropped this bombshell during Friday’s exploratory talks, according to insider accounts confirmed by multiple outlets. The figure paints a grim picture of a nation teetering on the edge of economic ruin. Friedrich Merz, who campaigned on a promise to audit the federal books, must now wish he’d never peeked under the hood. What he found was worse than anyone dared predict: a fiscal mess so severe it’s rattling the foundations of Germany’s economic reputation. The numbers don’t lie, and they’re screaming a warning—Berlin’s balance sheet is bleeding red, and the coalition’s ambitions may drown in it. This isn’t just a hiccup; it’s a structural collapse years in the making. Analysts point to unchecked spending and systemic strains, though the talks remain tight-lipped on specifics. For now, the coalition hopefuls are scrambling to plug a gap that threatens to swallow their agenda whole.

This brings us to the Punch and Judy show and the team photo of the mimetically embarrassing group meeting in London. There, the two new strong men of Europe, Emmanuel Macron and host Keir Starmer, unceremoniously relegated the German Chancellor Olaf Scholz to last place, just to say: if you can't pay for anything, then you won't take part in the future big-man games!

Everyone knows that, with the possible exception of Poland, no other European state has any military power worth mentioning. They are all small shadows of their former selves, rotten economies with weak fiscal chests that have saved their shadow armies from the Cold War under the protective umbrella of the Americans, who are now withdrawing. But obviously no one in Europe has read this memo properly, otherwise how could this meaningless talk of boots on the ground in Ukraine and massive support for the country be understood? The Europeans will soon have to deal with completely different problems, migration policy, economic and security problems, and the Ukraine project will very quickly fade into the background. But to this day, no effort at diplomacy with Russia can be seen. It is a complete denial of reality among the so-called political elite of the old continent.

Let’s call it what it is: Germany’s fiscal implosion is a twisted stroke of good fortune for a continent on edge. For years, Berlin’s shot itself in the foot—wild spending sprees, an open-door rush into social welfare, and an economic self-sabotage that historians will marvel at in disbelief. This €150 billion chasm isn’t a glitch; it’s the bill coming due for a nation that’s been running on fumes. This economic seppuku might just douse the war drums thumping across Europe. With Germany’s credit rating poised to tank—hello, France’s shaky tier—the markets won’t stomach funding big kinetic wars or military gambits via the money printer. Hyperinflation would shred the euro before the first tank rolls. So, while Germany’s elites scramble to salvage their coalition, the rest of us might dodge a bullet. Economic chaos? Sure. But a quieter continent...

On a meta-level, a kind of war-weariness is taking place, which has demographic reasons and is based on the general decomposition of every form of patriotism. For decades, the radical left has successfully rooted out any form of traditional patriotic thinking from the minds and souls of the people and it will not be possible to activate them once again for a proxy war of the globalists from London and Brussels. No one in their right mind will fight for 15 minute cities, cbdc control money or forced vaccinations and total media control. The game is over!

#economy #eu #germany #debtcrisis #ecb #bitcoin #nostr #grownostr #plebchain

It was just over a week ago that the Germans re-elected the Bundestag after the collapse of the government a few months ago, and it quickly became clear that a coalition of familiar forces would be needed to keep the German globalists' mortal enemy, the AFD, out of business. And so the new Chancellor of the CDU, Friedrich Merz, will forge a coalition with the Social Democrats, as quickly as possible, and continue what they had started: the joint action against Putin's Russia.

It only took a few hours for Merz to announce immense new borrowing to expand the country's defense budget to possibly up to 600 billion euros in the coming years. Money that the eurozone's largest economy does not have, after having shot itself in the head several times economically. Just think of the war against the automotive industry and the phase-out of nuclear power, as well as the sanctions packages against Russia, which have left the German economy lagging behind.

Germany’s prospective black-red coalition is staring down this self-inflicted financial abyss. Sources close to the negotiations between the Union (CDU/CSU) and SPD reveal a staggering budget shortfall—between €130 billion and €150 billion—projected through 2028. Federal Finance Minister Jörg Kukies (SPD) dropped this bombshell during Friday’s exploratory talks, according to insider accounts confirmed by multiple outlets. The figure paints a grim picture of a nation teetering on the edge of economic ruin. Friedrich Merz, who campaigned on a promise to audit the federal books, must now wish he’d never peeked under the hood. What he found was worse than anyone dared predict: a fiscal mess so severe it’s rattling the foundations of Germany’s economic reputation. The numbers don’t lie, and they’re screaming a warning—Berlin’s balance sheet is bleeding red, and the coalition’s ambitions may drown in it. This isn’t just a hiccup; it’s a structural collapse years in the making. Analysts point to unchecked spending and systemic strains, though the talks remain tight-lipped on specifics. For now, the coalition hopefuls are scrambling to plug a gap that threatens to swallow their agenda whole.

This brings us to the Punch and Judy show and the team photo of the mimetically embarrassing group meeting in London. There, the two new strong men of Europe, Emmanuel Macron and host Keir Starmer, unceremoniously relegated the German Chancellor Olaf Scholz to last place, just to say: if you can't pay for anything, then you won't take part in the future big-man games!

Everyone knows that, with the possible exception of Poland, no other European state has any military power worth mentioning. They are all small shadows of their former selves, rotten economies with weak fiscal chests that have saved their shadow armies from the Cold War under the protective umbrella of the Americans, who are now withdrawing. But obviously no one in Europe has read this memo properly, otherwise how could this meaningless talk of boots on the ground in Ukraine and massive support for the country be understood? The Europeans will soon have to deal with completely different problems, migration policy, economic and security problems, and the Ukraine project will very quickly fade into the background. But to this day, no effort at diplomacy with Russia can be seen. It is a complete denial of reality among the so-called political elite of the old continent.

Let’s call it what it is: Germany’s fiscal implosion is a twisted stroke of good fortune for a continent on edge. For years, Berlin’s shot itself in the foot—wild spending sprees, an open-door rush into social welfare, and an economic self-sabotage that historians will marvel at in disbelief. This €150 billion chasm isn’t a glitch; it’s the bill coming due for a nation that’s been running on fumes. This economic seppuku might just douse the war drums thumping across Europe. With Germany’s credit rating poised to tank—hello, France’s shaky tier—the markets won’t stomach funding big kinetic wars or military gambits via the money printer. Hyperinflation would shred the euro before the first tank rolls. So, while Germany’s elites scramble to salvage their coalition, the rest of us might dodge a bullet. Economic chaos? Sure. But a quieter continent...

On a meta-level, a kind of war-weariness is taking place, which has demographic reasons and is based on the general decomposition of every form of patriotism. For decades, the radical left has successfully rooted out any form of traditional patriotic thinking from the minds and souls of the people and it will not be possible to activate them once again for a proxy war of the globalists from London and Brussels. No one in their right mind will fight for 15 minute cities, cbdc control money or forced vaccinations and total media control. The game is over!

#economy #eu #germany #debtcrisis #ecb #bitcoin #nostr #grownostr #plebchain

It was just over a week ago that the Germans re-elected the Bundestag after the collapse of the government a few months ago, and it quickly became clear that a coalition of familiar forces would be needed to keep the German globalists' mortal enemy, the AFD, out of business. And so the new Chancellor of the CDU, Friedrich Merz, will forge a coalition with the Social Democrats, as quickly as possible, and continue what they had started: the joint action against Putin's Russia.

It only took a few hours for Merz to announce immense new borrowing to expand the country's defense budget to possibly up to 600 billion euros in the coming years. Money that the eurozone's largest economy does not have, after having shot itself in the head several times economically. Just think of the war against the automotive industry and the phase-out of nuclear power, as well as the sanctions packages against Russia, which have left the German economy lagging behind.

Germany’s prospective black-red coalition is staring down this self-inflicted financial abyss. Sources close to the negotiations between the Union (CDU/CSU) and SPD reveal a staggering budget shortfall—between €130 billion and €150 billion—projected through 2028. Federal Finance Minister Jörg Kukies (SPD) dropped this bombshell during Friday’s exploratory talks, according to insider accounts confirmed by multiple outlets. The figure paints a grim picture of a nation teetering on the edge of economic ruin. Friedrich Merz, who campaigned on a promise to audit the federal books, must now wish he’d never peeked under the hood. What he found was worse than anyone dared predict: a fiscal mess so severe it’s rattling the foundations of Germany’s economic reputation. The numbers don’t lie, and they’re screaming a warning—Berlin’s balance sheet is bleeding red, and the coalition’s ambitions may drown in it. This isn’t just a hiccup; it’s a structural collapse years in the making. Analysts point to unchecked spending and systemic strains, though the talks remain tight-lipped on specifics. For now, the coalition hopefuls are scrambling to plug a gap that threatens to swallow their agenda whole.

