Once bitcoin surpasses real estate as the preferred store of value, architecture will shift to prioritize function over speculation.

Leon

@leonwankum@BitcoinNostr.com

npub1v5k4...8rd9

Bitcoin. Real Estate. Philosophy & Ethics. Proof-of-Work. Newsletter: leonwankum.substack.com

My new newsletter is out: from cypherpunks to corporations: what corporate adoption means for Bitcoin

Let me know your thoughts on this one! 🧠

From Cypherpunks to Corporations: What Corporate Adoption Means For Bitcoin

TBN 31 - In this edition, I’ll explain why I believe corporate Bitcoin adoption is a net positive for the entire ecosystem and what risks are ass...

Bitcoin-backed financial products make it possible to learn through insight, instead of the system having to collapse and people having to learn through suffering.

The legacy financial infrastructure is not compatible with Bitcoin.

As a result, legacy financial products will increasingly integrate and be exposed to bitcoin, not to reinvent the system, but to gradually harden existing structures (see $STRK & $STRF).

Over time, this process will lead to Bitcoin establishing itself as the monetary singularity, setting a new global monetary standard.

In my next newsletter, I’ll explore this in detail. Out next week!

The Bitcoin Newsletter | Leon Wankum | Substack

Bitcoin. Real Estate. Philosophy & Ethics. Click to read The Bitcoin Newsletter, by Leon Wankum, a Substack publication with thousands of subscribers.

My new newsletter, “Navigating the Shift from Real Estate to Bitcoin: Redefining How Humanity Saves, Builds Wealth, and Lives,” is out!

Navigating the Shift from Real Estate to Bitcoin: Redefining How Humanity Saves, Builds Wealth, and Lives

TBN 30 – In this edition of the newsletter, I dive into the strikingly similar investment thesis behind real estate and Bitcoin and explore tailo...

This was my first time speaking to a real estate crowd. 1,000+ RE investors open to learning about Bitcoin.

I was stunned at how openly BTC and its benefits for real estate development and management were embraced.

Clearly, the tide is shifting. ✨🛸

My new newsletter, "Navigating the Shift from Real Estate to Bitcoin: How Humanity Will Save and Live in the Future", launches this week!

The Bitcoin Newsletter | Leon Wankum | Substack

Bitcoin. Real Estate. Philosophy & Ethics. Click to read The Bitcoin Newsletter, by Leon Wankum, a Substack publication with thousands of subscribers.

The negative transformation in architecture, often rightly critiqued by Bitcoiners, wasn’t driven solely by fiat money. Both modern architecture and fiat currency are 20th‑century phenomena born of the same push for standardization, industrialization, and modernism

In the late 19th century, architecture, art, and design were deeply rooted in historical styles and maximalism. As the industrial revolution took hold, counter-movements emerged.

Adolf Loos was a radical early‑20th‑century Viennese architect who challenged norms by stripping away all ornamentation he deemed unnecessary. He argued that modernity required a break from the past.

He influenced a generation of architects. Among them was the Swiss architect Le Corbusier, who would become one of the most influential figures in modern architecture.

Simultaneously, the Bauhaus school emerged in Germany in 1919, under the leadership of Walter Gropius, with notable figures such as Ludwig Mies van der Rohe and Marcel Breuer.

Their emphasis on simple, functional forms made a lasting impact on global design, laying the groundwork for what we now consider modern, minimalist architecture. But not all minimalism is equal.

Early Bauhaus designers were arguably aesthetic innovators, but most things created since are not so elegantly designed. Today, the world has been filled with careless, knock-off minimalism, it feels cheap rather than stylish, boring instead of sleek.

We have also moved far away from the round shapes and attention to detail we find in nature. It is no wonder that people leave the city on weekends to reconnect with nature, where the calming effect of green soothes the human nervous system.

We have drifted far from nature. Traditional building materials like clay and wood, along with warm color schemes on both the interiors and exteriors of buildings, as well as the inclusion of gardens and dedicated spaces for the community, children, family life, and work, have largely been relegated to the background.

Coupled with rising costs driven by inflation, the deterioration of housing quality has become a hallmark of modernism.

The pendulum of fashion always swings one way, then another, and each generation reacts to what came before. So what is the future of architecture and design?

In much the same way that the Bauhaus movement standardized design, Bitcoin allows us to go back to a more individual design. Bitcoin’s fixed supply naturally encourages a low time‑preference mindset, with the potential to revive the intergenerational outlook vital for thoughtful design, architecture & urban development.

Under a Bitcoin standard, developers and residents alike would be motivated to invest in high‑quality, durable infrastructure and public spaces that benefit not just today’s generation, but those to come.

