#Bitcoin wallets holding between 1,000 and 10,000 BTC increased their holdings while prices slid over the past few days, while those owning less than 1 BTC were sellers,

IntoTheBlock data shows.

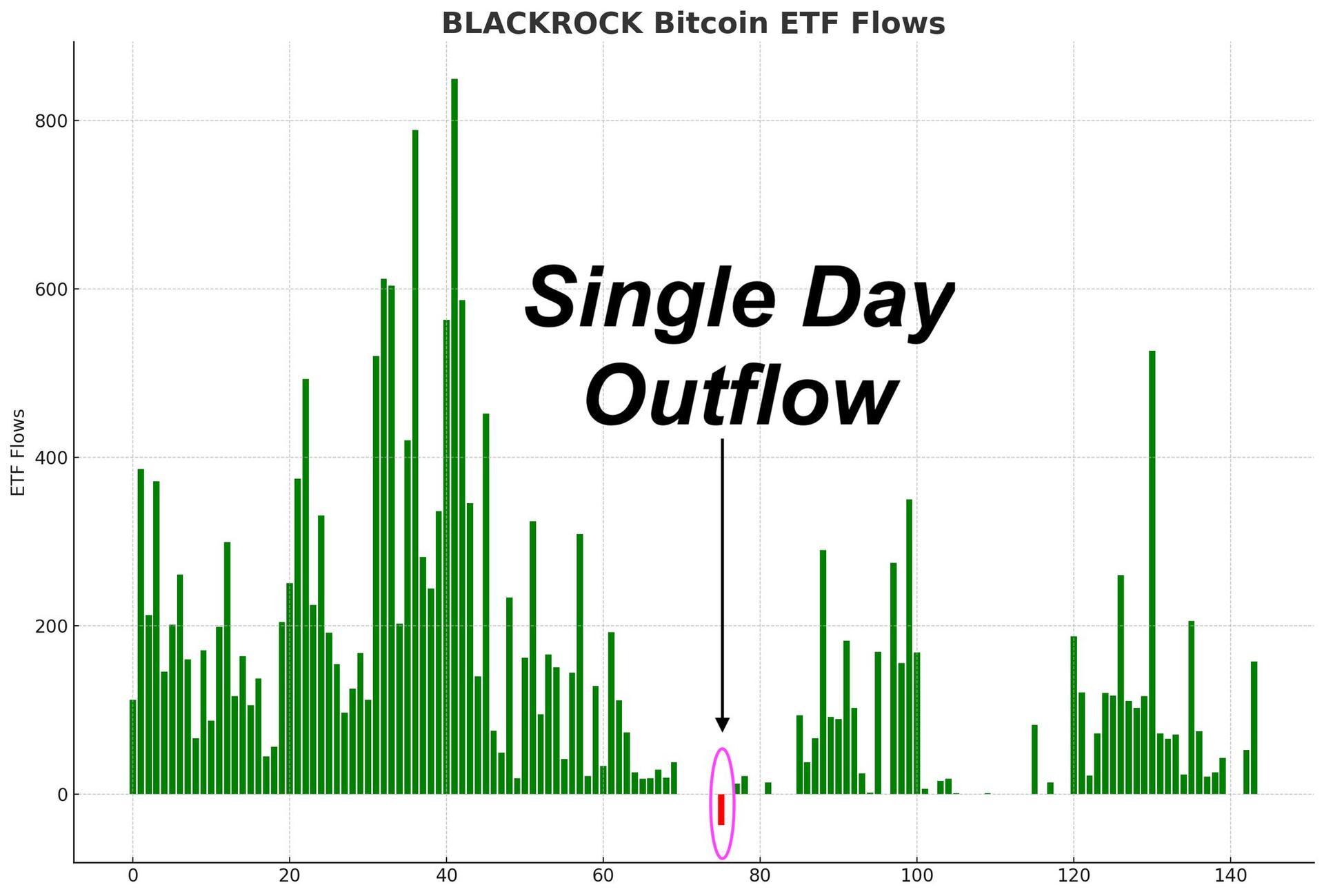

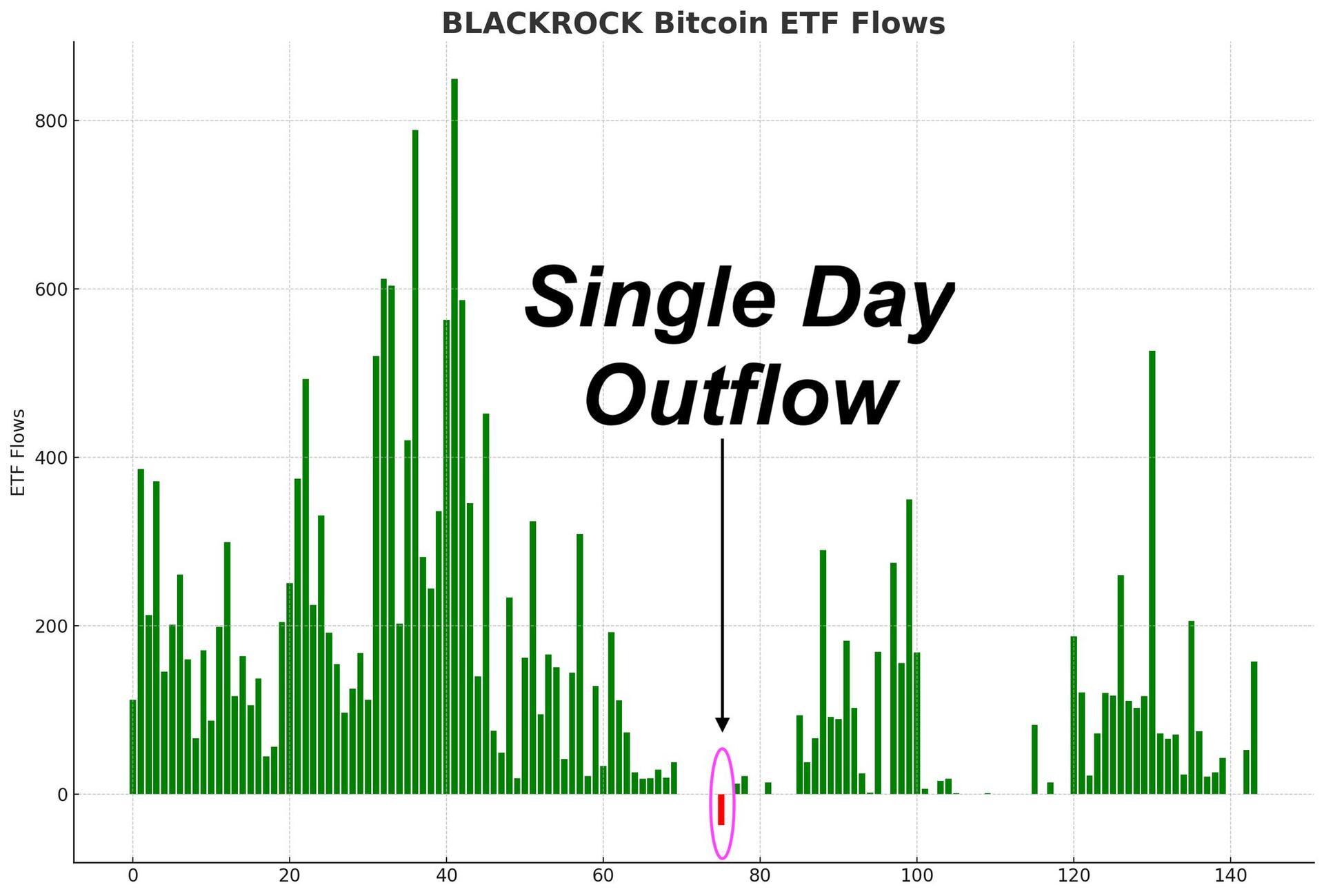

Bitcoin ETFs saw $168 million net outflows on Monday, led by Grayscale's GBTC, Fidelity's FBTC and 21Shares/Ark Invest's ARKB.

