Part 3: Family & Legacy Planning

Section 5: Building a Resilient Retirement on the Bitcoin Standard

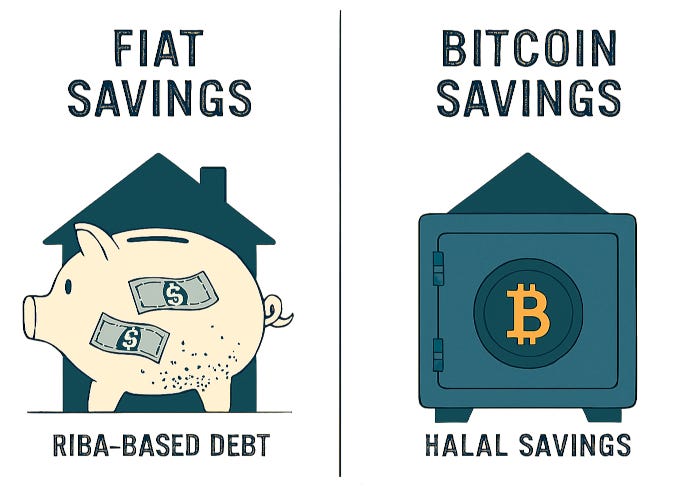

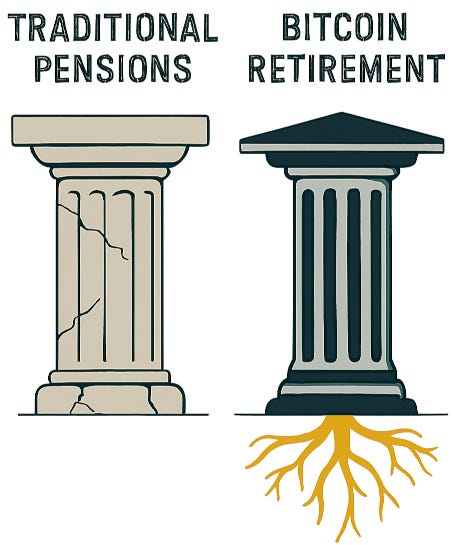

Traditional pensions are a promise based on a failing system. They invest in a market fuelled by debt and are denominated in currencies designed to lose value. For the next generation, relying solely on these systems is a risky bet. It's time to build a parallel, sovereign retirement plan.

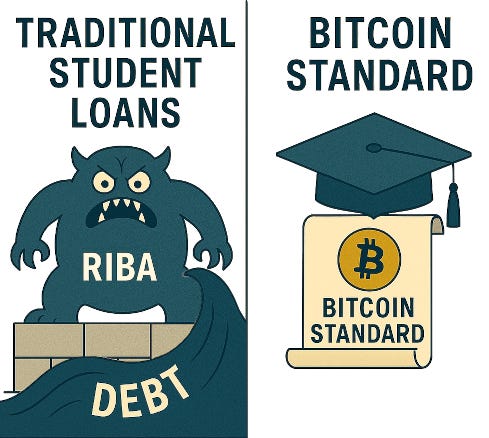

1. Why Traditional Pensions Are Failing:

Pensions face a perfect storm: longer life expectancies, low interest rates, and the constant debasement of the fiat currency they hold. The promise made to you today may not have the purchasing power you need in 30 years.

2. Bitcoin as Your Long-Term Retirement Hedge:

Your retirement plan is the ultimate low-time-preference goal. You are saving value across decades.

- A Lifelong Savings Vehicle: Think of Bitcoin as a personal pension fund that you control. By converting a portion of your income into Bitcoin throughout your working life, you are opting into a system with a fixed supply, protecting your future self from the monetary inflation of the fiat world.

- Global Portability: Your Bitcoin retirement fund is not tied to a government or a country. If you decide to retire abroad, your wealth moves with you, seamlessly and without permission.

3. Custody Strategies for Aging Individuals:

Self-custody is empowering, but it requires responsibility. As we age, it's wise to plan for secure and accessible custody.

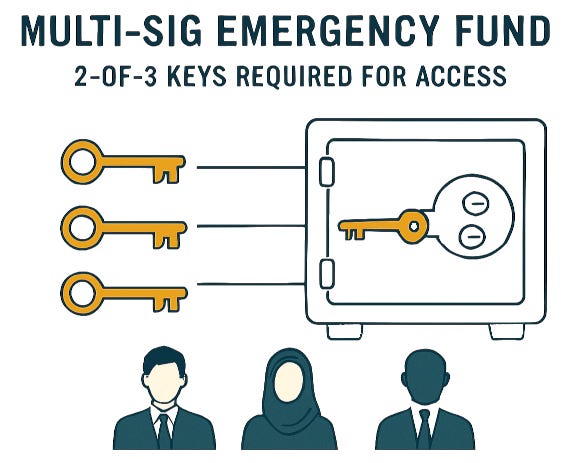

- Collaborative Custody (Multi-Sig): This is the gold standard. A 2-of-3 or 3-of-5 multi-sig setup with trusted heirs and advisors ensures that no single person can move the funds, but also that the funds are not lost if one person becomes incapacitated.

- Bitcoin ETFs in a SIPP: If self-custody and multi-sig are not something you are comfortable with, Bitcoin ETFs in a Self-Invested Pension Plan (SIPP) might be an option to consider. A SIPP is a type of personal pension that gives you more control over your investments for retirement. Unlike standard pensions, SIPPs allow you to choose from a wider range of investment options, including stocks, shares, and various types of funds. You can manage these investments yourself or appoint a financial advisor to do so. If Bitcoin ETFs are available in your jurisdiction, this may be a tax efficient option for you to consider.

- Education is Key: The most important part of this strategy is educating your loved ones. They need to understand what Bitcoin is, why it's valuable, and how to securely access it when the time comes.

Call to Action & Reflection:

What percentage of your retirement plan is outside of your direct control? Begin learning about self-custody and multi-sig solutions today. Building a sovereign retirement plan is a gift of security you give to your future self.

Disclaimer: The content of this article is not intended as financial, investment, or religious advice. Readers are encouraged to conduct their own research and consult with qualified professionals for specific guidance.

#BitcoinStandard #Ritirement

📱 Google Play: https://play.google.com/store/books/details?id=qjxlEQAAQBAJ

Bitcoin itu Halal (Bahasa Indonesia 🇮🇩)

📱 Google Play: https://play.google.com/store/books/details?id=bqtyEQAAQBAJ

📚 Paperback edition coming soon!

📱 Google Play: https://play.google.com/store/books/details?id=qjxlEQAAQBAJ

Bitcoin itu Halal (Bahasa Indonesia 🇮🇩)

📱 Google Play: https://play.google.com/store/books/details?id=bqtyEQAAQBAJ

📚 Paperback edition coming soon!