Sometimes witnesses being deposed think they can win their case right then and there if they answer questions a certain way.

IMO a more appropriate framing is you start a deposition with 100 points, and your goal is to lose as few as possible.

Mallard Beakman

mallardbeakman@iris.to

npub1vsl4...und7

Atlanta. COVID sanity. Bitcoin not crypto. Gay not LGBT. Former biochemist turned patent litigator.

A clear sign of a violent tornado is ground scouring. The most extreme example of this was the 2011 Philadelphia, Mississippi tornado. The EF5 removed up to two feet of soil in some spots.

I told a twink how in the 90s we could only get the weather from TV every ten minutes and how it always came with a particularly distinctive style of smooth jazz

What

It was only on the ground for 12 minutes, but this tornado was a high-end EF3 with estimated winds of 158 MPH in Waverly, Nebraska on April 26, 2024.

For tomorrow. "Multiple strong/potentially long-track tornadoes, very large to giant hail, and severe/damaging winds all appear likely."

Age verification laws are pointless at best.

Do apologists for the nanny state ever bother to think?

The infamous 2013 Washington, IL tornado was noteworthy for happening on a November morning. With low precipitation and the light of day, the high-end EF4 (190 mph) was well-documented as it traveled 46 miles in 48 minutes.

The most frustrating misunderstanding in bitcoin these days is conflating mempool rules with consensus rules.

Your mempool rules cannot stop consensus-valid transactions because consensus-valid transactions can skip the mempool.

Happy Friday!

What tyrannical overreach will the government announce today?

The April 26 Minden tornado was a mile wide at its peak and produced EF3 damage (estimated 160 MPH). A Doppler on Wheels, however, recorded winds of 224 MPH at an altitude of 2000 feet.

Interesting

This is where bitcoin's poor privacy properties become problematic.

