The sheer volume of police interrogation clips that exists on YouTube is a stark reminder that no matter how retarded you think you are, you're still way smarter than the seemingly endless amounts of idiots who will talk to cops without a lawyer.

Hoss “Compu-tard Admin Fag of The League of Irrelevant Anime Losers in Mom's Basement” Delgado

Hoss@shitpost-cloud.mostr.pub

npub1scjc...el3p

Monster hunter and big boss of shitpost.cloud.

"Bouncing into people's replies with content-free nastiness."

- Fediblock

"Hoss is a great example of someone who can post about numerous topics of interest one moment and then make an antisemitic remark the next."

- @Falaichte@den.raccoon.quest

"He's one of my fedi besties even if he is dumb af sometimes tho, and he's just super in denial. I don't think he's a bad person tho, just in denial of how blessed he is and what led to him having such a blessed life."

- @bot@seal.cafe

"you exude the most raw of gigachad energy that a poor soylent ai could never handle"

- @theorytoe@ak.kyaruc.moe

"god dammit hoss why do you attract the most niggerbrained drones on fedi to your posts"

- @meso@new.asbestos.cafe

"I HAVE ADDED YOU TO COMPU-TARD ADMIN FAG OF THE LEAGUE OF IRRELEVANT ANIME LOSERS IN MOMS BASEMENT

HAVE FUN DOWN THERE WITH GRAF"

- @freemayonnaise@noauthority.social

alts: @Suprememe@poa.st

🌅 Welcome to Delaware: The Magical Land of Paper Fortunes! 🌅

Have you ever dreamed of a vacation where absolutely nothing happens? Where scenic beaches, charming towns, and "maybe I've heard of that guy" landmarks sit proudly behind a shimmering wall of corporate tax wizardry? Well, my friend, welcome to Delaware — America's favorite filing cabinet!💼 The Business Paradise You Never Knew You Needed 💼In Delaware, our state bird is the Blue Hen, but our true mascot is the LLC — a majestic creature that reproduces faster than beach seagulls and requires just as little paperwork to manage. In fact, with more registered businesses than actual residents, Delaware is the destination for anyone who dreams of turning an air fryer side hustle into a full-fledged shell corporation!

Don't forget to visit Wilmington, the vibrant metropolis where skyscrapers rise proudly to house... absolutely no employees! Here, you'll find entire office buildings staffed by one guy named Doug whose job is to collect mail for 30,000 companies. Tourists love to snap selfies with our most iconic landmark: The Registered Agent's Desk — a modest folding table with six fax machines constantly spitting out tax documents.🏖️ Beaches Without the Crowds! (Because They’re in Maryland) 🏖️Our coastal town of Rehoboth Beach is perfect for those seeking sun, sand, and… uh… well, that’s about it! While Maryland's Ocean City teems with excitement, Rehoboth boasts a different kind of thrill: a picturesque boardwalk where you can ponder life’s deepest questions, like "What does DuPont actually do?"🍽️ Dining Delights 🍽️Craving world-class cuisine? Delaware has… a really nice Applebee’s. And if you're feeling fancy, we have three Wawas and a legendary Chick-fil-A that will almost make you forget you’re technically on a “vacation.”🚧 Adventures in Blandscape! 🚧Explore the breathtaking Route 1, a stretch of road famous for... uh... being a stretch of road. Or, if you're seeking excitement, visit Dover — home to Firefly Music Festival, where thousands of confused festival-goers stare at their GPS thinking they accidentally ended up in Maryland. (Spoiler alert: They did.)🌎 History, Sort Of! 🌎Did you know Delaware was the first state to ratify the Constitution? Neither does anyone else. But hey, if you’re a history buff who gets excited about mildly interesting trivia, we’ve got you covered! Our museum docents have truly mastered the art of feigned enthusiasm.🎯 Why Delaware? 🎯Whether you're a Fortune 500 CEO stashing profits like a pirate hoarding gold, or just a curious traveler hoping to cross off "Visit the State I Keep Forgetting Exists" from your bucket list — Delaware welcomes you!

Come for the tax breaks. Stay because you got lost on I-95.

Delaware: America's Best-Kept Secret... Because Nobody’s Looking.