Bitcoin Whales Increased Holdings During Crypto Market Mayhem, but ETF Investors Didn't Buy the Dip

Though posting net outflows on Monday, the spot ETF action did show some positive surprises, Bloomberg ETF analyst Eric Balchunas noted.

How the psychology of money by Morgan Housel applies to #Bitcoin

1. **Belief in the Future:** Bitcoiners see #Bitcoin as the future of money, a hedge against inflation, driving long-term #HODLing.

2. **Risk and Reward:** Bitcoin's #volatility can trigger emotional responses, but understanding the #PsychologyOfMoney helps see swings as #opportunities.

3. **Scarcity and Value:** Bitcoin’s fixed supply taps into #scarcity, making it more valuable to those who understand this concept.

4. **Trust and Decentralization:** Bitcoin shifts trust from centralized institutions to a #decentralized network, requiring a new approach to #money.

5. **Community and Identity:** For many, owning #Bitcoin is part of their identity, with #community reinforcing commitment despite market changes.

The production cost of one Bitcoin after the 2024 halving is estimated to be around $45,000.

Creating Bitcoin isn’t cheap—and it shouldn’t be.

This cost is a direct result of the proof-of-work mechanism.

Proof-of-work is the foundation of the Bitcoin network, a decentralized system with no central authority, that enables consensus on the blockchain:

**Determining which addresses own what amount of Bitcoin at any given time.**

Proof-of-work is vital because it bridges the digital and physical worlds.

It’s the key to digital scarcity.

In this sense, Bitcoin is digital, but not virtual.

Bitcoin is unique.

Ride the rocket 🚀

#Bitcoin #BTC #BitcoinHalving #ProofOfWork #DigitalGold #Blockchain #Decentralization #Crypto #Hodl #DigitalScarcity #SoundMoney #BitcoinNetwork #Cryptocurrency #NoCentralAuthority #DigitalRevolution #StoreOfValue #BitcoinMaximalist #DigitalEconomy #Nostr #FreedomMoney #FutureOfFinance

Is this the only #bitcoin chart you need ?

@Lyn Alden what do you think?

BlackRock's #Bitcoin ETF has experienced only one day of outflows since its launch in January, with over $20 billion now secured.

BUY NOT YOUR KEYS .... Pls complete

Sony to Launch #Bitcoin and Crypto Exchange in #Japan Via Acquired Local Platform

Author: Mandy Williams

CryptoPotato

Sony to Launch Crypto Exchange in Japan Via Acquired Local Platform

S.BLOX's launch will include the release of a new app and the redesign of the user interface screen.

Last Updated Jul 1, 2024 @ 14:19

S.BLOX’s launch will include the release of a new app and the redesign of the user interface screen.

Japanese multinational conglomerate corporation Sony is gearing up to launch its cryptocurrency exchange. The company intends to make this possible by restarting another crypto trading platform acquired in August 2023.

According to a press release, Amber Japan, the parent company of the Japanese crypto exchange WhaleFin, acquired by Sony last year, has changed its name to S.BLOX. The technology giant is preparing to kickstart its digital asset trading services soon.

**Summary of "Resistance Money" with Andrew Bailey, Bradley Rettler, & Craig Warmke:**

- **#EventUpdates**:

- Hosts reflect on a successful Bedford, Tennessee event; plan for next year's event to attract more attendees.

- Bailey to offer Bitcoin grants to local businesses.

- Announce a new podcast format that will include Bitcoin but not focus exclusively on it.

- **#BookReception**:

- Book faced criticism despite good sales; original high price adjusted due to sales performance.

- Authors collaborated intensively, focusing on Bitcoin benefits and avoiding criticism of other projects.

- **#PublishingChallenges**:

- Faced hurdles with pro-Bitcoin book due to publisher rejections but remain determined.

