BITCOIN IS NON-GOVERNMENT MONEY

Many people think that money has to be issued by the government. But this is not the case, and it never has been.

First, consider currency. In London, the pound is money, the euro is money in Paris, and Bitcoin is money in El Salvador: all of these are legal tender, endorsed by the respective national governments.

But money can also be whatever currency people agree is money without the government’s say so. The US dollar remains money in Cuba even though the government says it isn’t legal tender, and Bitcoin is widely accepted in Madeira without the government there saying anything much about it at all.

The same goes for banknotes. They are of course often issued by governments via their central banks. But notes have historically been issued by private banks as well. In some places they still are, such as Scotland, where Virgin Money subsidiary Clydesdale Bank (amongst others) still issues sterling banknotes, and Northern Ireland, where (amongst others) Danish multinational Danske Bank does the same.

And what about ledger money, which makes up most money in circulation today? The world over, this is mainly not issued by governments at all, but is instead created by non-government banks such as Banco Santander and Wells Fargo when they make loans. In the UK for example, retail banks such as HSBC and Lloyd’s create around 80% of the money in the economy in this way.

So while some money is government money, most money is not. Yet people the world over still agree it is money.

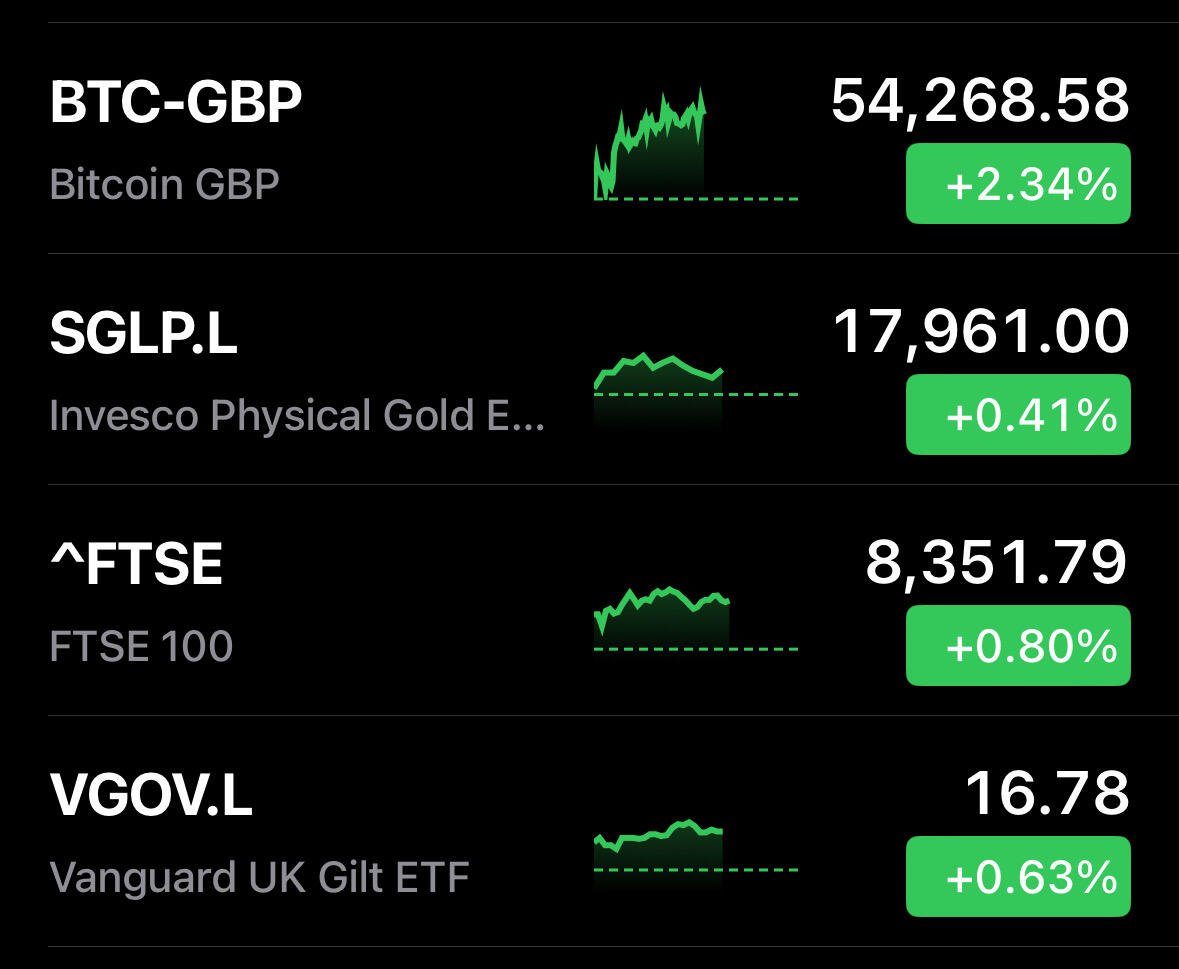

Similarly, Bitcoin is not government money, yet people all over the world agree it is money.

Bitcoin is non-government money.

bitcoms.xyz - Bitcoin is non-government money

Many people think that money has to be issued by the government. But this is not the case, and it never has been.

First, consider currency. In Lon...