"When the state and its governing bodies must routinely come to the citizenry to raise taxes, they will be cautious in what they request lest they be voted out of office. Many of the issues with the state stem from an overactive government using an inflation tax to do more than is necessary. For example, there is no way that the current global level of military spending, which invariably leads to conflict, would be sustained if the government used direct taxes to pay for it. What do you want: free healthcare or more AK-47s? Free university education or a fleet of F-16s? Affordable public transport or another nuclear missile-armed submarine? If the taxpayer decided, different types of public goods would be produced, leading to a better quality of life for many people."

Arthur Hayes, in his 'Hot Chick' newsletter.

OneBigLife

nostr@onebig.life

npub1dvnf...ypmm

Nostr brings freedom. Bitcoin gives hope.

THE DIFFERENCE BETWEEN MONEY AND WEALTH

(https://x.com/Devon_Eriksen_/status/1811272099647967330):

Middle-class leftists don't really understand the difference between wealth and money.

That's because what they have is a job as a retarded commie journalist, which pays them money, which they put in the bank before spending it on Funko Pops, cannabis, dildos, and tofu.

They think wealth is "more money". And when they think about "more money", they think about all the Funko Pops they want but can't afford, and about how Elon Musk can afford more Funko Pops than he could ever use, that is if Funko Pops could be used for anything, which they can't, unless you count leftists' strange propensity for putting unexpected things in places they do not belong.

They don't understand that Elon Musk doesn't have some sort of special titanium credit bank card connected to a bank account with 260,000,000,000 munnies in it, for the buying of Funko Pops.

What he has is some businesses he started, and a bunch of dudes whose job it is to guess the value of things have arrived at the consensus that they are worth that much. That guess changes by the hour.

Leftists can't really wrap their heads around this idea, not in the intuitive sense that would allow them to engage with it as a concept. They can't imagine what it would be like to be in that position.

Why not?

Because if they could, they wouldn't be leftists. In fact, many people can, and therefore are not leftists, so leftists are really just the group of people who are self-selected for not being able to figure this out.

This is why they can, without blushing, describe "reusable space launch capability" as "unnecessary wealth".

They don't understand that if you took every share of SpaceX away from Elon Musk, and all the other shareholders, it would still be valued at 200 billion dollars (or whatever it is on the day you are reading this), but it would not magically transform into 200 billion one-dollar bills that you could give to left-wing journalists to buy more Funko Pops with. It would still be a bunch of factories, and designs, and offices, and employment contracts, and rocket engines, and stuff.

The reality is that the earn-spend-consume model of money that retarded leftist commie journos are familiar with has an upper limit. Once you've spent on much on yourself as you want, a ceiling which varies depending on your character, you need a new source of meaning and purpose in life.

You need to develop different ambitions.

Then your spending becomes not about what you want to have, but what you want to create. You build the things you want to see in the world.

This is where money becomes wealth. Money is used to buy things. Wealth is used to build things.

When you create something that a lot of people care about, it's valued at a huge amount of money, because money is a measure of fucks given.

So maybe, when you have enough money to buy a mansion and a yacht, you decide that what you really want is "reusable space launch capability", because you're a nerd who reads science fiction, and so you think it's a kind of dumb idea for humanity to spend all its time on one tiny dust speck in an infinite universe.

So you buy some computers and you hire some dudes who are good at designing things on computers, and then you buy some metal, and hire some dudes who are good at cutting metal and sticking it together, and pretty soon you're the proud owner of whole bunch of stuff.... computers and factories and tanks full of liquid oxygen and launch pads and most importantly, rocket boosters.

And no Funko Pops. Not a single one.

Now, it's worth more money than you started with, because the people who guess the value of things (it's called a "stock market") are starting to agree that this was maybe a pretty good idea.

So, on paper, you're richer than you ever were. But that's your not bank account, or your Funko Pop collection. That's the fact that you now control humanity's effort to leave the gravity well. And you control it because you built it in the first place.

Wealth inequality is a measure of technological progress.

It doesn't exist in low-tech societies where everyone is chasing antelope with a throwing stick and a stone-tipped spear. Because no one invents anything and there's nothing to own.

