Buy the Dip.

Sats are cheaper.

BHAVIK

bhavik@nostrplebs.com

npub10hcs...f8fn

Bitcoin Hub

https://youtube.com/@inbitcoinhub

Unboxing Bitcoin (Hindi)

https://youtube.com/@UnboxingBitcoin

https://satsconverter.vercel.app/

https://priceofbitcoin.vercel.app/

Bitcoin’s Unique Self-Regulation: Proof-of-Work and Difficulty Adjustment

Bitcoin stands apart in the cryptocurrency landscape due to its ingenious combination of Proof-of-Work (PoW) and difficulty adjustment, which together form a self-regulated, decentralized system. This design ensures Bitcoin remains secure, predictable, and resilient over time, making it the foundation of the cryptocurrency ecosystem.

Proof-of-Work: The Core of Bitcoin’s Security

At the heart of Bitcoin’s protocol is the Proof-of-Work (PoW) consensus mechanism. PoW enables decentralized decision-making by allowing miners to compete in solving complex mathematical puzzles. The miner who solves the puzzle first earns the right to add a new block to the blockchain and receives Bitcoin as a reward. This process ensures that the network achieves consensus without requiring a central authority, making Bitcoin truly decentralized.

The energy-intensive nature of PoW is a critical feature, not a flaw. By requiring miners to expend significant computational power, Bitcoin’s network becomes extremely secure. For instance, Bitcoin’s current hash rate has reached an astounding 800 exahashes per second (EH/s), demonstrating the immense computational power backing the network. This hash rate, which fluctuates based on miner activity, is powered by approximately 20–25 gigawatts (GW) of electricity, enough to power several small countries.

The hash rate can increase or decrease depending on various factors, such as the price of Bitcoin, the cost of electricity, and mining hardware efficiency. When Bitcoin’s price rises, mining becomes more profitable, leading more miners to join the network and increasing the hash rate. Conversely, if mining costs (e.g., electricity or hardware expenses) outweigh potential profits, miners may leave, reducing the hash rate. Despite these fluctuations, Bitcoin’s protocol ensures stability through its difficulty adjustment mechanism.

Difficulty Adjustment: Bitcoin’s Self-Regulating Mechanism

Complementing PoW is Bitcoin’s difficulty adjustment, a feature that ensures the system remains stable and predictable regardless of external factors. Bitcoin’s protocol is designed to produce a block every 10 minutes on average, maintaining a consistent issuance rate.

If miners increase their computational power, causing blocks to be mined too quickly, the network automatically increases the difficulty of the PoW puzzles. Conversely, if miners leave the network, the difficulty decreases, making it easier to mine blocks. This adjustment occurs approximately every 2016 blocks (about two weeks), allowing Bitcoin to adapt to changes in hash power without human intervention.

The difficulty adjustment is essential for preserving Bitcoin’s economic model. By keeping block production steady, it aligns the network’s supply schedule with its hard cap of 21 million coins. This ensures that Bitcoin remains a deflationary asset, with a predictable issuance rate that is unaffected by external economic pressures.

The Unique Combination of PoW and Difficulty Adjustment

The synergy between PoW and difficulty adjustment makes Bitcoin unparalleled in the cryptocurrency space. Together, these mechanisms eliminate the need for centralized control, creating a truly autonomous system. Unlike other cryptocurrencies that rely on alternative consensus mechanisms like Proof-of-Stake, Bitcoin’s combination of PoW and difficulty adjustment provides unmatched robustness and resilience.

Furthermore, Bitcoin’s difficulty adjustment ensures long-term viability. As the network evolves and miners join or leave, this feature keeps the blockchain functional, ensuring that the system continues to operate smoothly until the last Bitcoin is mined around the year 2140.

Conclusion

Bitcoin’s Proof-of-Work and difficulty adjustment are the foundation of its uniqueness and success. These mechanisms ensure decentralization, security, and predictability, enabling Bitcoin to operate independently and self-regulate without the need for external intervention. With a hash rate of 800 EH/s and electricity usage of 20–25 GW, Bitcoin demonstrates the immense power behind its network. Its ability to adapt to market forces like miner profitability and Bitcoin price further underscores its resilience. This innovative design has established Bitcoin as the gold standard of cryptocurrencies, setting it apart from other digital assets and solidifying its role as a revolutionary form of money.

