You may have seen the clip of Steve Baker

doing the rounds this weekend. You may have laughed or dismissed his comments, perhaps because you disagreed with him on Brexit. But if you did so, please listen again, because what he's saying is important:

"Your government rode an enormous credit boom within which the money supply tripled, leading to the global financial crisis…and a sense of injustice which has led to many of our subsequent troubles.”

Then read the article shared in the thread, on the $91 trillion debt burden that is currently facing nation states around the world.

There is an unpalatable truth here, which sooner or later we are going to have to acknowledge:

The only way to get rid of a $91 trillion dollar debt is to debase the currency to the point where a trillion dollars will only buy you a loaf of bread.

There’s no sensible way in which a debt of this magnitude can ever be repaid, either through growth or taxation. So what may be likely to happen in the coming years, as this vast web of obligations compounds and continues to grow at an accelerating rate? This is a problem currently confronting Rachel Reeves, our new Chancellor, and Labour, and with which they must engage.

Debt, and credit, are not necessarily bad things. Credit oils the wheels of commerce, and enables us to pull profits from the future to invest and to grow businesses today.

But the warnings of the Ancient Greeks and the Romans that we should do ‘nothing to excess’ were as true for them as they are for us (nihil nimius in Latin, meden agan in Greek – common sayings for each culture, but sadly forgotten by us). There is no sense in which government debts equal to the size of the entire global economy are not excessive and are not a gigantic problem almost beyond resolution.

There are ways out, but none of them palatable. Default, refinancing, or inflation – which will we choose? (Remember that inflation, the enemy du jour, is actually rather good for some people – especially those who owe large sums of money; like nation states).

In our credit-based system, money is nothing more than another person's liability (whether the liability of a central bank, or of a commercial bank). It is backed by absolutely nothing other than the belief that the liability will be repaid (to quote even more Latin, this is the origin of the word 'credit', which comes from the Latin credo credere, to believe).

If a person holding your liability money begins to believe that you're not good for the money, the entire edifice collapses.

Governments cannot allow this loss of faith to happen. Remember, modern money is backed by absolutely nothing other than faith and belief. So a voluntary default (a refusal to pay) is off the table.

Refinancing is possible - issuing new debt to pay the principal and coupon of the old. This is the route most governments that can still access the bond markets have taken to date. This works up to a point, much like taking out a new credit card to pay off a previous one.

This doesn't get rid of the debt – it merely moves it around and can make it easier to service, but ultimately adds to the debt burden in the long run and has the unfortunate effect of compounding it at the same time. If you’d like to see this in highly unpleasant action, just read up on how the IMF and the World Bank treat borrower nations in the global south. I would recommend the excellent book 'Hidden Repression' from Alex Gladstein (link in the thread).

Which leaves us with debasement through inflation.

Governments will almost never admit or articulate this, but the surest way to get rid of a trillion dollar government liability is to debase the currency to the point where the nominal value of their obligations is negligible when measured in a currency whose actual value they have destroyed.

The quote below is from ‘When Money Dies’, a seminal work on the Weimar inflation. Bondholders and mortgage holders might eventually have got repaid in nominal terms – but the amounts they received were meaningless in comparison to the actual value of the assets that the debtors held (such as houses).

This is a nation state problem, but the profligacy of nation states has also made it YOUR problem.

Governments are by their nature unproductive - their sources of income are typically either their citizens (through taxation) or accrued via issuing liabilities against their good name (which, in a circular fashion, is actually yours). In one sense, nation states levy taxes not because they need the money – they can usually print it, after all – but in order to reassure the potential purchasers of their government debt that they are good for the money (belief, once again).

The exceptions to this tend to be the states that are the net exporters of the fundamental currency that actually enables civilisation to exist, namely energy.

So how can you protect yourself, if the conclusion is that the only likely solution to this gigantic problem is strategic inflation and currency debasement?

One option is to save whatever you can in hard and finite assets that cannot be replicated or produced with zero cost. That is, don't think you can save in government liability money.

Unfortunately, this practice has already hugely contributed to housing inequality in the UK, where, whether they know it or not, the richest among us have figured this out and keep their money not in cash but in houses.

You too should have the right to protect yourself - but I'd also like to see an alternative to a 'flight to housing' that exacerbates other social issues. Perhaps find something else. Ideally something that the government cannot confiscate when the house of cards finally comes tumbling down.

You'll likely know what I would recommend. But this is something you'll need to decide for yourself, and on behalf of your children, who will unfortunately inherit the mess that our governments and central banks have made.

fnew

fnew@Nostr-Check.com

npub1wl39...znlx

Word processor working on Bitcoin advocacy in the UK

It is both terrifying and uplifting that most users of Nostr will understand money creation, currency debasement and the role played by central banks better than a man who was the chief economist and economic adviser to Vice President Joe Biden under Obama.

He is right that a country which controls its own currency cannot go bankrupt. But that he cannot coherently describe why a country 'borrows' money that it can itself create is nothing short of appalling. It isn't hard to understand that the borrowing itself is in no small way how the money is actually created - because all modern money, other than gold and #Bitcoin , is nothing more than someone else's liability.

The government creates a debt obligation (a bond) and it promises to pay back the buyers of that debt obligation, together with a coupon or percentage rate (fun fact: these used to be actual physical coupons attached to the paper bonds, which is where the name comes from). The new money is backed only by trust that this liability will be repaid.

It's liability money, backed by nothing more than belief.

And it gets worse than this, when we consider how central banks themselves fund governments. When a central bank buys a government bond or makes a loan to a bank, it doesn't pay with cash. Instead, it merely credits the seller's or the borrower's account with new money that it creates from nothing, on a spreadsheet or a ledger it controls.

When creating this new money, from thin air, with a mere keystroke, the central bank dilutes the unit value of all the other money currently in the system prior to that point. The new money floods into the system, being exchanged for less liquid assets, and for goods and services. Inflation results; and prices are driven up in the process.

So what can we do? Is there anything we can do to stop this flywheel?

Not while we continue to use the liability money that they control and debase. But we now have an alternative.

They are fighting us, as hard as they can, because they are desperate that people do not understand how this process works, and how central banks and governments can dilute and debase their national currencies, to the benefit of a few and the detriment of many.

Because the many are beginning to realize that perhaps, after all, they do not need to use only those national currencies that are melting like ice cubes in the sun.

There is a new game in town - a money that can't be diluted, or debased, or issued without cost at the stroke of a key.

Thiers’ law states that good money will drive out bad money. And time is surely up for bad and collapsing monies.

Even if Jared Bernstein won't be able to explain why.

X (formerly Twitter)

Arnaud Bertrand (@RnaudBertrand) on X

This is absolutely priceless. And probably the most frightening clip you'll ever watch on the people in charge of the US economy.

Jared Bernstein ...