And it peaks in high-tech societies where enterprising people create entire economies ex nihilo by investing in a wild idea. Because things are being invented and people give a fuck about them, and so the innovators have a much higher net worth than the people who sit around eating processed snack foods and shopping for Funko Pops on the internet.

Reducing wealth inequality is a disaster, and typically requires one. If you reduce wealth inequality in a free market, you are either outright destroying growth enterprises, or transferring control of them to non-producers.

Which is what leftists really are. Useless journo flacks and cloistered academics who want to tear down the engines of tech innovation so they can buy more middle class consumer goods, until they tear down the engines that produce those, too.

The most important task in all of economics is keeping people who don't get shit done out of the way of people who do.

Leave humanity's orbital launch capability alone, Zaid.

It is already in the hands of the people who are best qualified to operate it. We know that because they are ones who built it in the first place.

The possibilities that lie in the future are infinite. When I say "It is our duty to remain optimists", this includes not only the openness of the future but also that which all of us contribute to it by everything we do: we are all responsible for what the future holds in store. Thus is it our duty, not to prophesy evil but, rather, to fight for a better world.

Karl Popper, The Myth of the Framework, 1994

Join early or join late.

Everyone is free to choose.

Join early or join late.

Everyone is free to choose.This is why Bitcoin is not like the other crypto-currencies.

Someone actually did the science:

Turns out that four years after The End Of The World (according to the mainstream media's 'Science' section), bitcoin uses 0.065% of global electricity, and produces 0.024% of emissions.

Turns out that four years after The End Of The World (according to the mainstream media's 'Science' section), bitcoin uses 0.065% of global electricity, and produces 0.024% of emissions.

BITCOIN POWER CONSUMPTION.INFO

Bitcoin power consumption

Bitcoin energy consumption & emissions, a climate alarmists take. TLDR- Bitcoin essential !

GM

Power Law

Power Law

ChatGPT fans need to be aware that they will increasingly be fed propaganda and have "inconvenient" narratives censored.

Alternatives do exist and I would suggest using them.

An example that just launched is

Alternatives do exist and I would suggest using them.

An example that just launched is  (needs to prove itself but on a quick comparison is way better: not censored and cheaper/faster than ChatGPT).

(needs to prove itself but on a quick comparison is way better: not censored and cheaper/faster than ChatGPT).

Alternatives do exist and I would suggest using them.

An example that just launched is

Alternatives do exist and I would suggest using them.

An example that just launched is

Venice AI

Venice | Private AI for Unlimited Creative Freedom

Try Venice.ai for free. Generate text, images, characters and video using private and unbiased AI.

This is an extraordinary clip from the Chair of the Council of Economic Advisors.

There is zero competence at the helm of the fiat financial system.

Choose #bitcoin, and choose sooner rather than later.

There is zero competence at the helm of the fiat financial system.

Choose #bitcoin, and choose sooner rather than later.

X (formerly Twitter)

Arnaud Bertrand (@RnaudBertrand) on X

This is absolutely priceless. And probably the most frightening clip you'll ever watch on the people in charge of the US economy.

Jared Bernstein ...

Opt out to bitcoin.

Defund the war machine.

Tax payers don't fund wars on the other side of the world, and would elect out politicians suggesting higher taxes for war.

Governments that can print infinite money don't care what the people think.

