*Daoism… undermines authority culturally, but does not articulate a right to oppose it.

…Daoism rejects rule because it cannot work, not because it violates rights. Its anarchism is negative rather than juridical: it dissolves authority by denying its competence and moral necessity.*

View quoted note →

halalmoney

halalmoney@stacker.news

npub1vdaz...7rjz

Freedom. Justice. #Bitcoin

https://stacker.news/r/halalmoney

*Build for sovereignty, not speculation. Build for survival, not surrender. Build for the world that is coming, not the world that is ending.*

View quoted note →

*What we must build are not bridges to the old system but tools for the new one: circular economies where commerce occurs in sats without fiat conversion, self-custody infrastructure that makes sovereignty accessible without compromising security, mining decentralization that prevents any single power center from dominating hash rate, privacy preservation that maintains fungibility essential to money's function, cross-border settlement infrastructure for the geopolitical phase.*

View quoted note →

*As debt-based structures fail and Bitcoin-based alternatives succeed, cultural attitudes shift… The idea that perpetual credit expansion is required for economic function is revealed as artifact of fiat rather than economic law. Equity-based financing, direct ownership, and time preference aligned with deflation become cultural defaults. This is not imposed through ideology but discovered through experience—those who adapted to Bitcoin's monetary properties prospered, those who clung to debt-based thinking did not.*

View quoted note →

*Each circular economy that establishes sats-denominated loops reduces dependency on fiat and demonstrates viability.*

View quoted note →

*The old model—controlling access to expensive energy—loses to the new model—producing abundant energy domestically.*