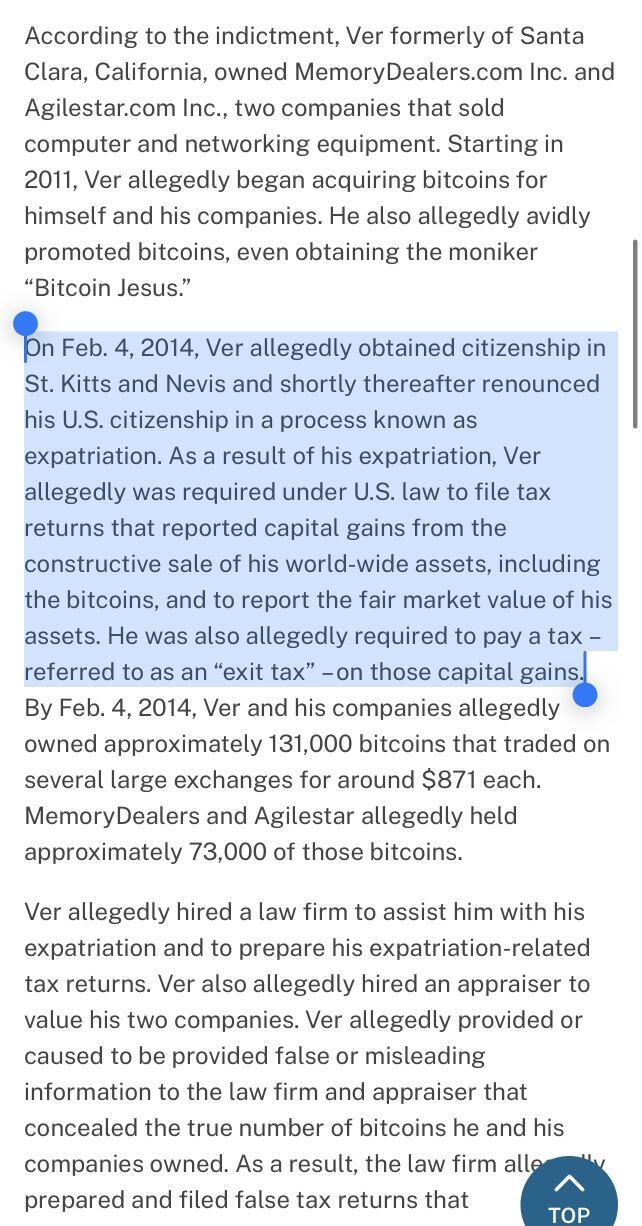

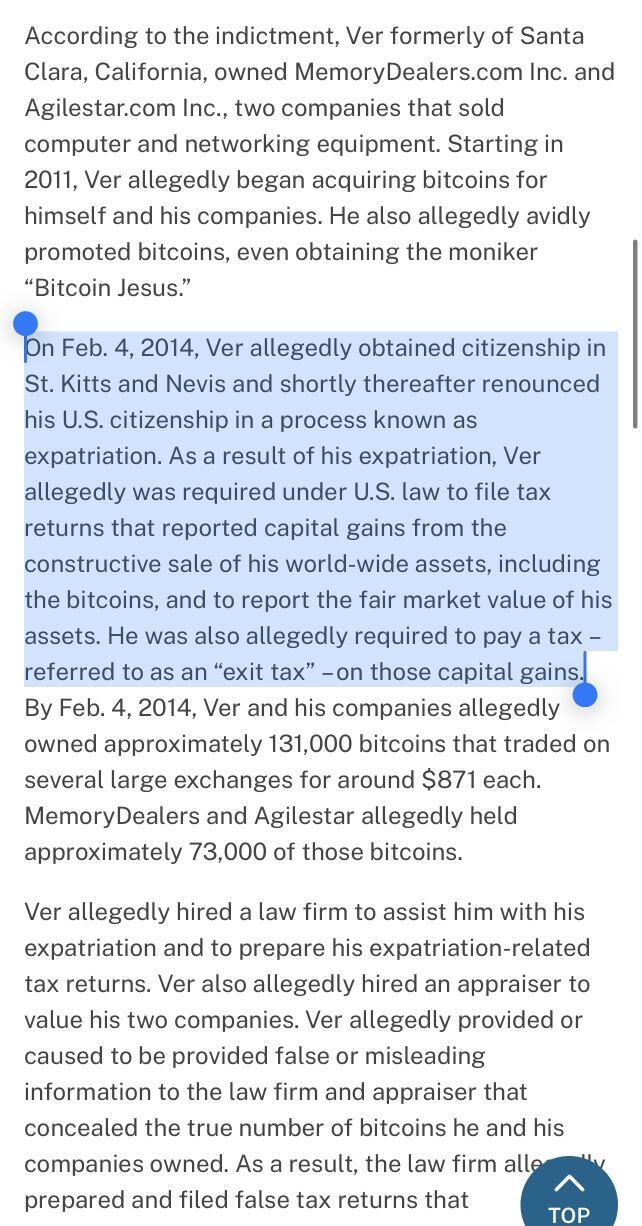

To renounce your US citizenship, you have to pay a tax on everything you own.

And because bitcoin is an open and transparent ledger, the gov't can more easily prove you owned BTC you failed to pay taxes on.

I can't breathe 🥵🥵🥵

I think people are confusing mixers with CoinJoin coordinators.

As is the case with miners, CoinJoin coordinators never obtain possession, custody, or control of the coins for which they facilitate transmission.

The case law isn't extensive, but it doesn't seem to take much to be a money transmitting "business."

Intuitively, I'd expect that liability under 18 U.S.C. § 1960 for the "business" requirement depends on the extent of money transmission. Is money transmission an object of the business, or is it merely incidental or accidental? Let's look at some cases I found that discuss the “business” requirement, which seems to be construed quite broadly. But first, I note that in 2021 Congress expanded the definition of "money transmitting business" to include "any other person who engages as a business in the transmission of currency, funds, or value that substitutes for currency, including any person who engages as a business in an informal money transfer system[.]” William M. (Mac) Thornberry National Defense Authorization Act for Fiscal Year 2021, P.L. 116-283, 134 Stat. 3388 (Jan. 1, 2021). Many of the cases below, therefore, won’t reflect the statutory language currently in effect:

United States v. Banki, 685 F.3d 99, 114 (2d Cir. 2011) (vacating conviction under section 1960 because the district court denied defendant’s motion to define “business” for the jury). The court reiterated Second Circuit precedent that “to find a defendant liable for operating an unlicensed money transmitting business, a jury must find that he participated in more than a ‘single, isolated transmission of money.’” Id. (citation omitted).

United States v. Elfgeeh, 515 F.3d 100, 108 (2d Cir. 2008) (affirming § 1960 conviction of defendant who ran a hawala, an informal money transmitting business, out of his ice cream shop). At trial, the defense argued that the hawala was merely a “service” to Brooklyn’s Yemeni community rather than a “business” under section 1960. Id. at 111. One defendant testified that “the hawala service was for Yemeni-Americans only, that he transmitted money only for individuals, not for businesses, and that he charged individuals for his service only in order to cover the banking fees charged by commercial banks for the transmissions and to cover the costs of delivering the money on the receiving end.” Id.(citations omitted). “The government had countered this defense with testimony by the New York State Banking Department representative, who testified that a money-transmitting business need not take in revenue, and need not be profitable, to trigger the licensing requirement.” Id. The jury apparently found the defense’s arguments unconvincing and convicted both defendants of operating an unlicensed money-transmitting business in violation of 18 U.S.C. § 1960(a). Id. at 107. The defendants did not raise the issue on appeal, and the convictions were affirmed for other reasons. Id. at 108.