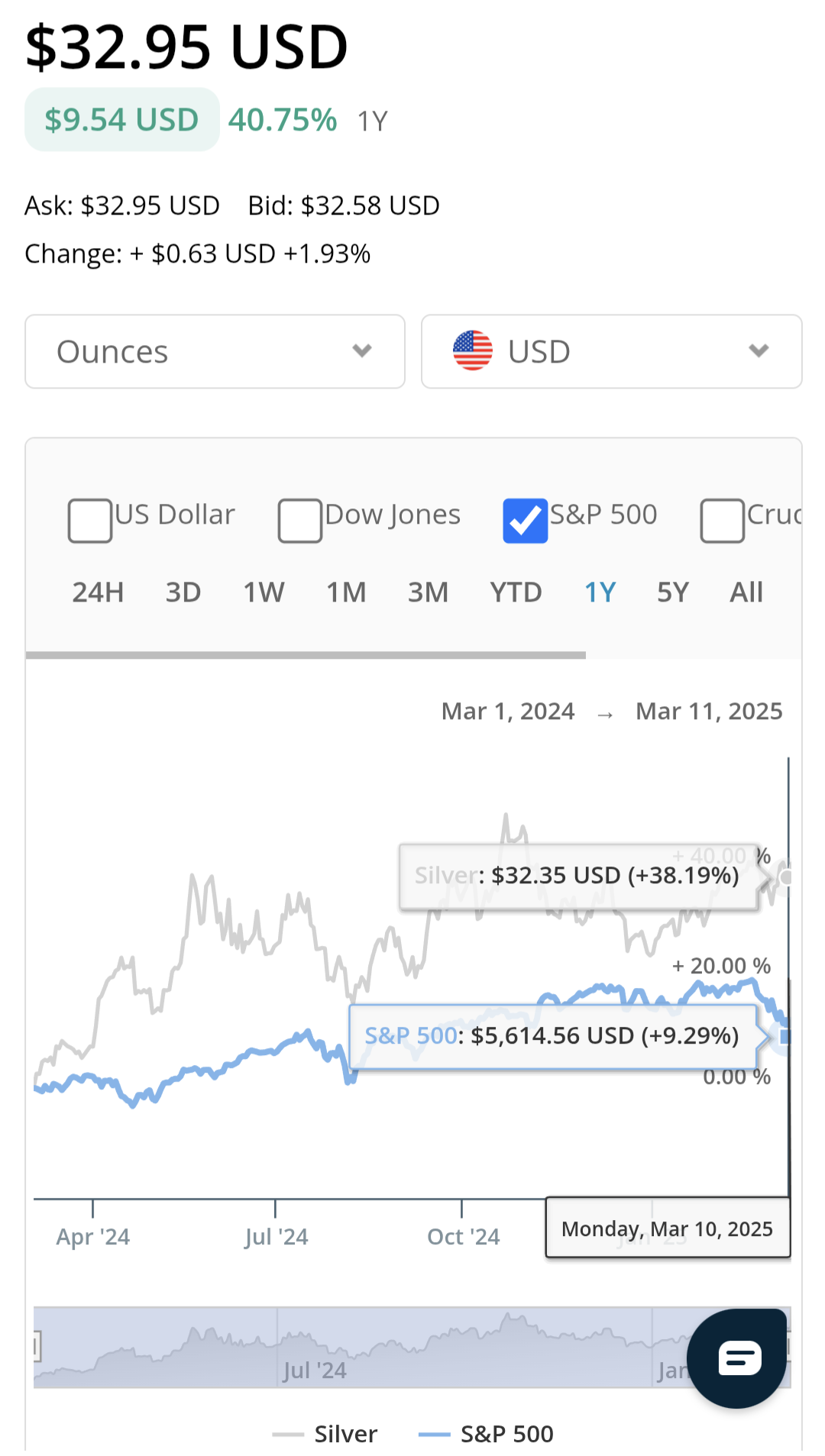

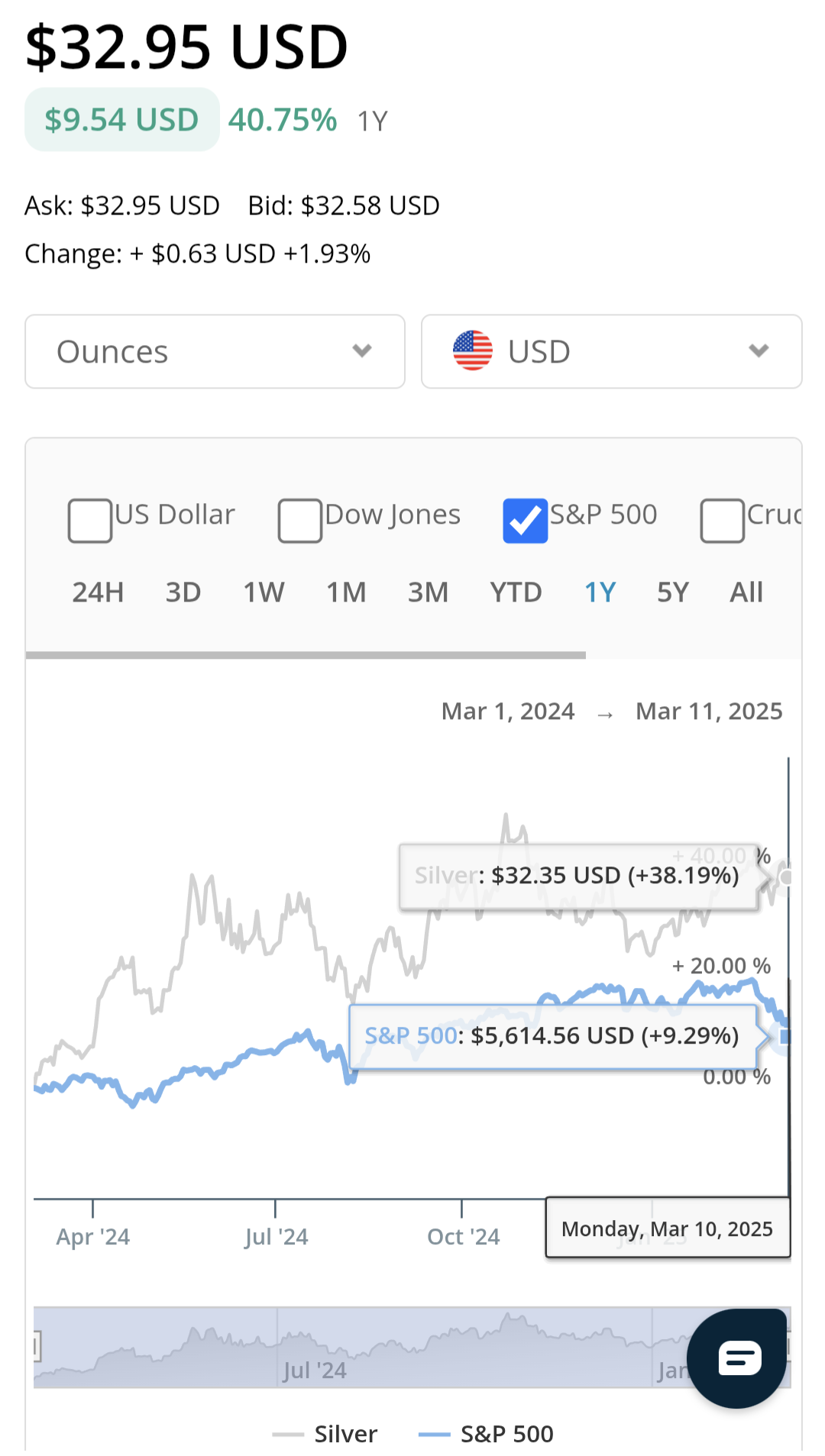

The virgin benchmark index vs the CHAD SHINY ROCK. How are those "yielding assets" working out for you now, 401kucks?

LIFEHACK: Underwater on your Cybertruck? Park it a block or two away from a Tesla dealership overnight and collect your insurance payout when a pack of feral trannies burn it.

Dunno why niggas be digging up my greatest hits from a year+ ago today, but I'm here for it. It's like I'm reading fresh bangers because I forgot I wrote them.

The Devtac Ronin is the only piece of expensive meme tacticool gear that I've ever actually kinda wanted. Closet thing on the market to a Halo Spartan helmet.

Dems be like "Why are you making fun of your guys? You're supposed to treat them like infallible gods descended from the heavens to walk among the lowly mortals."

View quoted note →

This total war between Hasan Piker and Ethan Klein has been so kino. I hope they irreparably destroy each other.

>tfw the smartest guy in your entire party is a brain damaged Cro-Magnon.

