If you listened to the maxis and stacked #BTC as hard as possible through the deepest part of the bear market (even if you started during the bull), you have not only outperformed every other investment strategy on earth by a wide margin (except perhaps 100% long $NVDA), you are very likely sitting on a stack of #bitcoin that you could not reasonably afford today. Perhaps multiples of your current income.

This is why the tradfi big brain financial commentator types are fighting #bitcoin .

It not only obsoletes them, it obsoletes them in spectacular fashion.

They are Kodak seething at the digital camera.

MAX ₿⚡️丰

max@nostr.pt

npub10fe0...d2p2

Orange pilled 🟠 & wordsmithed ✍️ I share #Bitcoin stories & insights on Nostr. Help me keep the sats flowing with a Lightning tip! (LN address & QR code in bio) #BitcoinContent #NostrTips #HodlerLife #Lightning

Edward Snowden says "#Bitcoin is the most significant monetary advance since the creation of coinage."

"#Bitcoin " google search trends worldwide, top 10 countries who most searched "#Bitcoin ":

- El Salvador (6.3 mil pop)

- Nigeria (213 mil. Pop)

- Brazil (214 mil. Pop)

- Netherlands(17.5 mil pop)

- Switzerland(8.7 mil pop)

- Austria 8.9 m

- Slovenia

- Germany

- Canada

- Czechia

Banks sent SEC a letter asking to change digital asset guidance because they want easier access to holding bitcoin.

ETF holders will be stronger hands than we are used to because they will largely substitute for people who would otherwise have kept their #BTC on exchanges, but won’t be getting daily bull market push notifications from @coinbase encouraging them to rotate profits into some illiquid “top mover” shitcoin scam.

This also means we will have a much less significant “alt season,”which was an artifact of volume-incentivized shitcoin casinos.

Here's the current progress of #Bitcoin becoming the most valuable asset on Earth:

Gold Market Cap

$13.60 trillion vs. $1.01 trillion

▓░░░░░░░░░░░░░░ 7%

Upside: 13x

Global Equities

$99.38 trillion vs. $1.01 trillion

░░░░░░░░░░░░░░░ 1%

Upside: 98x

Global Net Worth

$498.8 trillion vs. $1.01 trillion

░░░░░░░░░░░░░░░ 0.2%

Upside: 494x

Why are crypto ponzis always related to new stablecoins? A long post.

▫️ Buy 1 ETH for $3,000

▫️ Stake ETH into stETH

▫️ Turn stETH into wstETH

▫️ Use wstETH to mint mkUSD

▫️ Use mkUSD to borrow more ETH

▫️ Stake ETH into stETH...

This is how you create magic money and turn 3k into 30k. You double, triple, quadruple count the same collateral aka leverage it.

DeFi's total market cap pumps dozens of billions overnight in a bull market and also crashes 90% in a bear market because of it.

It's all FAKE money.

You create more "money" from nothing and stablecoins are a key ingredient in that recipe. They allow you to leverage up, fast.