#bitcoin

#cryptocurrency

#pow

#work

#future

Credit - @Stack Hodler

This week insurance companies watched the value of their bond portfolios plummet at the same time that some of the most expensive real estate in the country burned to a crisp.

Insurers are looking at losses of at least $20 Billion.

This is why a lot of insurance companies have simply stopped providing coverage in California.

But if you can't get insurance for your home, you can't get a mortgage from a bank.

And neither can a potential buyer for your property.

What does that mean for property values?

And the banks that really own these properties?

The days of balance sheets being primarily packed full of real estate and sovereign debt are coming to an end.

You can't live in a Bitcoin.

But it will never burn to the ground or be endlessly devalued by a government either.

No doubt many insurance companies and banks are understanding the value of such an asset this week.

“A lodging of a wayfaring men”

Cypherpunk Novel.  View quoted note →

View quoted note →

View quoted note →

View quoted note →A beautiful excerpt from the book “A LODGING OF A WAYFARING MEN”

#freedom

#trade

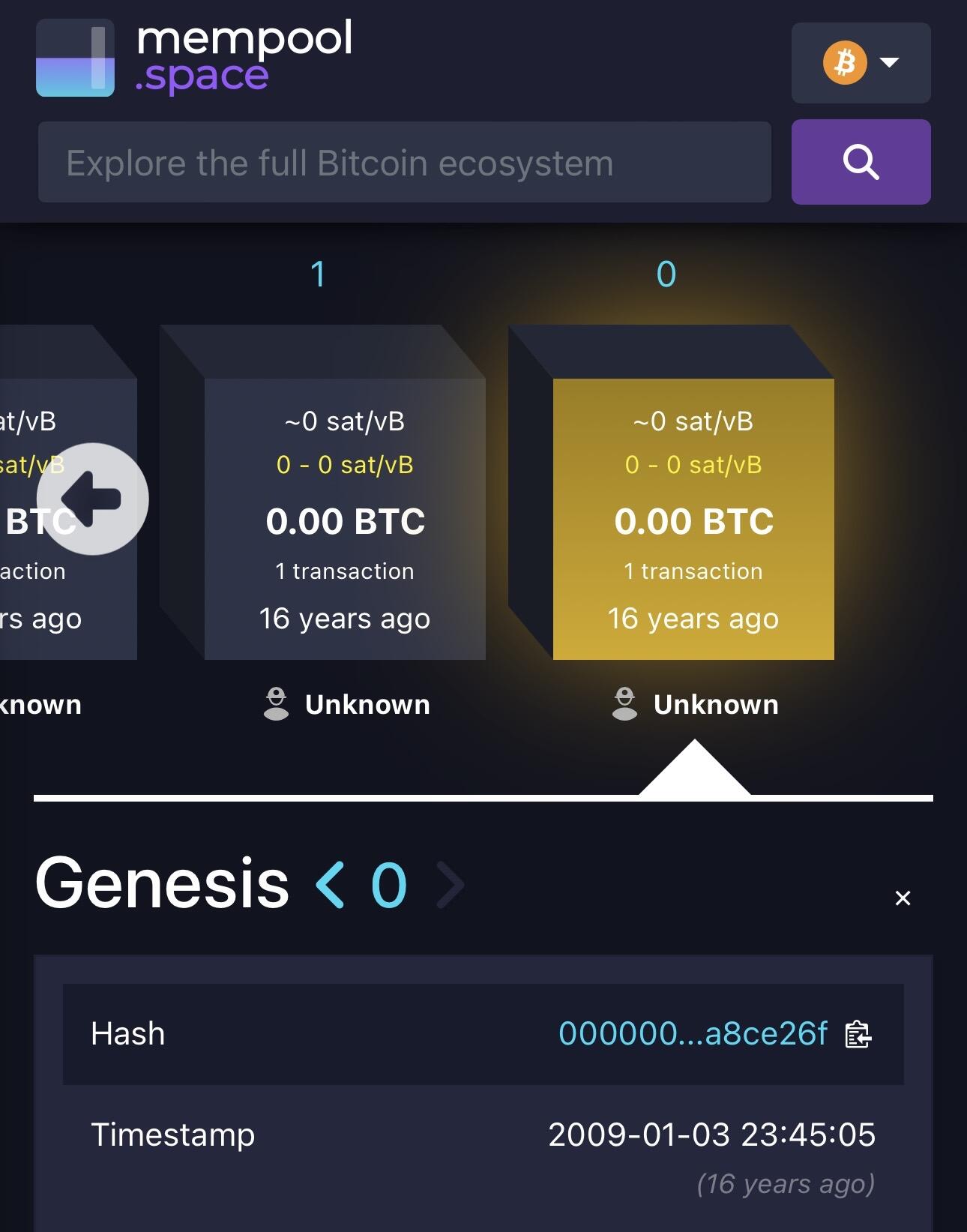

Happy 16th Birthday Bitcoin.

1st #bitcoin block called Genesis block was mined on 3rd January 2009, 16 years ago.

Karmageddon by Iyah may

Throughout history, humans have overcome scarcity through creativity, innovation, and cooperation, transforming limited resources into abundant possibilities. Today, a revolutionary tool—Bitcoin—offers humanity a chance to tackle scarcity, inequality, and control in ways that align with both economic and spiritual principles. With its fixed supply, decentralized structure, and censorship-resistant nature, Bitcoin represents a shift not only in how we trade value but in how we perceive abundance and human potential.

The Genesis of Scarcity and Control

Scarcity has always been a fundamental challenge for humanity. However, the scarcity we face today often isn’t natural—it is engineered by centralized systems that prioritize control over creativity.

• Fiat currencies, controlled by governments and central banks, are subject to manipulation through inflation, eroding the value of hard-earned savings.

• Gatekeepers in financial systems restrict access to wealth creation, leaving billions unbanked and marginalized.

At the root of these problems lies ego-driven control, where a select few dictate the rules for the majority, leading to inequality, inefficiency, and disempowerment.

Bitcoin: A Breakthrough for Abundance

