By the end of the week, someone will have created a BIP-39 themed dart board.

Josh Hendrickson

npub18wgt...r2wn

Professor of Economics and Chair, Ole Miss; Senior Fellow at the Bitcoin Policy Institute

How Can We Align the Interests of Bank Shareholders with Depositors?

How Can We Align the Interests of Bank Shareholders with Depositors?

You are reading Economic Forces, a free weekly newsletter on economics, especially price theory, without the politics.

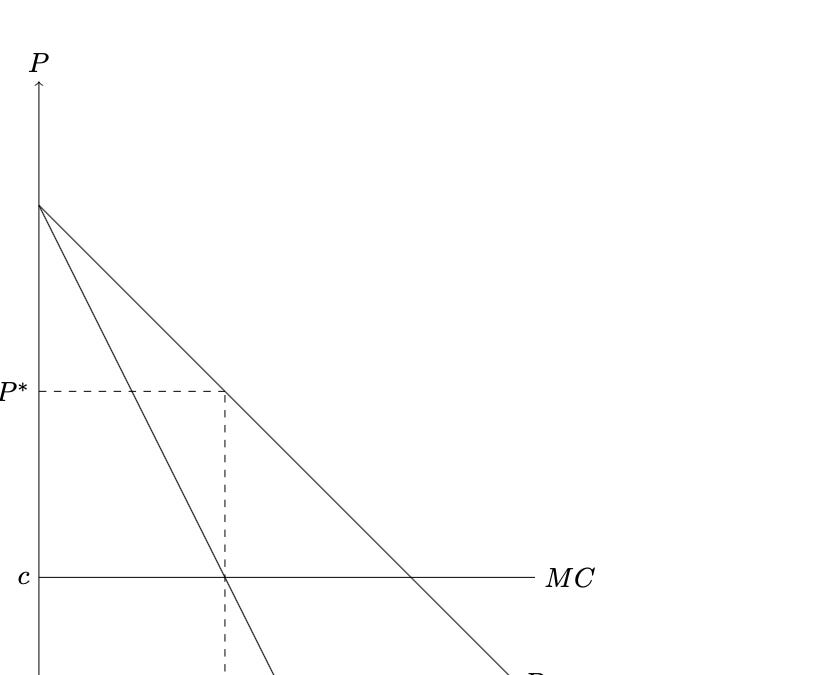

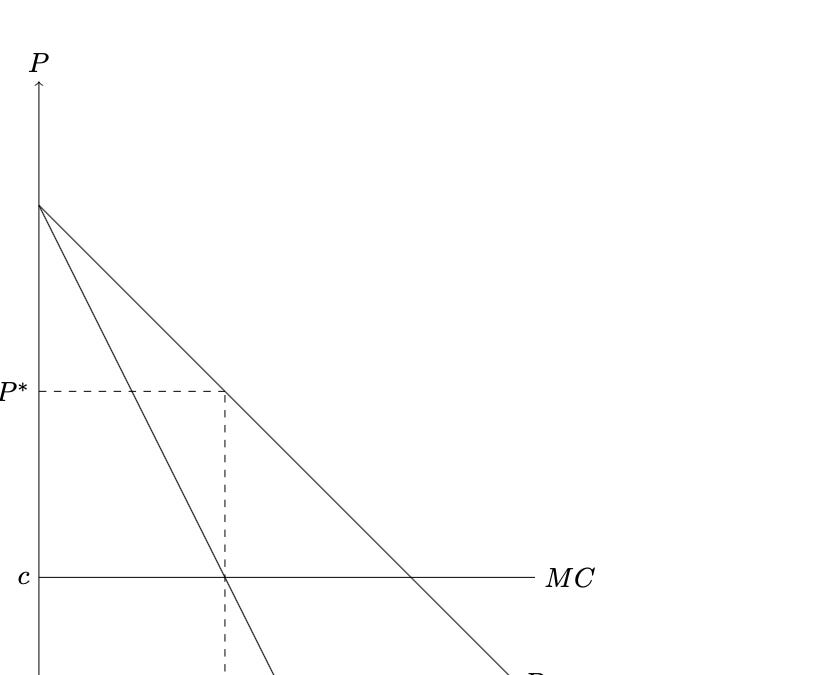

People are desperate to blame inflation on anything but Federal Reserve policy. They’d rather blame greedy corporations. Some people even point to rising markups of prices over costs as evidence that this is all just greed. But some basic knowledge of price theory tells us that if markups are rising, this is driven by demand and, in particular, expansionary monetary policy.