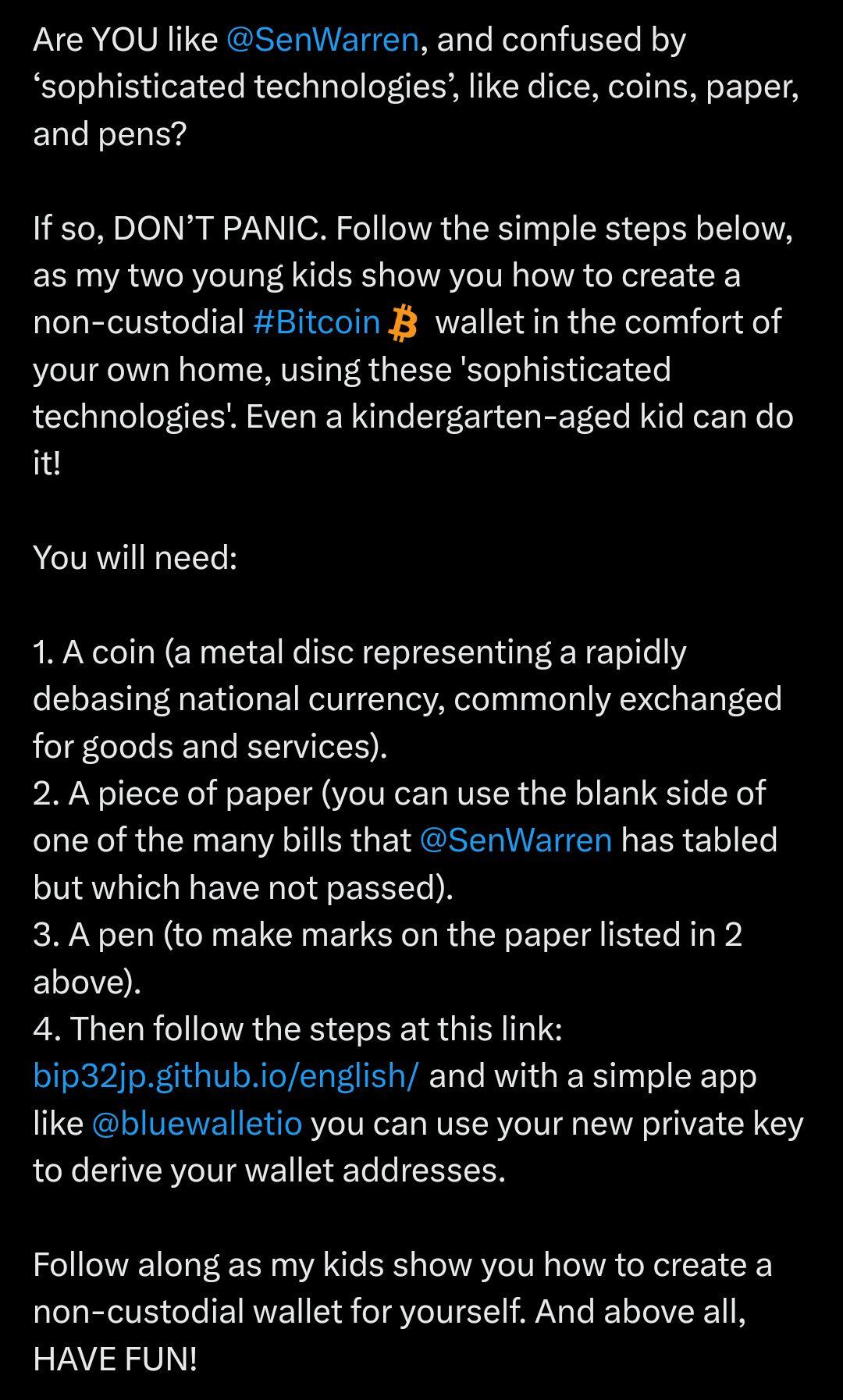

If, like many of us, you feel a bit taken aback by events of the past week in #Bitcoin , you may be wondering about what you can do, practically, to maintain your ability to transact freely and to preserve your privacy.

Whatever the enemies of freedom may tell you, in free and democratic countries it remains lawful to possess your own property, and to continue to hold and use that property without fear of unlawful search and seizure.

You should confidently continue to pursue self custody of your bitcoin with the knowledge that the law is on your side, even if certain people in positions of power are not.

However, it is important to remember that Bitcoin was intended to be a peer to peer system, and that delegating our personal responsibility to third party custodians has meant that the robustness of the system to resisting attacks has diminished.

If you want to be able to continue transacting freely with your bitcoin, or holding it peacefully and lawfully, then you may want to take some steps to ensure that the system is as robust and as widely distributed as possible. As we know from the Cypherpunk's Manifesto, a 'widely dispersed system can't be shut down.'

Here are some concrete suggestions of things that we can all do, right now, to ensure that the Bitcoin system is as widely dispersed as possible, and that each of us can continue interacting with it freely, no matter what.

I'll give further details on each of these, and will put links in the thread, but as a start:

1. If you don't already, learn how to run a node, and start running one.

2. Learn how to open your own Lightning channels on your node.

3. Use open source, non-custodial wallets

4. Learn how to connect these wallets to your nodes

5. Really focus on understanding self custody.

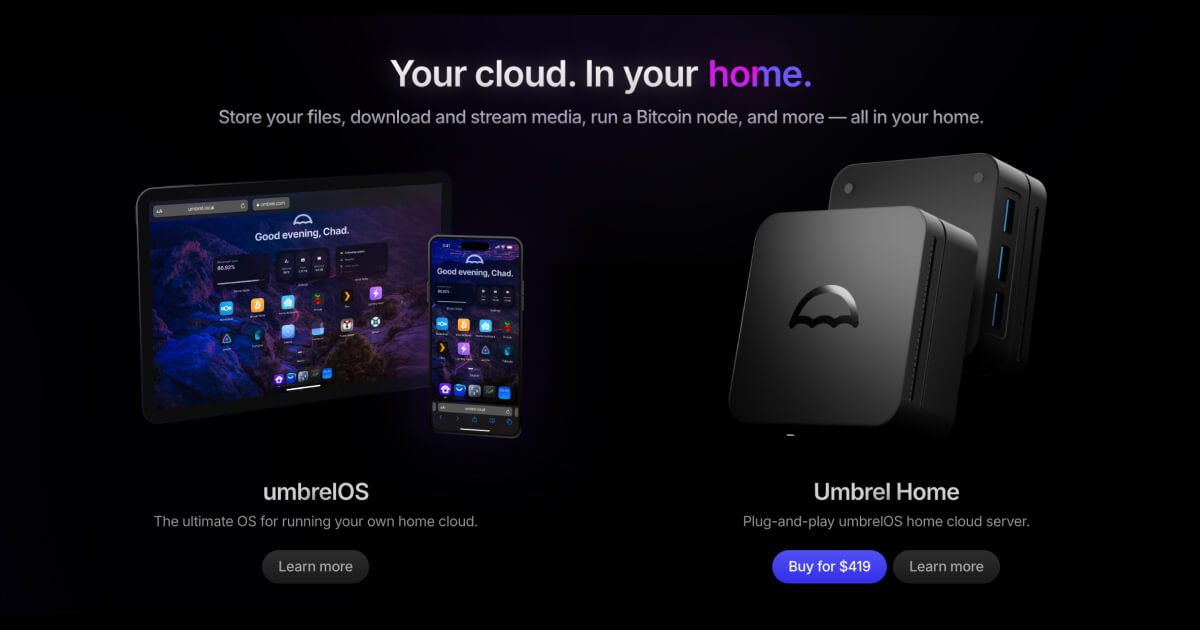

1. Run a node

Why is this important? It keeps the Bitcoin network of transaction validators as widely-dispersed as possible and helps to maintain the censorship-resistance of the network. If you run your own node, you will at the same time have access to a wallet that can't be removed from an app store and cannot be shut down.

