Issue #3 of Bits of Bitcoin Research is out now. 💡

Covering three topics:

1. Load Balancing and Bitcoin mining

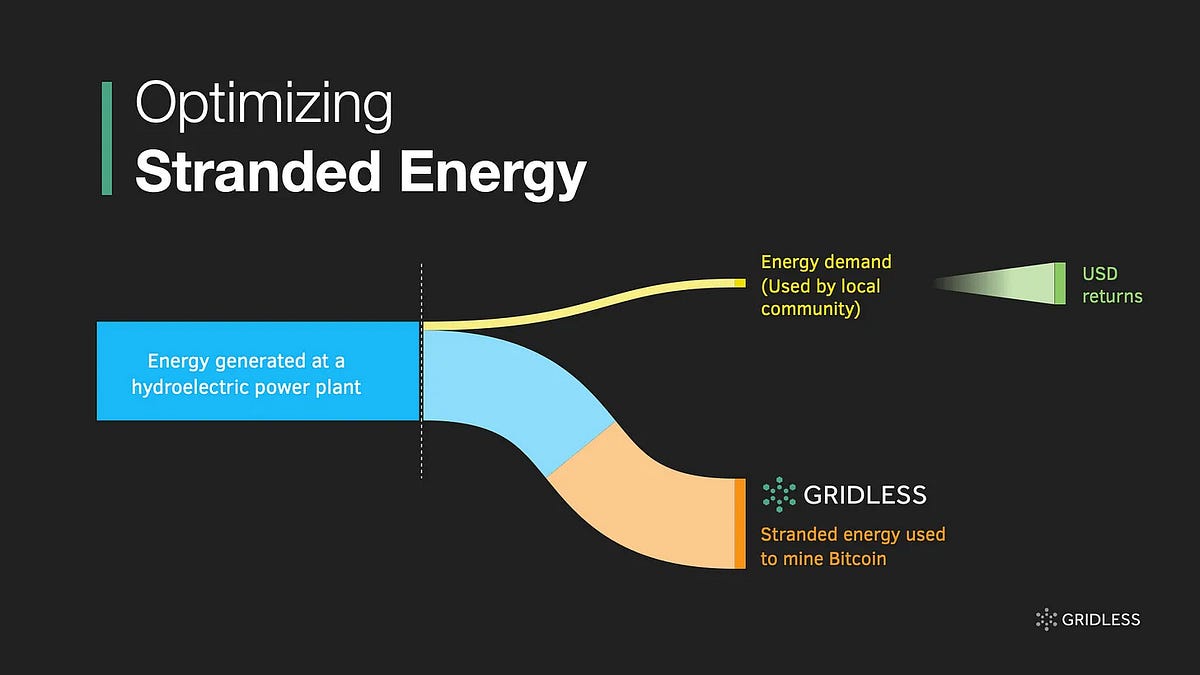

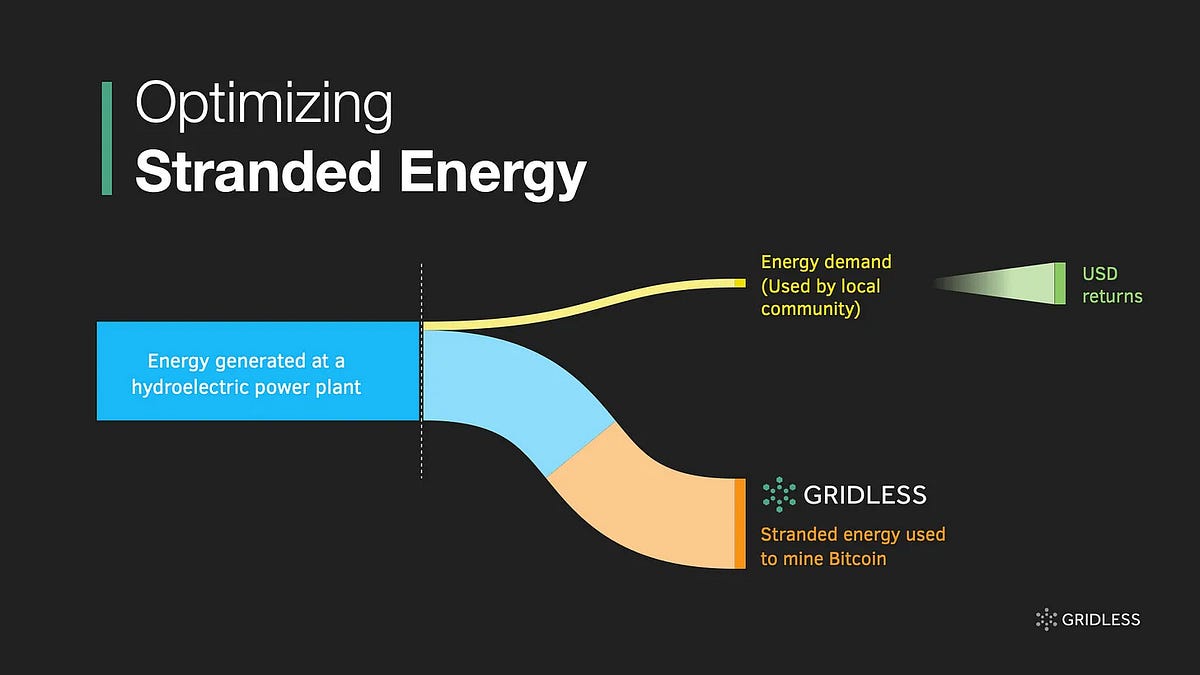

2. Microgrids in Africa

3. Bitcoin as Payments - Bitcoin more than digital Gold?

Enjoy the read.

Bits of Bitcoin Research (BBR) - Issue #3

Load Balancing, Microgrids in Africa, Bitcoin as Payments