Price Theory as an Antidote

Or, why that recent paper on markups and inflation doesn't say what people think

The trillion dollar coin idea to “solve” the debt ceiling would basically just have the Fed operate like FTX — worthless tokens as assets, immune from market valuations. Also, like FTX, this trick would make the central bank insolvent.

This One Simple Trick

You are reading Economic Forces, a free weekly newsletter on economics, especially price theory, without the politics.

Central bankers continue to use the Phillips Curve as a guide for monetary policy. This demonstrates a basic lack of understanding about the Phillips Curve itself and the last 50 years of macroeconomic theory.

What Theory Does and Does Not Say: Lessons from the Phillips Curve

You are reading Economic Forces, a free weekly newsletter on economics, especially price theory, without the politics.

The conventional wisdom on historical asset bubbles is that these were episodes of irrational exuberance. In reality, historical asset bubbles were much more interesting. The South Sea Bubble and the Mississippi Bubble were the end result of government debt consolidation schemes.

Tulipmania was an artifact. There was no bubble. The Dutch elite passed legislation that turned futures contracts into options contracts.

What About Bubbles?

Surely, I cannot seriously believe financial markets are efficient, right?

Economists routinely talk about the problems associated with monopoly, but there’s one monopoly that goes unquestioned: the monopoly on currency issuance.

The Unquestioned Monopoly

You are reading Economic Forces, a free weekly newsletter on economics, especially price theory, without the politics.

Inflation and Time

Inflation and Time

Thinking about the cost of living

Listen to me and Preston Pysh talk about bitcoin, live (well, it was live) from Bitcoin Park.

Open House: Bitcoin Stakeholder Incentives with Preston Pysh, Dr. Josh Hendrickson, and Rod @bitkite — Bitcoin Park — Overcast

The Fed is like a child trying to build the tallest tower of blocks. Each new lending facility adds a block to the tower. Each new block makes the tower look more impressive. But the taller the tower, the less stable the tower becomes and the more likely a small shock can bring the whole tower crashing down.

It’s become increasingly evident to people that we're on an unsustainable path.

The Fed continues to expand the scope of its operations. A new problem? Here's a new facility to deal with that. This makes the operations more and more complex, which makes the institution and the financial system more fragile.

The Fed's balance sheet is going to continue to get bigger and that will lead to more politicization. And the balance sheet is going to get riskier as these facilities simply transfer the risk from the financial system to the Fed.

Schrödinger's bond prices

Gee, I wonder what we’ll have to talk about in Nashville this week.

Meetup

Open House - Economics & Incentives of Bitcoin, Wed, Mar 15, 2023, 5:00 PM | Meetup

Date: \*Wednesday, March 15th\*

Doors open: 5:00p CT

**Open House**, a monthly bitcoin community meetup focused on actionable discussions and as a...

Just to review, this is the same guy who says he hasn’t heard of a single valid use case for bitcoin.

X (formerly Twitter)

Paul Krugman (@paulkrugman) on X

Too busy to tweet. But not to vent. I've been using Venmo for years, but now it won't allow me to make payments. I spent a long time in chat with r...

One of the most reliable red flags is when crypto people don’t understand bitcoin. It always ends like this.

https://www.coindesk.com/business/2023/03/04/multicoin-capitals-hedge-fund-lost-914-last-year-investor-letter-reveals/

This is the best they can do. It’s all they have. This lazy, tired narrative.

X (formerly Twitter)

MIT Technology Review (@techreview) on X

Ethereum's switch to proof of stake reduced its direct energy consumption by 99%. There's no technical obstacle preventing Bitcoin from doing the s...

Zaps are better than likes. This place is going to be wild soon.

It’s happening! https://overcast.fm/+npr-yjrb4

I’ve been around long enough to have read Burniske’s book on “Cryptoassets.” The book had a valuation model for these assets that was essentially nonsensical. Of course, he wrote it so early that prices of each of these assets is much higher than they were then. This gives him validation, but it’s false validation. Like the guy who successfully predicted the stock market crash of 1929 by applying the law of gravity to stock prices, this won’t end well for him.

X (formerly Twitter)

Chris Burniske (@cburniske) on X

A plethora of highly valued L2 competition on Ethereum, while Bitcoin really only has Stacks and Lightning in the general-purpose L2 race (thus far...