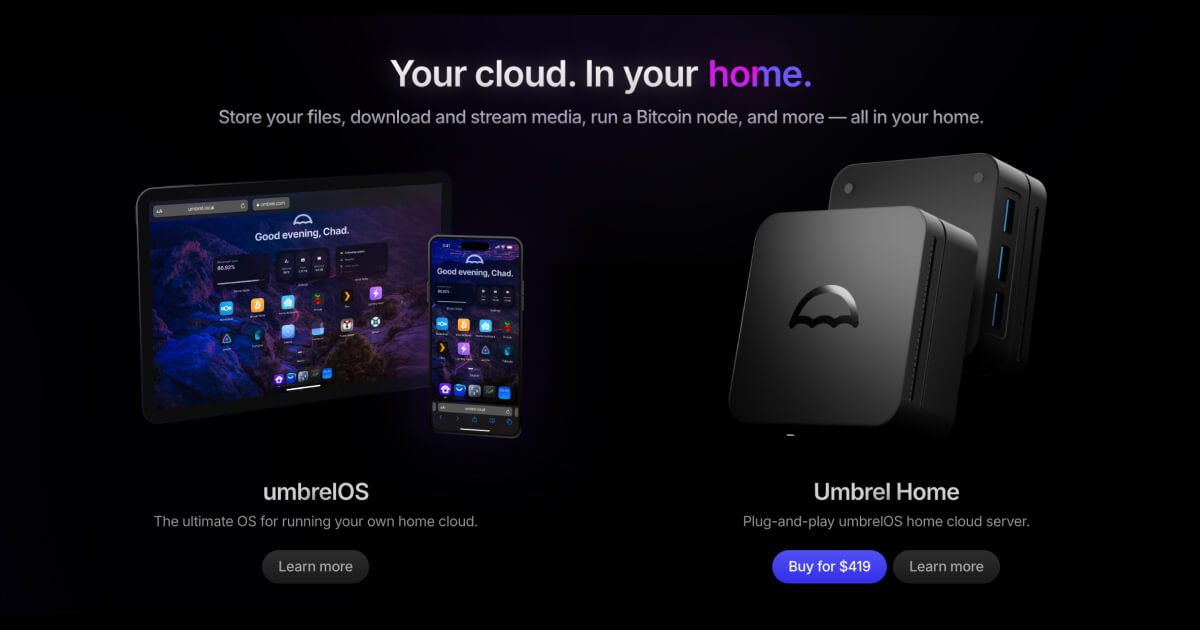

I run two - one on a little umbrel on a Raspberry Pi 4 (photo below) and the other on an old pc.

If you've never done this before, then Umbrel is a fun place to begin. You may also want to look into @start9labs - each provide a good basis to learn how to do this and become part of the network.

2. Learn how to use lightning in a self custodial way

Opening and closing channels costs sats; but your own channels mean that you are much more likely to maintain access to them. See the great tutorial from @BTCsessions in the thread. A second tutorial on Fedi is also linked.

3. Use open source, non custodial wallets

Especially if, like Mutiny, they can be installed as a progressive web app and don't need to be listed in one of the app stores. Either @MutinyWallet or @ZeusLN are great options.

4. Connect your wallet to your node

Zeus especially will enable you to be fully self-sovereign in this context.

5. Focus on self-custody

I cannot recommend the guide from @parman_the enough (link in thread). If you are starting from a position where your coins are still in a custodial wallet on an exchange, read the article in the thread below as a starting point, and begin working your way up the levels of self custody.

Bitcoin may be under attack; but this is what it was designed for. If it were not continually attacked, there would be no incentive for Bitcoin to improve, or for us, its users, to improve our own practices.

You are not alone, and you are not helpless. I hope the suggestions in this post will give anyone new to self custody, or exploring it for the first time, some pointers as to further reading - and encouragement that while we are in a fight, we are absolutely and unequivocally going to win it.

https://medium.com/the-bitcoin-hole/how-to-set-up-a-bitcoin-node-with-umbrel-on-a-raspberry-pi-4-32a22535c4bb

https://medium.com/the-bitcoin-hole/how-to-set-up-a-bitcoin-node-with-umbrel-on-a-raspberry-pi-4-32a22535c4bb

Umbrel - Personal home cloud and OS for self-hosting

Bring the cloud to your home with umbrelOS - a beautiful home server OS for self-hosting, and Umbrel Home - a plug-and-play home server. Install Ne...

Sovereign Computing | Start9

Sovereign computing for a free future

X (formerly Twitter)

BTC Sessions 😎 (@BTCsessions) on X

In the US? Hate having to keep switching lightning wallets because your government is full of tyrants? Get the @MutinyWallet progressive web app. N...

Bitcoin Storage – The ZeroTrust System – Bitcoin Guides

ZEUS: Bitcoin payments your way

A bitcoin wallet fit for the gods

MiniBolt

Build your own "DIY" Bitcoin & Lightning node, and other stuff on a personal computer. No need to trust anyone else.

You think that’s money in your bank account? It’s not – that money isn’t really there at all.

What do I mean by this?

All modern monies, with the exception of silver, gold and #Bitcoin , are liability monies – by which I mean that they are nothing more than a promise by someone else to pay up. They’re a credit and claim system, nothing more.

There’s nothing necessarily wrong with this from first principles. Indeed, some schools of thought suggest that a system of credit money may have arisen earlier in human society than a system of commodity money.

That is, a society that functions by keeping track of mutual promises and obligations could well have emerged before a system that designated gold or some other asset as a token that could be exchanged for any promise, good or service.

Where the problem arises is hidden deep in the nature of the word “credit.”

“Credit” is derived from the Latin verb Credo, Credere, Crediti, Creditum, which meant “to believe” or “to trust”.

Credit or liability money only works, even at the nation state level, for as long as you believe the person making a promise, and trust that they’ll pay up.

When you deposit your money at a bank, for example, you exchange your money for a promise. As a matter of law, what you technically have at this point is not “money” in your account, but a claim against the bank in an amount equal to the sum of money you deposited with them.

As long as you trust and believe that the bank is good for the money, then all is well.

But as soon as you and other depositors lose that faith, then you get a bank run.

And thanks to fractional reserve banking, almost all banks will have made more promises to their depositors than they can repay at any one time. If everyone asks them to make good on those promises at once, then the bank will fail.

What’s the analogy at sovereign level? What happens when a vastly indebted nation state begins to look as though it can’t service its gigantic debt burden, whether that is thirty-four trillion or a paltry 2.6 trillion?

Very simply, a nation state typically has two choices when faced with a snowballing debt burden; and in these circumstances you really want to be a nation state whose debts are denominated in a currency you control – if the United States, you want to owe dollars, and if the United Kingdom, pounds sterling.

The first choice is to default on the debt burden, which no right-thinking country will do. Remember, the entire system is built on credit and belief. Lenders NEED to believe in you; they NEED to trust that you’ll repay them.

The dollar, remember, is no longer backed by gold. We’re told it is backed by “the full faith and credit of the United States”. So no hard default is going to be remotely likely. Without belief, the system collapses; and they cannot allow people to stop believing (even less than Journey could 😉).