Bitcoin disrupts this cycle of scarcity and control by introducing a fundamentally different approach to money and value. Here’s how:

1. A Fixed Supply: A New Standard of Value

Bitcoin’s supply is capped at 21 million coins, with each Bitcoin divisible into 100 million Satoshis. This ensures that Bitcoin cannot be debased like fiat currencies.

• Unlike inflationary systems, Bitcoin preserves the value of labor over time. When people save and trade in Bitcoin, they are not at the mercy of central banks printing money at will.

• This predictability fosters long-term thinking and financial security, enabling individuals to plan, save, and build wealth sustainably.

2. Decentralization: Empowering the Marginalized

Bitcoin’s decentralized network operates without intermediaries or gatekeepers. It allows anyone with internet access to participate in the global economy.

• For the unbanked: Bitcoin offers financial inclusion, providing people in developing regions a means to save and transact securely.

• For innovators: Bitcoin removes barriers to entry, enabling creators and entrepreneurs to access global markets directly.

3. Censorship Resistance: Freedom to Trade

Bitcoin transactions are permissionless and censorship-resistant, ensuring that no government or corporation can block or seize an individual’s wealth.

• This feature empowers individuals to trade freely, even in politically unstable or authoritarian environments, fostering economic resilience and personal sovereignty.

4. Fairness and Equality

Bitcoin’s decentralized and transparent nature ensures that power is distributed rather than concentrated.

• No central authority can manipulate Bitcoin’s supply or enforce biased policies. This levels the playing field, allowing ordinary people to save and grow their wealth without needing access to exclusive investment opportunities like stocks or real estate.

Tackling Ego and Control

Bitcoin not only disrupts systems of control but also addresses the deeper issue: ego-driven domination. Ego thrives on centralized power, and Bitcoin’s trustless system removes the need for intermediaries who abuse their authority.

• Transparency: Bitcoin’s blockchain is fully open, ensuring accountability and preventing manipulative practices.

• Cooperation: The Bitcoin network incentivizes participants to work together rather than exploit one another, aligning with spiritual principles of collective well-being.

By decentralizing power, Bitcoin reduces the influence of those who seek control for personal gain, creating space for fairness, creativity, and innovation to flourish.