This brings us to the Punch and Judy show and the team photo of the mimetically embarrassing group meeting in London. There, the two new strong men of Europe, Emmanuel Macron and host Keir Starmer, unceremoniously relegated the German Chancellor Olaf Scholz to last place, just to say: if you can't pay for anything, then you won't take part in the future big-man games!

Everyone knows that, with the possible exception of Poland, no other European state has any military power worth mentioning. They are all small shadows of their former selves, rotten economies with weak fiscal chests that have saved their shadow armies from the Cold War under the protective umbrella of the Americans, who are now withdrawing. But obviously no one in Europe has read this memo properly, otherwise how could this meaningless talk of boots on the ground in Ukraine and massive support for the country be understood? The Europeans will soon have to deal with completely different problems, migration policy, economic and security problems, and the Ukraine project will very quickly fade into the background. But to this day, no effort at diplomacy with Russia can be seen. It is a complete denial of reality among the so-called political elite of the old continent.

Let’s call it what it is: Germany’s fiscal implosion is a twisted stroke of good fortune for a continent on edge. For years, Berlin’s shot itself in the foot—wild spending sprees, an open-door rush into social welfare, and an economic self-sabotage that historians will marvel at in disbelief. This €150 billion chasm isn’t a glitch; it’s the bill coming due for a nation that’s been running on fumes. This economic seppuku might just douse the war drums thumping across Europe. With Germany’s credit rating poised to tank—hello, France’s shaky tier—the markets won’t stomach funding big kinetic wars or military gambits via the money printer. Hyperinflation would shred the euro before the first tank rolls. So, while Germany’s elites scramble to salvage their coalition, the rest of us might dodge a bullet. Economic chaos? Sure. But a quieter continent...

On a meta-level, a kind of war-weariness is taking place, which has demographic reasons and is based on the general decomposition of every form of patriotism. For decades, the radical left has successfully rooted out any form of traditional patriotic thinking from the minds and souls of the people and it will not be possible to activate them once again for a proxy war of the globalists from London and Brussels. No one in their right mind will fight for 15 minute cities, cbdc control money or forced vaccinations and total media control. The game is over!

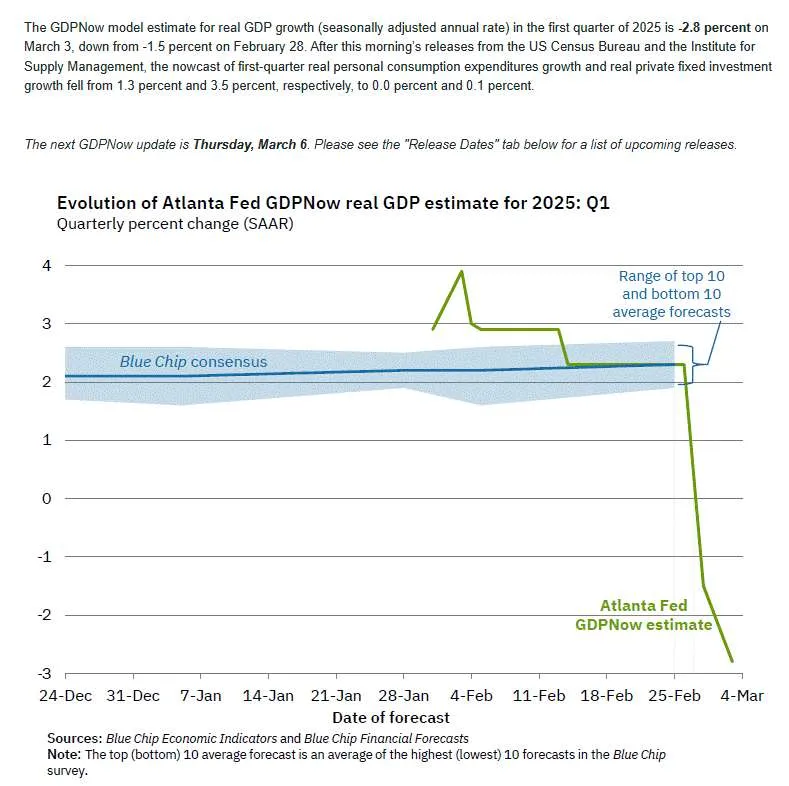

#economy #eu #germany #debtcrisis #ecb #bitcoin #nostr #grownostr #plebchainA wonderful example of the cooked figures from state institutions: the FED nowcast from the Atlanta Federal Reserve. Real GDP has plummeted from -1.5 % on Friday to -2.8 % on Monday. So the Americans obviously didn't consume anything over the weekend. I think it should be clear to the last person that government statistics are nothing but dog shit.