Therefore, almost all nations will take the less unpalatable route of creating new units of the currency they control in order to service and repay their debts. Lenders (namely all the people, companies and other nation states who hold those government bonds) will get repaid the right number of currency units, but the value of those units, and their purchasing power, will have been destroyed and debased by the dilution of the total value of the currency as a result of the money printing.

If a nation’s debts are denominated in its own currency, it will always print to repay those debts. It prints more and more promises to repay, more and more units of credit or liability money, but in doing so it dilutes the worth of its own credit at the same time as it debases its currency.

It’s at times like this that you might want to have a bit of a safety net in the form of a commodity money that is no one’s liability, a money with no counterparty risk that hasn’t been swapped for an empty promise from an insolvent bank or a bankrupt government, a money that you can hold onto and secure yourself, no matter the cascade of failing credit institutions, breaking under the weight of their liabilities.

Counterparty risk is only as good as the counterparties. And when our faith in those counterparties runs out, the money follows very quickly.

Regulators are determined to come after #Bitcoin.

Although many in the community are opposed to regulation in its entirety, my view is that that if regulation is coming (or already here), we need to do everything we can to make sure it is good and decent and does not impede the proper operation of the most important aspects of #Bitcoin . We discussed this approach recently on What Bitcoin Did, in the links below.

Having said this, why is it so hard to create, and lobby for, good and thoughtful regulation?

Firstly, in the UK, the instinctive reaction of regulators (and in particular the FCA) has been aggressive and one of reactive and unhelpful opposition to #Bitcoin, coupled with an unwillingness to listen to those at the coal face of the industry. Scroll through their publications or public statements and you will find the same old chestnuts: “it's a speculative asset with no use case”; “it has no intrinsic value”; “it is not backed by anything” (this last one being a particularly amusing, when you consider that a large number of the British public still labour under the misapprehension that the pound sterling is backed by our gold reserves).

Instead of levying these (frankly childish) allegations at #Bitcoin , they should instead take advantage of the very large number of people working in the industry who are ready to give up their time to assist the FCA in understanding, as far as it is possible to do so, what exactly Bitcoin really is, and what its properties really are.

Secondly, we unfortunately see poor and ineffective regulation emerging as a direct result of this reactive opposition and their failure to pay attention to advice.

Without understanding what Bitcoin is, regulators cannot regulate it, or its buyers, in any sensible fashion.

By way of example, take the ludicrous categorisation of #Bitcoin as a restricted mass market investment, which has required exchanges to impose ‘cooling off’ periods, and customers to answer questionnaires before they can buy on exchanges. Or, if you don’t want to do this, you can easily circumvent the FCA’s laughable attempts at preventing access to #Bitcoin by buying the asset simply and easily in a peer-to-peer and KYC-free manner with an app on your phone.

Utterly ineffective regulation is not good regulation – it is in fact idiotic and makes a mockery of the entire process.

It is symptomatic of a resolute failure to engage or to understand that this asset is unlike anything they have dealt with before, that its properties are unique – and that furthermore, it is impossible to write rules for the way that both people and the legal system interact with #Bitcoin if you do not at least attempt to understand its properties first.

If a regulator proposes a rule enabling Bitcoin to be confiscated from self-custody, they need to understand this is impossible without either keyholder cooperation or actual physical violence.

If a regulator proposes that UTXOs be frozen, then they need to tell us how.

If a regulator attempts to ban Bitcoin, we need to show them that users will keep holding and using it regardless.

Most importantly of all – I would exhort the FCA and all other government regulators to make use of the many volunteers in the industry who will give up their time and expertise to assist them in making good and effective regulation. Don’t consult them only to ignore their expertise.

I quote from the FCA’s recent policy statement released in response to feedback they had from the industry: “On our proposals for cryptoassets, respondents generally disagreed with our proposal to categorise cryptoassets as Restricted Mass Market Investments (RMMI)… Having considered the feedback, we intend to proceed as consulted with categorising cryptoassets as ‘Restricted Mass Market Investments’.”

Suggestion: if you’re learning to drive a car, it’s best to follow the advice of your driving instructor. Don’t simply try to make up a new Highway Code as you go.

No one else will pay attention to it.

"Don't panic" is only one of many snippets of life advice from Douglas Adams in Hitchhiker's Guide to the Galaxy, but probably one of the best (besides the tip always to have a towel on hand).

If this is your first #Bitcoin cycle, this is absolutely essential to remember (hell, if it's your second or third as well). Never get too euphoric, or too scared either.

All you need to ask, in response to new FUD, or new panic in the wider world, or the endlessly manic news cycle, are two simple questions:

Does this increase #Bitcoin''s limited supply?

And does this make it easier for a small group to make changes to the code without rough consensus?

If the answer to each of these is no, then you can go for a walk and rest easy.

If you look back over previous #Bitcoin cycles, you find a lot of evidence that while history doesn't repeat, it definitely rhymes.

This time the waffle is 'tokenisation of RWAs'. We've had this before, with 'tomatoes on the blockchain' in 2017. Previously, we also had NFT mania, 'blockchain not bitcoin', metaverse tokens, AI tokens, you name it.

Sadly, 'the blockchain' seems to be THE most efficient vehicle ever for tokenising and selling absolute bullsh!t to unwitting investors.

All this will fall away, and in the end, at the start of the next cycle, #Bitcoin will still be standing, but likely knee-deep in the effluent from a cloaca of pitch decks, all attempting to sell you something, which you should studiously ignore.

Some examples of this madness:

https://www.forbes.com/sites/jeffkauflin/2018/10/29/where-did-the-money-go-inside-the-big-crypto-icos-of-2017/

https://www.forbes.com/sites/jeffkauflin/2018/10/29/where-did-the-money-go-inside-the-big-crypto-icos-of-2017/

https://www.forbes.com/uk/advisor/investing/cryptocurrency/top-10-artificial-intelligence-ai-cryptocurrencies/

https://www.forbes.com/uk/advisor/investing/cryptocurrency/top-10-artificial-intelligence-ai-cryptocurrencies/

https://www.coindesk.com/consensus-magazine/2023/06/26/step-aside-blockchain-technology-imf-and-bis-have-a-new-buzzword-to-peddle/

https://www.coindesk.com/consensus-magazine/2023/06/26/step-aside-blockchain-technology-imf-and-bis-have-a-new-buzzword-to-peddle/

Bloomberg.com

Someone Figured Out How to Put Tomatoes on a Blockchain

The technology is being put to use in more prosaic fields like agriculture.

Here Are the Top 10 Cryptocurrencies of 2021

The metaverse, Ethereum-killers and memecoins dominated gains in a big bull year for cryptocurrencies.

Inc42 Media

2021 In Review: NFT Mania And The Celebrities That Caught It

Many stars from the world of Bollywood and cricket joined NFT projects, either as collaborators or investors.

Hacken

Tokenization Of Real-World Assets (RWAs): Explanations & Future Outlook

In the evolving landscape of finance and investment, tokenization of real-world assets (RWAs) stands out as a revolutionary concept, blending tradi...

The Bank of England is currently running ‘working groups’ on aspects of their #CBDC proposals.

Bitcoin Policy UK have submitted the paper in the link below, giving detailed feedback on our privacy concerns.

TLDR: While we remain opposed to the creation of a #CBDC in its entirety, our view is that the ‘least worst’ option would be a form of anonymous Chaumian e-cash, which no third party can monitor, control or censor - namely, a digital bearer equivalent to physical cash.