A Future of Abundance with Bitcoin

1. Redefining Wealth

Bitcoin reintroduces the concept of hard money, where value stems from scarcity and trust. In a Bitcoin-driven economy:

• Wealth is preserved over time, empowering individuals to focus on producing value rather than chasing returns to outpace inflation.

• Savings become accessible to everyone, fostering financial security across all socio-economic classes.

2. Global Inclusion and Innovation

Bitcoin unlocks untapped human potential by providing access to financial systems for billions of unbanked people.

• Innovators from remote regions can participate in global markets, driving progress in technology, healthcare, and education.

• The sharing of ideas and resources creates a borderless economy, where collaboration replaces competition.

3. Spiritual Growth and Harmony

Bitcoin aligns with spiritual principles of abundance, equality, and freedom:

• Ego-driven systems collapse: Without central authorities, humanity moves away from domination and toward cooperation.

• Focus on purpose: Freed from the oppression of financial instability, individuals can channel their energy into creativity, service, and personal growth.

4. A World of Peace and Freedom

With Bitcoin, financial oppression and inflationary theft become relics of the past. By enabling sovereign wealth and transparent systems, Bitcoin reduces conflicts driven by power struggles over monetary control.

The Vision: A Decentralized Utopia

Imagine a world where:

• A farmer in Africa saves in Bitcoin, bypassing inflation and corrupt banking systems.

• An artist in Asia sells digital art globally, receiving payment instantly in Bitcoin.

• A programmer in South America collaborates with peers worldwide, contributing to projects that redefine industries.

This is a future where wealth creation is decentralized and meritocratic, free from the artificial barriers imposed by centralized authorities. It’s a world where humanity moves closer to its higher potential, creating abundance not just economically, but spiritually.

Conclusion

Bitcoin is more than a currency—it’s a revolution. It offers humanity a chance to dismantle systems of scarcity and control, replacing them with fairness, freedom, and abundance. By trading their labor for Bitcoin, individuals take ownership of their wealth and sovereignty, paving the way for a decentralized future where creativity and cooperation thrive.

In this new paradigm, Bitcoin is not just a tool for financial empowerment—it’s a catalyst for humanity’s spiritual awakening and collective evolution. As ego-driven systems crumble, Bitcoin guides us toward a future rooted in trust, equality, and infinite possibilities.

#bitcoin #ego #freedom

Couldn’t stop myself to share this with my #nostr followers.

Exclusively for Nostrians🥰

Credit- Peter St Onge

#economy

99.99875% of the 8 Billion people don’t understand what this image says.

DON’T YOU THINK WE ARE SUPER (MILLION TIMES MORE) EARLY?  View quoted note →

View quoted note →

View quoted note →

View quoted note →I AM TELLING YOU AGAIN, EVEN AFTER 16 YEARS OF #bitcoin WE ARE

SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER

SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER

SUPER SUPER SUPER SUPER SUPER SUPER

EARLY

Edited the meme #bitcoin 🤪

Nikola Tesla to Walter Russel about his book “The Universal One”.

#universe

#tesla

Get on the #bitcon standard and then do this👇

Fiat dead companies are rising on a Bitcoin Standard.

First Indian public company to have Bitcoin on the balance sheet.

Market cap jumped from ₹380 Million to ₹650 Million, adding ₹270 Million to the market cap.

Company owns 12 Bitcoin worth of ₹108 Million.

Trading at 6 mNaV.

JetKing.

My cat loves to be near a basil plant.

❤️🥰

“Asymptotically Perfect: How #Bitcoin Realizes John Nash’s Vision”

-Bhavik

Bitcoin represents a revolutionary convergence of ideas, many of which trace their origins to principles discussed by thinkers like John Nash and schools of thought like Austrian economics. Let’s dive into these interconnected topics:

1. Bitcoin: The Realization of Ideal #Money

Bitcoin embodies the concept of ideal money—a form of money that is resistant to manipulation, inflationary policies, and centralized control. It offers:

• Decentralisation: No central authority controls Bitcoin; its governance relies on a distributed network.

• Fixed Supply: The 21 million cap on Bitcoin ensures #scarcity, addressing inflationary pressures seen in fiat currencies.

• Transparency: The blockchain ensures trustless verification and immutability.

• Global Neutrality: Bitcoin transcends borders and ideologies, offering a universal monetary protocol.