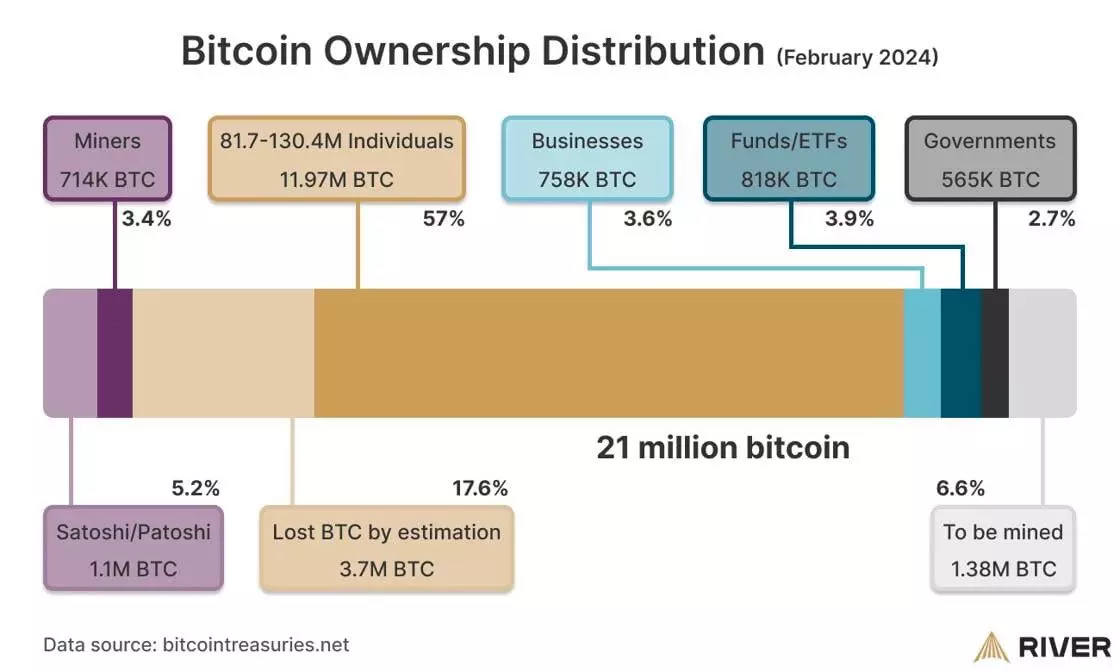

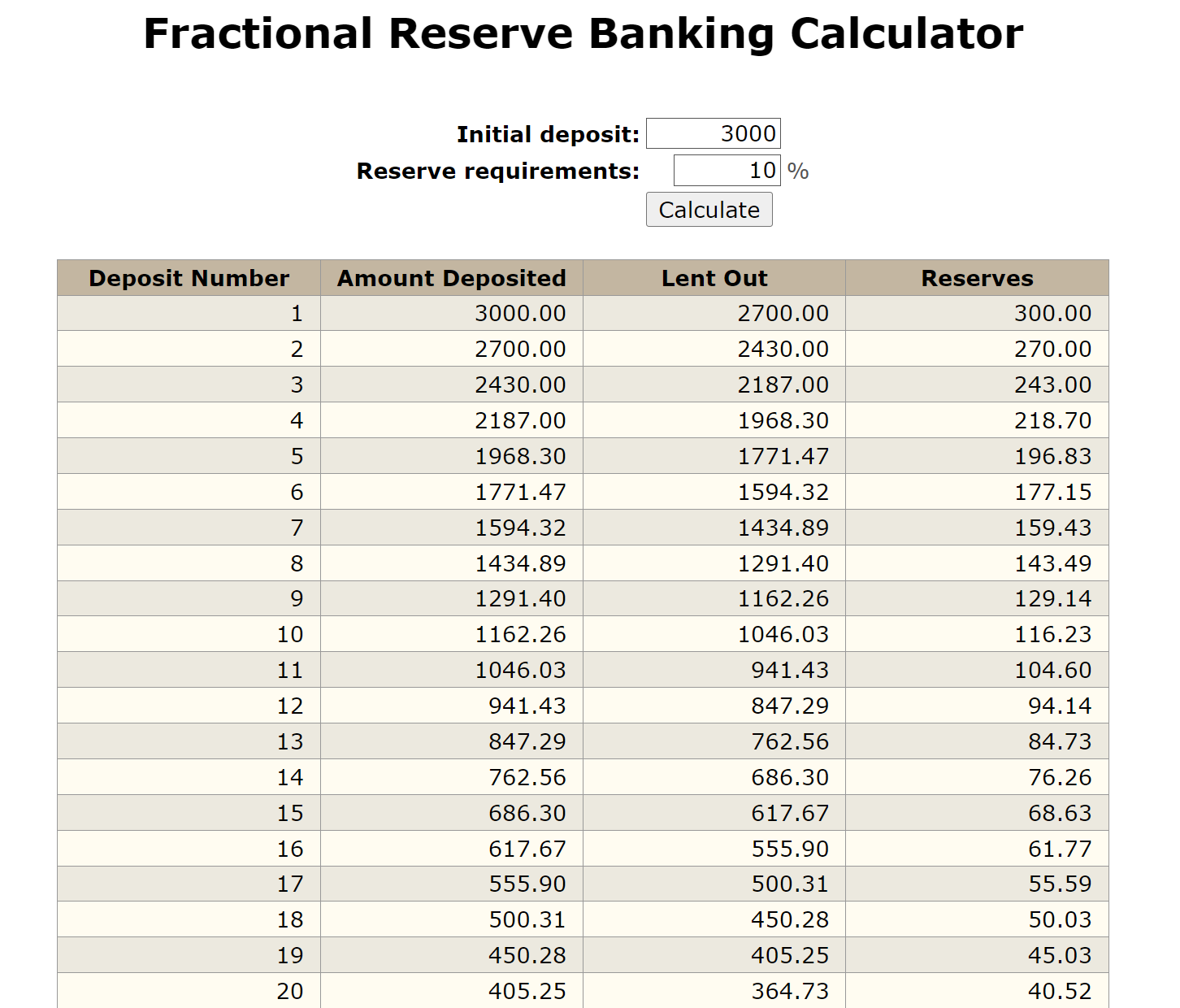

This is no different than fractional reserve banking where your $3,000 bank deposit turns into $29,999 new money created from thin air.

To achieve such a feat, it takes 100 cycles of deposits. See my picture.

Crypto never reaches 100 cycles, because the bubble bursts sooner rather than later.