#fed #usa #economy #bitcoin #nostr

#fed #usa #economy #bitcoin #nostr

#fed #usa #economy #bitcoin #nostr

#fed #usa #economy #bitcoin #nostrTariffs: Echoes from Ancient Rome

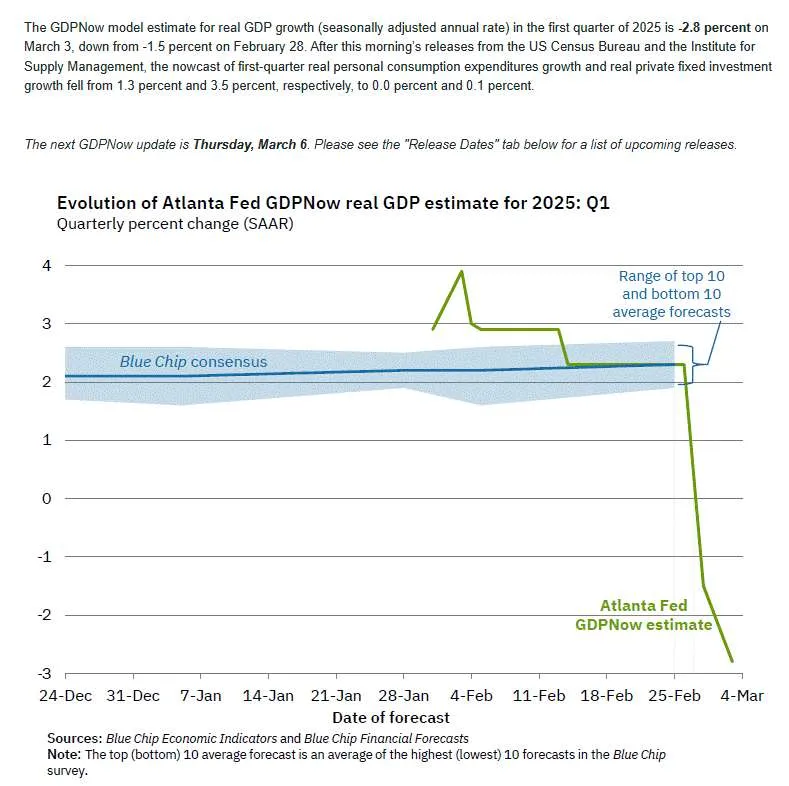

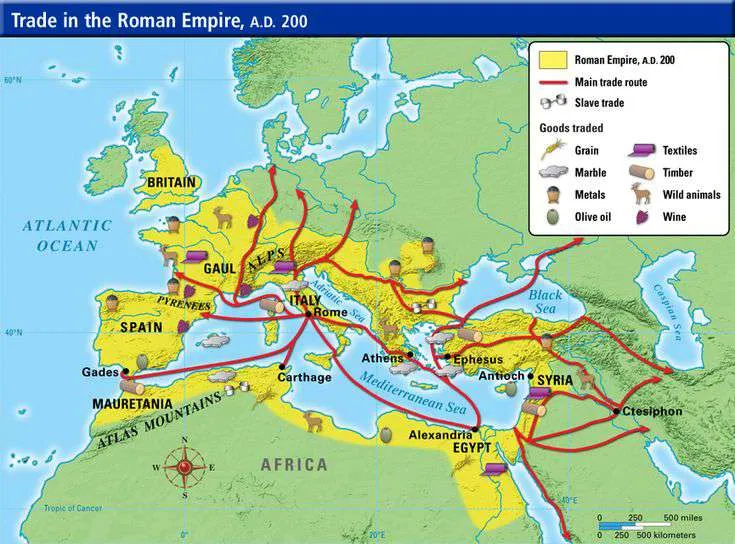

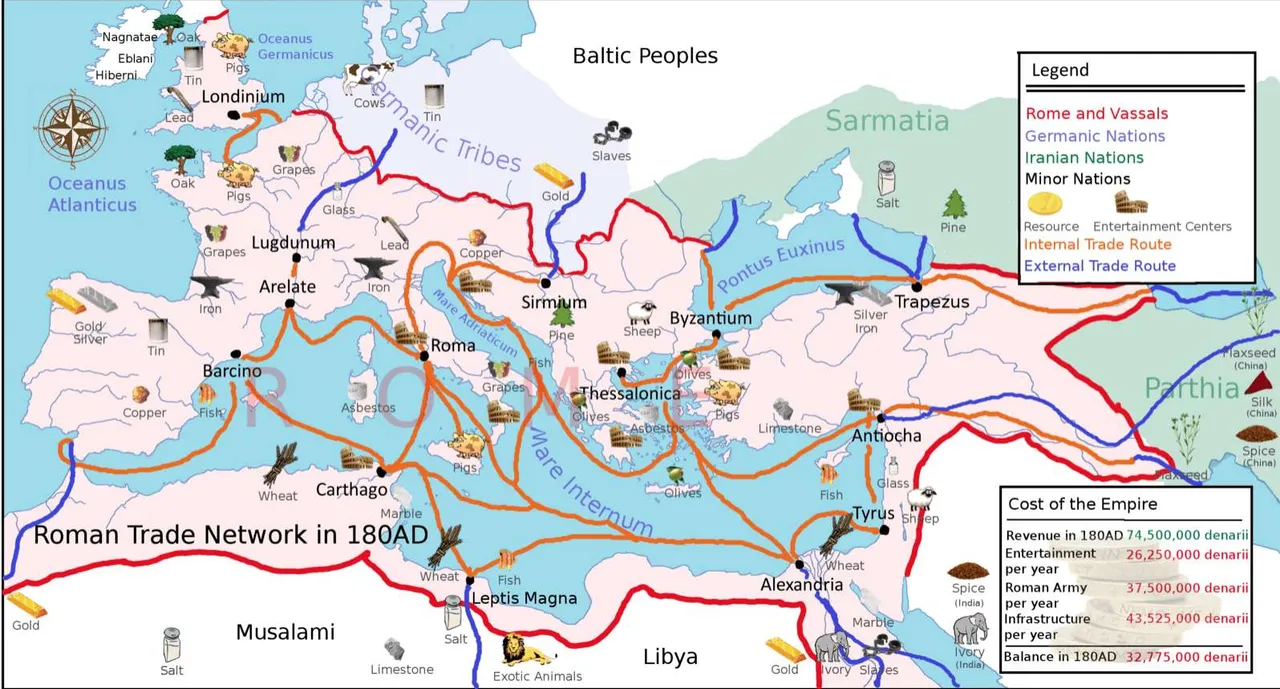

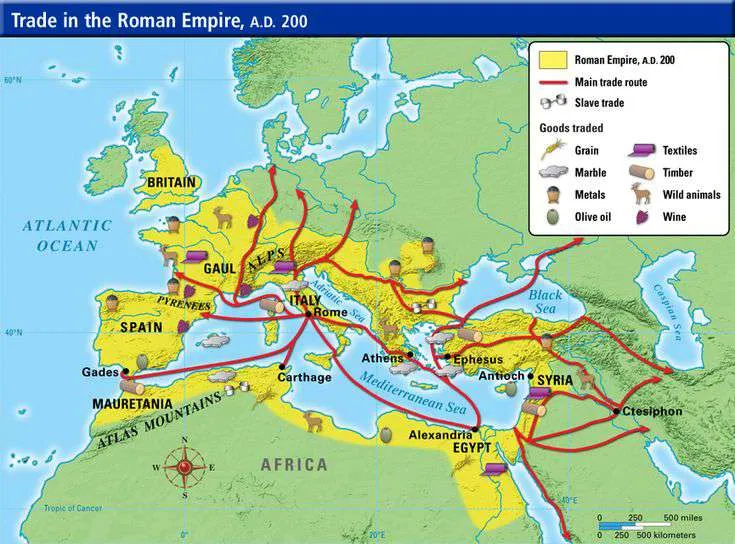

At its greatest extent under its emperor Trajan, the Imperium Romanum dominated the Mediterranean, the Black Sea and vast areas of the European continent, Northern Africa and the Middle East. Its political influence also helped to consolidate and pacify trade. The stable, high volume of commerce provided the central power in Rome with a rich source of income through customs policy - a topic that has been the subject of heated debate since the tide changed in the White House.

Picture Rome before Augustus took the reins around 27 BC. The financial system was a mess - a sprawling beast where local officials and provincial governors collected whatever they could grab, often pocketing more than they reported. It was less an economy and more a free-for-all, with corruption as common as the cobblestones on the Appian Way. Then came Augustus, stepping in to centralize and streamline Rome’s fiscal chaos. By 6 AD, he rolled out the Portorium publicum, a tariff system that wasn’t just about raking in denarii but about weaving an economic web across the empire. This wasn’t petty governance; it was a grand strategy, a way to assert control over the arteries of trade that pulsed through Rome’s vast domain.

Picture Rome before Augustus took the reins around 27 BC. The financial system was a mess - a sprawling beast where local officials and provincial governors collected whatever they could grab, often pocketing more than they reported. It was less an economy and more a free-for-all, with corruption as common as the cobblestones on the Appian Way. Then came Augustus, stepping in to centralize and streamline Rome’s fiscal chaos. By 6 AD, he rolled out the Portorium publicum, a tariff system that wasn’t just about raking in denarii but about weaving an economic web across the empire. This wasn’t petty governance; it was a grand strategy, a way to assert control over the arteries of trade that pulsed through Rome’s vast domain.

The Roman state’s financial machinery was a marvel of its time, a complex tapestry of revenue streams that kept the empire humming. Before Augustus’ reforms, the state leaned heavily on direct taxes—the tributum—which hit landowners and citizens based on their wealth and property. Historians estimate this made up about 30-40% of Rome’s state income by the late 1st century BC, a steady flow that paid for legions, infrastructure like roads or aqueducts, and the occasional lavish triumph and the famous vulgar games - 'panem et circenses', financed by the tax payer to entertain a growing army of parasitically living individuals from all parts of the known world. But it wasn’t enough on its own, and that’s where the indirect taxes like the Portorium came in, pulling in roughly 20-30% of the total haul. Within that slice, the Portorium itself might’ve accounted for 10-20%, depending on the ebb and flow of trade across the Mediterranean and beyond.

The Roman state’s financial machinery was a marvel of its time, a complex tapestry of revenue streams that kept the empire humming. Before Augustus’ reforms, the state leaned heavily on direct taxes—the tributum—which hit landowners and citizens based on their wealth and property. Historians estimate this made up about 30-40% of Rome’s state income by the late 1st century BC, a steady flow that paid for legions, infrastructure like roads or aqueducts, and the occasional lavish triumph and the famous vulgar games - 'panem et circenses', financed by the tax payer to entertain a growing army of parasitically living individuals from all parts of the known world. But it wasn’t enough on its own, and that’s where the indirect taxes like the Portorium came in, pulling in roughly 20-30% of the total haul. Within that slice, the Portorium itself might’ve accounted for 10-20%, depending on the ebb and flow of trade across the Mediterranean and beyond.

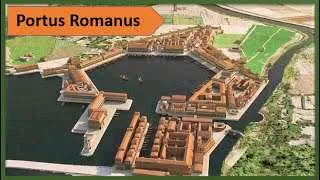

This tariff wasn’t just a tax; it was Rome’s way of putting a tollbooth on every trade route, ensuring that every amphora of wine or bundle of silk moving through its ports or frontiers paid its dues. Free trade principles weren't even a dream, they were completely out of reach as geopolitics those days were power politics in its basic form. Controlling the bottlenecks like the Dardanells were crucial part of stabilizing centralized power - a phenomenon we're witnessing again in our days, thinking of the Suez or Panama Channels. Bloodlines of Roman power where the flourishing provinces, the empire’s cash cows. From 27 BC to 14 AD, as Augustus solidified his grip, tributes from conquered lands and the spoils of war brought in another 20-30% of the state’s revenue. Think of it like Rome’s version of colonial dividends - gold, grain, and slaves funneled back to the capital from places like Gaul, Egypt, the depths of Africa or Sarmathia and Hispania. And let’s not forget the miscellaneous streams: selling public offices, tapping into mining profits, and other creative hustles that could’ve added another 10-20% to the pot. By the Pax Romana’s height in the 2nd century AD, this mix was a well-oiled machine, balancing the empire’s sprawling needs with a ruthless efficiency that modern central banks might envy.