United States v. Velastegui, 199 F.3d 590, 595 n.4 (2d Cir. 1999) (reversing dismissal of charge of illegal money transmitting under section 1960 but noting in dicta that the court’s “holding does not mean that an agent could face federal criminal prosecution for innocent conduct in mistakenly transmitting money that it had received on behalf of a licensed principal, or for an isolated instance of improper transmittal of money. First, section 1960(a) requires that the unlicensed entity be ‘an illegal money transmitting BUSINESS’ (emphasis added) which insures that persons or entities cannot be prosecuted for a single, isolated transmission of money”).

United States v. $215,587.22 in United States Currency, 306 F. Supp. 3D 213, 216, 220 (D.D.C. 2018) (rejecting argument that “a government-affairs and public-relations ‘consultancy’ [] is beyond the reach of the money transmitting statute as a matter of law” where the consultancy allegedly “distributed more than $8.4 million on behalf of clients through hundreds of wire transfers and checks to many different individuals, vendors, and financial institutions while charging a fee”). See also id. at 220 (“In a similar vein, the Szlaviks suggest that applying § 1960 to businesses that transfer funds as part of work they do for clients would subject other professional services firms, including law firms, to misguided prosecutions and civil forfeiture actions. This concern may well be valid. But the Court’s job at this juncture is to decide whether the government has statutory authority to seek forfeiture based on the conduct alleged in its complaint. It is not to predict how the government might choose to exercise its authority in future cases.”) (citations omitted).

United States v. Neumann, 2022 U.S. Dist. LEXIS 147582, at *13, (S.D.N.Y. Aug. 17, 2022) (rejecting Defendant’s argument that the “Government did not adequately allege that he conspired to operate a ‘business’ under § 1960 as it only allege[d]that he participated in four isolated transactions with the [cooperating witness]”). The court held that the “the allegations in Count Five alone are sufficient because the Government alleges that on multiple occasions, Defendant accepted cash amounts from the CW and gave him back a check for a similar amount minus a ten percent commission Defendant retained as fee ‘for laundering the cash.’ (Indictment ¶ 10.).” Id. at *15-16.

United States v. 47 10-Ounce Gold Bars, 35 1-Ounce Gold Coins, & 3,069 1-Ounce Silver Coins, No. CV 03-955-MA, 2005 U.S. Dist. LEXIS 2906, at *17 (D. Or. Jan. 28, 2005) (denying government’s motion for summary judgment in civil forfeiture action that “Crowne Gold operated a money transmitting business”). “While these records and other evidence in Exhibit 7 may show that Crowne Gold sold gold holdings and transferred the proceeds as directed to third parties, the bank records in Exhibit 7 do not establish that money transmission was an integral, not collateral, part of Crowne Gold's business in 2002. Many businesses receive and transmit funds as payment as a part of their business.” Id. at *16. Thus, the court held that“[t]he evidence is not adequate to establish that it is more probably true than not true that Crowne Gold was a ‘network of people who engage as a business in facilitating the transfer of money’ or to connect the gold and silver seized with purported money transmitting activities.” Id. at *17.

Disclaimer: I could've been tripping out on shrooms for all you know while I wrote this, so don't rely on it.

As of yesterday, the federal government's position is that no "control" is required to be a money transmitter.

Note: it is a crime to be an unlicensed money transmitting "business." Commentators on Twitter are overlooking the "business" requirement, IMO.

I will say this only on Nostr: my conviction in Bitcoin has been seriously rattled over the last few days.

What have I got myself into? Is Bitcoin doomed to failure due to its unfavorable privacy properties? Can it get co-opted and turned into fed surveillance coin? What if the Monero bros were right? Privacy on Bitcoin now seems as elusive as a dream.

And on a separate matter, as Matt Corallo just pointed out to Marty Bent, miner centralization is worse than we previously thought (many miners, it turns out, are just proxies for AntPool). Also concerning is the amount of hash power residing in the United States. And worst of all is that miners aren't even TESTING Stratum v2 to potentially alleviate these vulnerabilities.

Although I'd prefer to sink with the ship, I couldn't sell my bitcoin even if I wanted to. No exchange wants tainted coins at this point, and I have no way of calculating taxes due to my poor recordkeeping (I'm stuck in the U.S.).

I think for now I will focus on my fiat savings. I'm 31, which (although quite ancient for homosexuals) should theoretically give me time to save myself if my high conviction in bitcoin was misplaced. But should bitcoin fail, it would be an extremely painful setback.

I suppose it would be for many of you as well. I just wish I could share your optimism, but my mind is poisoned with doubts.

The most impressive footage I've seen from today's tornadoes