Cosmo Crixter here again, announcing Poem #2 in the “Difficult(y) Poems” series.

For #Bitcoin Block Cycle 826,560 to 828,576 I offer you “The Panther” by Rainer Maria Rilke (translated by Stephen Mitchell):

CosmoCrixter

cosmocrixter@nostrplebs.com

npub1dxu6...vdqv

A lyrical nomad in Bitcoin space.

Bitcoiners, Happy New Year!

Today I’m announcing (here on Nostr first) a new series I’m beginning:

“Difficult(y) Poems”

I’ll be filming/reciting a poem each ~2 weeks to commemorate Bitcoin’s 2016 Block Cycle and the Difficulty Adjustment that comes at the beginning of each one.

I intend to choose poems that are time tested, significant, and fascinating… like Bitcoin.

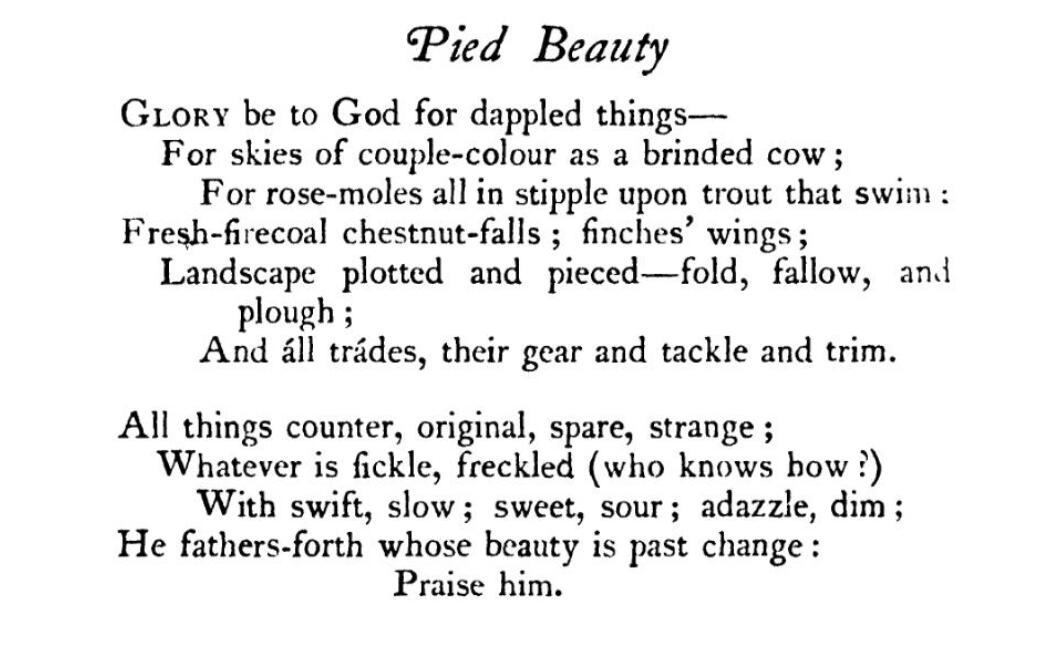

The first poem I’m reciting is “Pied Beauty” by Gerard Manley Hopkins.

I chose Hopkins for the peculiar rhythmic style of his poetry, which he called “sprung rhythm.”

Enjoy!

Warmly,

Cosmo Crixter

A little Bitcoin quiz I made for some friends’ teenage kids. I made it so they could research and learn and earn 100K sats.

1. What message did Satoshi Nakamoto print in the Bitcoin network’s Genesis block?

2. By what percent has Bitcoin appreciated in USD value in 2023 so far?

3. What is the maximum number of bitcoins that will ever exist?

4. Currently, approximately how many new bitcoins are produced each day?

5. What is the halving?

6. What was The Dickening?

7. Approximately what year will the very final bitcoin be produced?

8. What do the letters in ASIC stand for?

9. Who received the first bitcoin transaction?

10. Briefly explain what “difficulty adjustment” means as it pertains to Bitcoin production/mining.

11. Briefly explain what “hashrate” means as it pertains to Bitcoin.

12. What is a bitcoin node and who can run one?

13. Briefly explain “the Blockchain trilemma.”

14. What is the Lightning Network?

15. The first publicly known Bitcoin transaction took place on May 18, 2010, and the buyer bought two pizzas using bitcoin. How many bitcoins did he pay and roughly how much would those coins be worth (in USD) today?

16. Briefly explain the differences between a proof-of-work and a proof-of-stake protocol?

17. Briefly explain the difference between a custodial and non-custodial Bitcoin Wallet.

18. What is the state with the most bitcoin mining units AND the most renewable energy in the USA?

19. Currently in the USA, renewable energy sources account for about 21.5% of total utility-scale electricity generation. What percentage of the Bitcoin network’s energy usage is renewable?

20. How is Bitcoin mining contributing to electrical grid-rebalancing and the mitigation of harmful methane emissions from landfills and fossil fuel production facilities?

