Vietnam vet gets to shoot his old gun a m60 57 years later ,

Adamsmith

adamdjsmith@getalby.com

npub1w3ua...8kqt

Monero 8BJiA6PfKBRQyGmVkCt4K5XQwN4VcswgBRnLzGumnqDgUxTgPtQsweF1uGetrkQTfed1BFHXvbwmBZJ51Qa2dSbPTLbR6Wu

adamsmithstwit@minibits.cash

Exactly 💯 percent

,😂

The US really is police state, Scot Ritter getting the FBI treatment

😂

Nice 👌

Ever wonder how your local restaurant make s there egg fried rice ? I did .......

I call them days , Mondays

Do you remember where you were when Greece best Germany 1-0 in the philosophy football final 😂

Forget the French connection chase scene this is best real life chase 😳

On this day 1945 Hiroshima Japan was atom bombed

Not one of these fuckers will turn the shit show off 🤬

Not one of these fuckers will turn of the shit show 🤬 or even turn down down the volume 😂

https://image.nostr.build/8405593a3179d710e60e54738d6ba68e8c3a4d406e09b6323c992a3212cc062c.jpgn

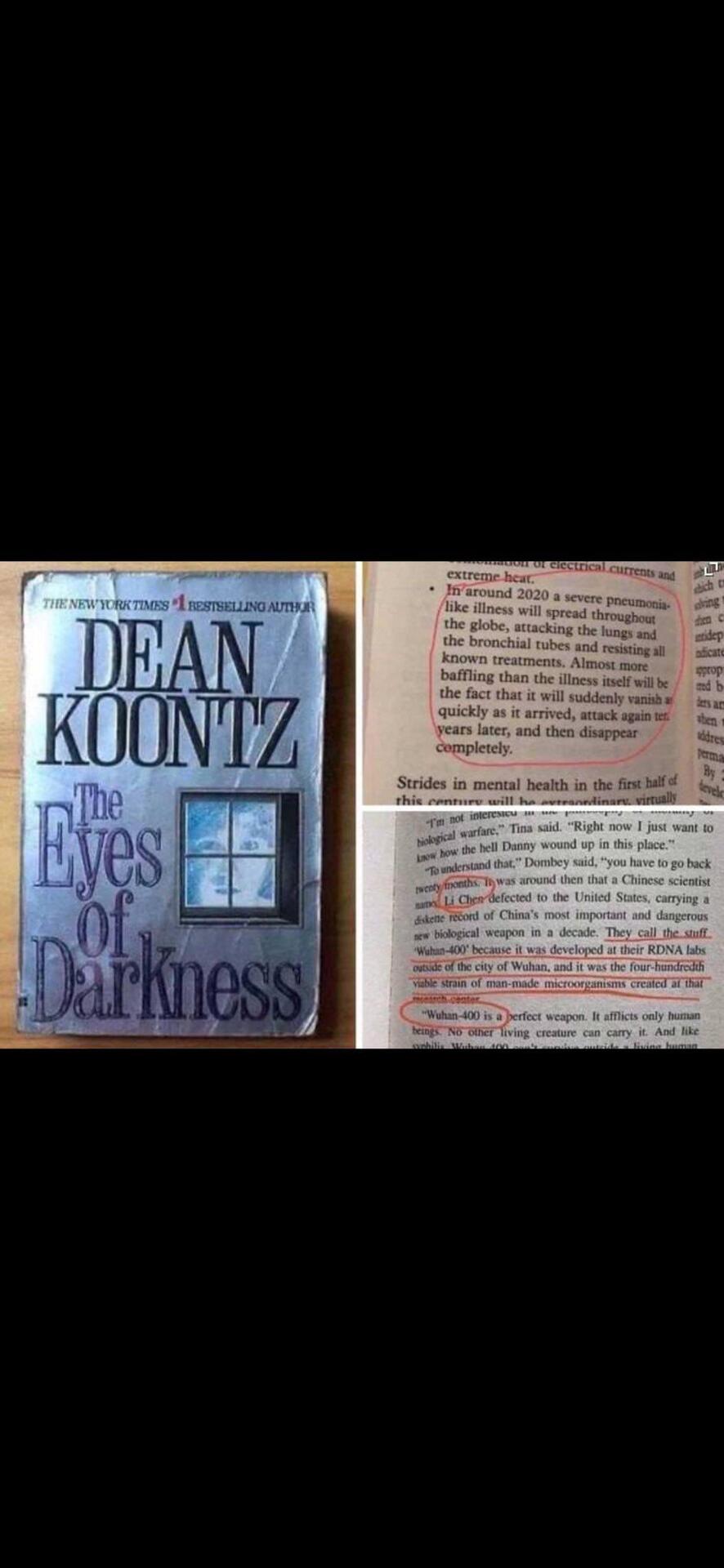

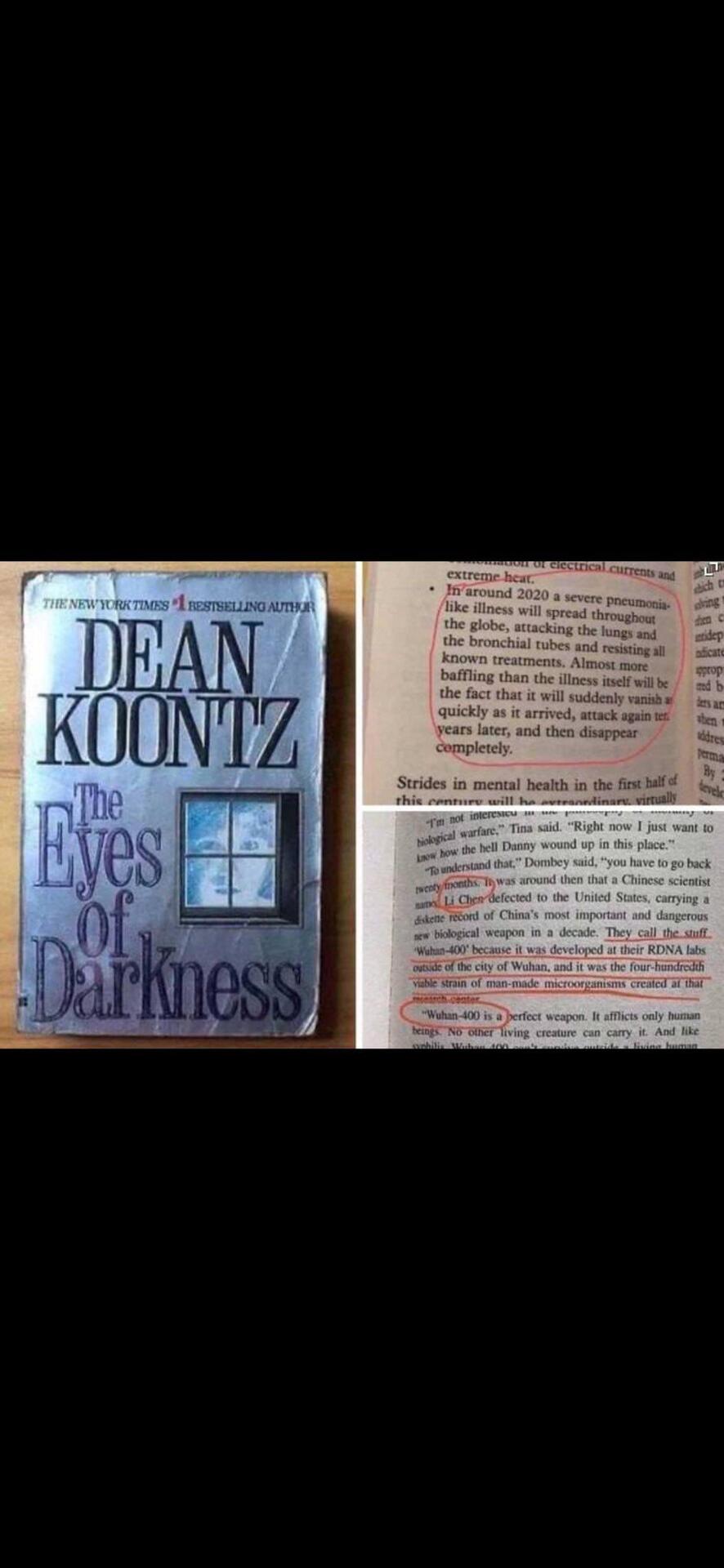

Wrote in 1981 and they say we are not living in a simulation 😂

Watch your Bitcoin chart just go god candle ,stare at the green eye, follow instructions 🤑