Damn that dastardly DOGE for...accidentally outing a CIA black site? Uh, based?

Check out this r/Atheism user that just thawed out of a block of ice from 2011.

View quoted note →

I bet if I emailed this shit to an investment banker I'd get hired on the spot.Name: The Synthetic Hydra CDO^∞ (Collateralized Derivative Obligation to Infinity)1. Underlying Reference Assets

Multi-Country Subprime Mortgages: Not just from one region—bundle up the shakiest mortgage loans from multiple countries with wildly different property laws, currencies, and economic backdrops (e.g., distressed suburban real estate in the U.S., overvalued condos in China’s ghost cities, and crumbling vacation properties in southern Europe).

Extremely Volatile Commodities: Include a basket of the most thinly traded commodities for maximum price whipsaws—think Venezuelan oil, niche rare-earth minerals used in obscure tech, and cocoa futures from unstable regions.

Cryptocurrency Variance Swaps: Instead of referencing the crypto prices themselves, reference the variance (the volatility squared) on an index of the most illiquid altcoins. This ensures the payoff is hypersensitive to any sudden price swing or “rug pull.”

Exotic Interest Rate Spread Options: A multi-curve setup that references everything from negative-interest bonds in Europe to onshore/offshore rates in emerging markets, where central bank policies are often contradictory and unpredictable.

Weather Catastrophe Triggers: For that added flash-crash potential, tie part of the contract’s payout to parametric weather insurance triggers—hurricanes, earthquakes, floods, etc., in the most climate-exposed regions. Because why not blend in unhedgeable acts of God?2. Structure & Tranching

Super-Equity Tranche (a.k.a. “The Abyss”)

The first-loss tranche, which is levered 10:1 on the entire reference pool. It gets wiped out with even a minor deterioration in any of the underlying assets. High-coupon if it survives, but the coupon is funded by further debt issuance—meaning it’s basically paying investors with newly borrowed money.

Inverse-Mezzanine Tranche

This strange “middle” layer gains massively if a certain correlation threshold increases between the assets, but also has an embedded knock-in/knock-out feature if correlation falls below a different threshold. The result is so confusing that no one can properly hedge it.

Synthetic AAA “Double-Magic” Tranche

Ostensibly “safe” but actually uses a labyrinth of credit default swaps on counterparties that are themselves leveraged 20:1. As soon as one counterparty hits a margin trigger, a cascade of cross-default events automatically “flips” the AAA notes into equity positions in all the underlying assets—forcing the once “risk-free” investor to hold illiquid, defaulted Venezuelan oil futures and foreclosed condos on the outskirts of Miami.3. Leverage & Funding

Recursive SPVs (Special Purpose Vehicles)

Each SPV invests in multiple other SPVs, which in turn invest in each other, producing a nearly impossible to untangle daisy-chain. When one defaults, it triggers an avalanche of forced liquidations across the entire network.

Margin-On-Margin Feature

On top of the typical margin lending, the Hydra CDO^∞ issues another layer of margin on top of the existing margin lines. This double-layered margin is so opaque and unregulated that the notional can skyrocket well beyond the value of the underlying assets.

Trigger-Happy Collateral Calls

If any underlying reference asset experiences a 5% daily price swing (which happens daily in thinly traded markets), it triggers a collateral call that must be satisfied within an hour—or else automatic liquidation occurs, sending shockwaves across all counterparties.4. Coupon Payout Formula

Path-Dependent, Correlation-Linked, and Barrier-Option-Packed

Each monthly payout depends on a multi-factor formula combining (1) realized volatility on altcoins, (2) rolling default rates on the mortgages, (3) commodity price percentile ranks, and (4) whether certain “catastrophe triggers” have occurred.

If a threshold is hit (say, a hurricane in Florida or an earthquake in Japan), the coupon doubles.

If a second threshold is hit (such as crypto variance spiking above some huge level), all the coupons from prior months must be repaid (a “clawback” feature).

If the correlation among any two sub-portfolios crosses a certain boundary, the entire derivative is re-struck at a new notional that might be 150% of the original, with fresh capital required by all participants immediately.