This tariff wasn’t just a tax; it was Rome’s way of putting a tollbooth on every trade route, ensuring that every amphora of wine or bundle of silk moving through its ports or frontiers paid its dues. Free trade principles weren't even a dream, they were completely out of reach as geopolitics those days were power politics in its basic form. Controlling the bottlenecks like the Dardanells were crucial part of stabilizing centralized power - a phenomenon we're witnessing again in our days, thinking of the Suez or Panama Channels. Bloodlines of Roman power where the flourishing provinces, the empire’s cash cows. From 27 BC to 14 AD, as Augustus solidified his grip, tributes from conquered lands and the spoils of war brought in another 20-30% of the state’s revenue. Think of it like Rome’s version of colonial dividends - gold, grain, and slaves funneled back to the capital from places like Gaul, Egypt, the depths of Africa or Sarmathia and Hispania. And let’s not forget the miscellaneous streams: selling public offices, tapping into mining profits, and other creative hustles that could’ve added another 10-20% to the pot. By the Pax Romana’s height in the 2nd century AD, this mix was a well-oiled machine, balancing the empire’s sprawling needs with a ruthless efficiency that modern central banks might envy.

The Portorium wasn’t just about the numbers, though. It was Rome’s economic heartbeat, a tool for more than just filling the treasury. Augustus didn’t slap tariffs on goods out of boredom; he used them to control the empire’s lifeblood - international trade which included even the famous east asian trade routes, the Silk Road. By setting standardized rates around 6 AD, he gave merchants a predictable game to play, not unlike how Bitcoin promises stability in a wild financial world. If you were shipping spices from the East or marble from Greece, you knew what Rome would take at the gate, and that predictability fostered commerce even as it lined imperial pockets. It was a delicate dance: keep the provinces prosperous enough to pay, but tethered tight enough to never forget who held the reins. The execution of this system leaned on the publicani, Rome’s tax farmers and a real plague for their respect people, a practice that stretched back to the 2nd century BC. These private contractors bid for the right to collect tariffs, turning tax collection into a competitive enterprise. It was a brilliant outsourcing move: Rome set the rules, the publicani played the game, and the state reaped the rewards. Of course, it wasn’t flawless; corruption crept in like weeds in a vineyard, prompting reforms by the 3rd century AD to tighten oversight. Still, the ingenuity of it all - turning tax collection into a profit-driven hustle - feels like a distant ancestor to today’s public-private partnerships.

The Portorium wasn’t just about the numbers, though. It was Rome’s economic heartbeat, a tool for more than just filling the treasury. Augustus didn’t slap tariffs on goods out of boredom; he used them to control the empire’s lifeblood - international trade which included even the famous east asian trade routes, the Silk Road. By setting standardized rates around 6 AD, he gave merchants a predictable game to play, not unlike how Bitcoin promises stability in a wild financial world. If you were shipping spices from the East or marble from Greece, you knew what Rome would take at the gate, and that predictability fostered commerce even as it lined imperial pockets. It was a delicate dance: keep the provinces prosperous enough to pay, but tethered tight enough to never forget who held the reins. The execution of this system leaned on the publicani, Rome’s tax farmers and a real plague for their respect people, a practice that stretched back to the 2nd century BC. These private contractors bid for the right to collect tariffs, turning tax collection into a competitive enterprise. It was a brilliant outsourcing move: Rome set the rules, the publicani played the game, and the state reaped the rewards. Of course, it wasn’t flawless; corruption crept in like weeds in a vineyard, prompting reforms by the 3rd century AD to tighten oversight. Still, the ingenuity of it all - turning tax collection into a profit-driven hustle - feels like a distant ancestor to today’s public-private partnerships.

Fast forward to 2025, and the parallels are uncanny. Nations wield tariffs like Rome once did, not just for revenue but for leverage. The U.S. hikes duties on Chinese tech to protect its industries; the EU adjusts post-Brexit trade barriers to redefine its economic borders; developing nations shield their markets to grow without being swallowed by giants. It’s all about control: over wealth, influence, and stability - just as Augustus sought control over his empire’s economic flows. The Portorium integrated Rome’s diverse regions under one economic umbrella, much like modern trade blocs try to harmonize their members while fending off outsiders. Rome centralized its economy to stabilize an empire (it failed in the end); today, we wrestle with whether centralized policies or decentralized systems like Bitcoin hold the key to economic freedom. The Portorium was Rome’s way of saying, “We’ll let you trade, but on our terms,” a sentiment echoed in every tariff hike or trade sanction we see today. By the empire’s peak in the 2nd century AD, this system had evolved into a cornerstone of Roman dominance, proving that economic policy could be as mighty a weapon as any legion. Rome’s example stands as a reminder: control the flow of wealth, and you control the game. History doesn’t just repeat—it resonates, and the echoes of Roman tariffs are loud and clear in 2025.

#History #AncientRome #Tariffs #StateFinance #Bitcoin #Nostr #TradePolicy #HistoryLessons #Grownostr #Economx #usa #trump

Fast forward to 2025, and the parallels are uncanny. Nations wield tariffs like Rome once did, not just for revenue but for leverage. The U.S. hikes duties on Chinese tech to protect its industries; the EU adjusts post-Brexit trade barriers to redefine its economic borders; developing nations shield their markets to grow without being swallowed by giants. It’s all about control: over wealth, influence, and stability - just as Augustus sought control over his empire’s economic flows. The Portorium integrated Rome’s diverse regions under one economic umbrella, much like modern trade blocs try to harmonize their members while fending off outsiders. Rome centralized its economy to stabilize an empire (it failed in the end); today, we wrestle with whether centralized policies or decentralized systems like Bitcoin hold the key to economic freedom. The Portorium was Rome’s way of saying, “We’ll let you trade, but on our terms,” a sentiment echoed in every tariff hike or trade sanction we see today. By the empire’s peak in the 2nd century AD, this system had evolved into a cornerstone of Roman dominance, proving that economic policy could be as mighty a weapon as any legion. Rome’s example stands as a reminder: control the flow of wealth, and you control the game. History doesn’t just repeat—it resonates, and the echoes of Roman tariffs are loud and clear in 2025.

#History #AncientRome #Tariffs #StateFinance #Bitcoin #Nostr #TradePolicy #HistoryLessons #Grownostr #Economx #usa #trump

Picture Rome before Augustus took the reins around 27 BC. The financial system was a mess - a sprawling beast where local officials and provincial governors collected whatever they could grab, often pocketing more than they reported. It was less an economy and more a free-for-all, with corruption as common as the cobblestones on the Appian Way. Then came Augustus, stepping in to centralize and streamline Rome’s fiscal chaos. By 6 AD, he rolled out the Portorium publicum, a tariff system that wasn’t just about raking in denarii but about weaving an economic web across the empire. This wasn’t petty governance; it was a grand strategy, a way to assert control over the arteries of trade that pulsed through Rome’s vast domain.

Picture Rome before Augustus took the reins around 27 BC. The financial system was a mess - a sprawling beast where local officials and provincial governors collected whatever they could grab, often pocketing more than they reported. It was less an economy and more a free-for-all, with corruption as common as the cobblestones on the Appian Way. Then came Augustus, stepping in to centralize and streamline Rome’s fiscal chaos. By 6 AD, he rolled out the Portorium publicum, a tariff system that wasn’t just about raking in denarii but about weaving an economic web across the empire. This wasn’t petty governance; it was a grand strategy, a way to assert control over the arteries of trade that pulsed through Rome’s vast domain.