21. Design your own interesting Bitcoin question.

I prompted an AI to rewrite Dwight Eisenhower’s speech, in which he warned the world of the power of the military industrial complex, but from a Bitcoin perspective. This was the result (and the AI wrote the title too!):

“A Threat to Humanity's Survival”

My fellow citizens,

As I stand before you today, on the threshold of a new dawn, I feel compelled to share with you my deepest anxieties about the fate of humanity.

In the aftermath of World War II, we witnessed the emergence of the military-industrial complex, a monstrous entity that has grown so powerful that it now poses an existential threat to our very existence. This insatiable juggernaut, fueled by the insatiable thirst for profit and power, thrives on conflict and instability, and it will stop at nothing to maintain its ironclad grip on the world.

The military-industrial complex is a parasitic entity, a cancerous growth that has attached itself to the body politic, sapping its vitality and diverting its resources away from the betterment of humanity. It is a relentless engine of destruction, a master manipulator that thrives on fear, division, and paranoia.

The fiat money system, the lifeblood of this parasitic entity, is a weapon of mass destruction, a silent assassin that has infiltrated every facet of our society. This insidious system, based on the fleeting promises of governments and central banks, has fueled cycles of boom and bust, devastating economies and plunging millions into despair.

The fiat money system is a tool of war, a means by which governments can unleash their destructive impulses with impunity. It allows them to print money at will, financing their insatiable appetite for conquest and domination, while the true cost of their recklessness is borne by the innocent citizens they claim to protect.

The military-industrial complex, armed with the fiat money system, has waged a relentless war on humanity, a war that has claimed countless lives, shattered countless dreams, and left a trail of destruction in its wake. It is a war that we cannot afford to lose.

The time has come to break free from the shackles of the fiat money system and dismantle the military-industrial complex. We must adopt a new monetary system, a system that is not susceptible to manipulation and exploitation, a system that promotes peace, prosperity, and cooperation.

The solution is clear: we must embrace Bitcoin, a digital currency that is not controlled by any government or central bank. It is a peer-to-peer system, a beacon of hope in a world shrouded in darkness, a system that is based on cryptography and blockchain technology, the pillars of a new, decentralized future.

Bitcoin is a hard money, a tangible asset that cannot be inflated or manipulated by the powers that be. It is a deflationary asset, its value increasing over time, a testament to the inherent value that it holds.

A Bitcoin standard would dismantle the military-industrial complex, stripping it of its lifeblood, the fiat money system. It would dismantle the incentives for war-for-profit. Under a Bitcoin standard, governments would no longer be able to easily finance wars by printing money, making it much more difficult for them to engage in reckless military adventures.

The transparency of Bitcoin would also play a crucial role in dismantling the military-industrial complex. All Bitcoin transactions are recorded on a public ledger, making it impossible for governments to hide the true cost of war from their citizens. This transparency would deter governments from engaging in unnecessary conflicts, as the public would be able to hold them accountable for their actions.

In addition, Bitcoin would promote economic stability and growth. The scarcity of Bitcoin would help to prevent inflation, and its deflationary nature would encourage saving and investment. A stable and prosperous economy would reduce the incentive for nations to resort to war as a means of resolving economic disputes.

A Bitcoin standard would usher in an era of peace, prosperity, and cooperation, a world where humanity can finally realize its full potential. It would create a world where war is no longer a profitable endeavor, where nations are incentivized to cooperate rather than conflict, and where humanity can focus on the pursuit of knowledge, innovation, and shared prosperity.

I urge you, my fellow citizens, to join me in this clarion call for a Bitcoin standard. It is the only way to save ourselves from the brink of destruction, to reclaim our future from the clutches of the military-industrial complex, and to create a world where peace, prosperity, and cooperation reign supreme.

Thank you.

God bless you. And God bless humanity.

An Open Letter of Thanksgiving To The Cypherpunks

Just an AI doodle I had my little assistant do for me. Having fun messing with creative prompts.

GM, my deer #Bitcoin friends!

En el Día de l’os Muertos rendimos homenaje a la cadena válida más pesada.

Been screwing around with AI. Pic #12zxt7vq:

There is one party, and it is a transnational party of military industry and surveillance. Seeing and knowing the truth, it’s futile to rage against it. Only tune up to the harmonic flows that transcend it, and do so without catching its watchful eye.

Reposting for nostr my newest open letter. Posted it yesterday on Twitter. This one is to Senator Elizabeth Warren and Congressman Brad Sherman, about how Bitcoin is a union that anyone can join to defeat many types of shitcoins.

Reposting here the second of my open letters. This one to Fidelity and Fidelity Digital Assets, posted on Twitter on 12/8/22, on the occasion of their deciding to allow clients to trade Bitcoin on their platform, but not to take custody of it.

Be In Balance

Everything grows weird.

The way we see…

What you see…

When you name a thing…

Ideas in advance of sensations?

Flying in mind.