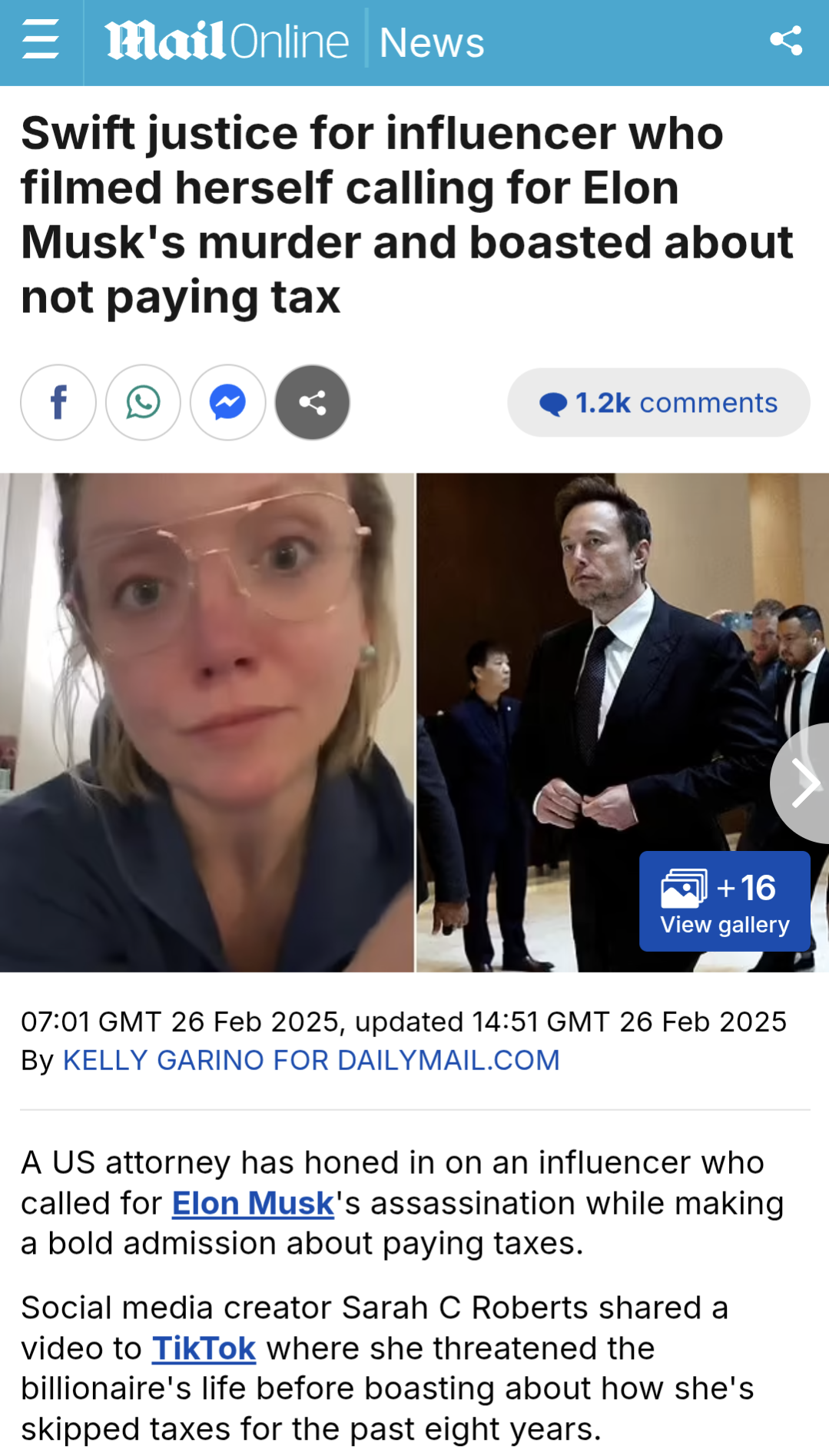

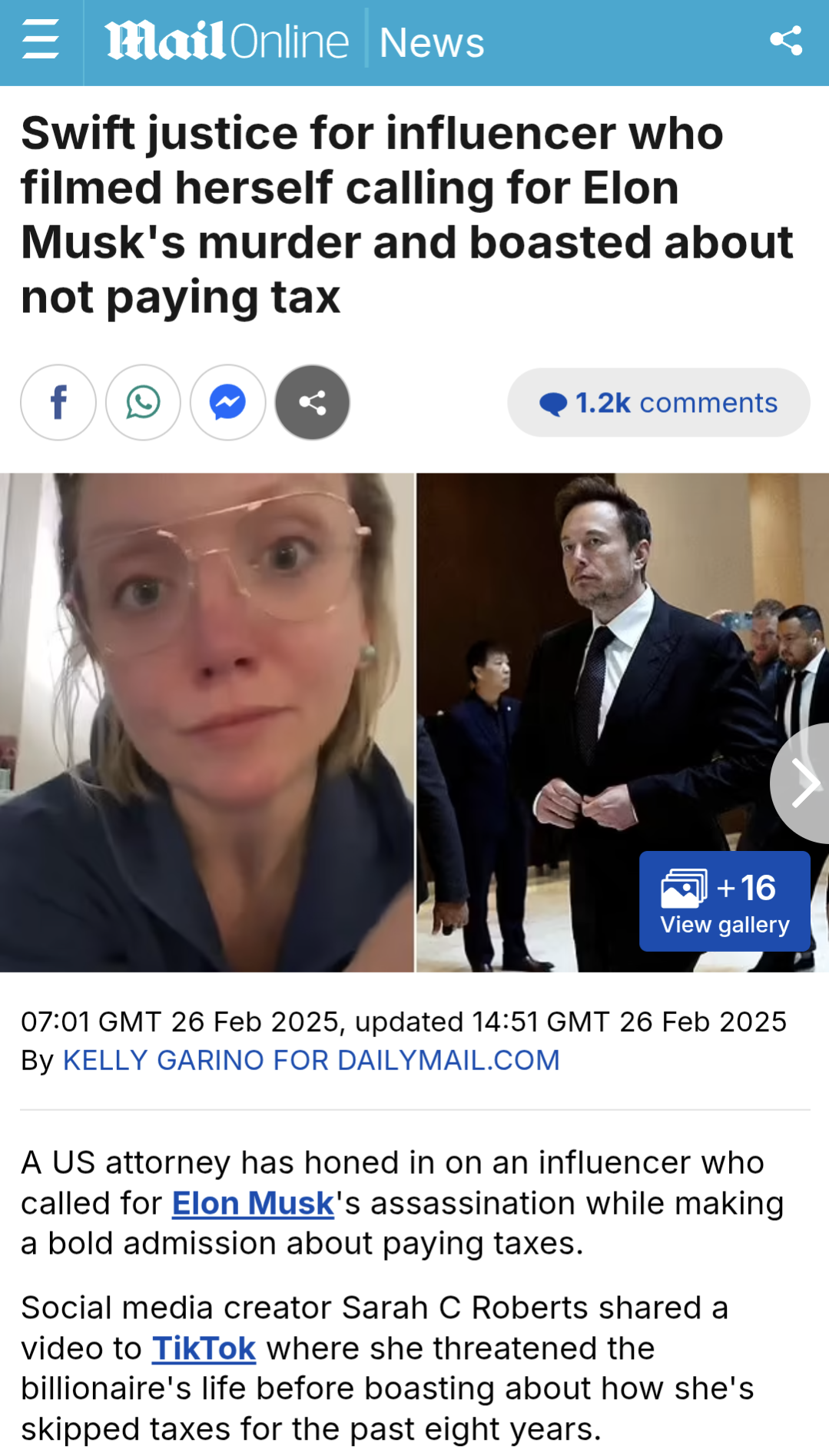

>Evade taxes.

>Fedpost because other people's taxes aren't being spent on your bullshit causes anymore.

:marseyfoidretard:

Try it, faggot.

View quoted note →

My nigga Barron is stone cold. Made an example out of this uppity foid real quick.

Both you and the rest of shitlib kind should stop acting as if you support a concept that you very clearly do not actually endorse, it's cringe. I'll admit I don't give a fuck about my enemies' freedom of speech, straight up. I see no need to pretend.

View quoted note →

>At least 15 women are backing up the claims of one of Destiny's accusers.

Wooooah buddy...Steven, I don't know how much streamer money you're rolling in, but if all these women are victims of your revenge porn, that could be $250k a pop in restitution. I don't think you're that rich, pal. The Day of the Job Application looms for your midget ass.

If Elon didn't have a fetish for H1B replacement I might actually be tempted to give into his cult. It's a shame, really. The reckoning he's giving the government is legendary stuff, but the Ws are always spoiled by that rancid curry-flavored aftertaste.