Fiat "economists" even call this process a "business cycle". A more appropriate name is a bubble driven by ponzinomics and irresponsible money creation due to greed.

If you read crypto twitter, you will see people talk about liquid staked tokens (LST like stETH) and liquid re-staking tokens (LRTs like reETH) as the next best thing in crypto since sliced bread.

WRONG.

It's the next big bubble or ponzi. EigenLayer should not excite you, it should WORRY you!

If you seek an alternative view, then hit a follow

@du09btc

to stay updated as this bubble develops.

Once you start seeing this "amazing" new LRT token being used to mint stablecoins on your X feed know that the bubble is about to reach its peak.

The higher the market cap of those new shinny stablecoins backed by LRTs tokens, the bigger the bubble.

Remember, $3,000 is the actual collateral for $30,000! That's a 10x leverage.

If ETH is 3k and it crashes by 10% or $300, the bubble deflates by 3k! That's 3k gone in your new shiny LRT stablecoin!

Such stablecoins will go to zero in the worst case scenario. This is how a liquidation cascade starts and panic begins.

Why does this concern me?

Because it will hurt native ETH holders that don't even stake their ETH. Picture this.

Let's say the LRT bubble grows to $50 billion. Actual backing? $5 billion in ETH or even less.

How exactly can $50 billion exit or sell at a profit using $5 billion of ETH collateral?

It can't.

What happens next is people get wiped out. LST and LRT tokens crash vs ETH's price by 10%, 50% or more. Any stables backed by LST/LRT tokens depeg and crash even more.

In the process, as $50 billion of fake money wants to exit, it will drag down ETH's price beyond a normal correction or crash. ETH is the liquidity of last resort for LST/LRT tokens.

Worse. It will drag down BTC's price as well. Because people will become DESPERATE to exit at ALL costs, even if they lose 50% of their money or more. BTC is the liquidity of last resort in crypto, just like the Fed for USD.

This is why bear markets are BRUTAL. They correct such imbalances. They are necessary and do well to punish such greed.

Don't believe me?

Have you heard of Blast L2? That's an ENTIRE network that will use LST tokens and stablecoins backed by LSTs to give its users "native yield".

Those users have no idea what's coming in the next two years and they deposited BILLIONS on Blast L2.

Projects always seek to create more yield to attract users, but that comes at the risk of an entire network like Blast going insolvent if they don't control their greed.

Do you trust them to put breaks on making free money?

In the last crypto cycle, Terra Luna UST imploded to 0 from $50 billion. It also used a stablecoin for their project. It double, triple, quadruple counted the same money while pretending it was real. Greed took over.

You need to EXIT early and well before that $5 billion in real collateral is gone. Cash out and don't ape back. That includes removing all assets from networks like Blast L2.

You are only safe on NATIVE chains like ETH or BTC.

This time, the bubble will use ETH LRTs and associated stablecoins. I'm concerned and few people will write about this because it puts a break on this bubble and greed.

I've seen too many crypto cycles repeat the same story. This is nothing new. At the end of the day, crypto is a free for all. There's no regulation, but at least we can educate.

Why risk your ETH for 3-6% yield when ETH will 2-5X this cycle?

Funny enough, this LST/LRT bubble will also be the reason ETH will pump hard because all those tokens will LOCK-UP ETH as collateral in a huge pyramid.

When Vitalik decided to take Ethereum from Proof of Work to Proof of Stake he enabled and allowed the creation of such ponzimonic mechanisms.

For this reason alone, Bitcoin is superior.

Don't be fooled by this market and don't let greed take over. It ends badly.

X (formerly Twitter)

Duo Nine ⚡ YCC (@duonine) on X

🚨 Why are crypto ponzis always related to new stablecoins? A long post.

▫️ Buy 1 ETH for $3,000

▫️ Stake ETH into stETH

▫️ Turn...

Incredibly realistic effects

Bloomberg's Eric Balchunas reports that BlackRock's spot #Bitcoin ETF has taken in $5.2 billion YTD, representing 50% of BlackRock's total net flows for their 417 ETFs 👀

Owning #bitcoin is like owning a massively successful business that will reward you handsomely every four years of your life and beyond.

Become an owner of the best business in the world. Buy #btc today and #hodl it.

If you already have a business you’repassionate about, add some #btc to it. Turbo charge that thing. That's what

@saylor

did. Why not you too?!

#stackharder and #hodl

Coinbase's GiveCrypto donates $3.6 MILLION to Brink to fund #Bitcoin developers 👏

#Bitcoin ETF Volume results of Friday 16th of February (26th trading day):

🥇 $GBTC $585m

🥈 $IBIT $469m

🥉 $FBTC $239m

🪵🏅 $ARK $97m

Total Colume for The Nine: circa $850m

GBTC wins the battle today, with the biggest volume so far. Likely Genesis GBTC sell-off started yesterday and increased today.