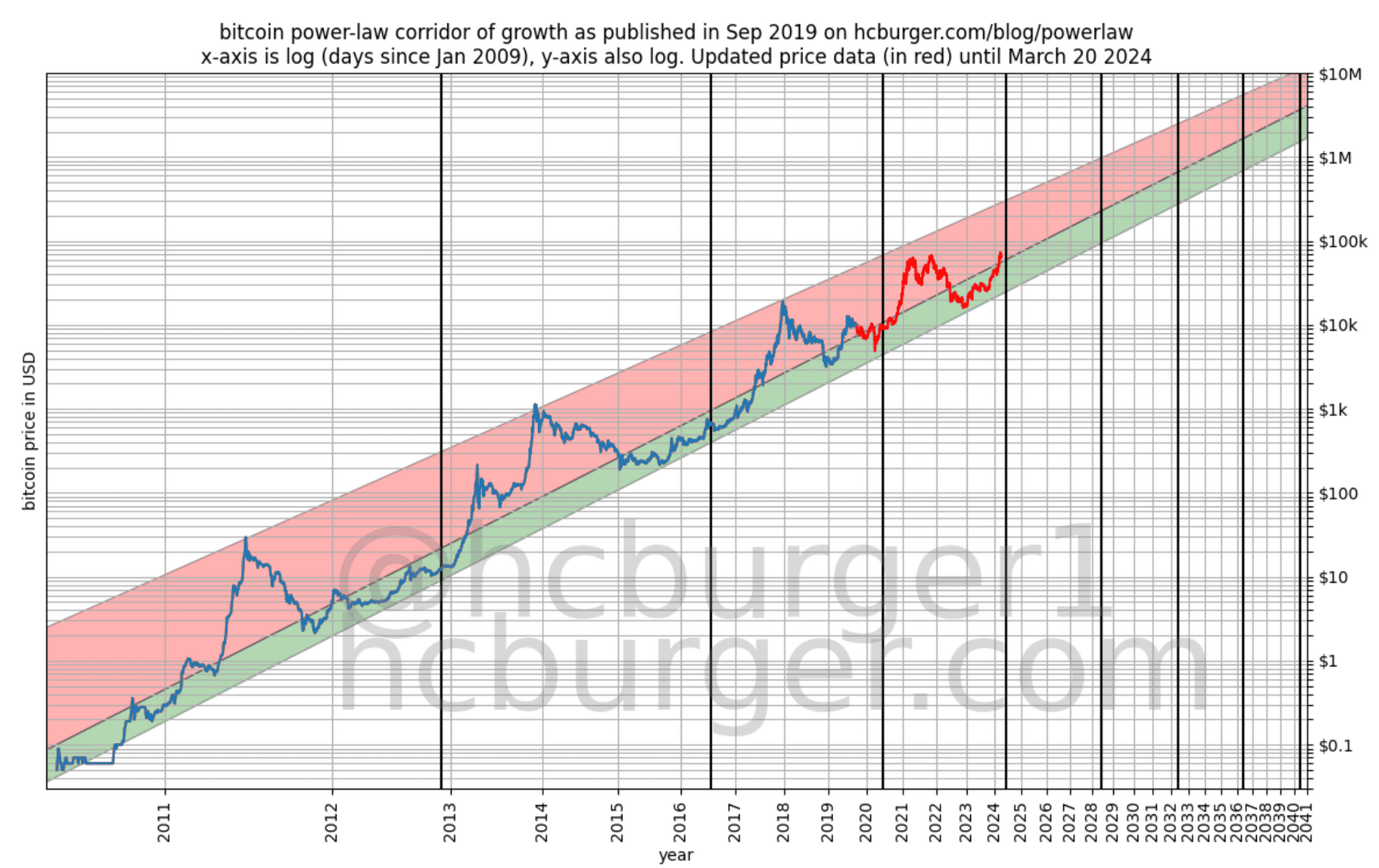

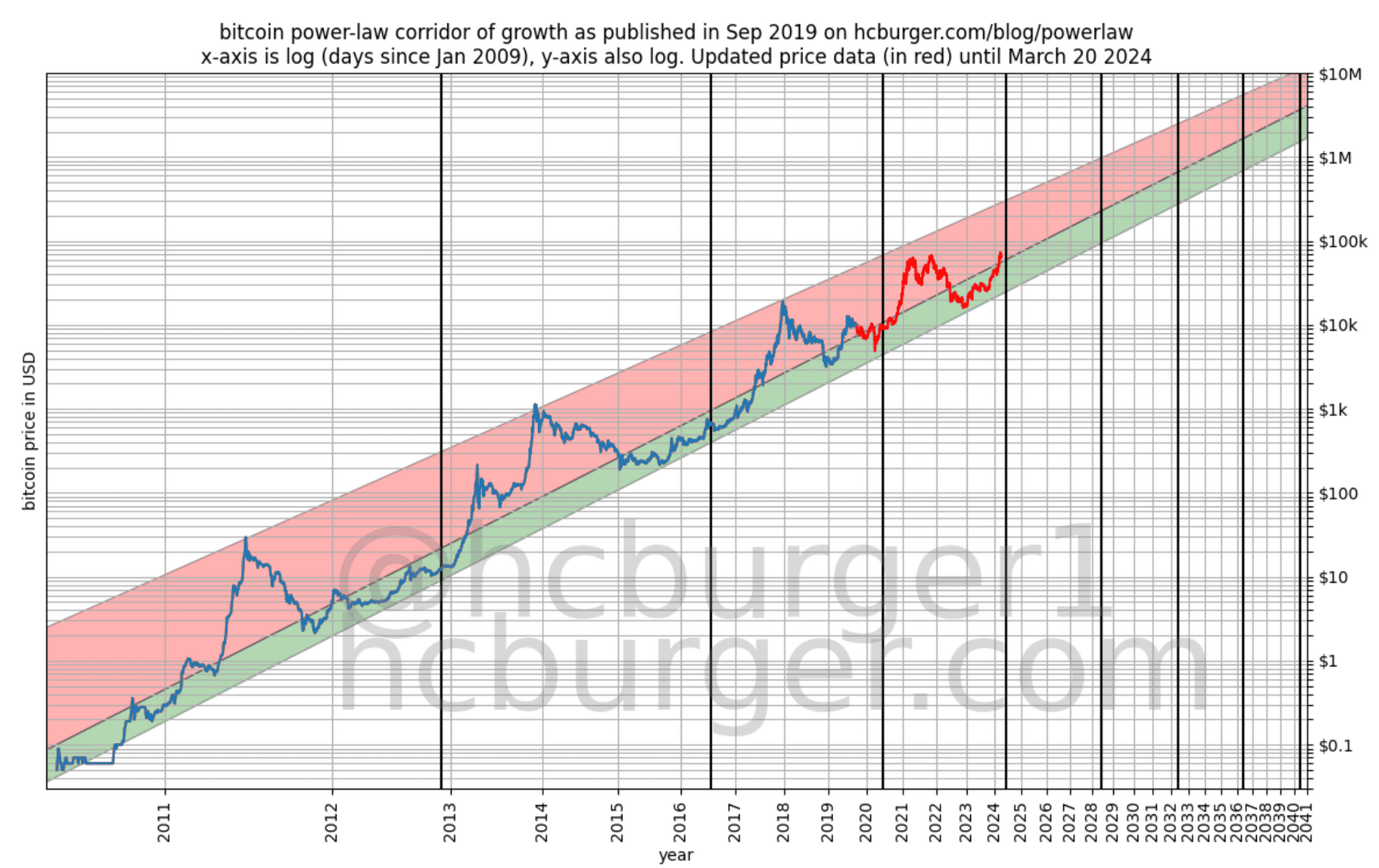

There has been a lot of recent discussion on the Power Law model (https://hcburger.com/blog/diminishingreturns) which gives a prediction of a range of bitcoin price against time.

It's noteworthy because price has continued to conform to the channel shown in the picture many years after the model was published - the red part of the line.

A model is just a model, and they can break. The log range used in these types of models is huge, so of course they are anyway useless as trading or timing tools. And as many people have pointed out, these chart models cannot take into account the real world fundamentals, such as the recent launch of the ETFs.

But there is still signal in these charts:

- we can expect ever increasing returns

- returns are a multiple of adoption increase (e.g. 10X adoption = 100X price)

- those returns are DIMINISHING rather than exponential.

You don't necessarily need a Power Law chart to work those things out, but the chart verifies the logic, and is currently the best model when correlating price against time. I don't suggest anyone (seriously) predicts price against time, because it will make you look like a fool.

But it is fun. And it is good marketing for bitcoin, which brings new adoption - and that is good.

A live chart is available at https://charts.bitbo.io/long-term-power-law/.

A model is just a model, and they can break. The log range used in these types of models is huge, so of course they are anyway useless as trading or timing tools. And as many people have pointed out, these chart models cannot take into account the real world fundamentals, such as the recent launch of the ETFs.

But there is still signal in these charts:

- we can expect ever increasing returns

- returns are a multiple of adoption increase (e.g. 10X adoption = 100X price)

- those returns are DIMINISHING rather than exponential.

You don't necessarily need a Power Law chart to work those things out, but the chart verifies the logic, and is currently the best model when correlating price against time. I don't suggest anyone (seriously) predicts price against time, because it will make you look like a fool.