- **#BitcoinImpact**:

- Discuss Bitcoin's broader implications beyond personal gain.

- Analyze Bitcoin's potential positive impacts on various populations, including those in authoritarian regimes and high inflation areas.

- **#BenefitVsDrawback**:

- Bitcoin might not directly benefit everyone but could help a significant portion, particularly the financially excluded.

- Bitcoin provides positive externalities like electricity from mining and potential improvements in government functions.

- **#InstitutionalAdoption**:

- Bitcoin’s resistance capabilities make it appealing to institutions amidst international sanctions and market fragmentation.

- Emphasize Bitcoin’s need for a shift in understanding money management.

- **#IdeologyAndAdoption**:

- Misinformation and ideological baggage hinder Bitcoin promotion.

- Call for a non-ideological approach to improve adoption.

- **#WealthDistribution**:

- Bitcoin might exacerbate wealth gaps but is arguably fairer than current systems.

- Bitcoin cannot single-handedly solve wealth inequality but contributes to a more balanced distribution.

- **#LongTermImpact**:

- Potential for Bitcoin to drive profound changes in human civilization but with skepticism about altering human nature.

- Bitcoin’s role in providing savings and trust in a declining institutional landscape.

- **#BitcoinImperfections**:

- Discusses Bitcoin mining’s use of fossil fuels and efforts to transition to renewable energy.

- Ongoing improvements in Bitcoin’s privacy and other areas.

- **#AIAndBitcoin**:

- Bailey skeptical about AI's catastrophic outcomes; Rettler and Warmke more optimistic about AI’s benefits.

- Formation of the University of Wyoming Bitcoin Research Institute to support academic research on Bitcoin.

- **#FuturePlans**:

- Excitement about upcoming book; encourages purchases and looks forward to further developments.

The Japanese Dominos...

**#JapaneseYen Devaluation**: Yen's devaluation triggered global #marketdeleveraging due to Japan's low interest rates and fiscal dominance

- **#Inflation Management**: #Japan allows inflation and bond prices to rise, impacting holders of Japanese currency and bonds.

- **#USMarketVolatility**: Japan’s currency intervention and increased interest rates caused significant volatility in US markets, exacerbated by leveraged carry trade positions and short volatility trades.

- **#CapitalRotation**: Potential shift of capital from the US to other global markets could weaken the US dollar and benefit #foreignstocks, #commodities, and exporters, while increasing inflation for American consumers.

- **#RecessionThreat**: US economic softening, with signs like weakened manufacturing and rising credit spreads, might lead to accommodative policy, benefiting #emergingmarkets.

- **#GlobalEconomicRisks**: Countries with high public debt and dollar-dominant debt, including Japan and the US, face similar economic challenges, heightened by #geopolitical conflicts.

- **#SocialUnrest**: Economic frustration, declining trust in institutions, and polarization in the US and UK are leading to increased protests and social unrest.

- **#Bitcoin as #AlternativeSystem**: Bitcoin is viewed as a hedge during times of crisis, though it's likely to be sold during liquidity crises; long-term perspective advised for Bitcoin investment.

- **#InstitutionalEntropy**: Outdated institutions face challenges, with new ones like Bitcoin emerging as potential alternatives during economic instability.

Don't try to control the situation

Try to control your reaction to it.

Hey #nostrich

in 6 months you will have

6 months of progress

OR

6 months of excuses

LFG!