The Roman state’s financial machinery was a marvel of its time, a complex tapestry of revenue streams that kept the empire humming. Before Augustus’ reforms, the state leaned heavily on direct taxes—the tributum—which hit landowners and citizens based on their wealth and property. Historians estimate this made up about 30-40% of Rome’s state income by the late 1st century BC, a steady flow that paid for legions, infrastructure like roads or aqueducts, and the occasional lavish triumph and the famous vulgar games - 'panem et circenses', financed by the tax payer to entertain a growing army of parasitically living individuals from all parts of the known world. But it wasn’t enough on its own, and that’s where the indirect taxes like the Portorium came in, pulling in roughly 20-30% of the total haul. Within that slice, the Portorium itself might’ve accounted for 10-20%, depending on the ebb and flow of trade across the Mediterranean and beyond.

The Roman state’s financial machinery was a marvel of its time, a complex tapestry of revenue streams that kept the empire humming. Before Augustus’ reforms, the state leaned heavily on direct taxes—the tributum—which hit landowners and citizens based on their wealth and property. Historians estimate this made up about 30-40% of Rome’s state income by the late 1st century BC, a steady flow that paid for legions, infrastructure like roads or aqueducts, and the occasional lavish triumph and the famous vulgar games - 'panem et circenses', financed by the tax payer to entertain a growing army of parasitically living individuals from all parts of the known world. But it wasn’t enough on its own, and that’s where the indirect taxes like the Portorium came in, pulling in roughly 20-30% of the total haul. Within that slice, the Portorium itself might’ve accounted for 10-20%, depending on the ebb and flow of trade across the Mediterranean and beyond.

This tariff wasn’t just a tax; it was Rome’s way of putting a tollbooth on every trade route, ensuring that every amphora of wine or bundle of silk moving through its ports or frontiers paid its dues. Free trade principles weren't even a dream, they were completely out of reach as geopolitics those days were power politics in its basic form. Controlling the bottlenecks like the Dardanells were crucial part of stabilizing centralized power - a phenomenon we're witnessing again in our days, thinking of the Suez or Panama Channels. Bloodlines of Roman power where the flourishing provinces, the empire’s cash cows. From 27 BC to 14 AD, as Augustus solidified his grip, tributes from conquered lands and the spoils of war brought in another 20-30% of the state’s revenue. Think of it like Rome’s version of colonial dividends - gold, grain, and slaves funneled back to the capital from places like Gaul, Egypt, the depths of Africa or Sarmathia and Hispania. And let’s not forget the miscellaneous streams: selling public offices, tapping into mining profits, and other creative hustles that could’ve added another 10-20% to the pot. By the Pax Romana’s height in the 2nd century AD, this mix was a well-oiled machine, balancing the empire’s sprawling needs with a ruthless efficiency that modern central banks might envy.

This tariff wasn’t just a tax; it was Rome’s way of putting a tollbooth on every trade route, ensuring that every amphora of wine or bundle of silk moving through its ports or frontiers paid its dues. Free trade principles weren't even a dream, they were completely out of reach as geopolitics those days were power politics in its basic form. Controlling the bottlenecks like the Dardanells were crucial part of stabilizing centralized power - a phenomenon we're witnessing again in our days, thinking of the Suez or Panama Channels. Bloodlines of Roman power where the flourishing provinces, the empire’s cash cows. From 27 BC to 14 AD, as Augustus solidified his grip, tributes from conquered lands and the spoils of war brought in another 20-30% of the state’s revenue. Think of it like Rome’s version of colonial dividends - gold, grain, and slaves funneled back to the capital from places like Gaul, Egypt, the depths of Africa or Sarmathia and Hispania. And let’s not forget the miscellaneous streams: selling public offices, tapping into mining profits, and other creative hustles that could’ve added another 10-20% to the pot. By the Pax Romana’s height in the 2nd century AD, this mix was a well-oiled machine, balancing the empire’s sprawling needs with a ruthless efficiency that modern central banks might envy.

The Portorium wasn’t just about the numbers, though. It was Rome’s economic heartbeat, a tool for more than just filling the treasury. Augustus didn’t slap tariffs on goods out of boredom; he used them to control the empire’s lifeblood - international trade which included even the famous east asian trade routes, the Silk Road. By setting standardized rates around 6 AD, he gave merchants a predictable game to play, not unlike how Bitcoin promises stability in a wild financial world. If you were shipping spices from the East or marble from Greece, you knew what Rome would take at the gate, and that predictability fostered commerce even as it lined imperial pockets. It was a delicate dance: keep the provinces prosperous enough to pay, but tethered tight enough to never forget who held the reins. The execution of this system leaned on the publicani, Rome’s tax farmers and a real plague for their respect people, a practice that stretched back to the 2nd century BC. These private contractors bid for the right to collect tariffs, turning tax collection into a competitive enterprise. It was a brilliant outsourcing move: Rome set the rules, the publicani played the game, and the state reaped the rewards. Of course, it wasn’t flawless; corruption crept in like weeds in a vineyard, prompting reforms by the 3rd century AD to tighten oversight. Still, the ingenuity of it all - turning tax collection into a profit-driven hustle - feels like a distant ancestor to today’s public-private partnerships.

The Portorium wasn’t just about the numbers, though. It was Rome’s economic heartbeat, a tool for more than just filling the treasury. Augustus didn’t slap tariffs on goods out of boredom; he used them to control the empire’s lifeblood - international trade which included even the famous east asian trade routes, the Silk Road. By setting standardized rates around 6 AD, he gave merchants a predictable game to play, not unlike how Bitcoin promises stability in a wild financial world. If you were shipping spices from the East or marble from Greece, you knew what Rome would take at the gate, and that predictability fostered commerce even as it lined imperial pockets. It was a delicate dance: keep the provinces prosperous enough to pay, but tethered tight enough to never forget who held the reins. The execution of this system leaned on the publicani, Rome’s tax farmers and a real plague for their respect people, a practice that stretched back to the 2nd century BC. These private contractors bid for the right to collect tariffs, turning tax collection into a competitive enterprise. It was a brilliant outsourcing move: Rome set the rules, the publicani played the game, and the state reaped the rewards. Of course, it wasn’t flawless; corruption crept in like weeds in a vineyard, prompting reforms by the 3rd century AD to tighten oversight. Still, the ingenuity of it all - turning tax collection into a profit-driven hustle - feels like a distant ancestor to today’s public-private partnerships.

Fast forward to 2025, and the parallels are uncanny. Nations wield tariffs like Rome once did, not just for revenue but for leverage. The U.S. hikes duties on Chinese tech to protect its industries; the EU adjusts post-Brexit trade barriers to redefine its economic borders; developing nations shield their markets to grow without being swallowed by giants. It’s all about control: over wealth, influence, and stability - just as Augustus sought control over his empire’s economic flows. The Portorium integrated Rome’s diverse regions under one economic umbrella, much like modern trade blocs try to harmonize their members while fending off outsiders. Rome centralized its economy to stabilize an empire (it failed in the end); today, we wrestle with whether centralized policies or decentralized systems like Bitcoin hold the key to economic freedom. The Portorium was Rome’s way of saying, “We’ll let you trade, but on our terms,” a sentiment echoed in every tariff hike or trade sanction we see today. By the empire’s peak in the 2nd century AD, this system had evolved into a cornerstone of Roman dominance, proving that economic policy could be as mighty a weapon as any legion. Rome’s example stands as a reminder: control the flow of wealth, and you control the game. History doesn’t just repeat—it resonates, and the echoes of Roman tariffs are loud and clear in 2025.

#History #AncientRome #Tariffs #StateFinance #Bitcoin #Nostr #TradePolicy #HistoryLessons #Grownostr #Economx #usa #trump

Fast forward to 2025, and the parallels are uncanny. Nations wield tariffs like Rome once did, not just for revenue but for leverage. The U.S. hikes duties on Chinese tech to protect its industries; the EU adjusts post-Brexit trade barriers to redefine its economic borders; developing nations shield their markets to grow without being swallowed by giants. It’s all about control: over wealth, influence, and stability - just as Augustus sought control over his empire’s economic flows. The Portorium integrated Rome’s diverse regions under one economic umbrella, much like modern trade blocs try to harmonize their members while fending off outsiders. Rome centralized its economy to stabilize an empire (it failed in the end); today, we wrestle with whether centralized policies or decentralized systems like Bitcoin hold the key to economic freedom. The Portorium was Rome’s way of saying, “We’ll let you trade, but on our terms,” a sentiment echoed in every tariff hike or trade sanction we see today. By the empire’s peak in the 2nd century AD, this system had evolved into a cornerstone of Roman dominance, proving that economic policy could be as mighty a weapon as any legion. Rome’s example stands as a reminder: control the flow of wealth, and you control the game. History doesn’t just repeat—it resonates, and the echoes of Roman tariffs are loud and clear in 2025.