To quote Silkie Carlo of Big Brother Watch, “Anonymous, private, low threshold e-cash could have a future - but Western Countries like Britain won’t accept anything that looks like a ‘spycoin’.”

Key points from our paper:

1. We remain opposed in principle to the creation of a digital pound or CBDC, and our policy position is unchanged - that it is a solution in search of a problem; one that will serve no useful purpose not already served by existing forms of digital money.

2. The proposals to give ‘tiered’ access to the #CBDC in return for the surrender of more and more personal data should be abandoned.

3. These proposals effectively treat personal and transaction data as a form of currency themselves - the digital pound would become more useful the more personal data is surrendered by its users, who would pay for increased usability with the currency of their personal data. It is therefore an unfair and exclusionary model of money.

4. There is little to no sense in expending time, personnel, money and other resources in replicating a system that will be broadly identical to the modern system of commercial bank accounts, while having none of the advantages of the physical cash system. If a CBDC has to exist at all, then better privacy may be afforded by the implementation of Chaumian e-cash.

5. For the Bank’s CBDC truly to replace physical cash, or to offer a genuine digital alternative, it needs to mirror the key features of physical cash. These include being a bearer instrument, offering strong anonymity for transactions and ownership, (the former two characteristics being of particular relevance to this privacy consultation) and must also allow direct claims against the central bank by the public.

6. Without these characteristics, the CBDC is unlikely to be attractive enough to compete with existing digital payment options, leading to public mistrust, low adoption, high running costs, and eventually the failure of the entire enterprise - which is not an outcome with which we as an organisation would be disappointed.

#NoSpycoin #NoToCBDCs

https://www.bitcoinpolicy.uk/post/privacy-and-the-digital-pound-resisting-threats-to-privacy-and-financial-freedom

Remember, it's never ‘time to gamble on Bitcoin', as you may have seen in the papers over the weekend.

🚨A health warning🚨! We’re going to see a lot of these headlines as the price spikes. Unfortunately, the price is almost always what attracts attention.

By all means, get curious. But I’d exhort you not to dive in because of price euphoria, without having read around the subject first, and understood a little more deeply what might be going on here.

I’m writing with the perspective of more than a decade in the space, and the more I have learned about Bitcoin, the more ignorant I feel and the more I realise how much I still have to learn. To steal a line from Newton, “I seem to have been only like a boy playing on the seashore, and diverting myself in now and then finding a smoother pebble or a prettier shell than ordinary, whilst the great ocean of truth lay all undiscovered before me.”

If you are beginning to discover Bitcoin for the first time, I can offer you only three pieces of advice with any certainty (and these are my firm opinions, not financial advice of any kind):

1. At some point, the Bitcoin price will drop.

2. When it does, there will be a flood of articles from journalists, from governments and from central banks, all declaring that Bitcoin is dead.

3. Bitcoin will not die.

It is the last of the above points that is the most important, and where I would suggest you begin your journey. It’s absolutely crucial to ask “Why won’t Bitcoin die?” and try to come up with a better answer than those bankers and journalists who have failed to provide a satisfactory response to this question over the past fifteen years.

It’s impossible to answer this question in a short Twitter post, so without going into the technical, social, financial, or game theoretical reasons why Bitcoin will not die, I’d like to leave you with just one breadcrumb at the start of this trail – ultimately, this isn’t about Bitcoin at all.

It is about a realisation that the financial system, and the way money is created, are gratuitously unfair, and that this unfairness is buried deep in the way that our systems operate, so deeply that it is barely visible and rarely thought about.

It is understanding that if you are not born into a vanishingly small percentile of the population, then the dice are loaded against you from the first day of your life, and that all your efforts to change your destiny by exchanging your time and your work for government-issued money will be undone, by the ability of governments and central banks to create that money from nothing, and to ensure that it flows to those closest to the point of creation – and not to you.

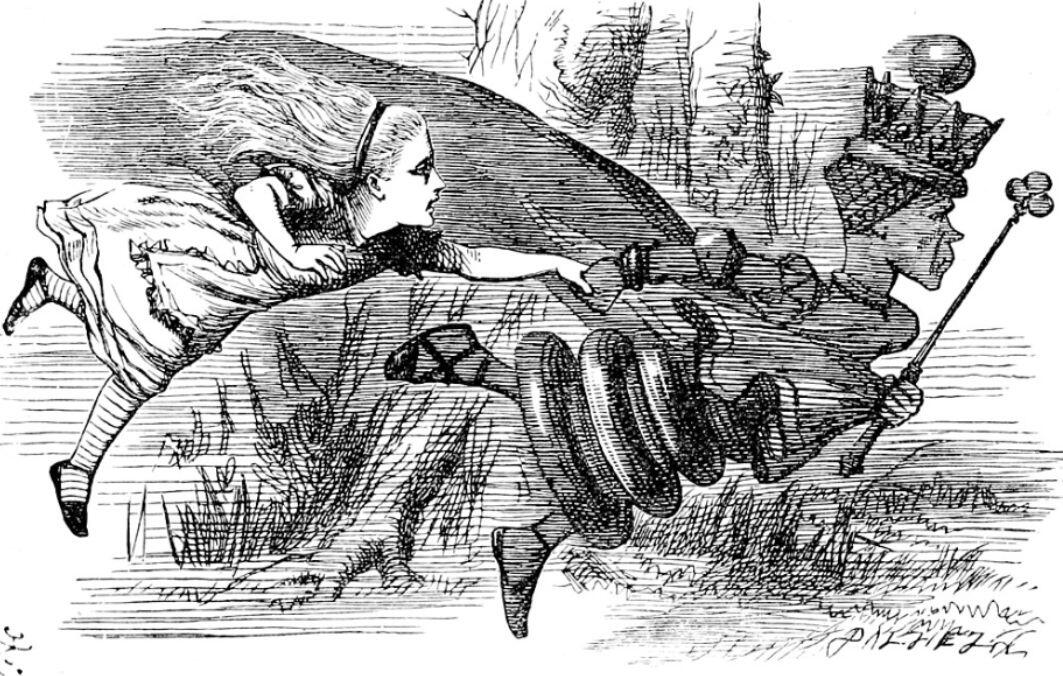

It is the realisation that your time, and your work, will be debased and diluted by the actions of governments and banks throughout your life, and like Alice Through the Looking Glass you will have to sprint alongside the Red Queen of the financial system for all of your days; sprinting just to stay in the same place, and ever at risk of falling behind.

Bitcoin is not a gamble. Its mere price will rise and fall. But its actual value is, strangely, not in itself but in what it represents, and in what it preserves – the value of human time, immune to manipulation and debasement. It represents something of yourself that cannot be taken away or diminished by a third party without your express consent.

Others have written far more eloquently about these ideas and I encourage you to seek them out. Then, when the price has fallen again, you may be able to decide if you want to let go of the Red Queen’s hand and choose another path through the Looking Glass world.

At that point, "It might make sense just to get some in case it catches on."

Imagine a company that began with no external funding of any kind, and which initially made no money at all. In fact, running this company would cost money, in the form of electricity bills. It has no marketing budget, no lobbyists, no highly paid consultants, and for a very long time its product has no market value. It is subjected to relentless and irrational attacks in the media, from politicians, and from those in banking and finance who begin to suspect that its product may disintermediate or replace them.