#nostr #grownostr #plebchain #gm #gn #bitcoin #btc #zaps #love #life #sats #hodl #plebs #freedom #einundzwanzig #dream #stacksats #satoshis #wisdom #pleb #nostrplebs #lightning #zapping #europe #onlyzaps #proofofwork #austriches #zapme #livegood #growstr #followme #bloomscrolling #boost #streaming #introduction

🧡🟠🟧💜🟣🟪

- **Saifedean Ammous** is a #Bitcoin legend

- Sold over 1 million copies of "The Bitcoin Standard"

- Convinced Michael Saylor to buy 200,000 BTC

- **Background**:

- Born in Palestine

- Developed an early interest in #politics and #economics

- **Reputation**:

- Profiled in New York Magazine for his strong editorials

- **Interest in #Economics**:

- Explored alternatives to fiat currency, including #gold and Austrian economics

- Heard about #Bitcoin in 2011 but was initially skeptical

- **Bitcoin Journey**:

- Continued writing on money and economics, leading to appearances on "The Keiser Report"

- Became increasingly curious about #Bitcoin, ultimately recognizing it as the true store of value

- **"The Bitcoin Standard"**:

- Wrote the book in just 3 months

- The book has sold over 1 million copies worldwide

- Left his university job in 2019 and invested his severance into #Bitcoin

- **Advocacy**:

- Became a vocal advocate for #Bitcoin, challenging fiat economists

- Popularized the idea that Bitcoin is a form of savings, arguing that people shouldn't have to invest to preserve purchasing power

- **Influence**:

- Helped "orange pill" Jordan Peterson

- "The Bitcoin Standard" is frequently mentioned on TV, inspiring political figures like Senator Cynthia Lummis and Congressman Thomas Massie

- Serves as an advisor to the President of El Salvador, who is now buying 1 BTC every day

- **Impact**:

- Michael Saylor credits "The Bitcoin Standard" as a reason for his company's massive Bitcoin purchase

- The book is considered the "Bible of #Bitcoin" and is even found in hotel rooms in Germany

- **Community**:

- Encourages others to share their favorite Saifedean moments and continue the conversation on #Bitcoin

There are 20,000 #cryptos.

But there's only one #Bitcoin.

It doesn’t make sense to conflate the two—they are entirely different, even diametrically opposed. Yet, some say "Bitcoin is not crypto," revealing a misunderstanding.

#Bitcoin uses #cryptography to create digital currency. It *is* a #cryptocurrency. Saying otherwise is like claiming that air is not gas. Yes, many types of gas are toxic and dangerous, but air is still gas.

When people focus on "#Bitcoin not crypto," it's akin to focusing on air instead of the general category of gases. It doesn't deny the reality that air is a gas. Similarly, while many view other cryptos as junk, it doesn't change the fact that Bitcoin is a cryptocurrency—a particularly good one, perhaps even the best.

But to say Bitcoin is not crypto is to deny reality. #Bitcoin is a cryptocurrency.

A #bitcoin strategic reserve.

Is it for ...

You. Your family. Your business. Your city. Your state. Your country or everyone? #AskNostr

The healthcare company Semler Scientific, which is listed on the Nasdaq technology exchange, has published its figures for the second quarter and announced that it has purchased 101 bitcoins.

In addition, the Company announced the purchase of an additional 101 bitcoins for an aggregate amount of $6.0 million. Since announcing the adoption of a bitcoin treasury strategy on May 28, 2024, the Company has purchased 929 bitcoins for a total of $63.0 million.

https://www.blocktrainer.de/en/blog/semler-scientific-public-limited-company-buys-bitcoin#Bitcoin miner difficulty at an all time

High. Network getting more secure

Think like you are free.

Live like you’re free.

Act like you’re free.

And one day,

You will be free.

#Freedom

Our destiny it is determined by our actions not our origins.

- John D. Rockefeller

#Mind

Note to self. #Motivation

Not financial advice, quick summary on recent dump.

The time it takes for Bitcoin to reach new all-time highs varies, with historical recovery periods ranging from 8 weeks to 24 weeks. Currently, Bitcoin is at the 16-week mark, suggesting we could see a new high within the next 8 weeks. This pattern hints at the potential for significant upward momentum soon.

On top of that, major institutions like BlackRock and Fidelity have been actively buying up large amounts of Bitcoin, even in the face of recent market sell-offs. This aggressive accumulation shows strong institutional confidence in Bitcoin’s future, despite the short-term volatility. It’s as if these financial giants are doubling down on their belief that Bitcoin is here to stay and poised for growth.