#History #AncientRome #Tariffs #StateFinance #Bitcoin #Nostr #TradePolicy #HistoryLessons #Grownostr #Economx #usa #trumpUSA And Russia Prepare For The Time After Sanctions

While the Europeans have to reorganize themselves after the obvious withdrawal of the Americans from European affairs, US investors are preparing the comeback of Nord Stream 2 together with Gazprom.

It is this disparity of action and the completely different perception of reality that is astonishing. The Europeans, culturally and economically shaken by the crisis, are letting their sabres rattle louder, while they have shrunk to a dwarf militarily. They are like a drunken poker player who can no longer distinguish a seven of hearts from an ace of clubs. With this denial of reality, the globalists from London and Brussels have plunged the people of the continent into a deep crisis, which more and more people are becoming aware of. Tough times ahead. The only good thing is that the money for more proxy wars will soon dry up and the senseless dying will end.

Source: https://shorturl.at/k9En4

#EU #UK #wef #russia #usa #nostr #grownostr #nordstream2 #trump #bitcoin

It is this disparity of action and the completely different perception of reality that is astonishing. The Europeans, culturally and economically shaken by the crisis, are letting their sabres rattle louder, while they have shrunk to a dwarf militarily. They are like a drunken poker player who can no longer distinguish a seven of hearts from an ace of clubs. With this denial of reality, the globalists from London and Brussels have plunged the people of the continent into a deep crisis, which more and more people are becoming aware of. Tough times ahead. The only good thing is that the money for more proxy wars will soon dry up and the senseless dying will end.

Source: https://shorturl.at/k9En4

#EU #UK #wef #russia #usa #nostr #grownostr #nordstream2 #trump #bitcoin

It is this disparity of action and the completely different perception of reality that is astonishing. The Europeans, culturally and economically shaken by the crisis, are letting their sabres rattle louder, while they have shrunk to a dwarf militarily. They are like a drunken poker player who can no longer distinguish a seven of hearts from an ace of clubs. With this denial of reality, the globalists from London and Brussels have plunged the people of the continent into a deep crisis, which more and more people are becoming aware of. Tough times ahead. The only good thing is that the money for more proxy wars will soon dry up and the senseless dying will end.

Source: https://shorturl.at/k9En4

#EU #UK #wef #russia #usa #nostr #grownostr #nordstream2 #trump #bitcoin

It is this disparity of action and the completely different perception of reality that is astonishing. The Europeans, culturally and economically shaken by the crisis, are letting their sabres rattle louder, while they have shrunk to a dwarf militarily. They are like a drunken poker player who can no longer distinguish a seven of hearts from an ace of clubs. With this denial of reality, the globalists from London and Brussels have plunged the people of the continent into a deep crisis, which more and more people are becoming aware of. Tough times ahead. The only good thing is that the money for more proxy wars will soon dry up and the senseless dying will end.