But it endures; and its product begins to monetise in real time, even in the face of this determined resistance, and without any external assistance aside from those who begin to believe in its thesis.

Bitcoin, of course, is not a company. But it has arisen from nothing, in the face of unified attacks from across the established world, and it continues to be attacked – fruitlessly – to this day. In some senses, we can say that Bitcoin actually needs these attacks in order to prove its thesis; that it is an unstoppable monetary and messaging network that no one can kill or shut down. If it were to crumble in the face of its opposition, then it would not be fit for purpose.

Bitcoin and the mythological Hydra have much in common. Slaying the Hydra was one of the Labours of Heracles, and one of the hardest; each time he cut off a head, three more grew in its place. He was able to triumph – or so he thought – with the help of his nephew Iolaus, who assisted him in burning the stumps and preventing new heads growing back. Heracles then dipped his arrows in the Hydra’s blood, and they remained a deadly, poisonous weapon during the rest of his life.

But the Hydra had the last laugh in the end. The centaur Nessus, felled by one of those poisoned arrows, begged Heracles’ wife Deianira to soak a robe in his blood as a ‘love potion’ and to give it to Heracles if ever his love wavered. When at last she put it on him, the Hydra’s venom ignited and devoured Heracles – the creature reached back out of the past and brought down the most powerful man of the ancient world.

Governments across the world have tried to ban or kill Bitcoin. So far, all have failed.

Central and commercial bankers mock Bitcoin daily. Each day that Bitcoin survives, producing new blocks and transferring value across the globe, they look more and more foolish.

We want Bitcoin’s enemies to understand that they cannot kill it, and they cannot turn it off. It is here, with us in the world, and it cannot now be uninvented.

And with this understanding, we want them to find a way to work with Bitcoin, not against it. To understand its many benefits, and to use them for all our interests, in our financial, energy and infrastructure systems.

They do not need to fight the Hydra and don the robe of Nessus – there is another way.

https://image.nostr.build/1c00b6a544b6d668a12d83781ff98c483de4ad353248c8729791dfdb085db515.jpg#m=image%2Fjpeg&dim=1078x1071&blurhash=%7CSG*s5s%2C%3FawcocxZt7ae%251_Lt6tkR*s.R%2BkBr%3Fj%5BE%2Bt7EMsmWBRkWXRkNHkCWVV%5BW%3BR%2Bs%3AWqNbRkS%24RkxFNHjZofxFt7V%5BofRks%2CWBM%7CxEj%40kVn%25W%3DxDofoyV%40WBWqWCX8kDWBoMxZnhj%5BoLo0oyoeNHS2WrWBkCWCj%5BoJ&x=aa086e5df25c632f9d9b06bd0b8ab7185c9cbe824038d5b8c1663692be0db4ec

When I was a junior lawyer at a Big Law firm, my peers and I often used to wonder how the partners could treat us as they did. Sometimes, I’d arrive at the office on Monday, and not leave the building till Thursday, sleeping one or two hours a night on the floor under my desk, or not at all. We had people in our team fainting in the corridors, and falling downstairs from exhaustion, cracking ribs. Once, I worked for 48 hours without a break, and with no sleep at all. I would have done anything, and told anyone whatever they wanted to hear, if they'd just told me I could go to bed.

We used to think the partners couldn’t possibly treat us like this if they thought we were human; and of course, we were right. We were looking at the question entirely the wrong way round. To the partners, we were not human; we were revenue-generating assets with a fixed cost base (our salaries), and we generated that revenue with our time. So the more revenue they got us to generate over time, the better for them. Only once we came to this realisation did it all make sense.

In the same way, we tend to look at journalism the wrong way round. If we are labouring under the misconception that journalism is a search for truth, then articles like this from Jemima Kelly in the Financial Times can be hard to comprehend. But when we realise that journalism is, fundamentally, no longer a search for truth, but for attention, then it becomes much easier to understand. We have also been looking at this question the wrong way round. Jemima is certainly winning attention for the FT ; witness this post. QED!

Jemima does ask “Is it time for the likes of me to admit we were wrong” about #Bitcoin . Although you can probably guess my answer to this, I actually wanted to address her conclusion, which is that in relation to #Bitcoin, “there is still no there there.”

In her defence, Jemima has, like many of us, grown up in a world where digital scarcity is an oxymoron. Our whole lives, up to the invention of Bitcoin, have been filled with digital abundance, where anything digital can be endlessly replicated without cost. In such a world, it might be forgivable to think that everything digital or intangible behaves in the same way. Most intangible things do – if I send you an email, we both have the same copy, and other copies exist on servers across the internet. If I tell you an idea, we both have the same idea afterwards.

But Bitcoin is not like this.

If I have a Bitcoin, and send it to you, I cannot reverse that transaction, and I lose control of that Bitcoin forever. It cannot be replicated, and it cannot be copied. It is utterly unique, and in sending it, I have lost it.

This is a poor analogy, but Bitcoin can be thought of as an email I can only send once, and a copy of which I cannot retain once sent. It is an idea that vanishes forever from my mind once I tell it to someone else. It is the discovery of digital scarcity in a world of endlessly copiable digital abundance, and we have never seen anything like it before.

If your job, in any sense, involves the pursuit of truth and the exploration of new ideas, then you should seize the chance to explore and understand something like this with both hands. You should not let the chance slip away, or go on repeating the same facile points for more than a decade after the facts have proven you comprehensively and thoroughly wrong.

https://image.nostr.build/7860b8520047d742c387b9a3ab0f517f2c45db8a1efe0245c7c570afe524bcf3.jpg#m=image%2Fjpeg&dim=1080x664&blurhash=rAMbGYpJH%3Dx%5Eo%7EZ%7EyYMc%25h.TDNyEMws%3Ax%5ER3tnMdDi%25iIAtSf%2BROtSROt8%25NRjofWAj%3Foef%2Bo0bINGaJo%7EWAjFo%23emg4V%3F.9SiV%40ozWVjEX8nhbc&x=b48893738dcb8b98e462ca6881143c8b7ac4cac71195ddbca872dc317dc6f5bc

Client Challenge

CALL TO ACTION!

@bitcoinpolicyuk have just submitted our consultation response to the European Securities and Markets Authority on the sustainability credentials of #Bitcoin mining. But now we need YOUR help.

ESMA and the EU are still labouring under the misapprehension that mining undermines our sustainability goals, when in fact the very opposite is true. Please read our submission at the link below, and feel free to quote from and use any of the research we have produced.

Please also read @DSBatten 's post below, and if you can, help out as follows:

Send a draft of 1-5 pages to

@jardemalie or @lyudakozlovska

using succinct objective language and evidence, by THIS FRIDAY 7 DEC or email lyudmylakozlovska@odfoundation.eu

In your submission, highlight:

- why and how Bitcoin can be a net-benefit to the environment

- point out that a framework which only evaluate only negative externalities of a technology is incomplete, unobjective/ unscientific

- DO NOT say "its energy use is justified because", "Other assets use more energy", or debate whether climate change is occurring or use language that personally attacks any one

- DO highlight that every technology initially has a carbon footprint, use evidence to show that emissions are not increasing and that there is a realistic chance Bitcoin can become the first industry to fully mitigate emissions without offsets, point out known limitations in current models, use your own examples of Bitcoin's positive environmental impact that are less well known.