But it is fun. And it is good marketing for bitcoin, which brings new adoption - and that is good.

A live chart is available at https://charts.bitbo.io/long-term-power-law/.

A model is just a model, and they can break. The log range used in these types of models is huge, so of course they are anyway useless as trading or timing tools. And as many people have pointed out, these chart models cannot take into account the real world fundamentals, such as the recent launch of the ETFs.

But there is still signal in these charts:

- we can expect ever increasing returns

- returns are a multiple of adoption increase (e.g. 10X adoption = 100X price)

- those returns are DIMINISHING rather than exponential.

You don't necessarily need a Power Law chart to work those things out, but the chart verifies the logic, and is currently the best model when correlating price against time. I don't suggest anyone (seriously) predicts price against time, because it will make you look like a fool.

But it is fun. And it is good marketing for bitcoin, which brings new adoption - and that is good.

A live chart is available at https://charts.bitbo.io/long-term-power-law/.

A model is just a model, and they can break. The log range used in these types of models is huge, so of course they are anyway useless as trading or timing tools. And as many people have pointed out, these chart models cannot take into account the real world fundamentals, such as the recent launch of the ETFs.

But there is still signal in these charts:

- we can expect ever increasing returns

- returns are a multiple of adoption increase (e.g. 10X adoption = 100X price)

- those returns are DIMINISHING rather than exponential.

You don't necessarily need a Power Law chart to work those things out, but the chart verifies the logic, and is currently the best model when correlating price against time. I don't suggest anyone (seriously) predicts price against time, because it will make you look like a fool.

But it is fun. And it is good marketing for bitcoin, which brings new adoption - and that is good.

A live chart is available at https://charts.bitbo.io/long-term-power-law/.@jack and COPA are legends!

Craig Wright finally destroyed.

🙏

It's so tiring trying to help loved ones.

When you gently show them all the reasons that bitcoin is the apex store of value, why do they always choose to base their thinking as if they bought the ATH and sold at the bottom?

A family member just sent me this even though they are currently up 7X on their first (and only) small allocation to bitcoin:

"Yes, but do we know what's round the corner. Anyone who invested say $110,000 in BTC in Nov 2021 would have seen its value fall to $34,000 by the following July, and $26,000 in Dec 2022. Have any of the other assets had such extreme roller coaster rides? Does anyone know what caused such violent swings? Are we in a more secure place now?"

Exhausting.

RELYING ON PROPERTY AS AN ASSET HAS BECOME DEFECTIVE.

"It was the best idea 200 years ago, but if you own a thousand acres and then someone establishes a state, and a mayor gets elected who decides to spend lavishly, raising your taxes once, twice, thrice, soon the farming family can’t afford the taxes. Then, the government decides you’re the bad guy, takes all your land, and evicts you. Maybe it doesn’t happen directly; maybe first, you mortgage the farm, then can’t pay the mortgage, and the bank seizes your property."

"[...or] the great-grandfather buys a farm, the grandfather and the father both farm the land, but now they can’t pay the taxes on it and have to sell it, moving into apartments"

@Michael Saylor at Bitcoin Atlantis in 2024

Fantastic to see how the bitcoin guys come in to correct false narrative.

Great job @Michael Saylor, @Troy Cross and @Dylan LeClair. 🙏

How do they stop the coming bank runs?

By closing the physical branches

(internet access can then be turned off with one button press at central office whenever things get hot)

https://www.news.com.au/finance/business/banking/bankwest-is-set-to-shut-down-all-60-branches-in-wa-as-the-company-goes-digital/news-story/e6df67eeef37a5f83a826b3ecb8d1610

You have a choice about putting your money into x (BTC) or y (USD):

a) x / 21million

b) y / infinity

Only junior maths required to see that for any x greater than zero, option a) wins.

#GetOffZero now.

The masses are sleeping, while the net of government control slowly tightens around them.

The UK discussing "plans for automated surveillance of millions of bank accounts".

Educate friends and family about Bitcoin.

the Guardian

Scrap plans to scan accounts of benefit claimants or risk new scandal, MPs told

Campaigners say ‘fully automated’ approach risks repeat of Post Office Horizon scandal

Stunning video, from a superb article.

A must watch.

View quoted note →