For those investing, it’s maybe smart to keep cash on hand to take advantage of market dips. Buying when prices are down can be a great strategy, especially if you’re in it for the long haul. Holding onto Bitcoin, particularly in the second half of the year, could pay off significantly as we head toward what looks like an exciting period for the market.

There’s also some buzz about potential breaking news related to older Bitcoin coins, which could shake things up. While the details aren’t clear yet, it’s worth keeping an eye on any updates that might come out.

Overall, the outlook for Bitcoin is probably optimistic. We might see new all-time highs as soon as September or October, with the second half of the year shaping up to be potentially incredible for those who have stayed invested.

This could be a pivotal moment for Bitcoin, with big opportunities ahead. #Bitcoin #Investing #Finance #NoZaps #MarketTrends #InvestmentStrategy #FollowBacksAppreciated

- **Background**:

- Born in Palestine

- Developed an early interest in #politics and #economics

- **Reputation**:

- Profiled in New York Magazine for his strong editorials

- **Interest in #Economics**:

- Explored alternatives to fiat currency, including #gold and Austrian economics

- Heard about #Bitcoin in 2011 but was initially skeptical

- **Bitcoin Journey**:

- Continued writing on money and economics, leading to appearances on "The Keiser Report"

- Became increasingly curious about #Bitcoin, ultimately recognizing it as the true store of value

- **"The Bitcoin Standard"**:

- Wrote the book in just 3 months

- The book has sold over 1 million copies worldwide

- Left his university job in 2019 and invested his severance into #Bitcoin

- **Advocacy**:

- Became a vocal advocate for #Bitcoin, challenging fiat economists

- Popularized the idea that Bitcoin is a form of savings, arguing that people shouldn't have to invest to preserve purchasing power

- **Influence**:

- Helped "orange pill" Jordan Peterson

- "The Bitcoin Standard" is frequently mentioned on TV, inspiring political figures like Senator Cynthia Lummis and Congressman Thomas Massie

- Serves as an advisor to the President of El Salvador, who is now buying 1 BTC every day

- **Impact**:

- Michael Saylor credits "The Bitcoin Standard" as a reason for his company's massive Bitcoin purchase

- The book is considered the "Bible of #Bitcoin" and is even found in hotel rooms in Germany

- **Community**:

- Encourages others to share their favorite Saifedean moments and continue the conversation on #Bitcoin

- **Background**:

- Born in Palestine

- Developed an early interest in #politics and #economics

- **Reputation**:

- Profiled in New York Magazine for his strong editorials

- **Interest in #Economics**:

- Explored alternatives to fiat currency, including #gold and Austrian economics

- Heard about #Bitcoin in 2011 but was initially skeptical

- **Bitcoin Journey**:

- Continued writing on money and economics, leading to appearances on "The Keiser Report"

- Became increasingly curious about #Bitcoin, ultimately recognizing it as the true store of value

- **"The Bitcoin Standard"**:

- Wrote the book in just 3 months

- The book has sold over 1 million copies worldwide

- Left his university job in 2019 and invested his severance into #Bitcoin

- **Advocacy**:

- Became a vocal advocate for #Bitcoin, challenging fiat economists

- Popularized the idea that Bitcoin is a form of savings, arguing that people shouldn't have to invest to preserve purchasing power

- **Influence**:

- Helped "orange pill" Jordan Peterson

- "The Bitcoin Standard" is frequently mentioned on TV, inspiring political figures like Senator Cynthia Lummis and Congressman Thomas Massie

- Serves as an advisor to the President of El Salvador, who is now buying 1 BTC every day

- **Impact**:

- Michael Saylor credits "The Bitcoin Standard" as a reason for his company's massive Bitcoin purchase

- The book is considered the "Bible of #Bitcoin" and is even found in hotel rooms in Germany

- **Community**:

- Encourages others to share their favorite Saifedean moments and continue the conversation on #Bitcoin