Source: https://shorturl.at/k9En4

#EU #UK #wef #russia #usa #nostr #grownostr #nordstream2 #trump #bitcoinGM,

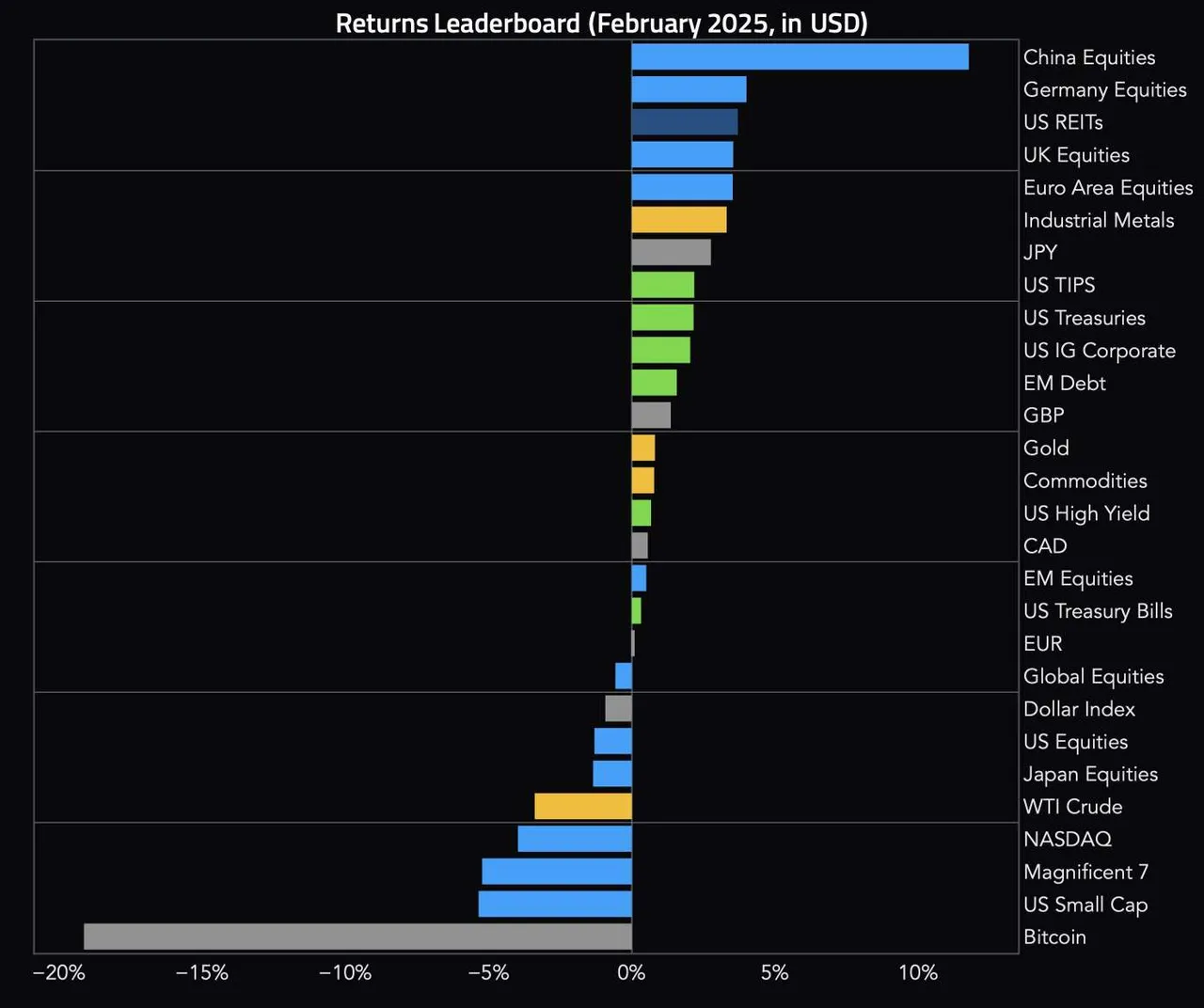

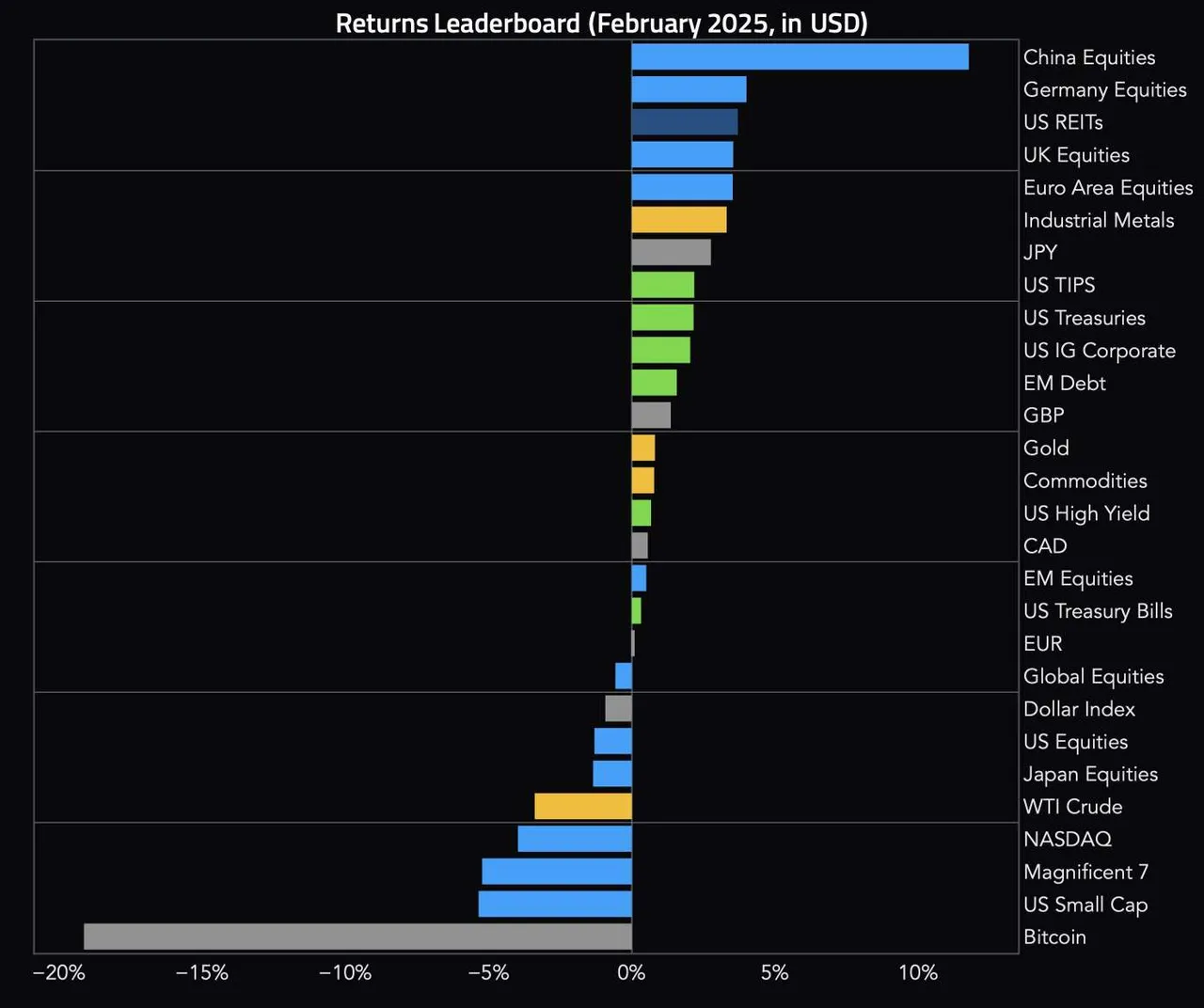

February 2025 is also in the books and we take a quick look at it and see that we briefly stopped off in Absurdistan!

Equities from China, of all places, which is in a deflationary death spiral, and Germany, which has politically shot itself in the brain, dominated February's asset performance.

Meanwhile our horse in the stable, Bitcoin, took a short breather in what has become a year-long ride. But I expect that, in view of improving economic macro data and an improved credit supply on a global level, the race will soon be on again and Bitcoin will regain its well-deserved top position.

And always remember: we are running a marathon here, with the goal firmly in sight and with the lowest possible time preference. That's how we win! The rest is noise.

#bitcoin #2025 #nostr #grownostr #plebchain #assets #capital #markets #economy #btc

Equities from China, of all places, which is in a deflationary death spiral, and Germany, which has politically shot itself in the brain, dominated February's asset performance.

Meanwhile our horse in the stable, Bitcoin, took a short breather in what has become a year-long ride. But I expect that, in view of improving economic macro data and an improved credit supply on a global level, the race will soon be on again and Bitcoin will regain its well-deserved top position.

And always remember: we are running a marathon here, with the goal firmly in sight and with the lowest possible time preference. That's how we win! The rest is noise.

#bitcoin #2025 #nostr #grownostr #plebchain #assets #capital #markets #economy #btc

Equities from China, of all places, which is in a deflationary death spiral, and Germany, which has politically shot itself in the brain, dominated February's asset performance.

Meanwhile our horse in the stable, Bitcoin, took a short breather in what has become a year-long ride. But I expect that, in view of improving economic macro data and an improved credit supply on a global level, the race will soon be on again and Bitcoin will regain its well-deserved top position.

And always remember: we are running a marathon here, with the goal firmly in sight and with the lowest possible time preference. That's how we win! The rest is noise.

#bitcoin #2025 #nostr #grownostr #plebchain #assets #capital #markets #economy #btc

Equities from China, of all places, which is in a deflationary death spiral, and Germany, which has politically shot itself in the brain, dominated February's asset performance.

Meanwhile our horse in the stable, Bitcoin, took a short breather in what has become a year-long ride. But I expect that, in view of improving economic macro data and an improved credit supply on a global level, the race will soon be on again and Bitcoin will regain its well-deserved top position.

And always remember: we are running a marathon here, with the goal firmly in sight and with the lowest possible time preference. That's how we win! The rest is noise.

#bitcoin #2025 #nostr #grownostr #plebchain #assets #capital #markets #economy #btc#Trump re-activates the bull with a bullshit #shitcoin tweet. I find myself still on the same planet, ruled by bullshit narratives and shitty story telling. I think I will return to my bullshit media shitposting job if this is the level of shit talk we're confronted with....

Stack Sats....

#bitcoin #nostr

While the EU leaders gather in Paris for an emergency meeting, there are once again mass protests in Romania against the annulment of the last election. At the same time, the Prime Minister of Slovakia, Fico, announces that he will not allow any more funding for the war in Ukraine. The resistance in Eastern Europe against the globalists of the West is growing faster.

#eu #Ukraine #Russia #wef #uk #nostr

Hjalmar Schacht: Hitler's Fiat Banker

The military resurgence of the German Reich after the defeat of the First World War and the catastrophe of the Weimar Republic is one of the most astonishingly fatal events of the 20th century. Millions upon millions lost their lives after the resentment-driven German people rose again militarily from the ruins of the Treaty of Versailles. In charge of financing the gigantic German war machine was an economist and intellectual who was not initially suspected of harboring nationalist or even extremist thoughts: the president of the German Reichsbank at the time, Hjalmar Schacht.

Born in 1877 in Tingleff, in northern Germany, into a middle-class family, the economist turned himself into a top banker, starting out at Dresdner Bank and making decisive reforms at the height of the hyperinflation of the Weimar Republic. It is all amazing what happened later, considering that Schacht was a founding member of the ddp party, a social-liberal grouping that had no connection whatsoever towards the resentment driven extremist groups that lateron brought Weimar to its kneed.

Born in 1877 in Tingleff, in northern Germany, into a middle-class family, the economist turned himself into a top banker, starting out at Dresdner Bank and making decisive reforms at the height of the hyperinflation of the Weimar Republic. It is all amazing what happened later, considering that Schacht was a founding member of the ddp party, a social-liberal grouping that had no connection whatsoever towards the resentment driven extremist groups that lateron brought Weimar to its kneed.

Was it the plundering by the Treaty of Versailles that radicalized this man from the middle class of society and put him on the path of Adolf Hitler or was Schacht nothing more than the typical successful careerist and political hanger-on who recognized the opportunity and took advantage of it?

Was it the plundering by the Treaty of Versailles that radicalized this man from the middle class of society and put him on the path of Adolf Hitler or was Schacht nothing more than the typical successful careerist and political hanger-on who recognized the opportunity and took advantage of it?

After Hitler’s ascent, Schacht was reappointed Reichsbank President (1933–1939) and named Minister of Economics (1934–1937). He engineered Germany’s economic recovery through innovative policies like the MEFO bills, which secretly financed rearmament, and public works programs that reduced unemployment. However, he clashed with Hitler and Hermann Göring over excessive military spending, which he believed destabilized the economy and violated the Treaty of Versailles (!!).

After Hitler’s ascent, Schacht was reappointed Reichsbank President (1933–1939) and named Minister of Economics (1934–1937). He engineered Germany’s economic recovery through innovative policies like the MEFO bills, which secretly financed rearmament, and public works programs that reduced unemployment. However, he clashed with Hitler and Hermann Göring over excessive military spending, which he believed destabilized the economy and violated the Treaty of Versailles (!!).

These tensions led to his resignation from the Reichsbank in 1939 and his dismissal as Minister without Portfolio in 1943. Of course, if you let the money printer run hot, things turned out as they had to: with the start of the Second World War and the invasion of Poland, Germany was faced with insolvency and hyperinflation, once again, which is why the Nazis consistently sought the gold reserves of the subjugated states first.

