Client Challenge

Baltas ∞/21M

npub1f7h5...w75e

Dollar-cost averaging involves investing the same amount of money in a target security at regular intervals over a certain period of time, regardless of price.

It's never too late to learn. Economics, mathematics, history, etc.

In the future, music, books, movies will be free. We simply ZAP for authors.

Amanda Palmer: The art of asking

The art of asking

Don't make people pay for music, says Amanda Palmer: Let them. In a passionate talk that begins in her days as a street performer (drop a dollar in...

Share your favorite TED talks

Derek Sivers: How to start a movement

How to start a movement

With help from some surprising footage, Derek Sivers explains how movements really get started. (Hint: it takes two.)

Zap me mama like Bitcoin whale. An uplifting song.

I thought the fight was just starting, but it turns out they have already won.

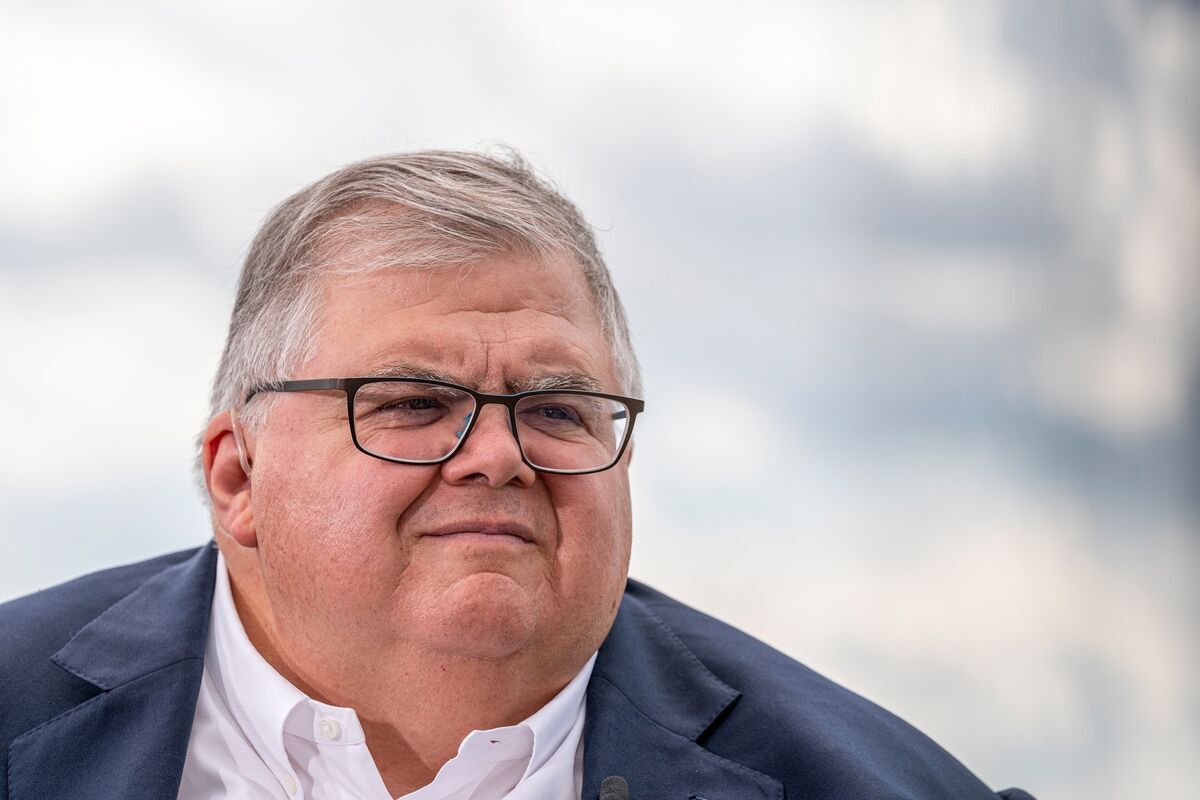

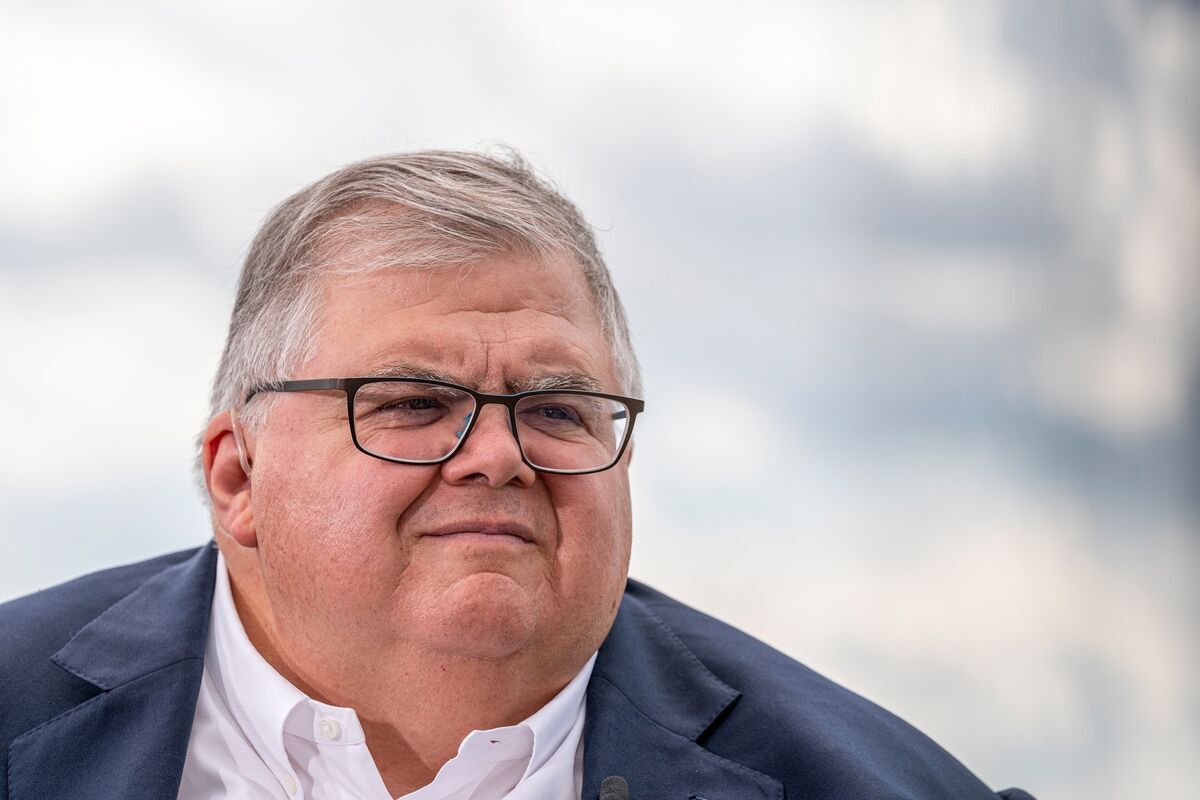

Bloomberg.com

Crypto Has Lost the ‘Battle’ Against Fiat Currency, BIS Chief Agustin Carstens Says

The argument that crypto is an alternative to fiat currency has been settled following last year’s turmoil in the digital-asset sector, according...

#Bitcoin

95% of people don't work, they slave away. They work out of fear, not for meaning and pleasure.

https://twitter.com/ChyrychAndrei1/status/1628796511151611905?t=BX9tueE5pqA0C0JcdAhrtQ&s=19

Hard work requires a hard wallet. #Trezor #Bitcoin #work