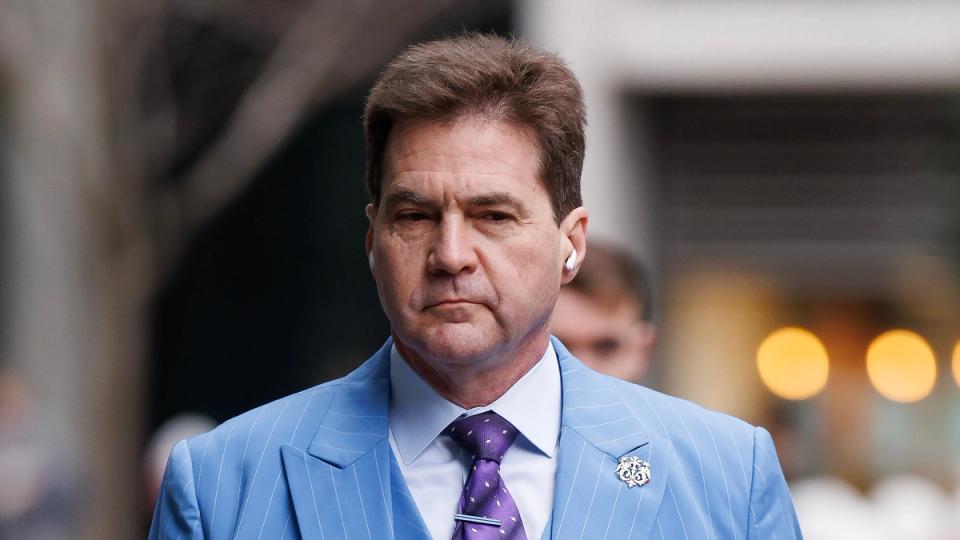

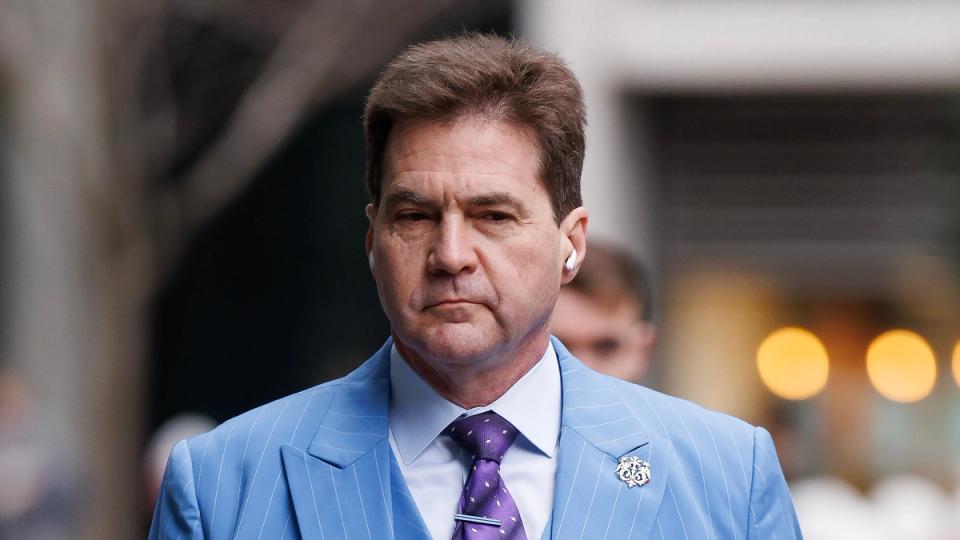

Craig Wright's sister recounted how she once saw him dressed as a ninja and working in a room full of computers, evidence, she says, he created #Bitcoin.

Craig Wright Trial Includes Ninja Anecdote Cited as Proof He's Bitcoin Creator Satoshi

On Friday, Craig Wright's sister Danielle DeMorgan recounted how she once saw him dressed as a ninja and working in a room full of computers, evide...

We went to $69k last bull season just from plebs stacking.

The largest financial institutions in the world are stacking this season.

You have no fcking idea what's coming.

#Bitcoin

#Bitcoin ETFs have had 15 consecutive days of NET Inflows worth a total $3.85 Billion (81,134 $BTC)

Momentum is...💪

New Record #Bitcoin Hashrate!

600,000,000,000,000,000,000x per second

We're lucky the Saudis don't like buying cheap stuff otherwise #BTC would already be trading at $1M.

The 9 new Bitcoin ETFs now hold 258,770 $BTC in total, buying an average of ~10,000 #Bitcoin a day.

This is about 11x the daily issuance from the block reward.

There are 3,400+ ETFs...

iShares Bitcoin ETF now in top 7% of *ALL* ETFs by assets.

IBIT in top 20 of *ALL* ETF launches over past 5yrs by current AUM.

In 5 weeks.