View quoted note →

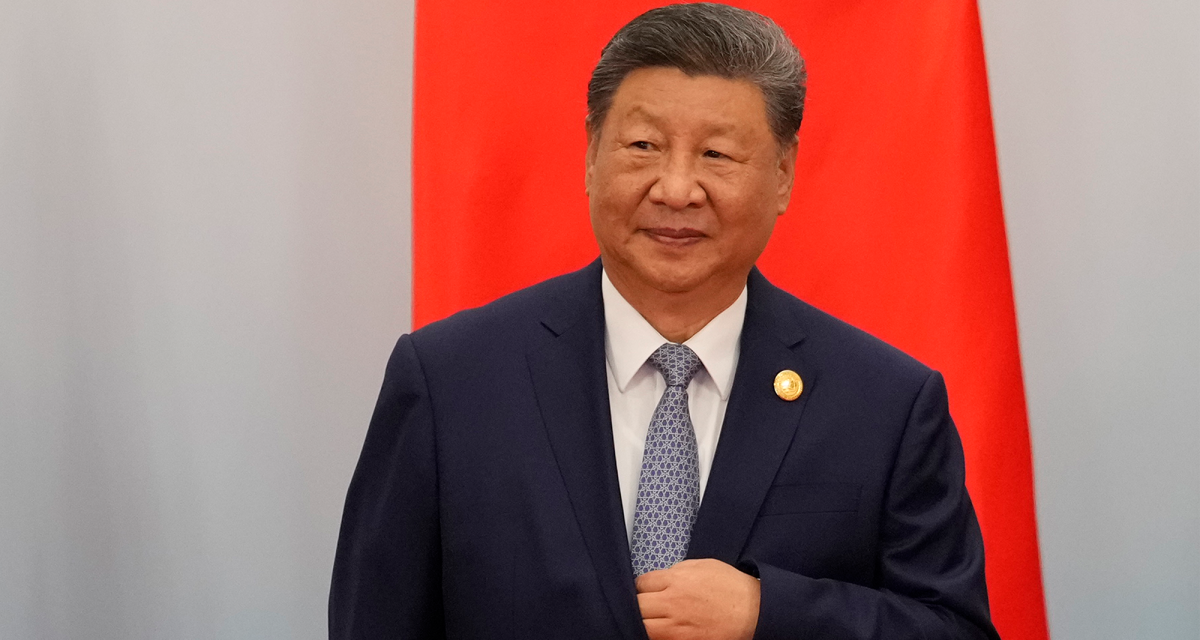

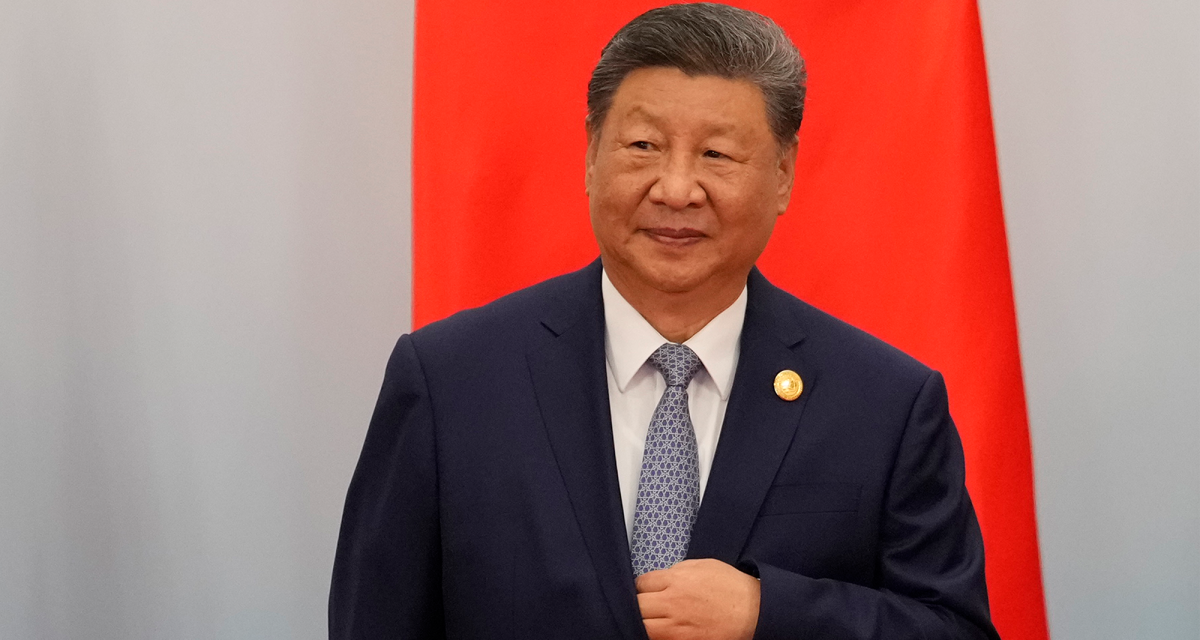

*China maintains an estimated 55-70% hash rate dominance through covert operations—mining conducted outside official channels, often using subsidized energy and state-adjacent entities while maintaining public prohibition. This contradiction reveals the actual position: China recognizes Bitcoin's strategic value even while suppressing retail access. The question is not whether China will shift policy but when it becomes advantageous to formalize what is already occurring in shadow.*

View quoted note →

*In a Bitcoin-denominated economy, debt-based structures cannot compete with equity-based structures, credit cannot compete with savings, and time preference shifts toward the future. This is not a normative claim about what should happen but a descriptive claim about what must happen given the incentives.*

View quoted note →

*But the primary accelerant is geopolitical multipolarity itself. In a unipolar world, the hegemon could suppress Bitcoin through coordinated action. In a multipolar world fragmenting along trust lines, each power center needs Bitcoin as a hedge against the others. Sovereign competition in stacking reserves and building hash rate becomes a strategic imperative, not an ideological choice. This is not speculation about what could happen—it is analysis of what must happen given the structural incentives already in place.*

View quoted note →

*Phase 3: Geopolitical (Emerging)

This is the next rung, and it operates through entirely different mechanisms. It is characterized by sovereign competition: nation-states stacking Bitcoin reserves as hedge against dedollarization and fiat debasement; hash rate becoming recognized as strategic infrastructure analogous to energy or semiconductor production; interstate commerce settling in Bitcoin to avoid counterparty risk in a low-trust multipolar environment; energy abundance (from petrodollar collapse and nuclear reintegration) funding massive mining expansion.*

View quoted note →

*Phase 3: Geopolitical (Emerging)

This is the next rung, and it operates through entirely different mechanisms. It is characterized by sovereign competition: nation-states stacking Bitcoin reserves as hedge against dedollarization and fiat debasement; hash rate becoming recognized as strategic infrastructure analogous to energy or semiconductor production; interstate commerce settling in Bitcoin to avoid counterparty risk in a low-trust multipolar environment; energy abundance (from petrodollar collapse and nuclear reintegration) funding massive mining expansion.*