THANK YOU in advance!

https://www.bitcoinpolicy.uk/post/bpuk-submission-to-european-securities-and-markets-authority-re-mica-sustainability-disclosures

https://www.bitcoinpolicy.uk/post/bpuk-submission-to-european-securities-and-markets-authority-re-mica-sustainability-disclosures

X (formerly Twitter)

Daniel Batten (@DSBatten) on X

Plebs, Bitcoin miners, human rights defenders unite!

The European Commission (EC) is about to take a draconian and unscientific stance towards Bit...

Bitcoin and Freedom - an article for the new and the curious

https://www.bitcoinpolicy.uk/post/bitcoin-and-freedom

Thank you, Satoshi.

True in 1958. Still true now.

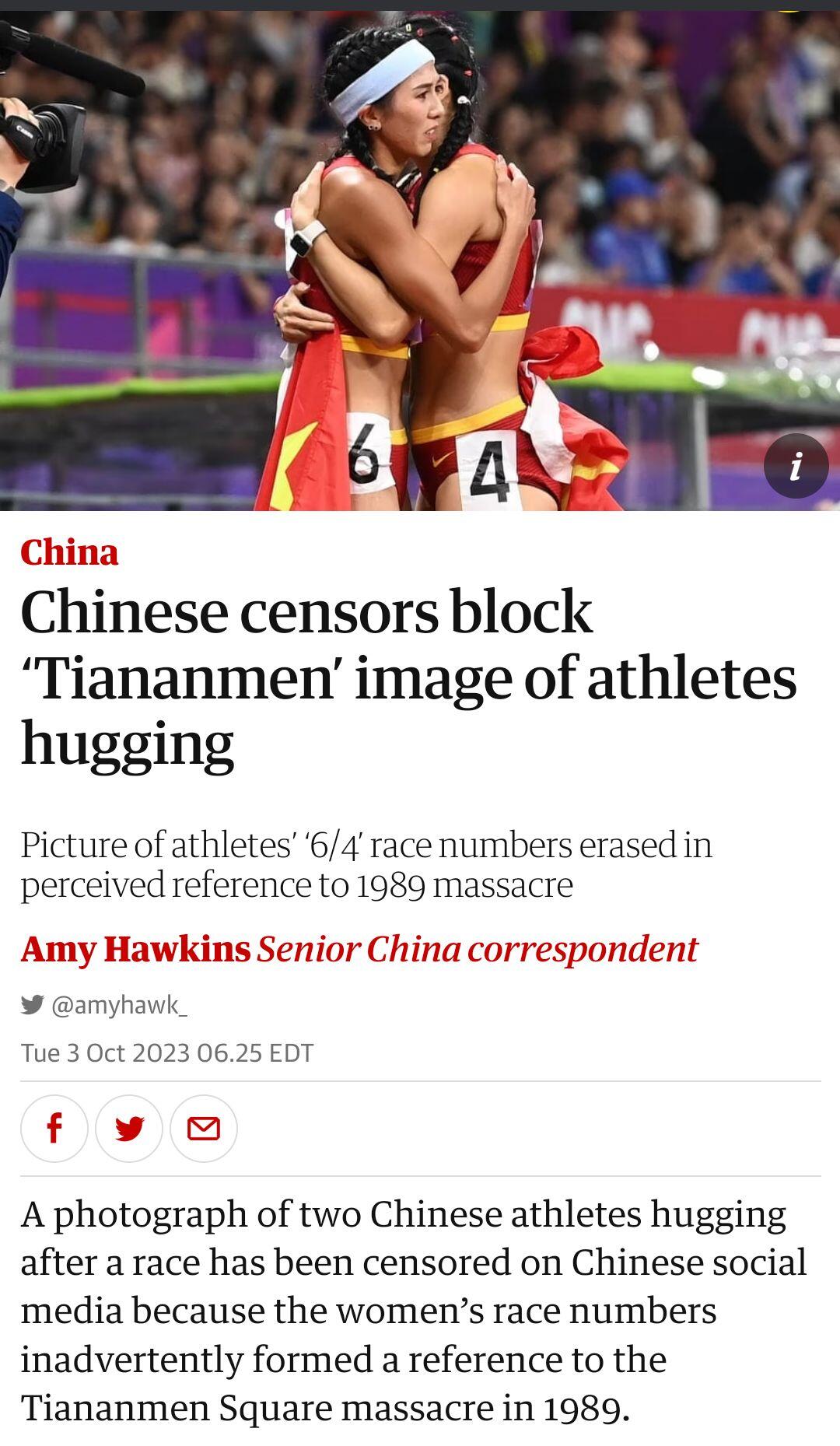

I hear Chinese censors are blocking the image below because of a potential link to the date of the Tiananmen Square massacre. Let's do our bit to help and keep an eye out for these pics so we can protect those sensitive CCP eyes!