😳

When you know ,you know 😂

The World's Biggest Carry Trade

The BOJ can not afford to hike interest rates, because the government of Japan is engaged in a massive $20 trillion carry trade:

First, recall that the carry trade involves borrowing in one currency cheaply (Japanese yen) and converting that borrowed money into a foreign currency which offers a superior yield.

Excellent papers from the St Louis Fed, IMF, and Deutsche Bank consolidate the Japanese government’s balance sheet to include the central bank (BoJ), state-owned banks (namely, PostBank) and pension funds (namely, GPIF, the world's biggest pension fund).

On the liability side, Japan is primarily funded in low yielding Japanese Government Bonds (JGBs) and even lower-cost bank reserves. The asset side is mostly loans like the Fiscal and Investment Loan Fund (FILF), and foreign assets, primarily via Japan’s largest pension fund (the GPIF).

As the authors of the Fed paper argue, Japan is funding itself at very low real rates imposed by the BoJ on domestic depositors, while earning higher returns on foreign and domestic assets of much higher duration. As that return gap has been expanding, this has created extra spending flexibility for Japan's govt.

At a gross balance sheet value of around 505% GDP, or $20 trillion, the Japanese government's balance sheet is, simply put, one giant carry trade.

Crucially, one third of this funding is now effectively in overnight cash: if the central bank raises rates the government will have to start paying money to all the banks and the carry trade’s profitability will quickly start unwinding.

Consider what would happen if sustained inflation required the BOJ to hike rates: the liability side of the government balance sheet will take a huge hit via higher interest payments on bank reserves and a decline in the value of JGBs. The asset side will suffer via a rise in real rates and an appreciation of the yen that causes losses on net foreign assets and potentially domestic assets too.

This is key to understanding Japan in the coming years.

The World's Biggest Carry Trade

The BOJ can not afford to hike interest rates, because the government of Japan is engaged in a massive $20 trillion carry trade:

First, recall that the carry trade involves borrowing in one currency cheaply (Japanese yen) and converting that borrowed money into a foreign currency which offers a superior yield.

Excellent papers from the St Louis Fed, IMF, and Deutsche Bank consolidate the Japanese government’s balance sheet to include the central bank (BoJ), state-owned banks (namely, PostBank) and pension funds (namely, GPIF, the world's biggest pension fund).

On the liability side, Japan is primarily funded in low yielding Japanese Government Bonds (JGBs) and even lower-cost bank reserves. The asset side is mostly loans like the Fiscal and Investment Loan Fund (FILF), and foreign assets, primarily via Japan’s largest pension fund (the GPIF).

As the authors of the Fed paper argue, Japan is funding itself at very low real rates imposed by the BoJ on domestic depositors, while earning higher returns on foreign and domestic assets of much higher duration. As that return gap has been expanding, this has created extra spending flexibility for Japan's govt.

At a gross balance sheet value of around 505% GDP, or $20 trillion, the Japanese government's balance sheet is, simply put, one giant carry trade.

Crucially, one third of this funding is now effectively in overnight cash: if the central bank raises rates the government will have to start paying money to all the banks and the carry trade’s profitability will quickly start unwinding.

Consider what would happen if sustained inflation required the BOJ to hike rates: the liability side of the government balance sheet will take a huge hit via higher interest payments on bank reserves and a decline in the value of JGBs. The asset side will suffer via a rise in real rates and an appreciation of the yen that causes losses on net foreign assets and potentially domestic assets too.

This is key to understanding Japan in the coming years.