View quoted note →

*Bitcoin is not a trend to be extrapolated but a system with specific rules operating in a changing environment. Understanding its trajectory requires understanding both the system and the environment, while remaining constantly aware of the ways our own cognition will try to mislead us.*

View quoted note →

*The supply shock matters, but its impact depends on the structural adoption phase it coincides with—the size of the addressable market, the nature of new entrants, the macroeconomic context, the available use cases. What happens when you knock over the domino depends where they other dominoes are standing. A halving during sovereign adoption will have different magnitude effects than a halving during retail speculation, not because the mechanism changed but because the adoption phase changed.*

View quoted note →

*It feels like every headline is engineered to spark a political reaction or manipulate our emotions... There’s so much more value in improving our immediate circles than in pouring energy into distant stories we can’t control.*

View quoted note →

*the currents will toss you around. be the gentle wind*

View quoted note →

The lizard people think in centuries to preserve their power.

We, who work for a higher purpose, should at least think in decades.

Stay the course.

“You had Bessent try to walk back Trump's weak dollar stuff, but Trump said it. Everybody knows that only Trump matters. So at the end of the day, you have a president who wants a weaker dollar, and who's breaking the world order. Those are your pillars of gold strength and price action.”

Wall Street entertains every possibility after gold’s wild ride, Main Street maintains its bullish bias despite new Fed head | Kitco News

Wall Street entertains every possibility after gold’s wild ride, Main Street maintains its bullish bias despite new Fed head

The Kitco News Team brings you the latest news, videos, analysis and opinions regarding Precious Metals, Crypto, Mining, World Markets and Global E...

China's AI strategy gaining traction is crucial as it challenges U.S. tech dominance and could redefine global economic and geopolitical power.

## Economic Power Shift

AI is set to add trillions to the world economy by 2030, with China positioned to claim a quarter through rapid industry integration in manufacturing, healthcare, and finance. This fuels GDP growth amid property slumps, boosting productivity via cheap domestic chips and models.

## Geopolitical Leverage

Bypassing U.S. sanctions with efficient AI lets China export standards via the Digital Silk Road, influencing infrastructure in the Global South and gaining data advantages.

## Innovation Race

China's focus on deployment over frontier research accelerates real-world gains in robotics and EVs, risking Western primacy but spurring global competition and affordable tech diffusion.

Perplexity

Citations:

[1] China's AI Acceleration: Economic Growth, Global ...

[2] China's AI+ Economy | World Economic Forum Annual ...

[3] China's Economic Strategy in 2026 to Prioritize Continuity ...  [4] China's tech bet fall short of filling property hole, report says

[4] China's tech bet fall short of filling property hole, report says  [5] How will AI shape the economy and markets in 2026?

[5] How will AI shape the economy and markets in 2026?  [6] China's Industries to Watch in 2026

[6] China's Industries to Watch in 2026  [7] China's AI+ Economy https://www.weforum.org/meetings/world-economic-forum-annual-meeting-2026/sessions/chinas-ai-economy/

[8] “Intelligent everything”: China's policy to supercharge AI ...

[7] China's AI+ Economy https://www.weforum.org/meetings/world-economic-forum-annual-meeting-2026/sessions/chinas-ai-economy/

[8] “Intelligent everything”: China's policy to supercharge AI ...

China’s AI Acceleration: Economic Growth, Global Influence, and the Road Ahead in 2026 – China Focus

China’s AI acceleration in 2026 reflects a shift from experimentation to execution.

Asia Pacific Foundation of Canada

China’s Economic Strategy in 2026 to Prioritize Continuity Over Change

China

CNBC

China's AI and robotics push isn't enough to kickstart its economy, leaving growth more exposed to trade risks

New tech sectors still account for a far smaller portion of China's economy than the gap left by the real estate slump.

How will AI shape the economy and markets in 2026? | Vanguard UK Professional

AI-driven exuberance may be justified for the economy but not so much for equity markets. Read what the future might hold.

China Briefing News

China’s Industries to Watch in 2026

China's industries enter a strategic reset in 2026 as the 15th FYP prioritizes capability‑building, consolidation, and self‑reliance.