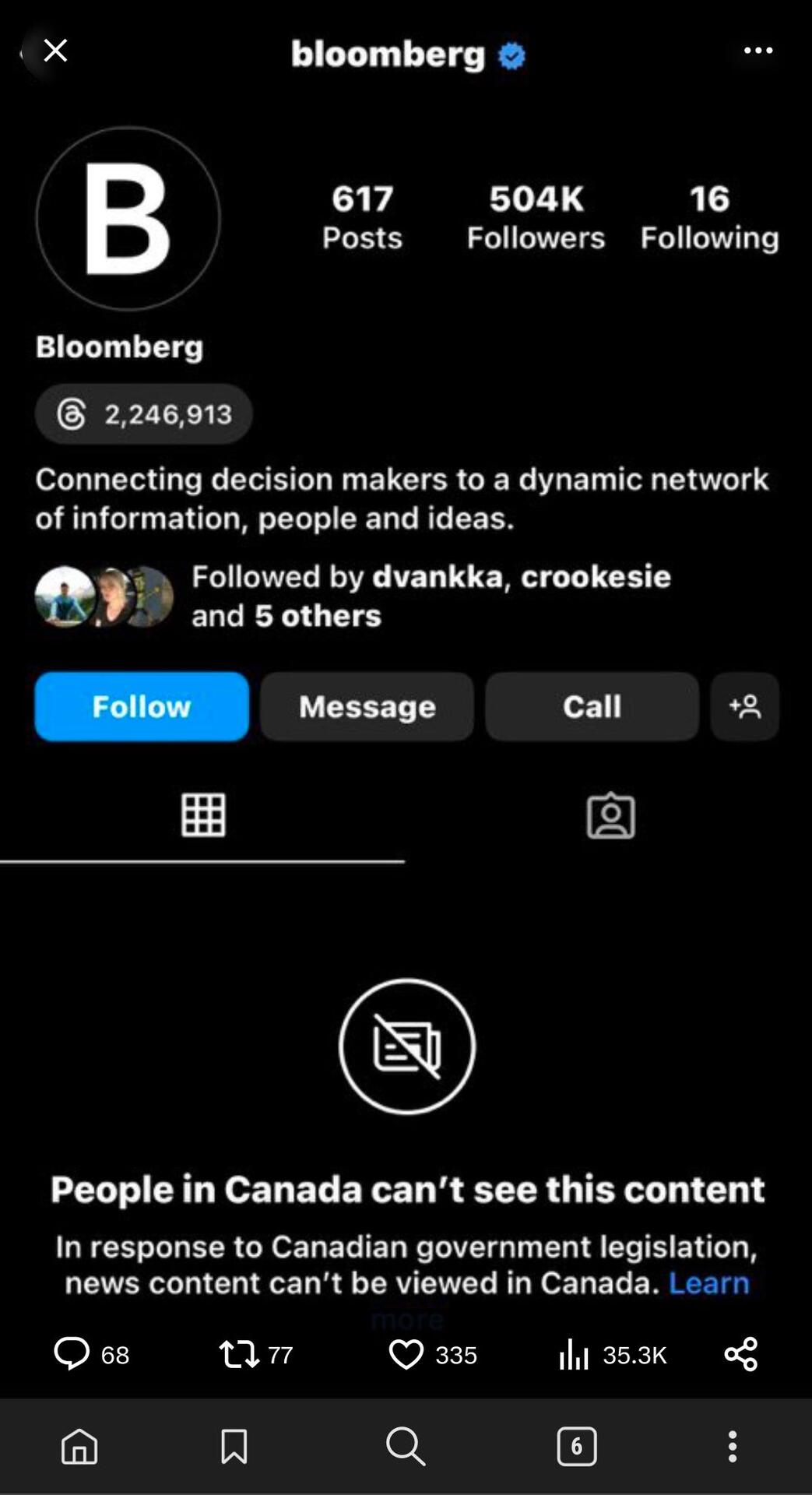

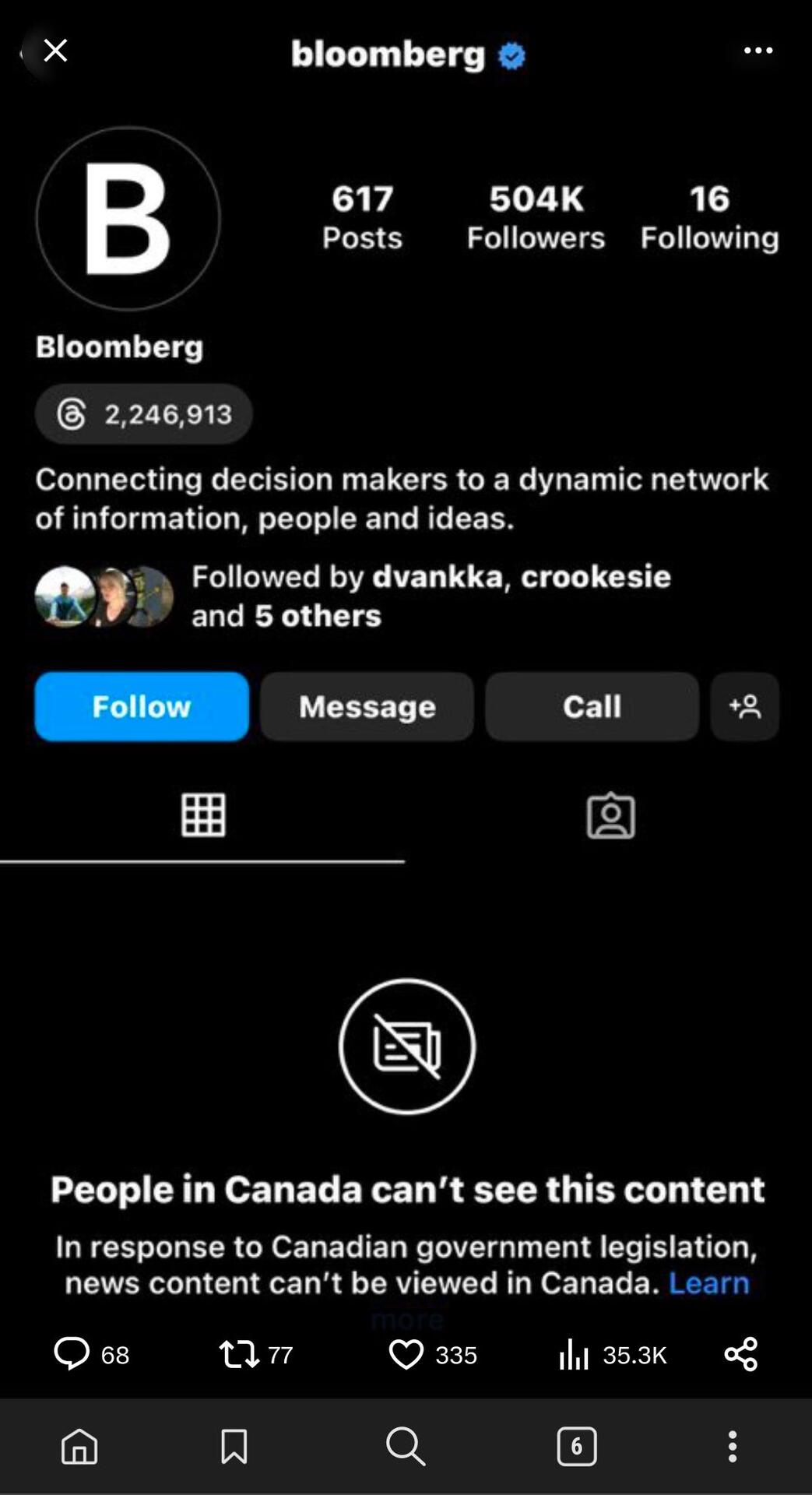

Canada seems to be conducting a live fire 1984 experiment:

Meta Newsroom

Changes to News Availability on Our Platforms in Canada

The Online News Act is based on the incorrect premise that Meta benefits unfairly from news content shared on our platforms, when the reverse is tr...

Rishi Sunak has been taking a lot of flak (largely from Keynesian economists) for saying that #inflation is a tax that disproportionately hits the less wealthy.

But if he'd simply said "Inflation *has the effect of a tax* that unfairly targets the less well off" then his critics might not be missing the point so badly.

#Inflation is of course not a tax levied by a Revenue service and payable by law in order to fund government spending.

But it DOES have an insidious effect similar to a direct tax, as it functions as a non-optional reduction in the amount of value that you have left over for discretionary payments (whether spending, saving, or paying down debt). It IS well established that inflation disproportionally disadvantages the poorer in society who do not hold assets or investment products whose value may increase in line with or faster than the rate of inflation (like houses).

Remember - your house hasn't become more valuable. It's just that the pounds you measure it with are worth less.

Another thing that is worth less are actual government debts (to the extent that they are not inflation-linked). In this way, inflation and the associated debasement of fiat currency can reduce the real value of government borrowing, even though the nominal amount may remain the same. Unfortunately for Rishi Sunak, about a quarter of GB government debt is index linked or tied to inflation, so this effect is not as marked as it could be, but inflation does nevertheless have this second order effect, indirectly and invisibly reducing the impact of government borrowing on the government - to the detriment of the poorest in society, who pay the price out of their own pockets.

Rishi is in good company as this is not a new idea; both William Easterly of the World Bank and Stanley Fischer of the IMF came to similar conclusions in this historic paper, for example:

"This paper presents evidence that supports the view that inflation makes the poor worse off. The primary evidence comes from the answers to an international poll of 31,869 respondents in 38 countries. These show that the disadvantaged on a number of dimensions the poor, the uneducated, the unskilled (blue-collar) worker are relatively more likely to mention inflation as a top concern than the advantaged on these dimensions."

https://economics.mit.edu/sites/default/files/2023-05/fischer_inflation_poor.pdf…