As Bitcoin continues to mature and integrate into our financial fabric, it may well catalyze a design and architecture revolution. Where the principles of tradition, modern architecture and sound money converge to create more affordable quality housing.

This was my first time speaking to a real estate crowd. 1,000+ real estate investors learning about Bitcoin.

I was absolutely amazed at how openly Bitcoin and its benefits for real estate development and management were embraced.

A testimonial to the work of @Tom Karadza and Nick Karadza at Rock Star Real Estate. Thank you for the invitation and the warm welcome.

The crowd was open for pure Bitcoin education, including demos of @AQUA Wallet and Bull Bitcoin! Clearly, the tide is shifting. ✨🛸

I really enjoyed this convo w @T-Bone, thanks for having me on 🫡

BASECAMP FOR MEN: The Podcast

Basecamp for Men E271: The Real Estate Implications of BTC - BASECAMP FOR MEN: The Podcast

Join Basecamp as they welcome thought-leader Leon Wankum, who operates at the crossroads of traditional real estate and Bitcoin.

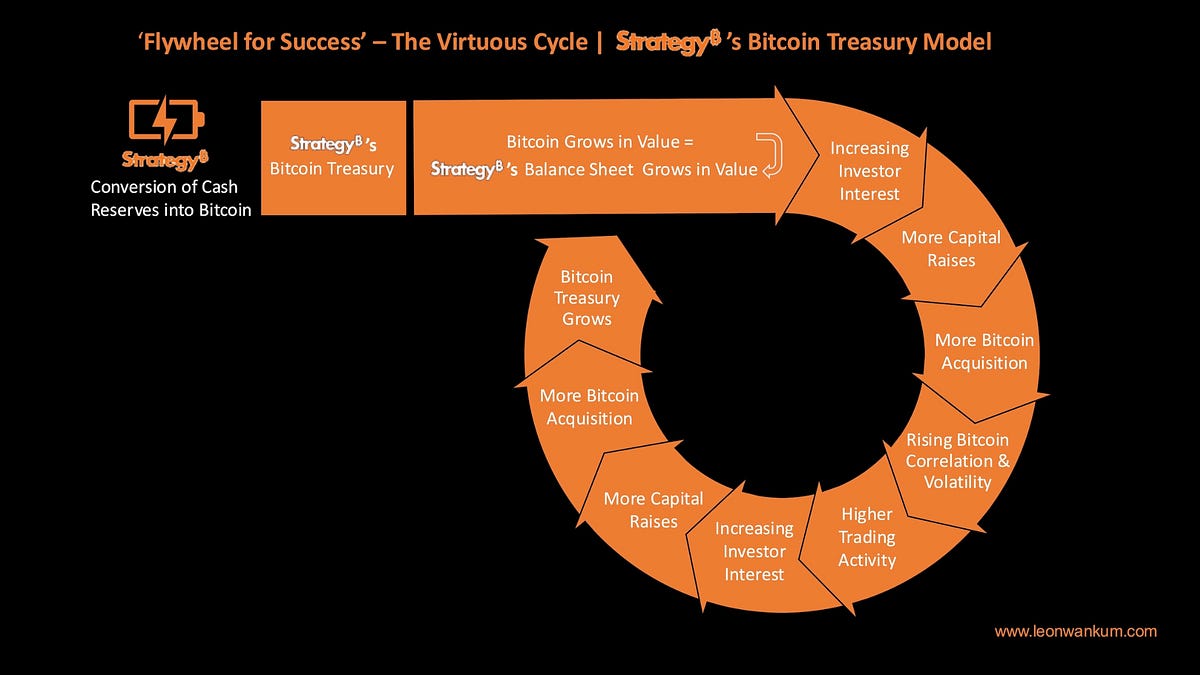

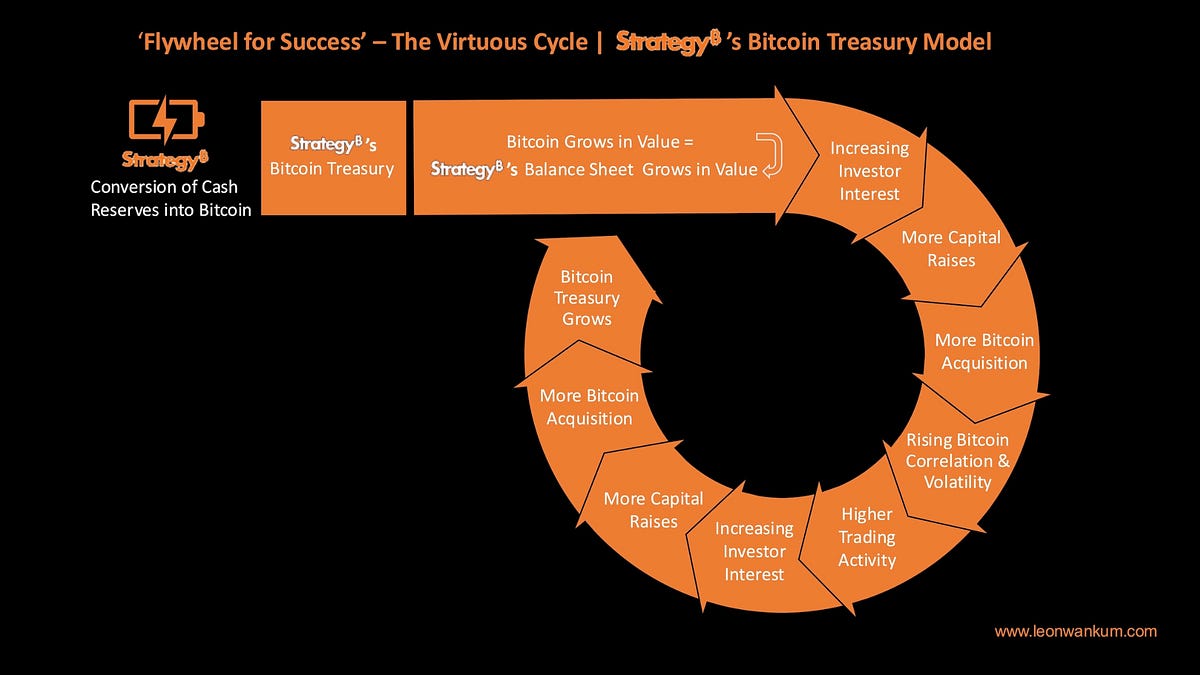

I finally published “The Strategy Playbook: Lessons for Real Estate Entrepreneurs”.

Although much has been written on this topic, I felt it was important to explore the strategy in greater detail.

As a real estate entrepreneur, I find this case particularly interesting because it serves as a blueprint for how real estate businesses can leverage their balance sheets to accumulate bitcoin in a similar way. The insights I gained will be integrated as a chapter in my book ‘Digital Real Estate’, and I welcome any feedback.

The Strategy Playbook: Lessons for Real Estate Entrepreneurs

TBN 29 - In this edition of the newsletter, I take a deep dive into how Strategy has uncovered a powerful financial dynamic that opens entirely new...

Keynesians are evil people. The world will eventually learn what a crime against humanity the disregard for monetary sovereignty was.

What Bitcoin has to offer to humanity is unprecedented: instead of society collapsing under inflation, bitcoin will be monetized through monetary debasement, serving as a cushion to elevate humanity to a new level of economic and social consciousness.