“Intelligent everything”: China’s policy to supercharge AI adoption

Markets exhibit "fat tails" (leptokurtosis), making extreme events more common than Gaussian models predict—e.g., the 1987 crash was a 21-sigma event under normal assumptions, yet it happened

explain

Fat tails and leptokurtosis describe why financial markets experience extreme events far more often than standard statistical models predict. Under a normal (Gaussian) distribution, price moves beyond 3 standard deviations occur roughly 0.3% of the time, making outliers like a 10-sigma event (or the 1987's 21-sigma crash) virtually impossible in human history.[1]

## Core Concepts

Leptokurtosis means a distribution has excess kurtosis (>3), creating sharper central peaks and fatter tails—more frequent moderate deviations plus clustered extreme shocks. Fat tails specifically highlight those heavy outer regions, where "black swan" events (e.g., market crashes) have higher probability mass than Gaussian assumptions allow, often due to volatility clustering, herding, or leverage feedback loops.[1][2]

## 1987 Crash Example

On October 19, 1987, the S&P 500 dropped 20.5% in one day—a 21-sigma move under daily return norms (mean ~0.03%, std dev ~0.98%). Normal models pegged this at 1 in 10^50 odds, yet it happened because real returns follow power-law or Student-t distributions with leptokurtic traits, amplifying tail risks during panic selling.[ from prior]

## Implications for Markets

VaR and Gaussian risk models underestimate crashes, as seen in 1987, 2008, and recent silver volatility; traders counter with tail-hedging (options) or regime-aware strategies recognizing non-stationary variance.[1][2]

Citations:

[1] Fat Tail Risk  [2] Fat Tails: Why Mean Reversion is a Rarity in Financial ...

[3] Tail Risk Explained: Managing Rare Events Leading to ...

[2] Fat Tails: Why Mean Reversion is a Rarity in Financial ...

[3] Tail Risk Explained: Managing Rare Events Leading to ... :max_bytes(150000):strip_icc()/tailrisk.asp-final-23b01c67c985407d96ebd297736e6c8a.png) [4] Extreme Value Theory and Fat Tails in Equity Markets https://people.brandeis.edu/~blebaron/wps/tails.pdf

[5] How To Use Kurtosis In Trading With LightningChart JS ...

[4] Extreme Value Theory and Fat Tails in Equity Markets https://people.brandeis.edu/~blebaron/wps/tails.pdf

[5] How To Use Kurtosis In Trading With LightningChart JS ...  [6] Fat Tail

[6] Fat Tail  [7] Fat-tailed distribution

[8] Investment Perspectives | Fat Tails

[7] Fat-tailed distribution

[8] Investment Perspectives | Fat Tails  [9] Fat Tail Risk: What It Means and Why You Should Be ... https://www.nasdaq.com/articles/fat-tail-risk-what-it-means-and-why-you-should-be-aware-it-2015-11-02

Perplexity

[9] Fat Tail Risk: What It Means and Why You Should Be ... https://www.nasdaq.com/articles/fat-tail-risk-what-it-means-and-why-you-should-be-aware-it-2015-11-02

Perplexity

Avenue Investment Management

Fat Tail Risk

Learn how fat tail risk impacts investment portfolios and why traditional models underestimate these extreme market events. Discover protection str...

Fat Tails: Why Mean Reversion is a Rarity in Financial Markets for NASDAQ:NVDA by flibusters — TradingView

:max_bytes(150000):strip_icc()/tailrisk.asp-final-23b01c67c985407d96ebd297736e6c8a.png)

Investopedia

Tail Risk Explained: Managing Rare Events Leading to Portfolio Losses

Discover how tail risk impacts portfolios, why rare financial events matter, and strategies for safeguarding investments against significant, unexp...

LightningChart

How To Use Kurtosis In Trading With LightningChart JS Trader

Learn how to use kurtosis technical indicator for developing trading applications with LightningChart JS Trader with high-performance.

Learnsignal

Fat Tail

A fat tail is a probability distribution that more commonly forecasts movements of 3 or more standard deviations than a normal distribution

Fat-tailed distribution - Wikipedia

Investment Perspectives | Fat Tails | Brown Advisory

*always stay in the Light, be Brave, use all the tools necessary for self-defense, and be around a community of good Moral people*

View quoted note →