2. John Nash’s “Ideal Money”

John #Nash, in his 2002 paper Ideal Money, described the characteristics of a currency that could maintain stable value and universal acceptance:

• Stable Value: Nash suggested that ideal money would be measured against a universal standard (like a basket of commodities) rather than being subject to inflationary monetary policies.

• Trustless Stability: Unlike fiat currencies, which are subject to government manipulation, ideal money would incentivize stability and global cooperation.

Nash envisioned that asymptotically ideal money would emerge in a free-market environment where incentives push competing monetary systems toward increasingly stable and universally desirable characteristics.

Bitcoin mirrors many of Nash’s ideas:

• Its limited supply prevents inflation.

• Its decentralized protocol creates a system immune to arbitrary tampering.

• Its acceptance grows asymptotically as more people recognize its value as a neutral monetary standard.

3. Nash Equilibrium and Bitcoin

The Nash equilibrium—a fundamental concept in game theory—occurs when individuals in a system choose strategies that maximize their outcomes given the choices of others. Applied to Bitcoin:

• #Mining: Miners must collaborate (to secure the network) while competing (for block rewards). The equilibrium lies in adhering to Bitcoin’s rules; deviating (e.g., creating invalid blocks) results in economic penalties.

• Adoption: As more people adopt Bitcoin, others are incentivized to do the same, creating a positive feedback loop. This aligns individual incentives with collective outcomes, enhancing Bitcoin’s network effects.

4. Asymptotically Ideal Money and Bitcoin

Nash argued that the concept of ideal money could evolve asymptotically—approaching perfection over time as monetary systems are refined through competition and market forces. Bitcoin fits this model:

• Constant Refinement: Its protocol evolves cautiously via decentralized consensus, ensuring gradual improvements without compromising stability.

• Global Competition: Competing fiat systems, once threatened by Bitcoin’s principles, might adopt sound monetary policies to remain relevant. This creates a competitive dynamic that gradually pushes global currencies closer to an “ideal” state.

5. Free Markets and Incentives

Bitcoin aligns with the principles of free-market economics by:

• Decentralizing Control: It removes monetary authority from centralized institutions, empowering individuals.

• Incentivizing Good Behavior: Miners are rewarded for maintaining the network, and users benefit from holding and transacting in a scarce, deflationary asset.

• Enabling Choice: It offers an alternative to fiat, allowing individuals to opt out of manipulated systems.

Austrian economics highlights the role of incentives and market forces in shaping optimal outcomes. Bitcoin’s design—driven by incentives rather than coercion—reflects these principles:

• It uses economic incentives (block rewards, transaction fees) to secure its network.

• It creates trust through transparency and competition rather than centralized oversight.

6. #Austrian Economics and Bitcoin

Austrian economics emphasizes individual liberty, free markets, and the rejection of central planning. Key Austrian principles reflected in Bitcoin include:

• Sound Money: Austrians advocate for money backed by intrinsic value or scarcity. Bitcoin’s fixed supply addresses this ideal better than fiat systems.

• Decentralization: Austrians distrust central banks and government intervention. Bitcoin operates independently of centralized institutions.

• Market-Driven Adoption: Austrian economists argue that markets—not governments—should determine what constitutes money. Bitcoin’s organic adoption illustrates this principle in action.

7. Bitcoin and the Future of Incentive Structures

Bitcoin fundamentally shifts global incentives:

• Wealth Storage: It allows ordinary individuals to store wealth securely without needing access to elite financial instruments like real estate or stocks.

• Global Collaboration: Its borderless nature fosters cooperation beyond national boundaries.

• Innovation: Bitcoin’s open-source model encourages innovation in financial technology, driving efficiency and inclusivity.

#Enlightenment Through Synthesis

Bitcoin is not just a digital asset; it’s a philosophical and economic movement:

• John Nash’s Vision: Bitcoin approaches the idea of ideal money through its stability, universality, and resistance to manipulation.

• Nash Equilibrium: It aligns individual incentives to secure the network and expand adoption.

• Austrian Economics: Bitcoin realizes the Austrian ideals of sound money and free-market monetary systems.

• Asymptotic Growth: As Bitcoin adoption spreads and monetary policies compete, it pushes humanity closer to a stable, universally accepted monetary standard.