Thank you for the help @Sovereign Origin 🥕 🤝

https://bitcoin.fits.money/now-live-digitalrealestate-org/

You can play w/ our Bitcoin & Real Estate Portfolio Estimator!

It’s designed to help you understand how incorporating Bitcoin into real estate financing can significantly enhance investment performance.

The inclusion of Bitcoin as collateral in property financing can create a more resilient financial system. Real estate, the most widely used collateral, is inflated by monetary expansion. As the bubble may eventually burst, Bitcoin could act as a stabilizer, preventing crises and enabling a smoother transition to a new system.

View quoted note →

We’ve completed the first draft of our Bitcoin & real estate portfolio value estimator! 🏠🚀

This tool shows how Bitcoin can enhance your real estate portfolio performance! Try the model ⤵️  We are still optimizing for mobile & open for feedback. Send it around to family & friends and help us battle-test it! + Let us know your thoughts below!

Thanks to @Sovereign Origin 🥕 for building the model with us. 🤝

S/o to @Diarie & @Imke Wedekind for helping to compile all the data.

We will continue to work on the model and look forward to your feedback!

We are still optimizing for mobile & open for feedback. Send it around to family & friends and help us battle-test it! + Let us know your thoughts below!

Thanks to @Sovereign Origin 🥕 for building the model with us. 🤝

S/o to @Diarie & @Imke Wedekind for helping to compile all the data.

We will continue to work on the model and look forward to your feedback!

Digital Real Estate | Bitcoin & Real Estate: Portfolio Value Estimator

Learn how Bitcoin can improve your real estate portfolio performance

Open communication has always been central to fostering innovation, but it is threatened in the modern digital age.

You can find my thoughts on the significance of Nostr and censorship-resistant communication for innovation and human progress in BM. 💜

Bitcoin Magazine

Nostr: The Importance Of Censorship-Resistant Communication For Innovation And Human Progress

Open communication has been a central part of fostering innovation, this is threatened in the modern digital age.

Houses should fall to their cost of production + a premium for location & maintenance.