In 2004, the Bank of #Norway sold off almost all of its #gold reserves, keeping just seven gold bars as souvenirs. The decision to sell the gold was based on several factors, including the high costs associated with storing and guarding the gold, and the fact that the gold holdings were not generating any income for the bank.

At the time of the sale, the Bank of Norway held around 3.5 million ounces of gold, worth approximately $1.5 billion USD. The sale was conducted over a period of several months, with the bank gradually selling off its gold holdings in order to avoid disrupting the gold market.

The decision to sell off its gold reserves was controversial at the time, with some critics arguing that the bank was making a mistake by getting rid of its gold. However, the bank defended its decision by pointing out that gold is a relatively unproductive asset, and that it made more sense for the bank to invest its funds in other assets that could generate income

#Bitcoin

Old pros don't show emotion anymore, they just enjoy the process.

The largest purchase of gold by the IMF was made in 1971, when the United States refused to redeem its dollars for gold under the Bretton Woods system. That year, the IMF bought 50 million ounces of gold from the United States, which amounted to about 1.5 million kilograms of gold.

Since the price of gold was fixed at $35 per ounce at that time, the IMF purchased this gold reserve for approximately $1.75 billion. This was one of the largest gold purchases in history.

#Inflation is like a genie, very easy to let out, but hard to put back in.

Humans are pre-programmed to be bad at investing. What to do? #DCA