Bitcoin is, in essence, a synthesis of these timeless ideas—a testament to the power of incentives, free markets, and the human desire for liberty.

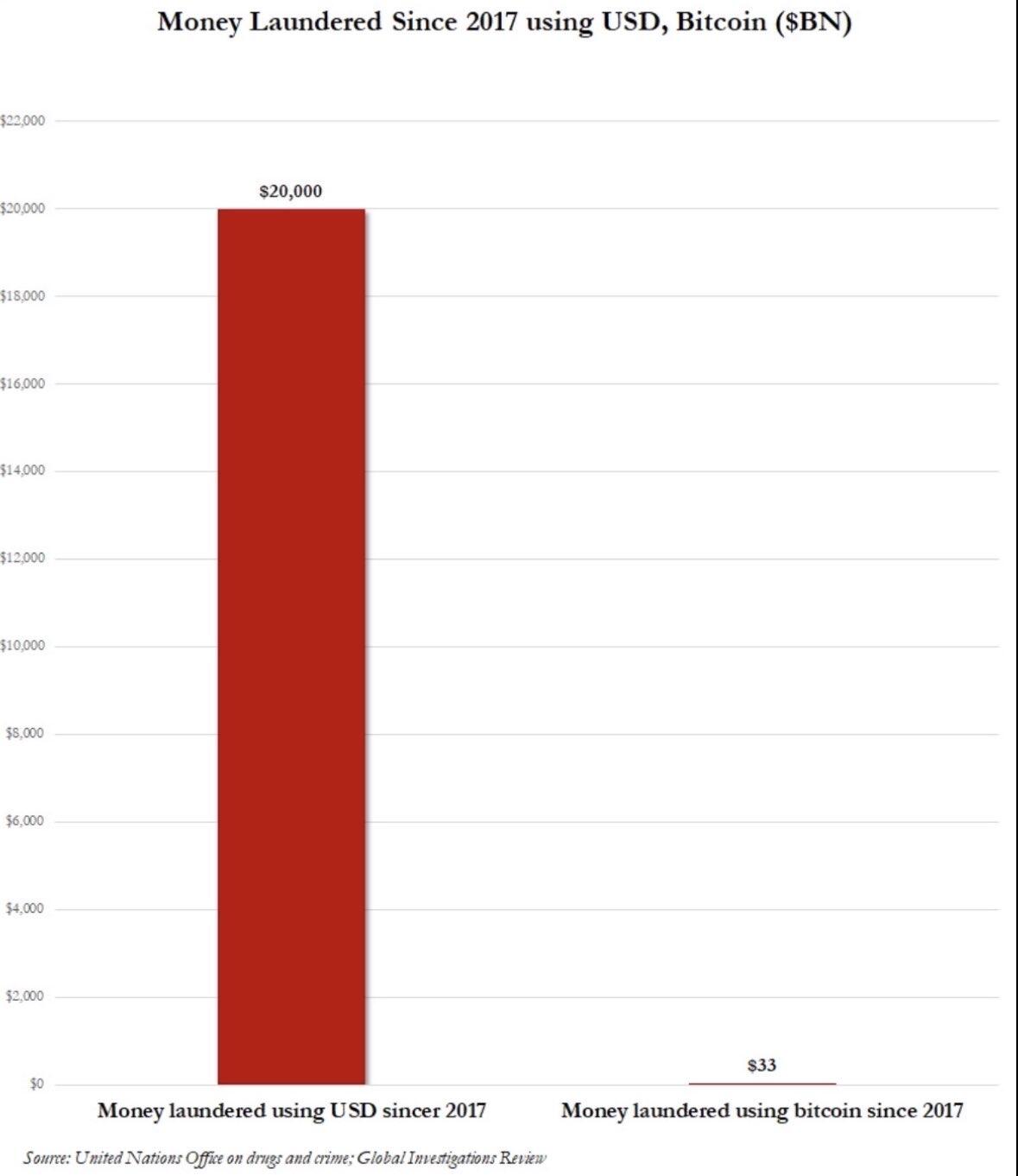

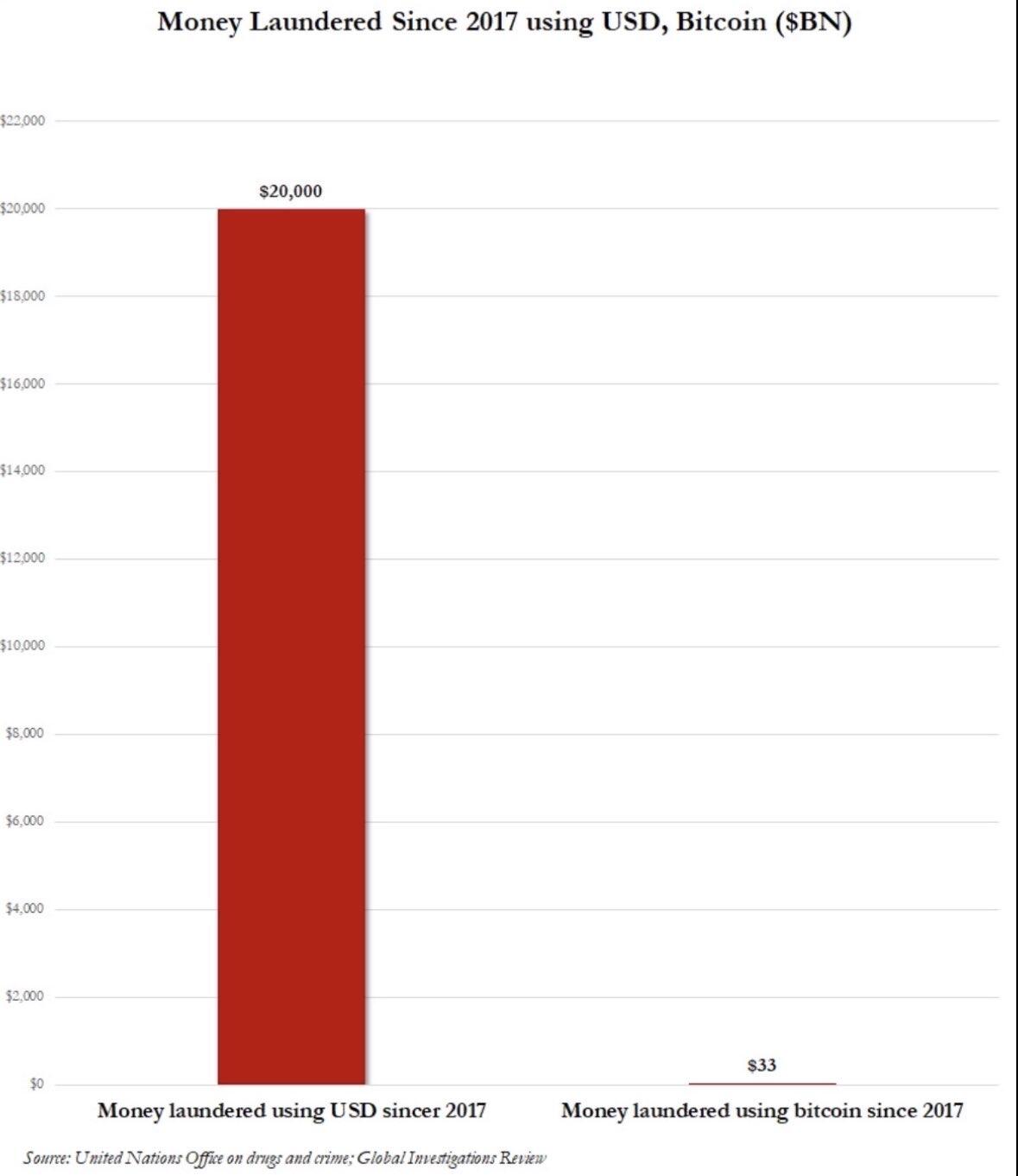

#bitcoin is for money laundering!

Cash transportation vehicle going to load some cash into ATM somewhere in 🇮🇳 INDIA.

Vs.

The network timestamps transactions by hashing them into an ongoing chain of hash-based proof-of-work, forming a record that cannot be changed without redoing the proof-of-work.

One is closed monopoly, non transparent, runs by mafia(you know them!) and manipulative tactics. Other is open, run by everybody, transparent, runs on Proof-Of-Work with energy.

Choose wisely.

🫵🏻😎