Schacht’s relationship with the Nazi regime soured further as he opposed Hitler’s aggressive policies. In 1944, after the failed July 20 assassination attempt on Hitler, he was arrested by the Gestapo for alleged contacts with the resistance and interned in concentration camps, including Ravensbrück and Flossenbürg.

These tensions led to his resignation from the Reichsbank in 1939 and his dismissal as Minister without Portfolio in 1943. Of course, if you let the money printer run hot, things turned out as they had to: with the start of the Second World War and the invasion of Poland, Germany was faced with insolvency and hyperinflation, once again, which is why the Nazis consistently sought the gold reserves of the subjugated states first.

Schacht’s relationship with the Nazi regime soured further as he opposed Hitler’s aggressive policies. In 1944, after the failed July 20 assassination attempt on Hitler, he was arrested by the Gestapo for alleged contacts with the resistance and interned in concentration camps, including Ravensbrück and Flossenbürg.

Liberated in 1945, he faced trial at Nuremberg but was acquitted in 1946, as the tribunal found insufficient evidence tying him to war crimes. German denazification courts later sentenced him to eight years in prison, but he was released in 1948 after an appeal.

Post-war, Schacht founded a private bank in Düsseldorf in 1953 and advised leaders like Egypt’s Gamal Nasser. A prolific writer, he authored 26 books, including The Stabilization of the Mark (1927) and Confessions of "The Old Wizard" (1956). Known for his high intellect—he scored 143 on an IQ test at Nuremberg—Schacht remains a controversial figure, celebrated for his economic genius yet criticized for his early Nazi collaboration.

This video from 'Slice Full Doc' takes an interesting look and angle at the events surrounding the Reichsbank before the second world war: https://shorturl.at/38ZmD

#history #schacht #hitler #germany #weimar #fiat #ww2 #bitcoin #nostr #grownostr #nostrlearn

Liberated in 1945, he faced trial at Nuremberg but was acquitted in 1946, as the tribunal found insufficient evidence tying him to war crimes. German denazification courts later sentenced him to eight years in prison, but he was released in 1948 after an appeal.

Post-war, Schacht founded a private bank in Düsseldorf in 1953 and advised leaders like Egypt’s Gamal Nasser. A prolific writer, he authored 26 books, including The Stabilization of the Mark (1927) and Confessions of "The Old Wizard" (1956). Known for his high intellect—he scored 143 on an IQ test at Nuremberg—Schacht remains a controversial figure, celebrated for his economic genius yet criticized for his early Nazi collaboration.

This video from 'Slice Full Doc' takes an interesting look and angle at the events surrounding the Reichsbank before the second world war: https://shorturl.at/38ZmD

#history #schacht #hitler #germany #weimar #fiat #ww2 #bitcoin #nostr #grownostr #nostrlearn

Born in 1877 in Tingleff, in northern Germany, into a middle-class family, the economist turned himself into a top banker, starting out at Dresdner Bank and making decisive reforms at the height of the hyperinflation of the Weimar Republic. It is all amazing what happened later, considering that Schacht was a founding member of the ddp party, a social-liberal grouping that had no connection whatsoever towards the resentment driven extremist groups that lateron brought Weimar to its kneed.

Born in 1877 in Tingleff, in northern Germany, into a middle-class family, the economist turned himself into a top banker, starting out at Dresdner Bank and making decisive reforms at the height of the hyperinflation of the Weimar Republic. It is all amazing what happened later, considering that Schacht was a founding member of the ddp party, a social-liberal grouping that had no connection whatsoever towards the resentment driven extremist groups that lateron brought Weimar to its kneed.

Was it the plundering by the Treaty of Versailles that radicalized this man from the middle class of society and put him on the path of Adolf Hitler or was Schacht nothing more than the typical successful careerist and political hanger-on who recognized the opportunity and took advantage of it?

Was it the plundering by the Treaty of Versailles that radicalized this man from the middle class of society and put him on the path of Adolf Hitler or was Schacht nothing more than the typical successful careerist and political hanger-on who recognized the opportunity and took advantage of it?

After Hitler’s ascent, Schacht was reappointed Reichsbank President (1933–1939) and named Minister of Economics (1934–1937). He engineered Germany’s economic recovery through innovative policies like the MEFO bills, which secretly financed rearmament, and public works programs that reduced unemployment. However, he clashed with Hitler and Hermann Göring over excessive military spending, which he believed destabilized the economy and violated the Treaty of Versailles (!!).

After Hitler’s ascent, Schacht was reappointed Reichsbank President (1933–1939) and named Minister of Economics (1934–1937). He engineered Germany’s economic recovery through innovative policies like the MEFO bills, which secretly financed rearmament, and public works programs that reduced unemployment. However, he clashed with Hitler and Hermann Göring over excessive military spending, which he believed destabilized the economy and violated the Treaty of Versailles (!!).

These tensions led to his resignation from the Reichsbank in 1939 and his dismissal as Minister without Portfolio in 1943. Of course, if you let the money printer run hot, things turned out as they had to: with the start of the Second World War and the invasion of Poland, Germany was faced with insolvency and hyperinflation, once again, which is why the Nazis consistently sought the gold reserves of the subjugated states first.

Schacht’s relationship with the Nazi regime soured further as he opposed Hitler’s aggressive policies. In 1944, after the failed July 20 assassination attempt on Hitler, he was arrested by the Gestapo for alleged contacts with the resistance and interned in concentration camps, including Ravensbrück and Flossenbürg.

These tensions led to his resignation from the Reichsbank in 1939 and his dismissal as Minister without Portfolio in 1943. Of course, if you let the money printer run hot, things turned out as they had to: with the start of the Second World War and the invasion of Poland, Germany was faced with insolvency and hyperinflation, once again, which is why the Nazis consistently sought the gold reserves of the subjugated states first.

Schacht’s relationship with the Nazi regime soured further as he opposed Hitler’s aggressive policies. In 1944, after the failed July 20 assassination attempt on Hitler, he was arrested by the Gestapo for alleged contacts with the resistance and interned in concentration camps, including Ravensbrück and Flossenbürg.

Liberated in 1945, he faced trial at Nuremberg but was acquitted in 1946, as the tribunal found insufficient evidence tying him to war crimes. German denazification courts later sentenced him to eight years in prison, but he was released in 1948 after an appeal.

Post-war, Schacht founded a private bank in Düsseldorf in 1953 and advised leaders like Egypt’s Gamal Nasser. A prolific writer, he authored 26 books, including The Stabilization of the Mark (1927) and Confessions of "The Old Wizard" (1956). Known for his high intellect—he scored 143 on an IQ test at Nuremberg—Schacht remains a controversial figure, celebrated for his economic genius yet criticized for his early Nazi collaboration.

This video from 'Slice Full Doc' takes an interesting look and angle at the events surrounding the Reichsbank before the second world war: https://shorturl.at/38ZmD

#history #schacht #hitler #germany #weimar #fiat #ww2 #bitcoin #nostr #grownostr #nostrlearn

Liberated in 1945, he faced trial at Nuremberg but was acquitted in 1946, as the tribunal found insufficient evidence tying him to war crimes. German denazification courts later sentenced him to eight years in prison, but he was released in 1948 after an appeal.

Post-war, Schacht founded a private bank in Düsseldorf in 1953 and advised leaders like Egypt’s Gamal Nasser. A prolific writer, he authored 26 books, including The Stabilization of the Mark (1927) and Confessions of "The Old Wizard" (1956). Known for his high intellect—he scored 143 on an IQ test at Nuremberg—Schacht remains a controversial figure, celebrated for his economic genius yet criticized for his early Nazi collaboration.

This video from 'Slice Full Doc' takes an interesting look and angle at the events surrounding the Reichsbank before the second world war: https://shorturl.at/38ZmD

#history #schacht #hitler #germany #weimar #fiat #ww2 #bitcoin #nostr #grownostr #nostrlearnThis is the moment when Schopenhauer recognized the cold truth of the human condition. After that, he was never the same again, this jolly old bone from Hamburg.

#philosophy #nostr #grownostr #bitcoin #life

#philosophy #nostr #grownostr #bitcoin #life

#philosophy #nostr #grownostr #bitcoin #life

#philosophy #nostr #grownostr #bitcoin #life